Automotive Industry Outlook Unveiled: Trends & Transformations 2024

The automotive industry outlook study involved analyzing the recent developments, trends and the performance of the players as well as the overall automobile industry in 2023 along with the projections for 2024. The analysis was based on the sales volume of the vehicles across passenger and commercial segment around the world. The regions covered in the report are North America, Europe, Asia Pacific and Rest of the World. The automotive industry overview includes study of automotive market performance in 2023, key developments achieved in 2023, trends that are likely to impact the market in 2024, major growth segments and opportunities for 2024, automotive vehicle sales in 2024 and track & analyze competitive developments such as deals (partnerships, joint ventures, mergers & acquisitions, collaborations and product developments) alongside other activities carried out by key industry participants.

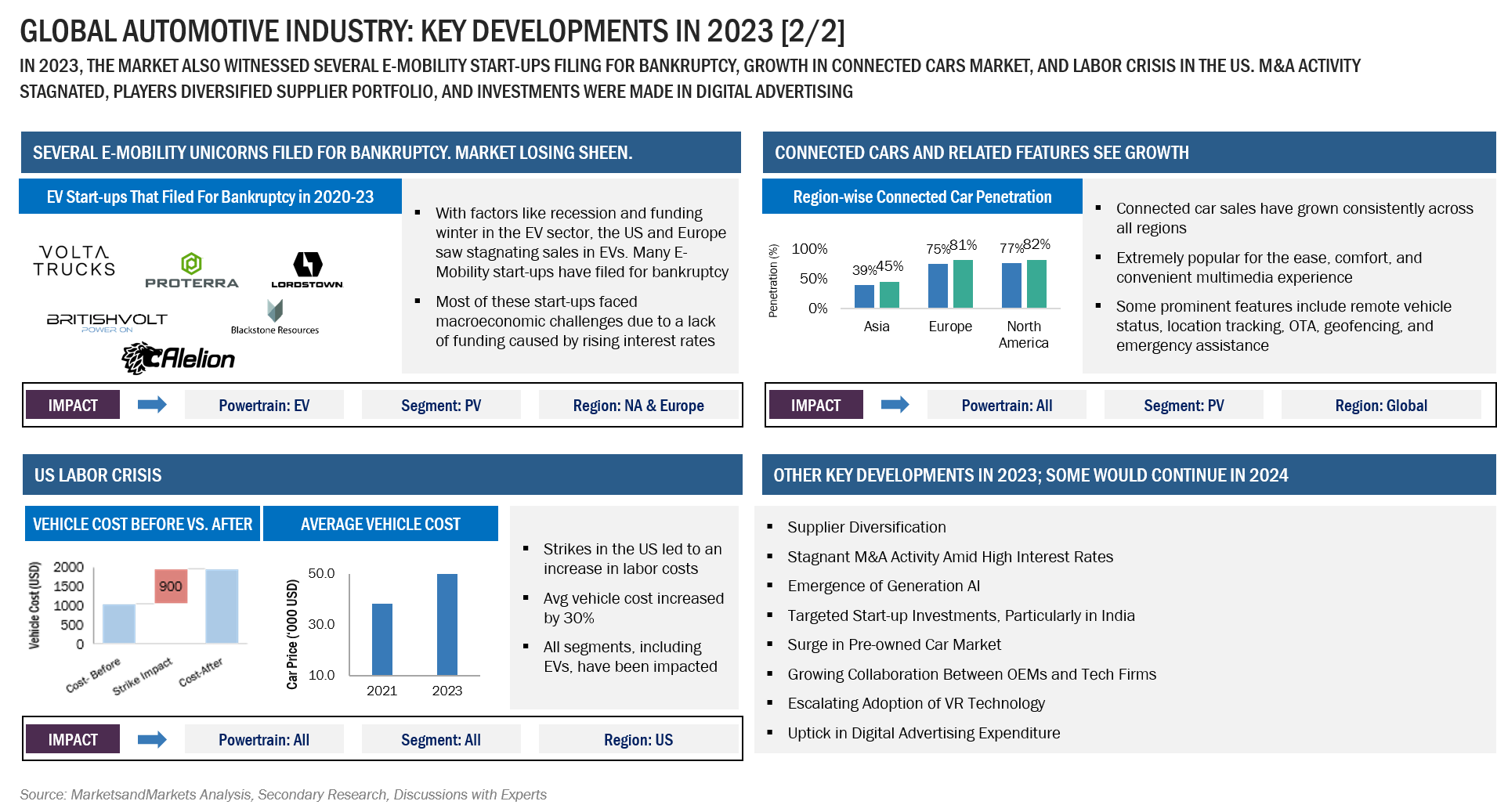

The automotive outlook 2024 is based on analysis of the major milestones achieved in the automotive industry across passenger vehicles and commercial vehicles and other critical aspects that took place in 2023. Whereas, the study also focusses on the rising demand for electric vehicles, advancements in autonomous, 5G connectivity, smart & automated manufacturing, shared mobility and online sales of vehicles in automotive industry shaping the future market.

For more details, get in touch with us here

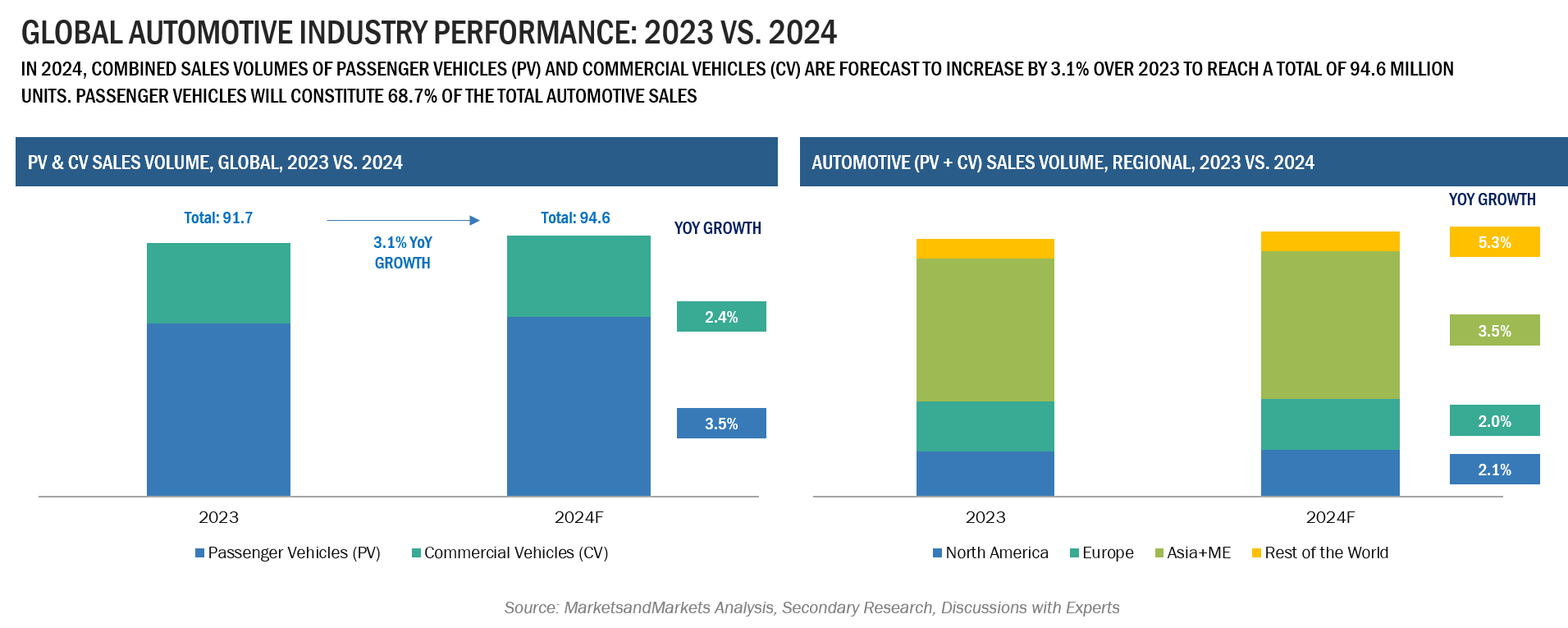

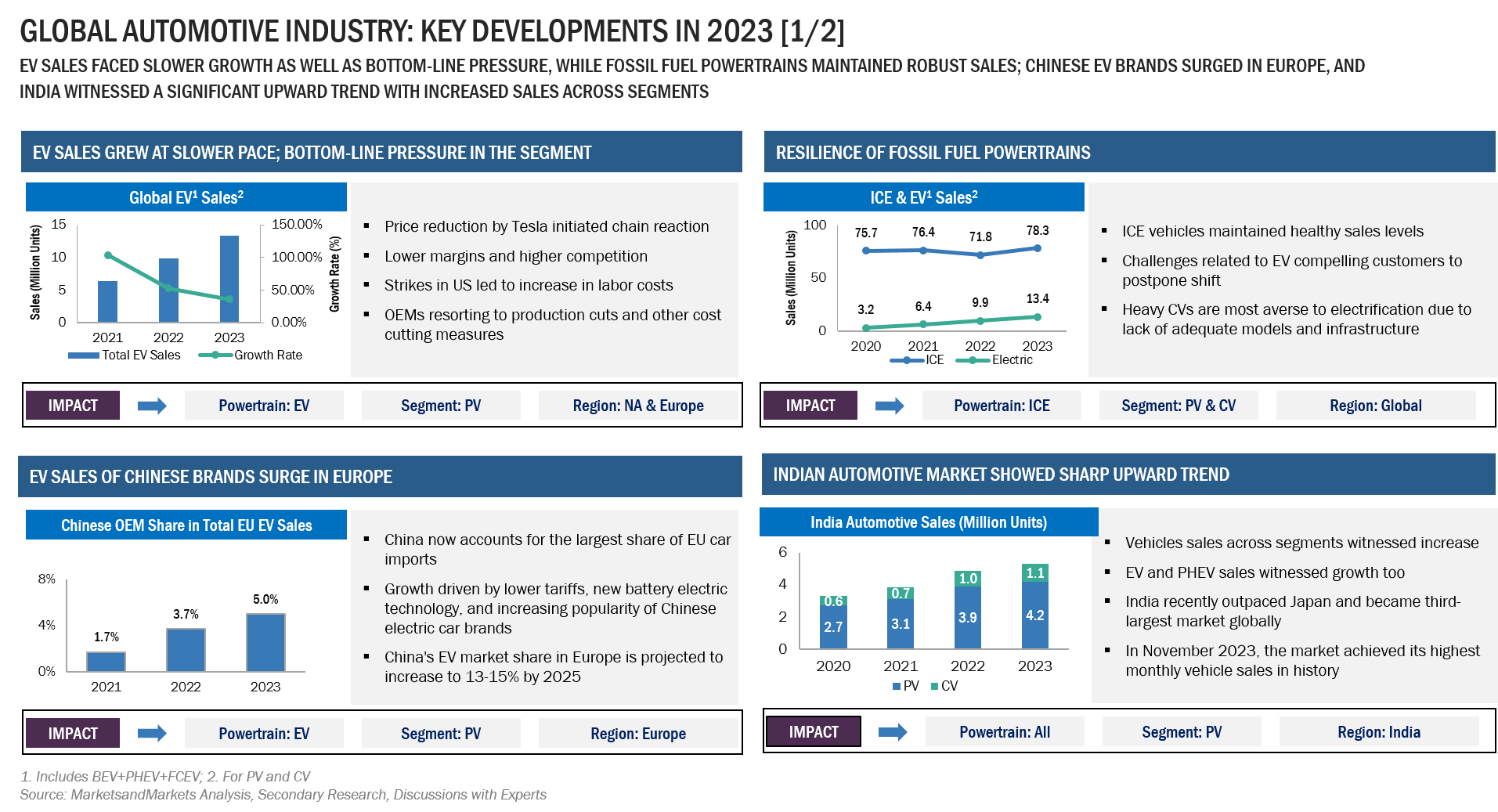

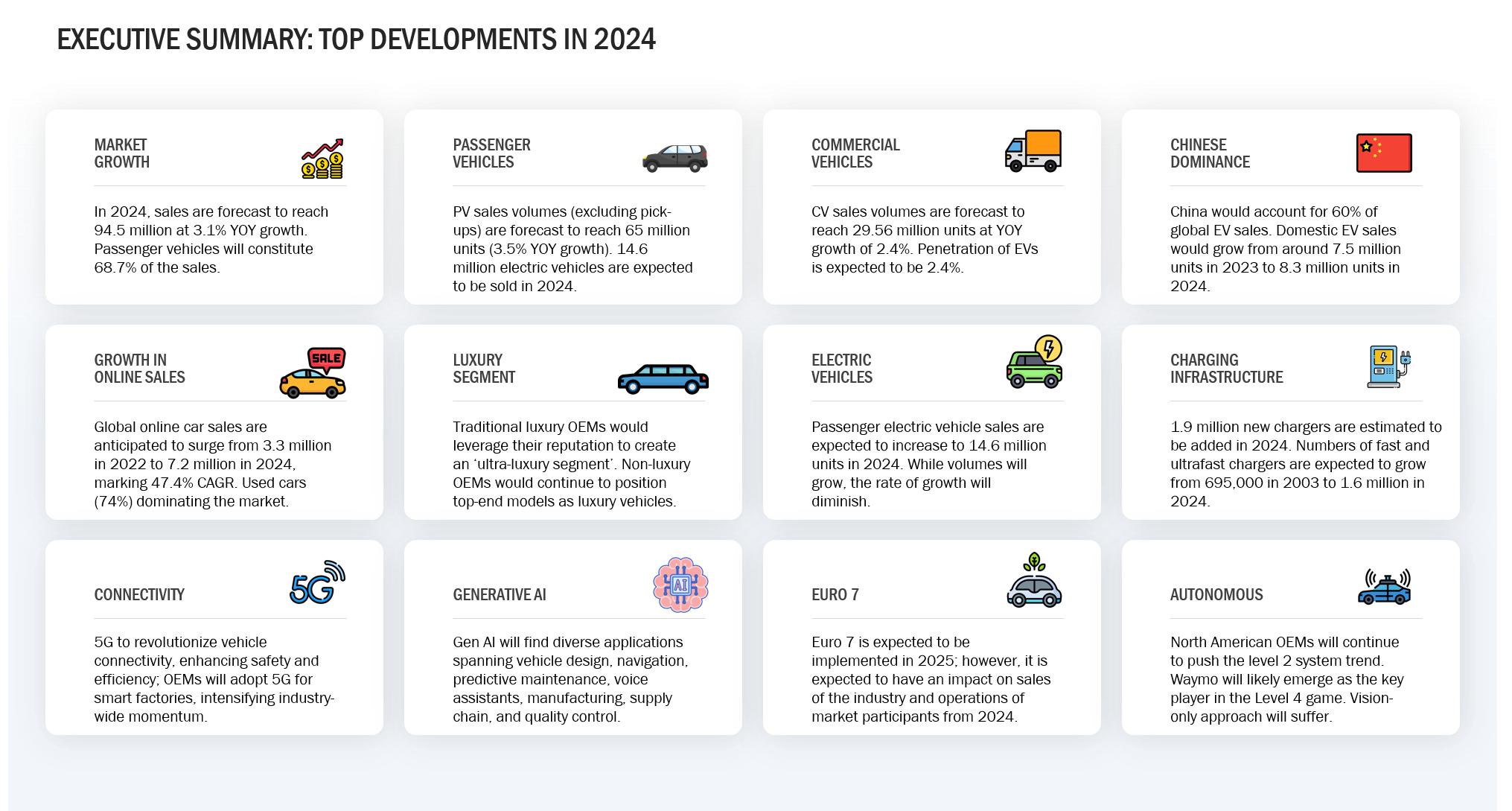

The automotive outlook study has sized the global passenger vehicles and commercial vehicles combined sales were 92 million units in 2023 and is projected to reach 95 million units in 2024, witnessing a YoY growth of 3.1% from 2023 to 2024. The unit sales of EV in 2023 crossed 13.5 million units globally. However, the EV market witnessed a slight decline in the YoY growth in 2023 compared to that in 2022. The expected growth rate of EV sales in the US is around 20% in 2024. Asia-Pacific and Middle East regions hold the major share in the sales volume of PV and CV combined. The Chinese market is the world’s largest market in terms of vehicle sales as well as production. In 2023, China’s sales volume for passenger vehicles was over 25 million units, with a share of around 50% globally. China is the most dominant nation in automotive industry with respect to supplying raw materials, manufacturing as well as its sales. China has the most powerful supply chain of EV batteries. Over 50% of the EV batteries are manufactured in China. Moreover, around 75% of the components of EV batteries are manufactured in China. Countries such as Japan, South Korea and India have increased their investments in the development of automotive industry due to the growing urban population and economy in these countries. Due to such investment demand for the automotive market will be more during the forecast period. Continuing this automotive outlook trend, the Asia region will dominate the market in 2024.

Automotive Outlook Key development trends in as follows:

- Connected car launches grew constantly across all regions.

- Ride-hauling operators continue to diversify service offerings.

- L3 automated driving features witnessed limited launches in 2023.

- Rising adoption of EV's across all segments, reduction in battery prices, growth in charging infrastructures.

- China dominating the automotive market.

Automotive Industry Outlook Industry Trends:

The automotive industry growth is influenced by various factors such as adoption of electric vehicles, development and manufacturing of long-range batteries along with installation of fast and ultra-fast charging points, introduction of autonomous vehicles and deployment of 5G connectivity. In addition, the automotive industry overview also covers several significant variables that have contributed to the used automobile, or preowned car, market's considerable expansion in recent years. The automotive industry is currently under constant pressure to adapt to new changes due to technological advancements and end-user preferences. Adoption of latest trends for customers is the foremost agenda of the OEMs and EV solution providing companies.

The Used Car Market Takes Center Stage

Firstly, a lot of people are looking for more economical transportation options due to economic uncertainties and changing consumer preferences, which makes used automobiles a desirable option. Moreover, because used cars are affordable and of high quality, people are becoming more confident when buying them owing to the modern car's growing longevity and dependability. Online marketplaces and digital platforms have advanced quickly, making it easier for consumers to obtain information about used automobiles. This allows them to compare costs, look up vehicle histories, and make well-informed decisions about what to buy.

China’s Continued Dominance in the EV Market

With 60% of global EV sales, China is a global influencer and industry leader amidst the sleek lines of state-of-the-art EVs. Its leadership is cemented by its tightly managed supply chain, unrelenting innovation, and expanding worldwide reach. Due to its affordable prices, state-of-the-art battery technology, and the increasing appeal of Chinese electric vehicle brands in the United Kingdom and other European and Asian markets, China is predicted to account for 12% of the European EV market by 2025. China will firmly establish itself as a global and domestic powerhouse in the EV revolution by 2024.

Plugging In for the Future: The EV Charging Revolution

By 2024, there should be a substantial rise in charging stations—roughly 2 million worldwide. Infrastructure is being extensively invested in by governments and OEMs, with ultra-speed and DC fast charging setting the standard. China is a major player, and by 2024, its fast-charging technology is predicted to treble. Significant expansion is also anticipated for depot charging solutions and e-forecourts. It is anticipated that the quantity of chargers for new electric commercial vehicles would reach 347K units in 2024 and climb to 1.14 million units by 2030, with DC chargers accounting for the majority of this growth. Between 2023 and 2030, the market for fast and ultra-fast chargers for electric commercial vehicles is predicted to expand at a compound annual growth rate of over 35%.

Surging Online Sales of Vehicles

Global sales of cars that are purchased online are predicted to soar, reaching 7.1–7.3 million units by 2024. Online sales are becoming more and more popular among EV manufacturers, and they are accessible in all major markets. With almost one-third of the worldwide market, North America leads the way. However, younger, tech-savvy generations in APAC are quickly catching up. This trend includes both new and used cars, with internet marketplaces providing openness and ease of use. Future totally online sales are expected to account for a sizable portion of overall new car sales in the automobile industry.

Automotive Industry Outlook Challenges

However, the automotive industry challenges are related to world's ongoing geopolitical upheaval its effect in increased costs for fuel and automotive component manufacture. Russia and Ukraine's conflict interrupted both the production of automobiles and the trading in gas and oil. Russia and Ukraine are two of the main nations that produce auto parts. Consequently, the conflict between these two nations caused a shortage of auto parts, which in turn caused a volatility in car costs. Fuel costs have increased as a result of restrictions against Russia's supply of gas and oil to the European Union. Furthermore, the US-China trade war negatively impacted the car industry's supply chain, leading to price fluctuations. While the Israel-Hamas war had limited impact on the automotive industry, the war resulted in increased oil prices which marginally affected the industry growth. These factors were identified in the the automotive industry outlook study as restraining factors for the growth of the automotive industry in 2023.

The automotive industry challenges are witnessed in numerous innovations and technological advancements. The development of a sustainable charging infrastructure and the advancement of battery technology are two of the biggest issues facing the automobile industry in the EV sector. Lithium-ion batteries play a major role in EVs, and battery technology developments are essential to enhancing energy density, lowering costs, and extending range. Furthermore, increasing the infrastructure for charging EVs is crucial to reducing customer range anxiety and promoting the wider use of EVs. Moreover, the establishment of a comprehensive regulatory framework is one of the biggest issues facing the autonomous driving industry. Different areas and nations have different regulations concerning cybersecurity, safety standards, accountability, and data privacy, which puts automakers and tech companies with unclear legal situations. It is imperative to address liability concerns and harmonize regulatory standards in order to guarantee the safe implementation of autonomous vehicles on public roads. In addition, overcoming many technological obstacles, such as sensor fusion, artificial intelligence, machine learning, and high-definition mapping, is necessary to develop completely autonomous cars. Large volumes of data from several sensors must be processed by autonomous driving systems in order for them to accurately and precisely navigate through uncertain situations. In order to overcome technological constraints like sensor performance, processing power, and software resilience, industry-wide cooperation, continuous research, and innovation are needed.

Opportunities in Automotive Industry Outlook

According to the automotive industry outlook study, in the automotive sector, car connectivity, EV charging and rise in sales of used cars has become a game-changer, opening up new business opportunities and facilitating efficient data-driven services and improved consumer experiences.

For more details, get in touch with us here

5G Takes the Wheel: The Connected Car & Living Revolution

By 2022, more than 90% of autos with internet access have incorporated 4G technology, laying the groundwork for improved connection and digital experiences while driving. But the expectation of 5G connection promises to significantly transform the car industry. As 5G technology becomes more widely used, the number of connected vehicles is predicted to skyrocket, offering never-before-seen levels of data transmission speed, dependability, and bandwidth. More than 20% of cars on the road are expected to have cellular connectivity by the end of 2024, which represents a major turning point in the development of connected mobility. Businesses across the automotive sector are keenly aware of the potential advantages afforded by car connectivity and have begun to invest heavily in this space to gain a competitive edge. From automakers to technology firms and service providers, the race to harness the power of connected vehicles is driving innovation and reshaping traditional business models.

Robotics, AI and IoT to drive the automotive manufacturing

Further, in the automotive outlook trend, smart manufacturing pertains to the use of cutting-edge technology like robotics, artificial intelligence (AI), IoT (Internet of Things), and data analytics to enhance the efficiency of the production process. This method boosts productivity overall, decreases waste, and permits real-time monitoring and management of production systems. Predictive maintenance is made easier by smart manufacturing, which enables producers to foresee equipment malfunctions and reduce downtime to guarantee smooth operations.

Introduction of Gigacasting as a manufacturing process

Furthermore, gigacasting technology is a revolutionary development in the automotive industry, especially for the manufacture of structural and chassis parts. It entails the use of sophisticated casting processes and specific molds to cast large-scale, single-piece components. gigacasting reduces assembly time, improves structural integrity, and streamlines production processes by casting whole structural elements in one piece rather than requiring many parts to be joined. Thanks to this technology, automakers can now produce stronger, lighter parts, which raises safety standards, fuel economy, and vehicle performance.

The top performing OEMs in 2023 were Toyota, General Motors, Honda, Hyundai, Stellantis NV accounting of around 25% of the market share. Whereas BYD Auto, Tesla and Volkswagen group led the EV segment with cumulative of over 30% of the market share. The EV companies are focused on battery technology development and investing into the battery ecosystem to ensure a sustainable supply chain. Key strategies such as new product launches, acquisitions, partnerships and collaborations to gain traction in the automotive market adopted by the market players are discussed in the automotive outlook 2024.

The automotive industry outlook study has information for key stakeholders such as automobile organizations/associations, component manufacturers, component suppliers, automotive OEMs, system manufacturers, electronics manufacturers, EV manufacturers, EV charging infrastructure companies, government & research organizations, software providers and traders, distributors, & suppliers of automotive components.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024

Automotive Industry Outlook 2024 Conclusion

Despite a slowing in growth rates for 2024, the industry is on track to reach a historic milestone of 100 million units in sales, including both passenger and commercial cars, by 2026. This will also bring in new business opportunities with respect to EV charging infrastructure, shift of manufacturing process and automation of manufacturing plants. Moreover, new cars will have advanced connectivity and level of development of autonomous driving.