Future Of E-Powertrain Market Size, Share & Analysis

Future of E-Powertrain Market by integration type (Integrated & Non-integrated), Component (Motor, Battery, BMS, Controller, PDM, Inverter/Converter, On-Board Charger), Propulsion (BEV, PHEV), Vehicle Type (PC & LCV) and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

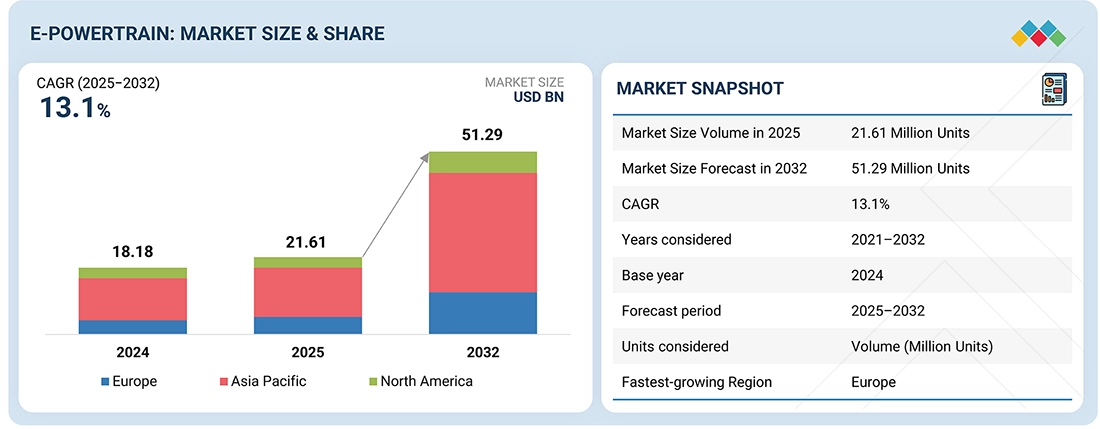

The e-powertrain market will likely grow from 21.61 million units in 2025 to 51.29 million units in 2032, at a CAGR of 13.1%. The electric powertrain industry is rapidly evolving, driven by a dual focus on efficiency and cost optimization. The adoption of multi-component e-axle systems integrating the motor, inverter, and transmission reduces complexity, weight, and manufacturing costs while improving performance. Advancements in SiC and GaN semiconductors further enhance power density and thermal efficiency, extending vehicle range. Meanwhile, oil-cooled and hairpin winding motors are improving durability and compactness, and software-defined powertrains enable continuous performance optimization through OTA updates. However, growth is challenged by the volatility and scarcity of critical materials, especially rare-earth magnets, as well as complex technical integration across diverse OEM platforms. These constraints pose risks to achieving economies of scale, slowing widespread electrification despite increasing market demand.

KEY TAKEAWAYS

-

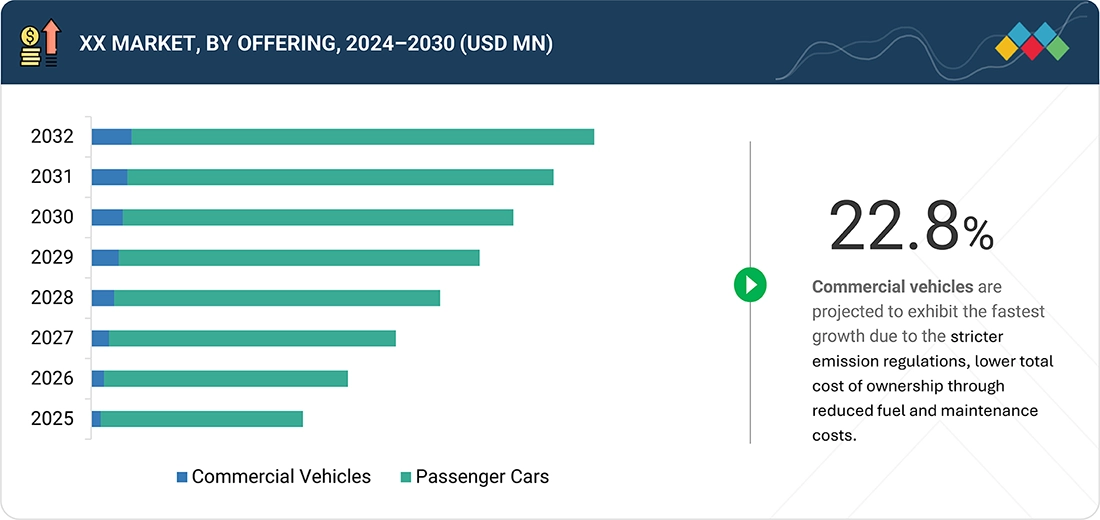

BY VEHICLE TYPEThe electric powertrain market for LCVs is expanding with rising demand from the last-mile delivery and e-commerce sectors. OEMs are improving motor efficiency and battery cost to enhance range and payload. Technologies like PMSMs and switched reluctance motors are preferred for high torque and durability. Magna, ZF, and Stellantis are leading developments, with Europe driving faster electrification than North America due to strong fleet decarbonization goals.

-

BY PROPULSIONBattery electric vehicles (BEVs) dominate the global electric powertrain market, driven by advancements in efficiency, integration, and performance. Growing EV adoption, especially in China, India, Europe, and North America, along with OEM–Tier I collaborations for modular, high-efficiency ePowertrains, is accelerating market growth.

-

BY INTEGRATION TYPEIntegrated powertrain systems lead the global market and are set for the fastest growth through 2032, driven by efficiency and cost benefits from component integration. While 2-in-1 and 3-in-1 systems dominate today, OEMs are advancing to 4-in-1 and 5-in-1 architectures that integrate thermal and charging systems for greater optimization. Next-gen 8-in-1 designs from BYD, Dongfeng Nammi, and JAC are expected to redefine EV powertrain efficiency beyond 2028.

-

BY COMPONENTInverters dominate the e-powertrain market due to their role in converting DC to AC for EV motors. Advancements in SiC- and GaN-based inverters, along with integrated inverter-charger designs, are boosting efficiency, power density, and compactness. The growing adoption of 800V systems and bidirectional charging is further driving innovation and demand.

-

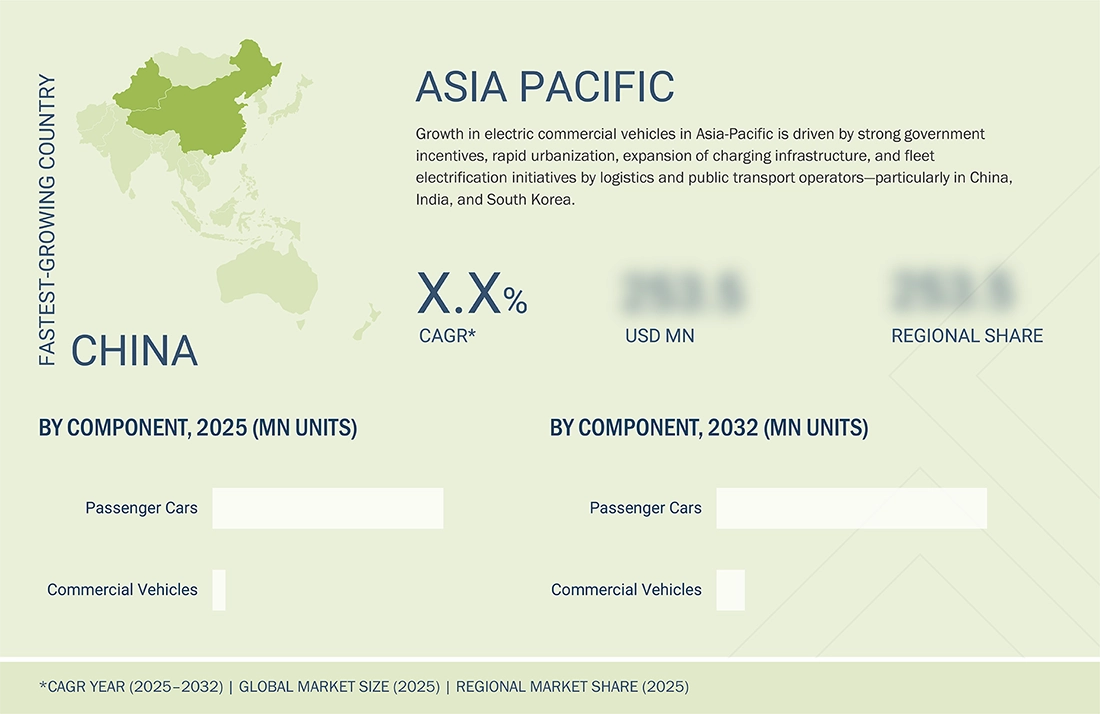

BY REGIONThe Asia Pacific region, led by China, India, Japan, and South Korea, dominates the e-powertrain market, driven by strong EV adoption policies, local manufacturing, and rapid infrastructure growth. China’s OEMs like BYD, Geely, and BAIC lead production, supported by suppliers such as Nidec, DENSO, and Hyundai Mobis. Government incentives, emission reduction goals, and advancing local supply chains are accelerating regional electrification and positioning the Asia Pacific as the global hub for electric powertrains.

-

COMPETITIVE LANDSCAPEKey players such as Robert Bosch GmbH (Germany), Magna International Inc. (Canada), Vitesco Technologies GmbH (Germany), Dana Limited (US), and Valeo (Germany) are driving advancements in the electric powertrain market through innovations in integrated drive systems, high-efficiency motors, inverters with SiC/GaN semiconductors, and advanced thermal management solutions. Their strategies focus on developing modular and scalable ePowertrain platforms, enhancing energy efficiency and power density, and supporting next-generation 800V architectures. These companies are expanding through strategic collaborations, OEM partnerships, R&D investments, and local manufacturing initiatives, aiming to deliver cost-effective, compact, and high-performance powertrain systems for the growing global EV ecosystem.

The electric powertrain market is driven by growing demand for electric vehicles. The need for extended range, & faster charging is leading to technological developments in the electric powertrain industry. Companies are working towards integrating electric powertrain components as these systems in electric powertrains can help OEMs reduce costs by integrating components like motors and thermal management into a single unit, thereby cutting material, assembly, and R&D expenses

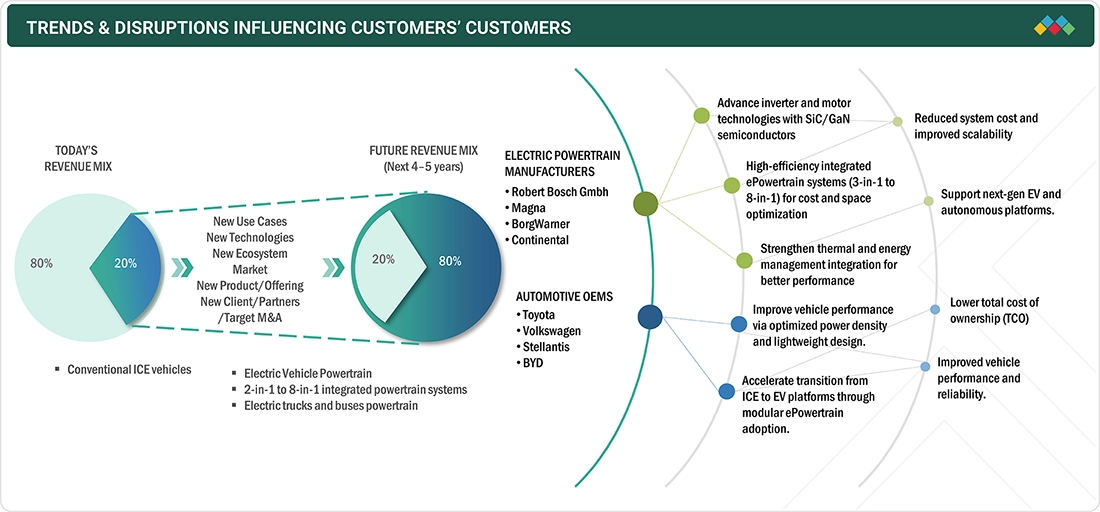

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Rapid electrification and advancements in e-mobility are reshaping the future of the electric powertrain market. Growing demand for higher efficiency, compact design, and cost-optimized integrated systems is driving OEMs and Tier-I suppliers toward 3-in-1 to 8-in-1 architectures that combine the motor, inverter, and transmission. The adoption of SiC and GaN semiconductors, enhanced thermal management, and high-voltage (800V) platforms are improving performance, range, and energy efficiency. These trends are redefining the value chain—from component manufacturers to system integrators, creating opportunities for innovation in modular, software-defined, and sustainable ePowertrain solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing vehicle electrification in the automobile industry

Level

-

Lack of infrastructure for charging Evs

Level

-

Development of lithium-ion battery technologies

Level

-

High cost of electric components

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing vehicle electrification in the automobile industry

Government incentives, expanding charging infrastructure, and rising electrification are accelerating the shift toward advanced electric powertrains. The market is moving rapidly toward 800V architectures, dual-motor configurations, and integrated powertrain systems for higher efficiency and faster charging. Permanent Magnet Synchronous Motors (PMSMs) and axial flux motors are gaining traction for their superior torque density and compact design, while advancements in solid-state and high-energy-density batteries are further enhancing performance and sustainability.

Restraint: Lack of infrastructure for charging Evs

Limited and unevenly distributed charging infrastructure remains a key restraint to EV adoption, particularly outside urban areas. Insufficient public chargers force many users to rely on costly home solutions, hindering the large-scale transition to EVs. Until widespread, accessible fast-charging networks are established, the growth of the electric powertrain market will remain constrained.

Opportunity: Development of lithium-ion battery technologies

Advancements in battery chemistry present major opportunities for the EV market, with a shift toward lithium metal, silicon anode, and solid-state technologies that offer higher energy density, faster charging, and improved safety. Sodium-ion and LFP batteries are also gaining traction due to lower cost and material abundance. Industry players like CATL, LG Energy Solution, Samsung SDI, and Panasonic are accelerating R&D and partnerships to commercialize next-gen battery architectures such as cell-to-pack and cell-to-chassis, enhancing range and reducing costs.

Challenge: High cost of electric components

High production costs remain a major challenge for the EV powertrain market, with battery packs alone accounting for about 40% of total vehicle cost. Expensive power electronics, electric motors, and converters further add to the burden. Factors such as raw material prices (silicon, copper, rare metals), complex manufacturing, and safety testing continue to elevate electronic component costs, limiting affordability and slowing broader EV adoption.

Future of E-Powertrain Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develop and supply high-efficiency e-motors, inverters, and control units with advanced materials and integrated cooling solutions for EV platforms. | Improve energy efficiency, enhance power density, and reduce system weight for extended range and performance. |

|

Design and manufacture advanced battery systems, including thermal management units, BMS, and high-voltage connectors tailored for integrated powertrains. | Enhance battery safety, lifespan, and efficiency while supporting faster charging and optimized vehicle packaging. |

|

Integrate modular and scalable e-powertrain systems (e-axles, integrated drive units) across passenger and commercial vehicle portfolios. | Enable higher production flexibility, reduced manufacturing costs, and improved vehicle performance and range. |

|

Supply complete e-drive systems and retrofit solutions for electric and hybrid vehicles, including 3-in-1 or 5-in-1 integrated configurations. | Simplify powertrain architecture, lower costs, and accelerate electrification through efficient, compact system integration. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem mapping highlights various players in the electric powertrain market, mainly including electric powertrain motor components manufacturers, electric powertrain battery components providers, automotive OEMs, and electric powertrain providers. The leading players in the Future of E-Powertrain market are Robert Bosch GmbH (Germany), Magna International Inc. (Canada), Vitesco Technologies GmbH (Germany), Dana Limited (US), Valeo (Germany), among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

E-powertrain Market, By propulsion

Battery electric vehicles (BEVs) dominate the electric powertrain market, driven by rapid technology integration and performance optimization. China and India focus on mid-range models, while Europe and North America lead in premium EVs. Advancements such as 6-phase motors, 3-in-1 and multi-in-1 drive systems, and SiC MOSFET inverters (≈94% efficiency) are enhancing range, efficiency, and power density. OEMs like Tesla and major Tier-I suppliers are collaborating on lightweight, high-efficiency powertrains, accelerating the shift toward next-generation EV architectures.

E-powertrain Market, By vehicle type

The electric powertrain market for light commercial vehicles (LCVs), including pickups, vans, and small trucks, is expanding steadily, driven by demand from last-mile delivery, logistics, and e-commerce sectors. OEMs are optimizing motor efficiency and battery cost to improve range and payload performance. Technologies such as PMSMs, asynchronous, and switched reluctance motors are gaining adoption for their balance of torque and efficiency under heavy loads. Leading players like Magna, ZF, and Stellantis are advancing eLCV platforms; for example, Magna’s eBeam delivers a lightweight, high-torque rear axle system that enhances towing and payload without performance loss. While North America dominates in conventional LCV sales, Europe leads in electrification, with growing fleet decarbonization goals accelerating demand for advanced electric powertrain solutions.

E-powertrain Market, By Integration Type

Integrated powertrain systems hold the largest global market share and are expected to grow at the fastest CAGR through 2032. These systems combine the motor, inverter, and gearbox into a single unit, reducing components, cabling, and energy consumption while improving overall efficiency. Currently, 2-in-1 and 3-in-1 systems dominate the market, but OEMs are increasingly adopting advanced 4-in-1 and 5-in-1 configurations integrating thermal management and charging components for higher cost and space savings. Nissan’s 5-in-1 modular system targets a 30% reduction in development costs. Emerging 8-in-1 and higher configurations by BYD, Dongfeng Nammi, and JAC are expected to gain traction post-2028, driving the next phase of EV powertrain innovation.

REGION

Asia Pacific is expected to be the largest region in the future of the e-powertrain market during the forecast period.

The Asia-Pacific region leads global EV production and sales, driven by strong government policies and rapid infrastructure growth. China dominates with over 90% market share, supported by goals for 45% ZEV sales by 2027 and over 5 million public chargers by 2024. India targets 30% EV adoption by 2030 and has surpassed 12,000 charging stations. Compact and mid-size EVs remain dominant, but demand for higher-capacity models (70 kWh+) is rising in China and South Korea. The region is transitioning toward 800V architectures, advanced power electronics, and integrated ePowertrains combining motor, inverter, and transmission for efficiency and cost savings. OEMs such as BYD, Hyundai, and Toyota are leading in integrated systems, while key suppliers like Bosch, Magna, Vitesco, and Dana are expanding regional capabilities to support next-gen ePowertrain development.

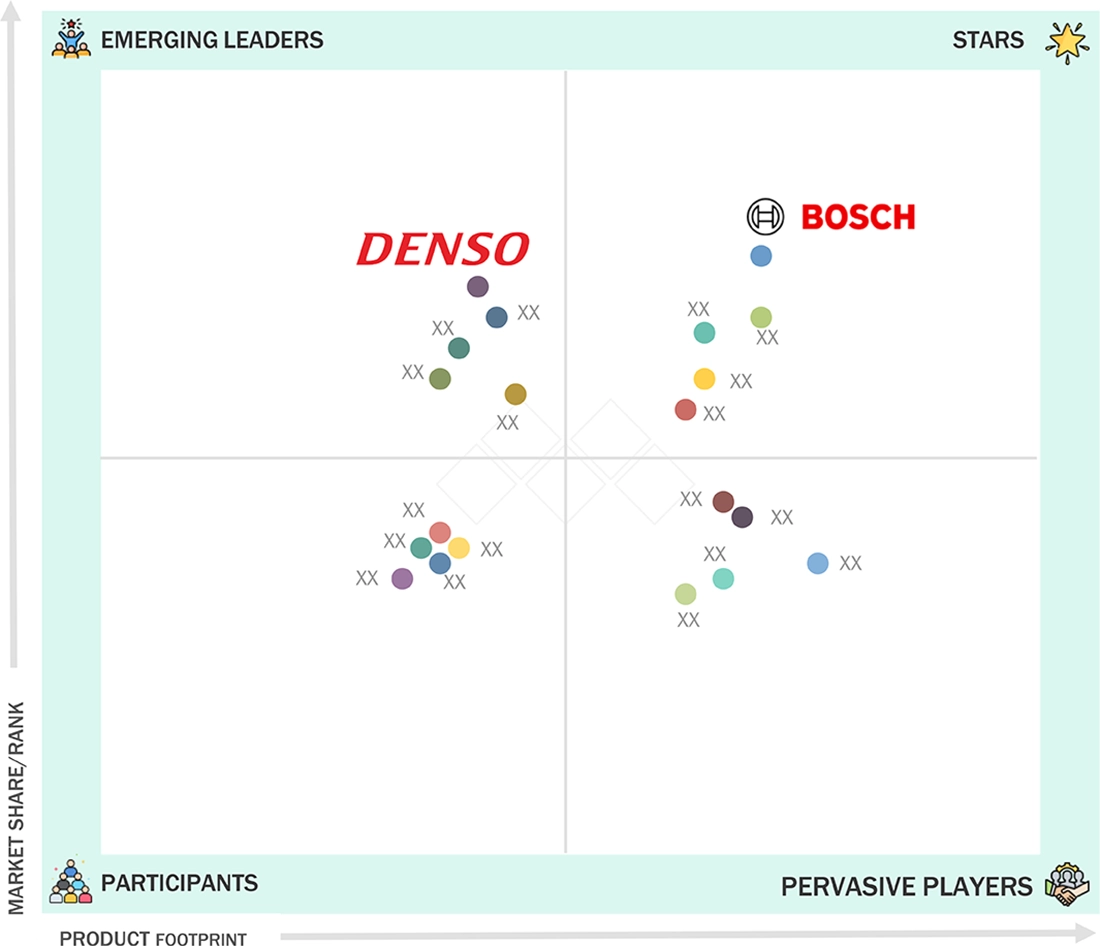

Future of E-Powertrain Market: COMPANY EVALUATION MATRIX

In the Future of E-Powertrain market matrix, Bosch (Germany) (Star) leads with a robust global presence and a diversified portfolio covering motors, inverters, e-axles, and integrated powertrain systems. The company’s focus on SiC-based inverters, high-efficiency eDrive modules, and scalable 400V–800V architectures positions it at the forefront of next-generation EV powertrains. DENSO (Japan) (Emerging Leader) is rapidly expanding its footprint with strong capabilities in thermal management and inverter technologies. The company is leveraging its expertise in semiconductor integration and compact eAxle systems to enhance performance, improve efficiency, and support broader electrification across hybrid and battery-electric platforms.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | 21.67 Million Units |

| Market Size Forecast in 2032 | 51.29 Million Units |

| Growth Rate | CAGR of 13.1% from 2025 to 2032 |

| Actual data | 2021-2032 |

| Base year | 2024 |

| Forecast period | 2025-2032 |

| Units considered | Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • By Vehicle Type- Passenger Car & Light Commercial Vehicle • By Propulsion – BEV & PHEV • By Integration Type (Integrated & Non-Integrated) |

| Regional Scope | Asia Pacific, Europe, North America |

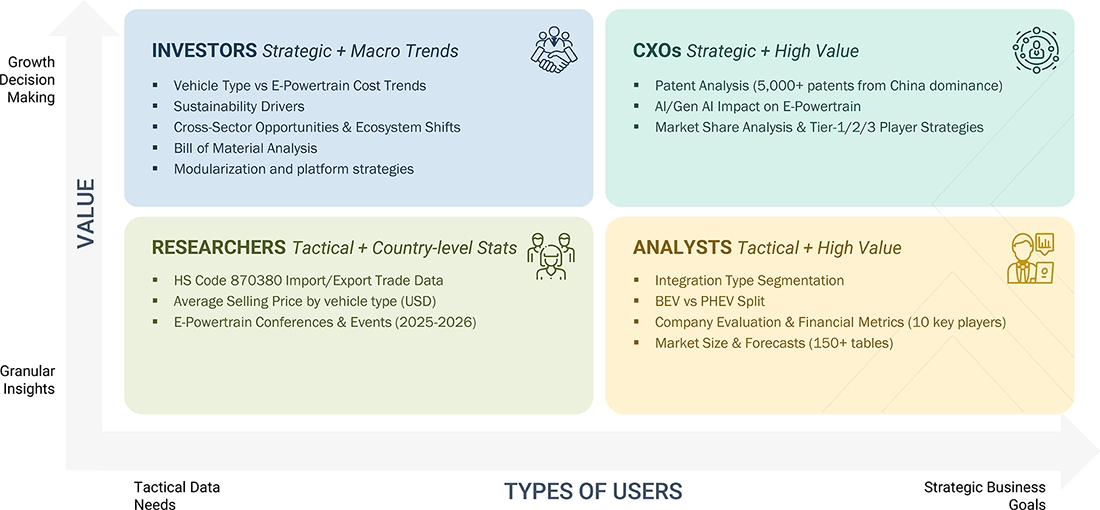

WHAT IS IN IT FOR YOU: Future of E-Powertrain Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based EV OEMs & Tier-I Suppliers | Benchmarking of advanced e-powertrain systems, including 3-in-1 and 5-in-1 integrated architectures (motor, inverter, transmission). | Identification of efficiency improvements through integrated e-axles, lightweight design, and optimized torque management. |

| Global OEMs targeting premium EVs & SUVs | ||

| OEMs expanding EV lineups & regional production |

RECENT DEVELOPMENTS

- July 2025 : ZF unveiled its new Select Modular ePowertrain System, integrating electric motors, inverters, converters, transmission, and control software into a flexible, interchangeable platform. The system features a magnet-free I2SM motor, which is 5 kg lighter and delivers up to 300 kW and 4,057 lb-ft of torque, reducing energy losses by over 25% at motorway speeds. Additionally, ZF’s new TherMaS heat management system compact propane-based heat pump, enhances thermal efficiency and can improve winter driving range by up to 30%.

- April 2025 : BorgWarner is expanding its electric drive motor portfolio with advanced technologies such as Hairpin and S-winding designs to boost efficiency and power density in electric and hybrid vehicles. The company's modular Integrated Drive Modules (iDMs) are available for various voltage systems and vehicle classes, supporting PMSM, IM, and EESM configurations, and cover outputs up to 350 kW. Flexible gearbox layouts and innovative cooling help customize solutions for both compact and high-performance applications

- June 2024 : Valeo partnered with Dassault Systèmes to accelerate its R&D digitalization by deploying the 3DEXPERIENCE platform to over 15,000 users. This platform will optimize the development of electrified, autonomous, and software-driven mobility solutions, enhance innovation, and reduce R&D expenses

- May 2024 : Mitsubishi Electric, Mitsubishi Electric Mobility, and AISIN agreed to form a joint venture to develop and sell traction motors, inverters, and control software for next-generation electric vehicles (EVs). Mitsubishi Electric Group will hold a 66% stake, while AISIN will have 34%. The venture aims to support global carbon neutrality and meet the growing demand for EV electrification systems.

Table of Contents

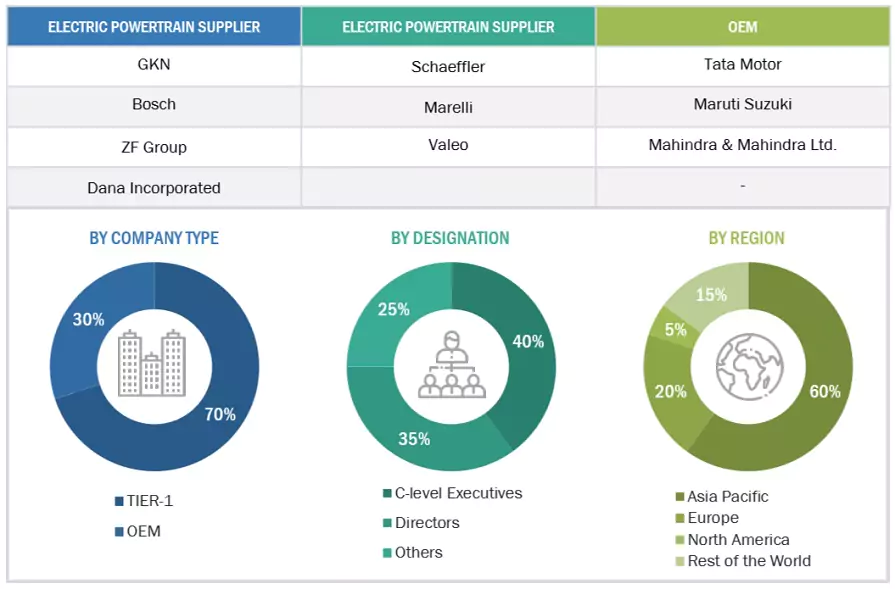

Methodology

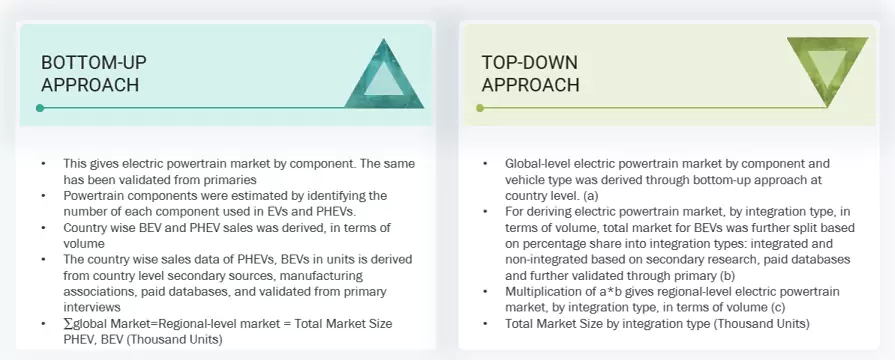

The study involved analyzing the recent developments, trends, and performance of the players and the electric powertrain market in 2024, along with the projections for 2032. The analysis was based on the sales volume of the EVs around the world. The study also analyzes the primary targets for EVs, market adoption, advancement in powertrain technologies, and government electrification goals—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts. The bottom-up and top-down approaches were employed to estimate the market size in EV sales for the segments considered.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications such as National Highway Traffic Safety Administration (NHTSA), European Automobile Manufacturers’ Association (ACEA), California Department of Motor Vehicles, White papers published by various industry experts, Corporate filings (such as annual reports, investor presentations, and financial statements), Trade, business, and related associations, International Organization for Standardization (ISO), articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles are used to identify and collect information useful for an extensive commercial study of the global electric powertrain market.

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the electric powertrain market. Country-wise BEV and PHEV sales were derived from various secondary sources, such as country-wise manufacturing associations and paid databases.

The market for BEVs and PHEVs was forecasted based on factors such as government and OEM targets, emission regulations, investments by OEMs & Tier-1 companies is taken into consideration which is further validated through primary research.

Once the base numbers were projected, the powertrain components were estimated by identifying the number of each element used in EVs and PHEVs. This gives the volume of the electric powertrain market by component.

The integrated vs. non-integrated system market was forecasted based on secondary sources like country-wise manufacturing associations, paid databases, etc., further validated through primary research. Factors considered for the forecast of this market include companies’ investment in weight and cost reduction, increasing investments towards electric powertrain, the adoption rate of integrated systems, overall supply chain readiness for integrated components, government’s support for e-powertrain (Subsidies and incentives for electric powertrain), future integrated powertrain launch announcements, etc.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Future of E-Powertrain Market : Top-Down and Bottom-Up Approach

Market Definition

BEV Powertrain: A battery electric vehicle (BEV) powertrain is used in EVs that rely solely on electricity for propulsion. Unlike hybrid cars, BEVs do not have an internal combustion engine and operate entirely on electric power stored in a high-voltage battery pack. The components of a BEV powertrain include electric motors/generators, batteries, battery management systems, on-board chargers, inverters, and power distribution modules.

PHEV Powertrain: A plug-in hybrid electric vehicle (PHEV) powertrain combines an internal combustion engine (ICE) with an electric motor and a battery pack. PHEVs are designed to operate in electric and hybrid models, offering the flexibility of driving on electric power alone or using the internal combustion engine for an extended range. The main components of a PHEV powertrain include motors/generators, batteries, battery management systems, control units, inverters, power distribution modules, and onboard chargers. While PHEV powertrain components share similarities with HEV powertrain components, the larger battery pack, charging capabilities, and extended electric-only range are the key differentiating factors that enable PHEVs to offer a more excellent electric driving experience.

Stakeholders

- Automobile Organizations/Associations

- Electric powertrain manufacturers and suppliers

- Regional manufacturing associations and automobile associations

- Automotive OEMs and electric vehicle manufacturers

- Component suppliers for electric powertrains

- Regional emission standard regulatory authorities

- Research Professionals

Report Objectives

- To analyze the electric powertrain market performance till 2032

- To provide critical developments expected to take place till 2030 and beyond.

- Identify the technological trends likely to impact the market during the forecast period.

- To identify significant growth segments and growth opportunities till 2032.

- To project the electric powertrain sales from 2024 to 2032

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Future of E-Powertrain Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Future of E-Powertrain Market