Client’s Goals

One of the largest oilfield services company in the world engaged MarketsandMarkets to grow its revenues. For this purpose, our team defined a series of problems and solved them, which helped the client to create revenue impact. Three key problems solved for the client were-

- Understanding of Total Addressable Market (TAM) for pre-commissioning, maintenance, decommissioning, and In-line Inspection related services across the oil & gas-pipeline & process assets, globally.

- Insights on market size (Serviceable Addressable Market (SAM)) for the set of services provided by the company across the oil & gas-pipeline & process assets; under the pre-commissioning, maintenance, decommissioning, and In-line Inspection related service market segments.

- Competitive intelligence on Share of Market (SOM) within Serviceable Addressable Market (SAM) for key players operating within the oil & gas-pipeline & process services market; under the pre-commissioning, maintenance, decommissioning, and In-line Inspection related service markets

Our Approach

We offered insights into industry specific potential, key trends across the oil & gas-pipeline & process assets across various regions through our AI-driven market intelligence platform. Our team not only provided information on key trends and market size, but also provided information of upcoming key oil & gas pipeline & process projects between 2019 to 2024 across various geographies along with the critical information on factors and trends which have not only influenced the market dynamics, but also affected the revenues of various companies operating within pipeline & process services market ecosystem. Our analyst hours were leveraged for understanding information on various operator, and Engineering Procurement and Construction (EPC) companies, with regards to the operations, and CAPEX & OPEX (Capital expenditure & Operating Expenditure) information. We provided market information not only in value (USD), but also in volume, with regards to total operational & upcoming pipeline (Km) & process (capacities) (refinery, petrochemical, Floating Production Storage-FPS, gas storage, and gas processing). Further, our client services team provided critical information and analysis around the pipeline & process services market across regions.

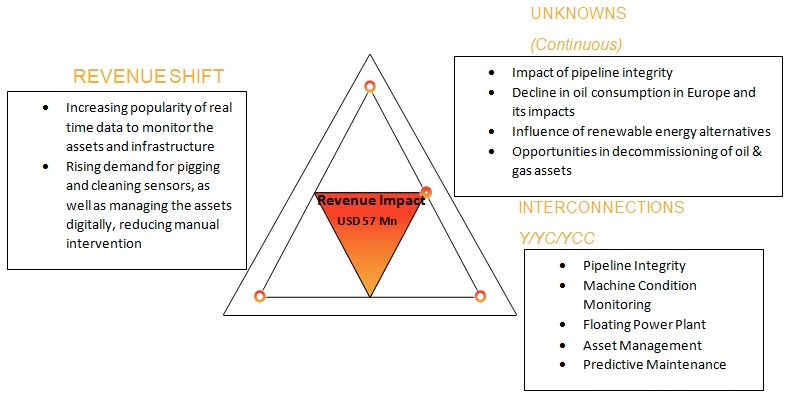

Revenue Shifts Identified

The shift is towards gathering real time data to monitor the assets and infrastructure. The pipeline operators and owners are demanding for pigging and cleaning sensors, as well as managing the assets digitally, reducing manual intervention. This has driven the pre-com, maintenance, and ILI market in midstream operations.

Interconnections

Our team estimates that revenues streams of companies providing pipeline & process services in the oil & gas industry are impacted by Pipeline Integrity, Machine Condition Monitoring, Floating Power Plant, Asset Management, and Predictive Maintenance, among others.

Unknowns Identified

Pipeline integrity ensures the proper running of pipelines. They provide information of metal loss/ corrosion, geometry measurement & bend detection, and leak & crack detection. Regulators are intended to evaluate the risk associated with pipelines and effectively allocate resources for inspection, prevention, detection, and mitigation activities. Thus, operators must invest in safe operation and assessment of pipelines to avoid accidents.

The decline in oil consumption in Europe is expected to continue as the region is transitioning from conventional fossil energy to renewable energy. This transition toward renewables is hampering the oil production growth rate, leading to slower than expected well drilling activities. The adoption of renewables in Europe, which has always been a significant energy buyer, will have a negative impact on the oil & gas producers, which, in turn, will hamper the pipeline & process services market. Thus, the client can leverage this opportunity by aligning its pipeline & process decommissioning services business in the European region. As decommissioning of oil & gas assets is likely to gain momentum in Europe in the near future.

Revenue Impact

We had a half year engagement with the client, and provided detailed insights in two phases for the “Pipeline & Process Services Market”. We assisted the client in generating a revenue impact of USD 57 million in this market.