Gas Insulated Switchgear Market

Gas Insulated Switchgear Market by Installation (Indoor, Outdoor), Insulation Type (SF6, SF6 free), Voltage Rating, Configuration ( Hybrid, Isolated Phase, Integrated three phase, Compact GIS), End-User, and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

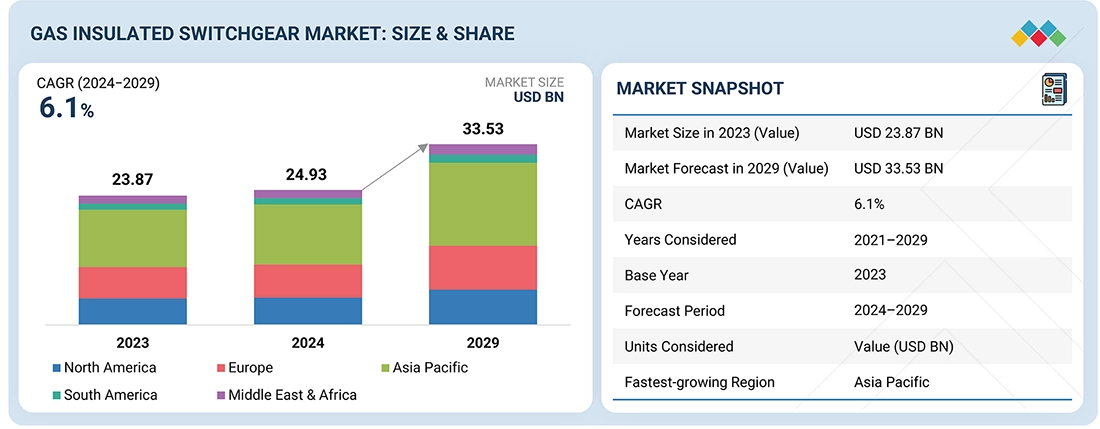

The gas-insulated switchgear market is expected to have significant growth, growing from approximately USD 24.93 billion in 2024 to USD 33.53 billion by 2029. The projected CAGR during the said period stands at 6.1%. The growth in this market is mainly driven by technological advancements, such as the application of IoT in home and building automation. Increasing adoption of IoT and perceived benefits of effective energy management system further encourage the use of GIS in view of real-time monitoring and optimizing energy usage.

KEY TAKEAWAYS

-

BY REGIONThe gas insulated switch gear market for the Asia Pacific region is estimated to dominate with a share of 44.8% in 2024.

-

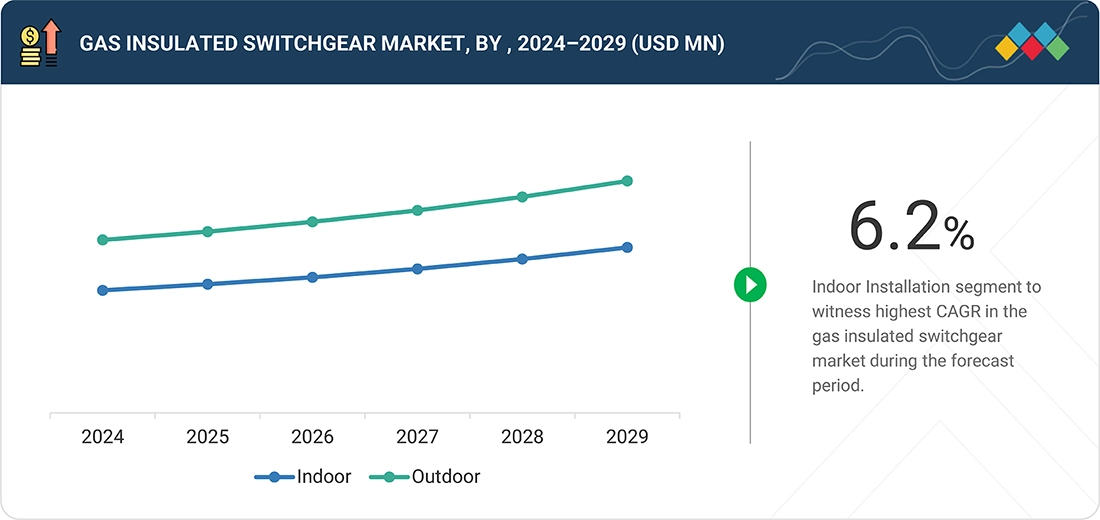

BY INSTALLATIONSBy installations, the indoor segment is expected to be the fastest growing market with a CAGR of 6.2% during the forecast period.

-

BY VOLTAGE RATINGBy voltage rating, the above 220 Kv segment is expected to account for the largest share of 31.1% in the gas insulated switch gear market by 2029.

-

BY CONFIGURATIONBy configuration, the hybrid segment is expected to account for the largest share of 32.5% in the gas insulated switch gear market by 2030.

-

BY INSULATION TYPEBy insulation type, the SF 6 segment is expected to dominate the gas insulated switch gear market by 2029.

-

BY END USERBy end user, the data centers segment is expected to be the fastest growing market with a CAGR of 6.6% during the forecast period.

-

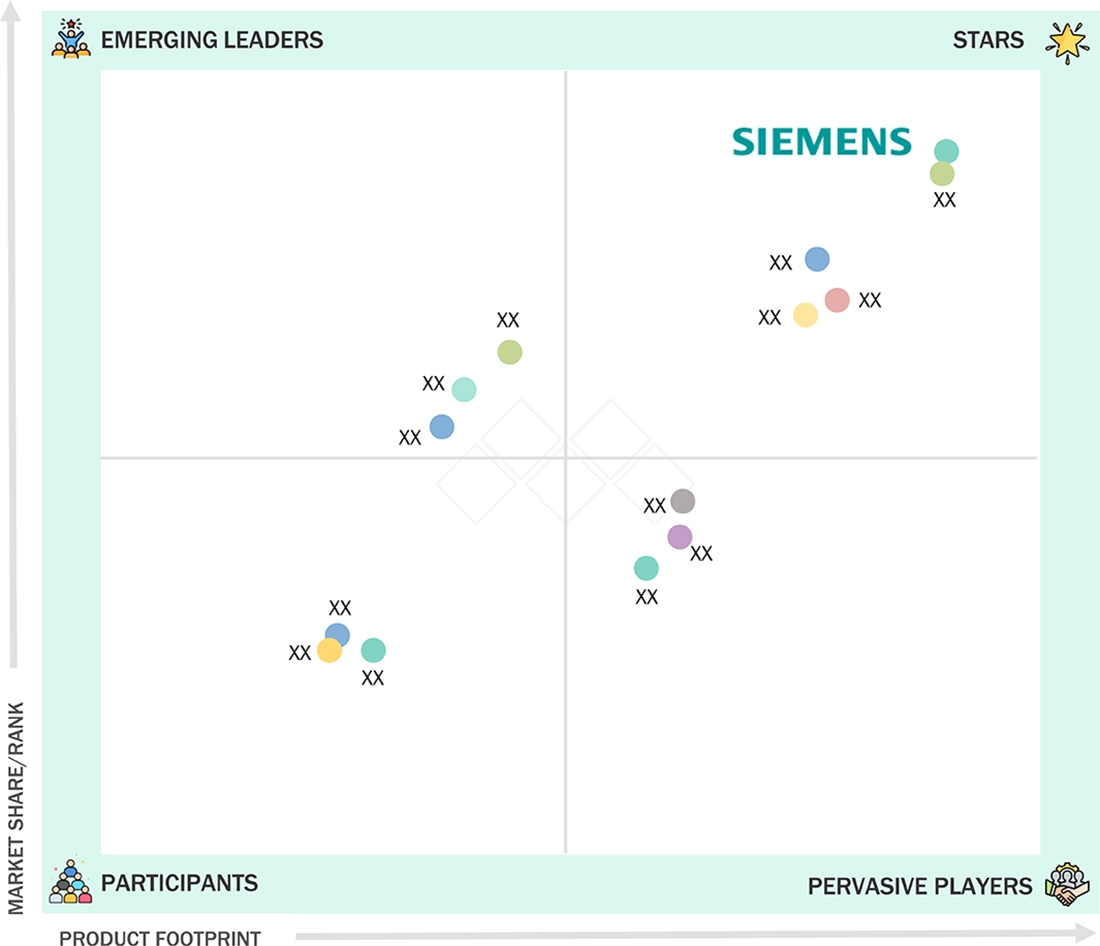

COMPETITIVE LANDSCAPEMajor players in the gas insulated switch gear market are adopting both organic and inorganic strategies, including partnerships and investments, to expand their market presence. Companies such as General Electric Company (US), Siemens (Germany), Schneider Electric (France), ABB (Switzerland) are actively forming collaborations to meet the growing demand for gas insulated switch gear solutions.

-

COMPETITIVE LANDSCAPEThe strong product ecosystem and global market penetration of nuventura GmBH and TGOOD Global Ltd. position them among the most influential startups and SMEs in the gas insulated switch gear landscape.

The industrial sector, still one of the dominant sources of demand, is spurred by the need for reliable power distribution and efficient system of manufacturing, oil & gas, and heavy industries. At the same time, the business, service, and residential sectors are embracing GIS solutions more and more, fueled by trends in urbanization, infrastructural development, and increasing electricity demand. Moreover, superior reliability, as compared to traditional switchgear systems, and the capability of GIS to work in compact spaces make it favorite in applications such as substations, utilities, and renewable energy integration.

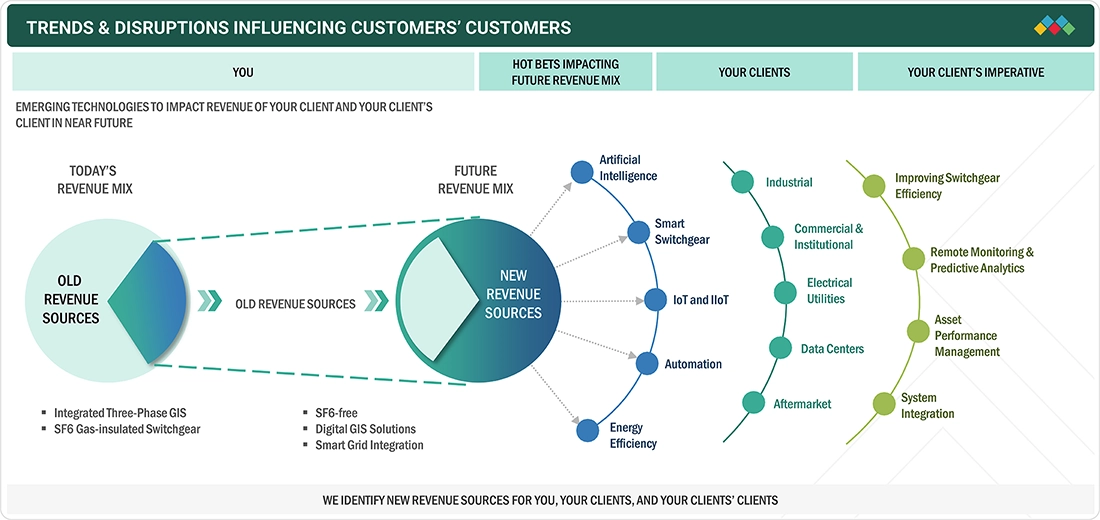

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The analysis shows a transition in the gas-insulated switchgear (GIS) market from conventional three-phase and SF6-based equipment toward digital, intelligent, and SF6-free solutions. Future revenue mix increasingly relies on new technologies such as digital GIS, smart switchgear, AI-enabled monitoring, IoT-based sensing, and automation to improve energy efficiency and reliability. These innovations create opportunities across industrial, commercial, institutional, electrical utility and data center customers, while enabling aftermarket and system integration revenues. For end users, the imperative is to enhance switchgear efficiency, enable remote monitoring and predictive analytics, and strengthen asset performance management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Adoption of SF6-free solutions

-

Transition toward renewable energy

Level

-

High procurement costs

-

Regulatory restrictions on SF6 gas emissions

Level

-

Increasing urbanization and industrialization

-

Expansion of smart grid networks

Level

-

Operational challenges associated with gas-insulated switchgear

-

Competition from unorganized sector

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Adoption of SF6-free solutions

Transition to SF6-free technology is emerging as a major impetus in the gas-insulated switchgear (GIS) market, driven by increasing regulatory pressures and growing environmental concerns associated with sulfur hexafluoride (SF6). SF6 is a potent greenhouse gas, with a global warming potential thousands of times that of carbon dioxide. High-voltage switchgear has long been used and brought environmental regulations into the spotlight. As such, there exists an urgent necessity to develop alternatives that can serve the functional operations required in GIS but with minimal negative impacts on the environment. Governments around the world are enforcing stricter regulations to have SF6 emissions curbed; hence, accelerated development and adoption of SF6-free GIS technologies. For example, the European Union set a very ambitious climate goal that required cuts in greenhouse emissions across all sectors, including energy sectors. The stringent regulatory environment is compelling utilities and industries to look for alternatives that are environmentally friendly-like dry air insulation or vacuum technology-whose environmental risks are not equivalent to SF6. In that sense, adopting alternatives would allow companies not only to fulfill regulatory requirements but also to enhance their sustainability profiles while aligning with broader corporate social responsibility goals.

Restraint: High procurement costs

One of the significant constraints limiting the growth of the GIS market is the high costs involved in acquiring such advanced systems. The upfront expenses for GIS are much higher compared to traditional air-insulated switchgear (AIS), and high costs may act as a deterrent for utilities and industries to switch to this technology, especially in areas where budgets are tight. High-cost attributes associated with GIS can be described as follows:. The manufacturing process for a GIS requires high sophisticated technology and precision in engineering, which naturally raises the production costs. Unlike AIS, construction is simpler, thus the materials used could be less expensive. But for a GIS, one needs to utilize specialized components which have to operate in a sealed environment full of insulating gas. These include circuit breakers, transformers, and other switching elements designed to withstand very high voltage operation with safety and reliability. Secondly, the materials used in GIS construction also tend to be pricey compared to those used in AIS. For example, the good metals and advanced insulation materials utilized by GIS ensure toughness and performance under various hostile conditions. Sulfur hexafluoride (SF6) gas is another example since its proper use as an insulator contributes to the total cost because of its high price and because it requires strict regulation.

Opportunity: Increasing urbanization and industrialization

Global trends in urbanization and industrialization are changing power distribution requirements, creating a demand for compact and efficient solutions such as gas-insulated switchgear (GIS). Land is scarce and expensive in urban centers; hence, technologies for electricity distribution in this area must be space-saving. GIS is smaller in footprint compared to traditional switchgear, thus ideal for cities which are relatively less spacious. Industrialization, which continues growing, only increases the demand since manufacturing facilities, refineries, and data centers all need more reliable and high-capacity power solutions. Almost 68% of the world's population is projected to reside in cities by 2050, up from 56% in 2023. Urbanization growth calls for consolidation of more power infrastructure to meet expanding residential, commercial, and public service requirements. For example, Singapore's Smart Nation initiative enables GIS deployment in urban substations, meaning the city's ever-increasing energy needs are catered for without a loss of space or efficiency. Industrialization is the same crucial factor for developing economies. Such countries as India and Indonesia already witnessed an improvement in the setting of manufacturing facilities, chemical plants, and heavy industries. The reason for its preference in such industries is the robust durability and operational efficiency at extreme conditions of GIS. For instance, the Jubail Industrial City in Saudi Arabia uses GIS in distributing energy throughout its large industrial areas; the power is delivered to crucial facilities.

Challenge:Operational challenges associated with gas-insulated switchgear

The high voltage GIS operates with many problems in its operation process and requires diligent management for optimal performance and reliability. The primary challenge is that these systems often require frequent inspections and maintenance. GIS constituents must be checked regularly for signs of wear, loose contacts, and other potential problems that may pose a danger to their functionality. This form of maintenance is crucial since any fault occurring in a GIS system leads to severe operational disruptions and safety hazards. Testing in periods such as insulation resistance testing and circuit breaker functionality assessment are performed to detect faults before they become severe. This process can take time, especially for large installations involving multiple components that require close examination. In addition, the high-voltage characteristic of GIS systems introduces characteristic challenges regarding insulation and arc interruption. Substantial electrical power is dealt with by such systems, which creates a requirement for specially designed, high-stress-resistant parts. Complexity in the design, production, and maintenance of such parts increases additional operational challenges.

GAS INSULATED SWITCHGEAR MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Schneider Electric sought to address the environmental impact of conventional gas insulated switchgear (GIS) systems that rely on sulfur hexafluoride (SF6), a potent greenhouse gas with high global warming potential. With increasing regulatory pressure and growing demand for sustainable power infrastructure, the company aimed to develop an eco-efficient GIS solution that maintains high performance, safety, and reliability while significantly reducing environmental footprint. This initiative was aligned with global decarbonization goals and utilities’ transition toward greener grid technologies. | Schneider Electric introduced SF6-free Green GIS using AirInsul, an innovative gas blend with nearly 99.9% lower global warming potential than SF6. The solution enables utilities and industrial users to meet sustainability targets without compromising insulation performance or operational reliability. Additional benefits include enhanced safety due to non-toxic and non-flammable properties, reduced leakage risk, lower maintenance requirements, and improved lifecycle environmental performance, making it a future-ready solution for sustainable power distribution. |

|

The widespread use of SF6, a potent greenhouse gas with a long atmospheric lifespan, poses significant environmental challenges, particularly in electrical networks. The push for decarbonization has highlighted the urgent need for sustainable alternatives. Recognizing this, Northern PowerGrid sought innovative solutions to reduce its carbon emissions. | In April 2022, Northern PowerGrid chose ABB's SafePlus medium-voltage switchgear, which integrates AirPlus and dry air insulation technologies with near-zero global warming potential. This switchgear is a key part of Northern PowerGrid’s broader sustainability plan to decarbonize its network by 2040, which includes modernizing over 63,000 substations and managing 96,000 kilometers of distribution network. This move aligns with its commitment to reducing carbon emissions and enhancing grid reliability by using eco-friendly alternatives to traditional SF6-insulated switchgear |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market for gas-insulated switchgear (GIS) is characterized by the presence of leading companies that are well-established, financially sound, and have excellent experience in the manufacturing of switchgear and associated parts. They have a high market share and an excellent product range. They employ high technologies and have also very extensive networks for direct sales and marketing all over the world. The key market players in this market include Eaton (Ireland), ABB (Switzerland), Siemens (Germany), Hitachi Ltd. (Japan), and Schneider Electric (France).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Gas-insulated switchgearmarket, By Installations

Gas insulated switchgear indoor segment, by installation, to grow at highest CAGR from 2024 to 2029.The most significant compound annual growth rate (CAGR) in the market for gas-insulated switchgear (GIS) from 2024 to 2029 is in the indoor category of installation. This is because urbanization and densely populated areas face a severe space constraint, thus requiring compact, reliable, and efficient power distribution systems. These include high-rise buildings, commercial complexes, and industrial facilities with underground substations where installations are impractical or impossible in the outdoors. Urbanization as well as the industrialization of emerging economies, especially in the Asia-Pacific region, further fuel this demand. Governments and utility companies opt for indoor GIS to modernize aging power infrastructure and integrate renewable energy sources. The safety features of indoor GIS are enhanced, hence have reduced chances of environmental contamination and lowered maintenance requirements due to their sealed design for critical and sensitive applications. All these result in a strong growth trajectory for the segment.

Gas-insulated switchgearmarket, By Voltage ratings

The above 220 kV voltage segment is likely to dominate the gas-insulated switchgear (GIS) market because of its critical role in high-voltage transmission networks supporting bulk power transfers across long distances. This voltage category, therefore, will be fundamental to the integration of renewable energy sources such as wind and solar farms into the power grid, which are often far from the consumption centers. The segment is driven by the increasing global focus on grid modernization to accommodate expanding electricity demand as well as deliver stability and reliability within the grid system. Governments and utilities all around the globe are investing in EHV and UHV transmission infrastructure in order to reduce losses and improve efficiency, especially in regions like Asia-Pacific and Europe wherein large-scale renewable projects are unfolding. The above-mentioned 220 kV GIS is offered with a compact design, low maintenance needs, and the ability to operate in hard environmental conditions. That is why it is widely demanded in industrial plant applications, substations, and inter-regional transmission of power. It is a combination of all these factors that has led to the segment's substantial market share.

Gas-insulated switchgearmarket, By Configuration

Hybrid segment, by configuration, to emerge as largest segment of gas insulated switchgear market. Based on the configuration, the hybrid segment is expected to dominate the market, as it can avail the best virtue of compact gas-insulated technology combined with all flexibility provided by air-insulated switchgear (AIS) toward a varied range of end-user. Hybrid GIS combines the compactness of gas-insulated technology with the flexibility of an AIS; thus, it is suitable for installations that require both space efficiency and modular adaptability. Especially with power substations, these configurations are useful at expansion, upgrade, or retrofitting stages by allowing new systems to be easily integrated into an existing set-up. Hybrid GIS also finds increased demand as the outdoor installations occur mainly in urban and semi-urban areas, having limited space but significant reliability needs. Additionally, it is an ideal choice for utilities, industrial applications, and renewable energy projects as it enhances operational efficiency, minimizes maintenance requirements, and withstands harsh environmental conditions. Continued modernization of power grids and the integration of renewable sources worldwide are forecast to further drive adoption in hybrid GIS, where the solution will be in the midst of solid market dominance.

Gas-insulated switchgearmarket, By Insulation Type

The SF6 insulation type is expected to hold the largest market share in the gas insulated switchgear (GIS) market supporting the US shore power market during the forecast period due to its proven reliability in high-voltage, high-power applications common at ports. SF6-insulated GIS offers superior dielectric strength, compact design, and high interruption capability, making it ideal for space-constrained port substations and ship-to-shore power interfaces. As US ports expand shore power capacity to serve large container and cruise vessels, utilities and port authorities continue to prefer SF6-based GIS for its long service life, low maintenance requirements, and ability to handle continuous heavy loads with high operational safety.

Gas-insulated switchgearmarket, By End User

The data centers segment, by end-user, is anticipated to grow at the highest CAGR from 2024 to 2029 on account of surging global demand for cloud computing, internet services, and digital transformation initiatives. Data centers demand reliable, efficient, and compact electrical systems that can effectively manage high energy loads to maintain continuous operation. The GIS provides outstanding performance in all such environments with compact design, high reliability, low maintenance, and enhanced safety features, making it ideal for the space-constrained and energy-intensive nature of data centers. Furthermore, investments in renewable energy powered data centers as well as a rise in hyperscale data centers augment demand for GIS, thereby fueling the segment growth at a significant rate.

REGION

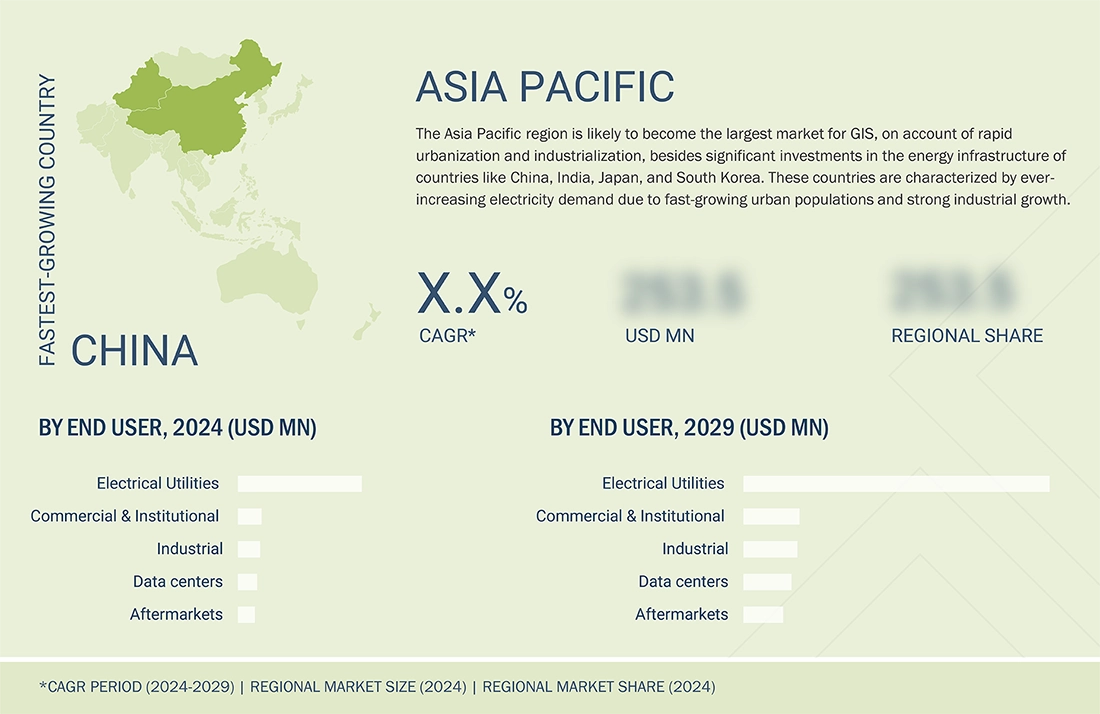

Asia Pacific is expected to dominate relay market during forecast period with highest CAGR

The Asia Pacific region would hold the largest market size during the forecast period as it would witness rapid urbanization and industrialization along with demand for reliable and efficient power distribution systems. Countries, such as China, India, and Japan, are investing significantly in transforming their aging power infrastructure and integration of renewable energy sources in the grid, creating huge demand for gas-insulated switchgear. Government policies to reduce carbon emissions and increase access for rural areas to electricity through smart grid technologies also add support to the market growth. The gas-insulated switchgear compact design, low maintenance and improved safety contribute to becoming a popular choice for densely populated urban centers and industries, which establishes the region's market leading position.

GAS INSULATED SWITCHGEAR MARKET: COMPANY EVALUATION MATRIX

Seimens, a leading provider of electrification and automation technologies and solutions is classified under the “Star” category as these players have a strong product portfolio and a wide presence and adopt effective business strategies. They lead in terms of new developments, such as product launches, innovative technologies, and adopting strategic growth plans.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- 1. ABB (Switzerland)

- 2. General Electric (US)

- 3. Siemens (Germany)

- 4. Schneider Electric (France)

- 5. Mitsubishi Electric (Japan)

- 6. Eaton Corporation (Ireland)

- 7. Hitachi Ltd. (Japan)

- 8. Hyundai Electric (South Korea)

- 9. Fuji Electric (Japan)

- 10. Toshiba energy systems & solutions corporation (Japan)

- 11. Hyosung Heavy Industries (South Korea)

- 12. ELEKTROBUDOWA SP Z.O.O. (Poland)

- 13. Yueqing Liyond Electric Co. Ltd. (China)

- 14. CG Power and Industrial Solutions (India)

- 15. Nissin Electric (Japan)

- 16. Meidensha Corporation (Japan)

- 17. Powell Industries (US)

- 18. Lucy Electric (UK)

- 19. Xian XD Switchgear Electric Co., Ltd. (China)

- 20. Sieyuan Electric Co., Ltd (China)

- 21. Switchgear Company (Belgium)

- 22. Henan Pinggao Electric Co., Ltd (China)

- 23. Chint (China)

- 24. SEL S.P.A. (Italy)

- 25. ILJIN Electric (South Korea)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 23.87 Billion |

| Market Forecast in 2029 (Value) | USD 33.53 Billion |

| Growth Rate | 6.1% |

| Years Considered | 2021–2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, Asia Pacific, North America, South America, Middle East & Africa |

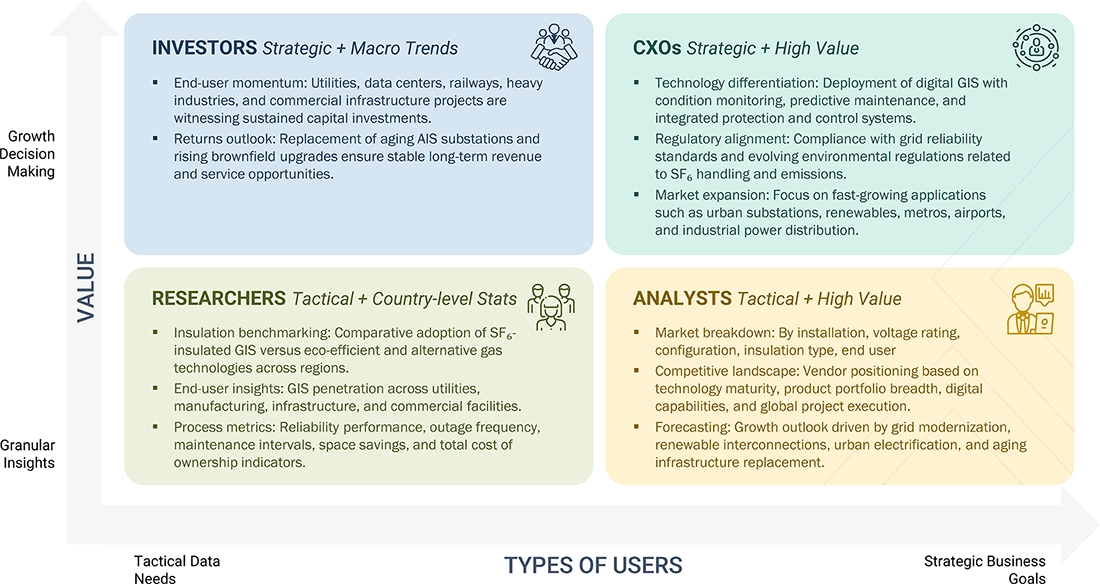

WHAT IS IN IT FOR YOU: GAS INSULATED SWITCHGEAR MARKET REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- February 2024 : ABB acquired SEAM Group, a US-based energized asset management and advisory services provider. This acquisition is intended to expand ABB’s Electrification Service portfolio, particularly in the US market. The acquisition will enable ABB to offer enhanced predictive, preventive, and corrective maintenance, electrical safety, renewables, and asset management services.

- July 2023 : Schneider Electric has started a significant project to modernize and automate Serbia’s medium-voltage (MV) electrical distribution network. This initiative aims to enhance the country's power infrastructure's reliability, efficiency, and sustainability. By integrating advanced digital technologies and automation solutions, Schneider Electric will help Serbia transition to a more resilient and intelligent grid system. This modernization effort is expected to improve operational performance, reduce downtime, and support the country’s energy transition goals.

- June 2023 : Eaton has announced the expansion of its manufacturing footprint in Puducherry, India. This move is part of the company’s broader strategy to enhance its production capabilities and meet the growing demand for its electrical solutions. The new facility will focus on producing a range of electrical products, including circuit breakers, busbars and switchgear, to support both domestic and international markets.

- March 2022 : GE Renewable Energy’s Grid Solutions introduced the world’s first 420 kV, 63 kA g3 gas-insulated substation (GIS) circuit breaker prototype. The g3 circuit breaker was demonstrated to a group of top transmission utilities from across Europe at a virtual roundtable discussion.

Table of Contents

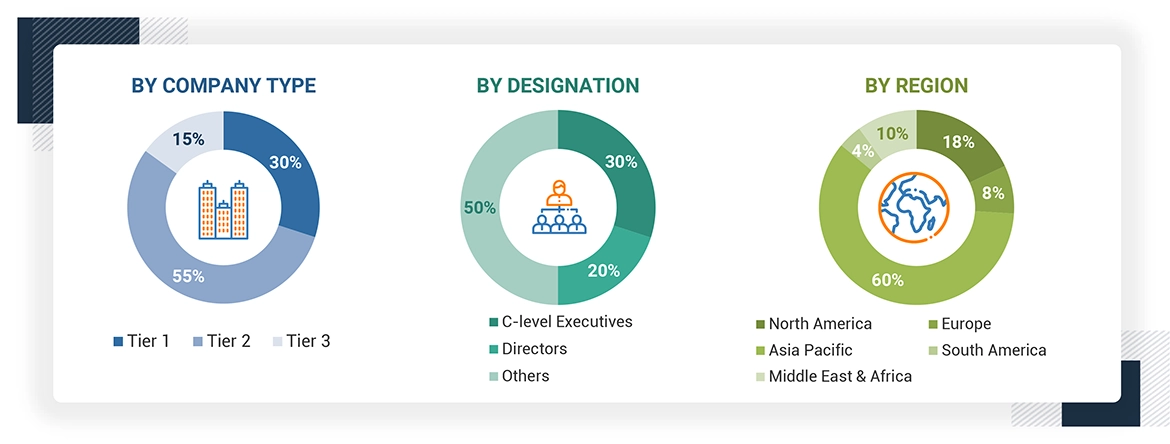

Methodology

This study included extensive work in determining the current size of the gas insulated switchgear market. It began with a detailed secondary research exercise that gathered data related to the market, comparable markets, and the overall industry. Thereafter, the findings, assumptions, and market size estimates were further validated with the help of primary research via consultative interactions with industry experts along the entire value chain. Country-specific analysis was conducted to study the total market size. Further, after this, it split down the market and cross-referenced data to estimate various sizes of segments and sub-segments in the market.

Secondary Research

An extensive amount of secondary data has been used in this research study, including directories, databases, and authentic references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, the US Department of Energy (DOE), and the International Energy Agency (IEA). These are used to gather some of the most important data concerning a detailed technical, market-oriented, and commercial analysis of the global gas insulated switchgear market. Annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles from renowned experts, information from industry associations, trade directories, and other sources of databases were additional secondary sources.

Primary Research

The scope of the gas insulated switchgear market involves a number of stakeholders, who are component manufacturers, product manufacturers/assemblers, service providers, distributors, and end-users within a supply chain. The demand for this market is driven by industrial end-users. Increasing demand from transmission as well as distribution utilities contributes to the growth of market. Supply Side: The demand for contracts from the industrial sector is significantly on the rise, and there is significant mergers and acquisitions among major players.

To get qualitative as well as quantitative insights, a number of primary sources from both supply as well as demand side of the market were consulted through interviews. The following breakup presents the primary respondents involved in the research study.

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2023: Tier 1 = > USD 1 billion, Tier 2

= From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

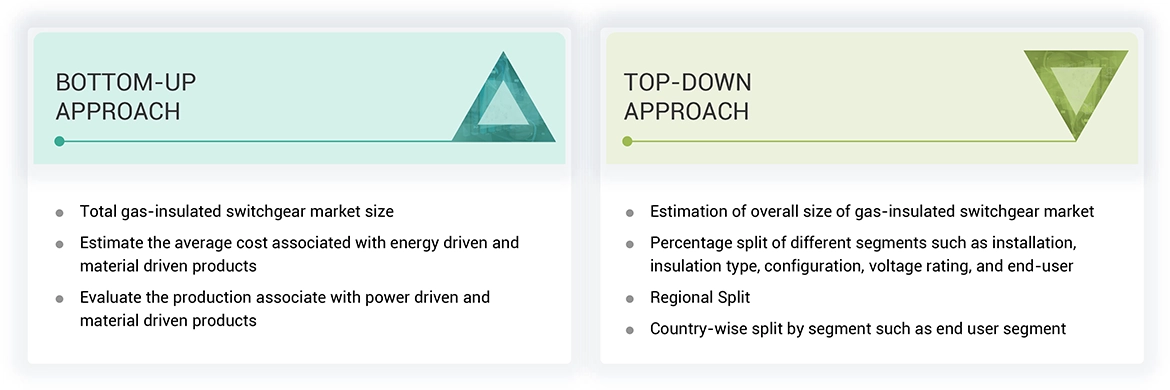

Market Size Estimation

The estimation and justification of the gas insulated switchgear market size have been conducted using a bottom-up and top-down approach. This approach was thoroughly employed to determine the dimensions of multiple segments within the market. The research process comprises the following key stages

Gas Insulated Switchgear Market : Top-Down and Bottom-Up Approach

Data Triangulation

The entire process of estimating the overall market size followed the methodologies outlined and then comprehensively divided the market into different segments and subsegments. Advanced market segmentation and data triangulation techniques have been used to derive accurate statistics for each segment and subsegment to ensure a total analytical study. Data triangulation was done by analyzing several factors and trends from the both demand and supply side viewpoints within the GIS market ecosystem, thus providing an overall and precise view of dynamics in that market.

Market Definition

Gas-insulated switchgear (GIS) is a compact and highly efficient electrical power distribution system that makes use of gas, typically sulfur hexafluoride (SF6), as the insulating medium. Unlike traditional air-insulated switchgear, GIS encases its electrical components, including circuit breakers, busbars, and disconnectors, within a sealed metal enclosure filled with pressurized insulating gas. This design imparts greater dielectric strength, enabling GIS to handle higher voltage levels while occupying much less space. GIS applications can be seen in locations where the space is confined such as urban substations, platforms located offshore, and industrial facilities. This is because it will have a very compact size, low maintenance, and with enhanced safety features such as arcing resistance. GIS systems also offer dependability and durability as well as operating efficiency under the most severe environmental conditions, including extreme temperatures and humidity. As such, gas-insulated switchgear forms the crux of current power transmission and distribution networks, serving the mounting global need for electricity in the most risk-free environmental and operational frameworks possible.

Stakeholders

- Government Utility Providers

- Independent Power Producers

- Switchgear manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Switchgear manufacturers, distributors, and suppliers

- Switchgear and circuit breaker original equipment manufacturers (OEMs)

Report Objectives

- The gas-insulated switchgear market will be defined, described, segmented, and forecasted based on installation, insulation type, voltage rating, configuration, and end-user.

- To forecast the GIS market by region, in terms of volume

- To forecast the gas-insulated switchgear market size for four key regions: North America, Europe, Asia Pacific, Middle East & Africa and South America along with their country-level market sizes, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the GIS market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall GIS market size

- To provide value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, average selling price (ASP) analysis, Porter’s five forces analysis, and regulations pertaining to the GIS market

- To analyze opportunities for stakeholders in the market and draw a competitive landscape for GIS market players

- To strategically analyze the ecosystem, regulations, patents, and trading scenarios pertaining to the GIS market

- To benchmark players within the GIS market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key GIS market players with respect to their GIS market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their GIS market rankings and core competencies2

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, partnerships, and collaborations, in the GIS market

- To study the impact of AI/Gen AI on the market under study, along with the global macroeconomic outlook

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Gas Insulated Switchgear Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Gas Insulated Switchgear Market

CHANG

Jan, 2019

How to purchase this report? for view and company development only.