Pulse Flours Market by Type (Pea, Bean, Chickpea, Lentil), Application (Food (Bakery Products, Extruded Food, Meat Products, Beverages), Feed, Nutraceuticals, Personal Care), and Region - Global Forecast to 2022

[129 Pages Report] The global pulse flours market accounted for a value of USD 9.78 Billion in 2016 and is projected to grow at a CAGR of 12.2% to reach USD 18.97 Billion by 2022 in terms of value. The objective of this study is to define, segment, and project the size of the pulse flours market on the basis of type, application, and region, and to provide detailed information about the crucial factors influencing the market dynamics (drivers, restraints, opportunities, and industry-specific challenges). The market opportunities and competitive landscape of market leaders are also studied for the stakeholders. Competitive developments such as new product launches, expansions, acquisitions, and investments are also included.

The years considered for the study are as follows:

- Base year: 2016

- Estimated year: 2017

- Projected year: 2022

- Forecast period: 2017 to 2022

Research Methodology

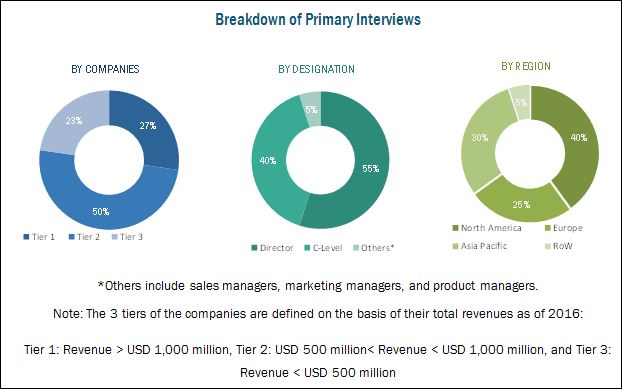

This report includes estimations of the market size in terms of value (USD Billion) and volume (MMT & KT). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the pulse flours market and of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources, such as Pulse Canada, Canadian International Grains Institute, Saskatchewan Pulse Growers, the Food and Agriculture Organization (FAO), the World Bank, the US Department of Agriculture (USDA), and the Institute of Food Technologists (IFT), as well as in numerous trade journals and similar publications, and have been verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The various contributors involved in the value chain of the pulse flours market include food raw material suppliers, food ingredient manufacturers, food processors, importers & exporters, traders, distributors, suppliers, and consumers. The value chain comprises key manufacturers in the pulse flours market, such as Ingredion (US), ADM (US), The Scoular Company (US), SunOpta (Canada), and Anchor Ingredients (US), which have diversified product portfolios and strong distributing networks and offices at strategic locations across the globe. These companies focus on product quality which helps them to cater to the growing demand in the pulse flours market. Other players in this market include EHL Limited (UK), Batory Foods (U.S.), Diefenbaker Spice & Pulse (Canada), which also have a strong presence in the market.

Scope of the report

Based on Type, the market has been segmented as follows:

- Pea

- Chickpea

- Bean

- Lentil

Based on Application, the market has been segmented as follows:

-

Food

- Bakery products

- Extruded food

- Meat products

- Beverages

- Others

- Feed

- Others (nutraceuticals, personal care, and other industrial applications)

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of European pulse flours market into Russia, Denmark, Sweden, Belgium, Poland, and Norway

- Further breakdown of the Rest of Asia Pacific pulse flours market into Malaysia, Vietnam, and Indonesia

Further breakdown of the RoW pulse flours market into Paraguay, Uruguay, Chile, and Cuba

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The global pulse flours market witnessed steady growth over the last few years. The market size is projected to reach USD 18.97 Billion by 2022, at a CAGR of around 12.2% from 2017. High protein profile of pulses and demand for health food products have been major drivers contributing to the growth of the market.

The pulse flours market, by type, is segmented into pea, bean, chickpea, and lentil. The chickpea flour segment dominated the market in the pulse flours market in 2016. It is a good source of proteins, vitamins, minerals, and carbohydrates, and consists of high levels of dietary fiber. Chickpea flour offers numerous health benefits, such as stabilizing blood sugar levels, improving digestion, weight management, and minimizing the risk of heart attack. It is widely used in aroma- and taste-enhancing products such as soups, sauces, dips, and spreads. Rise in health awareness among consumers and increase in consumption of chickpea flour in developing countries are the key factors driving the demand for chickpea flour.

On the basis of application, the pulse flours market is segmented into food, feed, and others. The further food segment is further segmented into bakery products, extruded food, meat products, beverages, and others. The food segment, on the whole, accounted for the largest market share in 2016 due to the rising demand for healthier and gluten-free products. This demand for natural and healthy ingredients from a larger section of the health-conscious population is also encouraging manufacturers to decrease spending on expensive ingredient systems and develop innovative flour-based systems for optimal use in extruded food products.

Pulse flours are used as substitutes for other agricultural products such as wheat, corn, soy, and other traditional ingredients in various food products to increase the nutrient profile of the final food product. This is one of the factors driving the pulse flours market in the food industry. Pulse flours have been of immense importance in the food processing industry. In the food segment, the bakery products subsegment accounted for the largest share in 2016. Growth in consumer demand for healthy bakery products is a trend which is well-established in developed regions, such as North America and Europe. This is expected to increase the use of pulse flour in bakery applications.

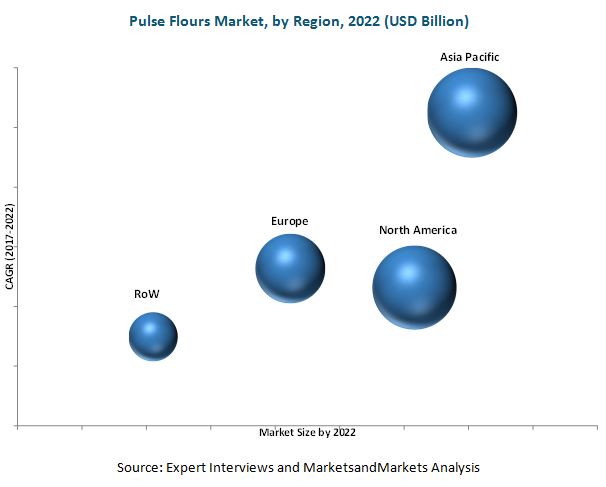

The pulse flours market in Asia Pacific accounted for the largest in 2016, and it is projected to grow at the highest CAGR during the forecast period. The region’s improved agricultural growth over the last decade, followed by advancements in the food processing and food service industry, has opened new avenues for pulse flours which is one of the major drivers here.

Unpleasant flavor of pulses and the prohibition of GM origin products in Europe are the major factors restraining the growth of the market. For instance, compounds such as aldehydes, alcohols, ketones, acids, pyrazines, and sulphur derivatives are responsible for the off-flavor in a few types of pulse flours. The consumer perception regarding the beany taste of pulses is expected to restrain the growth of the pulse flours market. Genetically modified crops are banned in Europe, where several countries, as part of the European Union, have banned their farmers from cultivating genetically modified crops, which has posed a retraining factor for the pulse flours market.

The pulse flours market is characterized by medium to high competition due to the presence of a number of large- and small-scale firms with low product differentiation. New product launches, acquisitions, and expansions are the key strategies adopted by these players to ensure their growth in the market. Players such as ADM (US), Ingredion (US), The Scoular Company (US), SunOpta (Canada), Anchor Ingredients (US), EHL Limited (UK), Batory Foods (US), Diefenbaker Spice & Pulse (Canada), Blue Ribbon (Australia), Great Western Grain (Canada), Best Cooking Pulses (Canada), and Bean Growers Australia (Australia) dominate this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered for the Study

1.5 Currency

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in Pulse Flours Market

4.2 Pulse Flours Market, By Type

4.3 Pulse Flours Market, By Application and Region

4.4 Pulse Flours Market, By Food Application and Region

4.5 Pulse Flours Market, By Key Countries

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Protein Profile of Pulse Flours

5.2.1.2 Demand for Healthy Food Ingredients and Its Impact on New Product Launches

5.2.1.3 Popularity of Protein-Rich Food Products

5.2.2 Restraints

5.2.2.1 Unpleasant Flavor of Pulses

5.2.2.2 Prohibition of GM Origin Products in Europe

5.2.3 Opportunities

5.2.3.1 Growth in Consumer Preference for Vegetarian and Vegan Diets

5.2.3.2 Demand for Clean Label and Gluten-Free Food Products

5.2.4 Challenges

5.2.4.1 Volatility in Global Pulse Prices

5.2.4.2 Fluctuation in Pulse Production

5.3 Supply Chain Analysis

6 Pulse Flours Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Peas

6.3 Chickpea

6.4 Bean

6.5 Lentil

7 Pulse Flours Market, By Application (Page No. - 50)

7.1 Introduction

7.2 Food

7.2.1 Bakery

7.2.2 Extruded Food

7.2.3 Meat Products

7.2.4 Beverages

7.2.5 Other Food Applications

7.3 Feed

7.4 Other Applications

8 Pulse Flours Market, By Region (Page No. - 61)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Spain

8.3.2 France

8.3.3 UK

8.3.4 Germany

8.3.5 Russia

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 India

8.4.2 China

8.4.3 Australia

8.4.4 Japan

8.4.5 Rest of Asia Pacific

8.5 Rest of the World (RoW)

8.5.1 South America

8.5.2 The Middle East

8.5.3 Africa

9 Company Landscape (Page No. - 92)

9.1 Pulse Flours Market Ranking, 2016

10 Company Profiles (Page No. - 93)

(Business Overview, Strength of Product Portfolio, Products Offered, Business Strategy Excellence, Recent Developments)*

10.1 Ingredion

10.2 ADM

10.3 The Scoular Company

10.4 Sunopta

10.5 Anchor Ingredients

10.6 EHL Limited

10.7 Batory Foods

10.8 Diefenbaker Spice & Pulse

10.9 Blue Ribbon

10.10 Great Western Grain

10.11 Best Cooking Pulses

10.12 Bean Growers Australia

*Details on Business Overview, Strength of Product Portfolio, Products Offered, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 122)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (64 Tables)

Table 1 Pulse Flours Market Size, By Type, 2015–2022 (MMT)

Table 2 Pulse Flours Market Size, By Type, 2015–2022 (USD Billion)

Table 3 Pea Flours Market Size, By Region, 2015–2022 (MMT)

Table 4 Pea Flours Market Size, By Region, 2015–2022 (USD Billion)

Table 5 Chickpea Flours Market Size, By Type, 2015–2022 (MMT)

Table 6 Chickpea Flours Market Size, By Region, 2015–2022 (USD Billion)

Table 7 Bean Flours Market Size, By Region, 2015–2022 (MMT)

Table 8 Bean Flours Market Size, By Region, 2015–2022 (USD Billion)

Table 9 Lentil Flours Market Size, By Region, 2015–2022 (MMT)

Table 10 Lentil Flours Market Size, By Region, 2015–2022 (USD Billion)

Table 11 Pulse Flours Market Size, By Application, 2015–2022 (MMT)

Table 12 Pulse Flours Market Size, By Application, 2015–2022 (USD Billion)

Table 13 Pulse Flours Market Size in Food, By Sub-Application, 2015–2022 (MMT)

Table 14 Pulse Flours Market Size in Food, By Region, 2015–2022 (MMT)

Table 15 Pulse Flours Market for Bakery Application, By Region, 2015–2022 (MMT)

Table 16 Pulse Flours Market Size in Extruded Food Products, By Region, 2015–2022 (MMT)

Table 17 Pulse Flours Market Size in Meat Products, By Region, 2015–2022 (MMT)

Table 18 Pulse Flours Market Size in Beverages, By Region, 2015–2022 (MMT)

Table 19 Pulse Flours Market Size in Other Food Applications, By Region, 2015–2022 (MMT)

Table 20 Pulse Flours Market in Feed, By Region, 2015–2022 (MMT)

Table 21 Pulse Flours Market Size in Other Applications, By Region, 2015–2022 (MMT)

Table 22 Pulse Flours Market Size, By Region, 2015–2022 (MMT)

Table 23 Pulse Flours Market Size, By Region, 2015–2022 (USD Billion)

Table 24 North America: Pulse Flours Market Size, By Country, 2015–2022 (MMT)

Table 25 North America: Pulse Flours Market Size, By Country, 2015–2022 (USD Billion)

Table 26 North America: Pulse Flours Market Size, By Type, 2015–2022 (MMT)

Table 27 North America: Pulse Flours Market Size, By Type, 2015–2022 (USD Billion)

Table 28 North America: Pulse Flours Market Size, By Application, 2015–2022 (MMT)

Table 29 North America: Pulse Flours Market Size, By Food Application, 2015–2022 (MMT)

Table 30 US: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 31 Canada: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 32 Mexico: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 33 Europe: Pulse Flours Market Size, By Country, 2015–2022 (MMT)

Table 34 Europe: Pulse Flours Market Size, By Country, 2015–2022 (USD Billion)

Table 35 Europe: Pulse Flours Market Size, By Type, 2015–2022 (MMT)

Table 36 Europe: Pulse Flours Market Size, By Type, 2015–2022 (USD Billion)

Table 37 Europe: Pulse Flours Market Size, By Application, 2015–2022 (MMT)

Table 38 Europe: Pulse Flours Market Size, By Food Application, 2015–2022 (MMT)

Table 39 Spain: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 40 France: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 41 UK: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 42 Germany: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 43 Russia: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 44 Rest of Europe: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 45 Asia Pacific: Pulse Flours Market Size, By Country, 2015–2022 (MMT)

Table 46 Asia Pacific: Pulse Flours Market Size, By Country, 2015–2022 (USD Billion)

Table 47 Asia-Pacific: Pulse Flours Market Size, By Type 2015–2022 (MMT)

Table 48 Asia-Pacific: Pulse Flours Market Size, By Type, 2015–2022 (USD Billion)

Table 49 Asia-Pacific: Pulse Flour Market Size, By Application, 2015–2022 (MMT)

Table 50 Asia-Pacific: Pulse Flours Market Size, By Food Application, 2015–2022 (MMT)

Table 51 India: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 52 China: Pulse Flours Market Size, By Type 2015–2022 (Kilo Mt)

Table 53 Australia: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 54 Japan: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 55 Rest of Asia Pacific: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 56 RoW: Pulse Flours Market Size, By Region, 2015–2022 (MMT)

Table 57 RoW: Pulse Flours Market Size, By Region, 2015–2022 (USD Billion)

Table 58 RoW: Pulse Flours Market Size, By Type 2015–2022 (MMT)

Table 59 RoW: Pulse Flours Market Size, By Type, 2015–2022 (USD Billion)

Table 60 RoW: Pulse Flour Market Size, By Application 2015–2022 (MMT)

Table 61 RoW: Pulse Flour Market Size, By Food Application 2015–2022 (MMT)

Table 62 South America: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 63 Middle East: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

Table 64 Africa: Pulse Flours Market Size, By Type, 2015–2022 (Kilo Mt)

List of Figures (31 Figures)

Figure 1 Market Segmentation

Figure 2 Geographic Scope

Figure 3 Pulse Flours Market: Research Design

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Breakdown & Data Triangulation

Figure 7 Pulse Flours Market, By Type (2017 vs 2022)

Figure 8 Pulse Flours Market, By Application (2017 vs 2022)

Figure 9 Pulse Flours Market Snapshot, By Food Applications (2017 vs 2022)

Figure 10 Pulse Flours Market Snapshot

Figure 11 Pulse Flours Market, By Region (2017 vs 2022)

Figure 12 Pulse Flours Market, By Country (2017 vs 2022)

Figure 13 Key Players Adopted New Product Developments as the Key Strategy From 2012 to 2017

Figure 14 India is Projected to Drive the Pulse Flours Market

Figure 15 Asia Pacific Estimated to Dominate the Pulse Flours Market, By Type, in 2017

Figure 16 Asia Pacific Estimated to Dominate the Pulse Flours Market for Food Application in 2017

Figure 17 Bakery Segment Estimated to Dominate the Pulse Flours Market in 2017

Figure 18 India to Register the Highest CAGR From 2017 to 2022, in Terms of Value

Figure 19 Drivers, Restraints, Opportunities, and Challenges

Figure 20 Nutrient Profile of Chickpea

Figure 21 New Products Containing Pulse Ingredients Launched in the US and Canada, 2005–2015

Figure 22 Pulse Flours: Supply Chain Analysis

Figure 23 Pulse Flours Market, By Type, 2016

Figure 24 Food Applications are Projected to Dominate the Pulse Flours Market Through 2022

Figure 25 Extruded Food Products to Grow at the Highest Rate (Volume) Through 2022

Figure 26 North America Pulse Flours Market Snapshot

Figure 27 Europe Pulse Flours Market Snapshot

Figure 28 Asia Pacific Pulse Flours Market Snapshot

Figure 29 Ingredion: Company Snapshot

Figure 30 ADM: Company Snapshot

Figure 31 Sunopta: Company Snapshot

Growth opportunities and latent adjacency in Pulse Flours Market