The study encompassed four primary tasks to determine the scope of the autonomous construction equipment market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the value chain corroborated and validated these findings and assumptions. Employing both bottom-up and top-down methodologies, the complete market size was estimated. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

TSecondary sources for studying the autonomous construction equipment market directly depend on the end-use industry's growth. Autonomous construction equipment market sales and end-use industry demand are derived through secondary sources such as Autonomous Vehicle Industry Association (AVIA), Association of Equipment Manufacturers (AEM), Indian Electric off-highway vehicle Manufacturers Association (ICEMA), Environmental Protection Agency (EPA), AUSTMINE, Indian Construction Equipment Manufacturers Association, Construction Equipment Association (CEA), Construction Equipment Rental Association (CERA), National Mining Association (NMA), Tractor and Mechanization Association (TMA), corporate filings such as annual reports, investor presentations, and financial statements, and paid repository. Historical production data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as autonomous construction equipment market sizing estimation and forecast, future technology trends, and upcoming technologies in the autonomous construction equipment market. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the points mentioned above.

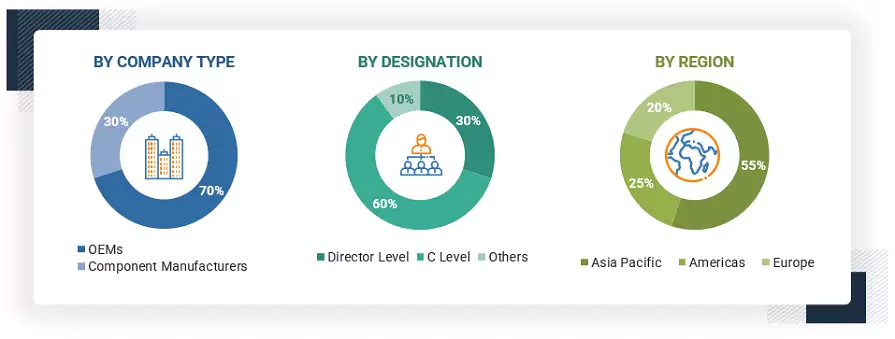

Primary interviews have been conducted with market experts from the demand-side (end-use industries) and supply-side (autonomous construction equipment providers) across four regions: North America, Europe, Asia Pacific, and the Rest of the World. Approximately 70% and 30% of the primary interviews were conducted on the OEMs and component manufacturer sides. Primary data has been collected through questionnaires, emails, and telephonic interviews. After communicating with primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts' opinions have led us to the conclusions described in the remainder of this report.

Company tiers are based on the supply chain (OEMs: autonomous construction & mining, farm tractors.

Component Manufacturers: LiDAR, RADAR, Vision System Providers. The revenue of the company is not

considered. Note: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As mentioned below, a detailed market estimation approach was followed to estimate and validate the value and volume of the autonomous construction equipment market and other dependent submarkets:

-

The bottom-up approach was used to estimate and validate the autonomous construction equipmentmarket's size by equipment type. The country-level sales of each equipment type (Dozer, Dump Truck, Loaders, Excavators, Haul Trucks, Compactors, and Farm tractors) were referred from country-level manufacturing associations and secondary sources (company publications, articles, etc.).

-

The forecast for this equipment is based on factors such as country-wise macro-economic indicators, infrastructure investment, farm mechanization, and government spending.

-

The penetration of autonomous equipment as a percentage of each total sales of the respective equipment is referred from secondary sources and then validated through Primary Interviews with industry experts (B).

-

The forecast of each autonomous equipment is based on factors like feasibility & usability of the equipment being autonomous, OEM-wise developments/investments in the equipment, and consumer readiness, among others.

-

The country-level autonomous construction equipment by equipment type (volume) were then multiplied by the country-level average selling price (ASP) of each equipment type to get the country-level equipment type market by value.

-

The summation of the country-level market would give the regional level, and then further addition provides the global autonomous construction equipment market by equipment type.

-

The top-down approach is used to estimate the propulsion type, level of automation, and power output at the regional level.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Global Autonomous construction equipmentMarket Size: Bottom-Up Approach

In the top-down approach, an exhaustive list of all the vendors offering products in the WCM market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of product type, deployment mode, architecture, and end user. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

Global Autonomous construction equipmentMarket Size: Top-Down Approach

The top-down approach was followed to determine the market size by propulsion type, by power output, and by level of automation in terms of volume and value for autonomous autonomous construction equipment market. Country-level autonomous construction equipment market by equipment type has been derived through the bottom-up approach. This country-wise market is summed up to get regional and global markets

The market sizing for propulsion type, by power output, and level of autonomy is derived using a top-down approach, where the regional autonomous construction equipment market is referred . The country-wise OEM-level model mapping is aligned with the respective equipment types. For instance, number of autonomous tractors manufactured, their propulsion, autonomy level, power output etc. is mapped for each OEM. The forecast of the propulsion, power output, and level of autonomy is based on factors such as company’s announcements & investments on electrification, power output, and autonomy, government regulations/subsidies to support electrification etc. The same assumption-based penetrations are validated with industry experts.

The average selling price of electric equipment is derived at regional level for each equipment type using secondary sources (which usually provides the incremental cost as a 10-20% of conventional equipment) and then multiplied with regional volumes to arrive at the regional values.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

Autonomous Construction Equipment : An autonomous construction equipmentis a specialized, self-operating machine designed to perform tasks in environments such as construction sites, mines, and agricultural fields without direct human intervention. These vehicles are equipped with advanced technologies, including sensors, cameras, GPS, LiDAR, and AI-driven software, enabling them to navigate complex terrains, detect obstacles, and carry out specific operations autonomously.

Stakeholders

-

Off-highway OEMs Sales Head, Technical Head, Autonomous Mobility Head

-

S/W Providers technical head and sales head

-

Autonomous Equipment Hardware Manufacturers Sales Head, Technical Head

Report Objectives

-

To segment and forecast the autonomous construction equipment market in terms of volume (units) and value (USD million)

-

To define, describe, and forecast the autonomous construction equipment market based

-

Equipment (dozer, dump truck, farm tractors, excavators, loaders, and compactors)

-

Application (construction, mining, and agriculture)

-

Level of Automation (fully autonomous and semi-autonomous)

-

Propulsion (diesel, electric, and hybrid)

-

Power Output (up to 30 HP, 31-100 HP, and 101 HP and above)

-

Region (North America, Europe, Asia Pacific and ROW)

-

Qualitative insights on the components market - LIDAR, RADAR, GPS, camera/vision system, and ultrasonic sensors.

-

To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

-

To analyze technological developments impacting the market

-

To analyze opportunities for stakeholders and the competitive landscape for market leaders in the market

-

To analyze the OEM analysis (Output Vs, Number of autonomous construction equipment), Investment and funding scenario, key buying criteria, Pricing analysis by equipment type & region, technological analysis of autonomous construction equipment market,

-

To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically analyze the supply chain analysis, ecosystem analysis, patent analysis, trade analysis, market quadrant matrix of key players, and case study analysis.

-

To strategically profile key players and comprehensively analyze their market shares/ market ranking and their core competencies

-

To track and analyze competitive developments such as product launches/developments, deals, and expansions undertaken by the key industry participants

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

AUTONOMOUS CONSTRUCTION & MINING EQUIPMENT MARKET, BY LEVEL OF AUTONOMY, BY COUNTRY

-

Dozer

-

Excavators

-

Haul Trucks

-

Dump Trucks

-

Loaders

-

Compactors (Road Roller)

AUTONOMOUS FARM TRACTORS MARKET, BY APPLICATION

-

Tillage (Primary & Secondary Tillage)

-

Seed Sowing

-

Harvesting

-

Other Farm Application

Note: This chapter will be further segmented at the regional level (Asia Pacific, Europe, North America, and the Rest of the World) regarding volume and value.

AUTONOMOUS FARM TRACTORS MARKET, BY POWER OUTPUT

-

Tillage (Primary & Secondary Tillage)

-

Seed Sowing

-

Harvesting

-

Other Farm Application

Note: This chapter will be further segmented at the regional level (Asia Pacific, Europe, North America, and the Rest of the World) regarding volume and value.

AUTONOMOUS FARM TRACTORS MARKET, BY POWER OUTPUT

-

Up To 30 HP

-

31-100 HP

-

Above 100 HP

Note: This chapter will be further segmented at the regional level (Asia Pacific, Europe, North America, and the Rest of the World) in terms of volume and value

AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT

-

Up To 100 HP

-

101-250 HP

-

Above 250 HP

Note: This chapter will be further segmented at the regional level (Asia Pacific, Europe, North America, and the Rest of the World) in terms of volume and value

AUTONOMOUS MINING EQUIPMENT MARKET, BY POWER OUTPUT

-

Up To 500 HP

-

500-1000 HP

-

Above 1000 HP

Note: This chapter will be further segmented at the regional level (Asia Pacific, Europe, North America, and the Rest of the World) in terms of volume and value

PRODUCT ANALYSIS

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Autonomous Construction Equipment Market