AI in Finance Market Size, Share, Industry, overview, Growth, Latest Trends

AI in Finance Market by Product (Algorithmic Trading, Virtual Assistants, Robo-Advisors, GRC, IDP, Underwriting Tools), Technology, Application (Fraud Detection, Risk Management, Trend Analysis, Financial Planning, Forecasting) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI in Finance market is projected to grow from USD 38.36 billion in 2024 to USD 190.33 billion by 2030, at a CAGR of 30.6%, driven by the sector’s shift toward AI-first operating models. Financial institutions are adopting cloud-native AI platforms, generative AI, and real-time analytics to modernize legacy systems, reduce costs, and deliver personalized services. Vendors like NVIDIA, Google Cloud, Microsoft, and AWS are enabling this transformation through industry-specific AI stacks and co-innovation programs. Key use cases include fraud detection, risk scoring, portfolio optimization, and AI-powered customer engagement. As over 80% of firms plan to increase AI investments, strategic priorities include building explainable AI (XAI) frameworks, enhancing model governance, and integrating predictive and generative AI to drive operational efficiency and innovation.

KEY TAKEAWAYS

- North America dominates the AI in Finance Market by 35.3% market share in 2024.

- By product, the compliance automation platforms segment is projected to have the fastest growth rate of 35.7%, during the forecast period.

- By technology, the other AI technologies segment is expected to dominate the market, with share of 91.4% in 2024.

- By application, the customer service & engagement segment is projected to have the highest CAGR, during the forecast period.

- By end user, the Retail & E-commerce segment is expected to dominate the market during the forecast period.

- Microsoft, Google and IBM are identified as some of the star players in the AI in Finance market, given their strong market share and product footprint.

- DataRails, DataVisor and InData Labs, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging leaders.

The AI in Finance market is rapidly transforming as institutions adopt AI for fraud detection, credit scoring, compliance automation, and algorithmic trading. The rise of robo-advisors, predictive analytics, and sentiment analysis is reshaping investment strategies. Key drivers include generative AI for portfolio optimization, machine learning and NLP for RegTech, and the expansion of digital banking. Vendors like Google Cloud, Microsoft, AWS, and NVIDIA are investing in financial-grade AI platforms, making AI central to modern banking, asset management, and financial services innovation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AI in finance market is undergoing a significant transformation as businesses increasingly rely on AI-driven insights for decision-making and strategic planning. This evolution is primarily driven by the demand for real-time analytics, personalized user experiences, and tailored solutions that address the unique needs of various financial services. Clients in the AI finance sector span a range of industries, including banking, investment, and insurance. They utilize AI tools to optimize risk assessment, fraud detection, and customer service. By harnessing the power of AI, these clients aim to enhance operational efficiency, improve client engagement, and gain a competitive edge. Financial institutions depend on AI to analyze vast amounts of transactional data, predict market trends, and provide personalized investment recommendations that align with individual client goals. Businesses require real-time data to make agile decisions and quickly adapt to shifts in market dynamics. AI solutions enable firms to monitor financial transactions, derive insights from customer interactions, and enhance service delivery. With the increasing volume of user-generated content, privacy and data security are critical concerns in finance.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for AI-powered financial forecasting to support strategic planning, portfolio optimization, and investment agility

-

Accelerated adoption of machine learning for risk analytics, enabling real-time fraud detection, credit scoring, and compliance automation

Level

-

Lack of model transparency and explainability in AI systems, leading to trust deficits and regulatory scrutiny

Level

-

Surge in demand for hyper-personalized financial products driven by AI-based customer segmentation, behavioral analytics, and dynamic pricing engines

-

Enhanced credit risk modeling and financial accuracy through AI-driven underwriting and alternative data utilization

Level

-

Persistent risks of algorithmic bias and ethical concerns in automated financial decision-making, impacting fairness and inclusivity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for AI-powered financial forecasting to support strategic planning, portfolio optimization, and investment agility

Financial institutions and fintech adopters are accelerating AI integration to enable accurate predictive analytics, supporting strategic investment planning and portfolio optimization in volatile markets. This demand is driven by the need to anticipate economic shifts and maximize returns. Indeed, predictive analytics for strategic planning is a top priority, with vendors like JP Morgan, Salesforce, and Affirm emphasizing AI's pivotal role in forecasting, portfolio optimization, and real-time decision support. AI is increasingly utilized to anticipate economic shifts, automate complex financial modeling, and enhance overall investment strategies. These advanced AI algorithms provide real-time insights, empowering financial decision-makers to make data-driven decisions, thereby positioning firms ahead in competitive AI finance trends.

Restraint: Lack of model transparency and explainability in AI systems, leading to trust deficits and regulatory scrutiny

A key restraint is the lack of transparency in financial AI models, which undermines trust in AI-driven decision-making and complicates regulatory compliance. This opacity is a widely acknowledged issue that creates challenges in auditing AI processes, increases scrutiny from regulators, and slows deployment. Consequently, vendors and regulators stress the need for Explainable AI (XAI) to ensure trust, auditability, and full regulatory compliance. Industry stakeholders are actively seeking clearer explanations of model outputs to align with rigorous governance standards in the evolving AI risk management landscape.

Opportunity: Surge in demand for hyper-personalized financial products driven by AI-based customer segmentation, behavioral analytics, and dynamic pricing engines

Financial service providers are increasingly investing in personalized banking AI solutions to foster long-term customer engagement through hyper-customized financial products and enhanced user experiences. Hyper-personalization is a major growth area, with vendors deploying AI to deliver tailored financial products, personalized investment advice, and dynamic pricing. Institutions are leveraging AI to analyze customer data, offer tailored loan products, and improve loyalty programs, driving growth by meeting the rising demand for individualized services in a competitive market.

Challenge: Persistent risks of algorithmic bias and ethical concerns in automated financial decision-making, impacting fairness and inclusivity

AI adopters in finance face significant challenges with algorithmic bias, which can lead to unfair outcomes such as skewed credit approvals or investment recommendations. Addressing this requires robust bias mitigation strategies, including advanced detection tools and diverse datasets, to ensure fairness, protect reputation, and maintain compliance with global regulatory frameworks in ethical fintech AI adoption.

AI in Finance Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

H2O.ai provided PayPal with a solution utilizing H2O Driverless AI, which enhanced fraud detection capabilities. By combining advanced ML with graph database techniques, PayPal was able to identify complex fraud patterns, such as collusion among buyers and sellers. | Improved fraud detection model accuracy by ~6%, strengthening PayPal’s fraud prevention capabilities and reducing financial exposure. |

|

Vena Solutions provided Shift4 Payments with a comprehensive financial planning platform that transformed their reporting and planning processes. By automating data flows from Shift4’s Oracle ERP Suite into a central database, Vena enabled the finance team to streamline monthly reporting and enhance flexibility in planning. | Supported scalable financial planning, enhancing adaptability to business growth and dynamic market conditions. |

|

Investa implemented Workiva's cloud-based platform, which facilitated real-time data collaboration and streamlined the reporting process. This transformation allowed Investa to produce timely and reliable reports, improving efficiency and reducing the workload for its finance team. | Boosted operational efficiency by automating workflows, allowing finance teams to focus on strategic analysis and decision-making. |

|

DataVisor and Microsoft azure collaborate to enhance real-time fraud detection. This architecture supports both public and private Azure deployments, ensuring comprehensive protection against sophisticated attacks. | Achieved 35%+ uplift in threat detection, enabling proactive fraud prevention and minimizing financial losses. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI in finance market ecosystem comprises a diverse range of stakeholders. Key providers include ERP & financial systems, chatbots and virtual assistants, automated reconciliation solutions, intelligent document processing, government, risk and compliance software, accounts payable/receivable automation software, robo-advisors, expense management systems, compliance automation platforms, algorithmic trading platforms, underwriting engines/platforms, and end users. These entities collaborate to develop, deliver, and utilize social media AI solutions, driving innovation and growth in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in finance Market, By Product Type

The compliance automation platforms segment is emerging as the fastest-growing product category in the AI in finance market. This growth is driven by intensifying regulatory scrutiny and the increasing complexity of financial compliance obligations. AI-enabled platforms are transforming how institutions manage anti-money laundering (AML) checks, Know Your Customer (KYC) verification, transaction monitoring, and audit trails—delivering higher accuracy and operational efficiency. The surge in RegTech adoption, integration with real-time risk management systems, and the need for scalable, regulation-ready frameworks are fueling strong demand for AI-based compliance automation across banking, insurance, and capital markets.

AI in finance Market, By Deployment Mode

While cloud deployment continues to dominate the AI in finance landscape, on-premises AI systems are witnessing accelerated growth in high-security financial environments. Institutions such as investment banks, central banks, and trading firms are increasingly adopting on-prem AI for use cases like algorithmic trading, fraud detection, and risk analytics—where ultra-low latency, data sovereignty, and maximum security are non-negotiable. Rising concerns around cybersecurity, regulatory mandates for data localization, and the need for proprietary control over AI infrastructure are driving this shift. Vendors are responding by offering modular, high-performance AI stacks tailored for sensitive financial operations.

AI in finance Market, By Use Case (Business Operations Applications)

Customer service and engagement applications are experiencing rapid growth, fueled by the expansion of digital banking platforms and omni-channel financial services. AI-driven tools such as chatbots, virtual assistants, and sentiment analysis engines are enabling hyper-personalized customer interactions, proactive issue resolution, and real-time financial guidance. The rise of conversational AI, integration of generative AI for client onboarding, and a growing emphasis on frictionless customer journeys are reshaping how financial institutions engage with clients. Enhanced customer experience is becoming a strategic lever for retention, cross-selling, and differentiation in highly competitive markets.

AI in finance Market, By End User (Business Function)

The healthcare and pharma sector is emerging as a high-growth vertical for AI in finance, driven by the adoption of AI-powered financial solutions for healthcare payments, claims management, and insurance underwriting. Pharmaceutical firms are leveraging AI for credit risk scoring, supply chain financing, and compliance analytics to support global operations. The sector’s complex regulatory landscape, high transaction volumes, and increasing demand for secure, fraud-resistant payment systems make it a significant driver of AI adoption in finance. Vendors are targeting this space with tailored solutions for insurance-linked financing and digital health payment ecosystems.

REGION

Asia Pacific to be the fastest-growing region in the AI in finance Market during the forecast period

Asia Pacific is emerging as the fastest-growing region in the AI in Finance market, propelled by rapid adoption of digital payments, fintech innovation, and AI-driven financial infrastructure. Countries such as India, China, and Singapore are at the forefront of integrating AI into core financial functions including fraud detection, risk analytics, credit scoring, and wealth management. The region’s growth is further supported by government-backed fintech initiatives, rising mobile-first financial ecosystems, and increasing demand for secure, intelligent financial platforms. Asia Pacific’s momentum positions it as a global hub for AI innovation in financial services, with vendors actively investing in localized solutions to meet regulatory and market-specific needs.

AI in Finance Market: COMPANY EVALUATION MATRIX

In the AI in finance market matrix, Fiserv (Star) leads with a strong market presence and a comprehensive suite of AI-driven financial capabilities, enabling large-scale adoption in areas such as fraud detection, real-time payments monitoring, credit risk assessment, and customer analytics. Brighterion (Emerging Leader) is gaining traction with its AI-powered anomaly detection, behavioral biometrics, and adaptive learning models, helping financial institutions strengthen compliance and reduce fraud in real time. While Fiserv dominates with scale, innovation, and enterprise-wide integration, Brighterion demonstrates strong growth potential, steadily advancing toward the star quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 38.36 Billion |

| Market Forecast in 2030 | USD 190.33 Billion |

| Growth Rate | CAGR of 30.6% during 2024-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: AI in Finance Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Delivered competitive profiling of additional vendors, brand comparative analysis, and a drill-down of country-level segmentation across key markets. | Enabled competitive positioning insights, product differentiation clarity, and multi-country market intelligence, supporting go-to-market strategy refinement and stakeholder alignment. |

| Leading Solution Provider (Europe) | Provided competitive profiling, brand benchmarking, and segmentation analysis across additional geographies. | Delivered in-depth market insights, comparative brand positioning, and segment-level intelligence, empowering strategic decision-making and regional growth planning. |

RECENT DEVELOPMENTS

- January 2025 : Unicaja and Fiserv entered a strategic partnership to enhance omnichannel payment processing in Spain, focusing on speed, security, and convenience. This marks Fiserv’s first major venture in the Spanish market, combining Unicaja’s financial reach with Fiserv’s technology to optimize merchant experiences across sectors. The initiative responds to rising demand for digital financial services and aims to strengthen e-commerce capabilities for Unicaja’s clientele.

- January 2025 : Pearson and Microsoft launched a multi-year partnership to revolutionize education and workforce development using Azure Cloud and AI technologies. Key initiatives include personalized learning at scale, AI credentials, and the deployment of Microsoft 365 Copilot across Pearson platforms. The collaboration targets the global AI skills gap, focusing on reskilling and empowering learners for an AI-driven economy.

- December 2024 : Fiserv acquired Payfare Inc. to strengthen its embedded finance capabilities, particularly for the gig economy. Payfare’s workforce payment solutions complement Fiserv’s existing offerings, enhancing technology and program management for efficient business payments. This move reflects Fiserv’s commitment to innovative financial services and opens new growth avenues in digital workforce payments.

- November 2024 : FIS partnered with Oracle to modernize utility billing via the BillerIQ solution on Oracle Cloud Infrastructure (OCI). The integration supports electronic bill delivery and multi-channel payment options (ACH, cards, digital wallets), improving operational efficiency and customer satisfaction. This collaboration addresses legacy billing inefficiencies and advances digital transformation in essential services.

- October 2024 : Google Pay partnered with Muthoot Finance to offer gold-backed loans, enhancing financial accessibility for users in India. This collaboration leverages digital wallet infrastructure to expand credit access and support inclusive finance through asset-backed lending.

Table of Contents

Methodology

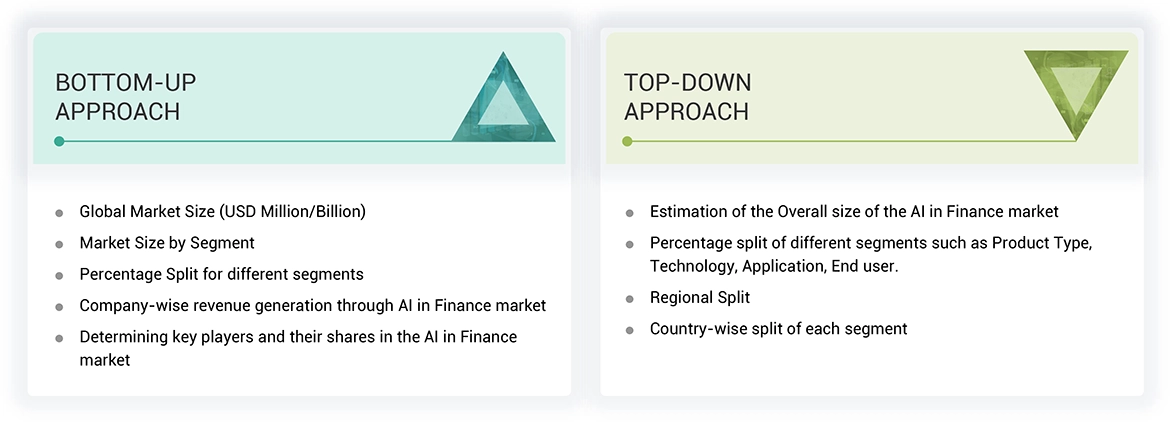

The study involved major activities in estimating the current market size for the AI in Finance market. Exhaustive secondary research was done to collect information on the AI in Finance market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the AI in Finance market.

Secondary Research

The market for the companies offering AI in Finance solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of AI in Finance vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

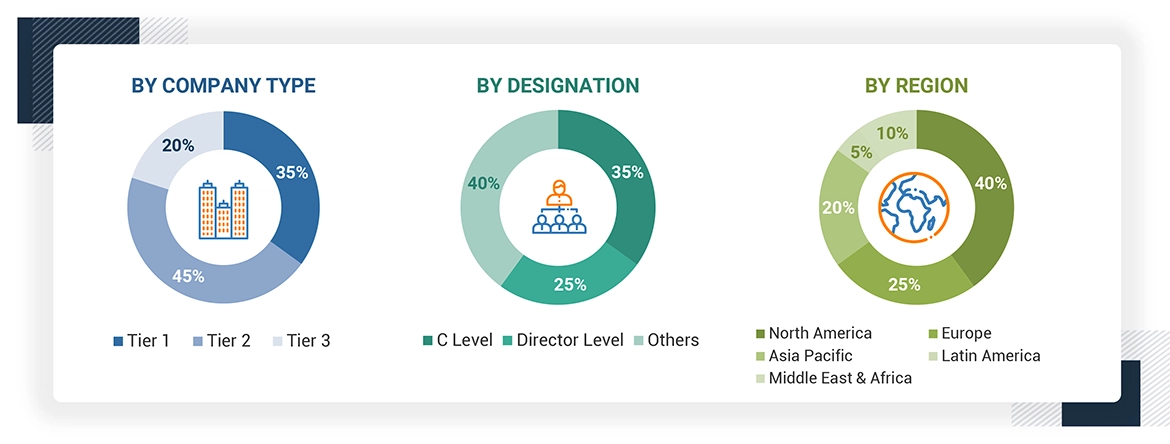

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the AI in Finance market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of AI in Finance solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: Tier 1 companies account for annual revenue of >USD 10 billion; tier 2 companies’ revenue ranges

between USD 1 and 10 billion; and tier 3 companies’ revenue ranges between USD 500 million–USD 1 billion

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cell culture market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

AI In Finance Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into various segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Artificial intelligence (AI) in finance helps drive insights for data analytics, performance measurement, predictions and forecasting, real-time calculations, customer servicing, intelligent data retrieval, and more. It is a set of technologies that enables financial services organizations to better understand markets and customers, analyze and learn from digital journeys, and engage in a way that mimics human intelligence and interactions at scale.

Stakeholders

- Risk Assessment and Compliance Software Developers

- AI in Finance Software Vendors

- Financial Analysts and Managers

- AI in Finance Service Providers

- Financial Marketers

- Business Owners and Executives

- Distributors and Value-Added Resellers (VARs)

- Independent Software Vendors (ISVs)

- Managed Service Providers

- Support and Maintenance Service Providers

- System Integrators (SIs)/Migration Service Providers

- Original Equipment Manufacturers (OEMs)

- Technology Providers

Report Objectives

- To define, describe, and predict the AI in Finance market by product (by type and deployment mode), technology, application (by business operation and business function), end user (by business function and business operation) and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AI in Finance market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers & acquisitions, in the market

- To analyze the impact of the recession across all regions in the AI in Finance market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American AI in Finance market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America AI in Finance market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Finance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Finance Market