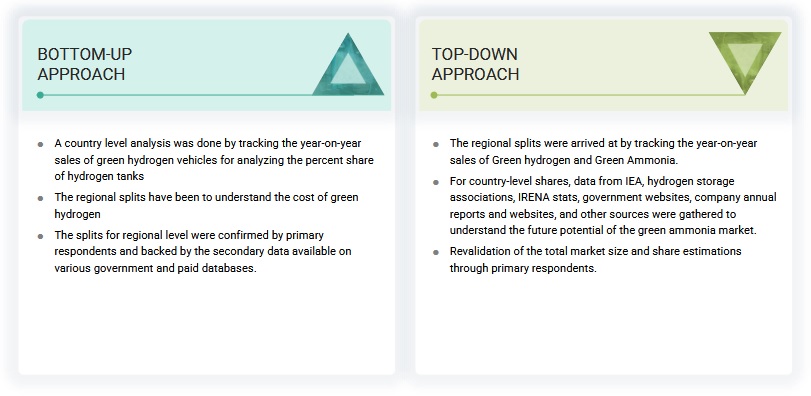

The study involved major activities in estimating the current size of the green ammonia market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study included secondary sources such as company annual reports, press announcements, and investor presentations, as well as white papers, certified publications, articles by renowned writers, and databases of numerous firms and associations. Secondary research has primarily been used to obtain key information about the industry's supply chain, monetary chain, total pool of key players, market classification and segmentation based on industry trends down to the lowest level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

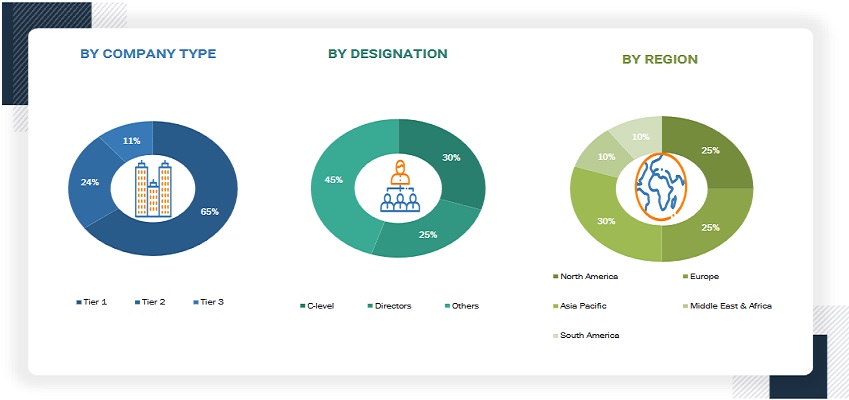

Primary research has been conducted to identify segments, industry trends, and the competitive landscape of the green ammonia market. In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the green ammonia market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the green ammonia market and its dependent submarkets. Key players in the market have been identified through secondary research, and their market share in the respective regions has been obtained through both primary and secondary research. The research methodology includes the study of the annual and financial reports of the top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, to gain key quantitative and qualitative insights related to the green ammonia market. The research methodology used to estimate the market size includes the following:

-

Extensive secondary research was used to identify the major players in the industry and market, and their market share was established using both primary and secondary research.

-

Both primary and secondary research methods were used to assess the industry's value chain and market size.

-

All percentage shares, splits, and breakdowns were obtained using secondary sources and validated by primary sources.

Green Ammonia Market Size: Top-Down and Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying numerous factors and trends from both the demand and supply sides. Additionally, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

Green ammonia refers to the manufacture of ammonia that is renewable and carbon-free. It is created by converting energy from sun, wind, and hydropower into an electrolyzer. It extracts hydrogen from water and removes nitrogen from the air using an air separation device. Ammonia is produced by reacting hydrogen and nitrogen at high temperatures and pressures. Green ammonia is used to produce carbon-neutral fertilizer products and decarbonize the food value chain, and it is likely to be used as a climate-neutral transportation fuel in the near future.

The Green ammonia market comprises revenues of companies for various end users such as transportation, power generation and industrial feedstock.

Key Stakeholders

-

Industrial gas companies

-

Ammonia manufacturers

-

Electrolyzer and other equipment providers

-

Hydrogen generation product and solution providers

-

Engineering, procurement, and construction companies

-

R&D laboratories

-

Consulting companies from the energy & power sector

-

Government and research organizations

-

Renewable energy providers

Objectives of the Study

-

To define, characterize, segment, and predict the value of the green ammonia market, by technology and end-use application.

-

To predict the market size across four important regions: North America, Europe, Asia Pacific, and Rest of the World, as well as country-level analysis in terms of value and volume.

-

To describe key elements required to produce green ammonia

-

Provide statistical data on ammonia production, hydrogen generation, installed renewable capacity, and greenhouse gas emissions for each area and nation.

-

To give extensive information about major drivers, restraints, opportunities, and industry-specific issues that influence the growth of the green ammonia market.

-

To strategically study the green ammonia market in terms of individual growth patterns, opportunities, and contributions of each sector to the industry.

-

To offer supply chain analysis, trends/disruptions effecting client business, market mapping, price analysis, and regulatory landscape for green ammonia.

-

To strategically study micromarkets in terms of individual growth patterns, anticipated expansions, and their contribution to the overall market.

-

Analyzing prospects for stakeholders in the green ammonia industry and creating a competitive landscape for market players

-

To benchmark market participants, use the company assessment quadrant, which examines market players based on numerous characteristics within the broad areas of business and product strategies.

-

To compare the main market participants based on their market share, product characteristics, and applications.

-

To strategically profile important players and thoroughly study their market ranking and essential strengths.

-

To examine competitive developments in the green ammonia market, such as sales contracts, agreements, investments, expansions, product launches, partnerships, joint ventures, and collaborations.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Green Ammonia Market