To determine the current size of the DNA diagnostics market, this study engaged in four main activities. A comprehensive study was conducted using secondary research methods to gather data about the market, its parent market, and its peer markets. The next stage involved conducting primary research to confirm these conclusions, assumptions, and sizing with industry experts throughout the value chain. A combination of top-down and bottom-up methods was used to assess the overall market size. The market sizes of segments and subsegments were then estimated using data triangulation techniques and market breakdown.

The four steps involved in estimating the market size are

Collecting Secondary Data

Within the secondary data collection process, a range of secondary sources were reviewed so as to identify and gather data for this study, including regulatory bodies, databases (like D&B Hoovers, Bloomberg Business, and Factiva), white papers, certified publications, articles by well-known authors, annual reports, press releases, and investor presentations of companies.

Collecting Primary Data

During the primary research phase, a comprehensive approach was adopted, involving interviews with a diverse array of sources from both the supply and demand sides. These interviews aimed to gather qualitative and quantitative data essential for compiling this report. Primary sources primarily comprised industry experts spanning core and related sectors, as well as favored suppliers, manufacturers, distributors, service providers, technology innovators, and entities associated with all facets of this industry's value chain. In-depth interviews were meticulously conducted with a range of primary respondents, including key industry stakeholders, subject-matter authorities, C-level executives representing pivotal market players, and industry advisors. The objective was to obtain and authenticate critical qualitative and quantitative insights and to evaluate future potentialities comprehensively.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers of companies are defined based on their total revenue. As of 2023, Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME

|

DESIGNATION

|

|

Roche Diagnostics Ltd.

|

Area Sales Manager

|

|

Danaher Corporation

|

General Manger

|

|

Thermo Fisher Scientific Inc.

|

Consultant

|

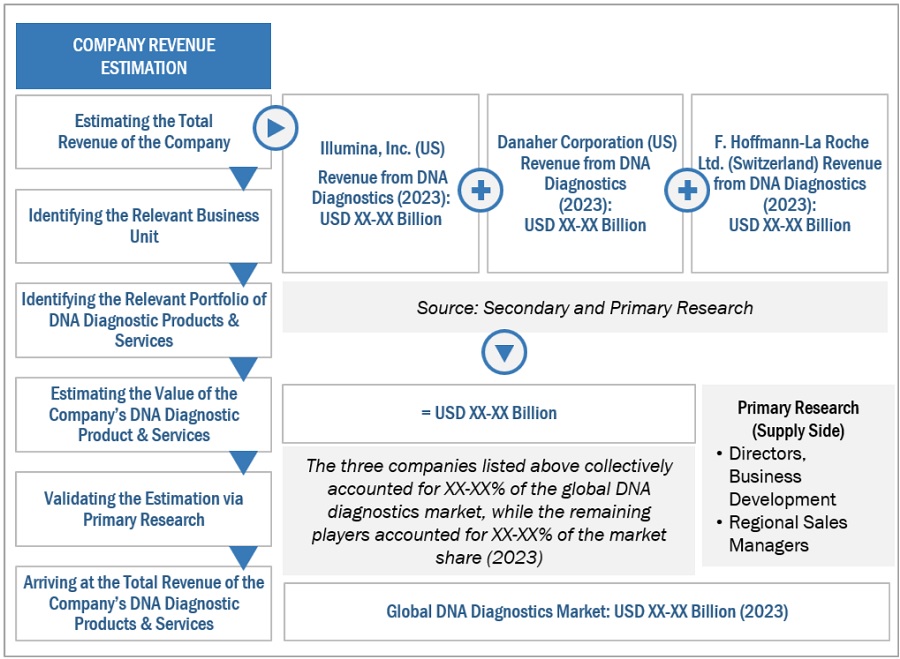

Market Size Estimation

All major product providers offering various products and services were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value of the DNA diagnostics market was also split into various segments and subsegments at the region and country level based on:

-

Offering mapping of various manufacturers for each type in the DNA diagnostics market at the regional and country-level

-

Relative adoption pattern of each DNA diagnostics market among key application segments at the regional and/or country-level

-

Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

-

Detailed secondary research to gauge the prevailing market trends at the regional and/or country level

Global DNA Diagnostics Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

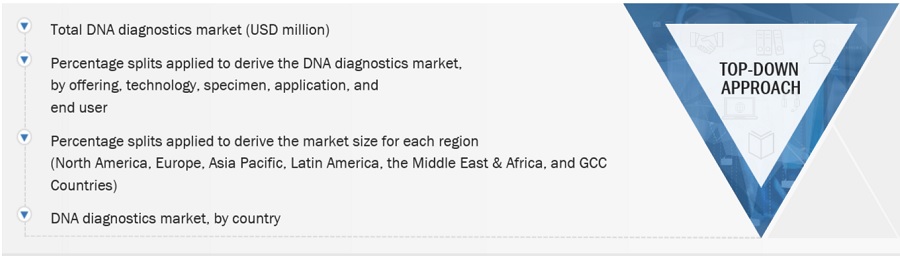

Global DNA Diagnostics Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

DNA diagnostic tests detect and analyze variations in the sequence, structure, or expression of deoxyribonucleic acid (DNA) to diagnose diseases or medical conditions. This includes identifying indications caused by specific pathogens or determining genetic carrier status.

DNA diagnostic techniques can detect numerous diseases, such as cancer, viral diseases, and myogenic disorders. They are also employed in prenatal diagnostics and clinical diagnostic confirmation.

Key Stakeholders

-

Manufacturers and Distributors of DNA Diagnostic Instruments and Assays

-

In Vitro Diagnostic (IVD) Companies

-

Hospital Laboratories

-

Diagnostic Laboratories

-

Diagnostics Suppliers

-

Blood Banks

-

Home Health Agencies

-

Market Research and Consulting Firms

-

Government Associations

-

Venture Capitalists and Investors

Report Objectives

-

To define, describe, segment, and forecast the DNA diagnostics market by offering, technology, specimen, application, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To assess the DNA diagnostics market with respect to Porter’s five forces, regulatory landscape, the value chain, the supply chain, ecosystem analysis, patent protection, pricing assessment, key stakeholders, and buying criteria

-

To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall DNA diagnostics market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To forecast the size of the market segments with respect to six regions, namely, North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries

-

To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

-

To track and analyze company developments such as product launches & approvals, acquisitions, collaborations, expansions, and other developments

-

To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s needs. The following customization options are available for the report:

Geographic Analysis:

Further breakdown of the DNA diagnostics market into specific countries/regions in Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries.

Company Information:

Detailed analysis and profiling of additional market players (up to Five), inclusive of:

-

Business Overview

-

Financial Information

-

Product Portfolio

-

Developments (last three years)

Note: Some companies are privately owned, and their revenues are unavailable in the public domain. Hence, revenues for privately owned companies will not be included in their profile. In addition, company developments that are not reported in the public domain will not be included.

Growth opportunities and latent adjacency in DNA Diagnostics Market