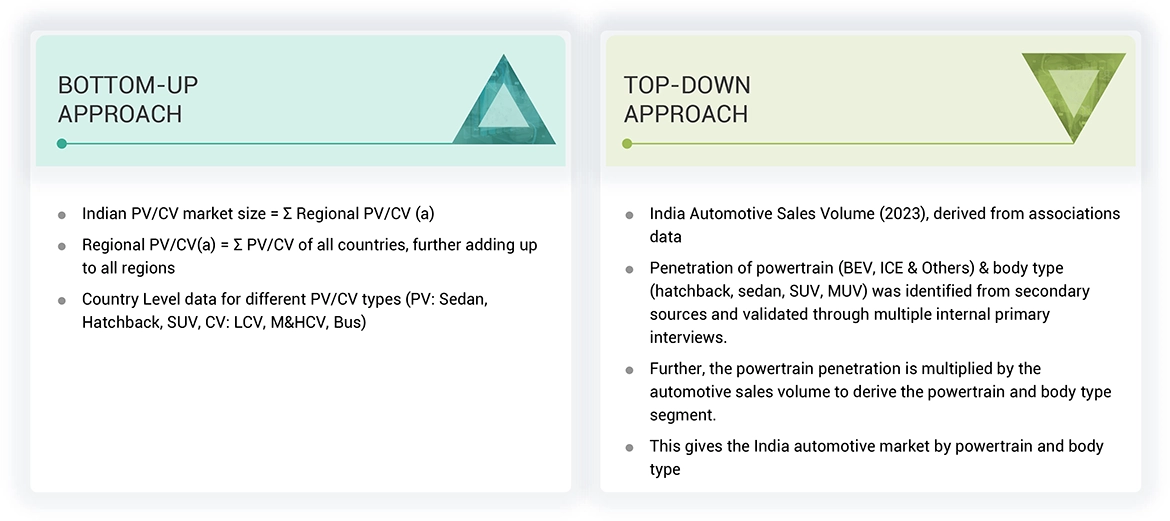

The India Automotive Market study involved analyzing the recent developments, trends, and performance of the players in the Indian automobile industry in 2023, along with the projections for 2030. The analysis was based on the sales volume of passenger, commercial, 3W, and 2W in India. The study also analyzes the major milestones in the automotive industry across vehicle connectivity, electrification, used car sales, and other critical aspects in 2023—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the complete market size regarding vehicle sales for the segments considered. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred for this research study include automotive OEMs, Tier I/II companies, and publications from government sources, automotive associations & databases [such as country-level automotive associations and organizations, Society of Indian Automotive Manufacturers (SIAM), Federation of Automotive Dealer Associations (FADA), Ministry of Road, Transports and Highway of India, International Energy Agency (IEA), Organization Internationale des Constructeurs d’Automobiles (OICA), European Automobile Manufacturers Association (ACEA), MarkLines and others]; corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to determine the overall sales volume, further validated through primary research.

Primary Research

Extensive primary research was conducted after understanding the India Automotive Market through secondary research. Primary research was done to understand and validate the findings on the automotive industry's performance in 2023 and validate the projections made for 2030.

Several primary interviews have been conducted with market experts from both the demand (OEMs/vehicle manufacturers) side. Approximately 80% of the experts involved in primary interviews have been from the demand side, and 20% have been from the industry's supply side. Primary data has been collected through questionnaires, emails, and telephonic interviews. Several primary interviews have been conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions have been conducted with experienced independent consultants to reinforce the findings from the primary interviews. This, along with the opinions of the in-house subject matter experts, has led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the Indian passenger vehicle sales volume by body type and powertrain. This approach was also used to identify the sales of various subsegments in the market. The research methodology used to estimate the market includes the following:

India Automotive Market : Top-Down and Bottom-Up Approach

Market Definition

The India Automotive Market 2030 includes an analysis of the key trends to impact the Indian automotive industry in 2030. The trends include electrification, rise in SUVs and E-SUVs sales, an increase in used car sales, India as Chauffeur capital of world, and others. The report also focuses on the developments in the automotive industry in 2024.

Stakeholders

-

Automobile Organizations/Associations

-

Automotive OEMs

-

Automotive System Manufacturers

-

Automotive Electronics Manufacturers

-

Automotive Technology Providers

-

Aftermarket Players

-

Country-specific Automotive Associations

-

Society of Indian Automotive Manufacturers (SIAM),

-

EV Component Manufacturers

-

EV Charging Infrastructure Companies

-

Authorized/Independent Aftermarket Players

-

Automotive TechGovernment & Research Organizations

-

Raw Material Suppliers for the Automotive Industry

-

Software Providers

-

Traders, Distributors, and Suppliers of Automotive Components

Report Objectives

-

To analyze the passenger vehicle, CV, 2W, 3W market performance in 2023-2030

-

To provide key developments achieved in 2023.

-

To identify the trends that are likely to impact the market in 2030.

-

To identify major growth segments and opportunities for 2030.

-

To project and forecast the light vehicle sales from 2024-2030

-

To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants.

Growth opportunities and latent adjacency in India Automotive Market