Pulse Ingredients Market by Type (Pulse Flour, Pulse Starch, Pulse Proteins, Pulse Fibers & Grits), Source (Lentils, Peas, Beans, Chickpeas), Application (Food & Beverages, Feed) and Region - Global Forecast to 2027

Pulse Ingredients Market Overview (2022-2027)

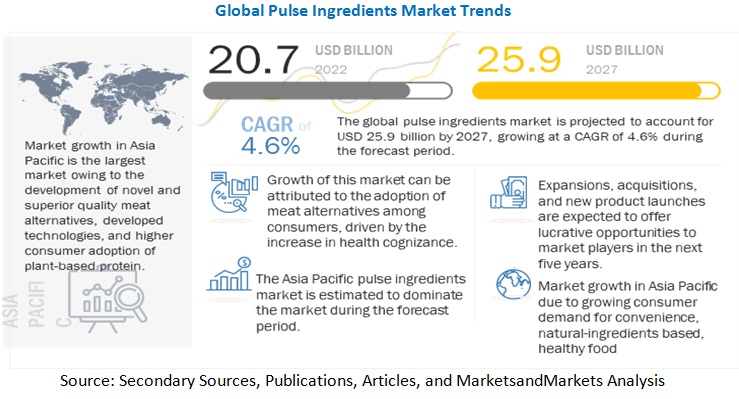

The global pulse ingredients market size was estimated at USD 20.7 billion in 2022 and is expected to grow at a CAGR of 4.6% from 2022 to 2027.

The pulse sector is undergoing dynamic changes at global, regional and country levels, to meet the challenge of growing demand in face of sluggish production growth. Projections indicate that demand for pulse ingredients will continue to grow in the short-to-medium term in developing counties due to growing population and rising per capita income. Pulse ingredients can play a major role in providing consumers with an alternative protein source. Soy and pea protein are still responsible for most new vegan products in Europe, according to The Vegan Review. But the growing demand for plant protein is also a good opportunity to shift away from these mainstream protein crops and introduce more variety in pulses or new protein sources such as sprouted grains. This may open opportunities for new source countries that can offer attractive bean varieties with consistent quality.

To know about the assumptions considered for the study, Request for Free Sample Report

Pulse Ingredients Market Growth Insights

Drivers:Rising demand for pulse starch in various food and industrial applications

Pulse starch offers various functions such as gelling, texturizing, binding, coating, thickening, and film forming. Due to its multi-functionalities, it has been used in various food applications, such as pasta and noodles, bakery, confectionery, soups and sauces, and meat and poultry. Also, it is also widely in manufacturing vermicelli as a binding agent. Pulse starch is also a potential replacement for other starches in food & beverage applications since it is an economical option and offers a wide range of functions. In 2021, The Saskatchewan Agriculture Ministry and the Ministry of Agriculture and Agri-Food announced USD 2.07 million in financing for research led by the University of Saskatchewan into new prospects for starches from pulse crops. The study team sought to enhance the capacity to isolate starch from seed and learn more about what it takes to transform pulse starches into value-added products.

In the pharmaceutical and cosmetic industries, it is used for its gelling, thickening, and texturizing properties. Since pulse starch is a good gelling agent, it is used as an alternative to gelatin in the manufacturing of capsules. With the rapid growth and changing trends in the pharmaceutical industry, the demand for pulse starch is expected to increase. Companies such as Meelunie B.V. (Netherlands) and Parrheim Foods (US) are the major producers of pulse starch, such as pea starch, which caters to the pharmaceutical and cosmetic industries.

Pea starch is also used for manufacturing ethanol. Corn is an important raw material for the production of ethanol. The rapid growth in the corn ethanol industry has contributed to a significant increase in the prices of corn and ethanol, owing to which, the producers have started shifting from corn to low-cost alternatives such as pea starch, which, in turn fuels the latter’s demand. The production of ethanol by pea starch improves the fermentation rates and allows ethanol producers to expand their annual production capacity and decrease their capital costs by increasing the number of fermentations per year.

Restraints: Unpleasant flavor of pulses

Although the importance of pulse ingredients is increasing in the food industry, there is still a strong need to modify the flavor of pulse ingredients. Chickpea flour has a strong flavor and is being avoided in dishes with delicate flavors like sugar cookies or biscotti. Pea flour, on the other hand, does not give taste to baked items. The off-flavor of pulses is partially inherent and partially developed during harvesting, processing, and storage. Compounds such as aldehydes, alcohols, ketones, acids, pyrazines, and sulfur derivatives are responsible for the off-flavor in a few types of pulse ingredients. The consumer perception regarding the beany taste of pulses is expected to restrain the growth of pulse ingredients market. The oxidation of unsaturated fatty acids through enzymatic and non-enzymatic processes is another major factor leading to the off-flavor element in pulse ingredients. Lentil and chickpea flours are prone to this oxidation due to their linolenic acid content. These are fatty acids that react with lipoxygenase to form volatile organic compounds that produce an off-flavor. However, processes such as micronization and enzymatic & ultrafiltration can help to modify the off-flavor element in pulse ingredients. These processes are important for manufacturers to include pulse ingredients in food products for consumers looking for meat alternatives for protein consumption.

Opportunities: Emerging markets illustrating great potential for pulse ingredients

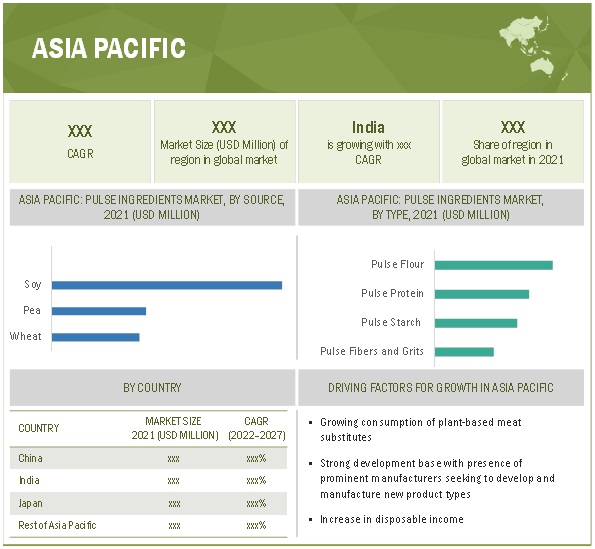

The demand for pulse ingredients is driven by an increase in processed and convenience foods production. Emerging economies such as India and China, in the Asia Pacific region, are exhibiting high growth. The Asia Pacific region also provides a cost advantage in terms of production and processing. High demand, coupled with low cost of production is a key feature, which will aid pulse ingredients suppliers and manufacturers in targeting market.

The increasing number of working women and nuclear families, improved standard of living, and changing lifestyles have contributed to the increase in demand for convenience and ready-to-eat foods. Busier lifestyles have increased the demand for on-the-go products so as to reduce the time spent on preparing meals; this results in a growing trend for snacks and consequently drives the market for RTE & bakery products, soups, and snacks prepared from pulse ingredients. The rise in demand for these products also results in an increased demand for healthier products incorporating pulse ingredients.

The pulse ingredients market is estimated to grow at a significant rate in the emerging markets of Brazil, and the Middle East, among others. The economic developments in these countries have resulted in an increase in the expenditure on food products. These economies are untapped markets and therefore offer significant opportunities for the pulse ingredients industry. They offer a huge consumer base with the growing need for processed foods. Steady sales of a variety of processed & packaged food products and prepared meals in the markets of developed economies have reached the maturity stage with limited growth scope.

Challenges: Fluctuations in the production of pulses

With the increasing demand for pulses in developed and developing regions, there is a gap between the demand and supply of pulses. Fluctuation in pulse production has posed a challenge for the growth of the pulse ingredients market. According to the International Food Policy Research Institute (IFPRI), diversification in pulse production has been witnessed in recent years.

Pulses are rich in proteins as well as plant-based and gluten-free products. The demand for pulse powder, pulse protein, and other emerging protein sources is soaring due to their wide applications in the food & beverage sector and well as the industrial sector. This has led to widespread production of pulses and pulse ingredients in the region. According to the FAO, pulse production climbed by almost 36 million MT between 1998 and 2018. The increased consumer demand for pulse protein and pulse fiber has resulted in the demand for pulse production, which has led to a surplus of pulse starch. Since pulse starch is a by-product of protein extraction from pulses, its production will be impacted by the increasing number of pulse processing activities.

The pulse production is expected to increase in economies like India, according to NITI Aayog research, pulse demand is expected to rise from 26.72 million tonnes in 2021-22 to 32.64 million tonnes in 2029-30. The Department of Agriculture and Farmers' Welfare launched the National Food Security Mission (NFSM), a Centrally Sponsored Scheme. It intends to boost rice, wheat, pulses, coarse cereals, and Nutri-cereals production in the country through area expansion and productivity enhancement, as well as to improve soil fertility, farm-level productivity, and knowledge transfer through demonstrations and training. The NFSM scheme is being implemented in 644 districts across Jammu and Kashmir's 28 states and union territories (UTs).

Pulse Ingredients Market by Type Insights

Pulse Proteins are in High Demand

Rising population and changing socio-demographics have led to an increase in demand for pulse protein as they are being increasingly incorporated in various food and beverage applications. On the other hand, the growing demand for animal-based protein is projected to have a negative environmental impact such as generation of greenhouse gas emissions and the requirement of water. These factors will lead to more sustainable production of existing sources of protein and other alternative sources for direct human consumption.

To know about the assumptions considered for the study, download the pdf brochure

Pulse Ingredients Market by Regional Insights

Asia Pacific is Projected to Account for the Majority of Share in the Global Market During the Forecast Period

Interest in pulses as a sustainable food source has expanded significantly. They are low in fat, high in nutrients, protein and soluble fiber. Because pulses do not contain gluten, they are acceptable for gluten-free diets for people with celiac disease and gluten intolerance. Pulses' high nutritional value makes them great food, especially in areas where access to meat and dairy products is difficult due to economic, distribution, and marketing barriers.

Japan is also one of the potential pulse ingredients market due to its large geriatric population base. This is expected to fuel the demand for protein-enriched food products, thereby boosting the sales of pulse ingredients. Thus, the Asia Pacific region is expected to generate high demand for pulse ingredients in the coming years owing to the large population base and developing economies shifting toward plant-based ingredients.

Key Players in Pulse Ingredients Industry

The key players in this market include DeLaval (Sweden), GEA Group Aktiengesellschaft (Germany), Lely (Netherlands), Trioliet B.V. (Netherlands), VDL Agrotech (Netherlands), ScaleAQ (Norway), BouMatic (US), Pellon Group Oy (Finland), Rovibec Agrisolutions (Canada), CTB, Inc. (US), Afimilk Ltd. (Israel), Dairymaster (US), Maskinfabrikken Cormall A/S (Denmark), HETWIN Automation System GmbH (Austria), and JH AGRO A/S (Denmark).

Pulse Ingredients Market Report Scope

|

Report Metric |

Details |

| Market valuation in 2022 | USD 20.7 Billion |

| Revenue forecast in 2027 | USD 25.9 Billion |

| Growth rate | CAGR of 4.6% |

|

Forecast period |

2022–2027 |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Prominent Firms Featured |

|

Target Audience:

-

Raw material suppliers

- Farmers

- R&D institutes

- Agricultural institutes

- Food & beverage suppliers and manufacturers

- Food & beverage importers and exporters

- Food & beverage traders and distributors

- Government and research organizations

-

Associations and industry bodies

- Food and Drug Administration (FDA)

- Institute of Food and Agricultural Sciences (IFAS)

- Food Safety and Standards Authority of India (FSSAI)

- US Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

- Institute of Food Technologists

- European Starch Industry Association (Starch Europe)

- Food and Agriculture Organization (FAO)

- All India Starch Manufacturing Association (AISMA)

- EC EUROPA

Pulse Ingredients Market Segmentation

This research report categorizes the pulse ingredients market, based on type, source application and region.

|

Aspect |

Details |

|

Market By Type |

|

|

Market By Source |

|

|

Market By Application |

|

|

Market By Region |

|

Recent Developments

- In November 2021, DSM acquired Vestkorn Milling, one of the largest producers of pea and bean-derived ingredients for plant-based protein products. This strategic move was to enhance the product portfolio and expertise of the company and strengthen its global reach.

- In October 2021, Roquette Frères in Portage la Prairie, Manitoba, the company opened its largest pea protein facility. It will assist Roquette's in becoming a global expert in plant protein. This facility joins those in France and the Netherlands that produce pea protein.

- In April 2020, ADM announced an investment to improve non-GMO soybean processing at its oilseed facility in Germany. This is part of its expansion plan to broaden its array of differentiated products to fulfill the rising and changing needs of its customers.

- In November 2019, The Scoular Company has selected a new site for its global headquarters in Omaha. The company’s main goals for a new site are accommodating its strategic growth plans and creating a foundation for a diverse, energizing, and high-performance workplace.

Frequently Asked Questions (FAQ):

How big is the pulse ingredients market?

The global market for pulse ingredients is expected to increase at a compound annual growth rate of 4.6%, reaching $20.7 billion in 2022 and $25.9 billion by the end of 2027.

Which players are involved in the manufacturing of pulse ingredients market?

The key players in this market include ADM (US), Roquette Frères (France), Ingredion (US), The Scoular Company (US), Axiom Foods, Inc., (US), PURIS (US), Emsland Group (Germany), AGT Food and Ingredients (Canada), Batory Foods (US), Vestkron Milling M/S (Norway), and Dakota Ingredients (US).

Which region is projected to be the fastest growing region in the global pulse ingredients market?

The Asia Pacific region is projected to be one of the growing markets for pulse ingredients. Substantial growth is witnessed in China, India, and Japan due to the increase in the purchasing power of consumers and the demand for healthier meat products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONAL SEGMENTATION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2019–2021

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 PULSE INGREDIENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET ESTIMATION, BY TYPE (SUPPLY-SIDE)

FIGURE 4 MARKET ESTIMATION (DEMAND-SIDE)

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 38)

TABLE 2 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 8 PULSE FLOURS SEGMENT TO DOMINATE MARKET, BY TYPE, 2022 VS. 2027

FIGURE 9 CHICKPEAS SEGMENT TO DOMINATE MARKET, BY SOURCE, DURING FORECAST PERIOD

FIGURE 10 FOOD & BEVERAGES SEGMENT TO DOMINATE MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 11 MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 OVERVIEW OF MARKET

FIGURE 12 GROWING ADOPTION OF PLANT-BASED ALTERNATIVES AND INCREASING HEALTH COGNIZANCE AMONG CONSUMERS TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY APPLICATION AND COUNTRY

FIGURE 13 INDIA ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2021

4.3 MARKET, BY TYPE AND REGION

FIGURE 14 ASIA PACIFIC TO DOMINATE MARKET, 2022 VS. 2027

4.4 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 15 FOOD & BEVERAGES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 16 INDIA TO BE LARGEST MARKET GLOBALLY FOR PULSE INGREDIENTS IN 2021

5 PULSE INGREDIENTS MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

FIGURE 17 CONSUMER PRICE INDEX FOR FOOD AND NON-ALCOHOLIC BEVERAGES, PERCENTAGE CHANGE, 2018–2021

5.2 MARKET DYNAMICS

FIGURE 18 PULSE INGREDIENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High protein profile of pulse ingredients increases popularity as healthy option

5.2.1.2 Increased health-consciousness among consumers drives market growth

5.2.1.3 Pulse ingredients increasingly used in food & beverage applications

5.2.1.4 Growing popularity of protein-rich food products

5.2.1.5 Increase in consumer appetite for vegan diets

FIGURE 19 UK: VEGAN POPULATION, 2014–2018

5.2.1.6 Allergen-free nature of pulses

5.2.2 RESTRAINTS

5.2.2.1 Stringent international quality standards and regulations

5.2.2.2 Unpleasant flavor of pulses

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in lactose intolerance increased pulse ingredients usage as dairy alternatives

FIGURE 20 GLOBAL PREVALENCE OF LACTOSE INTOLERANCE BY COUNTRY, 2017

5.2.3.2 Role of pulse ingredients in feed industry

5.2.3.3 Rising demand for sustainable, clean-label, and gluten-free food products

5.2.4 CHALLENGES

5.2.4.1 Volatility in raw material price

5.2.4.2 Fluctuations in pulse production

FIGURE 21 DISTRICT, NUMBER OF STATES, AND DISTRICT PMT IN NFSM STATES (PULSE), 2019–2020

FIGURE 22 PRODUCTION OF PULSES IN INDIA FROM 2016 TO 2019 (‘000 TONS)

6 PULSE INGREDIENTS INDUSTRY TRENDS (Page No. - 58)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT OF PULSE INGREDIENTS MARKET

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION & PROCESSING

6.2.4 DISTRIBUTION

6.2.5 MARKETING & SALES

FIGURE 23 VALUE CHAIN ANALYSIS OF MARKET

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 24 MARKET: SUPPLY CHAIN

6.4 MARKET MAPPING AND ECOSYSTEM OF PULSE INGREDIENTS

6.4.1 DEMAND-SIDE

6.4.2 SUPPLY-SIDE

FIGURE 25 PULSE INGREDIENTS: MARKET MAP

6.4.3 ECOSYSTEM MAP

TABLE 3 MARKET: ECOSYSTEM

6.5 TECHNOLOGY ANALYSIS

6.5.1 EXTRUSION

6.5.2 MICRONIZATION

6.5.3 FRACTIONATION

6.6 PRICING ANALYSIS

FIGURE 26 AVERAGE SELLING PRICE IN KEY REGIONS, BY SOURCE, 2018–2021 (USD/KG)

TABLE 4 CHICKPEAS: AVERAGE SELLING PRICE (ASP), BY REGION, 2018–2021 (USD/KG)

TABLE 5 PEAS: AVERAGE SELLING PRICE (ASP), BY REGION, 2018–2021 (USD/KG)

TABLE 6 BEANS: AVERAGE SELLING PRICE (ASP), BY REGION, 2018–2021 (USD/KG)

TABLE 7 LENTILS: AVERAGE SELLING PRICE (ASP), BY REGION, 2018–2021 (USD/KG)

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

FIGURE 27 REVENUE SHIFT IMPACTING MARKET

6.8 MARKET: PATENT ANALYSIS

FIGURE 28 NUMBER OF PATENTS GRANTED FOR MARKET, 2011–2021

TABLE 8 TOP PATENT APPLICANTS FOR MARKET, 2019–2022

FIGURE 29 TOP PATENT APPLICANTS IN MARKET, 2019–2022

FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED FOR MARKET, 2019–2022

6.8.1 LIST OF MAJOR PATENTS

TABLE 9 LIST OF A FEW PATENTS IN MARKET, 2019–2022

6.9 TRADE ANALYSIS: PULSE INGREDIENTS MARKET

6.9.1 EXPORT SCENARIO OF PULSES

FIGURE 31 PULSES EXPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 10 EXPORT DATA OF PULSES FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.2 IMPORT SCENARIO OF PULSES

FIGURE 32 PULSES IMPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 11 IMPORT DATA OF PULSES FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.3 EXPORT SCENARIO OF PULSE FLOUR

FIGURE 33 PULSE FLOUR EXPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 12 EXPORT DATA OF PULSE FLOUR FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.4 IMPORT SCENARIO OF PULSE FLOUR

FIGURE 34 PULSE FLOUR IMPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 13 IMPORT DATA OF PULSE FLOUR FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.10 CASE STUDIES: MARKET

6.10.1 INGREDION: PULSE PEA PROTEIN ISOLATES FOR DAIRY ALTERNATIVES

6.10.2 ROQUETTE FRÈRES: ORGANIC RANGE OF TEXTURED PEA PROTEIN

6.11 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 14 KEY CONFERENCES AND EVENTS IN MARKET

6.12 TARIFF AND REGULATORY LANDSCAPE

6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.2 REGULATORY FRAMEWORK

6.12.3 NORTH AMERICA

6.12.4 EUROPE

6.12.5 ASIA PACIFIC

6.12.6 ROW

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 19 MARKET FOR PULSE INGREDIENTS: PORTER’S FIVE FORCES ANALYSIS

6.13.1 DEGREE OF COMPETITION

6.13.2 BARGAINING POWER OF SUPPLIERS

6.13.3 BARGAINING POWER OF BUYERS

6.13.4 THREAT OF SUBSTITUTES

6.13.5 THREAT OF NEW ENTRANTS

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

6.14.2 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS

TABLE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS (%)

6.14.3 BUYING CRITERIA

FIGURE 36 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

TABLE 21 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 PULSE INGREDIENTS MARKET, BY TYPE (Page No. - 92)

7.1 INTRODUCTION

FIGURE 37 PULSE FLOURS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 22 MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 23 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 PULSE FLOURS

7.2.1 HIGH PROTEIN PROFILE OF PULSES AND DEMAND FOR HEALTHY FOOD PRODUCTS DRIVE PULSE FLOUR GROWTH

TABLE 24 PULSE FLOURS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 PULSE FLOURS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PULSE STARCHES

7.3.1 VERSATILITY OF PEA STARCH BOOSTS POPULARITY AMONG FOOD & BEVERAGE MANUFACTURERS

TABLE 26 PULSE STARCHES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 PULSE STARCHES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 PULSE PROTEINS

7.4.1 RISING POPULATION AND CHANGING SOCIO-DEMOGRAPHICS BOOST DEMAND FOR RESOURCES PROVIDING DIFFERENT FOOD TYPES

TABLE 28 PULSE PROTEINS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 PULSE PROTEINS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 PULSE FIBERS & GRITS

7.5.1 USE OF PULSE FIBERS AS FOOD GRADE ADDITIVE INCREASES DIETARY FIBER CONTENT WITHOUT ALTERING FLAVOR AND AROMA

TABLE 30 PULSE FIBERS & GRITS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 PULSE FIBERS & GRITS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 MARKET, BY SOURCE (Page No. - 99)

8.1 INTRODUCTION

FIGURE 38 CHICKPEAS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 32 MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 33 MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 34 MARKET, BY SOURCE, 2016–2021 (KT)

TABLE 35 MARKET, BY SOURCE, 2022–2027 (KT)

8.2 LENTILS

8.2.1 LENTIL FLOUR USED IN BAKERIES AS ADDITIONAL PROTEIN SOURCE BOOSTS DEMAND

TABLE 36 LENTILS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 LENTILS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 LENTILS: MARKET, BY REGION, 2016–2021 (KT)

TABLE 39 LENTILS: MARKET, BY REGION, 2022–2027 (KT)

8.3 PEAS

8.3.1 HIGH PROTEIN CONTENT COMBINED WITH EXCELLENT FUNCTIONALITY, SUSTAINABILITY, AND AFFORDABILITY TO STIMULATE DEMAND FOR PEA INGREDIENTS

TABLE 40 PEAS: PULSE INGREDIENTS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 PEAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 PEAS: MARKET, BY REGION, 2016–2021 (KT)

TABLE 43 PEAS: MARKET, BY REGION, 2022–2027 (KT)

8.4 CHICKPEAS

8.4.1 HEALTH BENEFITS OF CHICKPEA FLOUR TO MAKE IT POPULAR AMONG FOOD & BEVERAGE MANUFACTURERS

TABLE 44 CHICKPEAS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 CHICKPEAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 CHICKPEAS: MARKET, BY REGION, 2016–2021 (KT)

TABLE 47 CHICKPEAS: MARKET, BY REGION, 2022–2027 (KT)

8.5 BEANS

TABLE 48 BEANS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 BEANS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 BEANS: MARKET, BY REGION, 2016–2021 (KT)

TABLE 51 BEANS: MARKET, BY REGION, 2022–2027 (KT)

9 MARKET, BY APPLICATION (Page No. - 108)

9.1 INTRODUCTION

FIGURE 39 FOOD & BEVERAGES SEGMENT ACCOUNTS FOR LARGEST MARKET SIZE BY 2027

TABLE 52 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 53 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 FOOD & BEVERAGES

TABLE 54 FOOD & BEVERAGES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 55 FOOD & BEVERAGES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 FOOD & BEVERAGES: MARKET, BY SUB-APPLICATION, 2016–2021 (USD MILLION)

TABLE 57 FOOD & BEVERAGES: MARKET, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

9.2.1 MEALS & MEAT ANALOGS

9.2.1.1 Changes in consumption patterns and low preference for meat in diets drive demand

9.2.2 SNACKS

9.2.2.1 North America offers opportunities to use pulse ingredients in well-established snacks, noodles, and pasta industries

9.2.3 FRUITS AND VEGETABLES

9.2.3.1 Fruit purees with pulse proteins gaining traction in market

9.2.4 SOUPS, SAUCES, AND SEASONING

9.2.4.1 Pulse ingredients used as replacement for potato and corn starch in soups and sauces

9.2.5 PROCESSED FISH, MEAT, AND EGG PRODUCTS

9.2.5.1 Pulse components used as egg substitute drive demand

9.2.6 BAKERY & CONFECTIONERY

9.2.6.1 Health-conscious consumers drive demand for pulse ingredients in bakery & confectionery

9.2.7 BEVERAGES

9.2.7.1 Plant-based beverages gaining popularity among health-conscious people

9.2.8 OTHER FOOD & BEVERAGES

9.3 FEED

9.3.1 PULSE INGREDIENTS AS FUNCTIONAL BINDERS FOR AQUACULTURE FEED PELLETS BOOSTING MARKET GROWTH

TABLE 58 FEED: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 59 FEED: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 OTHER APPLICATIONS

TABLE 60 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 61 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 PULSE INGREDIENTS MARKET, BY REGION (Page No. - 117)

10.1 INTRODUCTION

FIGURE 40 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 41 GEOGRAPHIC SNAPSHOT: MARKETS IN EUROPE TO EMERGE AS NEW HOT SPOTS

TABLE 62 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 63 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2016–2021 (KT)

TABLE 65 MARKET, BY REGION, 2022–2027 (KT)

10.2 NORTH AMERICA

TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY SOURCE, 2016–2021 (KT)

TABLE 75 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (KT)

10.2.1 US

10.2.1.1 Widespread use of pulses in various food applications to be major market growth factor

TABLE 76 US: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 77 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increased consumption of pulses to boost market growth

TABLE 78 CANADA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 79 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Demand for healthy processed food products providing good nutritional value at reasonable price to drive market

TABLE 80 MEXICO: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 81 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 42 MARKET SNAPSHOT: EUROPE MARKET

TABLE 82 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: PULSE INGREDIENTS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY SOURCE, 2016–2021 (KT)

TABLE 91 EUROPE: MARKET, BY SOURCE, 2022–2027 (KT)

10.3.1 UK

10.3.1.1 UK government measures to improve national health profiles create opportunities for food & beverage manufacturers using pulse ingredients in products

TABLE 92 UK: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 93 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Imported feed as alternative for economic and environmental reasons creates opportunity for using pulse ingredients in feed

TABLE 94 FRANCE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.3 SPAIN

10.3.3.1 Increased awareness of consumption and limited domestic supply of dry beans create opportunities for pulse ingredients import

TABLE 96 SPAIN: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 97 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 Use of pulse starches, proteins, and fibers by food manufacturers in production of food products to meet demand from consumers for clean-label products

TABLE 98 GERMANY: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 99 GERMANY: MARKET BY TYPE, 2022–2027 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Changing consumer lifestyles toward vegan to boost market growth

TABLE 100 ITALY: PULSE INGREDIENTS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 101 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 102 REST OF EUROPE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 43 MARKET SNAPSHOT: ASIA PACIFIC MARKET

TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET BY SOURCE, 2016–2021 (KT)

TABLE 113 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (KT)

10.4.1 CHINA

10.4.1.1 Consumers shift toward healthier food options amid growing health concerns benefiting market

TABLE 114 CHINA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 115 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Use of pulse ingredients by food & beverage industries to stimulate demand

TABLE 116 INDIA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 117 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Large geriatric population base to be key factor for market growth

TABLE 118 JAPAN: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 119 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.4 AUSTRALIA AND NEW ZEALAND

10.4.4.1 Abundant pulse production boosts use of pulses in food & beverage applications

TABLE 120 AUSTRALIA AND NEW ZEALAND: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 121 AUSTRALIA AND NEW ZEALAND: MARKET , BY TYPE, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 122 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 124 REST OF THE WORLD: PULSE INGREDIENTS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 125 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 126 REST OF THE WORLD: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 127 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 128 REST OF THE WORLD: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 129 REST OF THE WORLD: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 130 REST OF THE WORLD: MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 131 REST OF THE WORLD: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 132 REST OF THE WORLD: MARKET, BY SOURCE, 2016–2021 (KT)

TABLE 133 REST OF THE WORLD: MARKET, BY SOURCE, 2022–2027 (KT)

10.5.1 SOUTH AMERICA

10.5.1.1 Food processing industry positively affects South American market

TABLE 134 SOUTH AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 135 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST

10.5.2.1 Industrial growth and rising middle-class population led to increased demand for healthy food & beverage options by high-spending customers

TABLE 136 MIDDLE EAST: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 137 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5.3 AFRICA

10.5.3.1 Increasing middle-class population opting for healthy options drives market demand

TABLE 138 AFRICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 139 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 155)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS, 2021

TABLE 140 PULSE INGREDIENTS MARKET: DEGREE OF COMPETITION (COMPETITIVE)

11.3 KEY PLAYER STRATEGIES

TABLE 141 STRATEGIES ADOPTED BY KEY PULSE INGREDIENTS MANUFACTURERS

11.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 44 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017–2021 (USD MILLION)

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 45 MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

11.5.5 PRODUCT FOOTPRINT

TABLE 142 COMPANY FOOTPRINT, BY SOURCE

TABLE 143 COMPANY FOOTPRINT, BY TYPE

TABLE 144 COMPANY FOOTPRINT, BY REGION

TABLE 145 OVERALL COMPANY FOOTPRINT

11.6 MARKET FOR PULSE INGREDIENTS: EVALUATION QUADRANT FOR STARTUPS/SMES, 2021

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 46 MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

11.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 146 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 147 PULSE INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

11.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.7.1 PRODUCT LAUNCHES

TABLE 148 PULSE INGREDIENTS: PRODUCT LAUNCHES, 2019–2022

11.7.2 DEALS

TABLE 149 PULSE INGREDIENTS: DEALS, 2019–2022

11.7.3 OTHERS

TABLE 150 PULSE INGREDIENTS: OTHERS, 2019–2022

12 COMPANY PROFILES (Page No. - 173)

12.1 INTRODUCTION

(Business overview, Products offered, Recent developments & MnM View)*

12.2 KEY PLAYERS

12.2.1 INGREDION

TABLE 151 INGREDION: BUSINESS OVERVIEW

FIGURE 47 INGREDION: COMPANY SNAPSHOT

TABLE 152 INGREDION: PRODUCTS OFFERED

TABLE 153 INGREDION: PRODUCT LAUNCHES

TABLE 154 INGREDION: DEALS

TABLE 155 INGREDION: OTHERS

12.2.2 ROQUETTE FRÈRES

TABLE 156 ROQUETTE FRÈRES: BUSINESS OVERVIEW

TABLE 157 ROQUETTE FRÈRES: PRODUCTS OFFERED

TABLE 158 ROQUETTE FRÈRES: PRODUCT LAUNCHES

TABLE 159 ROQUETTE FRÈRES: DEALS

TABLE 160 ROQUETTE FRÈRES: OTHERS

12.2.3 EMSLAND GROUP

TABLE 161 EMSLAND GROUP: BUSINESS OVERVIEW

FIGURE 48 EMSLAND GROUP: COMPANY SNAPSHOT

TABLE 162 EMSLAND GROUP: PRODUCTS OFFERED

TABLE 163 EMSLAND GROUP: DEALS

12.2.4 ADM

TABLE 164 ADM: BUSINESS OVERVIEW

FIGURE 49 ADM: COMPANY SNAPSHOT

TABLE 165 ADM: PRODUCTS OFFERED

TABLE 166 ADM: DEALS

TABLE 167 ADM: OTHERS

12.2.5 CARGILL, INCORPORATED

TABLE 168 CARGILL, INCORPORATED: PULSE INGREDIENTS MARKET BUSINESS OVERVIEW

FIGURE 50 CARGILL, INCORPORATED: COMPANY SNAPSHOT

TABLE 169 CARGILL, INCORPORATED: PRODUCTS OFFERED

TABLE 170 CARGILL, INCORPORATED: PRODUCT LAUNCHES

TABLE 171 CARGILL, INCORPORATED: DEALS

TABLE 172 CARGILL, INCORPORATED: OTHERS

12.2.6 THE SCOULAR COMPANY

TABLE 173 THE SCOULAR COMPANY: BUSINESS OVERVIEW

TABLE 174 THE SCOULAR COMPANY: PRODUCTS OFFERED

TABLE 175 THE SCOULAR COMPANY: OTHERS

12.2.7 AGT FOOD AND INGREDIENTS

TABLE 176 AGT FOOD AND INGREDIENTS: BUSINESS OVERVIEW

TABLE 177 AGT FOOD AND INGREDIENTS: PRODUCTS OFFERED

12.2.8 BATORY FOODS

TABLE 178 BATORY FOODS: BUSINESS OVERVIEW

TABLE 179 BATORY FOODS: PRODUCTS OFFERED

12.2.9 DIEFENBAKER SPICE & PULSE

TABLE 180 DIEFENBAKER SPICE & PULSE: BUSINESS OVERVIEW

TABLE 181 DIEFENBAKER SPICE & PULSE: PRODUCTS OFFERED

12.2.10 COSUCRA

TABLE 182 COSUCRA: BUSINESS OVERVIEW

TABLE 183 COSUCRA: PRODUCTS OFFERED

TABLE 184 COSUCRA: PRODUCT LAUNCHES

TABLE 185 COSUCRA: OTHERS

12.2.11 VESTKORN MILLING AS

TABLE 186 VESTKORN MILLING AS: BUSINESS OVERVIEW

TABLE 187 VESTKORN MILLING AS: PRODUCTS OFFERED

12.2.12 DAKOTA INGREDIENTS

TABLE 188 DAKOTA INGREDIENTS: BUSINESS OVERVIEW

TABLE 189 DAKOTA INGREDIENTS: PRODUCTS OFFERED

12.2.13 PURIS

TABLE 190 PURIS: BUSINESS OVERVIEW

TABLE 191 PURIS: PRODUCTS OFFERED

12.2.14 AXIOM FOODS, INC.

TABLE 192 AXIOM FOODS, INC.: BUSINESS OVERVIEW

TABLE 193 AXIOM FOODS, INC.: PRODUCTS OFFERED

12.2.15 AM NUTRITION

TABLE 194 AM NUTRITION: BUSINESS OVERVIEW

TABLE 195 AM NUTRITION: PRODUCTS OFFERED

12.3 OTHER PLAYERS (SMES/STARTUPS)

12.3.1 AVENA FOODS LIMITED

TABLE 196 AVENA FOODS LIMITED: BUSINESS OVERVIEW

TABLE 197 AVENA FOODS LIMITED: PRODUCTS OFFERED

TABLE 198 AVENA FOODS LIMITED: DEALS

12.3.2 AGRIDIENT B.V.

TABLE 199 AGRIDIENT B.V.: BUSINESS OVERVIEW

TABLE 200 AGRIDIENT B.V.: PRODUCTS OFFERED

12.3.3 SHANDONG HUA-THAI FOOD COMPANY

TABLE 201 SHANDONG HUA-THAI FOOD COMPANY: PULSE INGREDIENTS MARKET BUSINESS OVERVIEW

TABLE 202 SHANDONG HUATAI FOOD COMPANY: PRODUCTS OFFERED

12.3.4 CHICKP

TABLE 203 CHICKP: BUSINESS OVERVIEW

TABLE 204 CHICKP: PRODUCTS OFFERED

12.3.5 AMINOLA

TABLE 205 AMINOLA: BUSINESS OVERVIEW

TABLE 206 AMINOLA: PRODUCTS OFFERED

12.3.6 HERBA INGREDIENTS B.V.

12.3.7 SINOFI INGREDIENTS

12.3.8 AMERICAN KEY FOOD PRODUCTS

12.3.9 NUTRI-PEA

12.3.10 EBRO INGREDIENTS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 217)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATIONS OFFERED

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

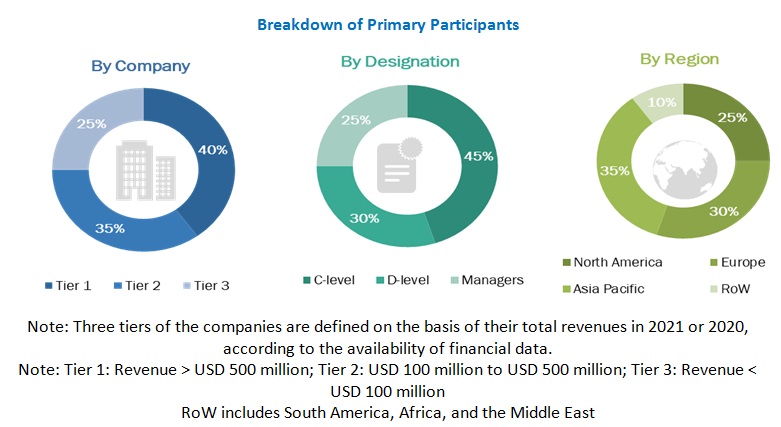

This research study involved the use of extensive secondary sources (such as directories and databases) Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet (which acquired Avention) to identify and collect information useful for this study of the pulse ingredients market. The primary sources mainly included several industry experts from the core and related industries and suppliers, manufacturers, distributors, alliances, and organizations related to all segments of this industry’s supply chain. In-depth interviews were conducted with various primary respondents including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain, the total pool of key customers, pulse ingredients market classification, and segmentation according to industry trends to the bottom-most level and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The pulse ingredients market includes several stakeholders in the supply chain suppliers, R&D institutes, and end-product manufacturers. The demand side of the market is characterized by the presence of farm owners. The supply side is characterized by the presence of key providers of pulse ingredients. Various primary sources from the supply and demand sides of both markets were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Pulse Ingredients Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total pulse ingredients market size. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

- The key customers in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market customers, along with extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Pulse Ingredients Market Report Objectives

- To define, segment, and project the global market for pulse ingredient market on the basis of type, application, source and region.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in pulse ingredient market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe pulse ingredients market into the Greece

- Further breakdown of other countries in the RoW market into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pulse Ingredients Market