Cryogenic Valve Assembly Market

Cryogenic Valve Assembly Market by Type (Gate, Globe, Ball, Check, Butterfly), Cryogen (Nitrogen, Argon, Oxygen, LNG, Hydrogen), End-user Industry (Metallurgy, Power, Chemicals, Electronics), Component, Application, and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The cryogenic valve assembly market is projected to grow from USD 4.83 billion in 2024 to USD 7.21 billion by 2029 at a CAGR of 8.3%. The growth in the cryogenic valve assembly market is driven by increasing demand for cryogenic applications in industries such as energy, healthcare, and manufacturing. Expansion in LNG trade and storage infrastructure, advancements in space exploration requiring cryogenic equipment, and the growing use of industrial gases in medical and industrial processes are some of the factors contributing to market expansion. Moreover, technological improvements in valve designs and materials with regard to performance at very low temperatures, along with the strict regulations on safety, continue to positively support market growth.

KEY TAKEAWAYS

-

BY TYPEThe cryogenic valve assembly market is segmented by type, which includes gate, globe, ball, check, butterfly and other valves. Ball valves account for the highest share of cryogenic valve assembly, driven by their superior sealing capability, durability, and ease of automation, making them ideal for handling sensitive cryogenic fluids like LNG and liquid nitrogen.

-

BY CRYOGENThe cryogenic valve assembly market, based on cryogen, has been segmented into nitrogen, argon, oxygen, LNG, hydrogen, other cryogens. Nitrogen is the largest segment in the cryogenic valve assembly market due to its extensive use across industries such as food processing, healthcare, electronics, and chemicals. Liquid nitrogen’s inert nature and extremely low boiling point make it ideal for ultra-cold storage and transport applications. The rising demand from pharmaceuticals and biotechnology further drives the need for reliable cryogenic valve assemblies, ensuring safe and efficient handling.

-

BY END-USER INDUSTRYThe cryogenic valve assembly market, based on end-user industry, has been segmented into metallurgy, energy & power, chemicals, electronics, transportation, and other end-user industries. The metallurgy segment is expected to capture the largest share of the market by end user. The extensive use of cryogenic gases such as oxygen, nitrogen, and argon in processes like steel manufacturing, welding, and metal fabrication drives the dominance of the metallurgy segment.

-

BY APPLICATIONThe cryogenic valve assembly market, by application, is divided into CASU and non-CASU segments. The CASU segment holds the largest share of the application segment. Cryogenic equipment is vital for the efficient and safe operation of Cryogenic Air Separation Units (CASUs). Specialized cryogenic valves and equipment ensure precise control of temperature, pressure, and flow, enabling the reliable production of high-purity gases. As industries continue to depend on these gases, the role of advanced cryogenic equipment in optimizing CASU operations will remain crucial for supporting global industrial growth and technological advancements.

-

BY COMPONENTThe cryogenic valve assembly market is segmented by components, including valve body, seats, seals, gaskets, backup rings, pipe sleeves, spacers, bearings, gears, actuator, bonnet, disc/plug, stem, throttle plates, and other components (handwheel or levers, spring, position indicators, limit switches, bonnet bolts/nuts, piston or diaphragm, strainer or filter, and drain or vent ports). The valve body segment accounts for a significant share of the cryogenic valve assembly market, driven by its critical role in withstanding extreme temperatures and pressures makes it essential for applications in LNG, industrial gases, and aerospace.

-

BY REGIONThe Asia Pacific region dominates the cryogenic valve assembly market, driven by strong government initiatives and rapid expansion of hydrogen and LNG infrastructure. Countries such as Japan, South Korea, and China are leading in hydrogen mobility through large-scale investments in fuel cell technologies and refueling networks.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and agreements. For instance, Flowserve Corporation, and Valmet have entered into a number of agreements, contracts and partnerships to cater to the growing demand for cryogenic valve assembly and its components.

The cryogenic valve assembly market is driven by the growing demand of liquefied natural gas (LNG), increased investments in space exploration, and the rising acceptance and use of cryogenic technologies for medical and industrial applications. Expanding applications in energy storage and transit will continue to foster growth, along with market concerns regarding safety and risks associated with extremely low temperatures in cryogenic technology. The ongoing advancement in valve technology and the global shift towards cleaner energy sources will also be beneficial for market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The cryogenic valve assembly market is being shaped by several key trends and disruptions, including the rising demand for LNG and hydrogen as cleaner energy sources, driven by global decarbonization efforts. Technological advancements, such as loT enabled smart valves and the use of advanced cryogenic-compatible materials, are enhancing performance and reliability. Tightening environmental regulations are pushing for safer and more efficient valve solutions, while global supply chain challenges, including raw material shortages and geopolitical tensions, are prompting a shift toward localized manufacturing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in demand for liquefied natural gas as clean and efficient energy source

-

Rise in investment in chemical industry

Level

-

Volatile raw material and metal prices and significant competition from gray market players

-

Hazards and greenhouse gas emissions resulting from leak of cryogenic fluids

Level

-

Expansion of industrial gas market

-

Growth of space, healthcare, and hydrogen industry

Level

-

Compliance with stringent regulations and safety standards

-

High maintenance and cost challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for liquefied natural gas as a clean and efficient energy source

Globally, countries are accelerating efforts to reduce greenhouse gas emissions and transition toward low-carbon energy sources such as liquefied natural gas (LNG). The increasing substitution of traditional fossil fuels with LNG underscores this shift, with Shell projecting a global LNG demand surge of over 50% by 2040. China and South Asia are transitioning from coal to gas, while Southeast Asia leverages LNG to sustain economic growth. In North Asia, LNG demand is expected to rise by 5% between 2024 and 2025. In 2023, LNG accounted for approximately 14% of global natural gas consumption, with total trade reaching around 404 million tons—an increase of 7 million tons from the previous year. As LNG becomes a cornerstone of the global energy transition, particularly in power generation and transportation, the need for advanced cryogenic valves has intensified. These valves are critical for the safe, efficient, and precise handling of LNG at ultra-low temperatures. Consequently, the expanding LNG infrastructure and global decarbonization initiatives are key drivers of growth in the cryogenic valve assembly market.

Restraint: Volatile raw material and metal prices, and significant competition from gray market players

Cryogenic equipment is manufactured using high-grade materials such as stainless steel, bronze, carbon steel, and specialized alloys. Price volatility in these metals has a direct impact on cryogenic valve production costs, as manufacturers depend on premium materials capable of maintaining structural integrity and performance at extremely low temperatures. Rising metal prices increase raw material expenses, compress profit margins, and may lead to higher product prices. This volatility also complicates pricing strategies and financial planning, particularly in a market already characterized by strong competition and the presence of gray market suppliers. In Q3 2024, stainless steel prices exhibited notable regional disparities, averaging USD 3,985 per MT in the United States, USD 3,670 per MT in Germany, and USD 1,615 per MT in China indicating persistent upward trends across Asia and Europe that continue to influence global production costs.

Opportunity: Expansion of industrial gas market

The demand for industrial gases is expanding across key sectors such as healthcare, manufacturing, chemicals, and energy. As industries transition toward cleaner energy solutions, gases like oxygen, nitrogen, and hydrogen play a vital role in applications including welding, cooling, and chemical synthesis. According to Statista, Linde, Air Liquide, Air Products, and Taiyo Nippon Sanso collectively dominate over 80% of the global industrial gas market. The rapid growth of renewable energy initiatives—particularly hydrogen production for fuel cells—is creating significant opportunities for industrial gas suppliers. Global economic expansion and rising industrial activity further amplify this demand. To ensure safe and efficient transport, cryogenic liquefied gases are stored in thermally insulated containers capable of withstanding extreme temperature variations. These include Dewar flasks for non-pressurized, short-term storage and liquid cylinders, which are pressurized vessels with integrated valves for controlled filling and dispensing, enabling secure handling of cryogenic fluids across industrial applications.

Challenge: Compliance with stringent regulations and safety standards

Cryogenic valve equipment is necessary for the safe handling of hazardous cryogenic liquids. It must meet strict standards, certifications, and regulations, such as ASME and ISO, to prevent accidents and meet safety requirements in industries like energy, healthcare, and aerospace. Across regions, such as the European Union, US, and Asia-Pacific, regulatory authorities enforce very stringent regulations for operational safety, environmental protection, and preventing accidents. Most of these regulations make it obligatory for manufacturers to meet complex certification processes like ASME standards, ISO certifications, and API specifications. Few of the key standards include ISO 5208, which addresses pressure testing of cryogenic valves, and ISO 10434, which specifies requirements for bolted bonnet steel gate cryogenic valves used in the petroleum, petrochemical, and allied industries. ISO 11114-1 and ISO 11114-2 focus on the compatibility of metallic and non-metallic valve materials with transportable gas cylinders, while ISO 15761 covers steel gates, globe, and check valves for sizes DN 100 and smaller, primarily for the petroleum and natural gas industries. These can result in higher production costs and longer development periods. Moreover, frequent updates to such regulations require incessant investment in compliance measures such as testing, documentation, and audits, which may discourage small and medium-sized enterprises from entering the market.

Cryogenic Valve Assembly Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A customer manufacturing 3-inch Class 600 cryogenic ball valves experienced significant issues with their existing PCTFE lip seals. The seals exhibited inconsistent performance, resulting in a 50% failure rate during testing. These frequent failures caused delays in valve deliveries, increased maintenance costs due to repeated disassembly and seal replacement, and required multiple rounds of testing after each failure. | Implementing James Walker’s Unilion cryogenic valve seals, the customer achieved a substantial improvement in sealing reliability and performance under cryogenic conditions. The Unilion seals demonstrated superior durability and consistency at extremely low temperatures, significantly reducing seal failure rates. This improvement led to lower maintenance costs, faster testing and delivery times, and overall enhanced operational efficiency and reliability for the customer. |

|

During the switchover of cryogenic gas supply tanks, operators manually operated cryogenic globe valves, which posed a high risk of human error. The existing method relied on padlocks and tags to indicate valve status but lacked an integrated guidance mechanism for proper sequencing. This created the potential for operators to accidentally close the active supply valve before opening the standby valve, leading to interruptions in the gas supply. Such errors could cause costly facility trips, downtime, lost production hours, and disruptions to the supply chain. | Alcatraz Interlocks implemented a key-based interlock system for cryogenic globe valves, providing a guided and fail-safe sequence for manual valve operation. The system ensured that the active supply valve could not be closed until the standby valve was fully opened, thereby preventing simultaneous closure and operational errors. This sequential control eliminated risks of supply disruption, improved operational safety, reduced downtime, and ensured a reliable and uninterrupted gas supply for the facility. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cryogenic valve assembly market operates within a complex and highly specialized supply chain ecosystem that integrates multiple stakeholders. Key stakeholders in this ecosystem include raw material suppliers, component manufacturers, EPC, and end user industry. Companies, including ArcelorMittal, Emerson Electric Co., among others provide raw materials and components whereas companies like JSC Grasys, Petrofrac provide EPC services. The ecosystem is further supported by regulatory bodies, research institutions, and technology partners driving standardization, safety compliance, and broader adoption of cryogenic technologies across industrial gas, energy, and medical applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cryogenic Valve Assembly Market, By Type

The cryogenic valve assembly market is segmented by type, which includes gate, globe, ball, check, butterfly and other valves. Ball valves account for the highest share of cryogenic valve assembly as they are very effective at providing better sealing capacity for handling such fluids as LNG, liquid nitrogen, and oxygen, which cannot tolerate leakage because their applications may need complete shutoff conditions. Additionally, ball valves are very durable, easy to operate, and suitable for automated systems, which makes them a good fit for industries like energy, chemicals, and transportation where efficiency and reliability are key. Their versatility across a wide range of cryogenic applications further cements their position in the market.

Cryogenic Valve Assembly Market, By Cryogen

The cryogenic valve assembly market, based on cryogen, has been segmented into nitrogen, argon, oxygen, LNG, hydrogen, other cryogens. Nitrogen is the largest segment in the cryogenic valve assembly market due to its wide usage across various industries. Liquid nitrogen is widely used in applications such as food freezing, medical cryopreservation, electronics manufacturing, and industrial processes. Its inert nature and low boiling point make it ideal for maintaining ultra-cold temperatures in storage and transport systems. The growing requirements of nitrogen for pharmaceuticals, biotechnology, and chemical industries also boost up the demand for reliable cryogenic valve assemblies for efficient and safe handling of liquid nitrogen. These valves are crucial for the safe handling, precise flow control, and efficient storage of liquid nitrogen, ensuring reliability and safety in operations. As industries continue to innovate and expand, the importance of nitrogen and the demand for advanced cryogenic valve assemblies are expected to grow significantly, solidifying their role in various critical applications.

Cryogenic Valve Assembly Market, By End-user Industry

The cryogenic valve assembly market, based on end-user industry, has been segmented into metallurgy, energy & power, chemicals, electronics, transportation, and other end-user industries. The metallurgy segment is expected to capture the largest share of the market by end user. Given the widespread use of cryogenic gases such as oxygen (O2), nitrogen(N2), and argon (Ar) in metallurgical processes such as steel manufacturing, welding, and fabrication, these gases are important to improving product quality, combustion efficiency, and also in controlling temperatures while processing metal. The increasing demand from sectors involved in manufacturing high-quality metals, including construction, automotive, and industrial metal products, increases the need for reliable cryogenic valve assemblies. The increase in infrastructure development and more advanced treatments of metal also increases the segment growth.

Cryogenic Valve Assembly Market, By Application

The cryogenic valve assembly market by application has been bifurcated into CASU and non-CASU. The CASU segment is set to grow faster due to the demand for nitrogen, oxygen, and argon gases in sectors such as healthcare, metallurgy, and electronics. The number of air separation plants is growing through increasing investment and demand for energy and manufacturing, increasing the demand for cryogenic valves as savings and efficiencies increase. The cryogenic valve assembly market is expected to expand due to growing demand for liquefied natural gas (LNG), industrial gases, and hydrogen in energy, healthcare, and manufacturing use cases. The transition to cleaner energy sources, especially in the Asia Pacific region, is resulting in new liquefied natural gas terminals and the production of hydrogen infrastructures, supporting the growth of the cryogenic valve assembly market. In industrial processes such as air separation units (CASU), metal processing, and food preservation, cryogenic technology plays a critical role in attracting developers and suppliers of cryogenic technology in general, resulting in continuing demand for related cryogenic valves.

Cryogenic Valve Assembly Market, By Components

The cryogenic valve assembly market is segmented by components, including valve body, seats, seals, gaskets, backup rings, pipe sleeves, spacers, bearings, gears, actuator, bonnet, disc/plug, stem, throttle plates, and other components (handwheel or levers, spring, position indicators, limit switches, bonnet bolts/nuts, piston or diaphragm, strainer or filter, and drain or vent ports). The valve body segment accounts for a significant share of the cryogenic valve assembly market due to its importance in withstanding low temperatures and high pressures. The demand for stronger and more reliable materials in LNG, industrial gas, and aerospace applications drives the need for the valve body. Technological advances in valve body design and materials enhance durability and safety. Furthermore, maintaining a functional cryogenic storage and transportation infrastructure contributes to additional demand. Additionally, regulations and standards emphasize high-performance valve components, bolstering the case for market expansion.

REGION

Europe to be largest-growing region in global LNG Station market during forecast period

Asia Pacific dominates the cryogenic valve assembly market. The region is expected to remain the main destination for LNG imports and the largest center for LNG demand through 2050. China, Southeast Asia, and South Asia are expected to be the main drivers of LNG demand growth in the Asia Pacific. This is due to their rapidly developing economies, urbanization, and growing need for cleaner energy sources. In addition, China, India, and Japan have significantly driven the market with expanding chemical, pharmaceutical, and electronics industries that highly depend on cryogenic technologies. The growing adoption of LNG as a cleaner energy source and the increasing investments in LNG infrastructure across countries like China, Japan, India, and Australia will continue to support the expansion of the cryogenic valve market in the region. Furthermore, the region’s GDP is anticipated to triple in size and constitute half of the world’s economic size by mid-century. Other important factors contributing to Asia Pacific's leadership position include the presence of major manufacturers and increasing use of advanced technologies. Combined with the region’s large population base, increasing industrialization, and the presence of leading valve manufacturers, these trends firmly establish Asia Pacific as a global leader in cryogenic valve assembly demand and innovation.

Cryogenic Valve Assembly Market: COMPANY EVALUATION MATRIX

PARKER HANNIFIN CORP (Market Leader) leads the Cryogenic Valve Assembly market, supported by its extensive expertise in precision fluid control, engineering excellence, and global service network. The company offers a broad portfolio of cryogenic valves designed for ultra-low temperature applications across industries such as liquefied natural gas (LNG), hydrogen, aerospace, and industrial gases. PARKER HANNIFIN’S advanced manufacturing capabilities and commitment to stringent international quality standards ensure superior performance, durability, and reliability under extreme cryogenic conditions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.48 Billion |

| Market Forecast in 2029 (Value) | USD 7.21 Billion |

| Growth Rate | CAGR of 8.3% from 2024-2029 |

| Years Considered | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, Africa, South America |

WHAT IS IN IT FOR YOU: Cryogenic Valve Assembly Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| European Client wanted an in-depth assessment of cryogenic valve demand across LNG, hydrogen, and industrial gas applications |

|

|

RECENT DEVELOPMENTS

- November 2024 : Crane Company acquired Technifab Products, Inc. on November 1, 2024, for USD 40.5 million. Technifab specialized in vacuum-insulated pipe systems and valves for cryogenic applications. The acquisition strengthened Crane’s cryogenic capabilities and expanded its reach into new markets in the semiconductor, medical, and pharmaceutical industries

- August 2024 : Flowserve acquired MOGAS Industries for USD 290 million, with a potential USD 15 million earnout. MOGAS, a leading manufacturer of severe service valves, will enhance Flowserve's Flow Control Division by adding complementary products and a strong brand, particularly in the mining and process industries. The acquisition aligns with Flowserve's 3D growth strategy, diversifying its portfolio and increasing aftermarket opportunities.

- January 2024 : Emerson launched the Fisher 63EGLP-16 Pilot Operated Relief Valve to meet the safety needs of storage tank applications, improving installation, maintenance, and operation for pressurized tanks. This new product extended Emerson’s safety valve portfolio with enhanced features to support the specific needs of liquid propane and ammonia storage systems. This would be beneficial for cryogenic valve application, ensuring the safety of operation.

- August 2023 : KITZ Corporation merged with Cephas Pipelines Co., Ltd. to consolidate its valve manufacturing and sales operations in Korea. The newly formed company, KITZ Corporation of Korea, would manufacture both Cephas and KITZ products. This merger aimed to strengthen sales capabilities and improve the stable supply of global products in Korea. The head office was based in Busan, Korea.

- August 2022 : PARKER HANNIFIN CORP launched ISO 15848-1 Class C certified Hi-Pro ball valves and H series needle valves, designed to minimize fugitive emissions in industries such as chemical, petrochemical, and natural gas. These valves were designed to meet strict leak rate standards through rigorous testing at varying temperatures and cycles, ensuring safety and environmental compliance. Their robust design and advanced sealing systems help reduce plant emissions and improve performance.

Table of Contents

Methodology

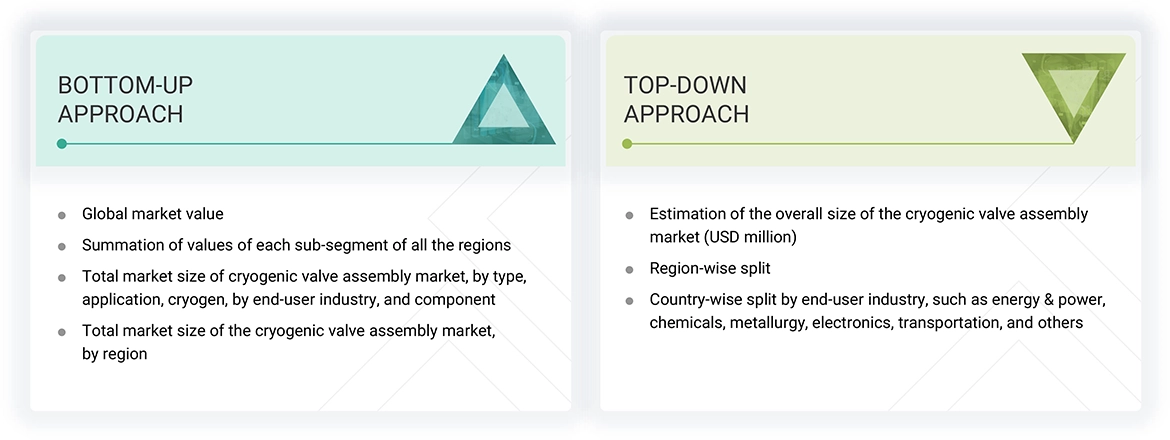

The study involved major activities in estimating the current size of the cryogenic valve assembly market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases of various companies and associations. Secondary research has been mainly used to obtain key information about the supply chain and to identify the key players offering cryogenic valves and components, market classification, and segmentation according to the offerings of the leading players, along with the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the cryogenic valve assembly market.

In the complete market engineering process, top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been conducted to complete the market engineering process and list key information/insights throughout the report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the cryogenic valve assembly market and its dependent submarkets. The key players in the market have been identified through secondary research, and their market shares in the respective regions have been obtained through both primary and secondary research. The research methodology includes the study of the annual and financial reports of the top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the cryogenic valve assembly market. The following sections provide details about the overall market size estimation process employed in this study.

Cryogenic Valve Assembly Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

The cryogenic valve assembly is a system of interconnected valves and components designed to control, regulate, and direct the flow of cryogenic fluids. These fluids generally include gases liquefied at very low temperatures (below -150 °C/-238 °F) and are used in various industries, including aerospace, healthcare, and energy.

The cryogenic valve assembly market is the sum of the revenues generated by the companies offering cryogenic valves and their components. The cryogenic valve assembly market has been analyzed for North America, Europe, Asia Pacific, South America, the Middle East, and Africa.

Stakeholders

- Consulting companies in the energy & power sector

- Government and research organizations

- Investment banks

- Manufacturing industries

- R&D laboratories

- Industrial gas supplying companies

- Hydrogen production and storage companies

- Engineering, procurement, and construction companies

- Cryogenic valve and component manufacturers

- Industry associations

Report Objectives

- To describe, segment, and forecast the cryogenic valve assembly market based on type, components, cryogen, end-user industry, and application in terms of value

- To provide qualitative insights on the cryogenic valve assembly market based on system type and construction material

- To describe and forecast the market for six key regions: North America, Europe, Asia Pacific, the Middle East, South America, and Africa, along with their country-level market sizes, in terms of value

- To strategically analyze micromarkets with respect to individual growth trends, future expansions, and their contribution to the overall cryogenic valve assembly market

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide the supply chain analysis, trends/disruptions impacting customers’ businesses, ecosystem analysis, regulatory landscape, pricing analysis, patent analysis, case study analysis, technology analysis, key conferences and events, trade analysis, Porter’s Five Forces analysis, key stakeholders and buying criteria sections, and global macroeconomic outlook in the cryogenic valve assembly market

- To analyze opportunities for stakeholders in the cryogenic valve assembly market and draw a competitive landscape

- To benchmark market players using the company evaluation quadrant, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players with respect to product specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments such as contracts and agreements, investments and expansions, acquisitions, partnerships, product launches, and collaborations in the cryogenic valve assembly market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the cryogenic valve assembly market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the cryogenic valve assembly market?

The current market size of the cryogenic valve assembly market is USD 4,830.6 million in 2024.

What are the major drivers for the cryogenic valve assembly market?

Favorable government policies and stringent laws are some of the major drivers for the cryogenic valve assembly market.

Which is the largest market for cryogenic valve assembly during the forecast period?

Asia Pacific is projected to dominate the cryogenic valve assembly market between 2024 and 2029.

Among types, which one is expected to be the largest subsegment in the cryogenic valve assembly market during the forecast period?

The ball valve segment is estimated to be the largest segment by type during the forecast period.

Which is expected to be the largest cryogen segment in the cryogenic valve assembly market during the forecast period?

Nitrogen is estimated to be the largest segment during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cryogenic Valve Assembly Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cryogenic Valve Assembly Market