Video Content Management System Market by Component Application (Education and Learning, Enterprise Communications, Recruitment and Training, Virtual Events), Deployment Model, Industry Vertical and Region - Global Forecast to 2026

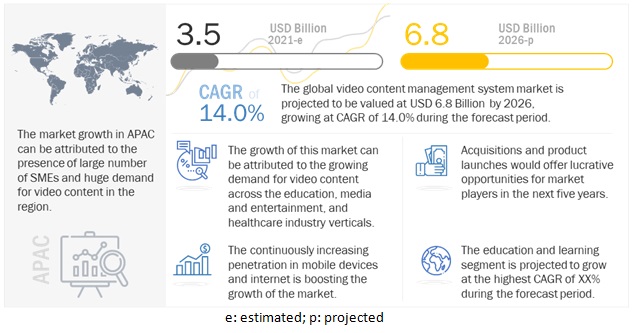

[198 Pages Report] The global video content management system market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period, to reach USD 6.8 billion by 2026 from USD 3.5 billion in 2021. Key factors that are expected to drive the growth of the market are the growing demand for onlin video content, adoption of cloud-based services by enterprises, increasing number of internet users around the world and rise in demand for video recording equipment and devices.

The video content management system market is growing due to the presence of large number of global players in the market. The major factors that are driving the adoption of video content management system among the enterprises as well as SMEs across various verticals including BFSI, IT and telecom, healthcare and lifesciences, education, media and entertainment, retail and ecommerce, and others due to significant adoption of cloud services and internet penetration. Developing countries across APAC and MEA are expected to offer more opportunities for vendors in the market. The recent economic slowdown with the impact of COVID-19 emphasizes the need for alternate business systems. COVID-19 impacts are foreseen to shift consumer demand to online channels. This may irreversibly change customer behavior as once people get into the habit of shopping online, it becomes a routine, and it is hard to get away from it easily, forcing companies to escalate their online presence. There was an immediate and widespread impact of COVID-19 on customer behavior across all industries. Education industry has been the most affected by the impact of pandemic when it comes to publishing and distributing content to students and employees. Organizations across different verticals are leaveragin video content management systems due flexibility of managing large video files, enhances corporate communication and offer opportunities for promotion, marketing and address live audiences.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of the COVID-19 pandemic on the market is covered throughout the report. The pandemic has had a positive impact on the video content manangement system market. The COVID-19 pandemic and the proliferation of remote work environments have created new complex barriers for businesses to overcome. The recent economic slowdown with the impact of COVID-19 emphasizes the need for alternate business systems. COVID-19 impacts are foreseen to shift consumer demand to online channels. This may irreversibly change customer behavior as once people get into the habit of shopping online, it becomes a routine, and it is hard to get away from it easily, forcing companies to escalate their online presence. Organizations across different verticals are leaveragin video content management systems due flexibility of managing large video files, enhances corporate communication and offer opportunities for promotion, marketing and address live audiences.

Market Dynamics

Driver: Growing demand for online video content

As per industry experts, in 2020, the viewers for video content increased by 250% and live stream events by 300%. As many organizations have adopted the work-from-home policy, owing to the COVID-19 lockdown, many people are working remotely. To enhance collaboration and communication between employees, organizations are opting for video-based communication solutions, such as web-based communication through video conferencing and video calling. As the pandemic started, the growth of video content consumption was seen to be rapidly increasing. For instance, as per GWI research 2020, in March 2020, the people of the US and UK increased their content consumption by 22%. The global consumption of SVoD content grew by 20%. By the end of 2020, the number of paid subscribers of VoD grew by 47 million globally.

Restraint: Data security and privacy concerns

The security and privacy of the video content shared across various platforms can pose major concerns for enterprises. Moreover, organizations are also concerned about copyright and Digital Rights Management (DRM) due to the possibilities of misuse, information leakages, and data breaches. The healthcare, finance, manufacturing, information, and public sectors witnessed the highest number of data breach incidents in 2019. To counter such challenges, enterprises need to restructure their strategies in employing video conferencing offerings before deploying these solutions. In the absence of policies and procedures for the proper management of video content, video conferencing solutions may witness a sluggish adoption rate. Furthermore, vendors need to offer interoperable and easy-to-use enterprise-grade video communication solutions that have in-built security features.

Opportunity: 5G to boost adoption of video content management system

5G provides more bandwidth, giving a faster upload and download speed allowing content creators to access improvements in wireless capacities, robust mobile connectivity, and decreased latency, enabling smoother streaming. With 5G in place, video content producers are not needed to invest in expensive infrastructures, such as satellite trucks, giving content distributors much more flexibility in video production. Enhanced mobile broadband will deliver a seamless, high-quality experience for cloud video services, such as content recording and storage.

Furthermore, newer technologies such as live closed captioning and face recognition-based searches using AI and ML will spur the adoption of video management services. The evolution of 5G is yet to realize its full transformational potential and provides a great growth opportunity for the video content management system market.

Challenge: Limited interoperatability of different video conferencing solutions

Unified Communications and Collaboration (UCC) helps increase cooperation, collaboration, and productivity, even though organizations cannot use video conferencing solutions as UCC tools. Due to the high costs and extensive infrastructure requirements associated with UCC video conferencing solutions, the use of most video communication tools remains restricted to conference rooms. Furthermore, some video conferencing solutions do not offer interoperability across platforms and devices, and thus, users face complexities in using video conferencing solutions. Vendors, therefore, face numerous challenges in promoting video conferencing solutions as a tool for UCC.

Services segment to grow at a higher CAGR during the forecast period.

Based on the component, the market is segmented into two categories: platform and services. The market for services is expected to grow at a higher CAGR during the forecast period. The growth is mainly attributed to the growing amount of video content consumption and cloud-based video services. Services are necessary for easy deployment, integration, and proper functioning of the video content management system. The services segment has been further segmented into training & consulting, support & maintenance, and implementation and integration. Services are necessary for easy deployment, integration, and proper functioning of the software.

On-premises segment to hold the largest market share in 2021.

The video content management syste market is segmented by deployment mode into on-premises and cloud. The on-premises segment account for a higher share of the video content management system market during the forecast period as large enterprises largely adopt on-premises video content management system solutions to have full control over their infrastructure and data; and upkeep their robust security of data pertaining to integration with internal company systems such as customer relationship management, employee management system, and sales management system. While the private cloud model is gaining popularity in organizations to overcome security and data privacy challenges.

Education vertical to grow at a higher CAGR during the forecast period.

Education is one of the fastest-growing verticals as the industry is undergoing extensive development, with advancements in technologies, thereby enhancing the overall industry vertical. The education segment has increased the adoption of video content management system platforms, giving it the highest market share. The education segment includes the higher education category and K-12. With the rise in education shifting online where schools and colleges and other types of educational gatherings have closed, the creation of video content has increased three-folds. According to industry experts, the Increasing adoption of digital platforms by educational institutes is expected to generate vast opportunities for industry players over the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

The growth of the video content management system market in the APAC region is attributed to various factors such as the proliferation of smart devices; high-speed internet connectivity; rise in digitalization of enterprises economic growth, and growing foreign investments in economies, such as India, Indonesia, Malaysia; and presence of high growth economies, such as Australia, Japan, China, South Korea. The developed countries in this region are expected to experience significant growth because of greater technological infrastructure. The developing countries are gradually advancing toward using video streaming platforms to advance and streamline their business processes. The densely populated countries, such as India and China, are gradually advancing toward video streaming monetization models to advance and streamline their business processes. In the past few years, the inclination of the audience toward global video content is offering growth opportunities to VoD players, such as Netflix, Amazon Prime Video, Yoku Tudou, iQiyi, Tencent Video, LeTV, Hooq, iFlix, YuppTV, BoxTV, and Hotstar, resulting in increased demand for video content management system solutions, such as video analytics, delivery, and security.

Key Players

Video content management system vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The video content manangement system market comprises major providers, such as IBM(US), Vimeo(US), Microsoft(US), BrightCove(US), Panopto(US), Kaltura(US), Sonic Foundry(US), Kollective(US), Vidyard(US), Cloudapp(US), Haivision(US), Dalet Digital Media Systems(France), MediaPlatform(US), Poly(US), Qumu(US), Vidizmo(US), VBrick(US), Telestream(US), Dacast(US), JW Player(US), Renderforest(Armenia), BigCommand(US), Genus Technologies(US), and Boxcast(US).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Million (USD) |

|

Segments covered |

By Component, Application (Education and Learning, Enterprise Communications, Recruitment and Training, Virtual Events), By Deployment Mode and Industry Vertical. |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

IBM(US), Vimeo(US), Microsoft(US), BrightCove(US), Panopto(US), Kaltura(US), Sonic Foundry(US), Kollective(US), Vidyard(US), Cloudapp(US), Haivision(US), Dalet Digital Media Systems(France), MediaPlatform(US), Poly(US), Qumu(US), Vidizmo(US), VBrick(US), Telestream(US), Dacast(US), JW Player(US), Renderforest(Armenia), BigCommand(US), Genus Technologies(US), and Boxcast(US) |

This research report of video content management system market based on application, vertical, deployment model, type, and organization size.

Based on the component:

- Platform

- Services

Based on the deployment mode:

- On-premises

- Cloud

Based on the application:

- Education and learning

- Enterprise communication

- Marketing and client engagement

- Recruitment and training

- Virtual events

Based on the Industry vertical:

- BFSI

- IT and Telecom

- Healthcare and life sciences

- Education

- Media and Entertainment

- Retail and Ecommerce

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- Rest of APAC

-

MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In July 2021, IBM collaborated with Canon to launch a new volumetric video technology to enable the creation of high-quality digital video content technology. The technology leverages cameras and advanced data processing that enables video point of view, creating a more immersive experience for viewers.

- In July 2021, Brightcove partnered With Wibbitz, a video creation tool provider, for enabling accessibility of Wibbitiz on BrightCove’s video cloud platform. The platform enables features for users to create polished videos from scratch through Wibbitz’s templates and photos, animations, transitions, video clips, and other smart media, allowing them to distribute the videos through the Brightcove platform to any other device.

- In February 2020, Vimeo introduced its new product Vimeo Create, a suite of tools for creating professional quality videos for small businesses. The new product combines smart editing technology with an intuitive interface and access to a gallery of professionally designed video templates and other editing tools to create a high-quality video for its users.

Frequently Asked Questions (FAQ):

How big is the Video Content Management System Market?

What is growth rate of the Video Content Management System Market?

What are the key trends affecting the global Video Content Management System Market?

Who are the key players in Video Content Management System Market?

What are the major revenue pockets in the Video Content Management System Market currently?

What is the future of Video Content Management System industry?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 6 VIDEO CONTENT MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakup of primaries

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 VIDEO CONTENT MANAGEMENT SYSTEM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1: BOTTOM-UP (SUPPLY-SIDE) – REVENUE OF ALL PLATFORMS AND SERVICES IN THE VIDEO CONTENT MANAGEMENT SYSTEM MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE) – COLLECTIVE REVENUE OF VIDEO CONTENT MANAGEMENT SYSTEM VENDORS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 - BOTTOM-UP (SUPPLY-SIDE) – CALCULATION OF REVENUES OF PLATFORMS AND SERVICES OF VIDEO CONTENT MANAGEMENT SYSTEM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (1/2)

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

2.4 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.5 COMPETITIVE LEADERSHIP MAPPING CRITERIA WEIGHTAGE

2.5.1 VENDOR INCLUSION CRITERIA

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 13 TOP-GROWING SEGMENTS IN THE VIDEO CONTENT MANAGEMENT SYSTEM MARKET

FIGURE 14 NORTH AMERICA IS ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE IN THE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 OVERVIEW OF THE VIDEO CONTENT MANAGEMENT SYSTEM SOFTWARE MARKET

FIGURE 15 INCREASING DEMAND FOR VIDEO CONTENT TO DRIVE THE MARKET GROWTH

4.2 VIDEO CONTENT MANAGEMENT SYSTEM MARKET, BY COMPONENT

FIGURE 16 PLATFORM SEGMENT ESTIMATED TO ACCOUNT FOR A LARGER SHARE IN THE VIDEO CONTENT MANAGEMENT SYSTEM SOFTWARE MARKET IN 2021

4.3 MARKET, BY INDUSTRY VERTICAL

FIGURE 17 BFSI SEGMENT ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE IN THE VIDEO CONTENT MANAGEMENT SYSTEM SOFTWARE MARKET IN 2021

4.4 NORTH AMERICA: MARKET, BY INDUSTRY VERTICAL AND COUNTRY

FIGURE 18 BFSI SEGMENT AND THE US ESTIMATED TO ACCOUNT FOR THE LARGEST SHARES IN THE NORTH AMERICAN MARKET IN 2021

4.5 ASIA PACIFIC: MARKET, BY INDUSTRY VERTICAL AND COUNTRY

FIGURE 19 BFSI SEGMENT AND REST OF APAC TO ACCOUNT FOR THE LARGEST SHARES IN THE ASIA PACIFIC VIDEO CONTENT MANAGEMENT SYSTEM SOFTWARE MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 VIDEO CONTENT MANAGEMENT SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for online video content

5.2.1.2 Adoption of cloud-based services by enterprises

FIGURE 21 GLOBAL CLOUD SERVICES MARKET, 2018-2022 (USD BILLION)

5.2.1.3 Increasing number of internet users around the world

FIGURE 22 NUMBER OF INTERNET USERS, BY REGION, 2015 VS. 2020

5.2.1.4 Rise in demand for video recording equipment and devices

5.2.2 RESTRAINTS

5.2.2.1 Data security and privacy concerns

FIGURE 23 NUMBER OF WORLDWIDE DATA BREACHES, BY INDUSTRY, 2019

5.2.2.2 Network connectivity and infrastructure issues

5.2.3 OPPORTUNITIES

5.2.3.1 5G to boost adoption of video content management system

FIGURE 24 5G MARKET SIZE, BY REGION, 2016 VS. 2020

5.2.3.2 Rising usage of video content for marketing among SMEs

5.2.4 CHALLENGES

5.2.4.1 Limited interoperability of different video conferencing solutions

5.2.4.2 Poor internet speed reducing the quality of service

5.3 ECOSYSTEM

FIGURE 25 VIDEO CONTENT MANAGEMENT SYSTEM MARKET: ECOSYSTEM

5.4 PATENT ANALYSIS

FIGURE 26 VIDEO PATENT APPLICANTS, BY COUNTRY, 2015-2020

5.5 AVERAGE SELLING PRICE

TABLE 2 PRICING ANALYSIS

5.6 VIDEO CONTENT MANAGEMENT SYSTEM MARKET: TECHNOLOGICAL LANDSCAPE

5.6.1 CLOUD SERVICES

5.6.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.6.3 5G NETWORK

5.7 USE CASES

5.7.1 CASE STUDY 1: CISCO PROVIDES CISCO-CONNECTED CLASSROOM AND CISCO WEBEX MEETING SOLUTIONS TO A.T. KEARNEY

5.7.2 CASE STUDY 2: ECOEGG IMPLEMENTED MICROSOFT TEAMS TO SOLVE ITS COMMUNICATION-RELATED CHALLENGES

5.7.3 CASE STUDY 3: COASTAL BEND COLLEGE IMPLEMENTED LIFESIZE VIDEO SYSTEMS ACROSS FOUR CAMPUSES

5.7.4 CASE STUDY 4: THE NORTHUMBERLAND COUNTY COUNCIL IMPLEMENTED GOOGLE MEET TO HELP FIREFIGHTERS

5.7.5 CASE STUDY 5: CANADIAN FOUNDATION FOR HEALTHCARE IMPROVEMENT IMPLEMENTED ADOBE CONNECT TO DELIVER VIRTUAL BILINGUAL EVENTS

5.8 PORTER’S 5 FORCES ANALYSIS

FIGURE 27 VIDEO CONTENT MANAGEMENT SYSTEM MARKET PORTER’S FIVE FORCES MODEL

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 COMPETITION RIVALRY

5.9 COVID-19 MARKET OUTLOOK FOR MARKET

FIGURE 28 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

FIGURE 29 MARKET: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.10 REGULATIONS

5.10.1 NORTH AMERICA

5.10.2 EUROPE

5.10.3 ASIA PACIFIC

5.10.4 MIDDLE EAST AND AFRICA

5.10.5 LATIN AMERICA

6 VIDEO CONTENT MANAGEMENT SYSTEM MARKET, BY COMPONENT (Page No. - 65)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 30 SERVICES SEGMENT TO GROW AT A HIGHER CAGR IN THE MARKET FROM 2021 TO 2026

TABLE 3 MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

6.2 PLATFORM

TABLE 4 PLATFORM: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 SERVICES

TABLE 5 SERVICES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 6 MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

6.3.1 TRAINING AND CONSULTING

TABLE 7 TRAINING & CONSULTING: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.2 SUPPORT AND MAINTENANCE

TABLE 8 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3 IMPLEMENTATION AND INTEGRATION

TABLE 9 IMPLEMENTATION AND INTEGRATION: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 VIDEO CONTENT MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE (Page No. - 72)

7.1 INTRODUCTION

FIGURE 31 CLOUD DEPLOYMENT MODE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

TABLE 10 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

7.2 ON-PREMISES

TABLE 11 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 CLOUD

TABLE 12 CLOUD: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 VIDEO CONTENT MANAGEMENT SYSTEM MARKET, BY APPLICATION (Page No. - 76)

8.1 INTRODUCTION

8.1.1 APPLICATION: MARKET DRIVERS

8.1.2 APPLICATION: COVID-19 IMPACT

FIGURE 32 EDUCATION AND LEARNING SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 EDUCATION AND LEARNING

TABLE 14 EDUCATION AND LEARNING: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3 ENTERPRISE COMMUNICATION

TABLE 15 ENTERPRISE COMMUNICATION: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.4 MARKETING AND CLIENT ENGAGEMENT

TABLE 16 MARKETING AND CLIENT ENGAGEMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.5 RECRUITMENT AND TRAINING

TABLE 17 RECRUITMENT AND TRAINING: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.6 VIRTUAL EVENTS

TABLE 18 VIRTUAL EVENTS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 VIDEO CONTENT MANAGEMENT SYSTEM MARKET, BY INDUSTRY VERTICAL (Page No. - 83)

9.1 INTRODUCTION

9.1.1 INDUSTRY VERTICAL: MARKET DRIVERS

9.1.2 INDUSTRY VERTICAL: COVID-19 IMPACT

FIGURE 33 EDUCATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 19 MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2026 (USD MILLION)

9.2 BFSI

TABLE 20 BFSI: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.3 IT AND TELECOM

TABLE 21 IT AND TELECOM: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.4 HEALTHCARE AND LIFE SCIENCES

TABLE 22 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.5 EDUCATION

TABLE 23 EDUCATION: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.6 MEDIA AND ENTERTAINMENT

TABLE 24 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.7 RETAIL AND E-COMMERCE

TABLE 25 RETAIL AND E-COMMERCE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.8 OTHER VERTICALS

TABLE 26 OTHER VERTICALS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10 VIDEO CONTENT MANAGEMENT SYSTEM MARKET, BY REGION (Page No. - 91)

10.1 INTRODUCTION

FIGURE 34 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 27 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT IN MARKET

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 28 NORTH AMERICA: VIDEO CONTENT MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

10.2.3 UNITED STATES

TABLE 34 UNITED STATES: VIDEO CONTENT MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 35 UNITED STATES: MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

TABLE 36 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.2.4 CANADA

TABLE 37 CANADA: VIDEO CONTENT MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 38 CANADA: MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

TABLE 39 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: VIDEO CONTENT MANAGEMENT SYSTEM MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT MARKET

TABLE 40 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 41 EUROPE: MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

TABLE 42 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 43 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2026 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

10.3.3 UNITED KINGDOM

TABLE 46 UNITED KINGDOM: VIDEO CONTENT MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 47 UNITED KINGDOM: MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

TABLE 48 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.3.4 GERMANY

TABLE 49 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 50 GERMANY: MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

TABLE 51 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: VIDEO CONTENT MANAGEMENT SYSTEM MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT ON MARKET

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2026 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

10.4.3 CHINA

TABLE 58 CHINA: VIDEO CONTENT MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 59 CHINA: MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

TABLE 60 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.4.4 JAPAN

TABLE 61 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 62 JAPAN: MARKET SIZE, BY SERVICES, 2019–2026 (USD MILLION)

TABLE 63 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: VIDEO CONTENT MANAGEMENT SYSTEM MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT ON THE VIDEO CONTENT MANAGEMENT SYSTEM SOFTWARE MARKET

TABLE 64 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2026 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

10.5.3 UNITED ARAB EMIRATES

TABLE 70 UNITED ARAB EMIRATES: VIDEO CONTENT MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 71 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

TABLE 72 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 73 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.5.5 SOUTH AFRICA

TABLE 74 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 75 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.5.6 REST OF MIDDLE EAST & AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT ON VIDEO CONTENT MANAGEMENT SYSTEM MARKET

TABLE 76 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 77 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 78 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 79 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 80 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2026 (USD MILLION)

TABLE 81 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

10.6.3 BRAZIL

TABLE 82 BRAZIL: VIDEO CONTENT MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 83 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.6.4 MEXICO

TABLE 84 MEXICO: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 85 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 120)

11.1 INTRODUCTION

FIGURE 37 MARKET EVALUATION FRAMEWORK

11.2 COMPETITIVE SCENARIO

11.2.1 NEW LAUNCHES

TABLE 86 VIDEO CONTENT MANAGEMENT SYSTEM MARKET: NEW LAUNCHES, 2019-2021

11.2.2 NEW DEALS

TABLE 87 MARKET: DEALS, 2019-2021

11.3 MARKET SHARE OF TOP VENDORS

TABLE 88 MARKET: DEGREE OF COMPETITION

11.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 38 HISTORICAL REVENUE ANALYSIS, 2017-2020

11.5 COMPANY EVALUATION QUADRANT

11.5.1 DEFINITIONS AND METHODOLOGY

TABLE 89 COMPANY EVALUATION QUADRANT: CRITERIA

11.5.2 STARS

11.5.3 EMERGING LEADERS

11.5.4 PERVASIVE PLAYERS

11.5.5 PARTICIPANTS

FIGURE 39 VIDEO CONTENT MANAGEMENT SYSTEM MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

TABLE 90 COMPANY FOOTPRINT

11.6 MARKET RANKING OF TOP PLAYERS

FIGURE 40 MARKET RANKING IN 2021

12 COMPANY PROFILES (Page No. - 130)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products, Key Insights, Recent Developments, MnM View)*

12.2.1 IBM

TABLE 91 IBM: BUSINESS OVERVIEW

FIGURE 41 IBM: COMPANY SNAPSHOT

TABLE 92 IBM: VIDEO CONTENT MANAGEMENT SYSTEM MARKET: DEALS

12.2.2 VIMEO

TABLE 93 VIMEO: BUSINESS OVERVIEW

FIGURE 42 IAC: COMPANY SNAPSHOT

TABLE 94 VIMEO: VIDEO CONTENT MANAGEMENT MARKET: NEW LAUNCHES

TABLE 95 VIMEO: MARKET: DEALS

12.2.3 MICROSOFT

TABLE 96 MICROSOFT: BUSINESS OVERVIEW

FIGURE 43 MICROSOFT: COMPANY SNAPSHOT

TABLE 97 MICROSOFT: VIDEO CONTENT MANAGEMENT SYSTEM MARKET: NEW LAUNCHES

12.2.4 BRIGHTCOVE

TABLE 98 BRIGHTCOVE: BUSINESS OVERVIEW

FIGURE 44 BRIGHTCOVE: COMPANY SNAPSHOT

TABLE 99 BRIGHTCOVE: MARKET: NEW LAUNCHES

TABLE 100 BRIGHTCOVE: VIDEO CONTENT MANAGEMENT MARKET: DEALS

12.2.5 PANOPTO

TABLE 101 PANOPTO: BUSINESS OVERVIEW

TABLE 102 PANOPTO: MARKET: NEW LAUNCHES

TABLE 103 PANOPTO: VIDEO CONTENT MANAGEMENT SYSTEM MARKET: DEALS

12.2.6 KALTURA

TABLE 104 KALTURA: BUSINESS OVERVIEW

FIGURE 45 KALTURA: COMPANY SNAPSHOT

TABLE 105 KALTURA: VIDEO CONTENT MANAGEMENT MARKET: NEW LAUNCHES

TABLE 106 KALTURA: VIDEO CONTENT MANAGEMENT MARKET: DEALS

12.2.7 SONIC FOUNDRY

TABLE 107 SONIC FOUNDRY: BUSINESS OVERVIEW

FIGURE 46 SONIC FOUNDRY: COMPANY SNAPSHOT

TABLE 108 SONIC FOUNDRY: VIDEO CONTENT MANAGEMENT SYSTEM MARKET: NEW LAUNCHES

TABLE 109 SONIC FOUNDRY: VIDEO CONTENT MANAGEMENT MARKET: DEALS

12.2.8 KOLLECTIVE

TABLE 110 KOLLECTIVE: BUSINESS OVERVIEW

TABLE 111 KOLLECTIVE: VIDEO CONTENT MANAGEMENT MARKET: NEW LAUNCHES

TABLE 112 KOLLECTIVE: VIDEO CONTENT MANAGEMENT MARKET: DEALS

12.2.9 VIDYARD

TABLE 113 VIDYARD: BUSINESS OVERVIEW

TABLE 114 VIDYARD: VIDEO CONTENT MANAGEMENT MARKET: NEW LAUNCHES

TABLE 115 VIDYARD: VIDEO CONTENT MANAGEMENT MARKET: DEALS

12.2.10 CLOUDAPP

TABLE 116 CLOUDAPP: BUSINESS OVERVIEW

TABLE 117 CLOUDAPP: VIDEO CONTENT MANAGEMENT SYSTEM MARKET: NEW LAUNCHES

12.2.11 HAIVISION

12.2.12 DALET DIGITAL MEDIA SYSTEMS

12.2.13 MEDIAPLATFORM

12.2.14 POLY

12.2.15 QUMU

12.2.16 VIDIZMO

12.2.17 VBRICK

12.2.18 TELESTREAM

12.2.19 DACAST

12.2.20 JW PLAYER

12.2.21 RENDERFOREST

12.2.22 BIGCOMMAND (ADILO)

12.2.23 GENUS TECHNOLOGIES

12.2.24 BOXCAST

*Details on Business Overview, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 174)

13.1 ADJACENT/RELATED MARKETS

13.1.1 LIMITATIONS

13.1.2 VIDEO STREAMING SOFTWARE MARKET – GLOBAL FORECAST TO 2025

13.1.2.1 Market definition

13.1.2.2 Market overview

13.1.2.3 Video streaming software market, by component

TABLE 118 VIDEO STREAMING SOFTWARE MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 119 VIDEO STREAMING SOFTWARE MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

13.1.2.4 Video streaming software market, by solution

TABLE 120 VIDEO STREAMING SOFTWARE MARKET SIZE, BY SOLUTION, 2014–2018 (USD MILLION)

TABLE 121 VIDEO STREAMING SOFTWARE MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

13.1.2.5 Video streaming software market, by industry vertical

TABLE 122 VIDEO STREAMING SOFTWARE SIZE, BY INDUSTRY VERTICAL, 2014–2018 (USD MILLION)

TABLE 123 VIDEO STREAMING SOFTWARE SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

13.1.2.6 Video streaming software market, by region

TABLE 124 VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 125 VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.1.3 VIDEO ANALYTICS MARKET – GLOBAL FORECAST TO 2025

13.1.3.1 Market definition

13.1.3.2 Market overview

13.1.3.3 Video analytics market, by component

TABLE 126 VIDEO ANALYTICS MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

13.1.3.4 Video analytics market, by deployment

TABLE 127 VIDEO ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

13.1.3.5 Video analytics market, by application

TABLE 128 VIDEO ANALYTICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

13.1.3.6 Video analytics market, by type

TABLE 129 VIDEO ANALYTICS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

13.1.3.7 Video analytics market, by industry vertical

TABLE 130 VIDEO ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

13.1.3.8 Video analytics market, by region

TABLE 131 VIDEO ANALYTICS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.4 UNIFIED COMMUNICATIONS AS A SERVICE MARKET – GLOBAL FORECAST TO 2024

13.1.4.1 Market definition

13.1.4.2 Market overview

13.1.4.3 Unified communications as a service market, by component

TABLE 132 UNIFIED COMMUNICATIONS AS A SERVICE MARKET, BY COMPONENT, 2017–2024 (USD MILLION)

13.1.4.4 Unified communications as a service market, by organization size

TABLE 133 UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

13.1.4.5 Unified communications as a service market, by industry vertical

TABLE 134 UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY INDUSTRY VERTICAL, 2017–2024 (USD MILLION)

13.1.4.6 Unified communications as a service market, by region

TABLE 135 UNIFIED COMMUNICATIONS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.1.5 VIDEO ON DEMAND MARKET – GLOBAL FORECAST TO 2024

13.1.5.1 Market definition

13.1.5.2 Market overview

13.1.5.3 Video-on-demand market, by component

TABLE 136 VIDEO ON DEMAND MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

13.1.5.4 Video on demand market, by solution

TABLE 137 VIDEO ON DEMAND MARKET SIZE, BY SOLUTION, 2017–2024 (USD MILLION)

13.1.5.5 Video-on-demand market, by monetization model

TABLE 138 VIDEO ON DEMAND MARKET SIZE, BY MONETIZATION MODEL, 2017–2024 (USD MILLION)

13.1.5.6 Video on demand market, by industry vertical

TABLE 139 VIDEO ON DEMAND MARKET SIZE, BY INDUSTRY VERTICAL, 2017–2024 (USD MILLION)

13.1.5.7 Video-on-demand market, by region

TABLE 140 VIDEO ON DEMAND MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global video content management system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total video content management system market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

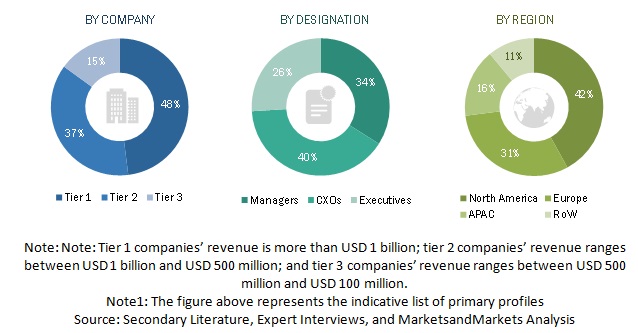

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources were mainly industry experts from the core and related industries, distributors, service providers, technology developers, and technologists from companies and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation

For making market estimates and forecasting the video content management system market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global Video content management system market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the video content management system market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the video content management system market based on application, vertical, deployment mode and organization size.

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the impact of COVID-19 on components, business functions, verticals, organization size, deployment types, and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the video content management system market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the video content management system market

- To profile key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and mergers and acquisitions, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Video Content Management System Market