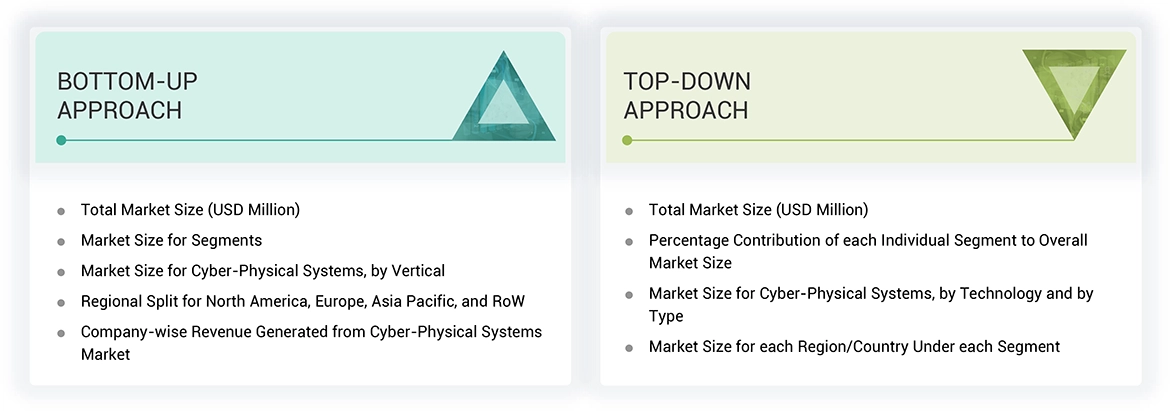

The study involved four major activities in estimating the current size of the cyber-physical systems market—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

Primary Research

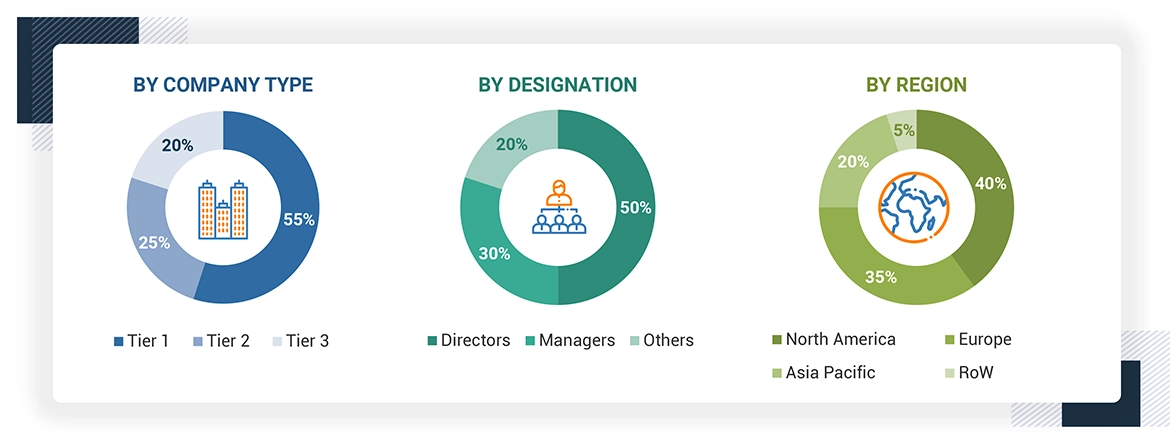

Extensive primary research was conducted after gaining knowledge about the current scenario of the cyber-physical systems market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Other designations include sales managers, marketing managers, and product managers.

The three tiers of the companies have been defined based on their total revenue as of 2023: tier 1: revenue greater than USD 1 billion, tier 2: revenue between USD 500 million and USD 1 billion, and tier 3: revenue less than USD 500 million.

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Data Triangulation

After arriving at the overall market size from the above estimation process, the market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Cyber-Physical Systems (CPS) are advanced integrations of computational and physical processes that leverage real-time data from sensors and actuators. These systems facilitate interaction between the digital and physical worlds and enhances efficiency, safety, and decision-making capabilities across various applications such as manufacturing, healthcare, transportation, and agriculture. Cyber-physical systems represent engineered systems made from and integrating physical and computational components. The development within the area of CPS provide the capabilities for adaptability, scalability, resiliency, safety, security, and usability, with expanded horizons for these vital systems. Technologies for the CPS are also changing the way people shall interact with engineered systems in ways similar to how the Internet has revolutionized the way people interact with information.

Key Stakeholders

-

Hardware providers

-

Software providers

-

System integrators

-

Government bodies and policymakers

-

Associations, organizations, and alliances related to the cyber-physical systems ecosystem

-

Market research and consulting firms

-

Raw material suppliers and distributors

-

Research institutes and organizations

-

Original equipment manufacturers (OEMs)

-

Traders and suppliers

-

Venture capitalists and private equity firms

-

End users of cyber-physical systems across various verticals, such as manufacturing, healthcare, agriculture, automotive & transportation, aerospace, energy, and infrastructure (smart cities), among others

Report Objectives

-

To define and forecast the cyber-physical systems market based on technologies and verticals in terms of value for cyber-physical systems.

-

To describe and forecast the cyber-physical systems market based on four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

-

To study the complete value chain of the cyber-physical systems market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the cyber-physical systemss ecosystem

-

To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies, and provide a detailed competitive landscape

-

To analyze competitive developments, such as product launches and developments, acquisitions, collaborations, agreements, and partnerships, in the cyber-physical systems market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Additional country-level analysis of the cyber-physical systems market

Product Analysis

-

Product matrix provides a detailed comparison of the product portfolio of each company in the cyber-physical systems market.

Growth opportunities and latent adjacency in Cyber-Physical Systems (CPS) Market