in Manufacturing Industry – Market Size in USA, Forecast to 20281523 × 571.jpg)

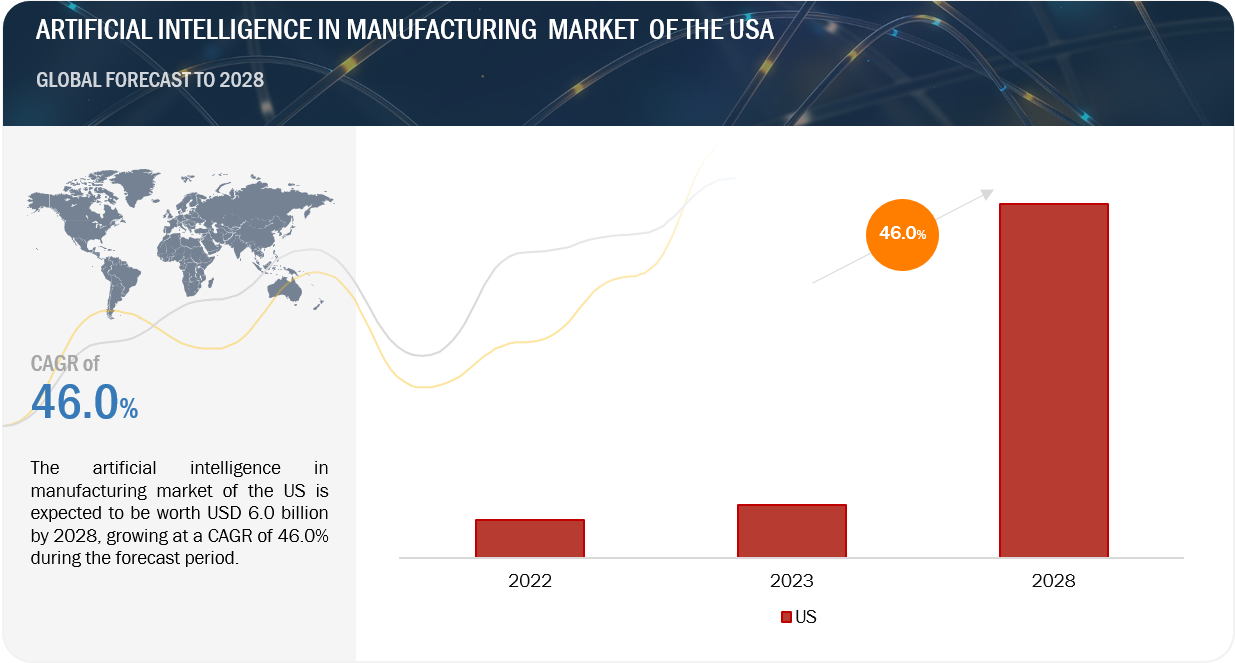

Artificial Intelligence (AI) in Manufacturing Industry – Market Size in USA, Forecast to 2028

The artificial intelligence (AI) in manufacturing industry size of the US is estimated to be valued at USD 0.9 billion in 2023 and is anticipated to reach USD 6.0 billion by 2028, at a CAGR of 46.0% during the forecast period. The industry growth is ascribed to emerging industrial IoT and automation technology. AI in manufacturing market’s growth in the US is fueled by automation for increased efficiency and lower costs, with predictive maintenance and quality control optimizing processes. Supply chain enhancements and customization capabilities improve overall productivity.

Attractive Opportunities in Artificial Intelligence in Manufacturing Market in USA

Artificial Intelligence (AI) in Manufacturing Trends

Driver: Rising need to handle increasingly large and complex dataset

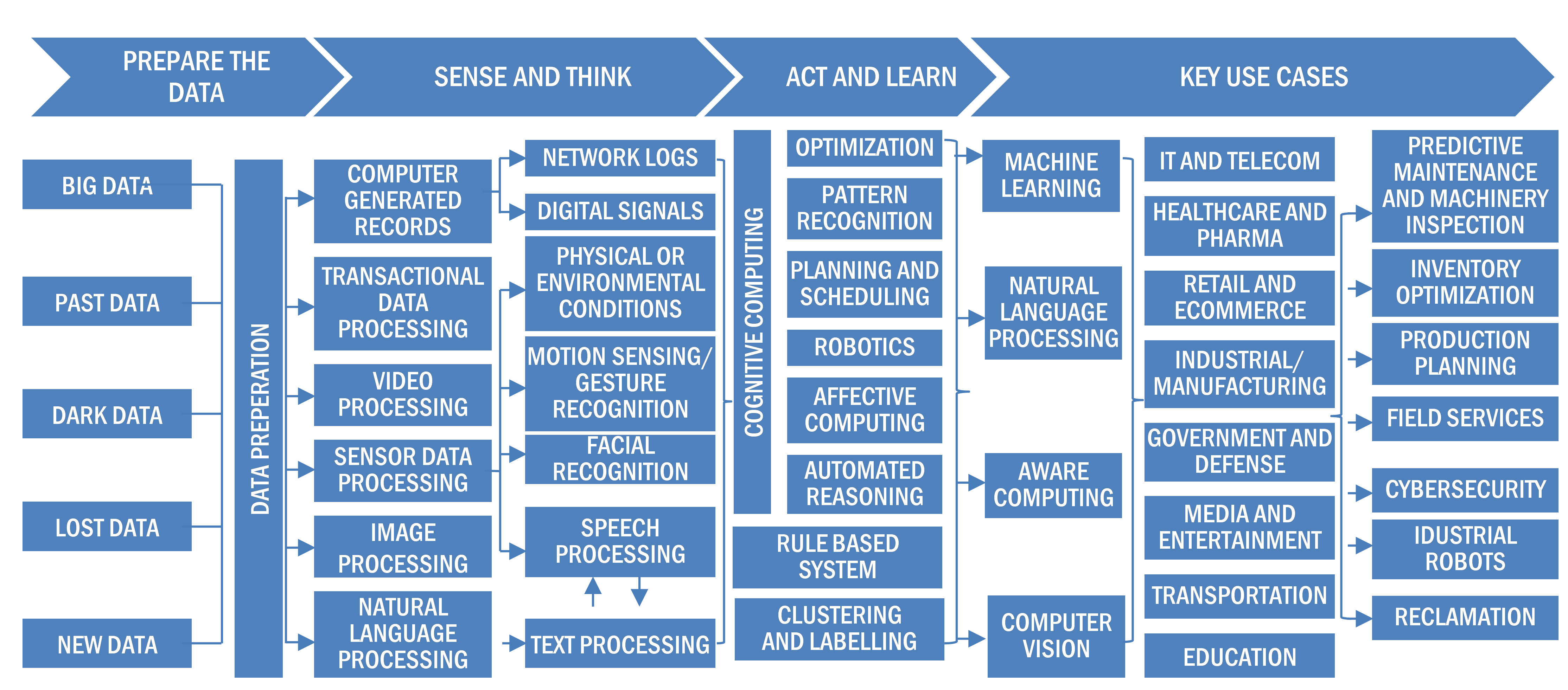

The increasing demand for Artificial Intelligence (AI) in the Manufacturing industry of the US region is propelled by the imperative to effectively manage the growing volume and intricacy of data. This trend is accentuated by the integration of advanced manufacturing technologies, the adoption of Industry 4.0 principles, and the evolution towards smart factories. The interconnected nature of IoT devices and automated machinery in these environments results in a substantial influx of data, necessitating AI solutions to process and derive actionable insights.

The applications of AI span predictive maintenance, quality control, customization, and supply chain optimization, all of which involve analyzing large and complex datasets. AI's continuous learning capabilities further contribute to ongoing process improvements, while ensuring regulatory compliance and facilitating efficient reporting. In essence, the rising need to handle extensive datasets underscores AI's pivotal role in enhancing efficiency, innovation, and competitiveness in the dynamic landscape of manufacturing in the US.

Restraint: Integration with existing systems

Many manufacturing facilities possess legacy systems that were not initially designed to accommodate AI, leading to difficulties in retrofitting and integration. The complexity arises from interoperability issues, diverse technology stacks, and the need to ensure data compatibility. Manufacturers face the daunting task of upgrading hardware and software, managing scalability challenges, and customizing AI solutions to align with unique manufacturing processes.

The associated costs, both in terms of financial investment and potential downtime during implementation, can act as barriers, particularly for smaller enterprises. Overcoming these challenges requires strategic planning, collaboration with AI and manufacturing experts, and potentially a phased approach to implementation, emphasizing the importance of industry standards for interoperability.

Opportunity: Application of AI-driven machine learning and NLP for intelligent enterprise processes

The opportunity of enhancing manufacturing efficiency through AI-powered predictive analytics and production planning in the US market is a transformative prospect with numerous benefits. By leveraging AI, manufacturers can optimize production processes, reduce maintenance costs, and improve quality control through real-time analysis of extensive datasets. The use of predictive maintenance not only minimizes downtime but also lowers maintenance expenses by allowing for planned interventions.

AI-driven production planning optimizes scheduling, resource allocation, and inventory management, leading to improved supply chain efficiency and responsiveness to market dynamics. This not only provides a competitive advantage by delivering high-quality products consistently but also allows for customization and flexibility in adapting to changing customer demands.

Moreover, AI contributes to cost savings, resource efficiency, and job enrichment within the manufacturing workforce, making it a strategic opportunity for US manufacturers to lead in innovation, productivity, and sustainability in the global market.

Challenge: Concerns regarding data privacy and cybersecurity regulations

Manufacturing processes generate substantial amounts of proprietary and confidential information, and the integration of AI introduces new security risks such as unauthorized access, data breaches, and intellectual property theft. Compliance with data privacy regulations, both domestic and international, adds complexity, requiring manufacturers to navigate a regulatory landscape that includes GDPR and industry-specific guidelines. Cross-border data transfers and ethical considerations related to transparency and accountability further complicate AI implementations.

Manufacturers must prioritize secure connectivity, address data ownership agreements, and enhance employee training to fortify their cybersecurity measures. Ensuring the integration of AI systems with existing security protocols and developing robust incident response plans are essential components in managing this multifaceted challenge and fostering responsible AI adoption in the US manufacturing sector.

Industry Ecosystem-

Artificial Intelligence (AI) in Manufacturing Industry: Key Trends

Siemens, IBM, Intel Corporation, NVIDIA Corporation, and General Electric are the top players in the artificial intelligence in manufacturing market. These artificial intelligence in manufacturing companies with advance robotics and AI technology trends with a comprehensive product portfolio and solid geographic footprint.

Software segment accounted for the largest share of artificial intelligence in manufacturing Industry in 2022

The artificial intelligence in manufacturing industry based on offering has been segmented into hardware, software, and services. The market for the software segment has been sub-segmented into AI platforms and AI solutions. The preeminence of the software segment in the adoption of artificial intelligence (AI) in the US manufacturing industry highlights the critical role of advanced algorithms and models.

In the US, a strong focus on predictive maintenance solutions, innovative digital twin platforms, and strategic supply chain optimization software underscores the commitment to efficiency and innovation. The adoption of computer vision software, leadership in edge AI platforms like Microsoft Azure IoT Edge, and the utilization of robotics process automation software further demonstrate the nation's dedication to leveraging AI-driven software for transformative advancements in manufacturing processes, enhancing competitiveness on a global scale.

Predictive maintenance & machinery inspection application to account for the largest share in the US market during forecast period.

Predictive maintenance and machinery inspection applications are poised to dominate AI in manufacturing industry in the US, holding the largest market share. This is driven by the compelling advantages they offer to the manufacturing sector. Predictive maintenance, enabled by AI, ensures cost savings, reduces downtime, and extends the lifespan of machinery through proactive repairs. The integration of AI with IoT and sensors allows real-time data analysis, contributing to informed decision-making.

Machinery inspection, powered by AI-driven computer vision, enhances product quality, safety, and regulatory compliance. These applications align seamlessly with the Industry 4.0 paradigm, reflecting the US manufacturing sector's commitment to technological advancements, innovation, and efficiency. Overall, the widespread scalability and adaptability of predictive maintenance and machinery inspection across industries underscore their pivotal role in shaping the modern manufacturing landscape in the US.

Metals & heavy machinery industry in North America to grow at a highest CAGR during the forecast period.

AI's optimization capabilities are poised to enhance efficiency and cut operational costs in the intricate manufacturing processes of the Metals & Heavy Machinery industry. Contributing factors include predictive maintenance, computer vision for quality control, and AI-driven supply chain optimization, all leading to heightened efficiency and minimized downtime. The synergy of AI with advanced robotics improves automation precision, aligning with the industry's sustainability goals to reduce energy consumption and waste. North American firms, acknowledging the competitive advantage offered by AI, actively embrace technological advancements and Industry 4.0 principles. Government initiatives and global market dynamics play pivotal roles in propelling the industry towards AI adoption, positioning it as a transformative driver for innovation, productivity, and competitiveness in the ever-evolving manufacturing sector.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024

Key Industry Players

The major companies in the artificial intelligence (AI) in manufacturing Industry are Siemens, IBM, Intel Corporation, NVIDIA Corporation, and General Electric, Microsoft Corporation, Google, Amazon Web Services among others. These companies have used both organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in artificial intelligence in manufacturing industry.

in Manufacturing Industry – Market Size in USA, Forecast to 2028370 × 247.jpg)

Recent Developments

- In October 2023, Microsoft and Siemens are joining forces to usher in a new era of human-machine collaboration. The result of the collaboration is the Siemens Industrial Copilot, a powerful AI assistant designed to enhance collaboration between humans and machines in the manufacturing sector.

- In August 2023, NVIDIA Corporation announced NVIDIA OVX Servers featuring the new NVIDIA® L40S GPU, a powerful, universal data center processor designed to accelerate the most compute-intensive, complex applications, including AI training and inference, 3D design and visualization, video processing and industrial digitalization with the NVIDIA Omniverse platform.

- In January 2023, Intel Corporation Launched 4th Gen Xeon Scalable Processors, Max Series CPUs and GPUs. These processors are Intel’s most sustainable data center processors, delivering a range of features for optimizing power and performance, making optimal use of CPU resources to help achieve customers’ sustainability goals.

- november 2022, IBM announced new software designed to help enterprises break down data and analytics silos so they can make data-driven decisions quickly and navigate unpredictable disruptions. IBM Business Analytics Enterprise is a suite of business intelligence planning, budgeting, reporting, forecasting, and dashboard capabilities that provides users with a robust view of data sources across their entire business.

- In January 2022, MicroAI, a Texas-based edge AI product developer, is demonstrating its Launchpad quick-start deployment tool along with its new security software at this year’s CES exhibition.

Frequently Asked Questions (FAQs)

1. What will be the industry size of artificial intelligence in manufacturing of US in 2023?

The artificial intelligence in manufacturing market of US is expected to be valued USD 0.9 billion in 2023.

2. Who are the global artificial intelligence in manufacturing industry winners?

Companies such as Siemens, IBM, Intel Corporation, NVIDIA Corporation, and General Electric fall under the winners’ category.

3. Which region is expected to hold the highest global artificial intelligence in manufacturing industry share?

Asia Pacific will dominate the global artificial intelligence in manufacturing market in 2023.

4. What are the major drivers of artificial intelligence in the manufacturing industry?

Rising need to handle increasingly large and complex dataset and emerging industrial IoT and automation technology.

5. What are the major strategies adopted by artificial intelligence in manufacturing companies?

The companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the market.

Authored by Shweta Surender, MarketsandMarkets

- Artificial Intelligence in Manufacturing Market by Processor (MPUS, GPUs, FPGA, ASICs), Software (On-premises, Cloud), Technology (Machine Learning, NLP, Context-aware Computing, Computer Vision, Generative Al), Application - Global Forecast to 2030

- Smart Manufacturing Market - Edge Computing, Industrial 3D Printing, Robots, Sensor, Machine Vision, Artificial intelligence, Cybersecurity, Digital Twin, Private 5G, AGV, AMR, AR & VR, CAD, CAM, PLM, HMI, IPC, MES, WMS, and ERP - Global Forecast to 2029

- Automotive Motors Market by EV Motor Type (Brushless, Brushed, Traction, Induction, Stepper), ICE Motor Type, Vehicle Type (PC, LCV, HCV), Electric Vehicle Type, Application, Function (Performance, Safety, Comfort) and Region - Global Forecast to 2027