Functional Flours Market by Type (Pre-cooked Flour, Specialty Flour), Application (Bakery, Soups & Sauces, R.T.E Products), Source (Cereals and Legumes), and Region (North America, Europe, Asia-Pacific, Rest of the World) - Global Forecast to 2022

[141 Pages Report] The global functional flours market size is expected to grow from USD 49.65 billion in 2016 to USD 78.00 billion by 2022, at a CAGR of 7.82% from 2016 to 2022. Functional flours are used in a variety of food & beverage products providing the desired organoleptic characteristics. These flours undergo heat treatment, protein treatment, enzyme treatment, vitamin and mineral treatment, or water treatment in order to increase their stability, regularity, and other functions and also to enhance their nutritive values. The market for functional flours is driven by the rising demand from the food & beverage processing industry. Functional flours are being used in many applications such as bakery products, soups & sauces, RTE products and other applications. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2022.

Market Dynamics

Drivers

- Increase in demand for premium food products

- Initiatives to promote functional flours

- Increasing consumption of convenience and healthy food products

- Intensification of the global trade of functional flours

Restraints

- Stringent government regulations

- Volatile commodity prices

Opportunities

- Growing demand for healthier low fat alternatives

- Emerging economies

Challenges

- Lack of infrastructure and technological resources in developing countries

Initiatives to promote functional flours drive the global functional flours market

Governments and associations are promoting the usage of functional flours due to the increasing instances of nutritional deficiency in larger demographics. They are hence promoting the usage of enriched flours. For instance, the associations of industrial millers in Latin America and the Caribbean played an important role in promoting and enabling flour fortification throughout the region. Another such program by the Flour Fortification Initiative has led to the broad implementation of flour fortification in countries of the Eastern Mediterranean, Middle Eastern, and North African regions. Many companies such as Cargill, Incorporated (US) have joined this initiative to promote functional flours.

These initiatives are creating awareness among processors and are resulting in the wider acceptance of enriched flours. Moreover, technological developments, business developments, increasing trade, and marketing in support of flour fortification are further promoting the usage of functional flours.

The following are the major objectives of the study.

- To describe and forecast the functional flour market, in terms of value, by type, application, source, and region

- To describe and forecast the market, in terms of volume, by type and application

- To describe and forecast the market, in terms of value, by regionAsia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of functional flour

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the functional flour

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the market

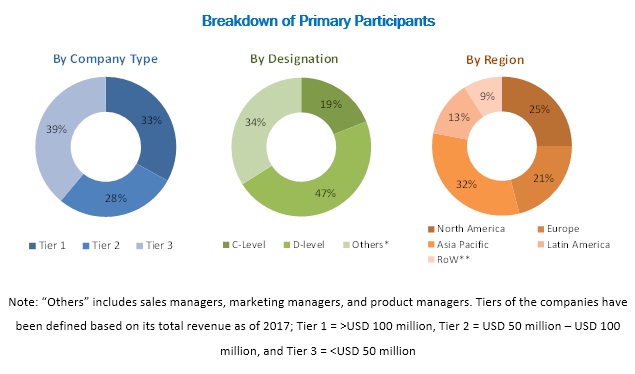

During this research study, major players operating in the functional flour market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study

To know about the assumptions considered for the study, download the pdf brochure

The key players in this market are Cargill, Incorporated (US), Archer Daniels Midland Company (US), Bunge Limited (US), Associated British Foods plc (UK), and General Mills, Inc. (US). Other players include The Scoular Company (US), AGRANA Beteiligungs-AG (Austria), The Hain Celestial Group, Inc. (US), SunOpta, Inc. (Canada), and Parrish and Heimbecker, Limited (Canada).

Major Market Developments

- In September 2016, ADM purchased certain assets of Caterina Foods (US), a leading manufacturer of specialty gluten-free and high-protein pastas. This acquisition would expand its production facilities to produce specialty pastas from legumes and grains.

- In June 2016, The Scoular Company purchased the assets of Tri-Fields Farms (U.K.). This enabled the company to meet the needs of its customers.

- In August 2015, ADM set up its distribution and merchandising offices in Central America. This enabled the company to enhance its distribution network for grain, meal, and oil products

- In July 2016, Bunge entered into a joint venture with Wilmar International Limited (Singapore), in Vietnam. This enabled the company to increase its marketing, operating, and logistics synergies across Vietnam.

- In February 2016, ADM agreed to purchase a controlling stake in Harvest Innovations (US), to meet the demand for gluten-free, expeller-pressed, organic, and non- GMO food.

Target Audience

- Raw material suppliers

- Farmers

- Agricultural institutes

- R&D institutes

- Functional flour manufacturers/suppliers

- Regulatory bodies

- Organizations such as the Food and Drug Administration (FDA), European Food Safety Authority (EFSA) , U.S. Department of Agriculture (USDA), and Food Standards Australia New Zealand (FSANZ)

- Government agencies and NGOs

- Food safety agencies

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- Food & beverage manufacturers/suppliers

- Retailers

- End users (soups, sauces, spreads, and bakery & meat products manufacturers)

Report Scope

By Type

- Pre-Cooked Flours

- Specialty Flours

- Others (enriched flours, instant flour mixes, and composite flours)

By Application

- Bakery Products

- Soups & Sauces

- RTE Products

- Others (seasoning bases, coatings & breadings, spreads & infant formula, special diet foods, and beverages)

By Source:

- Cereals

- Legumes

By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Critical questions which the report answers

- What are new application areas which the functional flour companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the clients specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in APAC based on application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The functional flour market is expected to grow from USD 49.65 billion in 2016 to USD 78.00 billion by 2022 at a CAGR of 7.82%. The market has been growing in accordance with the growth of the processed food industry. The effect of busy lifestyles and the inclination toward convenience and healthier food options in developing economies have propelled the market for processed food & beverages; hence, there is a rise in the demand for functional flours as well.

Flours that undergo heat treatment, water treatment, enzyme-treatment, fortification, extrusion, and/or other treatments in order to increase their organoleptic properties such as texture, stability, regularity, and other functions are termed as functional flours. Functional flours are used by manufacturers of R.T.E products, bakery items, snacks, soups & sauces, seasoning bases, coatings & breadings, spreads & infant formula, and special diet foods & beverages. These manufacturers are influenced by the changes in consumption patterns of consumers, price of ingredients, and regulatory norms.

The functional flour market has been segmented, on the basis of type, application, source, and region. The market for specialty flours is expected to grow at the highest CAGR between 2016 and 2022. Pre-cooked flours are produced to enhance their nutritional values, while maintaining functional and sensory properties in baked products such as cookies, biscuits, crackers, and tortillas. These flours are widely used in bakery products and breakfast cereals. The high usage of pre-cooked flours in bakery products and breakfast cereals contribute to the rapid growth of the market.

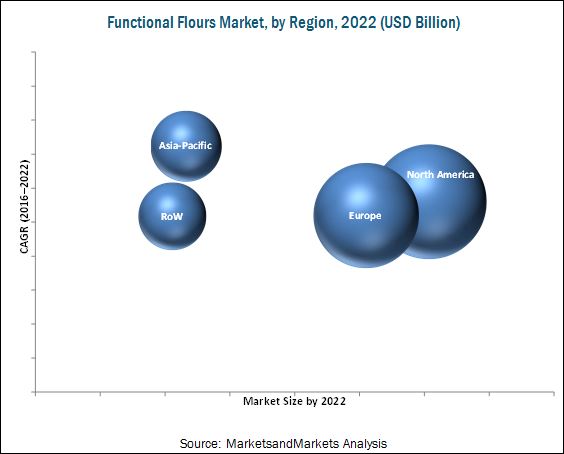

The market for functional flours in the Asia-Pacific region is projected to grow at the highest CAGR. For a highly populous region, the consumption of functional flours is very low in Asia-Pacific; this was because the sale of processed food products is comparatively lower due to lack of awareness in the region. Hence, there is still a huge market that has remained untapped, which is opening up opportunities for the functional flours industry.

Functional flour applications in RTE products, bakery products, and soups & sauces drive the growth of functional flour market

Rte Products

RTE products include breakfast cereals, snacks, pastas, ready-to-eat meals, and nutritional bars among others. There are various kinds of RTE products available in the market, in which functional flours are a major ingredient. Busy lifestyles of working populations demand on-the-go food in order to save time, which they would have otherwise spent in the preparation of food & beverages at home. This has led to emergence of a new class of RTE products that has varied offerings from breakfast to supper, coupled with healthier offerings that deliver whole-grain and other nutritional benefits that are in demand.

Bakery Products

Functional flours are widely used in the bakery industry. They are used in the production of breads, cakes & pastries, donuts & rolls, cookies, and other bakery products. Wheat flour is one of the most common and widely used bakery flours. Other flours such as corn, rice, and oats are largely composed from starch and protein; however, wheat flour is distinctive as it has very high levels of a class of proteins collectively known as gluten. When dough is made from wheat flour and water, the gluten develops into a thick, cohesive, elastic mass. When placed in an oven, it raises the dough and gives it a porous texture. This characteristic enables gluten to provide the structure required in baked products such as cakes and breads.

Soups & Sauces

Most soups & sauces have flour-based ingredients which are engineered to provide viscosity, texture, and flavor enhancements. Specialty flours such as pre-cooked flours, glutinous flours, and heat-treated flours improve product texture, performance, and storage stability. These flour products are superior in their ability to handle temperature fluctuations and can be kettle-cooked, retorted, refrigerated, and frozen without imparting negative attributes to the final product.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for functional flour?

Lack of Lack of infrastructure and technological resources in developing countries is a major factor restraining the growth of the market. According to the FAO, approximately 25% to 50% of the total food produced in the world is wasted every year due to the lack of proper facilities for handling, storage, and transport of fresh farm produce in many parts of the world. A major part of the food loss is accounted for by developing countries such as China, India, and Brazil, among others, which lack modern infrastructural facilities, despite being the top producers of grain crops and related products. According to the Food Corporation of India (FCI), as much as 194,502 metric tons was wasted in India due to various reasons between 2005 and March 2013. According to a University of Illinois agricultural economist, Brazil also reported a loss of around 10% of the total grain crops in 2013, owing to poor infrastructure. Thus, the lack of proper infrastructure acts as a challenge for companies to expand their market in emerging economies.

The key players in this market are Cargill, Incorporated (US.), Archer Daniels Midland Company (US), Bunge Limited (US), Associated British Foods plc (UK), and General Mills, Inc. (US). Other players include The Scoular Company (US), AGRANA Beteiligungs-AG (Austria), The Hain Celestial Group, Inc. (US), SunOpta, Inc. (Canada), and Parrish and Heimbecker, Limited (Canada).

These players are increasingly undertaking acquisitions as a key growth strategy to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Opportunities in the Functional Flours Market

4.2 Key Functional Flours Markets

4.3 Market, By Type

4.4 Europe: Market, By Application & Country

4.5 Market, By Source & Region

4.6 Developed vs Emerging Markets

4.7 Life Cycle Analysis: Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Type

5.2.2 Application

5.2.3 Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Consumption of Convenience and Healthy Food Products

5.3.1.2 Increase in Demand for Premium Food Products

5.3.1.3 IniTIAtives to Promote Functional Flours

5.3.1.4 Intensification of the Global Trade of Functional Flours

5.3.2 Restraints

5.3.2.1 Stringent Government Regulations

5.3.2.1.1 Fortified Flours

5.3.2.1.2 Gluten-Free Flours

5.3.2.2 Volatile Commodity Prices

5.3.3 Opportunities

5.3.3.1 Growing Demand for Healthier Low Fat Alternatives

5.3.3.2 Emerging Economies: Sole Frontiers of Growth

5.3.3.2.1 Emerging Markets & Changing Consumer Lifestyles

5.3.3.2.2 Growth Opportunities in Untapped Markets

5.3.4 Challenges

5.3.4.1 Lack of Infrastructure and Technological Resources in Developing Countries

5.4 Supply Chain

5.5 Industry Insights

6 Functional Flours Market, By Type (Page No. - 46)

6.1 Introduction

6.2 Pre-Cooked Flours

6.3 Specialty Flours

6.3.1 Gluten-Free Flours

6.3.2 Pre-Gelatinized Flours

6.3.3 Enzyme-Treated Flours

6.3.4 Extruded & ParTIAlly Transformed Flours

6.4 Other Functional Flours

7 Functional Flours Market, By Application (Page No. - 54)

7.1 Introduction

7.2 Bakery Products

7.2.1 Breads

7.2.2 Cakes & Pastries

7.2.3 Donuts & Rolls

7.2.4 Cookies

7.2.5 Others

7.3 Soups & Sauces

7.4 RT e Products

7.4.1 Breakfast Cereals

7.4.2 Snacks

7.4.3 Pasta Products

7.4.4 Others

7.5 Other Applications

7.5.1 Seasoning Bases and Coatings & Breadings

7.5.2 Spreads & Infant Formula

7.5.3 Special Diet Food

7.5.4 Beverages

8 Functional Flours Market, By Source (Page No. - 65)

8.1 Introduction

8.2 Cereals

8.3 Legumes

9 Functional Flours Market, By Region (Page No. - 73)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Italy

9.3.2 U.K.

9.3.3 Spain

9.3.4 Germany

9.3.5 France

9.3.6 Poland

9.3.7 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Australia

9.4.5 Rest of Asia-Pacific

9.5 Rest of the World (RoW)

9.5.1 Latin America

9.5.2 Africa

9.5.3 The Middle East

10 Competitive Landscape (Page No. - 102)

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Situation & Trends

10.3.1 Acquisitions

10.3.2 Expansions & Investments

10.3.3 Joint Ventures & Agreements

10.3.4 New Product Launches

11 Company Profiles (Page No. - 109)

11.1 Introduction

(Business overview, Products offered, Recent Developments, MNM view)*

11.2 Cargill, Incorporated

11.3 Archer Daniels Midland Company

11.4 Bunge Limited

11.5 Associated British Foods PLC

11.6 General Mills, Inc.

11.7 The Scoular Company

11.8 Agrana Beteiligungs-AG

11.9 The Hain Celestial Group Inc.

11.10 Sunopta, Inc.

11.11 Parrish and Heimbecker, Limited

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 Appendix (Page No. - 132)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (74 Tables)

Table 1 Global Functional Flours Market Snapshot

Table 2 Functional Flours Market Size, By Type, 20142022 (USD Billion)

Table 3 Market Size, By Type, 20142022 (MT)

Table 4 Pre-Cooked Flours Market Size, By Region, 20142022 (USD Billion)

Table 5 Pre-Cooked Flours Market Size, By Region, 20142022 (MT)

Table 6 Specialty Flours Market Size, By Region, 20142022 (USD Billion)

Table 7 Specialty Flours Market Size, By Region, 20142022 (MT)

Table 8 Other Market Size, By Region, 20142022 (USD Billion)

Table 9 Other Market Size, By Region, 20142022 (MT)

Table 10 Functional Flours Market Size, By Application, 20142022 (USD Billion)

Table 11 Market Size, By Application, 20142022 (MT)

Table 12 Functional Flours in Bakery Products Market Size, By Region, 20142022 (USD Billion)

Table 13 Functional Flours in Bakery Products Market Size, By Region, 20142022 (MT)

Table 14 Functional Flours in Soups & Sauces Market Size, By Region, 20142022 (USD Billion)

Table 15 Functional Flours in Soups & Sauces Market Size, By Region, 20142022 (MT)

Table 16 Functional Flours in RT e Products Market Size, By Region, 20142022 (USD Billion)

Table 17 Functional Flours in RT e Products Market Size, By Region, 20142022 (MT)

Table 18 Functional Flours in Other Applications Market Size, By Region, 20142022 (USD Billion)

Table 19 Functional Flours in Other Applications Market Size, By Region, 20142022 (MT)

Table 20 Market Size, By Source, 20142022 (USD Billion)

Table 21 Market Size, By Source, 20142022 (MT)

Table 22 Cereal-Based Market Size, By Type, 20142022 (USD Billion)

Table 23 Cereal-Based Market Size, By Type, 20142022 (MT)

Table 24 Cereal-Based Market Size, By Region, 20142022 (USD Billion)

Table 25 Cereal-Based Market Size, By Region, 20142022 (MT)

Table 26 Legume-Based Market Size, By Type, 20142022 (USD Billion)

Table 27 Legume-Based Market Size, By Type, 20142022 (MT)

Table 28 Legume-Based Market Size, By Region, 20142022 (USD Billion)

Table 29 Legume-Based Market Size, By Region, 20142022 (MT)

Table 30 Market Size, By Region, 2014-2022 (USD Billion)

Table 31 Market Size, By Region, 20142022 (MT)

Table 32 North America: Market Size, By Country, 2014-2022 (USD Billion)

Table 33 North America: Market Size, By Country, 20142022 (MT)

Table 34 North America: Market Size, By Type, 20142022 (USD Billion)

Table 35 North America: Market Size, By Type, 20142022 (MT)

Table 36 North America: Pre-Cooked Flours Market Size, By Country, 20142022 (USD Billion)

Table 37 North America: Pre-Cooked Flours Market Size, By Country, 20142022 (MT)

Table 38 North America: Specialty Flours Market Size, By Country, 20142022 (USD Billion)

Table 39 North America: Specialty Flours Market Size, By Country, 20142022 (MT)

Table 40 North America: Other Flours Market Size, By Country, 20142022 (USD Billion)

Table 41 North America: Other Flours Market Size, By Country, 20142022 (MT)

Table 42 Europe: Market Size, By Country, 20142022 (USD Billion)

Table 43 Europe: Market Size, By Country, 20142022 (MT)

Table 44 Europe: Functional Flours Market Size, By Type, 20142022 (USD Billion)

Table 45 Europe: Market Size, By Type, 20142022 (MT)

Table 46 Europe: Pre-Cooked Flours Market Size, By Country, 20142022 (USD Billion)

Table 47 Europe: Pre-Cooked Flours Market Size, By Country, 20142022 (MT)

Table 48 Europe: Specialty Flours Market Size, By Country, 20142022 (USD Billion)

Table 49 Europe: Specialty Flours Market Size, By Country, 20142022 (MT)

Table 50 Europe: Other Flours Market Size, By Country, 20142022 (USD Billion)

Table 51 Europe: Other Flours Market Size, By Country, 20142022 (MT)

Table 52 Asia-Pacific: Market Size, By Country, 20142022 (USD Billion)

Table 53 Asia-Pacific: Market Size, By Country, 20142022 (MT)

Table 54 Asia-Pacific: Market Size, By Type, 20142022 (USD Billion)

Table 55 Asia-Pacific: Market Size, By Type, 20142022 (MT)

Table 56 Asia-Pacific: Pre-Cooked Flours Market Size, By Country, 20142022 (USD Billion)

Table 57 Asia-Pacific: Pre-Cooked Flours Market Size, By Country, 20142022 (MT)

Table 58 Asia-Pacific: Specialty Flours Market Size, By Country, 20142022 (USD Billion)

Table 59 Asia-Pacific: Specialty Flours Market Size, By Country, 20142022 (MT)

Table 60 Asia-Pacific: Other Flours Market Size, By Country, 20142022 (USD Billion)

Table 61 Asia-Pacific: Other Flours Market Size, By Country, 20142022 (MT)

Table 62 RoW: Functional Flours Market Size, By Region, 20142022 (MT)

Table 63 RoW: Functional Flours Market Size, By Type, 20142022 (USD Billion)

Table 64 RoW: Market Size, By Type, 20142022 (MT)

Table 65 RoW: Pre-Cooked Flours Market Size, By Country, 20142022 (USD Billion)

Table 66 RoW: Pre-Cooked Flours Market Size, By Country, 20142022 (MT)

Table 67 RoW: Specialty Flours Market Size, By Country, 20142022 (USD Billion)

Table 68 RoW: Specialty Flours Market Size, By Country, 20142022 (MT)

Table 69 RoW: Other Flours Market Size, By Country, 20142022 (USD Billion)

Table 70 RoW: Other Flours Market Size, By Country, 20142022 (MT)

Table 71 Acquisitions, 20122016

Table 72 Expansions & Investments, 20122016

Table 73 Joint Ventures & Agreements, 20122016

Table 74 New Product Launches, 20122016

List of Figures (51 Figures)

Figure 1 Market Segmentation

Figure 2 Functional Flours Market: Research Design

Figure 3 Breakdown of Primary Interviews, By Company Type, Designation, and Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Specialty Flours Segment to Dominate the Global Functional Flours Market, in Terms of Value (20162022)

Figure 8 Soups & Sauces Segment is Estimated to Grow at the Highest CAGR From 2016 to 2022 (USD Billion)

Figure 9 Cereals Segment to Lead the Functional Flours Market

Figure 10 Asia-Pacific Projected to Be the Fastest-Growing Regional Functional Flours Market

Figure 11 Opportunities in the Functional Flours Market, 20162022

Figure 12 Asia-Pacific to Register A High Growth Rate From 2016 to 2022

Figure 13 North America is Estimated to Dominate the Market, By Type, in 2016

Figure 14 RTE Products Segment is Estimated to Dominate the European Market in 2016

Figure 15 Cereals Segment is Projected to Grow at the Highest Rate From 2016 to 2022

Figure 16 China & Australia are Projected to Be the Most Attractive Markets for Functional Flours, 20162022

Figure 17 Asia-Pacific Market is Projected to Grow at A Significant Rate, 20162022

Figure 18 Market Segmentation, By Type

Figure 19 Market Segmentation, By Application

Figure 20 Market Segmentation, By Source

Figure 21Market Segmentation, By Region

Figure 22 Growing Demand for Convenience Food Products is an Important Driver of the Market

Figure 23 Raw Material Suppliers are Vital Components of the Supply Chain

Figure 24 Technological Developments is the Most Prevailing Strategic Trend in the Functional Flours Industry

Figure 25 Market Size, By Type, 2016 vs 2022 (USD Billion)

Figure 26 Market Size, By Type, 2016 vs 2022 (MT)

Figure 27 Market Size, By Application, 2016 vs 2022 (USD Billion)

Figure 28 Market, By Source, 2016 vs 2022 (USD Billion)

Figure 29 Market, By Source, 2016 vs 2022 (MT)

Figure 30 Geographic Snapshot (2016-2022): Markets in Asia-Pacific are Emerging as New Hot Spots

Figure 31 North American Functional Flours Market Snapshot

Figure 32 European Market Snapshot

Figure 33 RoW: Market Size, By Region, 2014-2022 (USD Billion)

Figure 34 Expansons & Investments:The Most Preferred Strategy By Key Players, 2012October 2016

Figure 35 Functional Flours Market Share Analysis, 2015

Figure 36 Acquisitions Fueled Growth, 2012October 2016

Figure 37 Acquisitions: the Key Strategy, 2012October 2016

Figure 38 Geographical Revenue Mix of Top Five Players

Figure 39 Cargill: Company Snapshot

Figure 40 Cargill: SWOT Analysis

Figure 41 ADM: Company Snapshot

Figure 42 ADM: SWOT Analysis

Figure 43 Bunge: Company Snapshot

Figure 44 Bunge: SWOT Analysis

Figure 45 ABF: Company Snapshot

Figure 46 ABF: SWOT Analysis

Figure 47 General Mills: Company Snapshot

Figure 48 General Mills: SWOT Analysis

Figure 49 Agrana: Company Snapshot

Figure 50 Hain Celestial: Company Snapshot

Figure 51 Sunopta: Company Snapshot

Growth opportunities and latent adjacency in Functional Flours Market