The study involved four major activities for estimating the current size of the global activated carbon market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of activated carbon through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the activated carbon market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the activated carbon market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The activated carbon market comprises several stakeholders in the supply chain, which include raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the activated carbon market. Primary sources from the supply side include associations and institutions involved in the activated carbon industry, key opinion leaders, and processing players.

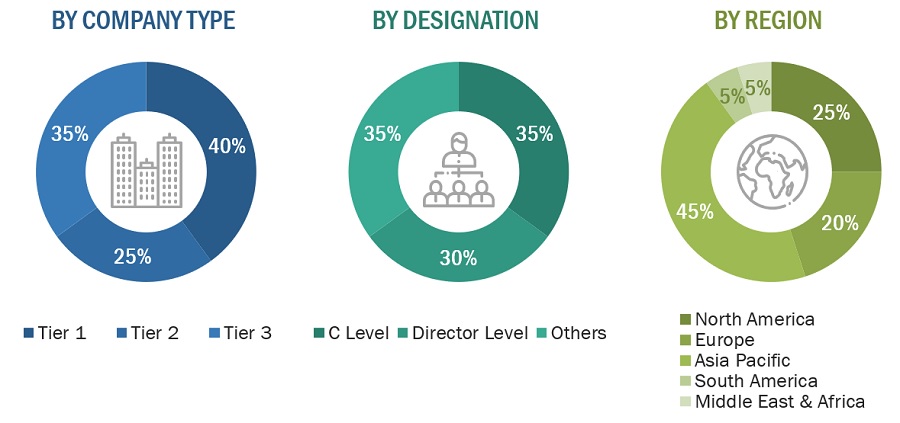

Following is the breakdown of primary respondents—

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2022: Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

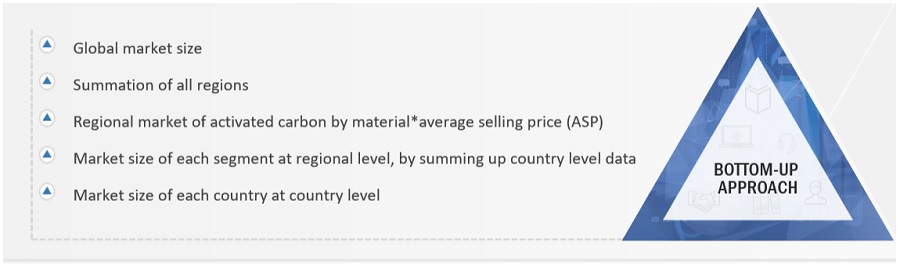

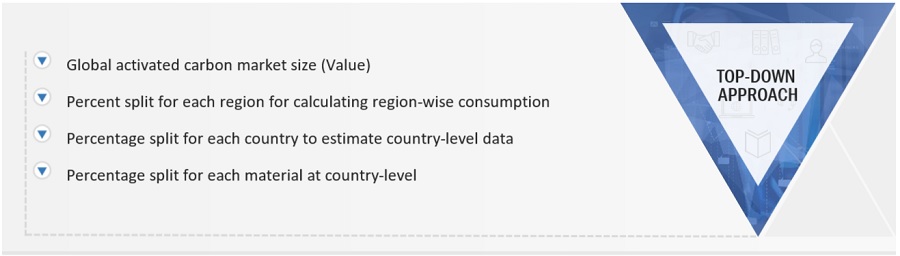

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global activated carbon market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

-

The key players in the industry were identified through extensive secondary research.

-

The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

-

All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the activated carbon market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Activated carbon, also known as activated charcoal, undergoes processing to create small pores with low volume, thus enhancing the surface area for adsorption or chemical reactions. As stated by the Activated Carbon Producers Association, activated carbons are manufactured and utilized as a solid substance in granular, powder, pellet, or textile formats, typically appearing black or dark grey. These activated carbons are made from various raw materials such as bituminous coal, coconut shells, lignite, peat, synthetic sources, semi-anthracite, and wood. Activated carbon is a porous, amorphous, high surface area adsorbent material composed of largely elemental carbon, with low or high skeletal density, depending on the manufacturing process used. Furthermore, the choice of raw material impacts the pore size of the final product. For instance, coconut shells and dense materials produce micropores (<2 nm), while moderately dense and lightweight materials result in meso- (between 2 and 50 nm) or macro-pores (> 50 nm).

Key Stakeholders

-

Component manufacturer and suppliers

-

Environmental associations

-

Consulting companies in the activated carbon industry

-

Activated carbon manufacturers

-

Traders and distributors of activated carbon

-

NGOs, governments, research organizations, investment banks, venture capitalists, and private equity firms

Report Objectives

-

To define, analyze, and project the size of the activated carbon market in terms of value based on type, raw material, application, End-use Industry, and Region.

-

To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

-

To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

-

To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders.

-

To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the activated carbon market

-

To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

-

Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

-

Further breakdown of the Rest of Asia Pacific market

-

Further breakdown of Rest of Europe market

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5)

Tyler

May, 2018

Interested in Activated Carbon market.

price

Jul, 2019

Global market analysis and market trends on activated carbon market.

Dennis

Jun, 2019

Activated carbon as a way of air filtration for automotive applications. market size, market dynamics, and general trends concerning this segment. .

Antonio

Jun, 2018

Activated Carbon market and go to market information/strategy.

Dennis

Jun, 2019

Information on activated carbon and market trends for the automotive industry .

Wang

May, 2012

Customer identification for Activated Carbon products.

Yashwanth

Jan, 2014

Specific information on activated carbon market in Canada and overall information on market share, demand and consumption.

krishnan

Jan, 2014

Specific interest on carbon activated market for automotive industry.

krishnan

Jan, 2014

Interested in activated carbon report with automotive filters coverage.

krishnan

Jan, 2014

interested in information on developing activated carbon for evaporative emission filters for automotive application..

Andrew

Apr, 2019

Detailed information on activated carbon market by application, market segments, and production costs .

Giri

Nov, 2016

Interested in Activated Carbon market.

Janet

Aug, 2019

Activated Carbon Market for Africa.

Bindu

Jul, 2013

Coconut shells based Activated carbon market and medical applications in India.

Ricardo

Sep, 2020

activated carbon supplier from the philippines.

Anthony

Jan, 2016

Information on the the uses, demand, supply and the prices of the various grades of Granular Activated Carbon made from Cattle Bone..

David

Jul, 2019

General information about Activated Carbon Market to consolidate M&A and strategy work.

Anna

Jun, 2015

Requires a cut-off of Poland, from the Activated Carbon report.

Anna

Jun, 2015

Report on activated carbon dedicated to Poland or at least to Eastern Europe region..

Anna

Jun, 2015

Requirement of report on activated carbon only for Poland.

Pablo

Mar, 2018

Interested in information on activated carbon - market structure and size, details on activated carbon media filters, market shares by companies, and comparing market shares of filter media such as activated carbon, clays, attapulgite, perlite, etc .

Rich

Oct, 2011

General query on Global Activated Carbon Market Report and the historical and future PAC pricing.

Abu

Jun, 2016

Need product form level breakup of activated carbon, charcoal market by applications such as Water treatment, Air Purification, Automotive, and Food & Beverages..

nikhil

Jun, 2014

Detail information activated carbon market trends, buyers, pricing analysis .

Alexey

Feb, 2019

Want to get information on technologies for activated carbon production, analysis of efficiency in sorbent production, and regulation in European and Middle East markets.

Emelyne

Dec, 2019

Production and export of activated charcoal in Philippines by company.

Dr.

Dec, 2018

Information on Foods & Beverages and Water Treatment applications.

Sheng

Nov, 2012

Market Share, Import and Export, details for Water and Vapour applications along with Government tenders for Coconut shell activated carbon..

Marlon

Nov, 2019

Market trends and demand of activated carbon .

Sultan

Nov, 2017

Interested in Jute Stick/Bamboo based Charcoal Powder or Granular types Applications, Global market forecast..

Sreekanth

Nov, 2014

Market information on Indian Activated Carbon market .

Philip

Nov, 2019

Looking for investors fo activated carbon production.

Campos

Oct, 2013

Information on activated carbon.

Angela

Oct, 2019

Potential of activated carbon for water remediation application .

Thiago

Sep, 2016

Interested in Brazilian activated carbon market study.

Pas

Sep, 2019

Detailed information on Activated Carbon Market for production expansion .

MD

Sep, 2019

Analysis of market demand of Activated Carbon to plan setting up a plant in Malaysia..

Umang

Aug, 2019

Global activated bamboo and coconut shell base activated carbon demand ,buyers , competitors .

Shashikant

Jul, 2014

Turn Key Projects in Manufacturing from Activated Carbon.

John

Jul, 2014

Interested to know about carbon activated product report.

John

Jul, 2014

Require activated carbon market report.

John

Jul, 2014

South america market and prices information nedded for activated carbon market.

Sobhan

Jul, 2019

Information on activated carbon plants and market .

Anthony

May, 2019

List of activated carbon manufacturers in India with supply or manufacturing in Ghana/Africa.

SHAJI

May, 2014

Interested in Waste Water Treatment with coverage in cokeoven and CRM plant.

Nagesh

May, 2018

Custom study on southern India for small scale enterprise.

Bindu

Apr, 2013

Specific information on activated carbon from coconut waste.

Jonathan

Apr, 2019

In activated carbon report, provide details of water security in South African market.

Matt

Apr, 2012

General information on activated carbon manufacturing process, quality and applications.

Matt

Apr, 2012

General information on market estimation, applications, growth trends of carbon activated market.

Matt

Apr, 2012

Intersted in Activated Carbon - Market Entry.

Matt

Apr, 2012

quality, applications, and value of activated carbon as well as the size of the global activated carbon market. .

André

Apr, 2019

Interested in activated carbon market report specific for Protugal and Spain.

Renzo

Mar, 2015

General information on market estimation, pricing analysis, application of Carbon Activated market.

zack

Mar, 2017

Want us to send the Other section to review as a sample (granular and palletized (other) carbon).

BIMBO

Mar, 2019

Interested in a market entry feasibility for natural charcoal setup in UK and Nigeria.

Dennis

Feb, 2019

Interested in activated carbon market as air filtration for automotive application, trends, and its markets share in overall market.

Kian

Feb, 2019

Current market demand, key market drivers, and key company profiles and their major growth strategies adopted on activated carbon market.

JOSEPH

Jan, 2018

General information on activated carbon manufacturing process and overall industry.

JOSEPH

Jan, 2018

Information on major manufacturers of carbon activated carbon present in the report.

Dennis

Jan, 2019

Interested in Market size of activated carbon market for air filteration in automotive application. Also, interested in current trends and challenges in the market.

Axit

Jan, 2021

Need details of ACTIVATED CARBON suppliers from the Philippines. Does this report also include ASEAN countries in detail?.