Biometric Identification Market for ICE, EV, & Autonomous Vehicles, by Authentication Process (Fingerprint, Voice, Iris, Facial, Gesture, Multimodal), Sensor (CMOS, Optical, Retinal), Processing Component, Application, Wearable, and Region - Forecast to 2022

[200 Pages Report] The biometric identification market for automotive is projected to grow from USD 6.94 Billion in 2017 to USD 21.72 Billion by 2022, at a CAGR of 25.61% during the forecast period. The key factors driving the global market are increasing demand for vehicle security, safety, and comfort. The future growth of biometric identification systems would be fueled by the development of autonomous cars and integrated mobility solutions, which have personalized access and payment systems.

Years considered for this report:

- 2016 – Base Year

- 2017 – Estimated Year

- 2019 & 2022 – Projected Years

Objectives of the Study:

- To define and segment the global market sizing and forecast (2017–2022), in terms of volume (‘000 units) and value (USD million)

- To segment the country-level market for biometric identification and forecast the market size, by value and volume, based on identification process (fingerprint recognition, voice recognition, iris recognition, and facial recognition)

- To segment the global market, by volume, for autonomous cars

- To segment the ICE and alternate fuel vehicle market for biometric identification and forecast the market size, by value and volume, based on vehicle type (passenger cars, Battery Electric Vehicles (BEV), Hybrid Electric Vehicles (HEV), and Plug-In Hybrid Electric Vehicles (PHEV)

- To segment the market for biometric identification and forecast the market size, by value and volume, based on characteristics, components and sensor type, namely, metal oxide semiconductor (CMOS)/ image sensors, optical/fingerprint & palm sensors, iris/retinal recognition sensors, microphone/ voice sensors, and signature/keystrokes sensors

- To segment the market, by volume, for biometric wearables during the forecast period

- To understand the market for biometric identification, by volume, for commercial vehicles in fleet management services

- To segment the market for biometric identification and forecast the market size, by volume, based on application, namely, biometric vehicle access system, engine start-stop system, driver fatigue & drowsiness monitoring system, memory steering, memory seats, and infotainment system

The research methodology used in the report involves various secondary sources including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of this market. The bottom-up approach has been used to estimate the market size, by volume. The market size, by volume, is multiplied by the average OE price (AOP) of biometric units required for each application and vehicle type to calculate the market in terms of value. The summation of the country-wise market gives the regional market, and further summation of the regional market provides the global market. Biometric manufacturer associations such as the European Association for Biometrics (EAB), International Biometric Industry Association (IBIA), International Association for Biometrics (IAFB), and Swedish National Biometric Association (SNBA), among others were consulted for gathering the information.

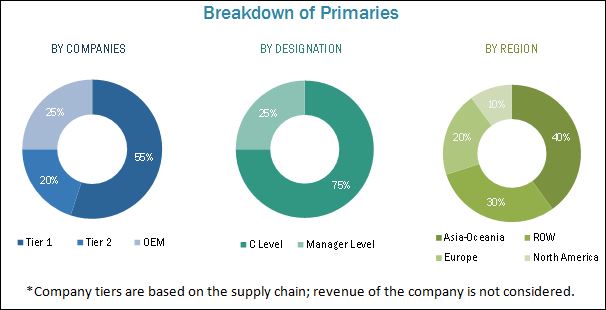

The figure below shows the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

- Biometrics technology suppliers

- Biometric system/component manufacturers

- Dealers and distributors of automotive biometrics components and systems

- Industry associations

- Raw material suppliers

- Automobile organizations/associations

- Traders and distributors of biometric vehicle access systems

- Automotive original equipment manufacturers (OEM)

“The study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years (depends on a range of forecast period) for prioritizing their efforts and investments.”

Scope of the Report

-

Global Market for Passenger Cars, By Technology & Region (Country)

- Fingerprint Recognition

- Voice Recognition

- Iris Recognition

- Facial Recognition

- Gesture Recognition

- Multimodal Identification

-

Global Market for Passenger Cars, By Characteristics, Sensors Type & Components

-

By Physiological Characteristics & Sensor Type

- Metal Oxide Semiconductor (CMOS)/Image Sensors

- Optical/Fingerprint & Palm Sensors

- Iris/Retinal Recognition Sensors

-

By Behavioral Characteristics & Sensor Type

- Microphone/Voice Sensors

- Signature/Keystrokes Sensors

-

By Components

- Processing Units

- Embedded Micro-Computers

- Micro-Chipsets

-

By Physiological Characteristics & Sensor Type

-

Global Market for Passenger Cars, By Application & Region

- Biometric Vehicle Access System

- Engine Start-Stop System

-

Driver Fatigue & Drowsiness Monitoring System

- Eye Tracking/Blink Monitoring

- Facial Expressions/Head Movements

- Heart Rate Monitoring

- Memory Steering

- Memory Seats

- Infotainment System

-

Global Market for Passenger Cars, By Biometric Wearables

- Watches

- Eyeglasses

- Headsets

-

Global Market for Commercial Vehicles, By Fleet Management Services

- Electronic Logging Device (Driver Time Analysis)

-

Driver Monitoring System

- Eye Tracking/Blink Monitoring

- Driver Behavior Monitoring

- Heart Rate Monitoring

- Drowsiness Monitoring

- Others

-

Global Market for Electric Vehicle, By Vehicle Type & Region

-

Electric Vehicle Biometric Identification

- BEV Biometric Identification

- HEV Biometric Identification

- PHEV Biometric Identification

-

Electric Vehicle Biometric Identification

-

Impact Of Autonomous & Semi-Autonomous Cars On Biometric Identification (By Volume)

-

Vehicle Access Biometric Identification For Autonomous Cars & Semi-Autonomous Cars

- Fingerprint Recognition

- Iris Recognition

- Voice Recognition

-

In-Vehicle Biometric Identification For Autonomous Cars & Semi-Autonomous Cars

- Eye Movement Recognition

- Voice/Gesture Recognition

- Vein Recognition

- Butt Biometrics

- Verification Using ECG

-

Vehicle Access Biometric Identification For Autonomous Cars & Semi-Autonomous Cars

Available Customizations

With the given market data, MarketsandMarkets can provide market data for below categories:

- Global Market for Ride Hailing, By Region

- Global Market for Integrated Mobility Solutions, By Region

- Global Market for Future Goods Transport Services, By Region

-

Global Market, By Component & Country

-

Asia-Oceania

- India

- China

- Japan

- South Korea

-

Europe

- Germany

- U.K.

- France

- Spain

-

North America

- U.S.

- Canada

- Mexico

-

RoW

- Brazil

- Russia

-

Asia-Oceania

The biometric identification market for automotive is projected to grow at a CAGR of 25.61% during the forecast period, to reach USD 21.72 Billion by 2022. The market is estimated to grow in the near future owing to factors such as increased demand for vehicle security and passenger comfort. Beyond 2025, the demand for biometric identification system would be driven by the advancements in future mobility solutions such as autonomous cars and their infrastructure, integrated mobility solutions, and goods transport through personalized pods. These future mobility solutions are projected to have personalized access systems, payment gateways, and infotainment.

The study segments the global market by the identification process (fingerprint, voice, iris, facial, gesture, and multimodal recognition system). The fingerprint recognition market is estimated to grow at the highest rate during the forecast period owing to its reliability for authentication or identification and ease of installation. The market for voice recognition is estimated to have the largest market share owing to its use for multiple applications such as navigation and infotainment among others.

The study segments the global market, by application, into biometric vehicle access system, engine start-stop system, driver fatigue & drowsiness monitoring system, memory steering, memory seats, and infotainment system. With the increase in demand for in-vehicle health monitoring and comfort applications, the demand for memory seats is expected to rise. The memory seat market is thus projected to grow at the highest rate during the forecast period. The market for biometric vehicle access is estimated to have the largest market share due to rising concerns for vehicle security.

The market is also segmented by electric vehicle type into battery electric vehicles (BEV), hybrid electric vehicles (HEV), and plug in hybrid electric vehicles (PHEV). Based on characteristics, components, and sensor type, namely CMOS sensors, optical sensors, retinal recognition sensors, and processing components, the biometric component market is calculated.

The market for biometric wearables such as watches, eyeglasses, and headsets has increased owing to their increased demand and in-vehicle applications. Due to the increase in government mandates for installing biometric devices, electronic logging devices and driver monitoring system are considered under the fleet management services. In the case of autonomous and semi-autonomous vehicles, biometric in-vehicle features and features used for vehicle access are mapped.

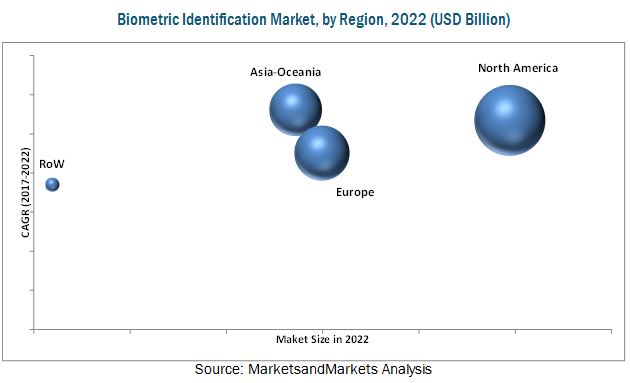

China and India together contribute 35% of the global vehicle production and 34% of the global passenger car production. Also, the demand for luxury vehicles has increased in these countries. Due to this, Asia-Oceania is estimated to be the fastest growing market for biometric identification during the forecast period. The North American region is projected to have the largest market. With the increase in demand for luxury vehicles and an increase in vehicle thefts in the region, there are rising concerns for driver authentication. The market growth in this region is also supported by the presence of a large number of biometric system and component manufacturers.

The major factors hindering the growth of this market in vehicles are the high cost of system or module and potential failure of electronic components used for the biometric system.

Automotive biometric system manufacturers have adopted the strategies of new product development and geographical expansion to gain traction in the automotive biometric identification market. The key market players are Hitachi, Ltd. (Japan), FUJITSU (Japan), Synaptics Incorporated (U.S.), Robert Bosch GmbH (Germany), Continental AG (Germany), and Valeo (France).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Factor Analysis

2.2.1 Demand-Side Analysis

2.2.1.1 Growth in Luxury Vehicle Sales

2.2.1.2 Rising Demand for Hybrid and Electric Vehicles

2.2.2 Supply-Side Analysis

2.2.2.1 Technological Advancements in Biometric Identification Industry Owing to the Increased Focus on Safety & Comfort

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.4 Data Triangulation

2.5 Assumptions & Limitations

2.5.1 Parameters & Assumptions Followed for Market Analysis

2.5.2 Parameters & Limitations for Market Analysis

3 Executive Summary (Page No. - 35)

3.1 Introduction

3.2 Global Market, By Country

3.3 Global Market , By Component

3.4 Global Market , By Application

3.5 Global Market , By Wearable Technology

3.6 Global Market for Electric Vehicles, By Region

3.7 Global Market for Autonomous & Semi-Autonomous Vehicles

3.8 Global Market , By Fleet Management Service

4 Premium Insights (Page No. - 43)

4.1 Opportunities in the Biometric Identification Market

4.2 Global Market, By Identification Type

4.3 Global Market, By Component

4.4 Global Market, By Application

4.5 Global Market, By Electric Vehicle & Region

4.6 Global Market, By Wearable Technology

4.7 Global Market, By Autonomous & Semi-Autonomous Vehicle

4.8 Global Market, By Fleet Management Service

5 Market Overview (Page No. - 48)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Concerns for Vehicle Security & Increased Use of Multifactor Authentication

5.3.1.2 Increased Demand for Premium Segment Vehicles to Boost the Market for Biometric Identification

5.3.1.3 Increase in Legislations Regarding Biometric Identification Systems

5.3.1.4 Increasing Benefits From Insurance Companies for Vehicles Installed With Biometric Systems

5.3.2 Restraints

5.3.2.1 High Cost of Biometric Identification Systems/Modules

5.3.2.2 Potential Failure of Electronic Components Used in Biometric Identification

5.3.3 Opportunities

5.3.3.1 Major Automobile Oems Partnering With Biometric System Manufacturers

5.3.3.2 Advent of Concept Cars and Electric Vehicles in the Automotive Industry

5.3.4 Challenges

5.3.4.1 Increased Connectivity Would Induce Risk of Cyber Attacks

5.3.4.2 Weather Conditions Might Hamper the Functionality of Biometric Systems

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Technical Overview

5.5.1 Evolution

5.5.1.1 Fingerprint Recognition System

5.5.1.2 Facial Recognition System

5.5.1.3 IRIS Recognition System

5.5.1.4 Voice Recognition System

5.5.2 Technology Roadmap: Biometric Identification Systems

5.5.3 Biometric Identification : Technological Characteristics

6 By Identification Process (Page No. - 68)

6.1 Introduction

6.1.1 Fingerprint Recognition System

6.1.2 Voice Recognition System

6.1.3 IRIS Recognition System

6.1.4 Facial Recognition System

6.1.5 Multimodal Identification

6.2 Global Market, By Identification Process

6.3 Global Market, By Region

6.4 Asia-Oceania Market, By Identification Process & Country

6.4.1 Asia-Oceania: Market, By Identification Process

6.4.2 Asia-Oceania: Market, By Country

6.4.2.1 India: Market, By Identification Process

6.4.2.2 China: Market, By Identification Process

6.4.2.3 Japan: Market, By Identification Process

6.4.2.4 South Korea: Market, By Identification Process

6.4.2.5 Asia-Oceania Others: , By Identification Process

6.5 Europe Market, By Identification Process & Country

6.5.1 Europe: Market, By Identification Process

6.5.2 Europe: Market, By Country

6.5.2.1 Germany: Market, By Identification Process

6.5.2.2 U.K.: Market, By Identification Process

6.5.2.3 France: Market, By Identification Process

6.5.2.4 Spain: Market, By Identification Process

6.5.2.5 Europe Others: Market, By Identification Process

6.5.2.6 Europe Others: Market, By Identification Process

6.6 North America Market, By Identification Process & Country

6.6.1 North America: Market, By Identification Process

6.6.2 North America: Market Size, By Country

6.6.2.1 U.S.: Market, By Identification Process

6.6.2.2 Canada: Market, By Identification Process

6.6.2.3 Mexico: Market, By Identification Process

6.7 RoW Market, By Identification Process & Country

6.7.1 RoW: Market, By Identification Process

6.7.2 RoW: Market Size, By Country

6.7.2.1 Russia: Market, By Identification Process

6.7.2.2 Brazil: Market, By Identification Process

6.7.2.3 RoW Others: Market, By Identification Process

7 By Components (Page No. - 103)

7.1 Introduction

7.2 Biometric Identification Components Based on Physiological Characteristics

7.2.1 Complementary Metal Oxide Semiconductor (CMOS)/Image Sensors

7.2.2 Optical/Fingerprint & Palm Sensors

7.2.3 IRIS/Retinal Recognition Sensors

7.3 Biometric Identification Components Based on Behavioral Characteristics

7.3.1 Microphone/Voice Sensors

7.3.2 Signature/ Keystrokes Sensors

7.4 Biometric Identification Sub-Components

7.4.1 Processing Units

7.4.2 Embedded Microcomputers

7.4.3 Microchip Sets

7.5 Market, By Components

7.6 Biometric Identification Components Market, By Region

7.6.1 Image Sensors Market, By Region

7.6.2 Palm Sensors Market, By Region

7.6.3 IRIS Sensors Market, By Region

7.6.4 Voice Sensors Market, By Region

7.6.5 Keystrokes Sensors Market, By Region

7.6.6 Processing Units Market, By Region

7.6.7 Embedded Microcomputers Market, By Region

7.6.8 Microchip Set Market, By Region

8 By Application (Page No. - 118)

8.1 Introduction

8.2 Biometric Identification: Vehicle Security Systems

8.2.1 Biometric Vehicle Access System

8.2.2 Biometric Engine Start-Stop System

8.3 Biometric Identification: Driver Safety Systems

8.3.1 Driver Fatigue & Drowsiness Monitoring System

8.3.1.1 Eye Tracking/Blink Monitoring

8.3.1.2 Facial Expressions/Head Movements

8.3.1.3 Heart Rate Monitoring

8.4 Biometric Identification: Comfort & Luxury Systems

8.4.1 Advanced Steering

8.4.2 Memory Seats

8.4.3 Infotainment

8.5 Market, By Application

8.5.1 Biometric Vehicle Access System Market, By Region

8.5.2 Biometric Engine Start-Stop System Market, By Region

9 Global Market for Electric Vehicle, By Region (Page No. - 127)

9.1 Introduction

9.2 Global Market for Electric Vehicle, By Region

9.3 Electric Vehicle Market, By Vehicle Type

9.3.1 BEV: Market By Region

9.3.2 HEV: Market By Region

9.3.3 Phev: Market By Region

10 By Wearable Technology (Page No. - 133)

10.1 Introduction

10.1.1 Watches

10.1.2 Eyeglasses

10.1.3 Headsets

10.2 Market, By Wearable Technology

10.3 Market for Wearable Technology, By Region

11 By Autonomous & Semi-Autonomous Cars (Page No. - 137)

11.1 Introduction

11.2 Market for Semi-Autonomous Cars, By Identification Process

11.3 Market for Autonomous Cars, By Identification Process

12 Global Market for Commercial Vehicles, By Fleet Management Services (Page No. - 141)

12.1 Introduction

12.2 Market Size for Commercial Vehicles, By Fleet Management Service

12.3 Market Size for Commercial Vehicles, By Driver Monitoring System

13 Competitive Landscape (Page No. - 144)

13.1 Market—Competitive Leadership Mapping

13.1.1 Visionary Leaders

13.1.2 Innovators

13.1.3 Dynamic Differentiators

13.1.4 Emerging Companies

13.2 Strength of Product Portfolio

13.3 Business Strategy Excellence

Top 25 Companies Analyzed for This Study are - Robert Bosch GmbH, FUJITSU, Mitsubishi Electric Corporation, Continental AG, Hitachi, Ltd., DENSO CORPORATION, Valeo, Synaptics Incorporated, Gentex Corporation, HID Global Corporation/ASSA ABLOY AB, Fingerprint Cards AB, Methode Electronics, Nuance Communications, Inc., VOXX International Corp., Visteon Corporation, Ams AG, Safran, Voicebox Technologies Corporation, Sonavation, Inc., Sensory Inc., Techshino Technology, IRITECH, Inc., Bioenable Technologies Pvt. Ltd., BIODIT Ltd.

13.4 Biometric Identification Market: Ranking Analysis, 2016

14 Company Profiles (Page No. - 149)

(Overview, Product Offering, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

14.1 Hitachi, Ltd.

14.2 FUJITSU

14.3 Safran

14.4 Synaptics Incorporated

14.5 Nuance Communications, Inc.

14.6 Methode Electronics

14.7 HID Global Corporation/Assa ABLOY AB

14.8 VOXX International Corp.

14.9 Fingerprint Cards AB

14.10 Voicebox Technologies Corporation

14.11 Robert Bosch GmbH

14.12 Continental AG

14.13 Valeo

*Details on Overview, Product Offering, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 192)

15.1 Primary Insights

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Available Customizations

15.4.1 Global Market for Ride Hailing, By Region

15.4.2 Global Market for Integrated Mobility Solutions, By Region

15.4.3 Global Market for Future Goods Transport Services, By Region

15.4.4 Global Market, By Component & Country

15.4.4.1 Asia-Oceania

15.4.4.1.1 India

15.4.4.1.2 China

15.4.4.1.3 Japan

15.4.4.1.4 South Korea

15.4.4.2 Europe

15.4.4.2.1 Germany

15.4.4.2.2 U.K.

15.4.4.2.3 France

15.4.4.2.4 Spain

15.4.4.3 North America

15.4.4.3.1 U.S.

15.4.4.3.2 Canada

15.4.4.3.3 Mexico

15.4.4.4 RoW

15.4.4.4.1 Brazil

15.4.4.4.2 Russia

15.5 Related Reports

15.6 Author Details

List of Tables (105 Tables)

Table 1 Currency Exchange Rates (Per USD)

Table 2 Luxury Vehicle Sales of Key Manufacturers, India, 2013–2015

Table 3 Luxury Vehicle Sales of Key Manufacturers, China, 2013–2015

Table 4 Government Incentives for Electric Vehicles

Table 5 Change in the Demand for Premium Vehicles, 2015 vs 2016, By Country

Table 6 Luxury Passenger Car Production of Key Manufacturers in China, U.S., Germany, & U.K., 2015–2016

Table 7 Partnerships & Agreements Between Biometric Identification System/Module Manufacturers and Oems

Table 8 Technological Characteristic of Biometric Authentication System

Table 9 Global Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 10 Global Market Size, By Identification Process, 2015-2022 (USD Million)

Table 11 Global Market Size, By Region, 2015-2022 ('000 Units)

Table 12 Global Market Size, By Region, 2015-2022 (USD Million)

Table 13 Asia-Oceania: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 14 Asia-Oceania: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 15 Asia-Oceania: Market Size, By Country, 2015-2022 ('000 Units)

Table 16 Asia-Oceania: Market Size, By Country, 2015-2022 (USD Million)

Table 17 India: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 18 India: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 19 China: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 20 China: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 21 Japan: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 22 Japan: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 23 South Korea: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 24 South Korea: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 25 Asia-Oceania Others: Market Size, By Identification Process,2015-2022 ('000 Units)

Table 26 Asia-Oceania Others: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 27 Europe: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 28 Europe: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 29 Europe: Market Size, By Country, 2015-2022 ('000 Units)

Table 30 Europe: Market Size, By Country, 2015-2022 (USD Million)

Table 31 Germany: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 32 Germany: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 33 U.K.: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 34 U.K.; Market Size, By Identification Process, 2015-2022 (USD Million)

Table 35 France: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 36 France: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 37 Spain: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 38 Spain: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 39 Europe Others: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 40 Europe Others: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 41 North America: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 42 North America: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 43 North America: Market Size, By Country, 2015-2022 ('000 Units)

Table 44 North America: Market Size, By Country, 2015-2022 (USD Million)

Table 45 U.S.: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 46 U.S.: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 47 Canada: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 48 Canada: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 49 Mexico: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 50 Mexico: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 51 RoW: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 52 RoW: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 53 RoW: Market Size, By Country, 2015-2022 ('000 Units)

Table 54 RoW: Market Size, By Country, 2015-2022 (USD Million)

Table 55 Russia: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 56 Russia: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 57 Brazil: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 58 Brazil: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 59 RoW Others: Market Size, By Identification Process, 2015-2022 ('000 Units)

Table 60 RoW Others: Market Size, By Identification Process, 2015-2022 (USD Million)

Table 61 Key Components, By Identification Process

Table 62 Global Market Size, By Components, 2015−2022 ('000 Units)

Table 63 Global Market Size, By Components, 2015−2022 (USD Million)

Table 64 Biometric Identification Components Market Size, By Region, 2015−2022 ('000 Units)

Table 65 Biometric Identification Components Market Size, By Region, 2015−2022 (USD Million)

Table 66 CMOS/ Image Sensors Market Size, By Region, 2015−2022 ('000 Units)

Table 67 CMOS/ Image Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 68 Optical/ Fingerprint & Palm Sensors Market Size, By Region, 2015−2022 ('000 Units)

Table 69 Optical/ Fingerprint & Palm Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 70 IRIS/Retinal Recognition Sensors Market Size, By Region, 2015−2022 ('000 Units)

Table 71 IRIS/Retinal Recognition Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 72 Microphone/Voice Sensors Market Size, By Region, 2015−2022 ('000 Units)

Table 73 Microphone/Voice Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 74 Signature/ Keystrokes Sensors Market Size, By Region, 2015−2022 ('000 Units)

Table 75 Signature/ Keystrokes Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 76 Processing Units Market Size, By Region, 2015−2022 ('000 Units)

Table 77 Processing Units Market Size, By Region, 2015−2022 (USD Million)

Table 78 Embedded Microcomputers Market Size, By Region, 2015−2022 ('000 Units)

Table 79 Embedded Microcomputers Market Size, By Region, 2015−2022 (USD Million)

Table 80 Microchip Set Market Size, By Region, 2015−2022 ('000 Units)

Table 81 Microchip Set Market Size, By Region, 2015−2022 (USD Million)

Table 82 Global Market Size, By Application, 2015–2022 ('000 Units)

Table 83 Global Market Size, By Application & Region, 2015–2022 ('000 Units)

Table 84 Biometric Vehicle Access System Market Size, By Region, 2015–2022 (‘000 Units)

Table 85 Biometric Engine Start-Stop System Market Size, By Region, 2015–2022 (‘000 Units)

Table 86 Biometric Driver Fatigue & Drowsiness Monitoring System Market Size, By Region, 2015–2022 ('000 Units)

Table 87 Biometric Memory Steering System Market Size, By Region, 2015–2022 ('000 Units)

Table 88 Biometric Memory Seat Market Size, By Region, 2015–2022 ('000 Units)

Table 89 Biometric Infotainment System Market Size, By Region, 2015–2022 ('000 Units)

Table 90 Global Market Size for Electric Vehicles, By Region, 2015–2022, (’000 Cars)

Table 91 Global Market Size for Electric Vehicles, By Vehicle Type, 2015–2022, (’000 Cars)

Table 92 BEV: Market Size, By Region, 2015–2022, (’000 Cars)

Table 93 HEV: Market Size, By Region, 2015–2022, (’000 Cars)

Table 94 PHEV: Market Size, By Region, 2015–2022, (’000 Cars)

Table 95 Global Market, By Wearable Technology, 2018–2027 (’Ooo Units)

Table 96 Global Market for Wearable Technology, By Region, 2018–2027 (’Ooo Units)

Table 97 Global Market Size for Semi-Autonomous Cars, By Identification Process, 2015–2022 (’000 Units)

Table 98 Global Market Size for Autonomous Cars, By Identification Process, 2022–2030, (’000 Units)

Table 99 Global Market Size for Commercial Vehicles, By Fleet Management Service, 2018–2027 (’000 Units)

Table 100 Global Market Size for Commercial Vehicles, By Driver Monitoring System, 2018–2027 (’000 Units)

Table 101 Ranking of Key Players in this Market, 2016

Table 102 Hitachi, Ltd.: Manufacturing Plants

Table 103 FUJITSU: Manufacturing Plant for Biometric Products

Table 104 Safran: R&D/Design Centers

Table 105 Synaptics Incorporated: Design Centers

List of Figures (67 Figures)

Figure 1 Market Segmentation: Automotive Biometric Identification

Figure 2 Global Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Market Size Estimation Methodology for the Global Market: Bottom-Up Approach

Figure 6 The Market in the U.S. is Estimated to Be the Largest Due to the Increase in Demand for Biometric Identification Modules/Systems, 2017 vs 2022 (Value)

Figure 7 The Processing Units Segment is Expected to Be the Largest Market, 2017 vs 2022 (Value)

Figure 8 Government Regulations to Drive the Use of In-Vehicle Driver Monitoring Systems, 2017 vs 2022 (Volume)

Figure 9 Technological Advances are Expected to Drive this Market, By Wearable Technology, 2018–2022 (Volume)

Figure 10 The Market in Asia-Oceania is Estimated to Be the Largest Electric Vehicle Biometric Identification Systems Market, 2017–2022 (Volume)

Figure 11 Increase in Demand for Semi-Autonomous & Autonomous Vehicles is Expected to Drive the Global Biometric Identification Market, 2022 vs 2025 (’000 Cars)

Figure 12 Government Mandates to Install Eld Will Drive this Market, By Fleet Management Service, 2022 (Volume)

Figure 13 Increasing Vehicle Production & Growing Concerns About Safety & Security to Create Immense Opportunities for Biometric Identification Systems Manufacturers

Figure 14 The Voice Recognition & Fingerprint Recognition Segments are Expected to Be the Fastest Growing Markets, 2015–2022 (USD Million)

Figure 15 The Optical Sensors Segment is Projected to Grow at the Highest CAGR During the Forecast Period, 2017 vs 2022 (USD Million)

Figure 16 The Biometric Vehicle Access & Driver Monitoring Systems Segments are Expected to Hold More Than 60% of the Market Share, By Application, 2017–2022 (’000 Units)

Figure 17 The Market in Asia-Oceania is Expected to Be the Largest Electric Vehicle Biometric Identification Market, 2017 (’000 Units)

Figure 18 Technological Advances & In-Vehicle Health Monitoring are Expected to Drive the Biometric Identification Wearable Technology Market, 2018–2027 (’000 Units)

Figure 19 Increase in Comfort Features is Expected to Drive the Semi-Autonomous & Autonomous Vehicles Market (Units)

Figure 20 In-Vehicle Health Monitoring Features are Expected to Drive the Fleet Management Services Market, 2018–2027 (Value)

Figure 21 Global Market Segmentation

Figure 22 Global Market Dynamics

Figure 23 Total Number Motor Vehicles Stolen Across World, 2010−2016

Figure 24 Porter’s Five Forces Analysis

Figure 25 Threat of New Entrants: Medium

Figure 26 Threat of Substitutes: Medium

Figure 27 Bargaining Power of Suppliers: Low

Figure 28 Bargaining Power of Buyers: Medium

Figure 29 Intensity of Competitive Rivalry: Medium

Figure 30 Flow of Data in Fingerprint System

Figure 31 Flow of Data in Facial Recognition System

Figure 32 Flow of Data in IRIS Recognition System

Figure 33 Flow of Data in Voice Recognition System (Enrollment)

Figure 34 Flow of Data in Voice Recognition System (Verification)

Figure 35 Biometric Identification Technology: Life Cycle Hypothesis

Figure 36 Voice Recognition System is Projected to Have the Largest Share of the Global Market

Figure 37 Asia-Oceania: Market, By Country, 2017-2022

Figure 38 Europe: Market Snapshot

Figure 39 Europe: Market, By Country, 2017-2022

Figure 40 North America: Market Snapshot

Figure 41 North America: Market, By Country, 2017-2022

Figure 42 Global Market, By Components: Market Share 2017 (Value)

Figure 43 Biometric Identification Components Market Share, By Region, 2017 vs 2022 (Value)

Figure 44 Regional Share of this Market, By Region, 2017 (Volume)

Figure 45 Electric Vehicle Sales, By Type & Region, 2022 (’000 Units)

Figure 46 Global Market for Electric Vehicles: Market Share Comparison, 2017 vs 2022

Figure 47 Global Market, By Wearable Technology, is Expected to Grow Rapidly, 2022 vs 2027 (’000 Units)

Figure 48 Global Market Share for Semi-Autonomous Cars, By Type, 2015–2022

Figure 49 Global Market Share for Autonomous Cars, By Type, 2022–2030

Figure 50 Global Market Size for Commercial Vehicles, By Fleet Management Service, 2019–2027 (’000 Units)

Figure 51 Competitive Leadership Mapping Global Market

Figure 52 Hitachi, Ltd.: Company Snapshot

Figure 53 Hitachi, Ltd.: Manufacturing Plants

Figure 54 FUJITSU: Company Snapshot

Figure 55 FUJITSU: Manufacturing Plant for Biometric Products

Figure 56 Safran: Company Snapshot

Figure 57 Safran: R&D/Design Centers

Figure 58 Synaptics Incorporated: Company Snapshot

Figure 59 Synaptics Incorporated: Design Centers

Figure 60 Nuance Communications, Inc.: Company Snapshot

Figure 61 Methode Electronics: Company Snapshot

Figure 62 HID Global Corporation/ASSA ABLOY AB: Company Snapshot

Figure 63 VOXX International Corp.: Company Snapshot

Figure 64 Fingerprint Cards AB: Company Snapshot

Figure 65 Robert Bosch GmbH: Company Snapshot

Figure 66 Continental AG : Company Snapshot

Figure 67 Valeo: Company Snapshot

Growth opportunities and latent adjacency in Biometric Identification Market