3D Printing Robot Market Size, Share & Trends, 2025 To 2030

3D Printing Robot Market by Component & Service (Robot Arm, 3D Printing Head, Software, Service), Robot Type (Articulated, Cartesian, SCARA, Polar, Delta Robots), Application (Prototyping, Tooling, Functional Part Manufacturing) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The 3D printing robot market is projected to reach USD 3.14 billion by 2030 from USD 2.00 billion in 2025, at a CAGR of 9.5% from 2025 to 2030. Growth is driven by the increasing integration of robotics with additive manufacturing to enable automated, high-precision production across industries such as aerospace, automotive, construction, and healthcare. The demand for customized components, lightweight structures, and on-demand manufacturing is accelerating adoption, while advancements in robotic arms, multi-axis printing, and AI-based design optimization are enhancing productivity and scalability in industrial 3D printing applications.

KEY TAKEAWAYS

-

By RegionThe North America 3D printing robot market accounted for a 39.8% revenue share in 2024.

-

By ComponentBy component, the service segment is expected to register the highest CAGR of 28.5%.

-

By Robot TypeBy Robot Type, the scara robot segment is projected to grow at the fastest rate from 2025 to 2030.

-

By End-user IndustryBy end-use industry, the automotive segment will grow the fastest during the forecast period.

-

By ApplicationBy application, the functional part manufacturing segment is expected to dominate the market, growing at the highest CAGR of 11.5%.

The 3D printing robot market is witnessing strong growth, driven by the rising convergence of robotics and additive manufacturing to enable faster, more flexible, and automated production processes. Increasing adoption in sectors such as aerospace, automotive, construction, and healthcare is fueling demand for robotic 3D printers capable of producing complex, large-scale, and customized components with high precision. Industry advancements, including ABB’s robotic additive manufacturing solutions, KUKA’s integration of multi-axis robotic arms for metal printing, and MX3D’s large-format robotic printing systems, are reshaping the manufacturing landscape by improving scalability, reducing material waste, and accelerating time-to-market for next-generation products

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The 3D printing robotics ecosystem is undergoing a structural transformation as revenue streams shift from conventional desktop and fixed-platform printers to advanced, intelligent, and automated printing systems. Emerging technologies such as M2M integration, multi-axis robotic printing, AI-based print optimization, and collaborative robotic systems are redefining manufacturing workflows. These innovations are catalyzing new revenue opportunities across industries — from autonomous aerospace component production and rapid tooling in automotive to large-scale robotic construction and personalized healthcare applications. As clients increasingly adopt on-demand and in-situ fabrication models, value creation is moving toward automation, flexibility, and material innovation, driving a new generation of smart, interconnected manufacturing ecosystems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift toward automation and personalized manufacturing

-

Advancements in robotic arms and additive manufacturing

Level

-

High initial investment costs

-

Lack of skilled workforce

Level

-

Focus of construction industry on sustainability

-

Emergence of mobile 3D printing robotic solutions

Level

-

Complexities associated with system integration

-

Concerns regarding durability and structural integrity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing shift towards automation and personalized manufacturing

One of the most significant drivers fueling the expansion of the 3D printing robot market is the growing trend toward automation and customized manufacturing. As businesses are confronted with mounting pressure to enhance productivity, minimize labor dependency, and address changing consumer needs, automation by means of robotic 3D printing presents a compelling solution. Robotic solutions coupled with additive manufacturing allow for quicker production cycles, repeatable output quality, and the potential for continuous operation. This is especially important in industries such as automotive, aerospace, and consumer products, where time-to-market and customization are paramount

Restraint: High Initial Investment Costs

One of the largest barriers to the mass use of 3D printing robots is the immense initial investment needed. Installation of robotic additive manufacturing machines requires large capital outlay in the form of purchase of advanced robotic arms, 3D printing heads, control systems, and advanced software. In addition, integration, training, and the need for trained individuals incur additional costs that increase the total monetary cost. For the majority of small and medium-sized business (SME) firms, these type of initial costs are usually too costly, which may lead to delay or even discourage the use of this technology

Opportunity: Growth in Sustainable Construction

The growing demand for sustainable construction offers a mind-boggling prospect for robotic technology in 3D printing. As the construction sector globally strives to minimize its carbon footprint, robotic additive manufacturing is a key means of enhancing sustainability. Robots used in 3D printing can use green materials, such as recycled concrete and biodegradable materials, thus making the construction of homes with little waste possible. Robotic 3D building compared to conventional building methods is marked by precision, which not only saves materials but also leads to energy-efficient houses.

Challenge: System Integration Complexity

The biggest challenge to the 3D printing robot market is system integration. Installation of robot additive manufacturing systems requires combining different parts of equipment, such as robotic arms, 3D printing heads, sensors, software platforms, and control systems, into one efficient solution. Hardware and software components from different manufacturers often are not compatible and require time-consuming and technically challenging integration, especially in industrial environments that have legacy systems.

3D Printing Robot Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

ABB collaborated with the German Red Cross (DRK) to construct Germany’s first non-residential 3D-printed building. The project used the ABB IRB 6700 six-axis industrial robot integrated into a large-format polymer 3D printer to create complex walls and facades efficiently. | The solution enabled faster, flexible, and environmentally friendly construction, more than doubled DRK’s space, improved material efficiency, and set a benchmark for automated, digitalized building processes. |

|

Eplus3D partnered with a medical team to create customized titanium prosthetic limbs for a cat using advanced metal 3D printing. The prosthetics were designed to match the cat’s anatomy, ensuring strength, biocompatibility, and long-term stability. | The solution restored the cat’s full mobility, enabled walking, running, and climbing, and demonstrated the potential of 3D-printed, bio-compatible prosthetics in veterinary and medical applications. |

|

Protolabs partnered with Small Robot Company to produce lightweight, durable, and highly detailed components for the Tom V4 autonomous farming robot using Multi Jet Fusion 3D printing. This enabled rapid prototyping, design optimization, and customization of critical parts like the steering actuator cap and SSD mount. | The solution reduced the robot’s weight, improved durability and performance, allowed modular and scalable design, and accelerated time-to-market for precision farming robots while lowering production costs. |

|

Yaskawa Europe implemented robotic automation for Resin Transfer Molding (RTM) at Hilger u. Kern GmbH, streamlining resin injection, mixing, and curing processes. Robots precisely managed coupling and uncoupling of molds, reducing manual intervention and improving process consistency. | The solution significantly shortened production cycle times, enhanced system availability, enabled scalable large-batch manufacturing, and improved efficiency and throughput in composite component production. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Companies in the market offer 3D printing robots suitable for various applications such as automotive, FMCG, construction, culinary, among others. Prominent 3D printing robot providers include KUKA AG (Germany), ABB (Switzerland), Yaskawa Electric Corporation (Japan), FANUC Corporation (Japan), Universal Robots A/S (Denmark).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

3D Printing Robot Market, By Component

Tooling is expected to maintain the second-highest CAGR in the "by application" segment of the 3D printing robot market during the forecast period due to the growing need for rapid, cost-effective, and customized tool production across various industries. Traditional tooling methods are time-consuming and expensive, particularly for low-volume or complex parts. Robotic 3D printing takes lead times down dramatically and minimizes waste material, yet allows for the creation of complex geometries that are hard to produce by other means

3D Printing Robot Market, By Robot Type

The Cartesian robot type will have the second-largest market share in the "by robot type" segment of the 3D printing robot market during the forecast period, due to its large number of industrial applications, accuracy, and design simplicity. These robots operate on three linear axes (X, Y, and Z), and as such, they are perfect for compliant, high-precision additive manufacturing processes

3D Printing Robot Market, By Application

Tooling is expected to maintain the second-highest CAGR in the "by application" segment of the 3D printing robot market during the forecast period due to the growing need for rapid, cost-effective, and customized tool production across various industries. Traditional tooling methods are time-consuming and expensive, particularly for low-volume or complex parts

3D Printing Robot Market, By End User

The defense and aerospace sector is expected to hold the second-largest market share under the "by end user" segment of the 3D printing robot market during the forecast period due to its heavy focus on high-performance, lightweight, and complex pieces. This area is marked by high material expectations with low levels of production, and this renders traditional manufacturing less feasible. Additive manufacturing using robots easily addresses these challenges by providing scalability, customization, and consistent quality

REGION

Asia Pacific to be fastest-growing region in global data center GPU market during forecast period

Asia Pacific is expected to register the highest compound annual growth rate (CAGR) for the 3D printing robot market during the forecast period, with the region being driven by rapid industrialization, strong government initiatives towards advanced manufacturing, and increasing adoption of automation technologies in the dominant industries. China, Japan, South Korea, and India are investing significantly in smart manufacturing programs, thus driving the adoption of robotic 3D printing solutions.

3D Printing Robot Market: COMPANY EVALUATION MATRIX

In the 3D printing robot market matrix, ABB (Star) leads with a strong market share and a broad technological footprint, supported by its advanced robotic platforms and integrated automation solutions that enable large-scale, high-precision additive manufacturing across industrial, construction, and aerospace sectors. Universal Robots (Emerging Leader) is rapidly gaining momentum through its collaborative robotic systems optimized for flexible 3D printing applications, especially in small and mid-sized enterprises. While ABB dominates through scale, system integration, and innovation leadership, Universal Robots demonstrates strong growth potential to advance toward the leaders’ quadrant as demand for adaptable and cost-efficient 3D printing robots accelerates.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.87 BN |

| Market Forecast in 2030 (Value) | USD 3.14 BN |

| Growth Rate | 9.5% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: 3D Printing Robot Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Industrial Automation OEM | Competitive profiling of key 3D printing robot manufacturers (financials, product capabilities, patent strength) | Identify qualified automation partners; detect technology gaps in current robotics lineup; enable collaboration with leading additive manufacturing innovators |

| Aerospace & Automotive Manufacturers | Benchmarking of 3D printing robot adoption across manufacturing lines; analysis of robotic integration for large-scale metal and composite printing | Insights on productivity improvement and lightweight component manufacturing; enable adoption of hybrid production cells |

| Construction & Infrastructure Firms | Evaluation of robotic 3D printing technologies for concrete and polymer-based structures; cost-benefit analysis of automation vs traditional methods | Highlight opportunities for sustainable, on-site, and rapid construction; support decisions for technology adoption and partnerships |

| Medical Device & Healthcare Equipment Manufacturers | Mapping of robotic 3D printing use cases in biocompatible materials and prosthetics; regulatory and certification landscape study | Support entry into personalized medical manufacturing; identify regulatory pathways and innovation trends |

| Defense & Space Contractors | Assessment of 3D printing robots for lightweight, high-strength components; supplier ecosystem mapping for defense-grade additive manufacturing | Strengthen positioning in next-gen defense and space programs; identify early-mover advantages in mission-critical applications |

RECENT DEVELOPMENTS

- February 2025 : In February 2025, Caracol introduced the xHF (Extra Flow) Extruder at JEC World 2025. This high-throughput extruder, compatible with the Heron AM platform, offers an extrusion rate of up to 75 kg/h and the ability to process two materials simultaneously. Its dual-motor torque distribution and advanced thermal control enable the production of large-scale composite parts with enhanced speed and precision, benefiting sectors like aerospace, marine, construction, and architecture.

- November 2024 : In November 2024, Hans Weber Maschinenfabrik partnered with Forward AM, a German provider of 3D printing materials, to showcase sustainable large-scale 3D printing solutions at Formnext 2024. The collaboration involved the creation of translucent wall panels using recycled Ultrafuse® rPETG pellets, demonstrating the potential of sustainable materials in additive manufacturing for architectural applications

- November 2024 : Launched in November 2024, CEAD unveiled the Flexcube, a cartesian-style large-format 3D printer designed for industrial applications. Featuring a 3+1 axis system for 45-degree printing and integrated CNC milling capabilities, the Flexcube offers a compact, all-in-one solution for producing complex geometries. Its modular design caters to sectors like architecture, design, and tooling, emphasizing ease of use and space efficiency.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

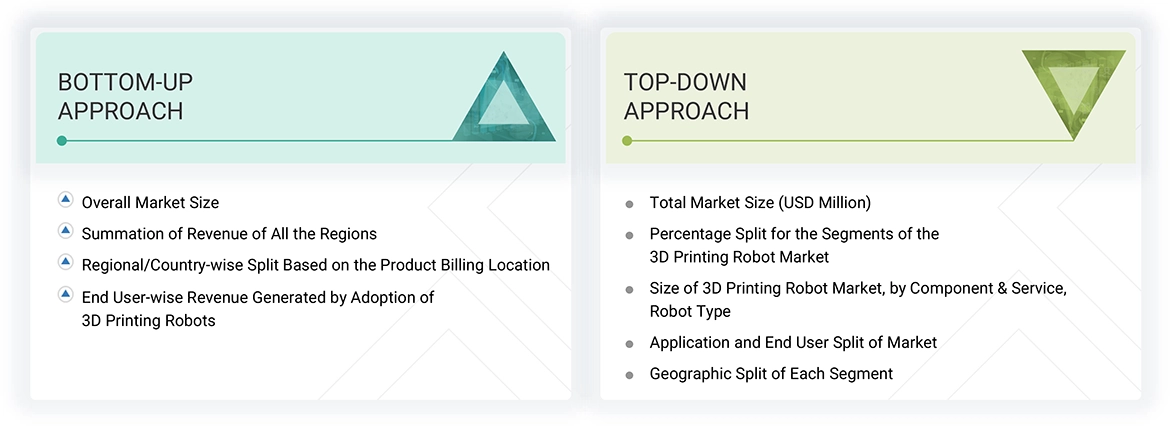

The study involved four major activities in estimating the current size of the 3D printing robot market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process has referred to various secondary sources to identify and collect necessary information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the 3D printing robot market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers. The three tiers of the companies are based on their total revenues as of 2024 - Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Bottom-Up Approach

- Identifying key participants in the 3D printing robot market that influence the entire market, along with the related component players

- Analyzing major manufacturers of 3D printing robots, studying their portfolios, and understanding different types

- Analyzing trends about the use of 3D printing robots in different kinds of industries

- Tracking the ongoing and upcoming developments in the market, such as investments, R&D activities, product/service launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand different types of 3D printing robot trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing the revenues of companies generated through the sales of 3D printing robots, and then combining them to estimate the overall market size

- Segmenting the overall market into various other market segments

- Verifying and cross-checking the estimate at every level, from discussions with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the 3D printing robot market, further splitting the key market based on component & service, robot type, end user, application, and region, and listing the key developments

- Identifying all leading players in the 3D printing robot market based on component & service, robot type, end user, and application through secondary research and fully verifying them through a brief discussion with Industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

3D Printing Robot Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments using the market size estimation processes explained above. Data triangulation and market breakdown procedures were employed to complete the entire market engineering process and determine the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides in the 3D printing robot market.

Market Definition

A 3D printing robot employs layer-by-layer additive manufacturing via a multi-axis robotic arm, print head, and build platform. It constructs objects using 3D printing technology, making it pivotal for precision and customization in various fields. These robots are used in multiple industries, such as aerospace & defense, automotive, construction, fast-moving consumer goods (FMCG), and culinary.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Technology solution providers

- Research institutes

- Market research and consulting firms

- Industrial robot forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- Existing and prospective end users

- Business providers

- Professional service/solution providers

Report Objectives

-

To describe and forecast the 3D printing robot market,

by component & service, robot type, application, end user, and region - To forecast the 3D printing robot market, by function, in terms of volume

- To estimate the market size in North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter's five forces analysis, investment and funding scenario, regulations, and 2025 US trump tariff and AI/Gen AI impact analysis pertaining to the market.

- To strategically analyze micromarkets about individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies, and provide a competitive market landscape

- To analyze strategic approaches such as product launches, expansions, and partnerships in the 3D printing robot market

- To analyze the impact of the macroeconomic outlook for each region

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the 3D Printing Robot Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in 3D Printing Robot Market