The study involves four main activities to estimate the current size of the automotive filters market.

-

Exhaustive secondary research and country-wise model mapping to collect information on automotive filter type, vehicle type, filter media type, fuel type, and automotive filter materials.

-

The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

-

Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered in this study.

-

After that, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources referred for this research study include automotive organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA), the International Energy Agency (IEA), and the European Automobile Manufacturers' Association. The secondary sources included annual reports, press releases, and investor presentations of manufacturers; white papers, certified publications; articles from recognized authors, directories, and industry databases; and articles from recognized associations and government publishing sources.

Secondary research was used to obtain critical information about the industry's value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

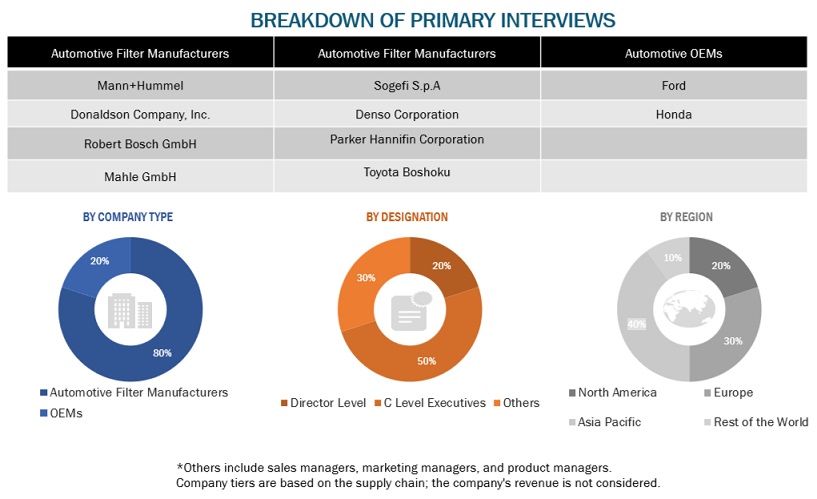

After understanding the automotive filters market scenario, extensive primary research was conducted. Several industry experts from automotive filter providers, component/system providers, and end-user organizations across four major regions, North America, Europe, Asia Pacific, and RoW, were contacted for the primary interviews. Most interviews were conducted from the supply side and some from OEMs. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration, were contacted to provide a holistic viewpoint in the report while canvassing primaries. After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This and the opinions of in-house subject matter experts led to the conclusions delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

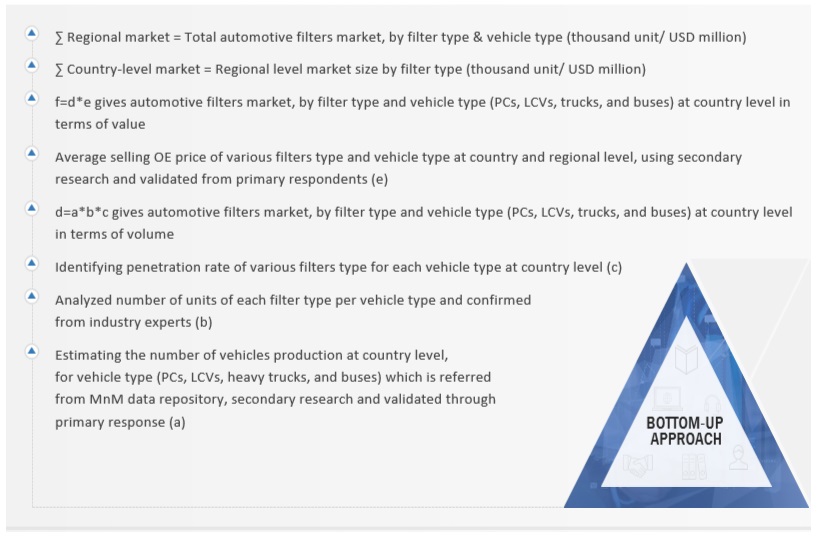

The bottom-up approach has been used to estimate and validate the size of the automotive filter market. The market size, by volume, of the automotive filters market has been derived by identifying the country-level vehicle production data (a) for each vehicle type (PCs, LCVs, trucks, and buses) and the number of units installed of different filter types per vehicle in all considered vehicle types (b) and penetration rate of each filter type in different vehicle types considered (c). Multiplying all three factors will provide the country-level market size by volume filter and vehicle type. The market size, by value, has been arrived at by multiplying the average selling OE price of filters for each vehicle type at the country level. The summation of the country-level market gives regional and global automotive filter markets by filter type and vehicle type. A similar approach is followed for the electric & hybrid vehicle filters market by vehicle type and filter types, off-highway by equipment type and filter type, and aftermarket by filter type in terms of volume and value.

Automotive Filters Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

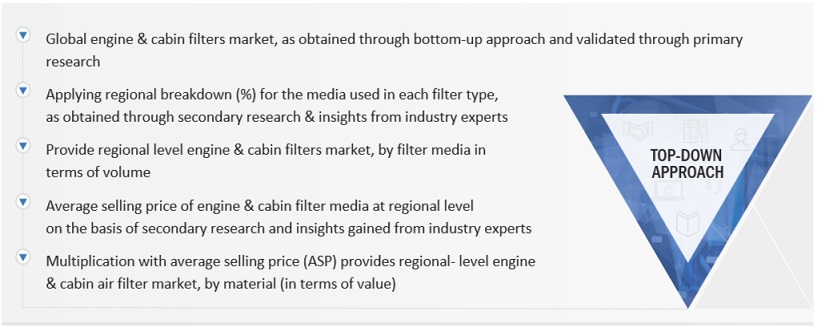

The market size of engine & cabin air filters, by material, was calculated using the top-down approach. Extensive secondary and primary research was carried out to understand the global market scenario for the types of material used in engine & cabin air filters. Several primary interviews were conducted with key opinion leaders concerning cabin air filter development, including key OEMs, Tier-I suppliers, and filter manufacturers. Qualitative aspects, such as market drivers, restraints, opportunities, and challenges, were considered while calculating and forecasting the market size.

Automotive Filters Market: Top-Down Approach

Market Definition:

Filters in a vehicle remove foreign and unwanted substances/particles, which can cause severe damage to the vehicle system or human health. Some automotive filters include air filters, oil filters, brake dust filters, steering filters, cabin air filters, fuel filters, and coolant filters.

According to Mann+Hummel, a renowned automotive filter market player, combustion air always contains particles that should not be allowed to penetrate the inside of the engine. Therefore, applying air filters is essential to protect the engine and its components.

Stakeholders:

-

Automotive OEMs

-

Filters Manufacturers

-

Component and Raw Material Suppliers of Automotive Filters

-

On-highway and Off-highway Vehicle Manufacturers

-

Automotive Component Providers

-

Filters Design Companies

-

Automobile Organizations/Associations

-

Traders, Distributors, and Suppliers of Automotive Filters

-

Legal and Regulatory Authorities

-

Dealers, Distributors, and Retailers

-

Associations, Forums, and Alliances Related to ICE and Electric Vehicles

-

Government Agencies and Policymakers

-

Automobile Organizations/Associations

Report Objectives

-

To define, describe, and forecast the automotive filters market based on

-

Filter types (air filters, fuel filters, oil filters, oil separators, transmission oil filters, coolant filters, steering filters, brake dust filters, cabin filters, urea filters, DPF (Diesel Particulate Filters), GPF (Gasoline Particulate Filters), and crankcase ventilation filters)

-

Air filter by media type (cellulose and synthetic)

-

Cabin filter by material type (particle cabin filters, activated carbon filters, and electrostatic cabin filters)

-

Fuel filter by fuel type (gasoline filters and diesel filters)

-

Automotive Filter Aftermarket, by Filter Type (oil filters, fuel filters, air filters, cabin filters, coolant filters, and transmission oil filters)

-

Automotive Filters Market by vehicle type (passenger cars, light commercial vehicles, buses, and trucks)

-

Electric & hybrid vehicle filters market by vehicle type (BEV (battery electric vehicle) and PHEV (Plug-in hybrid electric vehicle)

-

Electric & hybrid vehicle filters market by filter type (air filters, fuel filters, oil filters, transmission oil filters, EMI/EMC filters, brake dust filters, cabin filters, cooling air particle filters)

-

Off-highway filters market by equipment type (agriculture tractors and construction equipment)

-

Off-highway filters market by filter type (fuel filters, engine oil filters, air filters, cabin air filters, and transmission oil filters)

-

By Region [Asia Pacific (China, India, Japan, South Korea, Thailand, and Rest of Asia Pacific), Europe (France, Germany, Russia, Spain, Turkey, the UK, and Rest of Europe), North America (Canada, Mexico, US) and RoW (Iran, Brazil, and Others in RoW)

-

To provide detailed information about significant factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

-

To evaluate the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To strategically profile key players and comprehensively analyze their market shares and core competencies

-

To strategically analyze the key player strategies/right to win

-

To study the market with supply chain analysis, ecosystem analysis, trade analysis, case study analysis, pricing analysis, patent analysis, trends/disruptions impacting buyers, technology trends, regulatory analysis, and recession impact analysis

-

Analyzing the competitive leadership mapping of the global automotive filter manufacturers in the market and understanding their market position with the help of a company evaluation matrix.

-

To track and analyze competitive developments, such as joint ventures, collaborations, partnerships, mergers & acquisitions, new product developments, and expansions, in the automotive filters market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s needs.

Automotive Filters Market By Sales Channel (Region Level)

Automotive Filters Market By Ice Vehicle Type (Country Level)

-

Passenger Cars

-

LCVs

-

Trucks

-

Buses

Electric And Hybrid Vehicle Filters Market, By Filter Type And Vehicle Type

-

Oil Filters

-

Fuel Filters

-

Air Filters

-

Cabin Filters

-

Transmission Oil Filters

-

Brake Dust Filters

-

EMI/EMC Filters

-

Cooling Air Particle Filters

Note: Asia Pacific (China, India, Japan, South Korea, Thailand, and others); Europe (France, Germany, Russia, Spain, Turkey, the UK, and others); North America (Canada, Mexico, the US) and RoW (Iran, Brazil, and others)

Amey

Nov, 2019

Up to date (2017) Off highway filter marketplace Globally and by region for all types - Oil, Fuel, prefuel, hydraulic, transmission.

Amey

Nov, 2019

I would appreciate to have a sample of market research of the Brazilian Oil,Fuel,Air and HVAC market, production and market players split.

Amey

Nov, 2019

Air , Oil and Fuel filter Market at Canada , who is suppliers what size is it in aoutomotive including buses,trucks and business heavy equipments market .

Amey

Nov, 2019

Hello, I am interested in receiving reports for Aftermarket data for filters in the United States. Specifically, I would like to locate Vehicle in Operation information, or demands for Heavy Duty Filters. Any information provided would be much appreciated. Thank you.

Amey

Nov, 2019

What is the expected evolution of filter markets considering that the reliability of vehicles and quality of oils is continuously improving and enable to space out visits?.

Amey

Nov, 2019

yes Fuel Filters especially the Diesel Market size. I would like to see if you have info specifically units and dollars for the diesel fuel filter market in the u.s.

Amey

Nov, 2019

Interested to Know market potential for Fuel Filter Cum Water Separator for Ashok leyland Vehicles and current After market share held by various competetions in India.

Amey

Nov, 2019

we are conducting a final career project on filters for motorbikes. Your study migth help us. Regards.

Amey

Nov, 2019

I am seeking an air filter market report with a narrow focus. Specifically, the focus is medium and heavy vehicle in the North America markets (US and Canada data). May I please have a quote and a table of contents for a report with this focus? Thank you, Megan .

Amey

Nov, 2019

I'm specifically interested in automotive-filter manufacturers based in China and the markets/regions they supply to/support. .

Amey

Nov, 2019

I want to get a sense of how Mahle are doing in the UK and Europe within the Aftermarket compared to the leader. If I can get this, I will be able understand the full value of the report.

User

Jul, 2019

Hi, I am looking for specific information on Capacitive dividers for EVT, Testing, RC Dividers, Grading AIS, Grading GIS, TRV AIS, TRV GIS, Thyristor Valve, HVDC Bypass, Filter capacitor, EVT For the following countries and region - Europe. U.S., Canada, India, China, South America, and Middle East Can you please help me with a quote and timeline for the same?.

User

Jul, 2019

Diesel and Gasoline Particulate Filters, Catalysts for the automotive industry globally and all vehicle segments(i.e PC HCV). Thanks.

Swati

Jun, 2019

Hello, I am a consultant/investor in the North America Automotive Aftermarket space and would like a sample report to determine if it can add value for my filter manufacturer client. Regards, Frank.

Atul

May, 2019

We would be interested in purchasing the Report on automotive filters. Could you please provide us with some information prior to the purchase: Is there an extended table of content that you can share with us? Could you share with us the forecast model that is underlying the report? .

Atul

May, 2019

What is the source of the data used in the forecast? (Is it based on IHS data when it comes to volumes for instance?) .

Atul

May, 2019

Can you give us details regarding the methodology? We would need datapoints going back to 2013. Could you provide these? Many thanks in advance! .