The study involved estimating the current endpoint protection platform market size significantly. Exhaustive secondary research was done to collect information on the endpoint protection platform industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the endpoint protection platform market.

Secondary Research

The market for the companies offering endpoint protection platform solutions and services is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of endpoint protection platform vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain essential information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

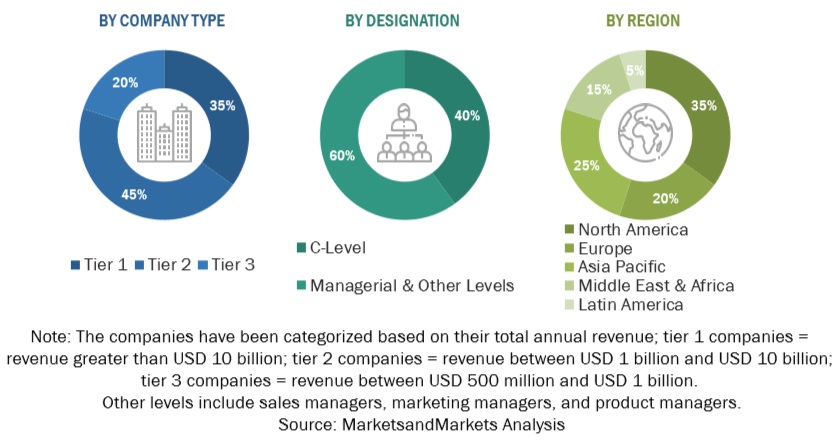

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the endpoint protection platform market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of endpoint protection platform solutions offered by various market players, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

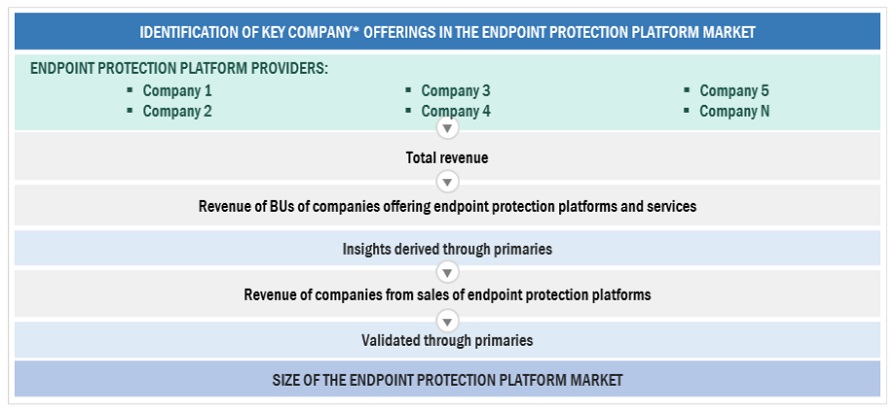

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global endpoint protection platform market and the size of various other dependent sub-segments in the overall endpoint protection platform market. The research methodology used to estimate the market size includes the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

INFOGRAPHIC DEPICTING BOTTOM-UP AND TOP-DOWN APPROACHES

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to MarketsandMarkets, an “Endpoint Protection Platform (EPP) is a unified and integrated suite of cybersecurity technologies designed to safeguard individual endpoint devices within organizational networks, including desktops, laptops, tablets, and smartphones. It combines essential security functionalities such as antivirus, firewall, intrusion prevention, data encryption, data loss prevention, and advanced threat detection and response capabilities like Endpoint Detection and Response (EDR) and Extended Detection and Response (XDR). EPPs leverage cloud-based management and AI-driven analytics to continuously monitor and analyze endpoint activities for signs of malicious behavior or policy violations.

Key Stakeholders

-

Chief Technology and Data Officers

-

Consulting Service Providers

-

Managed Security Services Professionals

-

Business Analysts

-

Information Technology (IT) Professionals

-

Government Agencies

-

Investors and Venture Capitalists

-

Small and Medium-sized Enterprises (SMEs) and Large Enterprises

-

Third-party Providers

-

Consultants/Consultancies/Advisory Firms

-

Managed and Professional Service Providers

Report Objectives

-

To define, describe, and forecast the endpoint protection platform market based on - offering, enforcement point, deployment mode, organization size, vertical, and region.

-

To define, describe, and forecast the endpoint protection platform market by – offering, enforcement point, deployment mode, organization size, vertical, and region.

-

To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

-

To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market.

-

To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the endpoint protection platform market.

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the endpoint protection platform market.

-

To profile the key players of the endpoint protection platform market and comprehensively analyze their market size and core competencies.

-

Track and analyze competitive developments, such as new product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the global endpoint protection platform market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

-

Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further breakup of the North American market into countries contributing 75% to the regional market size

-

Further breakup of the Latin American market into countries contributing 75% to the regional market size

-

Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

-

Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Endpoint Protection Platform (EPP) Market