Flip Chip Technology Market by Wafer Bumping Process (CU Pillar, Lead-Free), Packaging Technology (2D IC, 2.5D IC, 3D IC), Packaging Type (BGA, PGA, LGA, SIP, CSP), Product (Memory, LED, CPU, GPU, SOC), Application and Geography - Global Forecast to 2022

The flip chip technology market is expected to grow from USD 19.01 Billion in 2015 to USD 31.27 Billion by 2022, at a CAGR of 7.1% between 2016 and 2022. The report aims at estimating the size and future growth potential of the flip chip technology market across different segments on the basis of bumping process, packaging technology, packaging type, product, application, and region. Consumer electronics application is expected to be the fastest-growing segment in the flip chip technology market during the forecast period, followed by automotive application.

According to the MarketsandMarkets forecasts, the flip chip technology market is expected to grow from USD 19.01 Billion in 2015 to USD 31.27 Billion by 2022, at a CAGR of 7.1% between 2016 and 2022. The growth of flip chip technology market is mainly attributed to the increasing demand for miniaturization and high performance in electronic devices and strong penetration of the advanced packaging technology in the consumer electronics sector. There has been considerable reduction in the size of the die, with the introduction of flip chip packaging technology, thereby saving the silicon cost. Also the total package size can also be reduced using flip chip technology. The other benefits of flip chip technology include reduction in signal inductance, reduction in power inductance, and higher signal density.

The scope of this report covers the flip chip technology market by bumping process, packaging technology, packaging type, product, application, and region. The copper pillar process is expected to hold the largest market share of the global market, and it is also expected to be the fastest-growing technology to manufacture chips in various applications during the forecast period. The maximum growth of Cu pillars is driven by the need of finer pitches, higher I/O counts, lithography nodes below 28nm, emergence of 2.5D/3D packaging, and increased current density, and thermal dissipation needs.

On the basis of packaging, the market is segmented into FC BGA, FC PGA, FC LGA, FC QFN, FC SiP, and FC CSP. FC LGA led the market in 2015.The market for FC CSP is expected to grow at the highest CAGR during the forecast period. All the CPUs including the application processors utilize flip chip land grid array package type for mounting the ICs on the substrate or external carrier.

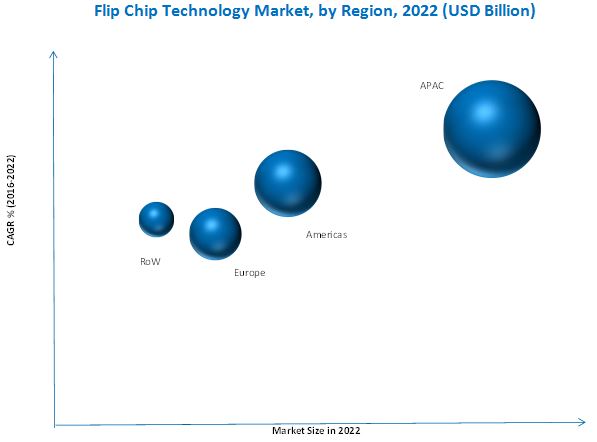

The market in APAC is estimated to grow rapidly between 2016 and 2022. Majorly, the demand for flip chip technology is coming from the consumer electronics sector and particularly from smartphones and tablets. As a result, the presence of major companies in this sector such as Samsung (South Korea), Sony (Japan), and many other are driving the flip chip technology market in the APAC region. Additionally, this region is home to three of the major players in flip chip market ASE group (Taiwan), TSMC (Taiwan), and Samsung (South Korea).

The major challenge for the adoption of flip chip technology is the high cost associated with flip chip packaging solutions, which are generated from wafer fabrication vendors, substrate vendors, and assembly/packaging subcontractors. With the added costs of assembly/packaging, the flip chip package becomes a cost-prohibitive option for the customers. The packaging and assembly houses have taken steps toward providing cost-effective solutions by offering flip chip packaging options on a standard leadframe (FCSOL), quad flat pack no leads (QFN), and standard bis-maleimide triazine resin substrates

Major players in this market are Samsung (South Korea), Intel (U.S.), GlobalFoundries (U.S.), UMC (Taiwan), ASE, Inc. (Taiwan), Amkor Technology (U.S.), STATS ChipPAC (Singapore), Powertech Technology (Taiwan), and STMicroelectronics (Switzerland) among others. These players adopt various strategies such as partnerships, agreements, mergers and acquisitions, and new product developments to achieve growth in the global flip chip technology market. Amkor Technology, which is a market leader in the flip chip technology, has entered into a partnership with Electronics Industry Citizenship Coalition (EICC) to design and develop several package layouts and technologies, including the Package-on-Package (‘PoP’) platform with Through-Mold Via (‘TMV’) technology, fusion quad, flip chip ball grid array (FCBGA), multi-chip modules (MCM) with a silicon interposer placed between the module chips and substrate, copper pillar bumping, and fine pitch copper pillar flip chip packaging technologies. The company has merged with Toshiba’s Malaysian Semiconductor Packaging (Japan) to develop a new research technology in advance semiconductor packaging.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Market Share Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Global Market

4.2 Flip Chip Technology Market Size, By Packaging Type, 2016–2022

4.3 Market Size, By Wafer Bumping Process, 2016–2022

4.4 Market Size, By Packaging Technology, 2016–2022

4.5 Market Size, By Product, 2016–2022

4.6 Market Size, By Application, 2016–2022

4.7 Market Size, By Geography

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Flip Chip Technology Market, By Wafer Bumping Process

5.2.2 Market, By Packaging Technology

5.2.3 Market, By Packaging Type

5.2.4 Market, By Product

5.2.5 Market, By Application

5.2.6 Geographic Analysis

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Miniaturization and High-Performing Electronic Devices

5.3.1.2 Penetration in the Consumer Electronics Sub Segment

5.3.2 Restraints

5.3.2.1 Reliability Challenges

5.3.3 Opportunities

5.3.3.1 Growth in the IC Industry

5.3.4 Challenges

5.3.4.1 High Cost Associated With Flip Chip Packaging Solutions

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Flip Chip Technology Market, By Wafer Bumping Process (Page No. - 54)

7.1 Introduction

7.2 Copper (CU) Pillar

7.2.1 Benefits of Copper Pillar Bumping Process Over Other Wafer Bumping Processes

7.3 Lead (PB)-Free

7.4 Tin-Lead (SN-PB) Eutectic Solder

7.5 Gold-Stud+ Plated Solder

8 Flip Chip Technology Market, By Packaging Technology (Page No. - 59)

8.1 Introduction

8.2 2D IC Packaging Technology

8.3 2.5D IC Packaging Technology

8.3.1 Major Benefits of 2.5D IC Packaging Over the Traditional 2D IC Packaging Technology

8.4 3D IC Packaging Technology

8.5 Comparison Between 2D, 2.5D, 3D IC Packaging Technology

9 Flip Chip Technology Market, By Packaging Type (Page No. - 67)

9.1 Introduction

9.2 FC BGA (Flip Chip Ball Grid Array)

9.3 FC PGA (Flip Chip Pin Grid Array)

9.4 FC LGA (Flip Chip Land Grid Array)

9.5 FC QFN (Flip Chip Quad Flat No-Lead)

9.6 FC SIP (Flip Chip System-In-Package)

9.7 FC CSP (Flip Chip-Chip-Scale Package)

10 Flip Chip Technology Market, By Product (Page No. - 74)

10.1 Introduction

10.2 Memory

10.3 Light-Emitting Diode (LED)

10.4 CMOS Image Sensor

10.5 RF, Analog, Mixed Signal, and Power IC

10.6 CPU

10.7 GPU

10.8 SOC

11 Flip Chip Technology Market, By Application (Page No. - 84)

11.1 Introduction

11.2 Consumer Electronics

11.2.1 Smartphones & Tablets

11.2.2 Laptops

11.2.3 Desktop PC

11.2.4 Set-Top Box/Hybrid Set Top Box

11.2.5 Game Stations

11.3 Telecommunications

11.3.1 Network Equipment

11.3.2 Base Stations

11.3.3 Servers

11.4 Automotive

11.4.1 ECU

11.4.2 Sensors

11.4.3 Power Modules

11.4.4 Others

11.5 Industrial

11.5.1 Industrial Wireless Sensor Network

11.5.2 Identification and Monitoring

11.5.3 Others

11.6 Medical Devices

11.6.1 Patient Monitoring Devices

11.6.2 Smart Sensor System

11.6.3 Others

11.7 Smart Technologies

11.7.1 Military & Aerospace

11.7.2 Radar Equipment

11.7.3 Satellite Communication Devices

11.7.4 Others

12 Geographic Analysis (Page No. - 101)

12.1 Introduction

12.2 Americas

12.2.1 North America

12.2.1.1 U.S.

12.2.1.2 Canada

12.2.1.3 Brazil

12.2.1.4 Argentina

12.2.1.5 Others

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 U.K.

12.3.4 Others

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 Taiwan

12.4.4 South Korea

12.4.5 Others

12.5 Rest of the World (RoW)

12.5.1 Middle East & Africa

12.5.2 Russia

13 Competitive Landscape (Page No. - 118)

13.1 Introduction

13.2 Market Ranking Analysis, 2015

13.3 Competitive Situations and Trends

13.3.1 Collaborations

13.3.2 Acquisitions, Joint Ventures, and Agreements

13.3.3 Others

14 Company Profiles (Page No. - 123)

(Overview, Products and Services, Financials, Strategy & Development)*

14.1 Introduction

14.2 Taiwan Semiconductor Manufacturing Company Limited (TSMC Ltd.)

14.3 Samsung Electronics Co., Ltd.

14.4 Intel Corp.

14.5 United Microelectronics Corp.

14.6 ASE Group

14.7 Amkor Technology

14.8 Siliconware Precision Industries Co., Ltd.

14.9 Powertech Technology, Inc.

14.10 Stats Chippac Ltd.

14.11 Jiangsu Changjiang Electronics Technology Co., Ltd

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 149)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

List of Tables (66 Tables)

Table 1 Analysis of Market Drivers

Table 2 Analysis of Market Restraints

Table 3 Analysis of Market Opportunities

Table 4 Analysis of Market Challenges

Table 5 Flip Chip Technology Market Size, By Wafer Bumping Process, 2013–2022 (USD Billion)

Table 6 Market Size, By Packaging Technology, 2013–2022 (USD Billion)

Table 7 Market Size, By Packaging Type, 2013–2022 (USD Million)

Table 8 Market Size for FC BGA, By Product, 2013–2022 (USD Million)

Table 9 Market Size for FC PGA, By Product, 2013–2022 (USD Million)

Table 10 Flip Chip Technology Market Size for FC LGA, By Product, 2013–2022 (USD Million)

Table 11 Market Size for FC QFN, By Product, 2013–2022 (USD Million)

Table 12 Market Size for FC SIP, By Product, 2013–2022 (USD Million)

Table 13 Market Size for FC CSP, By Product, 2013–2022 (USD Million)

Table 14 Market Size, By Product, 2013–2022 (USD Million)

Table 15 Market Size for Memory, By Packaging Technology, 2013–2022 (USD Million)

Table 16 Flip Chip Technology Market Size for Memory, By Packaging Type, 2013–2022 (USD Million)

Table 17 Market Size for LED, By Packaging Technology, 2013–2022 (USD Million)

Table 18 Market Size for LED, By Packaging Type, 2013–2022 (USD Million)

Table 19 Market Size for CMOS Image Sensor, By Packaging Technology, 2013–2022 (USD Million)

Table 20 Market Size for CMOS Image Sensor, By Packaging Type, 2013–2022 (USD Million)

Table 21 Market Size for RF, Analog, Mixed Signal, and Power IC, By Packaging Technology, 2013–2022 (USD Million)

Table 22 Flip Chip Technology Market Size for RF, Analog, Mixed Signal, and Power IC, By Packaging Type, 2013–2022 (USD Million)

Table 23 Market Size for CPU, By Packaging Technology, 2013–2022 (USD Million)

Table 24 Market Size for CPU, By Packaging Type, 2013–2022 (USD Million)

Table 25 Market Size for GPU, By Packaging Technology, 2013–2022 (USD Million)

Table 26 Market Size for GPU, By Packaging Type, 2013–2022 (USD Million)

Table 27 Market Size for SOC, By Packaging Technology, 2013–2022 (USD Million)

Table 28 Flip Chip Technology Market Size for SOC, By Packaging Type, 2013–2022 (USD Million)

Table 29 Market Size, By Application, 2013–2022 (USD Million)

Table 30 Market Size, By Consumer Electronics, 2013–2022 (USD Million)

Table 31 Market Size for Consumer Electronics, By Region, 2013–2022 (USD Million)

Table 32 Americas: Flip Chip Technology Market Size, By Region, 2013–2022 (USD Million)

Table 33 Market Size, By Telecommunication Application, 2013–2022 (USD Million)

Table 34 Market Size for Telecommunication, By Region, 2013–2022 (USD Million)

Table 35 Americas: Flip Chip Technology Market Size, By Region, 2013–2022 (USD Million)

Table 36 Market Size, By Automotive Application, 2013–2022 (USD Million)

Table 37 Market Size for Automotive, By Region, 2013–2022 (USD Million)

Table 38 Americas: Market Size, By Region, 2013–2022 (USD Million)

Table 39 Market Size, By Industrial, 2013-2022 (USD Million)

Table 40 Market Size for Industrial, By Region, 2013–2022 (USD Million)

Table 41 Americas: Flip Chip Technology Market Size, By Region, 2013–2022 (USD Million)

Table 42 Market Size, By Medical Devices, 2013–2022 (USD Million)

Table 43 Market Size for Medical Devices, By Region, 2013–2022 (USD Million)

Table 44 Americas: Market Size, By Region, 2013-2022 (USD Million)

Table 45 Market Size, By Smart Technologies, 2013–2022 (USD Million)

Table 46 Market Size for Smart Technologies, By Region, 2013–2022 (USD Million)

Table 47 Americas: Market Size, By Region, 2013–2022 (USD Million)

Table 48 Global Flip Chip Technology Market Size, By Military and Aerospace Application, 2013–2022 (USD Million)

Table 49 Market Size for Military & Aerospace Application, By Region, 2013–2022 (USD Million)

Table 50 Americas: Market Size for Military & Aerospace Application, By Region, 2013–2022 (USD Million)

Table 51 Market Size, By Region, 2013–2022 (USD Million)

Table 52 Americas: Market Size, By Region, 2013–2022 (USD Million)

Table 53 North America: Market Size, By Country, 2013–2022 (USD Million)

Table 54 South America: Market Size, By Country, 2013–2022 (USD Million)

Table 55 Flip Chip Technology Market Size in Americas, By Application, 2013–2022 (USD Million)

Table 56 Market Size in North America, By Application, 2013–2022 (USD Million)

Table 57 Market Size in South America, By Application, 2013–2022 (USD Million)

Table 58 Europe: Flip Chip Technology Market Size, By Country, 2013–2022 (USD Million)

Table 59 Market Size in Europe, By Application, 2013–2022 (USD Million)

Table 60 Market Size in APAC, By Country, 2013–2022 (USD Million)

Table 61 Market Size in APAC, By Application, 2013–2022 (USD Million)

Table 62 RoW: Market Size, By Region, 2013–2022 (USD Million)

Table 63 Market Size in RoW, By Application, 2013–2022 (USD Million)

Table 64 Most Significant Collaborations in the Market, 2010–2015

Table 65 Most Significant Acquisitions, Joint Ventures, and Agreements in the Market, 2014–2015

Table 66 Most Significant Other Strategies in the Flip Chip Technology Market, 2014–2015

List of Figures (71 Figures)

Figure 1 Flip Chip Technology Market Segmentation

Figure 2 Market: Research Design

Figure 3 Process Flow of Market Size Estimation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Breakdown & Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Flip Chip Technology Market Size, By Packaging Type, 2016–2022

Figure 9 2D IC Packaging Technology to Hold the Largest Market Size in 2016, While the 3D IC Packaging Technology to Grow at the Highest Rate During 2016–2022

Figure 10 Copper (CU) Pillar Bumping Process to Hold Largest Market Size 2016

Figure 11 LED Expected to Grow at the Highest Rate During Forecast Period

Figure 12 Consumer Electronics Application to Hold Largest Market Size in 2016 and Also Grow at the Highest Rate During the Forecast Period

Figure 13 APAC Held the Largest Market in 2015 and Expected to Grow at the Highest Rate During the Forecast Period

Figure 14 Increasing Demand for Miniaturization Along With High Performance in Electronics Devices to Spur the Market Growth

Figure 15 The Market for FC CSP to Grow at A High Rate During the Forecast Period

Figure 16 Copper (CU) Pillar Process to Grow at the Highest Rate During the Forecast Period

Figure 17 The Market for 3D IC Packaging Technology to Grow at the Highest Rate During the Forecast Period

Figure 18 The Market for LED of Flip Chip to Grow at the Highest Rate During the Forecast Period

Figure 19 The Market for Consumer Electronics Segment to Grow at the Highest Rate During the Forecast Period

Figure 20 The Flip Chip Technology Market in the APAC Expected to Grow at the Highest Rate During Forecast Period

Figure 21 Market, By Geography

Figure 22 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Ecosystem of Flip Chip Technology

Figure 24 Porter’s Five Forces Analysis, 2015

Figure 25 Porter’s Five Forces Analysis, 2015

Figure 26 Flip Chip Technology Market: Threat of New Entrants

Figure 27 Market: Threat of Substitutes

Figure 28 Market: Bargaining Power of Suppliers

Figure 29 Market: Bargaining Power of Buyers

Figure 30 Market: Intensity of Competitive Rivalry

Figure 31 Market, By Wafer Bumping Process

Figure 32 Market for Copper (CU) Pillar Bumping Process Expected to Grow at the Highest Rate

Figure 33 Market, By Packaging Technology

Figure 34 Market for 3D IC Packaging Technology Expected to Grow at the Highest Rate

Figure 35 Illustration of 2D IC Packaging Technology

Figure 36 Illustration of 2.5D IC Packaging Technology

Figure 37 Illustration of 3D IC Packaging Technology

Figure 38 Market, By Packaging Type

Figure 39 Market for FC CSP Packaging Type is Expected to Grow at the Highest Rate

Figure 40 Market, By Product

Figure 41 Market for LED Expected to Grow at the Highest Rate

Figure 42 Market, By Application

Figure 43 Market for Consumer Electronics Application Expected to Grow at the Highest Rate

Figure 44 Geographic Snapshot, 2015

Figure 45 The Flip Chip Technology Market in the APAC Region Expected to Grow at the Highest Rate

Figure 46 Americas Snapshot

Figure 47 Market Size in Brazil, 2013–2022 (USD Million)

Figure 48 Market Size in Argentina, 2013–2022 (USD Million)

Figure 49 Market Size in Other Countries, 2013–2022 (USD Million)

Figure 50 Europe Snapshot

Figure 51 APAC Snapshot

Figure 52 Companies Adopted Collaborations as the Key Growth Strategy Between 2010 and 2015

Figure 53 Market Ranking Analysis for the Flip Chip Technology Market, 2015

Figure 54 Market Evaluation Framework

Figure 55 Battle for Market Share: Collaboration Was the Key Strategy

Figure 56 Geography Revenue Mix for Top Five Players

Figure 57 TSMC Ltd.: Company Snapshot

Figure 58 TSMC Ltd.: SWOT Analysis

Figure 59 Samsung Electronics Co., Ltd.: Company Snapshot

Figure 60 Samsung Electronics Co., Ltd.: SWOT Analysis

Figure 61 Intel Corp.: Company Snapshot

Figure 62 Intel Corp.: SWOT Analysis

Figure 63 United Microelectronics Corp.: Company Snapshot

Figure 64 ASE Group.: Company Snapshot

Figure 65 ASE Group: SWOT Analysis

Figure 66 Amkor Technology: Company Snapshot

Figure 67 Amkor Technology: SWOT Analysis

Figure 68 Spil Co., Ltd. : Company Snapshot

Figure 69 Powertech Technology, Inc.: Company Snapshot

Figure 70 Stats Chippac Ltd.: Company Snapshot

Figure 71 Jiangsu Changjiang Electronics Technology Co., Ltd.: Company Snapshot

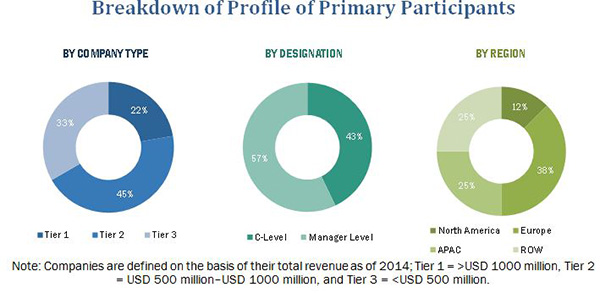

The research methodology used to estimate and forecast the flip chip technology market begins with capturing data on key vendor revenues through the secondary research. Vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall size of the global flip chip technology market from the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and sub-segments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary interviews is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights regarding ecosystem of this market such as product manufacturers and suppliers, OEMs, OSATs, system integrators, middleware and firmware providers, suppliers and distributors, This study answers several questions for stakeholders, primarily which market segments to focus on in the next six years for prioritizing efforts and investments.

Key Target audience:

- Wafer manufacturers

- Raw material and manufacturing equipment suppliers

- Chip manufacturers

- System integrators

- Device manufacturers

- Foundry players

- Distributors and retailers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

- OSATs

Scope of the Report:

The research report segments the flip chip technology market to following sub-segments:

By Wafer Bumping Process:

- Copper (Cu) pillar

- Lead-free

- Tin/lead eutectic solder

- Gold stud+ plated solder

By Packaging Technology:

- 2D IC

- 2.5D IC

- 3D IC

By Packaging Type:

- FC BGA

- FC PGA

- FC LGA

- FC QFN

- FC SiP

- FC CSP

By Product:

- Memory

- LED

- CMOS Image sensor

- RF, analog, mixed signal, and power IC

- CPU

- SoC

- GPU

By Application:

- Consumer electronics

- Telecommunication

- Automotive

- Industrial sector

- Medical devices

- Smart technologies

- Military & aerospace

By Region:

- Americas

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Flip Chip Technology Market