Digital Denture Market Size, Growth, Share & Trends Analysis

Digital Denture Market by Type (Complete Denture, Partial Denture), Tool (Equipment, Software), Usability (Removable Denture, Fixed Denture), Material (Resin, Plastic), End User (Dental Hospital & Dental Clinic) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global digital dentures market, valued at USD 1511.45 million in 2025, stood at USD1620.98 million in 2026 and is projected to advance at a resilient CAGR of 6.7% from 2026 to 2031, culminating in a forecasted valuation of USD 2398.74 million by the end of the period. The market for digital dentures is experiencing rapid growth, driven by the rising incidence of tooth loss and edentulism, especially among the growing elderly population, and by increasing demand for faster, more accurate, and personalized dental treatments. Digital denture solutions leverage CAD/CAM technology and 3D printing to deliver superior fit, aesthetics, and patient comfort while drastically reducing chairside and total treatment times compared with conventional methods. The widespread adoption of digital workflows in dental clinics and laboratories, continuous advances in intraoral scanning and dental materials, and demand for efficient, cost-effective, and scalable denture production are the main drivers of market growth. Additionally, rising oral health awareness, improvements in dental healthcare infrastructure, and supportive reimbursement policies in developed regions have led to the worldwide adoption of digital dentures.

KEY TAKEAWAYS

-

By RegionBased on region, the North America accounted for a larger share of 38.8% of the digital dentures market in 2025.

-

By ProductBased on product, the equipment segment accounted for a larger share in the digital dentures market in 2025.

-

By TypeBased on type, the partial dentures segment accounted for a larger share of 56.1% the digital dentures market in 2025.

-

By MaterialBased on material, in 2025, the resin segment accounted for the largest share of the digital dentures market.

-

By End UserBased on end user, the dental hospitals & clinics segment held the largest share in the digital dentures market druing the forecast period

-

COMPETITIVE LANDSCAPE3Shape A/S and Dentsply Sirona were recognized as star players due to their established strong product portfolio.

-

COMPETITIVE LANDSCAPE- STARTUPSCompanies such as Overjet among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The digital dentures market is driven by the rising incidence of tooth loss and edentulism, especially among older adults, along with an increased need for faster, more accurate, and personalized dental services. Research and development in dental technologies, including CAD/CAM, intraoral scanners, and 3D printing, help ensure a better fit and enhanced aesthetics and comfort with dentures, while significantly reducing chair time and turnaround time. Moreover, the growing need to adopt fully digital dental processes, the search for an economical approach to denture replication, and ongoing developments in dental materials technology are also contributing to demand in the digital dentures market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The major trends and disruptions in the digital dentures market, and their impact on stakeholder groups, from solution providers to patients. Currently, the market is witnessing a paradigm shift from traditional and semidigital denture systems to fully digital and 3D-printed systems, driven by advances in scanning, CAD/CAM software, and materials. These disruptions are reshaping revenue streams for manufacturers even as the major imperatives of dental labs, hospitals, clinics, and DSOs are being met, including reduced turnaround time and improved accuracy and esthetics of the dentures. Ultimately, these disruptions are ensuring effective denture delivery, patient comfort, productivity, and clinical success outcomes for patients, thereby underpinning the growing future of the digital dentures market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding market for dental tourism

-

Increasing prevalence of oral health disorders

Level

-

High cost of dental imaging systems and inadequate reimbursements

Level

-

Investments in CAD/CAM technologies by dental laboratories

-

Growth potential of emerging economies

Level

-

Shortage of skilled dental practitioners

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Expanding market for dental tourism

The expanding dental tourism market is significantly fueling the growth of the digital dentures market, as more patients travel globally to access high-quality dental treatments at reasonable prices. Eastern European, Southeast Asian, and some Latin American countries are becoming favorite destinations for dental tourists thanks to their excellent dental infrastructure, the presence of qualified clinicians, and drastically lower costs compared to developed markets. Digital denture technologies offer faster turnaround times, high accuracy, and highly predictable results, making them well suited for international patients who prefer treatments completed in the fewest possible visits. The ability to deliver same-day or short-stay digital denture solutions not only enhances patient convenience but also increases clinic efficiency, which in turn encourages adoption. As dental tourism continues to expand, more dental clinics invest in digital denture workflows to attract international patients, increase their competitiveness, and provide consistent, high-quality prosthetic results.

Restraint: High cost of dental imaging systems and inadequate reimbursements

The high cost of dental imaging solutions and the lack of favorable reimbursement rates are major factors that hamper the growth of the digital denture market. Advanced imaging solutions such as intraoral scanners, CBCT systems, and CAD/CAM software used in the denture industry are expensive in terms of both equipment and service costs, which may hinder the penetration of digital denture technology in the global dental industry. In addition, in many countries, favorable reimbursement rates for digital denture procedures have not been well defined. A major challenge is that insurance companies in many countries pay similar or higher reimbursement rates for conventional denture procedures, which may negatively impact the penetration of digital denture technology in the dental industry.

Opportunity:Investments in CAD/CAM technologies by dental laboratories

Investment in CAD/CAM technologies by dental laboratories is a major growth lever for the digital dentures market, as it helps make denture production faster, more accurate, and highly standardized. By implementing digital workflows that combine intraoral scanning, computer-aided design, and computer-aided manufacturing, dental laboratories can not only minimize manual errors but also shorten turnaround times and enhance the consistency and fit of digital dentures. In addition, these techniques help labs process more cases efficiently, provide customized and visually appealing denture solutions, and keep digital patient records readily available for remakes or adjustments. As rivalry among dental labs intensifies and dentists increasingly prefer partners who can deliver high-quality digital prosthetics, further investment in CAD/CAM facilities is expected to ramp up the use of digital dentures, thereby pushing market growth.

Challenge: Shortage of skilled dental practitioners

The shortage of competent dental professionals is a significant barrier to the development of the digital denture market, as the successful adoption of digital denture technology requires specialized training. Digital dentures rely on cutting-edge technologies such as intraoral scanning, CAD/CAM design, and 3D printing, which require trained professionals with expertise in both clinical and digital technologies. In most parts of the globe, and in most developing nations in particular, there is a lack of trained dentists and dental professionals in the field of digital dentistry, thereby hindering the shift toward digital denture technology. There is also a lack of standardized training programs, with steep skill development curves, which inhibit the adoption of the technology. Therefore, despite advancements in the technology, the shortage of sufficient trained professionals may hamper adoption, slowing the growth of the digital denture market.

DIGITAL DENTURE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

3Shape offers advanced intraoral scanning technology that facilitates the creation of a digital impression for denture planning and production. These intraoral scanning systems are commonly employed in dental and hospital setups for the precise acquisition of intraoral information for patients requiring partial and complete dentures. This marks the initial process of a completely digital denture production chain. | 3Shape intraoral scanners can enhance the accuracy of impressions, patient comfort, and consistency of data, and at the same time they completely remove the need for traditional impression materials. The digital scans can be used for the accurate design of dentures, thus the number of remakes is decreased, the treatment time is shortened, and the CAD/CAM and 3D printing systems can be integrated seamlessly. |

|

The company, Dentsply Sirona, provides digital denture base materials that are required in CAD/CAM and 3D printing processes in order to create custom denture bases. The product helps dental labs and dental clinics in producing aesthetically attractive and strong digital dentures. | High strength, excellent fit, and natural aesthetics are some of the characteristics that the digital denture base materials have, thus patient comfort and satisfaction are greatly improved. Their compatibility with digital manufacturing also helps to increase production efficiency, reduce the amount of manual work, and maintain quality consistency in denture cases. |

|

Straumann manufactures advanced dental resin materials. These materials are applied in the production of digital dentures by using additive manufacturing and milling technologies. Such materials have the capability to create partial and full dentures with a high degree of accuracy. | Straumanns resin materials are characterized by superior biocompatibility, mechanical stability, and color accuracy, which allows the users to have comfortable and durable dentures. These materials facilitate the production at high speed, are highly reproducible, and can be integrated into digital workflows in a very straightforward way, thus the clinical outcomes and the laboratory efficiency are improved. |

|

The company offers specialized dental materials suitable for 3D printing in digital denture production. The materials are used in large-scale production in dental labs focused on denture bases and teeth production. | Desktop Metals dental materials facilitate printing at high speeds, less material waste, and economical mass production of digital dentures. Their consistency, longevity, and meeting of regulatory requirements allow for better workflow efficiency, quicker turnaround times, and dependable denture quality. |

|

Modern Dental Group provides digital dental prosthetics, including digital dentures, developed through their widespread global laboratory network. The company combines digital scanning, design, and manufacturing capabilities to provide customized denture care. | Modern Dental Groups digital prosthetics offer excellent precision, consistent quality, and enhanced aesthetics on a large scale. The companys powerful production facilities allow for quicker delivery, lower costs, and access to a wide market, thus supporting the increasing use of digital dentures in both developed and emerging regions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The digital dentures market ecosystem consists of a highly integrated system of manufacturers, distributors, end-users, and regulatory institutions that work toward the advancement, promotion, and acceptance of digital denture products. These system leaders in digital denture innovation include 3Shape, Dentsply Sirona, Straumann, Planmeca, Stratasys, Desktop Metal, and Modern Dental Group, which focus on innovation through advanced denture scanning systems, CAD-CAM systems, three-dimensional printing systems, and denture materials. The distributors for the system include highly prominent companies such as Henry Schein, McKesson, Medline, and Cardinal Health, which make a significant contribution to facilitating appropriate access to the markets. The end-users also make a significant contribution to these systems through prominent healthcare institutions, such as major hospital systems, thus making a highly appropriate contribution to the markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Digital Dentures Market, By Product

In the digital dentures market, equipment is the single largest contributor to the product segment by a wide margin, as it is a basic necessity for complete digital denture workflows. Core equipment, including intraoral scanners, CAD/CAM software systems, milling units, and 3D printers, enables accurate data capture, precise digital design, and high-quality denture fabrication. The growing adoption of digital dentistry has prompted dental clinics and laboratories to invest heavily in advanced equipment to improve operational efficiency, reduce manual errors, shorten production time, and enhance clinical outcomes. In addition, equipment purchases are premium, long-term investments that make a substantial contribution to overall market revenues. Continuous technological breakthroughs, the increasing popularity of chairside solutions, and the requirement for efficient, scalable in-house denture manufacturing continue to propel equipment's dominant role in the digital dentures market.

Digital Dentures Market, By Type

Partial dentures hold the largest market share in the digital dentures industry, primarily due to the higher prevalence of partial tooth loss compared with complete tooth loss across a wide range of age groups. Many individuals lose some teeth due to dental caries, periodontal diseases, trauma, and age-related factors, maintaining strong demand for partial dentures over the years. Digital denture technologies enable the design and production of partial dentures with advanced fit, comfort, and aesthetics while preserving the patient's remaining natural teeth, thereby improving acceptance among both dentists and patients. Additionally, partial dentures are preferred as a less costly and less traumatic alternative to dental implants, especially in less developed countries. The increasing adoption of CAD/CAM and 3D printing for the production of removable partial dentures, along with faster processing and better customization, continues to sustain the large market share of partial dentures.

Digital Dentures Market, By Material

In the digital dentures market, resins account for the largest share of the material segment, primarily because of their strong compatibility with the latest digital manufacturing technologies, such as 3D printing and CAD/CAM systems. Dental resins offer substantial design freedom, enabling the production of dentures in any shape, size, and style, and supporting the creation of accurate, lightweight, and aesthetically pleasing dentures with a perfect fit. Moreover, advances in resin formulations have improved mechanical strength, durability, biocompatibility, and color stability, making them suitable for both partial and full digital dentures. Additionally, resin-based materials allow shorter manufacturing times, less material waste, and more cost-effective scalability compared with traditional materials such as metal frameworks. Lastly, their wide availability, ease of processing, and strong regulatory acceptance for dental use further contribute to the dominant market position of dental resins in the digital dentures sector.

Digital Dentures Market, By End User

In the digital dentures industry, dental hospitals and clinics hold the largest share of the end-user market because of their large patient bases requiring prosthetic dental work and the resulting rise in demand for chairside digital dentures. These centers are typically the first point of care for patients with complete or partial tooth loss, creating consistent demand for denture solutions. Investments by dental hospitals and clinics in advanced digital technologies, including intraoral scanners, CAD/CAM solutions, and in-house 3D printing, are also increasing their demand for digital dentures by enabling faster turnaround times and one-visit or same-day denture solutions, among other benefits. Furthermore, their expertise and patient confidence are further increasing their dominance in the digital dentures industry as a whole.

REGION

Europe to be fastest-growing region in global digital dentures market during forecast period

Europe is likely to be the region with the highest growth rate in the global digital dentures market as a result of the quick adoption of advanced digital dentistry technologies throughout the region. An extensive and aging population worldwide, especially in Western and Northern Europe, is leading to increased consumption of dentures and other prosthetic dental solutions. The robust integration of CAD/CAM systems, intraoral scanners, and 3D printing technologies combined with the existence of leading digital dentistry companies and well, established dental laboratory networks are among the factors that are helping to accelerate the transition to digital denture workflows. What is more, dental clinics and laboratories, in order to financially benefit from the local policy environment, are more willing to invest in digital solutions, as it can be inferred from the fact that favorable reimbursement policies, a high level of oral health awareness, and supportive regulatory frameworks are in place. Europe's role as the top market for digital dentures is being maintained by continuous technological innovations, increasing usage of chairside and same, day dentistry, and strong partnerships between manufacturers and dental service providers.

DIGITAL DENTURE MARKET: COMPANY EVALUATION MATRIX

In the digital dentures market matrix, 3Shape A/S (Germany) (Star) and Dentsply Sirona (US) (Star) lead with their unmatched global presence, strong brand recognition, and comprehensive portfolios of smoke evacuation systems. Modern Dental Group Limited (Hong Kong) (Emerging Leader) is rapidly gaining traction with its versatile products, which include medical gas and equipment for various therapeutic and diagnostic applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 1,511.5 Million |

| Revenue Forecast in 2031 | USD 2,398.7 Million |

| Growth Rate | CAGR of 6.7% from 2026-2031 |

| Actual data | 2025-2031 |

| Base year | 2025 |

| Forecast period | 2026-2031 |

| Units considered | Value (USD Million), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Related Segment & Geographic Reports |

US Digital Dentures Market Europe Digital Dentures Market |

WHAT IS IN IT FOR YOU: DIGITAL DENTURE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment by volume (units) for dental equipments used in digital dentures ecosystem |

|

| Product Analysis | Further breakdown of other applications in the market | Insights on other applications involved in the market |

| Company Information |

|

Insights on market share analysis by country |

| Geographic Analysis |

|

Country level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- March 2025 : At the IDS 2025 event in Cologne, SprintRay launched a strategic partnership with the Straumann Group, which led to the launch of Straumann Signature Midas by SprintRay. This joint offering combines the Midas Digital Press from SprintRay with the AXS digital platform and SIRIOS intraoral scanner from Straumann. The partnership is intended to help speed the adoption of same-day dentistry globally by enhancing speed, accuracy, and efficiency in restorative dental procedures.

- January 2024 : Stratasys launched its TrueDent digital denture solution in Europe to offer advanced 3D-printed dentures to a larger region. The digital denture solution enables dental labs and practices to produce monolithic and multi-material dentures in a single print. The digital denture solution enables improved aesthetics, strength, and fit while reducing manual processing. The launch of the digital denture solution is intended to ensure faster turnaround times and greater efficiency in the European dental market.

Table of Contents

Methodology

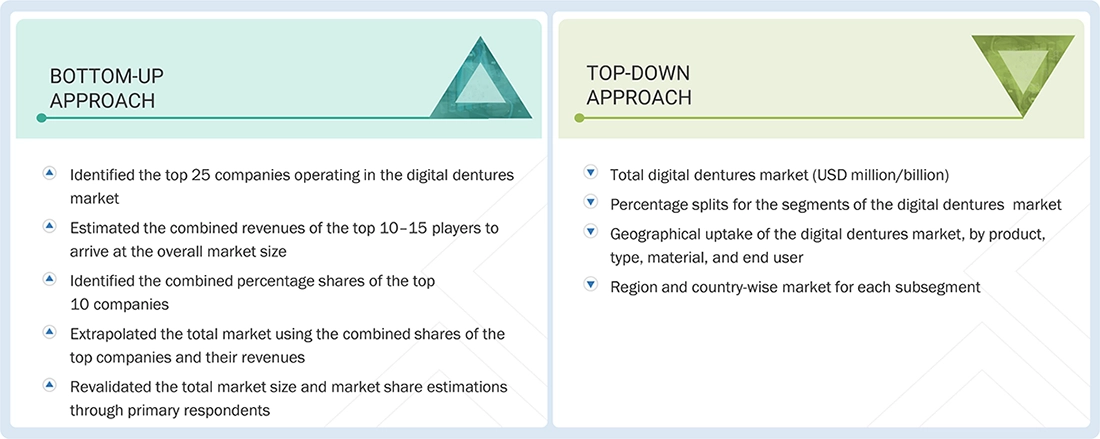

This study involved four major activities to estimate the current size of the digital dentures market. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate segment and subsegment market sizes.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the digital dentures market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources on the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and other key executives from various companies and organizations operating in the digital dentures market. The primary sources on the demand side included industry experts, purchasing and sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends and market dynamics.

A breakdown of the primary respondents for the digital dentures market is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global digital dentures market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players. Also, the global digital dentures market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various digital dentures manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from digital dentures (or the nearest reported business unit/product category)

- Revenue mapping of major players to be covered.

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global digital dentures market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Digital Denture Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall size of the global digital dentures market using the above-mentioned methodology, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, as applicable, to complete the overall market engineering process and obtain exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Digital dentures are dental prostheses created with scanners, design software, and mills or printers. These digital tools can provide greater accuracy, efficiency, and often greater patient comfort. The digital denture workflow can start in different ways. For example, sometimes a conventional impression is still needed, sometimes a direct scan in the patient’s mouth is used to create a digital impression for dentures, and sometimes an impression isn't needed because the clinician duplicates an existing denture. The workflow depends entirely on the clinical situation and the type of denture being created.

Key Stakeholders

- Manufacturers and distributors of medical devices

- Manufacturers and distributors of medical device components

- Digital denture companies

- Healthcare institutes

- Diagnostic laboratories

- Hospitals and clinics

- Academic institutes

- Research institutes

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, analyze, and forecast the global digital denture market product, type, usage, materials, end user, and region

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro markets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the digital denture market in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and GCC countries.

- To profile the key players in the digital denture market and comprehensively analyze their core competencies.

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches and approvals in the digital denture market.

- To analyze the impact of the recession on the digital denture market

Available customizations:

Based on the given market data, MarketsandMarkets offers customizations tailored to your company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe digital dentures market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific digital dentures market into South Korea, Taiwan, and others

- Further breakdown of the Rest of Latin America digital dentures market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia digital dentures market into Malaysia, Singapore, New Zealand, and others

Competitive Landscape Assessment

- Market share analysis, by region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), which provides market shares of the top 3-5 key players in the digital dentures market

- Competitive leadership mapping for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Digital Denture Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Digital Denture Market