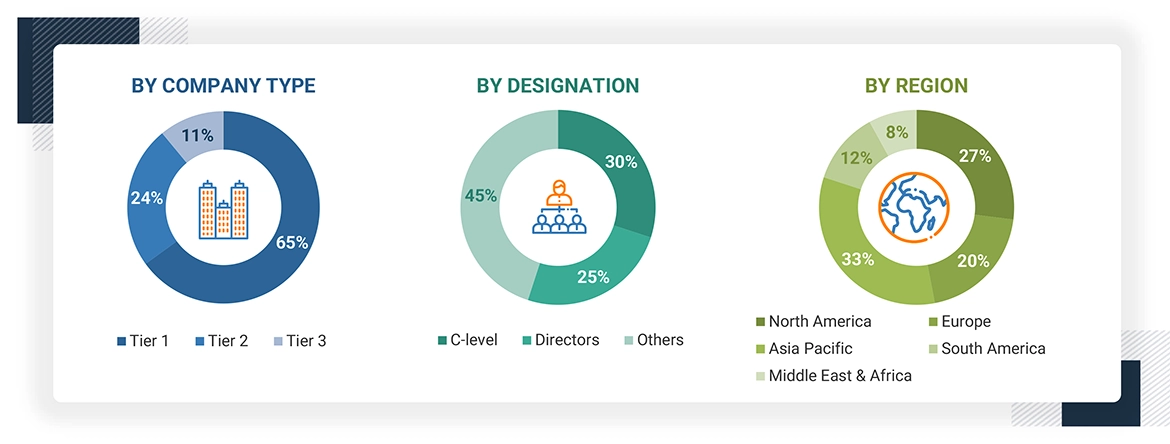

This research study involved the extensive use of secondary sources, such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, the World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the Electric Scooter Motor market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players (electric scooter motor manufacturers and suppliers), and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess market prospects.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information on the electric scooter motor market for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors; directories; databases; and articles from recognized associations and government publishing sources.

Primary Research

Extensive primary research was conducted after understanding the electric scooter motor market scenario through secondary research. Several primary interviews were conducted with market experts from both demand-side vehicle manufacturers [(in terms of component supply) country-level government associations and trade associations] and supply-side OEMs and component manufacturers across three major regions, namely, North America, Europe, and Asia Pacific. Approximately 30% and 70% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in the report.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the opinions of in-house subject matter experts, led to the findings, as described in the remainder of this report.

Note: The tiers of companies are based on the value chain of the electric scooter motor market. Tier I companies

are the largest or the most technically capable companies in the supply chain, and Tier II companies are small or

medium companies in the supply chain of the electric scooter motor market. Other designations include design

engineers, manufacturing engineers, operational heads, and sales executives.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach has been followed to estimate and validate the value and volume of the electric scooter motor market and other dependent submarkets, as mentioned below:

The market size has been derived by collecting sales of electric two-wheelers (electric scooters/mopeds and electric motorcycles) through associations and paid databases. This data has then been multiplied by the number of motors in each vehicle type to derive the market size for electric scooter motor market.

Key players in the electric scooter motor market have been identified through secondary research, and their global market share has been determined through primary and secondary research.

The research methodology includes the study of annual and quarterly financial reports, regulatory filings of major market players, and interviews with industry experts to gain detailed market insights.

All major penetration rates, percentage shares, splits, and breakdowns for the electric scooter motor market have been determined through secondary sources and verified through primary sources.

All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

Electric Scooter Motor Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

An electric scooter motor is the power source that converts electrical energy from the battery into mechanical energy, which powers the e-scooter and e-motorcycle. The motor is a critical component that determines its performance, including:

-

Acceleration: How quickly the scooter can accelerate

-

Top speed: The maximum speed the scooter can reach

-

Hill-climbing ability: How well the scooter can climb hills

-

Power consumption: How much power the scooter uses

Stakeholders

-

Associations, Forums, and Alliances of Electric Scooter and Motorcycle Motor Manufacturers

-

Automobile Manufacturers

-

Automotive Component Manufacturers

-

Automotive Investors

-

Distributors and Retailers of Electric Two-wheeler Motors

-

Electric Battery Manufacturers

-

Government Agencies and Policymakers

-

Manufacturers of Electric Two-wheeler Motors

-

Manufacturers of Electric Two-wheelers

-

Manufacturers of Electric Two-wheeler Components

-

Motor Controller Manufacturers

Report Objectives

-

To segment and forecast the electric scooter (e-scooter) motor market in terms of volume (thousand units) and value (USD million)

-

To define, describe, and forecast the market based on vehicle type, positioning, motor type, motor power, drive type, component, and region

-

To segment and forecast the market by vehicle type (e-scooter/moped and e-motorcycle)

-

To segment and forecast the market by motor type (PMSM and BLDC)

-

To segment and forecast the market by positioning (hub motor and mid-drive motor)

-

To segment and forecast the market by motor power (less than 1.5 kW, 1.5–3 kW, and above 3 kW)

-

To segment and forecast the market by drive type (belt drive and chain drive)

-

To segment the market by component (rotor, stator, shaft, and others)

-

To forecast the market size with respect to key regions: North America, Europe, and Asia Pacific

-

To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

-

To analyze technological developments impacting the market

-

To analyze opportunities for stakeholders and the competitive landscape for market leaders in the market

-

To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically profile key players and comprehensively analyze their market shares and their core competencies

-

To track and analyze competitive developments such as product launches/developments, deals, and expansions undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

-

Electric scooter motor market, by positioning at country level (for countries covered in the report)

-

Profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Electric Scooter Motor Market