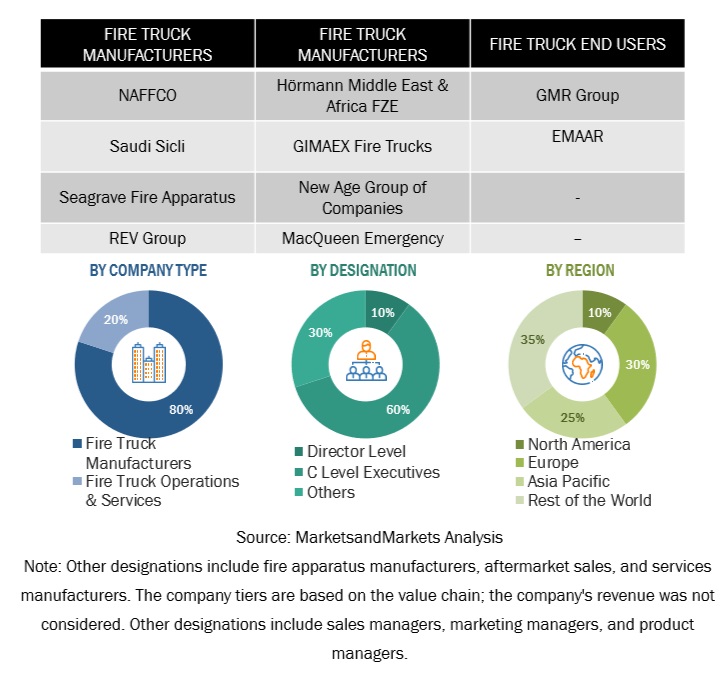

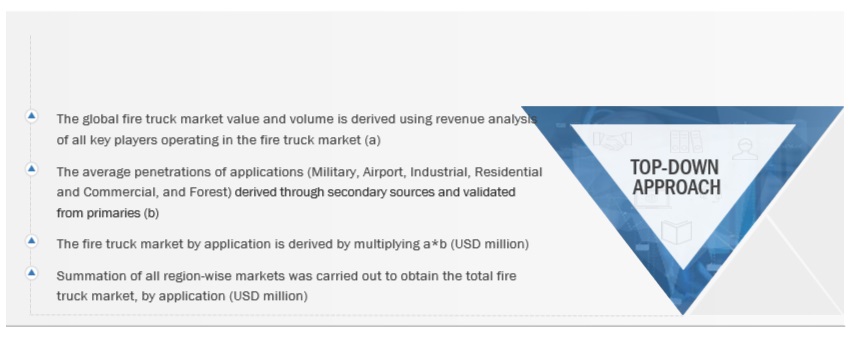

Various secondary sources, directories, and databases have been used to identify and collect information for an extensive fire truck market study. The study involved four main activities in estimating the current size of the fire truck market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as the number of fire trucks sold globally, upcoming technologies, capacity trucks, and electric powertrain development in fire trucks. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources, such as company annual reports, presentations, and press releases; associations, such as Fire Apparatus Manufacturers' Association (FAMA), National Fire Protection Association (NFPA), Committee of European Fire Equipment and Services Manufacturers (CEFE), European Fire Services (EFS), The European Committee of the Manufacturers of Fire Protection Equipment and Fire Fighting Vehicles (EUROFEU), Asian Firefighting and Rescue Association (AFRA), The Institution of Fire Engineers Asia (IFE Asia), Vahan, and National Institute of Statistics and Censuses (INDEC). Secondary research was used to obtain critical information about the industry's value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the OEM side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various companies.

After the complete market engineering, which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation, extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been undertaken to identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Extensive qualitative and quantitative analysis has been performed on the complete market engineering process to list key information/insights throughout the report.

After interacting with industry experts, the team also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter expert's opinions have led us to the conclusions described in this report's remainder.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

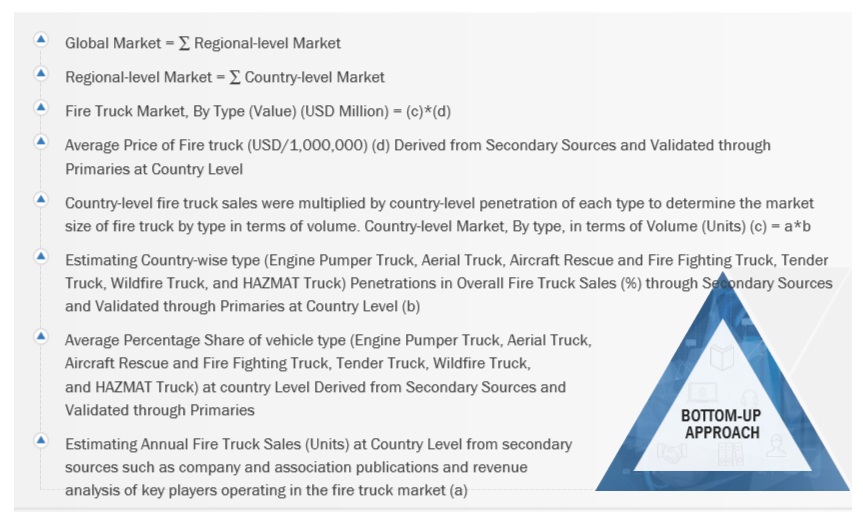

The bottom-up approach was used to estimate and validate the size of the fire truck market by type (aerial fire truck, engine pumper truck, aircraft rescue and firefighting truck, tender truck and HAZMAT truck). The market size by volume, was derived by identifying the country level equipment type sales that were derived through detailed model mapping at the country level as well as company publications (investor presentations, annual reports etc.). The sales volume and percentage share of each type was then verified with the primary respondents. Country-level fire truck sales were multiplied by country-level penetration of each type to determine the market size of fire truck by type in terms of volume. In terms of volume, the country-level fire truck market size of each type was added to derive the regional market. All the regional markets were further added to derive type from the global fire truck market. The country-level fire truck market was then multiplied by the country-level average selling price of fire truck by each type, which resulted in country-level market size. The addition of respective countries gives the regional-level market, and then the summation of regional-level markets gives the global fire truck market by type in terms of value.

The forecast of the country wise fire trucks is based on multiple factors such as OEM’s investments, new product launches, government support and regulations towards number monitoring fire stations and fire trucks, technological landscape, economic conditions, infrastructure development, increase in number of airports, and growth in population

Fire Truck Market size: Bottom-up approach (regional and vehicle type)

To know about the assumptions considered for the study, Request for Free Sample Report

Fire Truck Market SIZE: TOP-DOWN APPROACH (application)

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed input and analysis and presented in the report. The following figure illustrates this study's overall market size estimation process.

Market Definition

Definition: A car which has been built for combating fires is known as fire truck, sometimes referred to as a fire engine. When there's a fire or other emergency, it usually arrives first and transports firefighters and equipment to the scene. These fire trucks that used to put out the fires and conduct rescue operations are outfitted with water tanks, pumps, hoses, ladders, and other essential tools and equipment. These are a vital aspect of a fire department's apparatus, offering the manpower and resources required to adequately respond to and contain fire-related incidents in a community.

Fire trucks come in various types, each designed to serve a specific purpose in firefighting and emergency response. The most common types of fire trucks include engine/pumper trucks, which carry water and pump it at high pressure to extinguish fires; Aerial trucks/ladder trucks, which have an aerial ladder or platform to access elevated areas; and rescue trucks, which are equipped with specialized tools and equipment for technical rescue operations, such as vehicle extrication, confined space rescue, and hazardous materials response. Additionally, there are specialized fire trucks like tanker trucks, which carry large volumes of water to supplement the water supply at the scene, and wildfire trucks, designed for off-road firefighting in rural and forested areas. Each type of fire truck plays a crucial role in a fire department's overall firefighting and emergency response capabilities, ensuring they can effectively address various incidents and emergencies within their community.

Stakeholders

-

Fire truck Manufacturers (OEMs)

-

Firefighting equipment suppliers

-

Battery, Motor, and Drivetrain Suppliers for Electric Fire trucks

-

Other Component Suppliers for Fire trucks

-

Government and Regulatory Authorities

-

Fire Truck Dealers and Distributors

-

Fire Truck Component Manufacturing Associations

-

Traders, Distributors, and Suppliers of Fire truck Systems/Components

-

Automotive Industry Associations, Government Authorities, and Research Organizations

Report Objectives

-

To define, describe, and forecast the size of the fire truck market, in terms of value (USD million) and volume (Units) based on:

-

To segment and forecast the market in terms of value and volume based on

-

By Type (Engine Pumper Truck, Aerial truck, Aircraft Rescue and Firefighting Truck, Tender Truck, Wildfire Truck, and HAZMAT truck)

-

Propulsion (Electric and ICE) at the regional as well as country level

-

Application (Military, Airport, Industrial, Residential & Commercial, and Forest) at the regional level

-

Capacity (<500 gallons, 501 – 1,000 gallons, 1,001 – 2,000 gallons, and >2,000 gallons) at the regional level

-

Region (Asia Pacific, Europe, North America, Rest of the World)

-

To understand the market dynamics (Drivers, Restraints, Opportunities, and Challenges) and conduct Patent Analysis, Pricing Analysis, Recession Impact, Key Buying Criteria, Trade Analysis, OEM analysis, Technology Analysis, ASP Analysis, Trades and Conferences, Case Study Analysis, Supply Chain Analysis, Regulatory Analysis, critical conference and events, and Ecosystem Mapping

-

To understand the dynamics of the market players and distinguish them into stars, emerging leaders, pervasive players, and participants according to their product portfolio strength and business strategies.

-

To strategically analyze markets concerning individual growth trends, prospects, and contributions to the total market

-

To analyze recent developments, such as partnerships, supply agreements, joint ventures/mergers and acquisitions, geographic expansions, and product developments of key players in the market

AVAILABLE CUSTOMIZATIONS

FIRE TRUCK MARKET BY TYPE

-

Rescue Fire Trucks

-

Light Rescue Trucks

FIRE TRUCK MARKET, BY COUNTRY

-

South Korea

-

brazil

-

Thailand

-

Russia

ELECTRIC FIRE TRUCK MARKET, BY BATTERY CAPACITY

-

<50 kWh

-

50 – 200 kWh

-

100 – 500 kWh

-

>500 kWh

Detailed analysis and profiling of additional market players (UP TO 3)

Growth opportunities and latent adjacency in Fire Truck Market