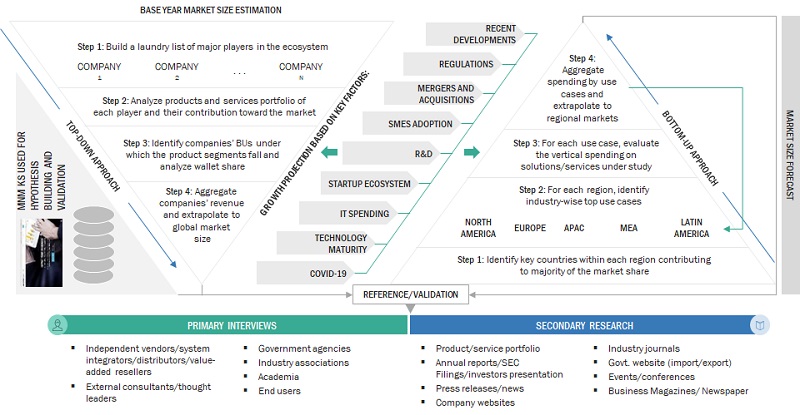

The study involved four major activities in estimating the size of the cloud native storage market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, and whitepapers; certified publications; and articles from recognized associations and government publishing sources, such as the Cloud Native Computing Foundation (CNCF), Kubernetes and Cloud Native Associate (KCNA), Storage Networking Industry Association (SNIA) and Distributed Management Task Force (DMTF).

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives.

Primary Research

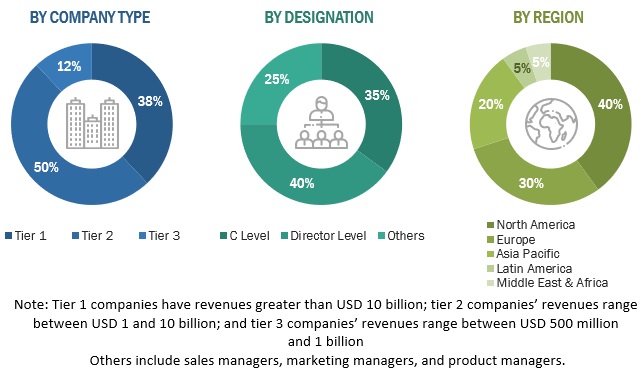

In the primary research process, various primary sources from both the supply and demand sides of the cloud native storage market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing cloud native storage offerings; associated service providers; and SIs operating in the targeted countries. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make the estimates and forecasts for the cloud native storage market and other dependent submarkets, both top-down and bottom-up approaches were used. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of the other individual markets via percentage splits of the market segments.

Global Cloud Native Storage Market Size: Bottom-Up and Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the BFSI, government & public sector, healthcare & life sciences, telecom, IT & ITeS, manufacturing, energy & utilities, retail & consumer goods, media & entertainment, and other verticals. Others include education, and travel & hospitality.

Market Definition

-

Cloud-native technologies empower organizations to build and run scalable applications in modern, dynamic environments such as public, private, and hybrid clouds. Containers, service meshes, microservices, immutable infrastructure, and declarative APIs exemplify this approach.

-

Cloud-native architecture and technologies are an approach to designing, constructing, and operating workloads that are built in the cloud and take full advantage of the cloud computing model.

Stakeholders

-

Cloud native storage vendors

-

Cloud native storage service vendors

-

Managed service providers

-

Support and maintenance service providers

-

System Integrators (SIs)/migration service providers

-

Value-Added Resellers (VARs) and distributors

-

Distributors and Value-added Resellers (VARs)

-

System Integrators (SIs)

-

Independent Software Vendors (ISV)

-

Third-party providers

-

Technology providers

-

Independent software vendors

-

Value-added resellers and distributors

Report Objectives

-

To describe and forecast the cloud native storage market market based on offering, application, verticals, and regions

-

To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

-

To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

-

To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the major players

-

To comprehensively analyze the core competencies of the key players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

-

Further breakup of the North American cloud native storage market

-

Further breakup of the European market

-

Further breakup of the Asia Pacific market

-

Further breakup of the Middle Eastern & African market

-

Further breakup of the Latin America cloud native storage market

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Cloud Native Storage Market