Concrete Sealers Market

Concrete Sealers Market by Type (Water-Based, Solvent-Based), Function (Topical Sealers, Penetrating Sealers, Other Functions), Application (Residential, Non-residential), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The concrete sealers market is estimated to grow from USD 1.93 billion in 2023 to USD 2.95 billion by 2030, at a CAGR of 6.43% between 2024 to 2030. The strongest factor driving the growth of the concrete sealers market is the surging global construction and infrastructure development, particularly in emerging economies. A concrete sealer is a solution applied on concrete surfaces to shield them against damage, corrosion, and staining by preventing pores or creating an impermeable film to stop water and chemical invasion. It helps protect concrete surfaces by inhibiting moisture intrusion, lowering water absorption, and limiting cracking, spalling, and freeze-thaw damage. It adds strength by protecting against wear, abrasion, and chemical exposure and minimizing oil, grease, and other staining. Concrete sealers also enhance appearance by improving color and gloss and prolonging the life of concrete surfaces.

KEY TAKEAWAYS

-

BY TYPEThe solvent-based sealers segment is estimated to be the second-fastest growing segment of the concrete sealers market during the forecast period. A major benefit of solvent-based sealers is that they cure quickly. Since downtime is often a major concern, clients prefer solutions that are cured in less time. The solvents evaporate quickly, leaving a hard protective surface ready for activity. This benefit is beneficial on time-sensitive projects or in regions where the weather is unpredictable. Harsh weather could cause a new application to be delayed or be ruined by a runoff due to rain or debris while the application is curing.

-

BY APPLICATIONThe residential segment held the second-largest share of the concrete sealers market. Basements and indoor concrete floors can use sealers that prevent moisture infiltration, mold growth, and odors. In areas with humidity and flood potential, sealers are the first line of defense against water damage, protecting the concrete and the home’s structural integrity. Sealers are also used in laundry rooms and crawl spaces to promote healthier indoor air quality by eliminating moisture and allergens.

-

BY FUNTIONThe other functions segment is projected to record the third-highest CAGR in the concrete sealers market between 2024 and 2030. Hybrid, fluorinated, and polyaspartic sealers exhibit the best characteristics of several chemistries to deliver extraordinary resistance to UV, chemicals, and abrasion. They outperform traditional sealers when subjected to harsh industrial environments, coastal conditions, and heavy traffic areas, providing long-lasting protection. Besides, they withstand extreme temperatures, corrosives, and mechanical forces, making them vital for any infrastructure, manufacturing plant, and outdoor installations that require high durability.

-

BY REGIONEurope was the second-largest regional market for concrete sealers. Strict environmental policies like REACH and the EU Green Deal are speeding the transition to green concrete sealers in Europe. Most sealers are now composed of water-based, low-VOC, and solvent-free formulas as manufacturers have reformulated products to meet the performance and emission standards. The restrictions on harmful chemicals in construction materials influence the innovation of bio-based and sustainable sealer technologies.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansion, collaborations, partnerships, acquisitions and investments. For instance, Mapei S.P.A. acquired Wykamol, a British manufacturer specializing in waterproofing and property renovation solutions, which includes products related to concrete sealing.

Strict environmental regulations have led to a high focus on lowering VOC emissions and adopting sustainable construction practices. As a result, concrete sealer manufacturers are innovating and shifting to low-VOC and water-based formulations. These environmentally friendly formulations reduce off-gassing of detrimental chemicals, enhance indoor air quality, and lessen the overall environmental impact of sealers, making them suitable for inclusion in green building ratings such as LEED. The increasing demand for high-performing and environmentally conscious solutions is driving market growth while manufacturers invest in new chemistries, balancing durability and adherent properties with aesthetics and environmental issues.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Emerging trends and technological advancements in the construction and infrastructure industries are driving the demand for high-performance and sustainable sealers. With regulatory bodies worldwide enforcing stricter environmental and safety standards, end users are increasingly opting for eco-friendly, low-VOC, and non-toxic concrete sealers. Additionally, advancements in nanotechnology, silane-siloxane formulations, and self-healing coatings are enhancing the durability, water resistance, and longevity of concrete structures. These megatrends are expected to fuel market growth, creating new opportunities for manufacturers and boosting revenue streams in the concrete sealers industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising global construction activities

-

Increasing demand for durable concrete solutions

Level

-

High initial costs

-

Environmental concerns

Level

-

Rising demand for eco-friendly sealers

-

Growing market potential in emerging economies

Level

-

Fluctuating raw material prices

-

Competition from alternative flooring solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing preference for decorative concrete surfaces

Growing preference for decorative concrete surfaces is expected to drive the concrete sealers market. The need for protective sealers has increased with the growing use of decorative concrete in residential and commercial applications to improve functionality and aesthetic appeal. Techniques such as stamping, staining, and polishing transform regular concrete into decorative surfaces that mimic expensive materials such as tile, slate, or brick. Since decorative concrete allows for unlimited design possibilities, it can create unique design solutions integrated into many architectural styles and provides a cost-effective alternative to natural materials. The use of concrete sealers becomes critical in preserving aesthetics and providing protection from external elements like moisture, UV rays, and temperature changes. Sealers prolong the life of the decorative surface by acting as a barrier that keeps stains away, minimizes wear, and enhances color vibrancy.

Restraint: High initial costs

The growth of the concrete sealers market is expected to be restrained by their high initial costs. Concrete sealers are critical elements for enhancing durability, protecting surfaces against chemicals and moisture, and extending the service life of concrete surfaces and structures. The quality of the raw materials used in the formulation of concrete sealers is the reason for the higher price associated with concrete sealers. Advanced formulations include high-performance chemicals in solutions, such as epoxy-based and polyurethane concrete surface sealers, which protect against environmental damage, wear, and stains. Along with increasing research and development, prices for concrete sealers have also increased. Manufacturers are improving adhesion, durability, and weather resistance for their products. With the introduction of innovative technologies, testing, and certification of the new products need to conform to industry standards. These costs are reflected in the total price of the products, leading to high-performance sealers being more expensive than traditional alternatives.

Opportunity: Growing market potential in emerging economies

Growing market potential in emerging economies is expected to create opportunities for growth for companies operating in the concrete sealers market. One of the main elements contributing to this demand is rapid urbanization. As more people relocate to urban centers due to improved job opportunities, there is increased pressure to supply housing, transportation infrastructure, and retail space. These hard surfaces and structures in urban settings must be protected against environmental factors such as moisture, chemicals, and high foot traffic; therefore, concrete sealers are vital to the modern-day construction industry. As urban infrastructure continues to expand, applying sealers to extend the life of concrete structures is a green and economical option for city planners and developers. Another key opportunity for market growth in developing economies is industrialization. As new factories, warehouses, and other industrial facilities are developed, there will be even more need for robust flooring solutions.

Challenge: Fluctuating raw material prices

Fluctuating raw material prices are a challenge for the market players. Concrete sealers are used extensively in commercial, industrial, and residential applications to protect surfaces from abrasion, moisture, and chemicals. Sealers are manufactured using basic materials, including acrylics, epoxies, polyurethanes, and silicates. Many external factors impact the prices of these essential chemicals, causing market instability and affecting pricing strategies, production costs, and profit margins. Volatility in the pricing of petrochemical sources has been one of the factors contributing to fluctuating raw material prices of concrete sealers. Many sealers, especially acrylic and polyurethane-based sealers, rely on petrochemical raw materials derived from crude oil. Natural disasters, supply interruptions, geopolitical conflicts, and economic conditions impact the global crude oil market, impacting price and industry stability. The volatility of the pricing of crude oil materials can disrupt long-term price points, adding uncertainty to the supply chain.

concrete-sealers-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Applies concrete sealers on bridges, pavements, and industrial floors. | Enhances durability, prevents water ingress, and reduces long-term maintenance costs. |

|

Uses sealers for parking decks, basements, and facades. | Improves resistance to oil, salt, and freeze-thaw cycles, extending building surface lifespan. |

|

Utilizes sealers on factory floors for heavy machinery operations. | Provides abrasion resistance, dust-proofing, and easy cleaning, ensuring a safer workspace. |

|

Applies decorative sealers on hotel driveways, poolsides, and patios. | Enhances visual appeal, prevents staining, and maintains glossy finish under high foot traffic. |

|

Uses sealers on warehouse and store floors. | Increases surface hardness, resists chemical spills, and preserves aesthetic quality. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of concrete sealers. These companies have been in business for a while and have broad product portfolios, innovative technologies, and wide international sales and marketing networks. The prominent companies in this market include Sika AG (Switzerland), RPM International Inc. (US), Arkema (France), Mapei S.P.A. (Italy), PPG Industries Inc. (US), Prosoco (US), BASF SE (Germany), Wacker Chemie AG (Germany), Sherwin-Williams Company (US), and Evonik Industries AG (Germany).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Concrete Sealers Market, By Type

Water-based sealers is projected to be the fastest-growing segment in the concrete sealers market during the forecast period. Water-based sealers are vital for concrete in wet or moist environments since their permeable composition allows trapped vapor to escape while continuing to protect the surface. This avoids damaging blistering, delamination, and adhesive failure due to moisture accumulation under the sealer. By ensuring adequate vapor transmission, these sealers help maintain the structural integrity of the concrete in adverse conditions such as coastal regions.

Concrete Sealers Market, By Application

Non-residential is projected to be the fastest-growing segment in the concrete sealers market during the forecast period. Concrete sealers are excellent, low-maintenance solutions for areas with high footfall, such as warehouses, retail centers, and office buildings. Sealers create a durable, protective surface that lessens wear and tear and provides greater stain resistance, reducing frequent repairs or deep cleaning. This results in lower long-term maintenance costs and fewer operational disruptions.

Concrete Sealers Market, By Function

Topical sealers held the largest share of the concrete sealers market in 2023. Topical concrete sealers are available in many formulations, such as acrylic, epoxy, and polyurethane, each optimized for specific performance. Acrylics are superior for UV resistance, inhibiting discoloration of sun-exposed surfaces. Epoxies are ideal for hard chemical resistance in industrial applications. Polyurethanes offer the best abrasion resistance for high-traffic floors, and hybrid mixes offer combinations of benefits. This diversity allows people to select the best sealer for specific conditions of the environment and provides customized protection for all concrete uses, ranging from decorative flooring to heavy-duty pavement.

REGION

Asia Pacific to be largest market for concrete sealers during forecast period

Asia Pacific is the largest consumer of concrete sealers. The region is experiencing unprecedented growth in urban development, encouraging developers of megacities to find concrete solutions for roadways, bridges, and high-rise structures that offer high durability. Governments in the region are investing heavily in smart city projects and transportation networks, fueling the need for high-performing sealers to extend the life of infrastructure. These sealers protect against the corrosive atmosphere in coastal cities while also preventing the costs of maintaining heavily used public buildings, making them essential for sustainable urban expansion.

concrete-sealers-market: COMPANY EVALUATION MATRIX

In the Concrete Sealers market matrix, Sika AG (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across applications. BASF SE (Emerging Leader) is gaining traction due to its diversified product portfolio and continuous investment in R&D. While SikaAG dominates with scale, BASF SE shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2023 | USD 1.93 BN |

| Revenue Forecast in 2030 | USD 2.95 BN |

| Growth Rate | CAGR of 6.43% from 2024-2030 |

| Actual data | 2019−2030 |

| Base year | 2023 |

| Forecast period | 2024−2030 |

| Units considered | Value (USD Billion) and Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: concrete-sealers-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Concrete Sealers Manufacturer |

|

|

| Asia Pacific-based Concrete Sealers Manufacturer |

|

|

RECENT DEVELOPMENTS

- October 2024 : Mapei S.P.A. acquired Wykamol, a British manufacturer specializing in waterproofing and property renovation solutions, which includes products related to concrete sealing.

- September 2023 : Arkema announced a two-and-a-half-fold increase in organic peroxide production capacities at its Changshu site in China.

- August 2023 : Sika AG agreed to acquire Chema, a leading manufacturer of tile setting materials in Peru.

Table of Contents

Methodology

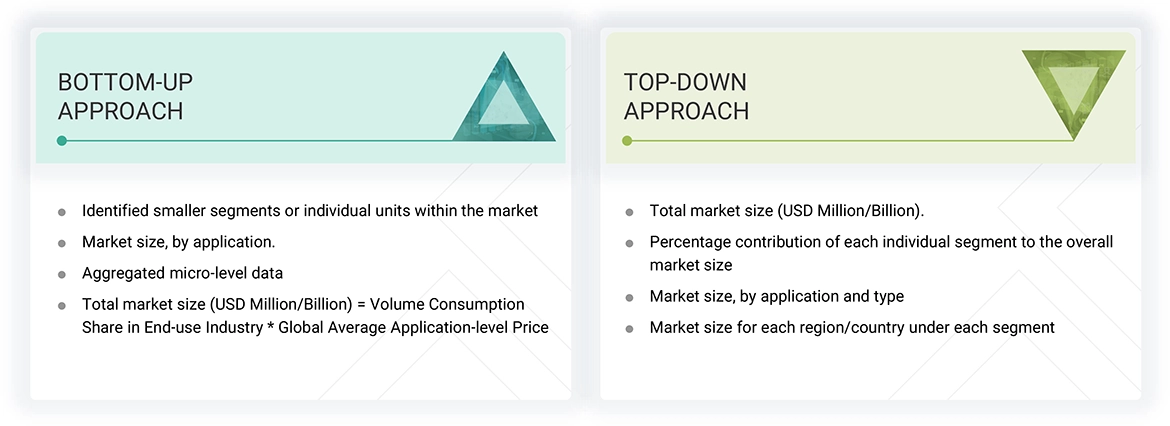

The study involved four major activities in estimating the size of the concrete sealers market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Lastly, the market breakdown and data triangulation procedures have been used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources considered in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study have been verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of the profiles of the primary interviewees has been illustrated in the figure below.

Primary Research

The concrete sealers market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market has been characterized by key opinion leaders in various applications of concrete sealers. Advancements in technology and widening application scope characterize the supply side. Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/ 2024, available in the public domain, product portfolios, and geographic presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Sika AG | Senior Manager | |

| RPM International Inc. | Innovation Manager | |

| Arkema (Bostik) | Vice-President | |

| Mapei S.P.A. | Production Supervisor | |

| PPG Industries, Inc. | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the concrete sealers market. These methods have also been used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that impact the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

The market has been split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes as explained above. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the concrete sealers industry.

Market Definition

A concrete sealer is a solution applied on concrete surfaces to shield them against damage, corrosion, and staining by preventing pores or creating an impermeable film to stop water and chemical invasion. It helps protect concrete surfaces by inhibiting moisture intrusion, lowering water absorption, and limiting cracking, spalling, and freeze-thaw damage. It adds strength by protecting against wear, abrasion, and chemical exposure and minimizing oil, grease, and other staining. Concrete sealers also enhance appearance by improving color and gloss and prolonging the life of concrete surfaces.

Stakeholders

- Concrete sealers manufacturers

- Concrete sealers suppliers

- Raw material suppliers

- Service providers

- Government bodies

Report Objectives

- To define, describe, and forecast the concrete sealers market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size based on type, function, application, and region

- To forecast the size of the market for five main regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To strategically profile key players and comprehensively analyze their growth strategies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Concrete Sealers Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Concrete Sealers Market