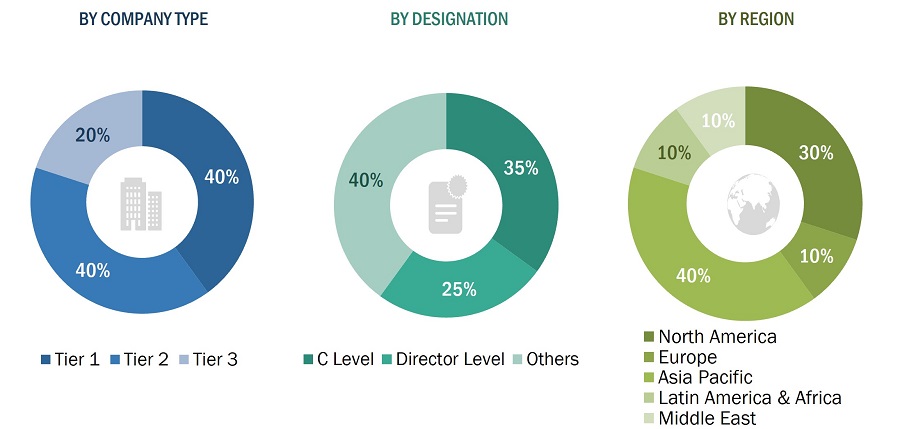

The research study conducted on the autonomous boats market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews of various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market as well as assess the growth prospects of the market. A deductive approach, also known as the bottom-up approach combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the autonomous boats market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturers' associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the marine industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the autonomous boats market. Several primary interviews were conducted with market experts from both the demand and supply sides across major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America & Africa. Primary sources from the supply side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the autonomous boats market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the autonomous boats market. The research methodology used to estimate the market size includes the following details. Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, marine vessel maintenance professionals, and SMEs of leading companies operating in the autonomous boats market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the autonomous boats market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

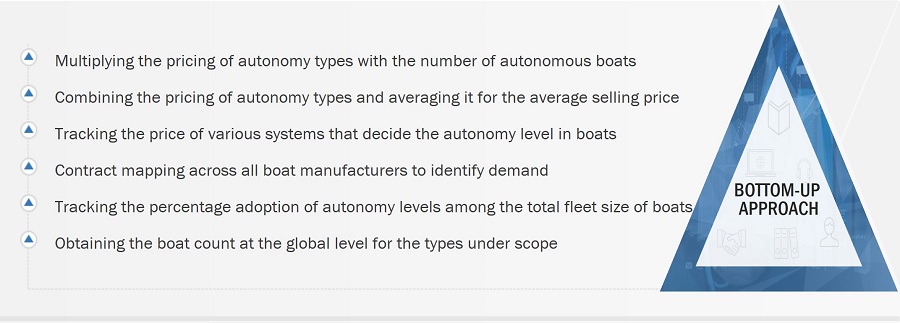

Bottom-Up Approach

The bottom-up approach was employed to determine the overall size of the autonomous boats market. Calculations for the market relied on global autonomous boats adoption were based on regional vessel sizes for each country. The bottom-up approach was also implemented to extract secondary research data to validate different market segments' revenues. With the data triangulation procedure and data validation through primaries, the overall sizes of the autonomous boats market from the revenues of key players and their shares in the market and each market segment were determined and confirmed in this study.

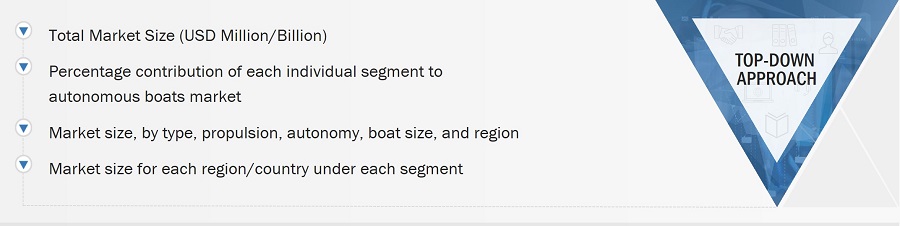

Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in market segmentation) through percentage splits based on secondary and primary research.

For calculating the sizes of specific market segments, the most appropriate and immediate parent market size was used to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

Market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the parent market and each individual market were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data triangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, market breakdown & data triangulation procedures explained below were implemented, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Autonomous boats refer to smaller watercraft that involves the integration of various systems and subsystems, enabling effective decision-making based on sensor fusion technology and artificial intelligence (AI) for processing data, hence reducing, or eliminating the need for human intervention. The level of autonomy achieved by integrating autonomy-related systems is categorized into partially autonomous, remotely operated, and fully autonomous.

Stakeholders

Various stakeholders of the market are listed below:

-

Autonomous Boat Manufacturers

-

Marien Autonomous System Manufacturers

-

Subcomponent Manufacturers

-

Raw Material Suppliers

-

Technology Support Providers

-

System Integrators

-

Government Agencies

-

Commercial Vessel Operators

-

Research Organizations

Report Objectives

-

To define, describe, segment, and forecast the size of the autonomous boats market based on propulsion, autonomy, boat size, type, and region

-

To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

-

To understand the structure of the autonomous boats market by identifying its various segments and subsegments

-

To identify and analyze key drivers, restraints, opportunities, and challenges that influence market growth

-

To forecast the size of market segments across North America, Europe, Asia Pacific, Middle East, Latin America & Africa, along with major countries in each region

-

To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

-

To profile key market players and comprehensively analyze their market share and core competencies2

-

To provide a detailed competitive landscape of the market, along with an analysis of business and strategies, such as, partnerships, and agreements , in the autonomous boats market

1. Micromarkets are further segments and subsegments of the autonomous boats market market.

2. Core competencies of companies were captured in terms of their key developments and strategies adopted to sustain their position in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

-

Further breakdown of the market segments at the country level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Autonomous Boats Market