Data Center Chip Market Size, Share and Trends

Data Center Chip Market by Offerings (GPU, CPU, FPGA, Trainium, Inferentia, T-head, Athena ASIC, MTIA, LPU, Memory (DRAM (HBM, DDR)), Network (NIC/Network Adapters, Interconnects)) – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The data center chip market is valued at USD 206.96 billion in 2025 and is projected to reach USD 390.65 million by 2030, at a CAGR of 13.5%. The expansion of data center capacity is one of the primary drivers of the growth of the data center chip market. With the growing demand for more digital services, organizations handle more volumes of data and are adopting emerging technologies, which is increasing the demand for data center capacity.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific data center chip market accounted for a 34.2% share in 2024.

-

By ComponentBy component, the processor segment is expected to register the highest CAGR of 14.7%.

-

By Data Center SizeBy data center Size, the large data center segment is expcted to have largest market share of 37.1% in 2024.

-

By End UserBy end user, the cloud service provider segment is expected to dominate the market.

-

By ApplicationBy application, the AI segment will grow the fastest during the forecast period.

-

Competitive LandscapeNVIDIA Corporation (US) and AMD (US) were identified as some of the star players in the piezoelectric device market (global), given their strong market share and product footprint.

-

Competitive LandscapeHailo Technologies Ltd (Israel), and Tenstorrent (Canada), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialised niche areas, underscoring their potential as emerging market leaders

The expansion of data center capacity is one of the primary drivers of the growth of the data center chip market. With the growing demand for more digital services, organizations handle more volumes of data and are adopting emerging technologies, which is increasing the demand for data center capacity. This expansion is attributed to the proliferation of data-intensive applications, the advent of cloud computing, the rise in the number of IoT devices, and the trend of increased data-based decisions. The emergence of sovereign Al is one of the major opportunities in the market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the rapidly evolving landscape of artificial intelligence (AI), the demand for data center chips is a crucial factor shaping the market growth. As Al technologies advance, data centers increasingly become the backbone of modern digital infrastructure. The current revenue mix primarily includes traditional components, such as DRAM, interconnects, and CPU. As Al continues to permeate various sectors, there is a growing demand for GPUs and ASICS, better suited for handling the intensive computational requirements of Al workloads. This shift is propelled by 'hot bets' expected to cause a decline in revenue from older technologies while opening up new avenues for growth. The shift from traditional CPUs to GPUs and ASICs represents a move toward more parallel processing capabilities, which are essential for Al tasks, such as machine learning and deep learning. The growth of CPUs, GPUs, and FPGAs is disrupting enterprises, cloud service providers, and government organizations by enabling faster data processing and real-time analytics, essential for modern applications like Al and machine learning. This shift compels these entities to adopt more specialized hardware solutions to meet increasing computational demands, transforming their operational frameworks and enhancing their capabilities in handling complex tasks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid expansion of data center capacity

-

Rising need for low-latency and high-throughput data processing

Level

-

Shortage of skilled workforce

-

High costs of data center GPUS

Level

-

Emergence of sovereign Al

-

Increasing adoption of FPGA-based accelerators

Level

-

High energy consumption in data centers

-

Security concerns associated with data center hardware components

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rapid expansion of data center capacity

The expansion of data center capacity is a key driver for the data center solutions market. As demand for digital services increases, organizations are handling larger volumes of data and adopting emerging technologies, which in turn increases the need for greater data center capacity. The proliferation of data-intensive applications fuels this demand, the rise of cloud computing, the increasing number of lot devices, and a trend toward data-driven decision-making.

Shortage of skilled workforce

Data centers are complex systems, and companies require experts and a skilled workforce for developing, managing, and implementing Al systems. Integrating Al technology into existing systems is a challenging task that requires well-funded in-house R&D and patent filing. A workforce possessing in-depth knowledge of this technology is limited as Al as a technology is still in its early stage

Emergence of sovereign Al

The focus on sovereignty in Al will drive innovation in chip technology while simultaneously creating a competitive landscape where companies must adapt quickly to meet the evolving demands of sovereign

High energy consumption in data centers

More data center operations result in more electricity consumption, leading to this factor becoming a challenging aspect for this market

DATA CENTER CHIP MARKET SIZE, SHARE AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

STMicroelectronics needed to enhance its research and development data center performance to keep pace with the increasing complexity of chip design. The company aimed to improve efficiency while keeping sustainability goals, particularly reducing energy consumption without compromising performance | The integration of AMD EPYC processors led to a 12% improvement in performance and a 30% reduction in power consumption per core. Overall, STMicroelectronics achieved a 33% decrease in electricity consumption across its data center, allowing for faster chip design delivery while meeting efficiency and sustainability targets. |

|

DBS Bank sought to transform its data center infrastructure to enhance operational efficiency while reducing costs. The bank faced challenges related to high hardware costs and energy consumption, impacting its overall performance and sustainability efforts. | The deployment of AMD EPYC processor-powered servers resulted in a remarkable 75% reduction in hardware costs for DBS Bank. Additionally, the bank achieved a 50% decrease in power consumption and nearly 99% virtualization of its workloads |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Designers, including integrated device manufacturers, electronic design automation, and fab designers, characterize the data center chip market ecosystem. Few companies working under this segment are Analog Devices (US), Intel Corporation (US), Synopsys (US), and Cadence (US). The next stage includes manufacturers of wafers, which include companies such as ASML (Netherlands), Samsung (South Korea), and Texas instruments (US). The next part of the ecosystem includes chip providers. These are companies that provide data center chips, such as GPUs, CPUs, FPGAS, ASICS, and Memory. Few companies that provide these are Intel Corporation (US), NVIDIA Corporation (US), AMD (US), Micron Technology (US), and SK HYNIX Inc. (South Korea). The end users of these data center chips are companies such as AWS (US), Google (US), Siemens (Germany), and Microsoft (US) to meet their data center requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center Chip Market, By Component

Processors used in the data center chip market consist of a graphic processing unit (GPU), central processing unit (CPU), field programmable gate array (FPGA), DOJO & full self-driving (FSD), Trainium & Inferential, ATHENA ASIC, T-head, meta training and inference accelerator (MTIA), and language processing unit (LPU). Processors like GPUS can handle computational loads to train and run deep learning models. This makes them essential in data centers and Al research applications. New GPUs are constantly being developed and released by leading companies like NVIDIA Corporation (US), Intel Corporation (US), and Advanced Micro Devices, Inc., among others. CPUs orchestrate all system operations, handle data flow, and manage pre- and post-processing tasks for Al workloads in data centers. They are essential in low-latency application fields, such as Al inferencing within recommendation systems or financial trading algorithms in real time.

Data Center Chip Market, By Data Center Size

Large data centers are usually used by organizations that require high server density and computational power, covering an area of 25,000 square feet or more. Large data centers offer cost-effective power management, dynamic resource allocation, and efficient management and monitoring of resources. Large-scale data centers are needed to host and manage cloud service infrastructures such as laaS, PaaS, and Saas. Such large data centers can cater to the requirements of IT infrastructure and consumer demands, allowing organizations to expand their operations smoothly and provide global service coverage. The financial services sector, scientific research, and pharmaceutical businesses and the development and deployment of Al and ML models depend on heavy processing for simulative and calculating work.

Data Center Chip Market, By End User

The enterprises segment is projected to register the highest CAGR during the forecast period. Enterprises include healthcare, BFSI, automotive, retail & e-commerce, media & entertainment, law firms, marketing agencies, research centers, educational institutions, and architectural, engineering & design firms. This end-use segment is characterized by the implementation of solutions for better operational efficiency, improvement in decision-making processes, and innovative products and services. In contrast to cloud service providers, enterprises usually deploy data center chips in on-premises data centers or edge devices, which necessitates a combination of high-performance and application-specific Al accelerators tailored to their specific use cases. Data center chips become essential components of enterprise IT infrastructure that can speed up complex computations and support machine learning algorithms.

Data Center Chip Market, By Application

The data center chip market is expected to experience a high growth rate in the generative Al segment due to the rapid adoption of generative models such as GPT-4, DALL-E, and Stable Diffusion across industries. These models require massive computational power in real time to generate high-quality content, such as text, images, and videos. The deployment of generative Al for applications such as content creation, drug discovery, and design automation increases the demand for high-performance data center chips in various organizations. Companies like NVIDIA and AMD continue developing specific GPUs with highly improved tensor cores optimized to suit the parallel processing demands that generative models require

REGION

Asia Pacific to be fastest-growing region in global AI server market during forecast period

The data center chip market in Asia Pacific is projected to register the highest CAGR during the forecast period. The Asia Pacific market has been segmented into China, Japan, India, and the Rest of Asia Pacific. The Rest of Asia Pacific mainly includes South Korea, Australia, Singapore, the Philippines, Taiwan, Thailand, and Indonesia. The region is a vital player in the global data center chip market, driven by its robust manufacturing capabilities and technological advancements. However, macroeconomic trends in the major economies of China, Japan, and India over the past few quarters will have profound implications for the data center chip market in the region.

DATA CENTER CHIP MARKET SIZE, SHARE AND TRENDS: COMPANY EVALUATION MATRIX

In thedata center chip market matrix, NVIDIA Corporation (US) and AMD (US) leads with a strong market share and extensive product footprint, This is one of the leading players in terms of developments such as product launches, innovative technologies, and the adoption of strategic growth plans. Groq, Inc. (US) (Emerging Leader) is gaining visibility The company hold a small share of the market. However, the company have innovative product and service portfolios.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- NVIDIA Corporation (US)

- AMD (US)

- Intel Corporation (US)

- Samsung (South Korea)

- SK Hynix Inc. (South Korea)

- Google (US)

- Amazon Web Services, Inc. (US)

- Monolithic Power Systems, Inc (US)

- Texas Instruments Incorporated (US)

- Micron Technology, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 162.35 Billion |

| Market Forecast in 2030 (Value) | USD 390.65 Billion |

| Growth Rate | CAGR of 13.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: DATA CENTER CHIP MARKET SIZE, SHARE AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hyperscale Data Center Operators | End-to-end data center chip architecture roadmap covering CPUs, GPUs, AI accelerators, DPUs, and memory integration | Workload-level performance and power benchmarking across AI training, inference, cloud-native, and HPC workloads |

| Cloud Service Providers (Public & Private) | Detailed CPU/GPU/AI accelerator comparison across vendors and process nodes | Power, thermal, and cooling efficiency assessment |

RECENT DEVELOPMENTS

- July 2024 : NVIDIA Corporation and Mistral Al collaborated to develop Mistral NeMo to support coding, summarization, chatbots, and multilingual tasks. This solution accelerates the performance of large language models and generative Al for various use cases.

- June 2024 : Advanced Micro Devices, Inc. introduced AMD Ryzen Al 300 Series processors with powerful NPU offering 50 TOPS Al processing power for next-gen AI PCs. It is powered by the new Zen5 architecture with 12 high-performance CPU cores. It features advanced Al architecture for gaming and productivity.

- June 2024 : Advanced Micro Devices, Inc. partnered with Microsoft to deliver CoPilot+ PCs powered by Ryzen Al. This partnership supports Al's rapid acceleration, boosting the demand for high-performance computing platforms.

- March 2024 : NVIDIA Corporation introduced the NVIDIA Blackwell platform to enable organizations to build and run real-time generative Al featuring six transformative technologies for accelerated computing. It enables Al training and real-time LLM inference for models up to 10 trillion parameters.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the data center chip market—exhaustive secondary research collected information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. These secondary sources include data center chip technology journals and magazines, annual reports, press releases, investor presentations of companies, white papers, certified publications and articles from recognized authors, and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

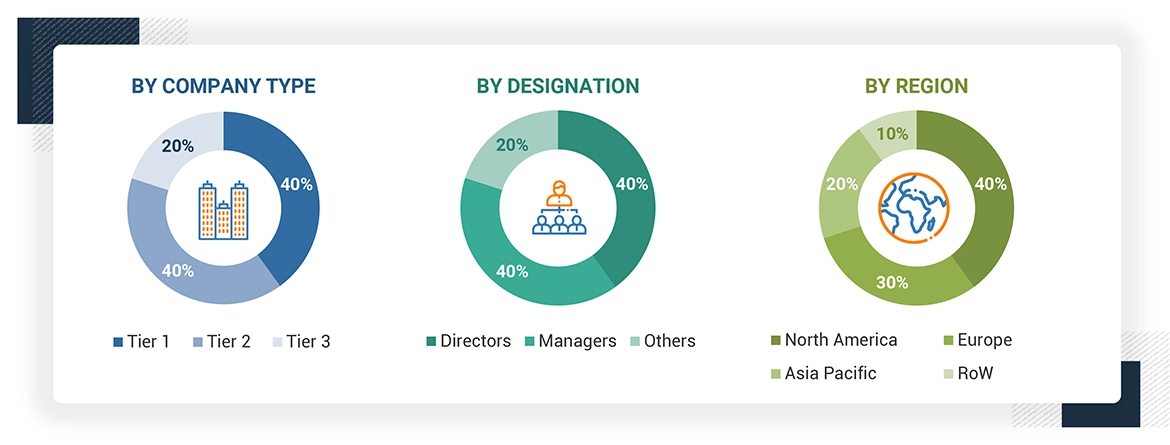

Various primary sources from both supply and demand sides have been interviewed in the primary research process to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the data center chip market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

Note: Other designations include sales, marketing, and product managers. Tier 1 = USD 1 billion, Tier 2 = USD 0.5–1.0 billion, and Tier 3 = USD 0.5 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

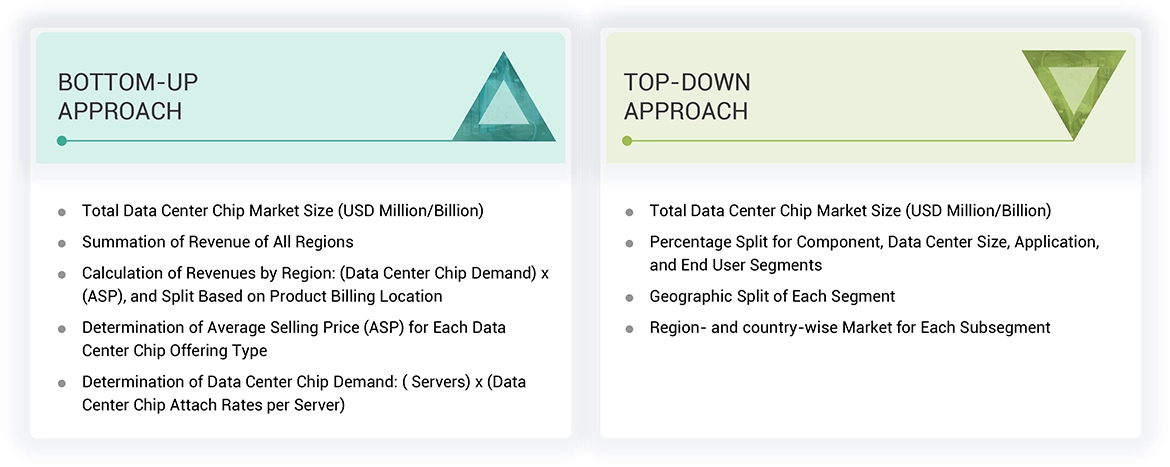

In the complete market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been conducted on the complete market engineering process to list the key information/insights throughout the report.

The key players in the market, such as Intel Corporation (US), NVIDIA Corporation (US), Google (US), Advanced Micro Devices, Inc. (US), and Micron Technology, Inc. (US), have been identified through secondary research and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top players as well as extensive interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the data center chip market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Center Chip Market : Top-Down and Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall size of the data center chip market. The bottom-up methodology for data center chip market calculations begins with determining data center chip demand by multiplying server numbers by chip attach-rates per server. Average Selling Prices for each data center chip offering type are then identified. Revenues are calculated for each region or country by multiplying the local data center chip demand by the corresponding ASP, considering product billing locations. These regional revenues are summed to provide a global figure. The total market size is derived by combining all calculated revenues

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. The top-down methodology for the data center chip market analysis starts with the total market size as the foundation. This figure is then divided into percentage splits for key segments such as Component, Data Center Size, Application, and End User. Each segment is further divided into geographic regions, clearly showing market distribution across different areas. The analysis then delves deeper, offering region and country-wise splits for each sub-segment. This approach allows for a comprehensive market view, starting from the broadest perspective and progressively narrowing down to specific details. This provides an effectively mapped-out entire data center chip market landscape, identifying trends, opportunities, and potential growth areas across various dimensions and geographical locations.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends identified from both the demand and supply sides.

Market Definition

Considering the views of various sources and associations, a data center is a centralized facility that houses computing, storage, and networking equipment, along with the necessary infrastructure for managing and processing large volumes of data, supporting organizations' IT requirements. Data center chip market refer to a comprehensive set of components and technology designed to optimize, manage, and enhance the efficiency, reliability, and security of data centers.

Key Stakeholders

- Government and financial institutions and investment communities

- Analysts and strategic business planners

- Semiconductor product designers and fabricators

- Application providers

- AI solution providers

- AI platform providers

- Business providers

- Professional service/solution providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Report Objectives

The following are the primary objectives of the study.

- To describe and forecast the data center chip market size, in terms of value and volume, by component, application, data center size, end user, and region

- To describe and forecast the market size across four key areas, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective country-level market size, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges of the data center chip market

- To strategically analyze the micromarkets1 concerning the individual growth trends, prospects, and their contribution to the data center chip market

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To provide a detailed overview of the data center chip value chain and ecosystem

- To provide information about the key technology trends and patents related to the data center chip market

- To provide a detailed overview of the supply chain, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, average selling price (ASP) analysis, AI/gen AI impact analysis, Porter's five forces analysis, macroeconomic outlook, and regulations about the market of the data center chip.

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as contracts, acquisitions, product launches and developments, collaborations, and partnerships, along with research & development (R&D), in the data center chip market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Chip Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Chip Market