Bulk Food Ingredients Market by Primary Processed Type, Secondary Processed Type, Application (Food, Beverage), Distribution Channel (Direct from Manufacturers, Distributors), and Region - Global Forecast to 2028

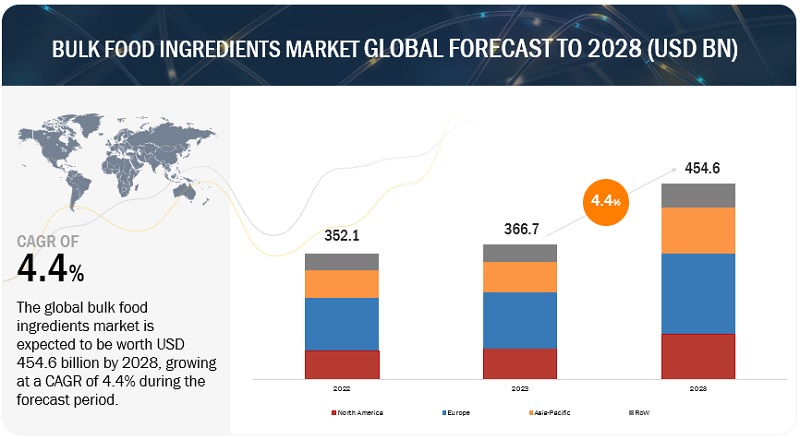

The global bulk food ingredients market is projected to reach USD 454.6 billion by 2028 from USD 366.7 billion by 2023, at a CAGR of 4.4% during the forecast period in terms of value. The need for packaged ready-to-eat meals like confectionary, biscuits, beverages, and chocolates is one lifestyle element that drives the market for bulk ingredients. The market has been helped by the expansion of food service retail chains and the rise in the number of restaurants and cafés. These businesses buy a substantial amount of food ingredients from wholesalers, including grains, spices, and herbs. The market for bulk food ingredients is expanding due to a variety of factors, including changing lifestyles, the embrace of Western culture, and an expanding labour force. In addition, the preference for tea and coffee over carbonated beverages is anticipated to fuel market expansion. Market participants are releasing several kinds of herbal and ayurvedic teas that are also healthy, raising demand for them in many regions of the world.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Bulk food Ingredients Market Dynamics

DRIVER : Rise in end-use applications

The demand for products that are rich in nutrients is significantly high in Europe and North America due to the increase in consumer awareness. The consumption of products with an extensive nutritional profile would continue to increase as parents prefer opting for food products—such as grains, oilseeds, and nuts, that are estimated to account for a key share in the bulk ingredients market. These products offer nutrition for healthy child development. End-use applications such as bakery & confectionery, snacks & spreads, ready meals, infant formulas, and dairy products are projected to witness significant growth in the next five years, resulting in increased demand for bulk food ingredients.

Food products are processed for various purposes, including the preparation of safer food products by eliminating harmful microorganisms such as bacteria, enhancing the shelf life of products, and increasing convenience. These bulk food ingredients are available in different end user application industries after being processed. Bulk food ingredients account for a major part of the raw materials required by the food processing industry. Hence, the increase in demand for packaged/processed food products is projected to drive the growth of the bulk food ingredients market.

Restraint: Improper storage management and infrastructure

The challenges faced by the bulk food ingredients processors/wholesalers require them to maximize the available space, manage different storage temperatures, and respond to a high turnover of stock while maintaining hygiene levels and product traceability. The Food and Agricultural Organization (FAO) reported that nearly one-third of all produced foods (1.6 billion tons of edible food) is lost every year across the supply chain, the monetary value of which is nearly USD 936 billion. In developing countries, food products are lost mainly in post-harvest and processing, i.e., by poor practices, technical and technological limitations, labor and financial restrictions, and the lack of proper infrastructure for transportation and storage. The amount of Food Waste in industrialized countries is nearly 222 million tons, which is nearly equal to the total net production in Sub-Saharan African (SSA) countries (230 million tons). In addition, when waste food is thrown into landfills, a substantial portion is converted into greenhouse gas and methane, which has a global warming potential of 25 times higher than carbon dioxide.

A study by the National Academy of Agricultural Sciences (NAAS) highlights that the lack of access to a storage facility is the most important cause of post-harvest losses for all types of food products in India. India loses nearly 10% of its grain and oilseeds annually. Harvest to household losses may actually be more than what a country such as Australia exports. The major reason for these losses is inappropriate storage management. Hence, the loss of food ingredients due to improper storage management and infrastructure can be a major restraining factor for the growth of the bulk food ingredients market.

Opportunity: Rise in demand for natural or clean label products

Healthy, and ‘clean’ food products with fewer additives. Unlike organic, however, the term ‘natural’ remains undefined by legislators. Consumers are opting for cleaner products that contain an absolute minimum of synthetic or chemical additives.

According to the survey conducted by Consumer Reports National Research Center in 2013, two-thirds of the US consumers prefer locally grown products, whereas more than 60% of the population opt for ‘clean’ or ‘natural’ labeled products. As a result of the increase in demand for organic products in the North American and European region, as well as the other parts of the world, there is a significant growth in demand for bulk food ingredients products.

Clean-label products are organic, natural, non-GMO, and minimally processed consumer-friendly products. According to the Clean Label Alliance, it is witnessed that nearly 75% of consumers are willing to pay high prices for clean-label products. The increase in health awareness among consumers is projected to drive the demand for natural and clean-label products, which, in turn, would drive the demand for bulk food ingredients. Consumers are becoming inclined toward clean-label products, as they are becoming more aware of the non-synthetic ingredients and their negative effects. This is projected to encourage the adoption of products and diets with clean-label ingredients.

Clean label is one of the most important features of packaged foods. Consumer awareness is strengthening the clean label trend, which, in turn, encourages them to adopt plant-based and natural diets that support the growth of the bulk ingredients market. Retailers are also catering to the growing demands for clean-label products among consumers by offering their private label brands. The recent outbreak of COVID-19 has led consumers to buy more clean label products due to their safe consumption and health benefits. This is projected to drive the growth of the bulk food ingredients market.

The below figure indicates consumer preference for clean label products in the US and suggests that the demand for clean label products in the US is increasing.

Challenge: Unstable agricultural supply results in price volatility

Price fluctuations are a common feature of well-functioning agricultural product markets. Measures such as import duties, export taxes, non-tariff barriers, or domestic policies, such as price support, influence the price changes in domestic markets. According to FAO, the global markets have witnessed a series of dramatic fluctuations in commodity prices. Since 2000, prices have deviated from their long-term negative growth trend and have become increasingly volatile. In addition, prices have witnessed an increase between late 2006 and mid-2008 to their highest level in thirty years and have decreased sharply through 2009. In late 2010 and early 2011, the prices regained their peak. Currently, food prices are projected to remain high and volatile in the market.

Price is one of the major restraining factors in the bulk food ingredients market. There are various fluctuations in raw material prices, such as the prices of starch and sugar for sweetener ingredients. According to a report published by the FAO, in 2018, the starch price was quoted at nearly USD 507/ton, which is 44% higher than in October 2017. In addition, the quotations have exhibited considerable volatility throughout 2018. The price of sugar across the world keeps on fluctuating. According to FAO, the sugar price index has increased by 5.5% from December 2019 to January 2020, making the fourth consecutive monthly increase. The latest increase was encouraged by a 17% drop in India’s sugar output and a 66% production fall in Brazil, which is one of the largest sugar-producing countries, and a 25% contraction in Mexico’s harvest. Export nut prices witnessed a decrease of 20.5% from December 2019 to June 2020. This decline has resulted from a loss in demand from Asia due to the restaurant closures and a decrease in purchases of some nuts (perceived luxury foods). In addition, a low export record of the almond crop in California supported the drop in prices.

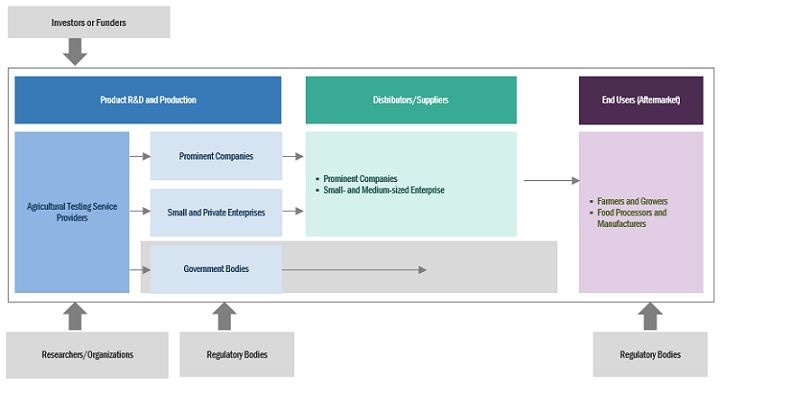

Bulk Food Ingredients Market Ecosystem

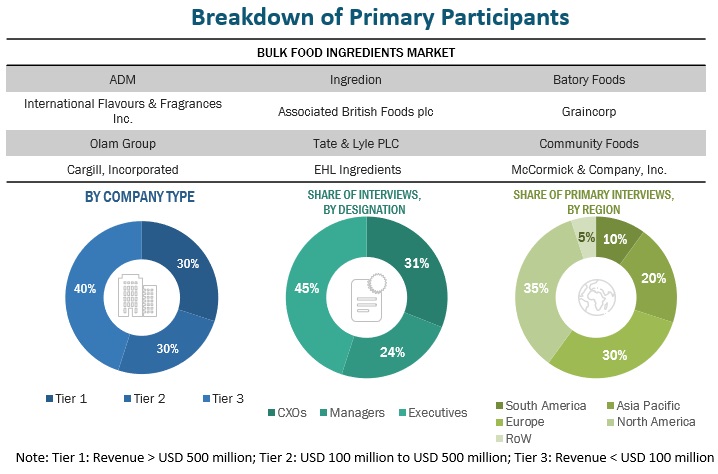

Prominent companies in this market include well-established, financially stable manufacturers of bulk food ingredients. These companies have been operating in the market for several years and possess a diversified service portfolio, state-of-the-art laboratory & technologies, and strong global sales and marketing networks. Prominent companies in this market include Archer Daniels Midland Company (US), International Flavours & Fragrances Inc. (US), Olam Group (Singapore), Cargill, Incorporated (US), Ingredion (US), Associated British Foods plc (UK), Tate & Lyle PLC (UK), EHL Ingredients (UK), Batory Foods (US), Graincorp (Australia), Community Foods (UK), McCormick & Company, Inc. (US), The Source Bulk Foods (Australia), Essex Food Ingredients (US), and Subnutra (India).

By primary processed type, herbs & spices segment is projected to have the fastest growing rate during the forecast period.

There is an increasing global demand for natural and organic ingredients, driven by the growing consumer preference for clean label products. Herbs and spices are natural flavor enhancers that provide unique tastes, aromas, and health benefits. They are widely used in various cuisines and food applications, including processed and packaged foods, beverages, sauces, and seasonings. Herbs and spices offer a wide range of flavors and can provide differentiation to food products, allowing manufacturers to create unique and appealing taste profiles. With consumers seeking diverse and exciting flavor experiences, the demand for a variety of herbs and spices is on the rise.

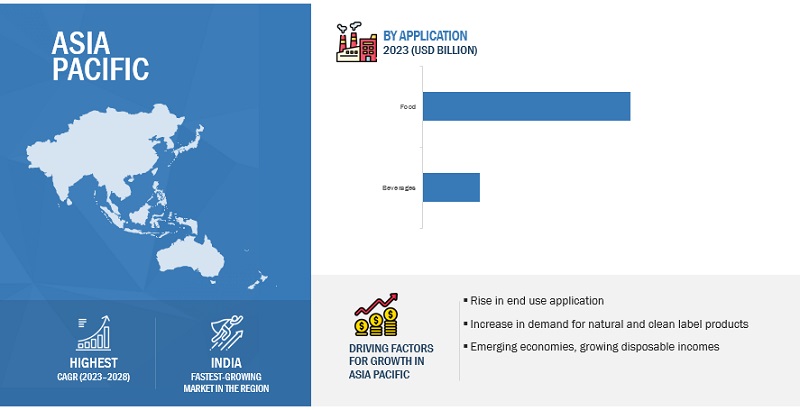

By application, beverage segment is projected to have fastest growing rate during the forecast period.

There is a growing global demand for a wide variety of beverages, including carbonated drinks, juices, sports drinks, ready-to-drink teas and coffees, functional beverages, and alcoholic beverages. As consumers seek convenience and new taste experiences, the beverage industry is constantly innovating to meet these demands. Consumers are increasingly conscious of their health and wellness, driving the demand for healthier beverage options. This includes beverages with natural ingredients, reduced sugar content, functional additives, and botanical extracts. Bulk food ingredients such as natural sweeteners, fruit extracts, natural flavors, and plant-based ingredients are essential in developing healthier and more appealing beverage products.

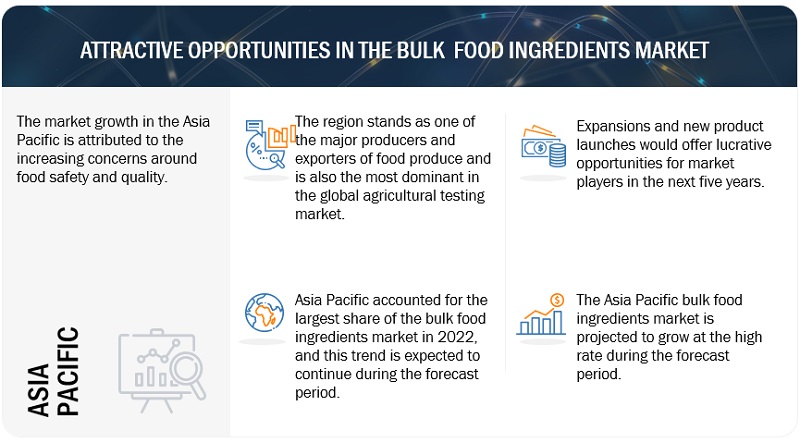

Asia Pacific is expected to have the fastest growing rate during the forecast period.

The Asia Pacific region has a large and rapidly growing population. The rising population leads to increased food consumption and drives the demand for bulk food ingredients to meet the growing production needs. As more people enter the middle class and experience higher disposable incomes, there is an increased demand for processed and convenience foods, further boosting the need for bulk ingredients. There is a shift in dietary patterns in the region. Urbanization, changing lifestyles, and Western influences have led to a higher consumption of processed and packaged foods. This trend increases the demand for bulk food ingredients as manufacturers require large quantities of ingredients to meet the growing demand for these convenience products. The region is witnessing rising consumer awareness of health and wellness, leading to a growing demand for natural and organic food products. Bulk food ingredients such as herbs, spices, natural sweeteners, and functional additives align with this consumer preference for clean label and healthier options.

Key Players in Bulk food Ingredients Industry

The key players in this include Archer Daniels Midland Company (US), International Flavours & Fragrances Inc. (US), Olam Group (Singapore), Cargill, Incorporated (US), Ingredion (US), Associated British Foods plc (UK), Tate & Lyle PLC (UK), EHL Ingredients (UK), Batory Foods (US), Graincorp (Australia), Community Foods (UK), McCormick & Company, Inc. (US), The Source Bulk Foods (Australia), Essex Food Ingredients (US), and Subnutra (India). These companies have been focusing on expanding their market presence, enhancing their solutions, and partnering with many channel partners and technology companies to cater to consumers across the globe. The deep roots of these players in the market and their robust offerings are among the major factors that have helped them achieve major sales and revenues in the global bulk food ingredients market.

Bulk food Ingredients Market Report Scope

|

Report Metric |

Details |

|

Market size value in 2023 |

US $366.7 billion |

|

Revenue forecast in 2028 |

US $454.6 billion |

|

Progress Rate |

CAGR of 4.4% |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Primary Processed Type, By Secondary Processed Type, By Distribution Channel, By Application, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Bulk food Ingredients Market Highlights

Market By Primary Processed Type

- Nuts

- Oilseeds

- Grains, pulses, and cereals

- Herbs & spices

- Sugar

- Tea, coffee, and cocoa

- Salt

- Other types (dried vegetables and citric acid)

Market By Secondary Processed Type

- Dry fruits & processed nuts

- Vegetable oil

- Processed herbs & spices

- Processed grains, pulses, and cereals

- Sugar & sweeteners

- Tea, coffee, and cocoa

- Flours

- Sea salt

- Other types (dried vegetables and citric acid)

Market By Distribution Channel

- Direct from manufacturers

- Distributors

Market By Application

-

Food products

- Bakery products

- Confectionery products

- Snacks & spreads

- Ready meals

- Other food applications

- (infant formula and dairy products)

-

Beverages

- Alcoholic beverages

- Non-alcoholic beverages

- Hot beverages

- Cold beverages

Market By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World

Recent Developments

- In January 2023, Cargill, Incorporated announced the completion of its acquisition of Owensboro Grain Company, a soybean processing facility and refinery located in Owensboro, Ky. Cargill's acquisition of Owensboro Grain Company will strengthen its efforts to build capacity across its North American oilseeds network to meet the rising demand for oilseeds in the food, feed, and renewable fuel industries.

- In October 2022, International Flavors & Fragrances Inc. opened its innovation center worth USD 30 million in Singapore, to innovate and launch products and technologies in all its businesses. This will help the company come up with innovative products in various categories such as sweeteners.

- In July 2022, Olam Group acquired Club Coffee L.P., which is one of Canada’s largest coffee roasters and packaging solutions providers. This will help the company grow its coffee business in Canada, strengthen its coffee business, and meet the growing demand for coffee.

- In June 2022, ADM (US) partnered with Bayer AG (Germany) to build and implement a sustainable crop protection model for soybean farmers in Maharashtra, India. During this partnership, Bayer will provide regular training to ADM cluster agronomist team in Soybean markets and Bayer will also develop a crop protection package for all crops of soybean and pulses.

Frequently Asked Questions (FAQ):

Which are the major companies in the Bulk food ingredients market? What are their major strategies to strengthen their market presence?

The key players in this include Archer Daniels Midland Company (US), International Flavours & Fragrances Inc. (US), Olam Group (Singapore), Cargill, Incorporated (US), Ingredion (US), Associated British Foods plc (UK), Tate & Lyle PLC (UK), EHL Ingredients (UK), Batory Foods (US), Graincorp (Australia), Community Foods (UK), McCormick & Company, Inc. (US), The Source Bulk Foods (Australia), Essex Food Ingredients (US), and Subnutra (India). These companies have been focusing on expanding their market presence, enhancing their solutions, and partnering with many channel partners and technology companies to cater to consumers across the globe. The deep roots of these players in the market and their robust offerings are among the major factors that have helped them achieve major sales and revenues in the global bulk food ingredients market.

What are the drivers and opportunities for the Bulk food ingredients market?

The rapid growth in the packaged food & beverage industry, rise in end-use applications, and environmental and economic benefits are the major drivers. Additionally, the rise in demand for natural or clean products creates opportunities for bulk food ingredients to meet the strict quality and safety standards of international markets.

Which region is expected to hold the highest market share?

The market in Asia Pacific will dominate the market share in 2023, showcasing strong demand from bulk food ingredients services in the region. Asia Pacific is the fastest-growing region in the bulk food ingredients market due to several factors. These include the region's large and rapidly growing population, changing consumer preferences, increasing urbanization, expanding food processing industry, rising disposable incomes, and the demand for convenience foods. Additionally, the region's rich culinary heritage and diverse cuisines drive the need for a wide variety of bulk food ingredients to meet the growing demand for processed and packaged food products.

Which are the key technology trends prevailing in the Bulk food ingredients market?

The bulk food ingredients industry is experiencing technological innovations as major players are offering faster and more accurate technologies such as Bulk food ingredients are an amalgamation of various technologies, such as sensors, blockchain, and AI. These technologies are revolutionizing the way bulk food ingredients are manufactured. AI is the trending technology that helps improve smart manufacturing and quality control. In 2020, the company worked with Cargill, Incorporated to form Grainbridge LLC, a joint venture that helped develop digital solutions for farmers to boost their efficiency and production in farming. As a result, both companies will be able to expand overall production of bulk food ingredients.

What is the total CAGR expected to be recorded for the bulk food ingredients market during 2023-2028?

The CAGR is expected to record a CAGR of 4.4% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSGROWING DEMAND FOR FORTIFIED FOOD OWING TO RISING HEALTH AWARENESSCONSUMER AWARENESS OF MICRONUTRIENT DEFICIENCIES

-

5.3 MARKET DYNAMICSDRIVERS- Rapid growth in packaged food & beverage industry- Rise in end-use applications- Environmental and economic benefitsRESTRAINTS- Improper storage management and infrastructure- Bulk food ingredients are prone to contaminationOPPORTUNITIES- Rise in demand for natural or clean label products- Untapped markets in emerging economiesCHALLENGES- Unstable agricultural supply resulting in price volatility- Lack of consistency in regulations pertaining to various ingredients

- 6.1 INTRODUCTION

-

6.2 SUPPLY CHAIN ANALYSISRESEARCH & PRODUCT DEVELOPMENTDISTRIBUTIONEND USERS

-

6.3 ECOSYSTEM

-

6.4 VALUE CHAIN ANALYSISRESEARCH & PRODUCT DEVELOPMENTSOURCINGPRODUCTION & PROCESSINGDISTRIBUTION, SALES & MARKETING

-

6.5 TECHNOLOGY ANALYSISBULK FOOD INGREDIENTS AND SENSORSBULK FOOD INGREDIENTS AND ARTIFICIAL INTELLIGENCE (AI)

- 6.6 AVERAGE SELLING PRICE TREND

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

6.8 PORTER’S FIVE FORCES ANALYSISBULK FOOD INGREDIENTS MARKET: PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

-

6.9 PATENT ANALYSISINTRODUCTION

-

6.10 PATENT ANALYSIS

- 6.11 KEY CONFERENCES & EVENTS IN 2023–2024

- 6.12 TRADE ANALYSIS

-

6.13 CASE STUDIES

-

6.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 7.1 INTRODUCTION

-

7.2 NORTH AMERICAUSCANADA

- 7.3 EUROPE

-

7.4 ASIA PACIFICCHINAINDIAJAPAN

-

7.5 SOUTH AMERICABRAZIL

- 8.1 INTRODUCTION

-

8.2 GRAINS, PULSES, AND CEREALSPOPULATION GROWTH AND CHANGE IN DIETS TO LEAD TO INCREASE IN DEMAND FOR GRAINS, PULSES, AND CEREALS

-

8.3 TEA, COFFEE, AND COCOAPREFERENCE FOR HERBAL & GREEN TEA AND COFFEE TO DRIVE SEGMENT

-

8.4 NUTSDIABETIC-FRIENDLY ATTRIBUTES OF ALMONDS TO LEAD TO SEGMENT’S GROWTH

-

8.5 HERBS & SPICESGLOBALIZATION AND EXPOSURE TO CULINARY TRADITIONS TO LEAD TO INCREASED DEMAND FOR HERBS & SPICES

-

8.6 OILSEEDSGROWING POPULARITY OF PLANT-BASED DIETS AND INCREASING DEMAND FOR ALTERNATIVE PROTEIN SOURCES TO DRIVE GROWTH

-

8.7 SUGARUSAGE OF SUGAR AS PRESERVATIVE TO DRIVE DEMAND IN BULK FOOD INGREDIENTS MARKET

-

8.8 SALTANTI-INFLAMMATORY PROPERTIES OF SEA SALT AND APPLICATION IN COSMETIC PRODUCTS TO DRIVE DEMAND

-

8.9 OTHER TYPESALIGNMENT OF DRIED VEGETABLES AND CITRIC ACID WITH PREFERENCES FROM HEALTH-CONSCIOUS CONSUMERS TO DRIVE DEMAND FOR OTHER TYPES

- 9.1 INTRODUCTION

-

9.2 PROCESSED GRAINS, PULSES, AND CEREALSHIGH FIBER AND PROTEIN CONTENT TO ENCOURAGE DEMAND FOR PROCESSED GRAINS, PULSES, AND CEREALS

-

9.3 VEGETABLE OILGROWTH OF QUICK-SERVICE AND PROCESSED FOOD INDUSTRIES TO DRIVE MARKET GROWTH

-

9.4 TEA, COFFEE, AND COCOARAPID GROWTH OF HOTELS, RESTAURANTS, AND CAFES TO DRIVE MARKET GROWTH

-

9.5 DRY FRUITS & PROCESSED NUTSRISE IN CONSUMER TREND OF HEALTHY SNACKING TO DRIVE MARKET GROWTH

-

9.6 FLOURSMULTIPLE HEALTH BENEFITS ASSOCIATED WITH CONSUMPTION OF VARIOUS TYPES OF FLOURS TO DRIVE DEMAND

-

9.7 SUGAR & SWEETENERSRISING NUMBER OF HEALTH-CONSCIOUS CONSUMERS TO LEAD TO INCREASE IN DEMAND FOR NATURAL SWEETENERS

-

9.8 PROCESSED HERBS & SPICESMEDICINAL PROPERTIES OF HERBS & SPICES AND EXTENSIVE USE IN AYURVEDA TO DRIVE DEMAND IN ASIA PACIFIC

-

9.9 SEA SALTINCREASE IN DEMAND AS SEASONING AGENT TO DRIVE MARKET GROWTH

- 9.10 OTHER TYPES

- 10.1 INTRODUCTION

- 10.2 FOOD APPLICATIONS, BY TYPE

-

10.3 FOOD APPLICATIONS, BY REGIONBAKERY PRODUCTS- Increase in preference for low-calorie, ready-to-eat food items among consumers to lead to higher demandSNACKS & SPREADS- Rapid urbanization to influence food preferences among consumersREADY MEALS- Consumers to prefer food items that can easily be consumed without much effortCONFECTIONERY PRODUCTS- Confectionery products to witness high demand as they are used for gifting purposesOTHER FOOD APPLICATIONS- Rise in infant population and decrease in infant mortality rate to drive demand for infant formulas

-

10.4 BEVERAGE APPLICATIONS, BY TYPEALCOHOLIC BEVERAGES- Growth of alcoholic beverages market in US to drive demand for acidulantsNON-ALCOHOLIC BEVERAGES- Non-alcoholic beverages to provide nutrition in form of antioxidants and probioticsNON-ALCOHOLIC BEVERAGES, BY TYPE- Hot beverages- Cold beverages

- 11.1 INTRODUCTION

-

11.2 DIRECT FROM MANUFACTURERSINCREASE IN R&D ACTIVITIES FOR PROCESSED AND CONVENIENCE FOODS TO DRIVE DEMAND AMONG DIRECT MANUFACTURERS

-

11.3 DISTRIBUTORSINCREASE IN GDP IN EMERGING MARKETS OF ASIA PACIFIC TO DRIVE MARKET GROWTH

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Expanding market for bulk food ingredients to be driven by prominent industry players and extensive distribution reachCANADA- Preference for convenience to drive market growth in CanadaMEXICO- Growing demand for bulk food ingredients to be driven by imports of processed food products

-

12.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Germany’s prominence as Europe’s largest industry sector and third-largest food & beverage exporter to drive marketUK- High demand for premium-quality food products to fuel growth of marketFRANCE- Attractive opportunities for players to boost market growth in FranceSPAIN- Food products, vegetables, and meat products to account for more than half of exports, leading to increased demand for bulk food ingredientsITALY- Potential of organic, functional, and low-fat food products in Italian market to drive demand for bulk food ingredientsREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Increasing import of bulk food ingredients to be driven by China’s consumer behaviorINDIA- Rising GDP and changing lifestyles to drive India’s food & beverage industry, in turn driving demand for bulk food ingredientsJAPAN- Shortage of land suited for farming to result in over 60% of import of food productsAUSTRALIA & NEW ZEALAND- New Zealand to hold top position as leading provider of processed beverages to Australia.SOUTH KOREA- Strong demand for healthy diets, diverse choices, and new flavors to drive market for bulk food ingredientsREST OF ASIA PACIFIC

-

12.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Growth of Brazilian food & beverage sector to contribute to elevated consumption of sugar and sugar substitutesARGENTINA- Impact of cane sugar production on sugar industry in Argentina to boost demand for bulk food ingredientsREST OF SOUTH AMERICA

-

12.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISAFRICA- Increasing consumer preference for convenience food products to fuel demand for bulk food ingredientsMIDDLE EAST- Market in Middle East set to grow as more food processing companies enter industry

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS, 2022

- 13.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 13.4 ANNUAL REVENUE VS. GROWTH OF KEY PLAYERS

- 13.5 EBITDA OF KEY PLAYERS

- 13.6 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

13.8 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSFOOTPRINT, BY TYPE

-

13.9 EVALUATION QUADRANT OF STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

13.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSADM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOLAM GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCARGILL, INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINGREDION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASSOCIATED BRITISH FOODS PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTATE & LYLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSÜDZUCKER AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAIZEN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGRAINCORP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWILMAR INTERNATIONAL LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMCCORMICK & COMPANY, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBORGES INTERNATIONAL GROUP, S.L.U- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEBRO FOODS, S.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJB COCOA- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

14.2 OTHER PLAYERSTHE GREEN LABS LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDÖHLER GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGRAIN MILLERS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDIEFENBAKER SPICE & PULSE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSILVA INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVAN DRUNEN FARMSBERGIN FRUIT AND NUT COMPANYROQUETTE FRÈRESFRENCH FOOD ADDITIVES COMPANYTECHNO FOOD INGREDIENTS CO., LTD

- 15.1 INTRODUCTION

-

15.2 RESEARCH LIMITATIONSSPECIALTY FOOD INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.3 SPICES & SEASONINGS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 4 BULK FOOD INGREDIENTS MARKET: ECOSYSTEM

- TABLE 5 KEY PATENTS PERTAINING TO BULK FOOD INGREDIENTS, 2020–2021

- TABLE 6 ALLERGEN SENSORS FOR CONSUMERS

- TABLE 7 SENSORY EXPERIENCE TO REMAIN KEY PRIORITY FOR CONSUMERS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BULK FOOD INGREDIENT APPLICATIONS

- TABLE 9 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 10 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 11 GRAINS, PULSES, AND CEREALS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 12 GRAINS, PULSES, AND CEREALS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 13 TEA, COFFEE, AND COCOA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 14 TEA, COFFEE, AND COCOA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 15 NUTS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 16 NUTS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 17 HERBS & SPICES: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 18 HERBS & SPICES: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 19 OILSEEDS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 20 OILSEEDS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 21 SUGAR: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 22 SUGAR: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 23 SALT: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 24 SALT: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 25 OTHER TYPES: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 26 OTHER TYPES: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 27 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 28 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 29 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2019–2022 (KT)

- TABLE 30 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2023–2028 (KT)

- TABLE 31 PROCESSED GRAINS, PULSES, AND CEREALS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 32 PROCESSED GRAINS, PULSES, AND CEREALS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 33 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN PROCESSED GRAINS, PULSES, AND CEREALS, BY REGION, 2019–2022 (KT)

- TABLE 34 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN PROCESSED GRAINS, PULSES, AND CEREALS, BY REGION, 2023–2028 (KT)

- TABLE 35 VEGETABLE OIL: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 36 VEGETABLE OIL: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 37 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN VEGETABLE OIL, BY REGION, 2019–2022 (KT)

- TABLE 38 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN VEGETABLE OIL, BY REGION, 2023–2028 (KT)

- TABLE 39 TEA, COFFEE, AND COCOA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 40 TEA, COFFEE, AND COCOA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 41 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN TEA, COFFEE, AND COCOA, BY REGION, 2019–2022 (KT)

- TABLE 42 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN TEA, COFFEE, AND COCOA, BY REGION, 2023–2028 (KT)

- TABLE 43 DRY FRUITS & PROCESSED NUTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 44 DRY FRUITS & PROCESSED NUTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 45 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN DRY FRUITS & PROCESSED NUTS, BY REGION, 2019–2022 (KT)

- TABLE 46 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN DRY FRUITS & PROCESSED NUTS, BY REGION, 2023–2028 (KT)

- TABLE 47 FLOURS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 48 FLOURS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 49 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN FLOURS, BY REGION, 2019–2022 (KT)

- TABLE 50 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN FLOURS, BY REGION, 2023–2028 (KT)

- TABLE 51 SUGAR & SWEETENERS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 52 SUGAR & SWEETENERS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 53 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN SUGAR & SWEETENERS, BY REGION, 2019–2022 (KT)

- TABLE 54 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN SUGAR & SWEETENERS, BY REGION, 2023–2028 (KT)

- TABLE 55 PROCESSED HERBS & SPICES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 PROCESSED HERBS & SPICES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN PROCESSED HERBS & SPICES, BY REGION, 2019–2022 (KT)

- TABLE 58 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN PROCESSED HERBS & SPICES, BY REGION, 2023–2028 (KT)

- TABLE 59 SEA SALT: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 SEA SALT: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN SEA SALT, BY REGION, 2019–2022 (KT)

- TABLE 62 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN SEA SALT, BY REGION, 2023–2028 (KT)

- TABLE 63 OTHER TYPES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 OTHER TYPES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN OTHER TYPES, BY REGION, 2019–2022 (KT)

- TABLE 66 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN OTHER TYPES, BY REGION, 2023–2028 (KT)

- TABLE 67 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 68 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 69 FOOD: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY SUBAPPLICATION, 2019–2022 (USD BILLION)

- TABLE 70 FOOD: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY SUBAPPLICATION, 2023–2028 (USD BILLION)

- TABLE 71 FOOD: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 72 FOOD: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 73 BAKERY PRODUCTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 74 BAKERY PRODUCTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 75 SNACKS & SPREADS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 76 SNACKS & SPREADS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 77 READY MEALS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 78 READY MEALS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 79 CONFECTIONERY PRODUCTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 80 CONFECTIONERY PRODUCTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 81 OTHER FOOD APPLICATIONS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 82 OTHER FOOD APPLICATIONS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 83 BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY SUBAPPLICATION, 2019–2022 (USD BILLION)

- TABLE 84 BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY SUBAPPLICATION, 2023–2028 (USD BILLION)

- TABLE 85 BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 86 BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 87 ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 88 ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 89 NON-ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 90 NON-ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 91 NON-ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 92 NON-ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 93 HOT BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 94 HOT BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 95 COLD BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 96 COLD BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 97 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

- TABLE 98 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD BILLION)

- TABLE 99 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

- TABLE 100 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD BILLION)

- TABLE 101 DIRECT FROM MANUFACTURERS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 102 DIRECT FROM MANUFACTURERS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 103 DIRECT FROM MANUFACTURERS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 104 DIRECT FROM MANUFACTURERS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 105 DISTRIBUTORS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 106 DISTRIBUTORS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 107 DISTRIBUTORS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 108 DISTRIBUTORS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 109 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 110 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 111 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 112 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 113 NORTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 114 NORTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 115 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 116 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 117 NORTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2019–2022 (KT)

- TABLE 122 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2023–2028 (KT)

- TABLE 123 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 124 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 125 NORTH AMERICA: FOOD APPLICATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 126 NORTH AMERICA: FOOD APPLICATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 127 NORTH AMERICA: BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 128 NORTH AMERICA: BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 129 NORTH AMERICA: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 130 NORTH AMERICA: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 131 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 132 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 133 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 134 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 135 US: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 136 US: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 US: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 138 US: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 139 CANADA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 140 CANADA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 141 CANADA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 142 CANADA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 MEXICO: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 144 MEXICO: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 MEXICO: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 146 MEXICO: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 148 EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 149 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 150 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 151 EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 152 EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 153 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 154 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 155 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 156 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 157 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 158 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 159 EUROPE: FOOD APPLICATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 160 EUROPE: FOOD APPLICATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 161 EUROPE: BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 162 EUROPE: BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 163 EUROPE: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 164 EUROPE: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 165 EUROPE: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 166 EUROPE: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 167 EUROPE: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 168 EUROPE: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 169 GERMANY: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 170 GERMANY: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 171 GERMANY: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 172 GERMANY: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 173 UK: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 174 UK: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 175 UK: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 176 UK: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 177 FRANCE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 178 FRANCE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 179 FRANCE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 180 FRANCE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 181 SPAIN: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 182 SPAIN: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 183 SPAIN: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 184 SPAIN: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 ITALY: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 186 ITALY: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 187 ITALY: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 188 ITALY: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 189 REST OF EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 190 REST OF EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 REST OF EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 192 REST OF EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 193 ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 194 ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 195 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 196 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 197 ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 198 ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 199 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 200 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 201 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 202 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 203 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 204 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 205 ASIA PACIFIC: FOOD APPLICATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 206 ASIA PACIFIC: FOOD APPLICATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 207 ASIA PACIFIC: BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 208 ASIA PACIFIC: BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 209 ASIA PACIFIC: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 210 ASIA PACIFIC: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 211 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 212 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 213 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 214 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 215 CHINA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 216 CHINA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 217 CHINA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 218 CHINA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 219 INDIA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 220 INDIA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 221 INDIA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 222 INDIA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 223 JAPAN: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 224 JAPAN: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 225 JAPAN: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 226 JAPAN: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 227 AUSTRALIA & NEW ZEALAND: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 228 AUSTRALIA & NEW ZEALAND: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 229 AUSTRALIA & NEW ZEALAND: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 230 AUSTRALIA & NEW ZEALAND: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 231 SOUTH KOREA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 232 SOUTH KOREA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 233 SOUTH KOREA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 234 SOUTH KOREA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 235 REST OF ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 236 REST OF ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 239 SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 240 SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 241 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 242 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 243 SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 244 SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 245 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 246 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 247 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2019–2022 (KT)

- TABLE 248 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2023–2028(KT)

- TABLE 249 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 250 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 251 SOUTH AMERICA: FOOD APPLICATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 252 SOUTH AMERICA: FOOD APPLICATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 253 SOUTH AMERICA: BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 254 SOUTH AMERICA: BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 255 SOUTH AMERICA: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 256 SOUTH AMERICA: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 257 SOUTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 258 SOUTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 259 SOUTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 260 SOUTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 261 BRAZIL: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 262 BRAZIL: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 263 BRAZIL: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 264 BRAZIL: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 265 ARGENTINA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 266 ARGENTINA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 267 ARGENTINA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 268 ARGENTINA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 269 REST OF SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 270 REST OF SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 271 REST OF SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 272 REST OF SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 273 ROW: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 274 ROW: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 275 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 276 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 277 ROW: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 278 ROW: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 279 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 280 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 281 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 282 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 283 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 284 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 285 ROW: FOOD APPLICATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 286 ROW: FOOD APPLICATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 287 ROW: BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 288 ROW: BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 289 ROW: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 290 ROW: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 291 ROW: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 292 ROW: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 293 ROW: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019–2022 (USD BILLION)

- TABLE 294 ROW: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023–2028 (USD BILLION)

- TABLE 295 AFRICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 296 AFRICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 297 AFRICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 298 AFRICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 299 MIDDLE EAST: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 300 MIDDLE EAST: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 301 MIDDLE EAST: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 302 MIDDLE EAST: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 303 BULK FOOD INGREDIENTS MARKET: DEGREE OF COMPETITION, 2022

- TABLE 304 COMPANY FOOTPRINT, BY TYPE

- TABLE 305 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 306 COMPANY FOOTPRINT, BY REGION

- TABLE 307 OVERALL COMPANY FOOTPRINT

- TABLE 308 BULK FOOD INGREDIENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 309 BULK FOOD INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 310 PRODUCT LAUNCHES, 2019–2023

- TABLE 311 DEALS, 2019–2023

- TABLE 312 OTHERS, 2019–2023

- TABLE 313 ADM: COMPANY OVERVIEW

- TABLE 314 ADM: PRODUCT LAUNCHES

- TABLE 315 ADM: DEALS

- TABLE 316 ADM: OTHERS

- TABLE 317 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- TABLE 318 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 319 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- TABLE 320 OLAM GROUP: BUSINESS OVERVIEW

- TABLE 321 OLAM GROUP: PRODUCT LAUNCHES

- TABLE 322 OLAM GROUP: DEALS

- TABLE 323 OLAM GROUP: OTHERS

- TABLE 324 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 325 CARGILL, INCORPORATED: PRODUCT LAUNCHES

- TABLE 326 CARGILL, INCORPORATED: DEALS

- TABLE 327 CARGILL, INCORPORATED: OTHERS

- TABLE 328 INGREDION: BUSINESS OVERVIEW

- TABLE 329 INGREDION: DEALS

- TABLE 330 INGREDION: OTHERS

- TABLE 331 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- TABLE 332 ASSOCIATED BRITISH FOODS PLC: OTHERS

- TABLE 333 TATE & LYLE: COMPANY OVERVIEW

- TABLE 334 TATE & LYLE: PRODUCT LAUNCHES

- TABLE 335 TATE & LYLE: DEALS

- TABLE 336 TATE & LYLE: OTHERS

- TABLE 337 SÜDZUCKER AG: BUSINESS OVERVIEW

- TABLE 338 RAIZEN: BUSINESS OVERVIEW

- TABLE 339 RAIZEN: DEALS

- TABLE 340 GRAINCORP: COMPANY OVERVIEW

- TABLE 341 WILMAR INTERNATIONAL LIMITED: BUSINESS OVERVIEW

- TABLE 342 MCCORMICK & COMPANY, INC.: BUSINESS OVERVIEW

- TABLE 343 MCCORMICK & COMPANY, INC.: DEALS

- TABLE 344 BORGES INTERNATIONAL GROUP, S.L.U: BUSINESS OVERVIEW

- TABLE 345 BORGES INTERNATIONAL GROUP, S.L.U: DEALS

- TABLE 346 BORGES INTERNATIONAL GROUP, S.L.U: OTHERS

- TABLE 347 EBRO FOODS, S.A.: BUSINESS OVERVIEW

- TABLE 348 JB COCOA: BUSINESS OVERVIEW

- TABLE 349 JB COCOA: OTHERS

- TABLE 350 THE GREEN LABS LLC: BUSINESS OVERVIEW

- TABLE 351 DÖHLER GMBH: BUSINESS OVERVIEW

- TABLE 352 GRAIN MILLERS, INC.: BUSINESS OVERVIEW

- TABLE 353 DIEFENBAKER SPICE & PULSE: BUSINESS OVERVIEW

- TABLE 354 SILVA INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 355 SILVA INTERNATIONAL: OTHERS

- TABLE 356 VAN DRUNEN FARMS: BUSINESS OVERVIEW

- TABLE 357 BERGIN FRUIT AND NUT COMPANY: BUSINESS OVERVIEW

- TABLE 358 ROQUETTE FRÈRES: BUSINESS OVERVIEW

- TABLE 359 FRENCH FOOD ADDITIVES COMPANY: BUSINESS OVERVIEW

- TABLE 360 TECHNO FOOD INGREDIENTS CO., LTD: BUSINESS OVERVIEW

- TABLE 361 ADJACENT MARKETS

- TABLE 362 ACIDULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 363 ACIDULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 364 SPICES & SEASONINGS MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 365 SPICES & SEASONINGS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 BULK FOOD INGREDIENTS MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 5 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 6 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD BILLION)

- FIGURE 7 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD BILLION)

- FIGURE 8 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 9 BULK FOOD INGREDIENTS MARKET (VALUE), BY REGION, 2022

- FIGURE 10 RISING CONSUMPTION OF READY-TO-EAT FOOD & BEVERAGE PRODUCTS TO DRIVE DEMAND FOR BULK FOOD INGREDIENTS

- FIGURE 11 GRAINS, PULSES, AND CEREALS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC

- FIGURE 12 PROCESSED GRAINS, PULSES, AND CEREALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 GRAINS, PULSES, AND CEREALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 DIRECT FROM MANUFACTURERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 FOOD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 AUSTRALIA: RETAIL SALES OF FUNCTIONAL AND FORTIFIED FOOD PRODUCTS, 2018–2022 (USD MILLION)

- FIGURE 17 NUMBER OF COUNTRIES MANDATING FOOD FORTIFICATION, 2011–2019

- FIGURE 18 PREVALENCE OF MALNUTRITION IN CHILDREN ACROSS MAJOR ECONOMIES, 2019

- FIGURE 19 RAPID DEVELOPMENT IN PACKAGED FOOD INDUSTRY TO DRIVE GLOBAL BULK FOOD INGREDIENTS MARKET GROWTH

- FIGURE 20 CONSUMPTION TREND OF ALCOHOLIC BEVERAGES, 2018–2020 (LITER PER CAPITA)

- FIGURE 21 NORTH AMERICA: PROCESSED FOOD CONSUMPTION SHARE IN DIETS, 2019

- FIGURE 22 FOOD PROCESSING INDUSTRY SALES, 2009–2019

- FIGURE 23 FOOD LOSS AND WASTAGE IN DIFFERENT STAGES OF SUPPLY CHAIN, 2019

- FIGURE 24 DIFFERENT CAUSES OF FOOD SAFETY ISSUES IN DEVELOPED AND DEVELOPING COUNTRIES, 2020

- FIGURE 25 US: CONSUMER PREFERENCE FOR CLEAN-LABEL PRODUCTS AND INGREDIENTS, 2020

- FIGURE 26 FAO FOOD PRICE INDEX, 2020–2022

- FIGURE 27 BULK FOOD INGREDIENTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 BULK FOOD INGREDIENTS: MARKET MAP

- FIGURE 29 VALUE CHAIN ANALYSIS: BULK FOOD INGREDIENTS

- FIGURE 30 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET: PRICING ANALYSIS, BY TYPE, 2014–2020 (USD/KT)

- FIGURE 31 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET: PRICING ANALYSIS, BY TYPE, 2014–2020 (USD/KT)

- FIGURE 32 YC-YCC: REVENUE SHIFT FOR BULK FOOD INGREDIENTS MARKET

- FIGURE 33 LIST OF TOP PATENTS IN MARKET FOR TEN YEARS

- FIGURE 34 KEY IMPORTERS & EXPORTERS OF WHEAT, 2020

- FIGURE 35 KEY IMPORTERS & EXPORTERS OF CORN, 2020

- FIGURE 36 KEY IMPORTERS & EXPORTERS OF RICE, 2020

- FIGURE 37 KEY IMPORTERS & EXPORTERS OF SORGHUM, 2020

- FIGURE 38 KEY IMPORTERS & EXPORTERS OF NUTS, 2020

- FIGURE 39 KEY IMPORTERS & EXPORTERS OF SUGAR, 2020

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BULK FOOD INGREDIENT APPLICATIONS

- FIGURE 41 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 42 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 43 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 44 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 45 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028

- FIGURE 46 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 47 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET

- FIGURE 48 INFLATION: COUNTRY-LEVEL DATA, 2018–2021

- FIGURE 49 NORTH AMERICAN PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 50 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 51 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 52 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET SNAPSHOT

- FIGURE 53 INFLATION: COUNTRY-LEVEL DATA, 2018–2021

- FIGURE 54 ASIA PACIFIC BULK FOOD INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 55 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 56 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022–2023

- FIGURE 57 ROW: INFLATION RATES, BY KEY REGION, 2018–2021

- FIGURE 58 ROW: RECESSION IMPACT ANALYSIS, 2022–2023

- FIGURE 59 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018–2022 (USD BILLION)

- FIGURE 60 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022 (%)

- FIGURE 61 EBITDA, 2022 (USD BILLION)

- FIGURE 62 BULK FOOD INGREDIENTS: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 63 BULK FOOD INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 64 BULK FOOD INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 65 ADM: COMPANY SNAPSHOT

- FIGURE 66 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 67 OLAM GROUP: COMPANY SNAPSHOT

- FIGURE 68 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 69 INGREDION: COMPANY SNAPSHOT

- FIGURE 70 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- FIGURE 71 TATE & LYLE: COMPANY SNAPSHOT

- FIGURE 72 SÜDZUCKER AG: COMPANY SNAPSHOT

- FIGURE 73 RAIZEN: COMPANY SNAPSHOT

- FIGURE 74 GRAINCORP: COMPANY SNAPSHOT

- FIGURE 75 WILMAR INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- FIGURE 76 MCCORMICK & COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 77 BORGES INTERNATIONAL GROUP, S.L.U: COMPANY SNAPSHOT

- FIGURE 78 EBRO FOODS, S.A.: COMPANY SNAPSHOT

- FIGURE 79 JB COCOA: COMPANY SNAPSHOT

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the bulk food ingredients market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the US Federal Food, Drug and Cosmetic Act (FD&C Act), Food and Drug Administration (FDA), Nutritional Labelling and Education Act (NLEA) Requirements, European Union (EU), FSS Packaging and Labelling Regulation, Food Safety and Standards Authority of India (FSSAI), World Trade Organization (WTO), Sanitary and Phytosanitary (SPS) Agreement and to Codex Alimentarius (CODEX) were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The bulk food ingredients market comprises several stakeholders, including food ingredients service providers and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, bulk food ingredients providers, and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of food manufacturers and growers through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

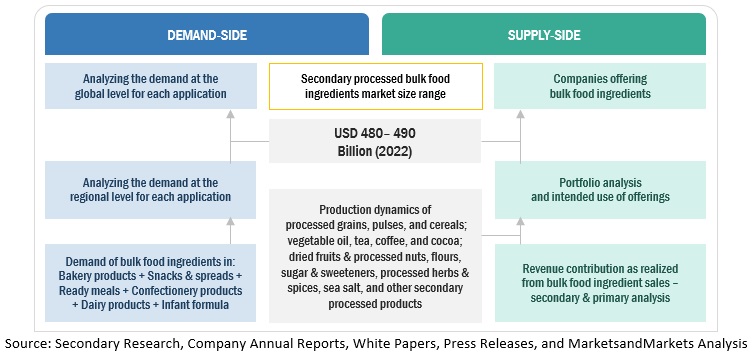

Bulk Food Ingredients Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the bulk food ingredients market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The bulk food ingredients value chain and market size in terms of value have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for this study.

Market size estimation: Bottom-up Approach

- In the bottom-up approach, bulk food ingredients for application, type, distribution channel, and region were added up to arrive at the global and regional market size and CAGR.

- The bottom-up procedure has been employed to arrive at the overall size of the bulk food ingredients market from the revenues of key players (companies) and their product share in the market.

Market size estimation methodology: Top-Down Approach

For the calculation of each type of specific market segment, the most appropriate, immediate parent and peer market sizes were used for implementing the top-down procedure.

Secondary reports from various sources like company revenues, associations, and regulatory bodies were considered. Further, appropriate weightage was assigned to the data derived from each parameter to arrive at the final shares for each region. The regional demand-supply trends, presence of labs, and regulatory scenario were also analyzed to further validate the shares arrived at. These shares were then confirmed with primary respondents from across regions.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall bulk food ingredients market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Bulk food ingredients refer to raw materials or substances that are purchased and used in large quantities by food manufacturers, processors, or retailers to produce various food products. These ingredients are typically purchased in bulk quantities, such as kilograms or metric tons, and are essential components in the formulation of food items. Examples of bulk food ingredients include grains, flour, sugars, oils, spices, nuts, seeds, and additives. The market for bulk food ingredients caters to the needs of the food industry, providing a wide range of high-quality and cost-effective ingredients to meet the demands of large-scale food production and supply chains.

Key Stakeholders

- Manufacturers/suppliers

- Food manufacturers & processors

- Research & development laboratories

-

Regulatory bodies