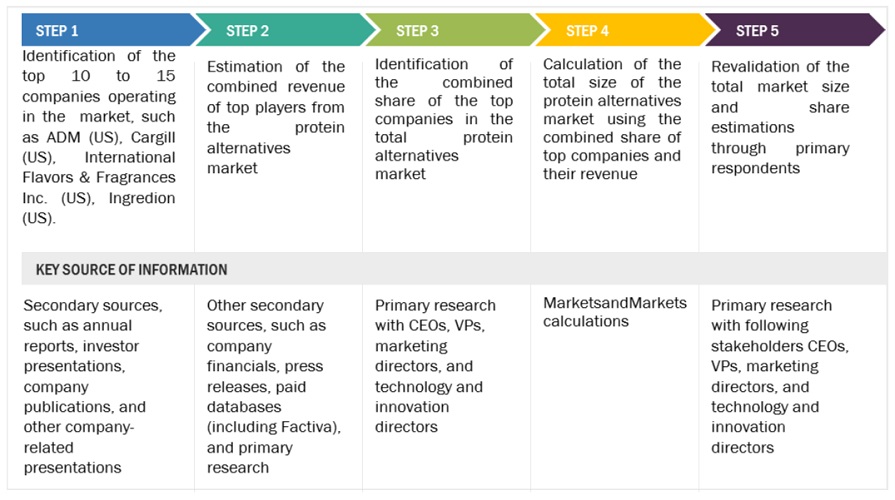

The study involved two major approaches in estimating the current size of the protein alternatives market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

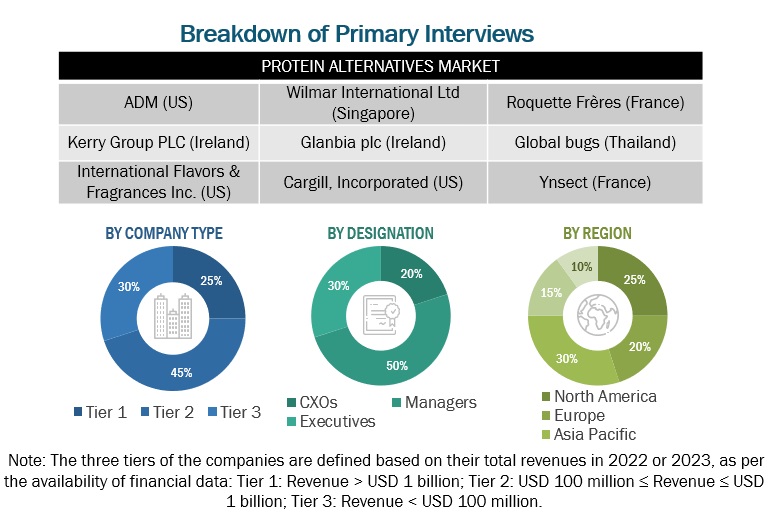

Extensive primary research was conducted after obtaining information regarding the protein alternatives market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to protein alternatives sources, application, form, nature, production process (qualitative) and region. Stakeholders from the demand side, such as processed food and functional food products manufacturers, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of protein alternatives and the outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME

|

designation

|

|

ADM (US)

|

General Manager

|

|

Cargill Incorporated (US)

|

Sales Manager

|

|

International Flavors & Fragrances Inc. (US)

|

Manager

|

|

Ingredion (US)

|

Head of processing department

|

|

Roquette Frères (France)

|

Marketing Manager

|

|

Wilmar International Ltd. (Singapore)

|

Sales Executive

|

Protein Alternatives Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the protein alternatives market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

The key players in the industry and the overall markets were identified through extensive secondary research.

-

All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

-

The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Protein Alternatives Market: Supply-side analysis.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Protein Alternatives Market: Top-Down Approach.

Data Triangulation

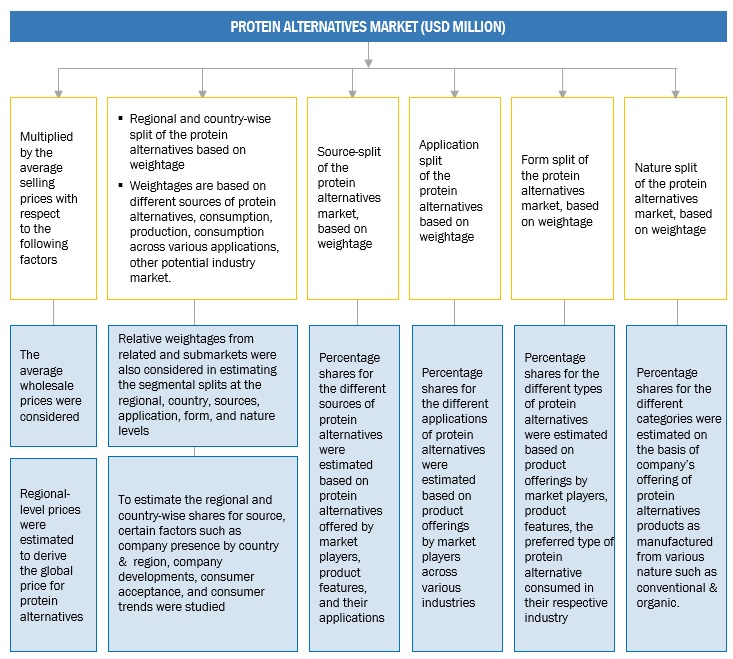

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall protein alternatives market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to GFI, alternative proteins are proteins produced from plants or animal cells, or by way of fermentation. These innovative foods are designed to taste the same as or better than conventional animal products while costing the same or less. Compared to conventionally produced proteins, alternative proteins require fewer inputs, such as land and water, and generate far fewer negative externalities, such as greenhouse gas emissions and pollution.

Plant protein refers to the derivation of protein from plant-based sources, such as pulses, grains, and seeds. Different sources of plant-based protein include soy, wheat, pea, canola, oats, rice, and potato. Proteins are polymers of amino acids, which are used in various applications for their nutritional and functional properties. Their potential to increase the nutritional level and the resultant healthy diet makes them one of the key ingredients in both the food and feed industries.

According to the US Agency for International Development (USAID), “Soy protein concentrates (SPC), and soy protein isolates (SPI) are processed food ingredients produced from wholly defatted soy meal through a water extraction process. The resulting concentrates and isolates contain 65%-90% protein, respectively, and are used as ingredients to enrich other food products.”.

According to the European Food Information Council (EUFIC), insects have the potential to produce less greenhouse gas (GHG) emissions and use fewer resources as compared to conventional sources such as plant and animal proteins. Proteins derived from insects, either through consumption of the whole of the insects or through extraction processes, are termed insect proteins. Insect-based protein is considered a viable alternative source for protein, majorly in food and feed applications. Like animal proteins, insects are rich in proteins and essential amino acids, which are easily digestible compared to plant-based proteins.

According to National Center for Biotechnology Information (NCBI), Microbial proteins, commonly known as single-cell proteins (SCP), are derived from several species of microorganisms but are most commonly derived from microalgae, fungi, yeast, or bacteria.

Key Stakeholders

-

Food & beverage manufacturers, suppliers, and processors

-

Research & development institutions

-

Traders & retailers

-

Distributors, importers, and exporters

-

Regulatory bodies

-

Organizations such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), EUROPA, and Food Safety Australia and New Zealand (FSANZ)

-

Government agencies

-

Intermediary suppliers

-

Universities and industry bodies

-

End users

-

Insect protein and other protein feed ingredient manufacturers

-

Insect farmers and field experts

-

Feed and feed additive manufacturers

-

Food processors and ingredient manufacturers

-

Food safety agencies such as the Food and Drug Administration (FDA) and the European Food Information Council (EUFIC)

-

Commercial research & development (R&D) institutions and financial institutions

-

Importers and exporters of alternative proteins

-

Traders, distributors, and suppliers

-

Government organizations, research organizations, and consulting firms

Report Objectives

Market Intelligence

-

To determine and project the size of the protein alternatives market with respect to the source, form, nature, application, production process (qualitative) and regions in terms of value and volume over five years, ranging from 2024 to 2029.

-

To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

-

To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

-

To identify and profile the key players in the protein alternatives market.

-

To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

-

Further breakdown of the European protein alternatives market into key countries.

-

Further breakdown of the Rest of Asia Pacific protein alternatives market into key countries.

Company Information

-

Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Protein Alternatives Market