This research study utilized a wide range of both primary and secondary sources. It examined various factors influencing the industry to identify different segmentation types, industry trends, key players, and the competitive landscape among market participants. Additionally, the study explored key market dynamics, including drivers, opportunities, challenges, constraints, and strategies employed by key players.

Secondary Research

This research study extensively utilized secondary sources, including directories and databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, as well as white papers, annual reports, and companies’ house documents. The secondary research aimed to identify and gather information for a comprehensive, technical, market-oriented, and commercial analysis of the digital twins in the healthcare market. Additionally, it was used to obtain crucial details about the leading players, market classification, and segmentation based on industry trends down to the finest level, covering geographic markets and key developments related to the market. A database of key industry leaders was also compiled using this secondary research.

Primary Research

In the primary research process, we interviewed various supply and demand sources to gather qualitative and quantitative information for this report. On the supply side, we engaged with industry experts, including CEOs, vice presidents, marketing and sales directors, technology and innovation directors, engineers, and other key executives from companies and organizations involved in the digital twins in healthcare market. On the demand side, we interviewed personnel from hospitals of all sizes (small, medium, and large), diagnostic centers, and stakeholders from corporate and government bodies.

Below is a breakdown of the primary respondents:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

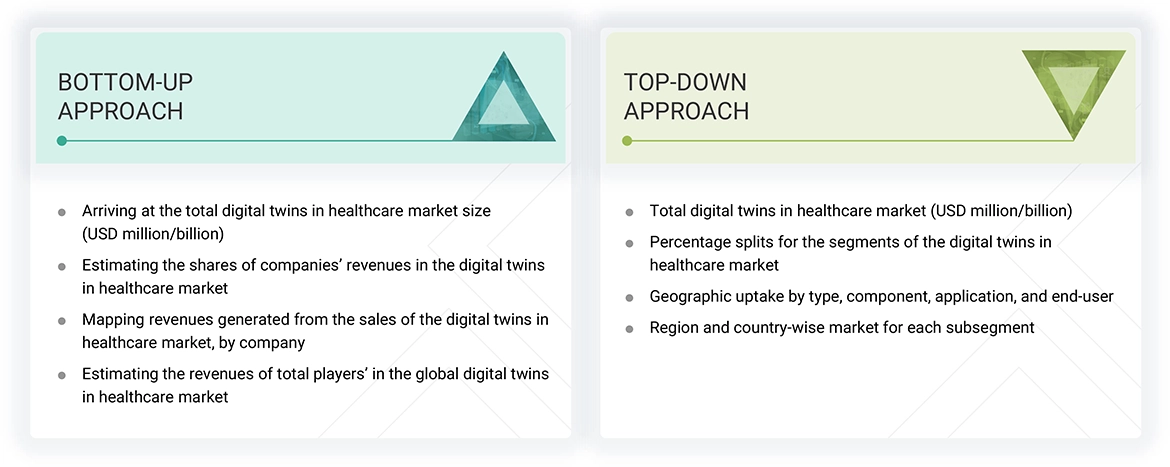

The total size of the digital twins market in healthcare was determined using data triangulation through two approaches. After completing each approach, a weighted average was calculated based on the level of assumptions made in each method.

Data Triangulation

The size of the digital twins in healthcare market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

-

Revenues for individual companies were gathered from public sources and databases.

-

Shares of leading players in the digital twins in healthcare market were gathered from secondary sources to the extent available. In some instances, shares of digital twins in healthcare businesses have been ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, and geographic reach & strength.

-

Individual shares or revenue estimates were validated through interviews with experts.

The total revenue of the digital twins in healthcare market was determined by extrapolating the market share data of major companies.

Market Definition

According to the Digital Twin Consortium, a digital twin is a virtual representation of real-world entities and processes synchronized at a specified frequency and level of detail. This technology enables users to monitor the status of physical assets in real time. By offering a comprehensive view of real-time behavior within a real-world environment, which is continuously updated in a virtual model, digital twins allow for anticipating maintenance needs, optimizing performance, and preventing expensive failures.

Stakeholders

-

Healthcare Providers

-

Healthcare Vendors

-

Technology Developers

-

Patients

-

Regulators & Policymakers

-

Insurance Companies & Payers

-

Academic Research Institutes

-

Imaging & Diagnostic Labs

-

Government Institutions

-

Market Research & Consulting Firms

-

Venture Capitalists & Investors

Report Objectives

-

To define, describe, and forecast the digital twins in the healthcare market based on type, component, application, end user, and region.

-

To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and industry-specific challenges)

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

-

To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the market size with respect to regions—North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

-

To profile the key players and comprehensively analyze their core competencies and market shares

-

To track and analyze competitive developments such as product/service launches/enhancements/approvals, agreements, expansions, partnerships, and collaborations.

-

Benchmarking players within the market using the proprietary "Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad business & product strategy categories.

Growth opportunities and latent adjacency in Digital Twins in Healthcare Market