Feed Phosphates Market

Feed Phosphates Market by Type (Dicalcium, Monocalcium, Mono-dicalcium, Defluorinated, and Tricalcium), Livestock (Ruminants, Swine, Poultry, and Aquatic), Form (Powder and Granule), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

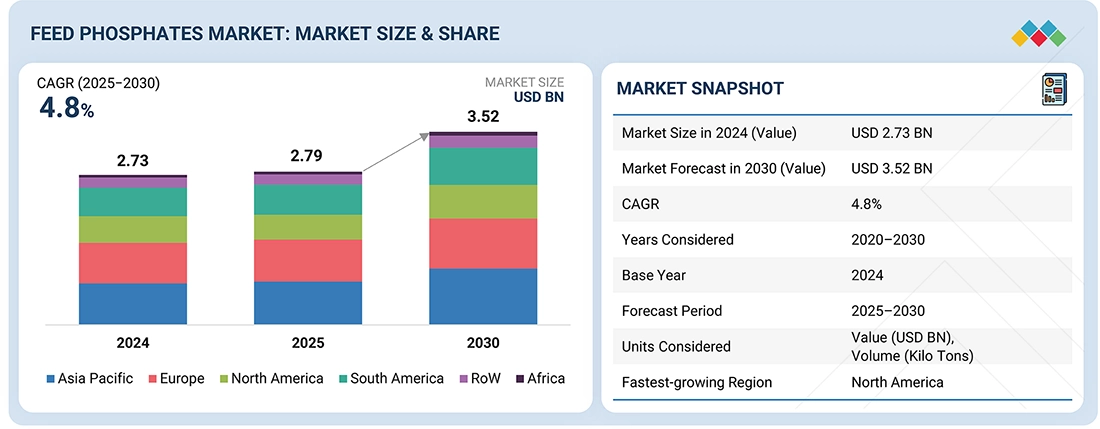

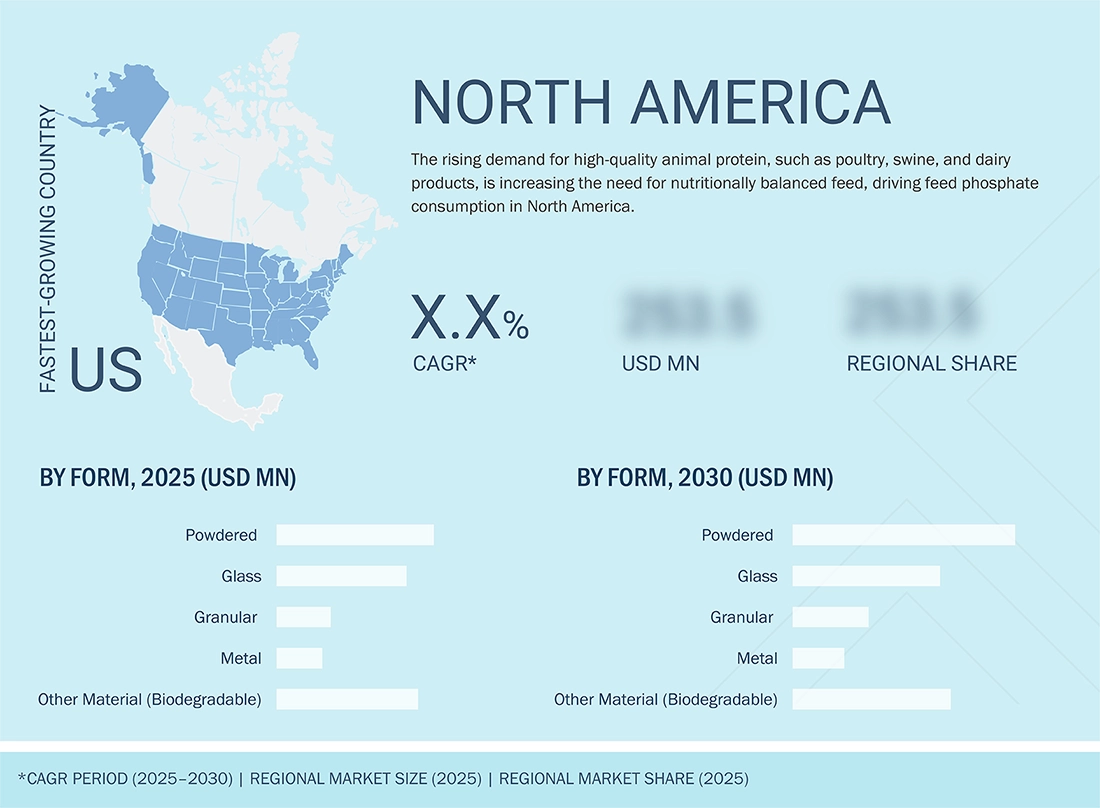

The feed phosphates market is projected to reach USD 3.52 billion by 2030 from USD 2.79 billion in 2025, at a CAGR of 4.8% from 2025 to 2030. The rising demand for high-quality animal protein, such as poultry, swine, and dairy products, is increasing the need for nutritionally balanced feed, driving feed phosphate consumption in North America.

KEY TAKEAWAYS

-

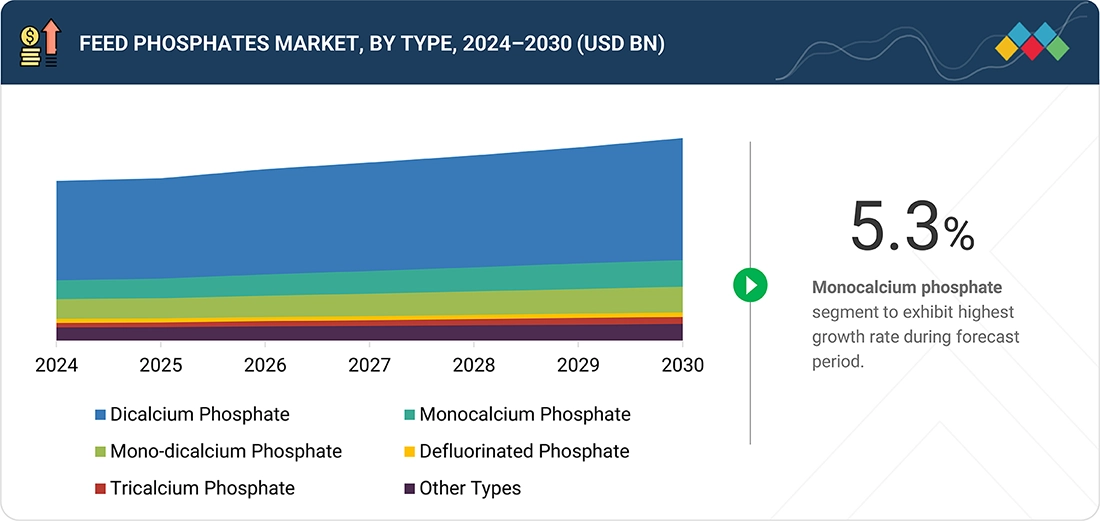

BY TYPEDicalcium phosphate (DCP) holds the largest share due to its cost-effectiveness and wide use in poultry and swine diets. Monocalcium phosphate (MCP) is the fastest-growing type, favored for its higher phosphorus bioavailability and better digestibility. Mono-dicalcium phosphate (MDCP) is gaining traction in regions emphasizing feed efficiency and nutrient absorption. Defluorinated phosphate (DFP) remains important in ruminant and aquaculture feed, where fluorine-free and highly digestible sources are preferred. Tricalcium phosphate (TCP) is used in niche applications, particularly in pet feed and specialty livestock formulations.

-

BY LIVESTOCKPoultry represents the dominant livestock segment, supported by rising global demand for poultry meat and eggs and the nutrient-dense diets required for rapid growth. Swine feed phosphate use remains significant, though inclusion rates are moderating with increased phytase enzyme use. Ruminants account for steady demand, primarily for bone health and milk yield optimization. The aquaculture segment is expanding fastest, driven by growth in fish and shrimp farming across Asia Pacific and South America, where phosphates support skeletal strength and feed conversion efficiency.

-

BY FORMGranular feed phosphates lead the market due to superior handling, mixing properties, and reduced dust during feed production. They are widely preferred by large feed mills and integrated producers. Powdered phosphates remain important in customized feed formulations and premixes, offering flexibility and precise nutrient dosing, particularly in poultry and aquaculture applications.

-

BY REGIONAsia Pacific dominates the global feed phosphate market, driven by high livestock populations, expanding commercial feed production, and increasing aquaculture output in China, India, Vietnam, and Indonesia. Europe shows steady demand, shaped by strict environmental regulations and adoption of precision nutrition to reduce phosphorus waste. North America maintains a strong market presence with advanced production technologies and established feed industries.

-

COMPETITIVE LANDSCAPEKey market leaders like Mosaic, Nutrien, OCP, EuroChem Group dominate through global reach and innovation. These companies are focusing on enhancing product purity, improving phosphorus efficiency, and expanding distribution networks in high-growth regions. Strategic partnerships, acquisitions, and sustainability-driven innovation are key competitive strategies.

Feed phosphates play a crucial role in animal nutrition by providing essential phosphorus and calcium for growth, bone health, and feed efficiency. They are widely used across poultry, swine, ruminant, and aquaculture feed formulations. The market is influenced by evolving livestock production practices, regulatory standards, and sustainability goals. With growing demand for high-quality animal protein, the industry is witnessing advancements in phosphate formulations, bioavailability, and environmentally responsible production

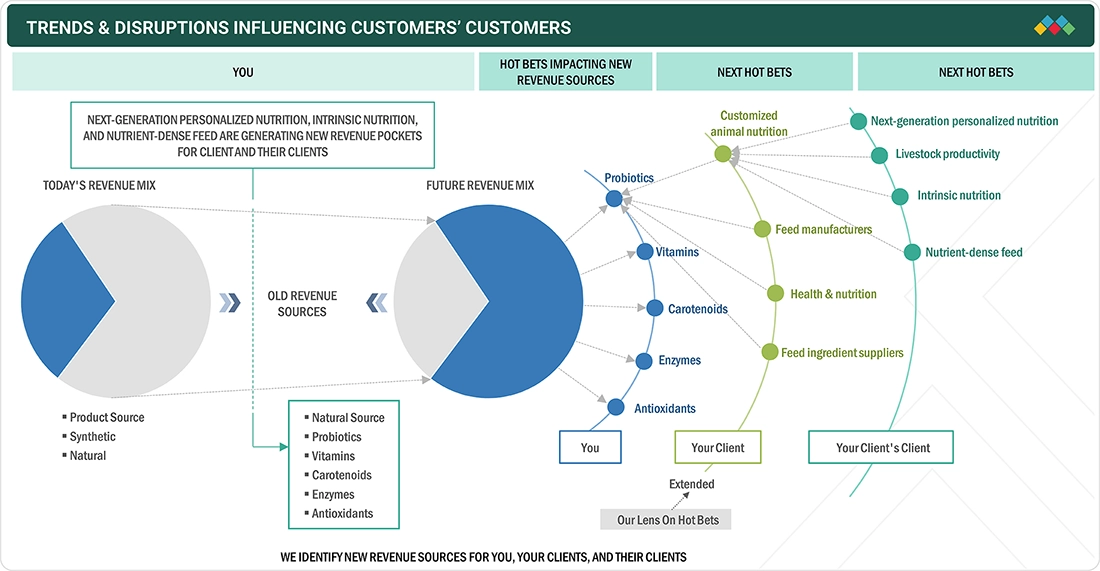

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Fluctuations in livestock production, feed ingredient prices, and regulatory standards directly influence the operations of the animal feed industry. These shifts impact key end users such as compound feed manufacturers, integrators, and commercial livestock producers. Consequently, changes in feed formulation practices, inclusion rates of phosphates, or adoption of alternative additives like enzymes affect phosphate consumption levels. As a result, variations in the profitability and output of the feed industry are expected to influence the demand for feed phosphates, thereby impacting the revenues of phosphate producers and suppliers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

• Increase in consumption of meat and dairy products

-

• Greater risk of diseases in livestock

Level

-

• Fluctuating phosphate prices

-

• Rise in use of phytase

Level

-

• Sustainable solutions and smart technologies in feed phosphates

-

• Strategic Partnerships and R&D Investments

Level

-

• Toxicity of feed phosphates

-

• Limited availability of phosphate rock

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increase in consumption of meat and dairy products

In recent years, global dietary habits have shifted, with rising consumption of meat and dairy products driven by population growth and urbanization. The world's population reached 8.0 billion by November 2024, up from 2.5 billion in 1950, while global meat production has more than quadrupled since 1961. The demand for fresh dairy products is also projected to increase steadily over the next decade. Regulatory relaxations, such as the removal of milk supply quotas in the EU, have further boosted production. In this context, feed phosphates are essential, providing phosphorus and calcium in ruminant diets, enhancing digestion, nutrient absorption, and overall animal health. Developing regions in Asia Pacific and South America are emerging as key growth drivers for the feed phosphate market.

Restraint: Fluctuating phosphate prices

Phosphate rock is the main raw material used to make feed phosphates. However, manufacturers often challenges due to rising and unpredictable prices. The number of accessible mines is declining, increasing costs for mining, refining, storing, and transporting phosphate rock. While global reserves may last for centuries, the quality and ease of access are diminishing, leading to potential supply shortages and price fluctuations. These factors make it difficult for feed phosphate producers to maintain a steady raw material supply and manage production costs. To address this, the industry is exploring alternative sources, recycling methods, and more efficient phosphorus use, although adopting these solutions introduces additional challenges and market uncertainty.

Opportunity: Sustainable solutions and smart technologies in feed phosphates

The feed phosphate market offers opportunities through innovation and sustainability. Companies are investing in R&D to explore alternative phosphorus sources and advanced production methods, including chemical precipitation, biological removal, crystallization, and fly ash-based processes. Emerging technologies such as nanotechnology, encapsulation, automation, and advanced analytics are improving efficiency, consistency, and yields. Sustainability is a key focus, with manufacturers adopting eco-friendly practices, optimizing water and energy use, reducing waste, and tailoring feed formulations to specific animal needs. These advancements not only enhance animal health and growth but also help companies meet regulatory standards, improve product quality, and strengthen competitiveness in the market.

Challenge: Toxicity of feed phosphates

Although feed phosphates are essential for animal growth and metabolism, excessive use can be toxic. High phosphorus intake can disrupt the balance of calcium, magnesium, and other minerals, leading to skeletal abnormalities, mineral deficiencies, and impaired bone development. Overconsumption may cause conditions such as osteopetrosis, urinary calculi, and reduced feed intake, negatively affecting productivity and milk yield. Contamination of feed phosphates with heavy metals like lead, cadmium, or arsenic can further harm organ function, growth, reproduction, and immunity. Additionally, excessive phosphorus can induce oxidative stress, inflammation, and suppressed immunity. Careful formulation and dosage management are therefore critical to prevent toxicity and ensure optimal animal health.

feed phosphate market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Phosphate supplementation in swine feed across integrated farms | Boosts reproductive performance, improves skeletal health, and increases overall meat yield |

|

Phosphate-based mineral mixtures for dairy cattle | Improves milk production, supports metabolic health, and reduces phosphorus deficiency risks |

|

Phosphate-enriched poultry feed for broiler chickens | Improves bone development, enhances feed conversion ratio, and supports rapid weight gain |

|

Use of monocalcium phosphate in salmon aquaculture diets | Supports skeletal integrity, enhances feed efficiency, and improves survival rates in fish farming |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The feed phosphate market ecosystem includes raw material suppliers like Jordan Phosphate Mines Compan and Sinofert Holdings, who produce essential compounds such as monocalcium phosphate and dicalcium phosphate from phosphate rock. These are processed by manufacturers like Yara and Nutrien into digestible feed additives for livestock. End users such as poultry, swine, cattle, and aquaculture producers, use these to boost animal growth and health. Demand is driven by rising meat and dairy consumption, sustainability goals, and regulatory standards, with collaboration across the value chain fueling innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Feed Phosphates Market , By Type

As of 2024, dicalcium phosphate (DCP) held the largest share of the feed phosphate market and will continue leading the market through 2025 due to its high calcium and phosphorus content, excellent bioavailability, and stability in feed formulations. Widely used in poultry, swine, and ruminant diets, DCP supports bone development, metabolic functions, and overall growth. Its fine texture ensures easy mixing with other feed ingredients, providing uniform nutrient distribution in compound feeds. The segment’s growth is further reinforced by rising demand for high-quality animal nutrition and the expanding livestock and aquaculture sectors, making DCP a critical ingredient in next-generation feed formulations.

Feed Phosphates Market, By Livestock

In 2024, poultry dominated the feed phosphate market, driven by the global demand for meat and eggs that require optimal phosphorus nutrition for growth and bone health. Feed phosphates such as DCP and MCP are integral to poultry diets, ensuring uniform nutrient absorption and feed efficiency. Swine follows closely, with phosphate supplementation supporting skeletal development and metabolic efficiency, while ruminants and aquaculture contribute to steady and high-growth demand, respectively. Increasing emphasis on feed optimization, cost-effective nutrient delivery, and production efficiency continues to support the dominance of the poultry segment in the feed phosphate market.

Feed Phosphates Market, By Form

The powdered form dominated the feed phosphate market in 2024, accounting for the largest share due to its ease of blending in compound feeds and uniform nutrient distribution. Powdered DCP enhances digestibility, feed conversion efficiency, and growth performance in livestock. Granular phosphates are gaining traction for large-scale feed production due to their handling advantages and reduced dust formation. Advancements in feed manufacturing technologies and the need for consistent nutrient delivery reinforce the powdered segment’s stronghold, positioning it as the preferred choice for animal feed producers across poultry, swine, ruminant, and aquaculture applications

REGION

North America is recognised to be the fastest-growing region in the feed phosphate market, driven by the well-established livestock and aquaculture industries, rising demand for high-quality animal protein, and increasing adoption of feed supplements to enhance productivity. The region’s advanced poultry and swine production systems rely heavily on feed phosphates such as dicalcium phosphate (DCP) and monocalcium phosphate (MCP) to ensure optimal bone development, growth, and metabolic efficiency. The United States leads regional consumption, supported by large-scale commercial farms, modern feed mills, and stringent nutritional standards. Canada and Mexico are also contributing to regional growth, focusing on sustainable and high-performance feed formulations. Additionally, regulatory emphasis on nutrient optimization and environmental management is encouraging the use of precise feed phosphate inclusion, positioning North America as both a major consumer and a driver of innovation in feed phosphate solutions globally.

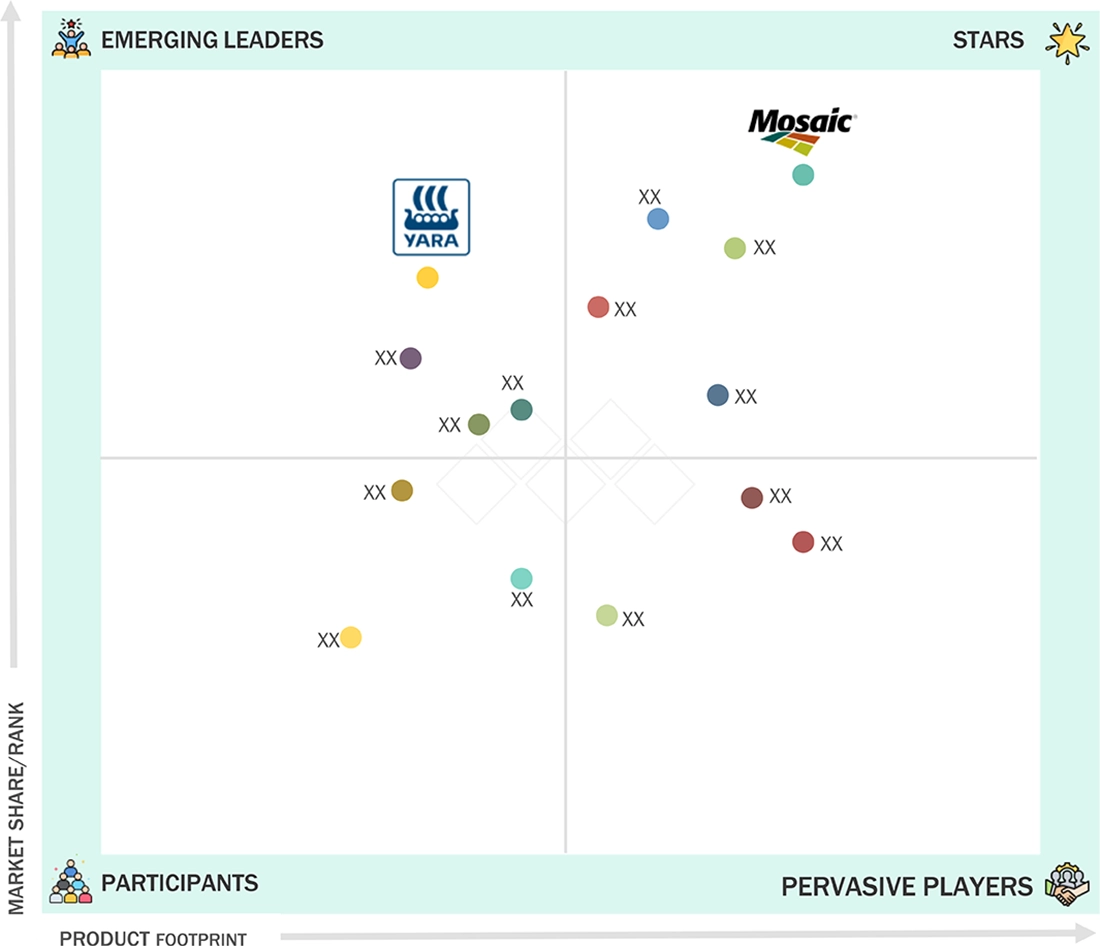

feed phosphate market: COMPANY EVALUATION MATRIX

In the feed phosphate market matrix, Mosaic (US), positioned as a Star, leads the market with its extensive portfolio of feed phosphate products, robust global supply chain, and strong focus on sustainable and responsible production practices. Yara (Norway), recognized as an Emerging Leader, is gaining traction with its innovative phosphate solutions and increasing emphasis on environmental stewardship and animal nutrition efficiency. While Mosaic maintains its leadership through operational scale, product diversity, and strategic partnerships, Yara demonstrates significant potential to move toward the leaders' quadrant by leveraging its technological innovations and growing global presence in the feed phosphate industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.73 Billion |

| Market Forecast in 2030 (Value) | USD 3.52 Billion |

| Growth Rate | CAGR of 4.8% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kilo Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, ROW |

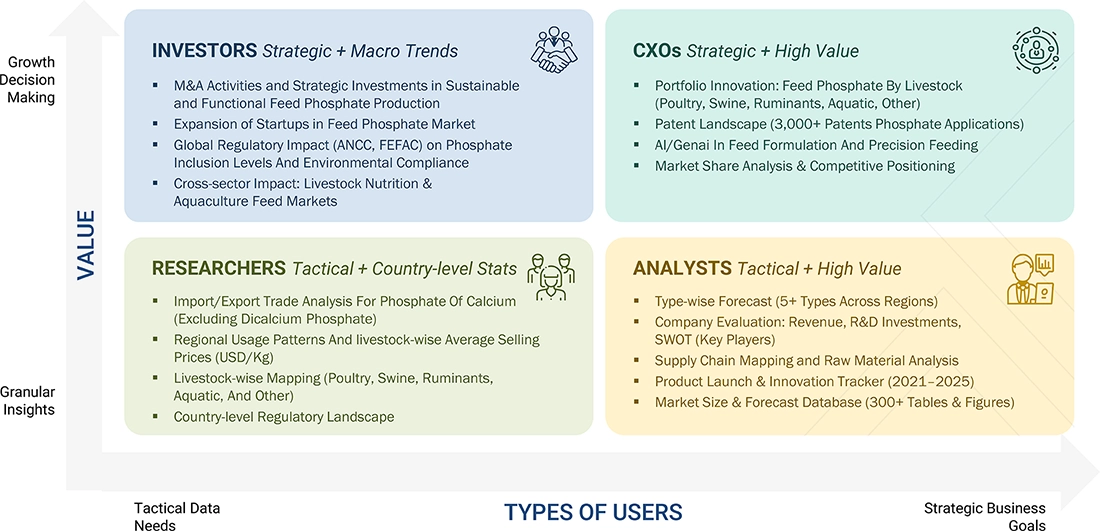

WHAT IS IN IT FOR YOU: feed phosphate market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Feed Phosphate Manufacturer |

|

|

| Mineral Supplier |

|

|

| Animal Nutrition Integrator |

|

|

RECENT DEVELOPMENTS

- February 2025 : OCP Group, along with Fertinagro Biotech S.L., a leading Spanish fertilizer producer, announced that OCP has increased its ownership in GlobalFeed S.L. by acquiring an additional 25% stake. This transaction raised OCP Group’s total shareholding in the company to 75%, following its initial acquisition of a 50% stake in May 2023.

- May 2023 : The OCP Group and Spanish fertilizer producer Fertinagro Biotech S.L. successfully completed the acquisition of Global Feed S.L. This strengthened OCP’s presence in the animal nutrition market.

- November 2022 : Phosphea announced the completion of its acquisition of SPO Indústria e Comércio LTDA, a Brazilian company operating a feed phosphate production facility with an annual capacity of 100,000 tonnes in Imbituba, Santa Catarina.

- February 2022 : EuroChem Group completed the USD 452 million acquisition of the Serra do Salitre phosphate project in Minas Gerais, Brazil. The project includes an open-pit mine with over 350 million metric tons of reserves and a fertilizer plant with a 1 million-tonne annual capacity. EuroChem plans to invest an additional USD 452 million to fully develop the project, aiming to start full fertilizer production by 2025. Currently, the mine and plant are operational, producing around 500,000 tonnes of phosphate rock annually.

Table of Contents

Methodology

The study involved two major approaches to estimating the current size of the feed phosphate market. Extensive secondary research was conducted to gather information on the market, related markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and gather information useful for a technical, market-oriented, and commercial analysis of the market.

In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

After obtaining information on the feed phosphate market scenario through secondary research, extensive primary research was conducted. Several primary interviews were undertaken with market experts from both the demand and supply sides across major countries in North America, Europe, Asia Pacific, South America, and the Rest of the World. Data was collected through questionnaires, emails, and phone interviews. The primary sources from the supply side included various industry experts, such as CXOs, VPs, Directors from business development, marketing, research and development teams, and key opinion leaders. Interviews were conducted to gather insights on market statistics, revenue data from products and services, market breakdowns, size estimations, forecasting, and data triangulation. Primary research also aided in understanding various trends related to feed phosphate type, livestock, form, and region. Stakeholders from the demand side, including research institutions, universities, and third-party vendors, were interviewed to understand their perspectives on the service, current usage of feed phosphate, and business outlook, which will affect the overall market.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Mosaic (US) |

R&D expert |

|

Nutrien (Canada) |

Sales Manager |

|

OCP (Morocco) |

Manager |

|

Yara (Norway) |

Sales Manager |

|

EuroChem Group (Switzerland) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were utilized to estimate and validate the overall size of the feed phosphate market. These methods were also extensively employed to ascertain the size of various subsegments within the market. The research methodology applied to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Feed Phosphates Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall feed phosphate market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Feed phosphates are essential mineral additives used in animal feeds for phosphorus, an important mineral for bone formation, metabolic processes, and overall animal growth and health. Because many naturally occurring feed sources do not provide sufficient bioavailable phosphorus, adding feed phosphates helps nutritionists meet the nutritional needs of livestock, aquaculture, poultry, and pets. The feed phosphate market encompasses the international production, distribution, and sale of phosphate-based products used as additives in livestock and other animal species. This market is crucial to the food supply chain, enabling effective, efficient, and balanced feeding of livestock and aquaculture production systems for meat, dairy, and fish/ seafood production, thereby satisfying the growing demand for animal protein, adhering to more stringent feed efficiency programs, and enhancing the welfare of animals raised for food. Various types of feed phosphates available in the market include dicalcium phosphate, monocalcium phosphate, mono-dicalcium phosphate, tricalcium phosphate, defluorinated phosphate, and phosphoric acid, which is used in some liquid feeds. These ingredients are utilized to manufacture compound feeds, premixes, and mineral supplements, designed to balance nutrition, enhance productivity, and optimize growth and development across many livestock species.

Stakeholders

- Feed manufacturers, processors, traders, and distributors

- Animal husbandry companies

- Large-scale ranches and poultry farms

- R&D institutes

-

Regulatory bodies

- Organizations such as the International Feed Industry Federation (IFIF)

- Associations and industry bodies such as The Association of American Feed Control Officials (AAFCO)

- Government agencies and NGOs

- Food safety agencies

- Financial institutions, importers, and exporters of feed phosphate ingredients and sources

- Feed & feed additive manufacturers

-

Trade associations and industry bodies

- Importers and exporters of feed and feed additives

Report Objectives

- To determine and project the size of the feed phosphate market with respect to the type, livestock, form, and regions in terms of value and volume over five years, ranging from 2025 to 2030

- To identify attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the feed phosphate market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Service Analysis

- Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe feed phosphate market into key countries.

- Further breakdown of the Rest of Asia Pacific feed phosphate market into key countries.

- Further breakdown of the Rest of South America feed phosphate market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the feed phosphate market?

The feed phosphate market is estimated to be USD 2.79 billion in 2025 and is projected to reach USD 3.52 billion by 2030, registering a CAGR of 6.0% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Mosaic (US), Nutrien (Canada), OCP (Morocco), Yara (Norway), and EuroChem Group (Switzerland) are some of the key market players. The market for feed phosphate is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing.

Which region is projected to account for the largest share of the feed phosphate market?

The European feed phosphate market is driven by regulatory pressures towards improving sustainability in animal production, different production units employing precision feeding methods, and stable livestock production and aquaculture.

What kind of information is provided in the company profiles section?

The provided company profiles offer essential information, including a comprehensive business summary that encompasses various segments, financial results, geographical presence, revenue distribution, and a breakdown of business revenue. They also provide insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the feed phosphate market?

The feed phosphate market is driven by the increasing global demand for animal protein, which drives livestock, poultry, dairy, and aquaculture sectors that depend on phosphorus-supplemented feed and efficient phosphorus utilization from this feed. The market is also positively influenced by technological advancements and tightening regulations, leading to a greater adoption of precision feeding, eco-friendly formulations for feed, and enhanced phosphate utilization.

Demand for dicalcium phosphate in poultry feed?

Dicalcium phosphate stands as the leading ingredient in poultry nutrition, capturing approximately XX.X% of the feed phosphate market in 2025. This dominance stems from its crucial function in delivering calcium and phosphorus nutrients that support strong bone development, healthy growth, and productive egg laying in birds. The ingredient's popularity is fueled by the expanding commercial poultry industry, particularly across Asia-Pacific and Latin American regions, alongside producers' increasing focus on nutrient-dense feeds that enhance feed efficiency and overall animal wellness. Market analysts predict the feed-grade dicalcium phosphate sector will experience robust expansion

What is the future of the feed phosphate market?

The broader feed phosphate industry is positioned for significant growth, with market value expected to climb from $2.79 billion in 2025 to $3.52 billion by 2030, reflecting a 6.0% growth rate. This expansion is powered by growing demand for enhanced livestock nutrition programs, increased consumption of meat and dairy products worldwide, and breakthrough developments in eco-friendly phosphate procurement and targeted feeding strategies. Market evolution is also influenced by tightening regulatory standards, environmental consciousness, and the emergence of cutting-edge products such as nano-phosphate formulations and enzyme-enhanced supplements designed to boost nutrient absorption while reducing environmental impact. Dicalcium phosphate and monocalcium phosphate are expected to maintain their market leadership, with poultry applications continuing as the primary demand driver.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Feed Phosphates Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Feed Phosphates Market