This research study extensively uses secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the e-Corner market. In-depth interviews have been conducted with various primary sources—experts from related industries, automotive OEMs, electric corner module manufacturers, autonomous driving platform/OS providers, and system integrators—to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

The market for the companies offering hydrogen trucks is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality.

Secondary research has identified key players in the e-Corner market. Primary research interviews have been conducted with key opinion leaders in the automotive sector, such as CEOs, directors, industry experts, and other executives, to validate revenues. The size of the market, in terms of volume (thousand units) for various regions, has been derived using forecasting techniques based on the demand for e-corner systems and market trends.

In the secondary research process, various secondary sources have been used to identify and collect information on the e-Corner market for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources.

Primary Research

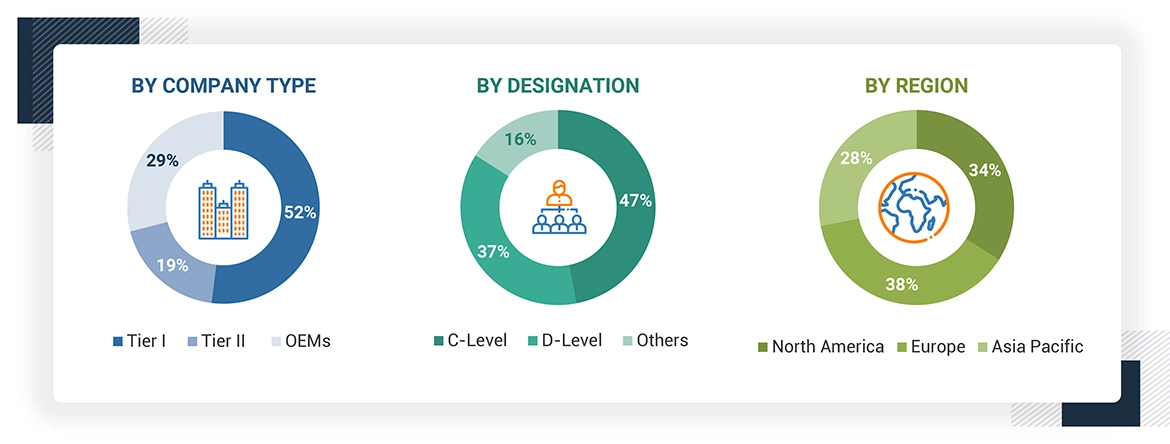

Extensive primary research has been conducted after understanding the scenario of the e-Corner through secondary research. Several primary interviews have been conducted with market experts from both the demand (OEMs) and supply (e-Cornerproviders, EV motor providers, and other component manufacturers) across three major regions: North America, Europe, and Asia Pacific. Approximately 29% and 71% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, have been covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions with highly experienced independent consultants have also been conducted to reinforce the findings from primaries. This and the in-house subject-matter experts’ opinions have led to the findings described in the remainder of this report.

In the complete market engineering process, the bottom-up approach was extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Bottom-up approach wase used to estimate and validate the total size of the e-Corner market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

e-Corner Market : Top-Down and Bottom-Up Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The e-corner or electric corner module is a highly advanced system that integrates propulsion, braking, steering, and suspension into a modular unit at each wheel. The module, which is built according to a conventional wheel's geometric specifications, includes an in-wheel electric motor for propulsion and electronically controlled steering, suspension, and electrically activated brakes. With fundamental mechanical linkages and a power connector, this modular design makes attaching to specific vehicle platforms simple. The e-corner, which is fully controlled by an electrical system attached to the car's steering column, improves handling and dynamics by giving each wheel precise, independent control over its movement.

Stakeholders

-

American Society of Mechanical Engineers (ASME)

-

Automobile OEMs

-

Battery Manufacturers

-

Chassis and Suspension Suppliers

-

Electric Corner Module Manufacturers

-

Environmental Protection Agency (EPA)

-

Fleet Operators

-

Government Agencies and Organizations

-

Research and Development Institutions

-

Software and Sensor Providers

Report Objectives

-

To analyze and forecast the e-Corner market in terms of value (USD million) and volume (thousand units) from 2020 to 2035

-

To segment the market by vehicle type, motor configuration, and region

-

To segment and forecast the market size by volume based on vehicle type (passenger car, light commercial vehicle)

-

To segment and forecast the market size by volume based on motor configuration (tri-motor, quad-motor)

-

To segment and forecast the market by volume based on region (Asia Pacific, Europe, and North America)

-

To strategically analyze the market for individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

-

Ecosystem Analysis

-

Value Chain Analysis

-

Technology Analysis

-

Bill of Material Analysis

-

Case Study Analysis

-

To track and analyze competitive developments such as deals, product launches/developments, expansions, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

-

e-Corner market, By Autonomous Shuttle Type at Regional Level

-

e-Corner market, Additional Countries (Up to 3)

-

Profiling of additional market players (Up to 3)

Growth opportunities and latent adjacency in e-Corner Market