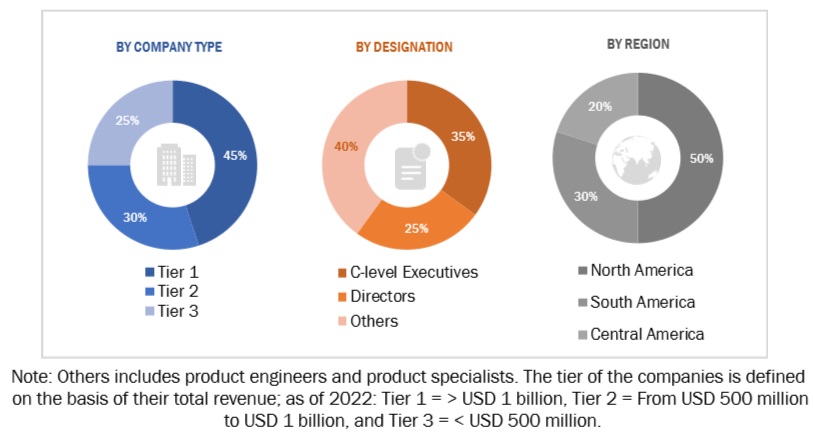

The study involved major activities in estimating the current size of the Americas Cables market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the Americas Cables market involved the use of extensive secondary sources, directories, and databases, such as North American Submarine Cable Association (NASCA), California Cable & Telecommunications Association (CCTA), Wire & Cable Manufacturers’ Alliance, Inc. (WCMA), National Electrical Code (NEC), CEC Rule 12-604 and NR 10- Safety in electrical installations and services, to identify and collect information useful for a technical, market-oriented, and commercial study of the global Americas Cables market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The Americas Cables market comprises several stakeholders such as cables manufacturers, manufacturers of subcomponents of cables, distributors and suppliers, and end users. A combination of factors is driving the growth of the cable sector in America. Demand is driven by new building in the residential and commercial sectors, while aging infrastructure requires renovation. Transmission lines also need to be strengthened due to the increasing use of renewable energy sources like solar and wind. High-speed data cables supporting automation and smart manufacturing are in demand from industrial users. Subsea cables are essential for long-distance data transmission and offshore wind farms, while underground cables are usually employed for aesthetics and to prevent weather damage.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

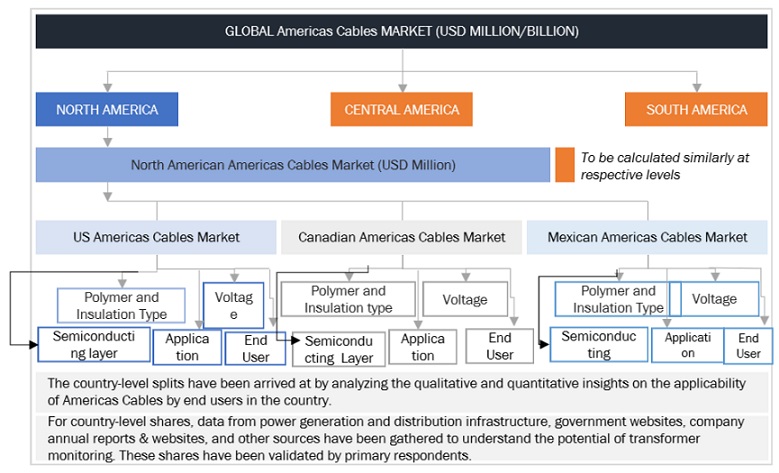

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Americas Cables market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

-

The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Americas Cables Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Americas Cables Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

An electrical cable with one or more conductors covered in layers of insulation and protection is called a power cable. It is used to transmit and distribute electrical power. Common insulation materials include ethylene propylene rubber (EPR) and its variant, high ethylene propylene rubber (HEPR), which are known for their flexibility and durability; cross-linked polyethylene (XLPE), which has high chemical and thermal stability; and ethylene propylene diene monomer (EPDM), which is prized for its electrical insulating qualities. To control electric fields inside the cable, semiconducting polymers are layered. These cables are used by a variety of end users, such as commercial infrastructures, industrial facilities, and the renewable energy industry for the transmission of wind and solar electricity. All of these end users require dependable and effective power distribution systems.

Key Stakeholders

-

Government & research organizations

-

Institutional investors and investment banks

-

Investors/shareholders

-

Environmental research institutes

-

Consulting companies in the energy & power sector

-

Raw materials and component manufacturers

-

Cable manufacturers, dealers, and suppliers

-

Petroleum companies (diesel and natural gas suppliers)

-

Power grid infrastructure companies

-

Power plant project developers

-

Renewable energy companies

-

Manufacturers’ associations

-

Process industries and power industry associations

-

Refinery operators

-

Manufacturing industry

-

Energy efficiency consultancies

Objectives of the Study

-

To define, describe, segment, and forecast the Americas Cables market, in terms of value and polymer and insulation type, semiconducting layer, voltage, application, end user, and region

-

To forecast the market size for three key regions: North America, South America, and Central America, along with their key countries

-

To provide detailed information about the key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

-

To analyze market opportunities for stakeholders and the competitive landscape of the market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

-

To analyze competitive developments, such as deals and agreements in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

-

Further breakdown of region or country-specific analysis

Company Information

-

Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Americas Cables Market