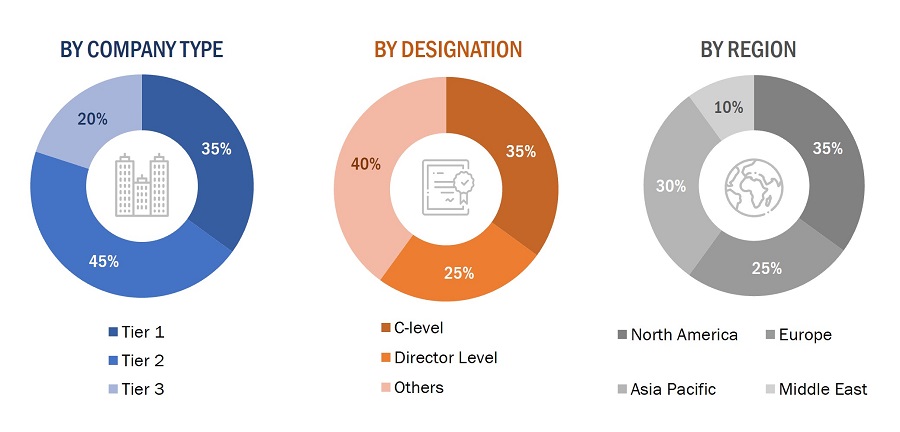

This research study on the defense electronics obsolescence involves the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Crunchbase, BusinessWeek, and Factiva, to identify and collect information relevant to the market. The primary sources considered include industry experts, as well as manufacturers, system providers, technology developers, alliances, and organizations related to all segments of the value chain of this defense electronics industry. In-depth interviews with various primary respondents, including key industry participants, subject-matter experts (SME), industry consultants, and C-level executives, have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the market, as well as to assess its growth prospects.

Secondary Research

The ranking analysis of companies in the defense electronics obsolescence has been determined using secondary data from paid and unpaid sources and analyzing the product/services/solutions portfolios of major companies operating in the market. These companies have been rated based on the performance and diversification of their products. Primary sources further validate these data points.

Secondary sources referred for this research study include financial statements of companies offering defense electronics obsolescence for all respective systems stages, such as human machine interface, targeting systems, electronic warfare system, communications systems, navigation systems, flight control systems and sensors, along with various trade, business, and professional associations. The secondary data has been collected and analysed to arrive at the overall size of the market, which has been validated by primary respondents.

Primary Research

Extensive primary research has been conducted after obtaining information about the current scenario of the defense electronics obsolescence through secondary research. Several primary interviews have been conducted with market experts from the demand and supply sides across five regions, namely, North America, Europe, Asia Pacific, the Middle East. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

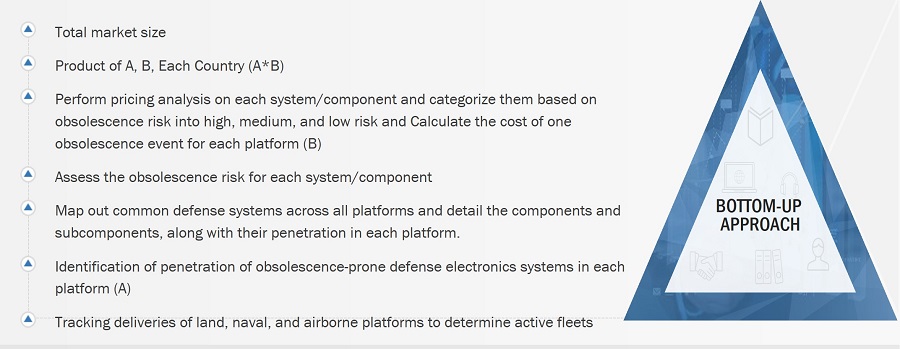

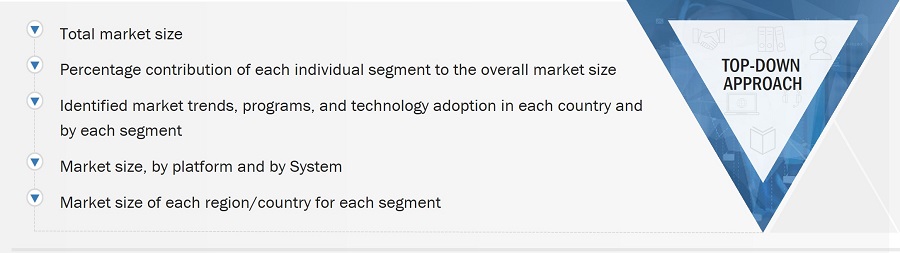

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the market. The research methodology used to estimate the market size also includes the following details:

-

Key players have been identified through secondary research, and their market ranking has been determined through primary and secondary research. This includes a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

-

All percentage splits and trends have been determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market Size Estimation Methodology: Bottom-Up Approach

Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures explained below have been implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both the top-down and bottom-up approaches.

Market Definition

?The defense electronics obsolescence market scope includes replacement demand for obsolete electronic components across marine, airborne, and land platforms arising from the long operational life of defense programs but a shorter life span of electronic components. The defense electronics obsolescence market encompasses a wide range of activities, including reverse engineering and retrofitting existing systems with modern components. It also involves collaboration between defense contractors, electronics manufacturers, and research institutions to address the unique challenges faced by the defense sector. Obsolescence in this context pertains to the state where electronic components, technologies, or systems are no longer available, supported, or sustainable due to technological advancements, manufacturing discontinuations, or the unavailability of replacement parts.

STAKEHOLDERS

-

Government Authorities

-

Regulatory Bodies

-

R&D Companies

-

Subsystem Manufacturers

-

Electronic Component Manufacturers

-

Electronic System Providers

-

Platform Manufacturers

-

Re-engineering Component and Sub-component Providers

-

Armed Forces.

Report Objectives

-

To define, describe, and forecast the defense electronics obsolescence market based on system, platform, and type from 2023 to 2028

-

To forecast the size of various segments of the market with respect to major regions: North America, Europe, Asia Pacific, the Middle East.

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

-

To analyze opportunities for stakeholders in the market by identifying key market trends

-

To analyze competitive developments such as contracts, acquisitions, agreements, and product launches in the market

-

To provide a detailed competitive landscape of the market, in addition to an analysis of business and corporate strategies adopted by leading market players

-

To strategically profile key market players and comprehensively analyze their core competencies.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at country-level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Defense Electronics Obsolescence Market