CCUS Absorption Market

CCUS Absorption Market by Absorption Type (Chemical Absorption, Physical Absorption), End-Use Industry (Oil & Gas, Power Generation, Chemical & Petrochemical, Cement, Iron & Steel), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The carbon capture, utilization, and storage market is projected to reach USD 17.75 billion by 2030 from USD 5.82 billion in 2025, at a CAGR of 25.0% from 2025 to 2030. The growth of the carbon capture, utilization, and storage market is driven by the rising emphasis on achieving zero-carbon targets and growing policy support from governments to reduce carbon emissions.

KEY TAKEAWAYS

-

BY SERVICEThe carbon capture, utilization, and storage market comprises carbon capture, storage, transportation, and utilization. Carbon capture is a key climate technology that prevents CO2 from entering the atmosphere by capturing emissions from power plants and industrial facilities. It enables hard-to-abate sectors like cement, steel, and petrochemicals to reduce their carbon footprint while supporting global net-zero targets.

-

BY TECHNOLOGYKey technologies include chemical looping, solvent & sorbents, membranes, and other technologies. Various CCUS technologies provide distinct advantages; for example, chemical looping enhances efficiency while reducing oxygen costs.

-

BY END-USE INDUSTRYThe end-use industries include oil & gas, power generation, chemicals and petrochemicals, cement, iron & steel, and other end-use industries. These industries play a crucial role in the growth of the carbon capture, utilization, and storage market, as they are the primary sources of CO2 emissions. By integrating capture, storage, and utilization solutions, these sectors are driving the large-scale adoption of CCUS as a practical approach to decarbonization.

-

BY REGIONThe carbon capture, utilization, and storage market covers Europe, North America, the Asia Pacific, South America, the Middle East, and Africa. North America is the largest market for carbon capture, utilization, and storage. It is home to several prominent oil & gas companies and is witnessing new CCUS projects with government support.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Fluor Corporation (US), Equinor ASA (Norway), and Shell plc (UK) have entered into a number of agreements and partnerships to cater to the growing demand for carbon capture, utilization, and storage across various industries.

Tightening emissions targets, rising carbon prices, and expanding financial support fuel the CCUS market, and the growing tally of new project announcements reported by the International Energy Agency (IEA) reinforces that momentum. Policymakers worldwide are establishing clear rules and incentives, tax credits, grants, and favorable loans that reduce risk and attract investment. At the same time, tougher carbon pricing makes capture technology more cost-effective than buying pollution permits. Engineering advances have driven down energy requirements and equipment costs, opening the door for projects in power plants, cement works, steel mills, and chemical factories.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from customer trends and disruptions. Hotbets are the clients of service providers in carbon capture, utilization, and storage, while target end-use industries are clients of CCUS manufacturers. Changes in trends or disruptions will affect the revenues of end users. This revenue impact on end users will, in turn, influence the revenues of hotbets, which will further affect the revenues of CCUS manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing announcements of CCUS facilities

-

Increasing demand for CO2 in EOR techniques

Level

-

High cost of carbon capture and sequestration

-

Safety concerns at storage sites

Level

-

Continuous investments to develop innovative capturing technology enable economic operations

-

Announcement of large-capacity hydrogen projects

Level

-

High initial investments

-

Transparency & Credibility risk: measurement errors, greenwashing and lobbying

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing announcements of CCUS facilities

As a greater number of new CCUS facilities begin operations each year, confidence in the technology continues to grow, leading to an increasing number of projects. The current pipeline features hundreds of capture sites, which range from natural gas processing plants and cement facilities to hydrogen hubs and direct air capture units. This expansion is pushing operational capacity to exceed 50 million tons (55.11 million tons) of CO2 annually, with ambitions to surpass 400 million tons (440.9 million tons) by 2030. Simultaneously, planned storage installations offer approximately 670 million tons (738.5 million tons) of underground capacity, reflecting a 10% increase compared to last year.

Restraint: High cost of carbon capture and sequestration

The high cost of carbon capture and sequestration remains one of the major barriers to market growth. This is particularly significant in developing countries and low-margin industries, as it directly impacts the economic feasibility of projects. Capturing CO2 requires advanced equipment, specialized materials, and a substantial energy input, all of which contribute to increased operational costs. The cost of capture can vary widely, typically ranging from tens to over a hundred dollars per ton, depending on the technology used and the concentration of CO2 in the emission stream. Sequestration adds further expenses due to the need for compressing CO2, transporting it through pipelines, and ensuring its secure long-term storage underground. This process also involves extensive site characterization, ongoing monitoring, and adherence to regulatory requirements. For many companies, especially those in hard-to-abate industries, the total costs often surpass short-term economic returns unless they are offset by significant government incentives, carbon pricing, or financial benefits from CO2 utilization..

Opportunity: Announcement of large-capacity hydrogen projects

The recent wave of large-scale hydrogen projects presents a significant opportunity for the CCUS industry because blue hydrogen production inherently generates high-purity CO2 streams that are far easier and cheaper to capture than dilute emissions from conventional power plants or industrial processes. As project developers finalize final investment decisions on multi-billion-dollar hydrogen facilities in North America, Europe, and Asia, they commit not only to separating hydrogen from natural gas but also to installing associated capture units capable of handling hundreds of thousands to millions of tons of CO2 per year. These projects establish key customers for transport infrastructure, including pipelines, shipping terminals, loading hubs, and dedicated storage sites like depleted reservoirs or saline aquifers.

Challenge: High initial investments

Financing a full-scale CCUS project means allocating hundreds of millions of dollars before a single ton of carbon is captured, creating a formidable barrier for developers. Every stage demands specialized work: outfitting plant exhaust with capture modules, laying pipelines for CO2 transport, building compressor stations, and preparing underground reservoirs with drilling and monitoring equipment. Site characterization alone can cost tens of millions, and unforeseen geological challenges often surface only after wells are drilled. These upfront expenditures occur long before revenue from carbon credits, enhanced oil recovery, or industrial CO2 sales begins to flow.

CCUS Absorption Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Captures ~1.0?MtCO2/year from hydrogen production at the Scotford bitumen upgrader (oil sands heavy-oil refinery) in Alberta | Reduces the upgrader's CO2 emissions by approximately 35% |

|

Captures ~125,000?tCO2/year from blast-furnace off-gases (and biomass) at the Ghent steel plant | Produces low-carbon ethanol, branded as Carbalyst, for fuels and chemicals, converting emissions into a sellable product |

|

A first-of-its-kind cement CCS retrofit at Norcem’s Brevik plant captures about 400,000?tCO2/year (~50% of the plant’s emissions) from clinker production | Cuts approximately 50% of the plant’s CO2 emissions and allows for the sale of "evoZero" carbon-neutral cement |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The carbon capture, utilization, and storage market ecosystem consists of carbon emission sources (e.g., British Petroleum and Saudi Arabian Oil Company), carbon capture service providers (e.g., Fluor Corporation, ExxonMobil, and Equinor ASA), carbon storage & transportation service providers (e.g., CarbiCrete, Wolf Midstream, and Green Minerals), and end users (e.g., ONGC, Chevron Corporation, and JSW Group). Collaboration across the value chain is key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Carbon Capture, Storage, and Utilization Market, by Service

The carbon capture segment is expected to lead the CCUS market in the forecasted period because it tackles the first and most critical step in reducing industrial and energy-related CO2 emissions, removing them directly at the source. Power stations, refineries, steel plants, cement kilns, and chemical facilities produce concentrated exhaust streams, making capture technically feasible at a large scale. These operations account for a major share of global emissions, so installing capture systems here can deliver immediate and significant reductions.

Carbon Capture, Storage, and Utilization Market, by Technology

Chemical looping is expected to be the fastest-growing technology in the forecasted period, which has improved energy efficiency and low operation cost in comparison to conventional capture processes. This technology utilizes metal oxides to shuttle oxygen for fuel combustion and thus inherently separates CO2 without using solvent regeneration, which is very expensive. This is the reason why the technologies maintain a lower energy penalty, allow the integration of various fuels (such as coal, natural gas, and biomass), and are even enticing in cases where they can co-produce some of the valuable outputs like hydrogen for both power and industrial applications.

Carbon Capture, Storage, and Utilization Market, by End-use Industry

The oil and gas sector is expected to remain the leading end-use industry in the carbon capture, utilization, and storage market until 2030. This is due to its significant contribution to concentrated CO2 emissions globally, as well as its extensive experience in subsurface reservoir management. Most CCUS installations are located near depleted oil and gas wells or large deep salt formations, making long-term storage both feasible and economically advantageous. Additionally, CO2 can be used in enhanced oil recovery within this sector, creating extra revenue opportunities and reducing capture costs.

REGION

Europe to be fastest-growing region in global carbon capture, utilization, and storage market during forecast period

Europe is anticipated to record the highest CAGR within the CCUS market in the forecasted period by virtue of its aggressive climate policies, such as the EU Green Deal and legally binding 2050 net-zero targets, which are urging massive deployment of carbon capture initiatives in the power, cement, steel, and chemical sectors. The area is favored by robust state support, carbon pricing in the EU Emissions Trading System, and cooperative cross-border projects such as the Northern Lights and Porthos ventures that combine capture, transport, and storage facilities. Europe’s established industrial base, supportive regulatory landscape, and low-carbon innovation focus provide a fertile breeding ground for explosive CCUS expansion.

CCUS Absorption Market: COMPANY EVALUATION MATRIX

Equinor ASA (Star) is the market leader in the carbon capture, utilization, and storage market, with the largest market share due to its pioneering Sleipner project and the Northern Lights joint venture, which together offer decades of offshore storage experience and a rapidly expanding commercial service. Linde plc (Emerging Leader) is gaining visibility due to its presence in industrial gas processing and proven CO2 capture, purification, and liquefaction technologies. Additionally, it has a number of CCUS projects lined up and has a partnership with various end-use players across different industries. While Equinor ASA dominates through scale and a diversified portfolio, Linde plc shows significant potential to move toward the leaders’ quadrant as demand for high-strength alloys continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Fluor Corporation (US)

- Equinor ASA (Norway)

- TotalEnergies SE (France)

- Shell plc (UK)

- Exxon Mobil Corporation (US)

- Linde plc (UK)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- JGC Holdings Corporation (Japan)

- Schlumberger Limited (US)

- Aker Solutions (Norway)

- Honeywell International (US)

- Hitachi Ltd (Japan)

- Siemens AG (Germany)

- GE Vernova (US)

- Halliburton (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.10 Billion |

| Market Forecast in 2030 (Value) | USD 17.75 Billion |

| Growth Rate | CAGR of 25.0% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: CCUS Absorption Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Carbon Capture Service Provider |

|

|

| Technology Provider |

|

|

| End User |

|

|

| Policymakers & Regulators |

|

|

RECENT DEVELOPMENTS

- April 2025 : Calpine and Exxon Mobil signed a CO2 transportation and storage agreement, under which Exxon Mobil will store up to 2 million tons (2.2 million tons) per year from Calpine’s Baytown Energy Center. The project will support the production of ~500 MW of low-carbon electricity, enough to power over 500,000 homes, while boosting US energy security and industrial competitiveness.

- April 2025 : Shell, along with partners Equinor and TotalEnergies, announced a USD 714 million investment to expand the Northern Lights CCS project, increasing its CO2 storage capacity from 1.5 to 5 million tons (1.65 to 5.5 million tons) per year. Enabled by a long-term agreement with Stockholm Exergi and supported by EU and Norwegian funding, the project marks a significant step in Europe’s decarbonization efforts, offering cross-border CO2 transport and secure offshore storage beneath the North Sea.

- April 2025 : Shell has taken Final Investment Decision (FID) on two major carbon capture and storage (CCS) developments in Canada: the Polaris CCS project at its Scotford Energy and Chemicals Park, designed to capture 650,000 tons (716,502.35 tons) of CO2 annually, and the Atlas Carbon Storage Hub, developed in partnership with ATCO EnPower, which will provide permanent underground storage for the captured CO2. These projects mark a significant expansion of Shell’s CCS portfolio.

Table of Contents

Methodology

The study involves two major activities in estimating the current size of the CCUS Absorption market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, information has been sourced from annual reports, press releases & investor presentations of companies; white papers; certified publications; trade directories; articles from recognized authors; and databases. Secondary research has been used to obtain critical information about the industry's value chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. These have also been utilized to obtain information about the key developments from a market-oriented perspective.

Primary Research

The stakeholders in the value chain of the CCUS Absorption market include raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Primary sources from the demand side include key opinion leaders from various end-use industries in the CCUS Absorption market. Primary sources from the supply side include experts from companies involved in CCUS Absorption.

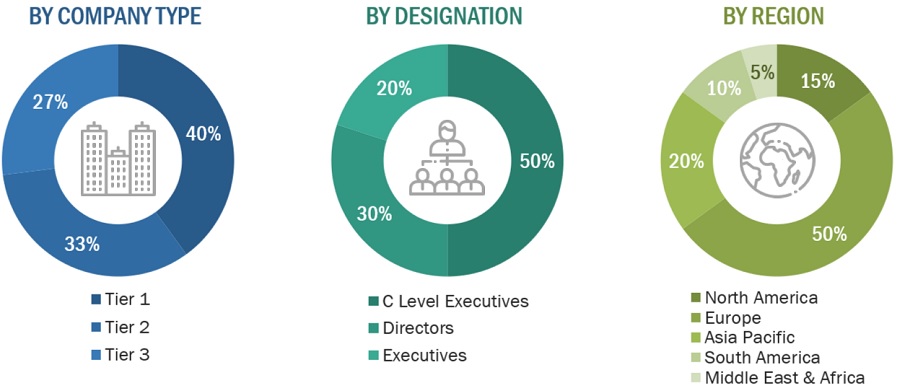

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2023.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

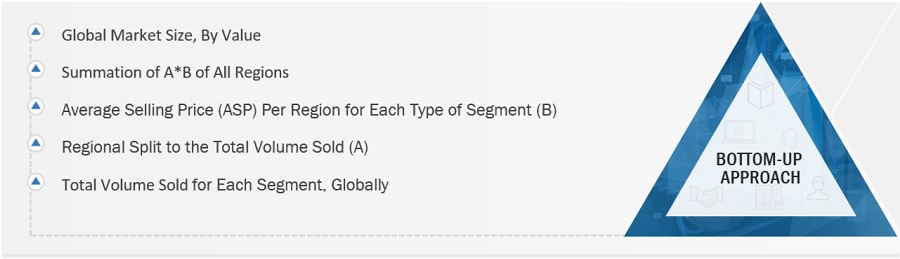

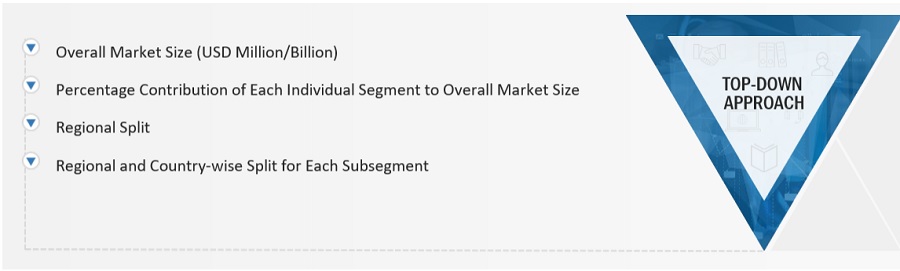

Both the top-down and bottom-up approaches were used to estimate and validate the total CCUS Absorption market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

CCUS Absorption Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

CCUS Absorption Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall CCUS Absorption market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the highways, bridges & buildings, marine structures & waterfronts and other applications.

Market Definition

Carbon Capture, Utilization, and Storage (CCUS) absorption is a process that involves capturing carbon dioxide (CO2) from industrial sources, such as power plants and manufacturing facilities, and storing it underground or utilizing it in various applications. The captured CO2 is chemically absorbed by a liquid solvent, typically an amine-based solution, and then transported to storage sites or utilized for enhanced oil recovery, production of fuels and chemicals, or other industrial processes. CCUS absorption plays a crucial role in reducing greenhouse gas emissions and mitigating climate change by preventing CO2 from entering the atmosphere. It is segmented based on absorption type (Chemical Absorption, Physical Absorption), End-Use industry (oil & gas, power generation, cement, chemicals & petrochemicals, iron & steel, others).

Key Stakeholders

- CCUS technology developers

- OEM

- Universities, governments, and research organizations

- CCUS technology associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environmental support agencies

- Investment banks and private equity firms

Report Objectives

- To define, describe, and forecast the CCUS Absorption market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global CCUS Absorption market by type, form, application, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the CCUS Absorption market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the CCUS Absorption Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in CCUS Absorption Market