Ammonium Sulfate Market

Ammonium Sulfate Market by Type (Solid, Liquid), Application (Fertilizers, Pharmaceuticals, Food & Feed Additives, Water Treatment, Textile Dyeing, Other Applications), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The ammonium sulfate market is projected to grow from USD 5.75 billion in 2025 to USD 6.81 billion by 2030, at a CAGR of 3.4% during the forecast period. Rising demand for ammonium sulfate is driven by its use in nitrogen–sulfur fertilizers, water treatment, and industrial applications, thanks to its cost-effectiveness and consistent performance.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific region accounted for a 27.3% share of the ammonium sulfate market in 2024.

-

BY TYPEBy type, the solid segment is expected to register the highest CAGR of 3.5% during the forecast period.

-

BY ApplicationBy application, the fertilizers segment is expected to dominate the market, accounting for a 87.1% revenue share in 2024.

-

COMPETITIVE LANDSCAPE - Key PlayersBASF, Evonik Industries AG, AdvanSix, LANXESS, and Sumitomo Chemical Co., Ltd. were identified as key players in the ammonium sulfate market, given their strong market share and product portfolios.

-

COMPETITIVE LANDSCAPE - StartupsJOST CHEMICAL CO. (US), RAVENSDOWN (New Zealand), Greenway Biotech, Inc. (US), and Vinipul Inorganics Pvt. Ltd. (India), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The transition toward ammonium sulfate is accelerating as end users move away from more complex or cost-intensive nitrogen sources, favoring a single, sulfur-containing fertilizer that aligns with soil nutrient balance requirements and sustainable agriculture goals. At the same time, improvements in production efficiency, granulation quality, and blending compatibility are enabling ammonium sulfate to deliver consistent nutrient release, handling performance, and application reliability across agricultural and industrial uses

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The ammonium sulfate industry is evolving as agriculture and industry move away from expensive or complex nitrogen fertilizers and toward the simpler, cheaper sulfur fertilizer that can be integrated into soil health initiatives and nutrient management strategies. This allows for better nutrient balance and crop response, reduced input costs, and streamlined fertilizer systems that continue to deliver dependable results in both agricultural and industrial sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Structural shift toward sulfur-containing nitrogen fertilizers under nutrient imbalance correction programs

-

Sustained demand from caprolactam and nylon-6 value chains

Level

-

Quality variability across production routes

-

Competition from blended and customized multi-nutrient fertilizers

Level

-

Development of region-specific nitrogen–sulfur ratios through granulation and compaction

-

Supplying pharmaceutical- and biotech-grade ammonium sulfate for protein purification

Level

-

Fragmented regulatory treatment across fertilizer, chemical, and environmental frameworks

-

Volatile price formation driven by upstream raw material and industrial linkage

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Structural shift toward sulfur-containing nitrogen fertilizers under nutrient imbalance correction programs

The ammonium sulfate industry is benefiting from a large-scale shift toward simultaneous application of sulfur and other nutrients, driven by worldwide efforts to address nutrient imbalances. These movements are driven by the implementation of nutrient-balancing programs in major farming regions. This has created a high demand for ammonium sulfate as more farmers become aware of the problems associated with Sulphur deficiency due to intensive agricultural practices, reduced atmospheric sulphur deposition, and increased soil sulphur removal through crops. Ammonium sulfate supplies nitrogen and sulphur in one product, increasing the efficiency of both nutrients' use in crops and the quality of produce. As more countries and agronomic agencies promote nutrient balance through their research programs, it is anticipated that ammonium sulfate will remain in demand for many years to support sustainable soil use and precision agriculture.

Restraint: Quality variability across production routes

Variability in quality across production methods restrains the growth of the ammonium sulfate industry. Ammonium sulfate produced from caprolactam, coke oven gas, flue gas desulfurization, and other industrial by-products will have differences in chemical composition (purity), crystal size, water content, or amount(s) of contaminants. Manufacturers of fertilizers and other industries that require uniform specifications use ammonium sulfate of equally high quality; however, variability in how these materials are treated prior to use or as manufactured creates issues when storing and handling these products. Furthermore, when heavy metals or insoluble materials exceed established limits, their use is restricted to the production of regulated agricultural products and to food applications. These quality concerns increase the need for additional processing, quality control, and certification, raising costs and constraining broader market adoption

Opportunity: Development of region-specific nitrogen–sulfur ratios through granulation and compaction

The growing demand for region-specific nitrogen-to-sulfur ratios in ammonium sulfate is driven by recent advancements in granulation and granular compaction technologies, which enable the production of tailored products. The variation in soil nutrient profiles, cropping patterns, and climatic conditions across regions necessitates the development of fertilizers tailored to each region's unique needs. By manufacturing ammonium sulfate products with optimized nitrogen-to-sulfur ratios for each region, manufacturers can enhance nutrient use efficiency, reduce the risk of nutrient overapplication, and increase crop yields. Additionally, granules and granulated, compactable products improve handling and storage while facilitating integration into bulk blending systems. This customized approach allows producers to better address their clients' agronomic requirements, strengthen their market presence, and support precision agriculture and balanced fertilization.

Challenge: Fragmented regulatory treatment across fertilizer, chemical, and environmental frameworks

The ammonium sulfate market is adversely affected by a fragmented regulatory framework encompassing fertilizer, chemical, and environmental regulatory systems, with ammonium sulfate potentially subject to more than one regulatory system depending on its production route and intended application. This leads to regulatory complexity for producers and distributors in complying with multiple sets of regulations. Additionally, fragmented regulatory systems lead to increased compliance costs, both administrative and financial, and can slow the pace at which products enter a market. These issues impede cross-border trade and product standardization for ammonium sulfate produced as a by-product of another process, creating higher compliance costs and reducing the incentive to invest in expanding manufacturing capacity or developing value-added products.

AMMONIUM SULFATE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses ammonium sulfate in specialized industrial applications such as production of fire extinguisher powders, nutrient media for microorganisms, and hardeners for wood-based materials, plus as fertilizer component in crop nutrition solutions | Enhances product functionality in industrial formulations, improves handling characteristics, supports broader agricultural fertilizer blends, and diversifies revenue streams beyond traditional fertilizer markets |

|

Markets “blueSulfate”, a high-grade ammonium sulfate solution used as liquid fertilizer supplying nitrogen and sulfur for plant growth and soil health, suitable for broad agriculture and industrial uses | Boosts nutrient uptake efficiency with slow nitrogen release, helps manage soil pH, supports sustainability goals, and reduces environmental footprint in crop and industrial applications |

|

Produces ammonium sulfate as a by-product of caprolactam and nylon-related chemical processes selling it into agricultural and industrial markets, leveraging vertical integration across production streams | Lowers feedstock waste and production cost through by-product utilization, supplies steady volumes to fertilizer and industrial buyers, and reinforces circular economy value in chemical manufacturing |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ammonium sulfate ecosystem includes all processes necessary to transform raw materials or industrial by-products into market-ready fertilizers and industrial-grade products. The growing number of producers, including integrated chemical companies and by-product generators, has increased supply availability and improved market access. Today's ammonium sulfate offers a consistent nutrient composition, is easy to handle, and is cost-effective, making it suitable for both direct application and blending. The value chain typically begins with sourcing raw materials or recovering by-products. This is followed by processes such as crystallization or granulation, drying, screening, storage, and packaging. The chain then extends to distribution, marketing, and application across agricultural and industrial end-use sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Ammonium Sulfate Market, by Type

Solid ammonium sulfate is the largest segment in the ammonium sulfate market, primarily due to its widespread use in agriculture and its compatibility with current fertilizer handling and application methods. Users prefer solid ammonium sulfate products, such as granular and crystalline forms, because they are easy to store, less likely to absorb moisture from the air compared to liquid products, and can be easily mixed with other nutrients. Furthermore, solid ammonium sulfate has consistent nitrogen and sulfur content, enabling even field application and improved nutrient management on farms. Its long shelf life and reduced transportation risks enable large-scale distribution. Additionally, solid ammonium sulfate products work well with mechanized agricultural operations, ensuring their continued presence in both domestic and international agricultural sectors.

Ammonium Sulfate Market, by Application

The application of ammonium sulfate as a fertilizer accounts for the largest market segment. Its dual function as both a nitrogen and sulfur source for crops significantly influences its use, especially since many agricultural soils are deficient in sulfur. Additionally, there is a growing emphasis on maintaining balanced nutrient levels in crops. Ammonium sulfate is particularly compatible with alkaline soils and can be easily mixed with other fertilizers, making it suitable for precision application techniques. This will likely continue to drive growth in this segment. Furthermore, ammonium sulfate is cost-effective, provides a predictable rate of nutrient release, and has been shown to enhance crop yield and quality. As the focus on soil health management and nutrient efficiency increases, the demand for ammonium sulfate in fertilizer applications is expected to remain strong.

REGION

Asia Pacific to be fastest-growing region in global ammonium sulfate market during forecast period

Asia Pacific is the largest regional market for ammonium sulfate, driven by strong demand across the region's agricultural and industrial markets. Its high use in the agricultural industry stems mainly from China's and India's high cropping intensity, the need for sulfur to amend sulfur-deficient soils, and the considerable amount of ammonium sulfate consumed as fertilizer in both countries. Ammonium sulfate is also widely used in various industrial processes. It is used extensively in the wastewater treatment industry, food processing, pharmaceutical manufacturing, and dyeing textiles. Ammonium sulfate is frequently used as a coagulant, processing aid, and/or pH regulator in industrial applications. Many chemicals manufactured in the Asia Pacific region also produce ammonium sulfate as a by-product. Due to the region's high level of chemical manufacturing and the demand for ammonium sulfate within the region's chemical manufacturing base, Asia Pacific's supply of ammonium sulfate will be further supported by the Asia Pacific's rapid industrialization, urbanization, and the low cost of ammonium sulfate among end users.

AMMONIUM SULFATE MARKET: COMPANY EVALUATION MATRIX

In the market matrix of ammonium sulfate, BASF (Star) holds a leadership position supported by its large-scale production capabilities, integrated chemical value chain, and strong presence across fertilizers, pharmaceuticals, food and feed additives, water treatment, and textile dyeing applications. BASF’s advantage lies in its ability to supply consistent-quality ammonium sulfate while meeting diverse regulatory and application-specific requirements across global markets. DOMO Chemicals (Emerging Leader) is steadily strengthening its position by leveraging by-product ammonium sulfate from its nylon and caprolactam operations, supported by process efficiency and growing penetration in fertilizer and industrial applications. With rising demand for sulfur-containing nitrogen fertilizers and increasing industrial usage, DOMO Chemicals has clear potential to move toward the leadership quadrant as application diversification and quality standardization improve.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BASF (Germany)

- Evonik Industries AG (Germany)

- LANXESS (Germany)

- AdvanSix (US)

- Sumitomo Chemical Co., Ltd. (Japan)

- OCI Global (Netherlands)

- Domo Chemicals (Belgium)

- Nutrien Ltd. (Canada)

- China Petrochemical Development Corporation (China)

- Martin Midstream Partners (US)

- UBE Corporation (Japan)

- Gujarat State Fertilizers & Chemicals (GSFC) (India)

- Jost Chemical Co. (US)

- Kanto Chemical Co., Inc. (Japan)

- Yara International ASA (Norway)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.56 Billion |

| Market Forecast in 2030 (Value) | USD 6.81 Billion |

| Growth Rate | CAGR of 3.4% from 2025–2030 |

| Years Considered | 2024–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: AMMONIUM SULFATE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Sub-segmentation of solid ammonium sulfate segment into different types | Solid ammonium sulfate segment further divided into crystalline and granular | Enabled deeper visibility into high-growth subsegments and highlighted packaging opportunities specific to each category |

| Provided detailed market sizing for 15 more countries in Asia Pacific | Delivered expanded country-level datasets, volume estimates, and revenue sizing for 15 additional Asia Pacific countries | Strengthened strategic decision-making by offering a comprehensive regional view and identifying new country-specific growth pockets |

RECENT DEVELOPMENTS

- October 2025 : BASF announced the construction of a new electronic-grade ammonium hydroxide facility at Ludwigshafen to support semiconductor chemicals demand, demonstrating investment in the high-purity ammonium derivatives supply chain.

- October 2024 : Evonik and BASF agreed on the first delivery of biomass-balanced ammonia with a reduced carbon footprint to support Evonik’s sustainable product production and enhance ammonia feedstock sustainability across its broader chemical portfolio.

- September 2024 : AdvanSix was awarded a USD 12?million grant to expand granular ammonium sulfate production under its SUSTAIN initiative, aiming to add ~200,000?tons annually at the Hopewell facility.

Table of Contents

Methodology

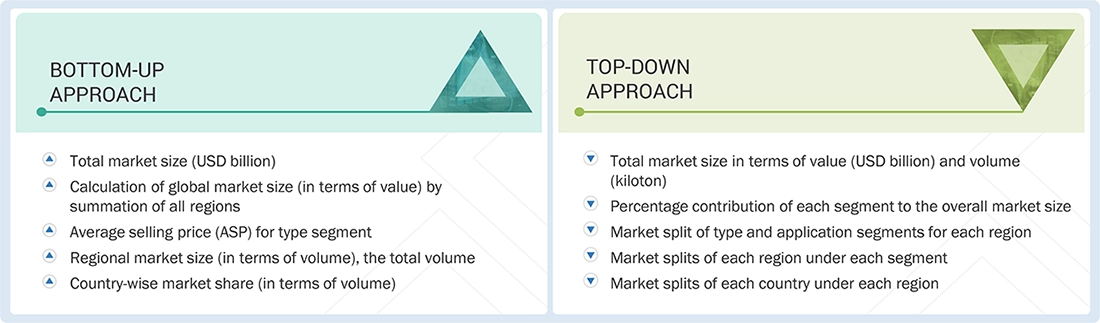

The study involved four major activities to estimate the current size of the global ammonium sulfate market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of ammonium sulfate through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the ammonium sulfate market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments of the market.

Secondary Research

The market for companies offering ammonium sulfate is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the ammonium sulfate market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations, as well as ammonium sulfate vendors, forums, certified publications, and white papers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the ammonium sulfate market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of ammonium sulfate offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Notes: Other designations include sales, marketing, and product managers. Tier 1: >USD 1 billion; Tier 2: USD 500 million–1 billion; and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global ammonium sulfate market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Ammonium Sulfate Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Ammonium sulfate is an inorganic compound containing both nitrogen and sulfur that is commonly used as a nutrient source and as a chemical intermediate. It is also used in many industries outside agriculture, including industrial processing, water treatment, pharmaceuticals, food processing, and emission control, due to its high solubility, stability, and consistent chemical properties across a wide range of applications.

Key Stakeholders

- Raw material suppliers

- Regulatory bodies

- Government and consulting firms

- End users

- Research and development organizations

- Ammonium sulfate manufacturers, dealers, traders, and suppliers

Report Objectives

- To define, describe, and forecast the size of the ammonium sulfate market based on type, application, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To analyze and forecast the market based on type and application

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, expansions, partnerships, and acquisitions in the ammonium sulfate market

- To provide the impact of AI on the ammonium sulfate market

Customization Options

Based on the given market data, MarketsandMarkets offers customizations tailored to client-specific needs.

The following customization options are available for the ammonium sulfate report:

Product Analysis

- A product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the ammonium sulfate market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Ammonium Sulfate Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Ammonium Sulfate Market