The estimation of the current size of the graphite market involved a four-step methodology. Initially, secondary research included all pertinent information about the market itself, as well as related and parent markets. These results, along with assumptions and metrics, were validated with primary research that involved experts from both the supply and demand sides of the graphite value chain. Total market size was determined through a top-down and bottom-up approach. Finally, the market sizes for various segments and subsegments were found using comprehensive market segmentation and data triangulation techniques.

Secondary Research

The research methodology followed in estimating the current graphite market size consisted of four significant activities. Extensive secondary research was conducted to provide information on the market, peer markets, and parent markets. These findings, assumptions, and metrics were validated through primary research undertaken with experts from the demand side of the graphite value chain. Both top-down as well as bottom-up approaches were followed for the estimation of the total market size. The complete market segmentation and data triangulation techniques had been applied for the final estimation of various segments and subsegments.

Primary Research

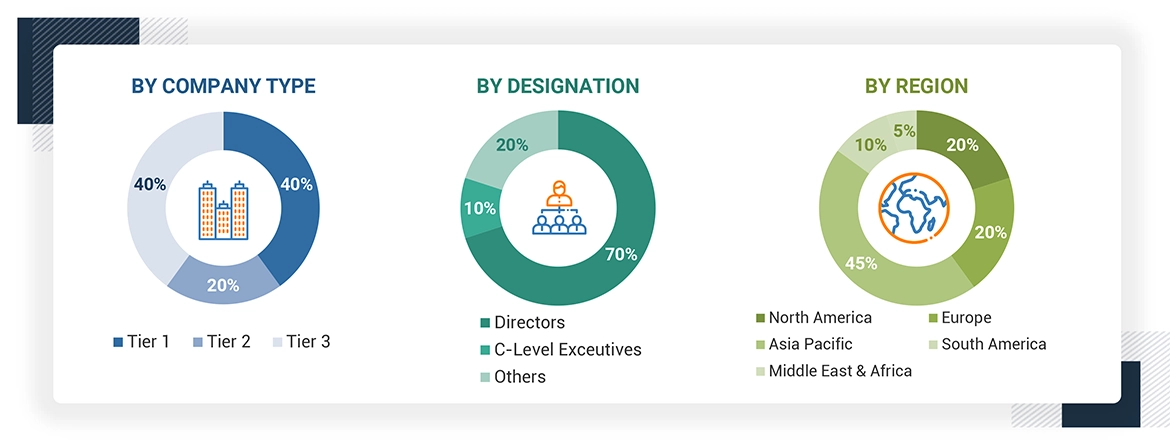

The graphite market comprises several stakeholders in the supply chain, such as graphite producers and Miners, graphite processing and refining companies, manufacturers, distributors and traders, government and regulatory bodies, and end users. The development of EV, metallurgy, electronics, textile and construction defines the demand side of this market. Interviews were conducted with various primary sources on both the supply and demand sides of the market to gather qualitative and quantitative data. Following is the breakdown of the primary respondents:

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the graphite market. These methods were used to determine the market size of various segments. The research methodology used for the market size estimation is as follows:

-

Extensive primary and secondary research was done to identify the key players.

-

The value chain and market size of the graphite market, in terms of value, were determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns were collected through secondary sources and verified through primary sources.

-

All possible parameters that affect the market were covered in this research study and are viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

This research includes the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Research Methodology

The research methodology used to estimate and forecast the global market size began by first aggregating data and information from the country and different levels. To estimate and validate the size of the graphite market, the top-down and bottom-up approaches have been used. Secondary research has been applied to identify the players involved in the market and, thereby, determine revenues generated by these players in the various regions. This procedure involves the study of annual and financial reports of key market players such as Shanshan Co (China), Resonac Holdings Corporation (Japan), SGL Carbon (Germany), GrafTech International (US), and Imerys (France). Interviews were also conducted with industry leaders, such as CEOs, directors, and marketing executives of leading companies, to gain insight into the graphite market

Graphite Market Size: Bottom-Up & Top-Down Approach

Data Triangulation

After estimating the overall market size using the above estimation, the market was split into various segments and subsegments. Data triangulation, market breakup techniques, and the market engineering process were used to reach the exact market analysis data for each segment and subsegment. data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

Graphite is a semimetal and possesses good electrical conducting properties. It is a form of crystalline carbon, in which carbon atoms are densely arranged in parallel-stacked, planar honeycomb lattice sheets. The demand for graphite is directly dependent on the growth of its application industries, including, electric vehicles, energy storage devices, refractory, foundry, battery, friction product, and lubricants Graphite is used across various end-use industries, such as aerospace & defense, steel, and automotive since it is lightweight and has excellent strength. Graphite-based composites are used in the manufacturing of automotive parts, such as exterior body parts, hoods, bonnets, test plates, suspension struts, and chassis, among others. There has been a growing demand for graphite particularly in battery technologies in electric vehicles

Stakeholders

-

Graphite producers and Miners

-

Graphite processing and refining companies

-

Electric Vehicle (EV) Manufacturers

-

Distributors and Traders

-

Research and Development Institutions

-

Regulatory Bodies

-

NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

-

Consumers ans End users

Report Objectives

-

To define, describe, and forecast the size of the global graphite market in terms of value and volume.

-

To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the graphite market

-

To analyze and forecast the size of various segments (type, purity, application and end use industry) of the graphite market based on five major regions—North America, Europe, Asia Pacific, Middle East & Africa and South America—along with key countries in each region.

-

To analyze recent developments and competitive strategies, such as expansions, new product developments, partnerships, and acquisitions, to draw the market's competitive landscape.

-

To strategically profile the key players in the market and comprehensively analyze their core competencies.

Growth opportunities and latent adjacency in Graphite Market