CMOS Image Sensor Market by Technology (CMOS and Others), Specification, Wafer & Sensor Size, Application (Automotive, Consumer Electronics, Industrial, Entertainment, & Security & Surveillance), and Region - Global Trends and Forecast to 2020

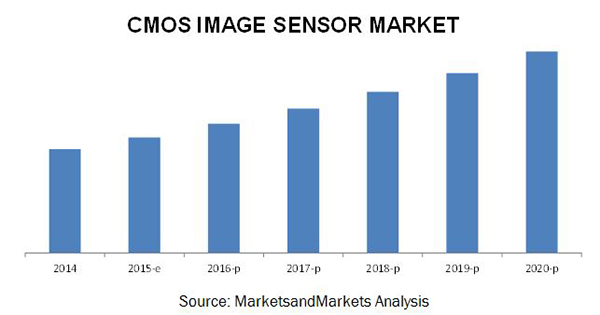

The CMOS image sensor market was valued at USD 8.8 Billion in 2014 and is expected to grow at a CAGR of 11.8% between 2015 and 2020. The base year used for study is 2014 and the forecast period is between 2015 and 2020. This report provides a detailed analysis of the market segmented on the basis of technology, specification, wafer & sensor size, application, and region. The consumer electronics market for CMOS image sensor was valued at USD 6.5 Billion in 2014; it is expected to hold a large share of the market. The market for the automotive sector is expected to grow at a high CAGR of 19.4% between 2015 and 2020.

The CMOS image sensor market is expected to grow at a CAGR of 11.8% between 2015 and 2020, from USD 9.80 Billion in 2015 to USD 17.1 Billion by 2020. The growth of the market is driven by factors such as the growing implementation of CMOS image sensor in the consumer electronics segment, investment by players to develop CMOS image sensor for automotive sector, and support of 4K pixel technology for the growth of the security and surveillance sector.

There is a growing market for CMOS image sensors in consumer electronics, automotive, and security & surveillance. The growing adoption of smartphones with inbuilt front and back cameras has accelerated the growth of the consumer electronics market. The innovation of self-driving cars and advancement in driver safety with the help of ADAS has fueled the growth of the automotive application. The ability of CMOS image sensor to perform in various lighting conditions such as dim light, darkness, and low light has also boosted the implementation of CMOS image sensors for security purposes, thereby supporting the CMOS image sensor market for security & surveillance.

The CMOS image sensor market is segmented on the basis of technology into CMOS and others. The CMOS market is further segmented into FSI, BSI, and others. FSI is a traditional method which was used for imaging with the help of metal wiring layer and transistors; however, this produces poor images in low light conditions. BSI overcomes this disadvantage and is widely used in applications such as consumer electronics, security & surveillance, and aerospace & defense as it provides high dynamic range, high sensitivity, low noise, and better quality of images. Another type of CMOS technology is 3D stacking which helps in reducing the size of the chip, while packing more pixels per unit size. Sony Corporation is an active participant in the development of 3D stacked image sensors.

Consumer electronics is the largest market in Asia-Pacific, whereas the automotive application is expected to grow at a high CAGR between 2015 and 2020. The major reasons driving the growth of APAC in the CMOS image sensor market is the large number of users for mobile devices, webcams, and tablet PCs. Some of the major companies such as Sony Corporation (Japan), Samsung Electronics Co., Ltd (South Korea), SK Hynix Inc. (South Korea) and Sharp Corporation (Japan) are located in this region.

The shortage of CMOS image sensor in APAC is the major restraint for the development of the market. The demand for consumer electronics in APAC is high, which drives the demand for CMOS image sensors. Sony, the major supplier of CMOS image sensors, is unable to satisfy the demand of vendors situated in this region. According to Taiwan’s handset supply chain, Sony was ~30% short of fulfilling its demands from smartphone vendors such as Xiaomi Technology, Huawei Device, Coolpad, and ZTE in May 2015. The vendors re expected to shift to the suppliers such as OmniVision, Samsung Electronics, and Toshiba for overcoming this shortage.

Sony Corporation (Japan) is the major player in the CMOS image sensor market. It has taken steps to develop CMOS image sensors for various applications by investing USD 895 Million (105 Billion yen) to increase the production capacity for stacked CMOS image sensors and it has also commercialized the CMOS image sensor for automotive cameras. The company has also developed CMOS image sensors with the help of Exmor technology for applications such as consumer electronics, automotive, and security.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.1.1 CMOS Image Sensor Market, By Wafer and Sensor Size

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 CMOS Image Sensor Market Expected to Have Huge Growth Opportunity in Automotive and Consumer Electronics

4.2 Market, By Application (2015–2020)

4.3 Market, By Region and Application

4.4 Market, By Region (2014)

4.5 Market, By Type

4.6 Market, By Image Processing Type

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Technology

5.3.2 By Application

5.3.3 By Specification Type

5.3.4 By Wafer Size and Sensor Size

5.3.5 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Growing Implementation of CMOS Image Sensors in Consumer Electronics Segment Supports the Growth of This Market

5.4.1.2 Investment By Major Players in Automotive Sector Expected to Boost the Market

5.4.1.3 4k Pixel Technology is Expected to Support the Growth of Security & Surveillance Sector of Market

5.4.2 Restraints

5.4.2.1 Shortage of CMOS Image Sensors to Vendors in Asia-Pacific

5.4.3 Opportunities

5.4.3.1 Emerging Opportunities in 3D Image Sensing

5.4.3.2 Stacked Image Sensor Expected to Create Opportunities for This Market

5.4.3.3 BSI to Become A Mainstream Technology

5.4.4 Challenges

5.4.4.1 Reducing Image Sensor Chip Size Leading to Loss of Pixel Size

5.4.4.2 Improving Resolution of CMOS Image Sensor With Increase in Pixel Count

6 Industry Trends (Page No. - 52)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

6.4 Industry Trends

6.4.1 Mergers and Acquisitions – CMOS Image Sensor

6.5 Strategic Benchmarking

6.5.1 Major Strategies Adopted By the Key Players

7 CMOS Image Sensor Market, By Technology (Page No. - 63)

7.1 Introduction

7.2 Complementary Metal-Oxide-Semiconductor (CMOS)

7.2.1 Fsi Technology

7.2.2 BSI Technology

7.2.3 Others

7.2.3.1 3D Stacked BSI

7.2.3.2 3D Hybrid Stacked

7.3 Others (sCMOS)

8 Market, By Specification (Page No. - 74)

8.1 Introduction

8.2 Market, By Processing Type

8.2.1 2D Image Sensor

8.2.2 3D Image Sensor

8.3 Market, By Spectrum

8.3.1 Visible Spectrum

8.3.2 Non-Visible Spectrum

8.3.2.1 Infrared Invisible Spectrum

8.3.2.2 X-Ray Light

8.4 Market, By Array Type

8.4.1 Linear Image Sensor

8.4.2 Area Image Sensor

9 Market Analysis, By Application (Page No. - 85)

9.1 Introduction

9.2 Aerospace

9.3 Automotive

9.4 Consumer Electronics

9.4.1 Smartphone

9.4.2 Tablet Pc

9.4.3 Camera

9.4.4 Wearable Electronics

9.4.5 Others

9.5 Healthcare

9.6 Industrial

9.7 Entertainment

9.8 Security & Surveillance

9.9 Others

10 Market Analysis, By Wafer and Sensor Size (Page No. - 120)

10.1 Market By Wafer Size

10.1.1 Introduction

10.1.2 200 Mm

10.1.3 300 Mm

10.1.4 Others

10.2 Market, By Sensor Size

10.2.1 Introduction

10.2.2 Medium Format

10.2.3 Full Frame

10.2.4 APS-H and APS-C

10.2.5 4/3 Inch

10.2.6 1 Inch and Below

11 Market, By Region (Page No. - 126)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 Rest of the World

12 Competitive Landscape (Page No. - 144)

12.1 Overview

12.2 Market Share Analysis: Image Sensor Market

12.3 Competitive Situation and Trends

12.3.1 New Product Developments

12.3.2 Agreements and Contracts

12.3.3 Acquisitions and Expansions

13 Company Profiles (Page No. - 151)

13.1 Introduction

13.2 Omnivision Technologies Inc.

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 MnM View

13.2.4.1 Key Strategy

13.2.4.2 SWOT Analysis

13.3 Samsung Electronics Co., Ltd

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 Recent Developments

13.3.4 MnM View

13.3.4.1 Key Strategy

13.3.4.2 SWOT Analysis

13.4 Sharp Corporation

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 Recent Developments

13.4.4 MnM View

13.4.4.1 Key Strategy

13.4.4.2 SWOT Analysis

13.5 SK Hynix Inc.

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 Recent Developments

13.5.4 MnM View

13.5.4.1 Key Strategy

13.5.4.2 SWOT Analysis

13.6 Sony Corporation

13.6.1 Business Overview

13.6.2 Products Offered

13.6.3 Recent Developments

13.6.4 MnM View

13.6.4.1 Key Strategy

13.6.4.2 SWOT Analysis

13.7 CMOSis N.V.

13.7.1 Business Overview

13.7.2 Products Offered

13.7.3 Recent Developments

13.8 E2V Technologies PLC.

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 Recent Developments

13.8.4 MnM View

13.8.4.1 Key Strategy

13.9 Galaxycore Inc.

13.9.1 Business Overview

13.9.2 Products Offered

13.9.3 Recent Developments

13.10 On Semiconductor Corporation

13.10.1 Business Overview

13.10.2 Products Offered

13.10.3 Recent Developments

13.11 Pixart Imaging Inc.

13.11.1 Business Overview

13.11.2 Products Offered

13.11.3 Recent Developments

13.12 Panasonic Corporation

13.12.1 Business Overview

13.12.2 Products Offered

13.12.3 Recent Developments

13.12.4 MnM View

13.12.4.1 Key Strategy

13.13 Stmicroelectronics N.V.

13.13.1 Business Overview

13.13.2 Products Offered

13.13.3 Recent Developments

13.14 Teledyne Technologies, Inc.

13.14.1 Business Overview

13.14.2 Products Offered

13.14.3 Recent Developments

13.15 Toshiba Corporation

13.15.1 Business Overview

13.15.2 Products Offered

13.15.3 Recent Developments

13.16 Taiwan Semiconductor Manufacturing Co., Ltd.

13.16.1 Business Overview

13.16.2 Products Offered

13.16.3 Recent Developments

14 Appendix (Page No. - 190)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT : Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (79 Tables)

Table 1 CMOS Image Sensor Market Size, 2013–2020 (USD Million)

Table 2 Market Size, By Technology, 2013–2020 (USD Million)

Table 3 Market, By Technology

Table 4 Market, By Application

Table 5 Market, By Specification

Table 6 Market, By Wafer & Sensor Size

Table 7 Investments in Automotive Sector By Major Players Expected to Boost the Demand

Table 8 Shortage of CMOS Image Sensors to Vendors in Asia-Pacific Limits the Growth of This Market

Table 9 CMOS Image Sensor Expected to Have A Large Application in 3D Image Sensing

Table 10 The Reducing Image Sensor Chip Size Leads to Loss of Pixel Size Acts as A Challenge is Acting as Major Challenges

Table 11 Mergers and Acquisitions - CMOS Image Sensor

Table 12 CMOS Image Sensor Market Size, By Technology, 2013–2020 (USD Million)

Table 13 Market Size, By Type, 2013–2020 (USD Million)

Table 14 Market Size, By Application, 2013–2020 (USD Million)

Table 15 Market Size, By Region, 2013–2020 (USD Million)

Table 16 Other Image Sensor Market Size, By Application, 2013–2020 (USD Million)

Table 17 Other Image Sensor Market Size, By Region, 2013–2020 (USD Million)

Table 18 CMOS Image Sensor Market Size, By Processing Type, 2013–2020 (USD Million)

Table 19 2D Image Sensor Market Size, By Application, 2013–2020 (USD Million)

Table 20 3D Image Sensor Market Size, By Application, 2013–2020 (USD Million)

Table 21 CMOS Image Sensor Market Size, By Spectrum Type, 2013–2020 (USD Million)

Table 22 Visible Spectrum: CMOS Image Sensor Market Size, By Application, 2013–2020 (USD Million)

Table 23 Non-Visible Spectrum: CMOS Image Sensor Market Size, By Application, 2013–2020 (USD Million)

Table 24 CMOS Image Sensor Market Size, By Array Type, 2013–2020 (USD Million)

Table 25 Market Size, By Application, 2013–2020 (USD Million)

Table 26 Aerospace : CMOS Image Sensor Market Size, By Technology, 2013–2020 (USD Million)

Table 27 Aerospace : Market Size, By Image Processing Type, 2013–2020 (USD Million)

Table 28 Aerospace : Market Size, By Spectrum, 2013–2020 (USD Million)

Table 29 Aerospace : Market Size, By Region, 2013–2020 (USD Million)

Table 30 Automotive : CMOS Image Sensor Market Size, By Pixel Resolution, 2013–2020 (USD Million)

Table 31 Automotive : Market Size, By Technology, 2013–2020 (USD Million)

Table 32 Automotive : Market Size, By Image Processing Type, 2013–2020 (USD Million)

Table 33 Automotive : Market Size, By Spectrum, 2013–2020 (USD Million)

Table 34 Automotive : Market Size, By Region, 2013–2020 (USD Million)

Table 35 Consumer Electronics: CMOS Image Sensor Market Size, By Pixel Resolution, 2013–2020 (USD Million)

Table 36 Market Size, By Consumer Electronics Application, 2013–2020 (USD Million)

Table 37 Consumer Electronics: CMOS Image Sensor Market Size, By Technology, 2013–2020 (USD Million)

Table 38 Consumer Electronics: Market Size, By Image Processing Type, 2013–2020 (USD Million)

Table 39 Consumer Electronics: Market Size, By Spectrum, 2013–2020 (USD Million)

Table 40 Consumer Electronics: Market, By Region, 2013–2020 (USD Million)

Table 41 Healthcare: CMOS Image Sensor Market Size, By Application, 2013–2020 (USD Million)

Table 42 Healthcare: Market Size, By Technology, 2013–2020 (USD Million)

Table 43 Healthcare: Market Size, By Image Processing Type, 2013–2020 (USD Million)

Table 44 Healthcare: Market Size, By Spectrum, 2013–2020 (USD Million)

Table 45 Healthcare: Market Size, By Region, 2013–2020 (USD Million)

Table 46 Industrial: CMOS Image Sensor Market Size, By Pixel Resolution, 2013–2020 (USD Million)

Table 47 Industrial: Market Size, By Technology, 2013–2020 (USD Million)

Table 48 Industrial: Market Size, By Image Processing Type, 2013–2020 (USD Million)

Table 49 Industrial: Market Size, By Spectrum, 2013–2020 (USD Million)

Table 50 Industrial: Market Size, By Region, 2013–2020 (USD Million)

Table 51 Entertainment : CMOS Image Sensor Market Size, By Technology, 2013–2020 (USD Million)

Table 52 Entertainment : Market Size, By Image Processing Type, 2013–2020 (USD Million)

Table 53 Entertainment : Market Size, By Spectrum, 2013–2020 (USD Million)

Table 54 Entertainment : Market Size, By Region, 2013–2020 (USD Million)

Table 55 Security & Surveillance: CMOS Image Sensor Market Size , By Pixel Resolution, 2013–2020 (USD Million)

Table 56 Security & Surveillance: Market Size, By Technology, 2013–2020 (USD Million)

Table 57 Security & Surveillance: Market Size, By Image Processing Type, 2013–2020 (USD Million)

Table 58 Security & Surveillance: Market Size, By Spectrum, 2013–2020 (USD Million)

Table 59 Security & Surveillance : Market Size, By Region, 2013–2020 (USD Million)

Table 60 Others: CMOS Image Sensor Market Size, By Technology, 2013–2020 (USD Million)

Table 61 Others: Market Size, By Image Processing Type, 2013–2020 (USD Million)

Table 62 Others: Market Size, By Spectrum, 2013–2020 (USD Million)

Table 63 Others: Market Size, By Region, 2013–2020 (USD Million)

Table 64 CMOS Image Sensor Market Size, By Region, 2013–2020 (USD Million)

Table 65 North America: CMOS Image Sensor Market Size, By Technology, 2013–2020 (USD Million)

Table 66 North America: Market Size, By Application, 2013–2020 (USD Million)

Table 67 North America: Market Size, By Country, 2013–2020 (USD Million)

Table 68 Europe: CMOS Image Sensor Market Size, By Technology, 2013–2020 (USD Million)

Table 69 Europe: Market Size, By Application, 2013–2020 (USD Million)

Table 70 Europe: Market Size, By Country, 2013–2020 (USD Million)

Table 71 APAC : CMOS Image Sensor Market Size, By Technology, 2013–2020 (USD Million)

Table 72 APAC : Market Size, By Application, 2013–2020 (USD Million)

Table 73 APAC : Market Size, By Country, 2013–2020 (USD Million)

Table 74 RoW: CMOS Image Sensor Market Size, By Technology, 2013–2020 (USD Million)

Table 75 RoW: Market Size, By Application, 2013–2020 (USD Million)

Table 76 RoW: Market Size, By Region, 2013–2020 (USD Million)

Table 77 New Product Developments, 2012–2015

Table 78 Agreements and Contract

Table 79 Acquisitions and Expansions

List of Figures (91 Figures)

Figure 1 Markets Covered

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 CMOS Image Sensor Market Segmentation

Figure 8 CMOS Image Sensor: Market Snapshot (2015 vs 2020): Consumer Electronics Expected to Hold A Large Market Share During the Forecast Period

Figure 9 CMOS Image Sensor Market, By Application (2015)

Figure 10 Market, By Region (2015)

Figure 11 Attractive Growth Opportunities in the Market

Figure 12 Consumer Electronics Expected to Hold the Largest Market Share During the Forecast Period (2015–2020)

Figure 13 Asia-Pacific to Hold the Largest Share of the Market in 2015

Figure 14 U.S. Held the Largest Share of the Market, 2014

Figure 15 BSI Expected to Hold the Largest Share of the CMOS Image Sensor Market By 2020

Figure 16 3D CMOS Image Sensor Market Expected to Grow at A High CAGR Between 2015 and 2020

Figure 17 Evolution of CMOS Image Sensor

Figure 18 Market, By Region

Figure 19 Demand for CMOS Image Sensor Expected to Increase in the Near Future

Figure 20 Value Chain Analysis: Maximum Value Added During the Design and Manufacturing Stage By CMOS Image Sensor Suppliers

Figure 21 Bargaining Power of Buyers Expected to Have High Impact

Figure 22 Porter’s Five Forces Analysis

Figure 23 Intensity of Competitive Rivalry in CMOS Image Sensor Market

Figure 24 Threat of Substitutes in Market

Figure 25 Bargaining Power of Buyers in Market

Figure 26 Bargaining Power of Suppliers in Market

Figure 27 Threat of New Entrants in Market

Figure 28 New Product Development : the Major Strategy Adopted By Industry Players (2012–2015)

Figure 29 CMOS Expected to Have the Largest Market Size By 2020

Figure 30 Backside Illumination Expected to Grow at Highest CAGR During the Forecast Period

Figure 31 CMOS Image Sensor Applications Expected to Grow at the Highest CAGR in Automotive Sector

Figure 32 CMOS Image Sensor Market in APAC Expected to Grow at Highest CAGR Between 2015 and 2020

Figure 33 Other Image Sensor Expected to Grow in Automotive Sector During the Forecast Period

Figure 34 Other Image Sensors Expected to Have High Growth Potential in Asia-Pacific

Figure 35 2D CMOS Image Sensor Expected to Grow at A High CAGR in Automotive Sector

Figure 36 Non-Visible Spectrum Expected to Grow at A Highest CAGR During Forecasted Period

Figure 37 Automotive Segment for Non-Visible Spectrum Expected to Grow at A High CAGR Between 2015 and 2020

Figure 38 Linear Image Sensor to Lead the CMOS Image Sensor Market

Figure 39 Market Scope of CMOS Image Sensor

Figure 40 Consumer Electronics Sector Expected to Have the Largest Market Size By 2020

Figure 41 Market for 2D CMOS Image Sensor Expected to Grow With Large Market Size

Figure 42 Features of CMOS Image Sensor in Automotive Application

Figure 43 Market for Automotive in CMOS Image Sensor Expected to Grow With Large Market Size

Figure 44 Non-Visible Spectrum in the Automotive Sector Expected to Witness High Growth During the Forecast Period

Figure 45 Smartphones Expected to Have A Large Market Size By 2020

Figure 46 2D Image Sensor Expected to Lead the CMOS Image Sensor Market Between 2015 and 2020

Figure 47 Market for the Healthcare Sector in Endoscopy Expected to Grow at the Highest CAGR Between 2015 and 2020

Figure 48 Market for CMOS Image Sensor in Industrial Sector Expected to Grow With A Largest Market Share

Figure 49 North America Expected to Have A Large Market Size By 2020

Figure 50 Market for 3D Image Sensor in Entertainment Sector to Grow at the Highest CAGR Between 2015 and 2020

Figure 51 CMOS Image Sensor Held A Large Share of the Market in Security & Surveillance Sector

Figure 52 CMOS Image Sensor Market in Security & Surveillance Expected to Hold A Large Share of the Asia-Pacific Market By 2020

Figure 53 CMOS Technology Expected to Hold the Major Market Share of Other Applications of CMOS Image Sensor

Figure 54 North America Expected to Hold the Largest Market Size By 2020

Figure 55 CMOS Image Sensor Market, By Wafer Size

Figure 56 Market, By Sensor Size

Figure 57 Geographic Snapshot – Global CMOS Image Sensor Market, By Geography

Figure 58 APAC Market Expected to Grow at A High Rate Between 2015 and 2020

Figure 59 North America Snapshot (2014–2020): Demand Likely to Be Driven By Automotive Application in the Market

Figure 60 CMOS Image Sensor Market in Automotive Expected to Grow at the Highest CAGR Between 2015 and 2020

Figure 61 U.S. Market for CMOS Image Sensor Expected to Grow at A High Rate in North America

Figure 62 Automotive Application Expected to Have High Growth Rate During Forecasted Period

Figure 63 Asia-Pacific Image Sensor Market Snapshot: India Expected to Be the Most Lucrative Market

Figure 64 Automotive Application Expected to Grow at the Highest CAGR in APAC

Figure 65 India Expected to Grow at A High Rate in Market

Figure 66 Middle East Market for Image Sensor Expected to Grow at A High Rate in RoW

Figure 67 Companies Adopted New Product Development as the Key Growth Strategy Between 2012 and 2015

Figure 68 CMOS Image Sensor Market Share, By Key Player, 2014

Figure 69 Market Evolution Framework: New Product Development Fueled Growth in Market

Figure 70 Battle for Market Share: New Product Development—The Key Strategy

Figure 71 Geographic Revenue Mix of Top 5 Market Players (2014)

Figure 72 Omnivision Technology Inc.: Company Snapshot

Figure 73 Omnivision Technology Inc.: SWOT Analysis

Figure 74 Samsung Electronics Co., Ltd.: Company Snapshot

Figure 75 Samsung Electronics Co., Ltd: SWOT Analysis

Figure 76 Sharp Corporation: Company Snapshot

Figure 77 Sharp Corporation: SWOT Analysis

Figure 78 SK Hynix Inc.: Company Snapshot

Figure 79 SK Hynix Inc.: SWOT Analysis

Figure 80 Sony Corporation: Company Snapshot

Figure 81 Sony Corporation: SWOT Analysis

Figure 82 CMOSis N.V.: Company Snapshot

Figure 83 E2V Technologies PLC.: Company Snapshot

Figure 84 Galaxycore Inc.: Company Snapshot

Figure 85 On Semiconductor Corporation: Company Snapshot

Figure 86 Pixart Imaging Inc.: Company Snapshot

Figure 87 Panasonic Corporation: Company Snapshot

Figure 88 Stmicroelectronics N.V.: Company Snapshot

Figure 89 Teledyne Technologies, Inc: Company Snapshot

Figure 90 Toshiba Corporation: Company Snapshot

Figure 91 Taiwan Semiconductor Manufacturing Co., Ltd.: Company Snapshot

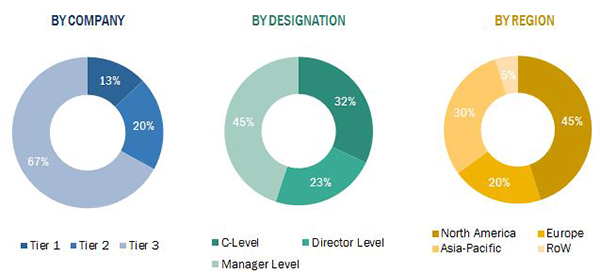

The research methodology used to estimate and forecast the market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global CMOS image sensor market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments.

To know about the assumptions considered for the study, download the pdf brochure

The stakeholders of this report include foundry players, CMOS image sensor developers, ODM and OEM technology solution providers, research organizations, technology investors, technology standards organizations, associations, forums, and alliances related to CMOS image sensor, government bodies such as regulating authorities and policy makers, and investors.

The target audience for the report includes key players such as OmniVision Technologies Inc. (U.S), Samsung Electronics Co., Ltd. (South Korea), Sharp Corporation (Japan), SK Hynix Inc. (South Korea), and Sony Corporation (Japan), CMOSIS N.V. (Belgium), e2v technologies plc (U.K.), ON Semiconductor Corporation (U.S.), and Panasonic Corporation (Japan). Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments.

Scope of the report:

This research report categorizes the global CMOS image sensor market on the basis of technology, specification, wafer & sensor size, application, and region.

On the basis of technology:

The CMOS image sensor market has been segmented on the basis of technology into CMOS image sensor technology and other image sensor. The other image sensor technology includes a combination of CMOS and CCD, known as hybrid or sCMOS.

On the basis of specification:

The CMOS image sensor market has been segmented on the basis of specification into image processing type, spectrum, and array type. The image processing type has been subsegmented into 2D image sensor and 3D image sensor. The market on the basis of spectrum includes visible spectrum and non-visible spectrum. The market segmented on the basis of array type includes linear image spectrum and area image sensor.

On the basis of wafer and sensor size:

The CMOS image sensor market has been segmented on the basis of wafer and sensor size. The segmentation on the basis of wafer size includes 200mm, 300mm, and others. Other wafer sizes include those below 200mm and above 300mm. The sensor size segmentation includes medium format, full frame, APS-H and APS-C, 4/3inch, and 1inch and below. Only qualitative data for wafer and sensor size has given in the report.

On the basis of application:

The CMOS image sensor market has been segmented on the basis of application into aerospace, automotive, consumer electronics, healthcare, industrial, entertainment, security & surveillance, and others which include motion capture and barcode and document scanners.

On the basis of Region:

The global CMOS image sensor market has been segmented on the basis of region into four geographies, namely, the Americas, Europe, Asia-Pacific, and Rest of the World along with their respective countries.

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in CMOS Image Sensor Market