Unified Communications as a Service Market by Component (Telephony, Unified Messaging, Conferencing, and Collaboration Platforms and Applications), Organization Size (SMEs and Large Enterprises), Vertical, and Region - Global Forecast to 2024

Unified Communications as a Service (UCaaS) Market Size - Global

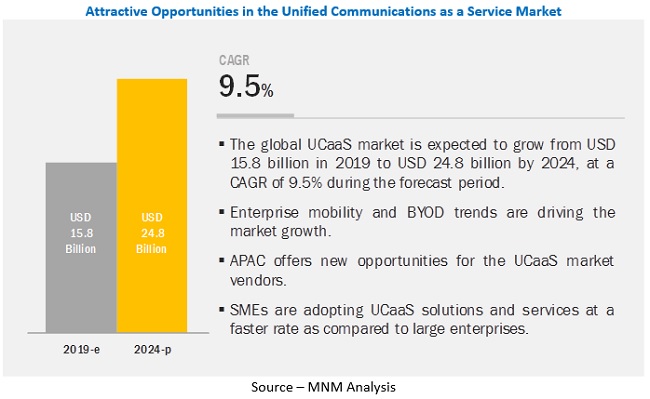

[137 Pages Report] The Unified Communications as a Service Market size as per revenue was surpassed $15.8 billion in 2019. Throughout the projection period, the Unified Communications as a Service industry is anticipated to increase at a CAGR of 9.5% in between 2019-2024 to reach around $24.8 billion in 2024.

The Unified Communications as a Service Market growth is driven by key factors include the increasing demand for UCaaS from both large enterprises and SMEs and growing trends toward mobility and Bring Your Own Device (BYOD). Moreover, factors such as advancements in artificial intelligence, machine learning, and other emerging technologies, are expected to create ample opportunities for UCaaS vendors.

Based on components, telephony and conferencing segment to contribute the highest market share during the forecast period

The telephony and conferencing segment are the most demanded UCaaS solutions among other components in 2019. However, collaboration platforms and applications segment is estimated to have higher demand during the forecast period due to its inherent benefits, such as security and low dependence on multiple vendors for UCaaS deployment. Vendors across the globe are offering telephony and conferencing as the main product due to an increasing demand among small and medium enterprises (SMEs) as these solutions help them in streamlining their enterprise communication and increase productivity.

Based on organization types, the large enterprises segment to hold a larger market size during the forecast period

The large enterprises across the world are adopting BYOD trends and thus, a large number of mobile workers are being employed leading to a higher demand for UCaaS solutions. The SMEs segment is expected to grow at a higher CAGR during the forecast period. An increasing number of SMEs and their global expansion have increased the demand for UCaaS solutions.

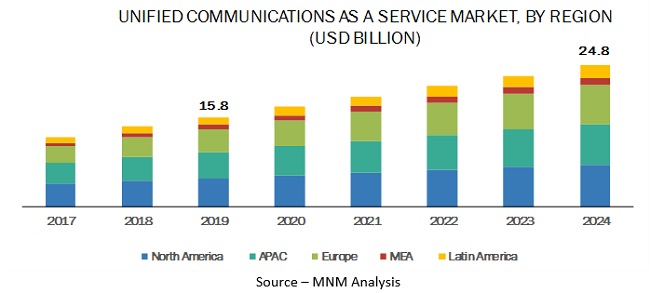

Based on regions, North America to account for the largest market size during the forecast period

The Unified Communications as a Service (UCaaS) market by region covers five major geographic regions: North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period; this can be attributed to the increasing technology adoption among North American enterprises for increasing productivity and the presence of a large number of UCaaS vendors.

Key Market Players

The major players in the Unified Communications as a Service (UCaaS) market are RingCentral (US), 8x8 (US), LogMeIn (US), Mitel (US), Cisco (US), Vonage (US), Fuze, Inc. (US), Microsoft (US), Google (US), Verizon (US), BT (UK), Orange S.A. (France), DialPad (US), StarBlue (Ireland), Windstream (US), Alcatel-Lucent Enterprise (France), Intrado Corporation (US), NTT Communications Corporation (US), Masergy (US), and Revation Systems (US).

The study includes an in-depth competitive analysis of these key players in the UCaaS market with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metrics |

Attributes |

|

Revenue Forecast in 2024 |

$24.8 billion |

|

Market Size in 2019 |

$15.8.8 billion |

|

Growth Rate |

9.5% CAGR in between 2019-2024 |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Million (USD) |

|

Market Segmentation |

Component (telephony, unified messaging, conferencing, and collaboration platforms and applications), Organization Size, Vertical, and Region |

|

Regions Covered |

North America, APAC, Europe, Latin America, and MEA |

|

Top Players |

RingCentral (US), 8x8 (US), LogMeIn (US), Mitel (US), Cisco (US), Vonage (US), Fuze, Inc. (US), Microsoft (US), Google (US), Verizon (US), BT (UK), Orange S.A. (France), DialPad (US), StarBlue (Ireland), Windstream (US), Alcatel-Lucent Enterprise (France), Intrado Corporation (US), NTT Communications Corporation (US), Masergy (US), and Revation Systems (US) |

Based on components, the Unified Communications as a Service (UCaaS) market has been segmented as follows:

-

Component

- Telephony

- Unified Messaging

- Conferencing

- Collaboration Platforms And Applications

Based on organization sizes, the market has been segmented as follows:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Based on verticals, the market has been segmented as follows:

- BFSI

- Telecom and IT

- Consumer Goods and Retail

- Healthcare

- Public Sector and Utilities

- Logistics and Transportation

- Travel and Hospitality

- Others (Education, Media and Entertainment, and Manufacturing)

Based on regions, the market has been segmented as follows::

-

North America

- US

- Canada

-

Europe

- UK

- Rest of Europe

-

APAC

- China

- Rest of APAC

- MEA

-

Latin America

- Mexico

- Rest of Latin America

Recent Developments

- In January 2020, Altura partnered with RingCentral to enhance cloud communications and contact center solutions. Altura will help RingCentral bring its cloud communications and contact center solutions to the US enterprises across multiple sectors, such as healthcare, government, and education.

- In July 2019, Verizon collaborated with Zoom to provide a new solution for unified communications. This collaboration provides access to Zoom meetings to the current Verizon customers from Verizon wireless phones or VoIP solutions, without having to pay for additional support or staff.

- In October 2019, 8x8, Poly, and ScanSource announced a strategic partnership to deliver cloud-based communication solutions. The partnership helped customers easily move away from on-premises business communication systems to cloud-based communication solutions.

Key questions addressed by the report:

- Where would all these developments take the industry in the mid to long term?

- What are the upcoming industry solutions for the Unified Communications as a Service (UCaaS) market ?

- Which are the major factors expected to drive the market?

- Which industry vertical would gain the highest market share in the market?

- Which region would offer high growth for vendors in the PIM market?

Frequently Asked Questions (FAQ):

What is the future of Unified Communication as a Service (UCaaS) Market?

What is the Unified Communication as a service market Growth?

What are the key opportunities in the Unified Communication as a Service Market?

Which are the top Unified Communication as a Service Companies profiled in the report?

Who will be the leading hub for Unified Communications as a service market?

What is the Unified Communication as a service market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.5.1 Vendor Inclusion Criteria

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Unified Communications as a Service Market

4.2 Market in North America, By Component and Vertical

4.3 Market in Europe, By Component and Country

4.4 Market in Asia Pacific, By Component and Vertical

5 Market Dynamics (Page No. - 32)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Demand for UCaaS From Both the Large Enterprises and SMES

5.1.1.2 Growing Trends of Mobility and Byod

5.1.2 Restraints

5.1.2.1 Security Concerns Over Cloud-Based Deployment

5.1.3 Opportunities

5.1.3.1 Increased Enterprise Mobility and Byod Usage

5.1.3.2 Potential or Less-Explored Markets

5.1.4 Challenges

5.1.4.1 Low Readiness to Move to Modern Unified Communications

5.2 Use Cases

5.2.1 Attraqt Leveraged RingCentral’s Mobile Cloud-Based Communications Solution to Tackle Its Mobile and Distributed Workforce Needs

5.2.2 Deployed Unified System to Save Cost and Improve Employee Experience Using Mitel’s Business Phone Systems

5.2.3 Cost and Time Saving, and Increase in Organizational Agility and Speed Using Meeting Solutions

6 Unified Communications as a Service Market By Component (Page No. - 37)

6.1 Introduction

6.2 Telephony

6.2.1 Telephony: Market Drivers

6.3 Unified Messaging

6.3.1 Unified Messaging: Market Drivers

6.4 Conferencing

6.4.1 Conferencing: Market Drivers

6.5 Collaboration Platforms and Applications

6.5.1 Collaboration Platforms and Applications: Unified Communications as a Service Market Drivers

7 Unified Communications as a Service Market By Organization Size (Page No. - 47)

7.1 Introduction

7.2 Large Enterprises

7.2.1 Large Enterprises: Market Drivers

7.3 Small and Medium-Sized Enterprises

7.3.1 Small and Medium-Sized Enterprises: Market Drivers

8 Unified Communications as a Service Market By Vertical (Page No. - 53)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.2.1 Banking, Financial Services, and Insurance: Market Drivers

8.3 Telecom and IT

8.3.1 Telecom and IT: Market Drivers

8.4 Consumer Goods and Retail

8.4.1 Consumer Goods and Retail: Market Drivers

8.5 Healthcare

8.5.1 Healthcare: Market Drivers

8.6 Public Sector and Utilities

8.6.1 Public Sector and Utilities: Market Drivers

8.7 Logistics and Transportation

8.7.1 Logistics and Transportation: Unified Communications as a Service Market Drivers

8.8 Travel and Hospitality

8.8.1 Travel and Hospitality: Market Drivers

8.9 Others

9 Geographic Analysis (Page No. - 72)

9.1 Introduction

9.2 North America

9.2.1 North America: Unified Communications as a Service Market Drivers

9.2.2 United States

9.2.3 Canada

9.3 Europe

9.3.1 Europe: Market Drivers

9.3.2 United Kingdom

9.3.3 Rest of Europe

9.4 Asia Pacific

9.4.1 Asia Pacific: Market Drivers

9.4.2 China

9.4.3 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 Middle East and Africa: Unified Communications as a Service Market Drivers

9.5.2 Kingdom of Saudi Arabia

9.5.3 Rest of Middle East and Africa

9.6 Latin America

9.6.1 Latin America: Market Drivers

9.6.2 Mexico

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 100)

10.1 Introduction

10.1.1 Visionary Leaders

10.1.2 Dynamic Differentiators

10.1.3 Innovators

10.1.4 Emerging Companies

11 Company Profiles (Page No. - 102)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Introduction

11.2 RingCentral

11.3 BT

11.4 Verizon

11.5 Orange S.A.

11.6 8x8

11.7 Cisco

11.8 Google

11.9 Microsoft

11.10 LogMeIn Inc.

11.11 Mitel

11.12 DialPad

11.13 Fuze

11.14 StarBlue

11.15 Windstream

11.16 Alcatel-Lucent Enterprise (ALE)

11.17 NTT Communications

11.18 Vonage

11.19 Intrado Corporation (Formerly West)

11.20 Masergy

11.21 Revation Systems

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 131)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (105 Tables)

Table 1 Factor Analysis

Table 2 Evaluation Criteria

Table 3 Unified Communications as a Service Market, By Component, 2017–2024 (USD Million)

Table 4 Telephony: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 5 North America: Telephony Market Size, By Country, 2017–2024 (USD Million)

Table 6 Europe: Telephony Market Size, By Country, 2017–2024 (USD Million)

Table 7 Asia Pacific: Telephony Market Size, By Country, 2017–2024 (USD Million)

Table 8 Unified Messaging: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 9 North America: Unified Messaging Market Size, By Country, 2017–2024 (USD Million)

Table 10 Europe: Unified Messaging Market Size, By Country, 2017–2024 (USD Million)

Table 11 Asia Pacific: Unified Messaging Market Size, By Country, 2017–2024 (USD Million)

Table 12 Conferencing: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 13 North America: Conferencing Market Size, By Country, 2017–2024 (USD Million)

Table 14 Europe: Conferencing Market Size, By Country, 2017–2024 (USD Million)

Table 15 Asia Pacific: Conferencing Market Size, By Country, 2017–2024 (USD Million)

Table 16 Collaboration Platforms and Applications: Market Size By Region, 2017–2024 (USD Million)

Table 17 North America: Collaboration Platforms and Applications Market Size, By Country, 2017–2024 (USD Million)

Table 18 Europe: Collaboration Platforms and Applications Market Size, By Country, 2017–2024 (USD Million)

Table 19 Asia Pacific: Collaboration Platforms and Applications Market Size, By Country, 2017–2024 (USD Million)

Table 20 Unified Communications as a Service Market Size, By Organization Size, 2017–2024 (USD Million)

Table 21 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 22 North America: Large Enterprises Market Size, By Country, 2017–2024 (USD Million)

Table 23 Europe: Large Enterprises Market Size, By Country, 2017–2024 (USD Million)

Table 24 Asia Pacific: Large Enterprises Market Size, By Country, 2017–2024 (USD Million)

Table 25 Small and Medium-Sized Enterprises: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 26 North America: Small and Medium-Sized Enterprises Market Size, By Country, 2017–2024 (USD Million)

Table 27 Europe: Small and Medium-Sized Enterprises Market Size, By Country, 2017–2024 (USD Million)

Table 28 Asia Pacific: Small and Medium-Sized Enterprises Market Size, By Country, 2017–2024 (USD Million)

Table 29 Unified Communications as a Service Market Size, By Vertical, 2017–2024 (USD Million)

Table 30 Banking, Financial Services, and Insurance: Market Size By Region, 2017–2024 (USD Million)

Table 31 North America: Banking, Financial Services, and Insurance Market Size, By Country, 2017–2024 (USD Million)

Table 32 Europe: Banking, Financial Services, and Insurance Market Size, By Country, 2017–2024 (USD Million)

Table 33 Asia Pacific: Banking, Financial Services, and Insurance Market Size, By Country, 2017–2024 (USD Million)

Table 34 Telecom and IT: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 35 North America: Telecom and IT Market Size, By Country, 2017–2024 (USD Million)

Table 36 Europe: Telecom and IT Market Size, By Country, 2017–2024 (USD Million)

Table 37 Asia Pacific: Telecom and IT Market Size, By Country, 2017–2024 (USD Million)

Table 38 Consumer Goods and Retail: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 39 North America: Consumer Goods and Retail Market Size, By Country, 2017–2024 (USD Million)

Table 40 Europe: Consumer Goods and Retail Market Size, By Country, 2017–2024 (USD Million)

Table 41 Asia Pacific: Consumer Goods and Retail Market Size, By Country, 2017–2024 (USD Million)

Table 42 Healthcare: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 43 North America: Healthcare Market Size, By Country, 2017–2024 (USD Million)

Table 44 Europe: Healthcare Market Size, By Country, 2017–2024 (USD Million)

Table 45 Asia Pacific: Healthcare Market Size, By Country, 2017–2024 (USD Million)

Table 46 Public Sector and Utilities: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 47 North America: Public Sector and Utilities Market Size, By Country, 2017–2024 (USD Million)

Table 48 Europe: Public Sector and Utilities Market Size, By Country, 2017–2024 (USD Million)

Table 49 Asia Pacific: Public Sector and Utilities Market Size, By Country, 2017–2024 (USD Million)

Table 50 Logistics and Transportation: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 51 North America: Logistics and Transportation Market Size, By Country, 2017–2024 (USD Million)

Table 52 Europe: Logistics and Transportation Market Size, By Country, 2017–2024 (USD Million)

Table 53 Asia Pacific: Logistics and Transportation Market Size, By Country, 2017–2024 (USD Million)

Table 54 Travel and Hospitality: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 55 North America: Travel and Hospitality Market Size, By Country, 2017–2024 (USD Million)

Table 56 Europe: Travel and Hospitality Market Size, By Country, 2017–2024 (USD Million)

Table 57 Asia Pacific: Travel and Hospitality Market Size, By Country, 2017–2024 (USD Million)

Table 58 Others: Unified Communications as a Service Market Size, By Region, 2017–2024 (USD Million)

Table 59 North America: Others Market Size, By Country, 2017–2024 (USD Million)

Table 60 Europe: Others Market Size, By Country, 2017–2024 (USD Million)

Table 61 Asia Pacific: Others Market Size, By Country, 2017–2024 (USD Million)

Table 62 Unified Communications as a Service Market Size, By Region, 2017-2024 (USD Million)

Table 63 North America: Market Size By Component, 2017–2024 (USD Million)

Table 64 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 65 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 66 North America: Market Size By Country, 2017–2024 (USD Million)

Table 67 United States: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 68 United States: Market Size By Organization Size, 2017–2024 (USD Million)

Table 69 United States: Market Size By Vertical, 2017–2024 (USD Million)

Table 70 Canada: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 71 Canada: Market Size By Organization Size, 2017–2024 (USD Million)

Table 72 Canada: Market Size By Vertical, 2017–2024 (USD Million)

Table 73 Europe: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 74 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 75 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 76 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 77 United Kingdom: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 78 United Kingdom: Market Size By Organization Size, 2017–2024 (USD Million)

Table 79 United Kingdom: Market Size By Vertical, 2017–2024 (USD Million)

Table 80 Rest of Europe: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 81 Rest of Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 82 Rest of Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 83 Asia-Pacific: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 84 Asia-Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 85 Asia-Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 86 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 87 China: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 88 China: Market Size By Organization Size, 2017–2024 (USD Million)

Table 89 China: Market Size By Vertical, 2017–2024 (USD Million)

Table 90 Rest of Asia Pacific: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 91 Rest of Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 92 Rest of Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 93 Middle East and Africa: Market Size By Component, 2017–2024 (USD Million)

Table 94 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 95 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 96 Latin America: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 97 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 98 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 99 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 100 Mexico: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 101 Mexico: Market Size By Organization Size, 2017–2024 (USD Million)

Table 102 Mexico: Market Size By Vertical, 2017–2024 (USD Million)

Table 103 Rest of Latin America: Unified Communications as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 104 Rest of Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 105 Rest of Latin America: Market Size By Vertical, 2017–2024 (USD Million)

List of Figures (35 Figures)

Figure 1 Global Unified Communications as a Service Market: Research Design

Figure 2 Breakup of Primary Profiles

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Approach 1 Bottom-Up (Supply Side) – Revenue of All Solutions and Services of Unified Communications as a Service Market

Figure 5 Market Size Estimation Methodology: Approach 1 Bottom-Up (Supply Side) – Calculation of Revenue of All Solutions and Services of Unified Communications as a Service Vendors

Figure 6 Market Size Estimation Methodology: Approach 2 Top-Down (Demand Side) – Share of the Overall Unified Communications as a Service Market

Figure 7 Unified Communications as a Service Market Holistic View

Figure 8 Growth Rate of Segments in the Market During the Forecast Period

Figure 9 Increasing Adoption of Unified Communications as a Service Solutions Among Small and Medium-Sized Enterprises to Provide Attractive Market Opportunities

Figure 10 Telephony and Telecom and IT to Hold the Highest Market Shares in North America in 2019

Figure 11 Telephony and Rest of Europe Accounts for the Highest Market Share in Europe in 2019

Figure 12 Telephony and Telecom and IT to Hold the Highest Market Shares in Asia Pacific in 2019

Figure 13 Unified Communications as a Service: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Telephony Segment to Hold the Largest Market Size During the Forecast Period

Figure 15 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Figure 16 Telecom and IT Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 17 Asia Pacific to Exhibit the Highest Growth Rate During the Forecast Period

Figure 18 North America: Market Snapshot

Figure 19 Asia-Pacific: Market Snapshot

Figure 20 Unified Communications as a Service Market (Global), Competitive Leadership Mapping, 2019

Figure 21 RingCentral: Company Snapshot

Figure 22 SWOT Analysis: RingCentral

Figure 23 BT: Company Snapshot

Figure 24 SWOT Analysis: BT

Figure 25 Verizon: Company Snapshot

Figure 26 SWOT Analysis: Verizon

Figure 27 Orange S.A: Company Snapshot

Figure 28 SWOT Analysis: Orange S.A.

Figure 29 8x8: Company Snapshot

Figure 30 SWOT Analysis: 8x8

Figure 31 Cisco: Company Snapshot

Figure 32 Google: Company Snapshot

Figure 33 Microsoft: Company Snapshot

Figure 34 LogMeIn Inc.: Company Snapshot

Figure 35 Mitel: Company Snapshot

The study involved four major activities in estimating the current market size for Unified Communications as a Service (UCaaS) solutions. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as The UCtoday, IMCCA, and BusinessWeek, have been referred, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

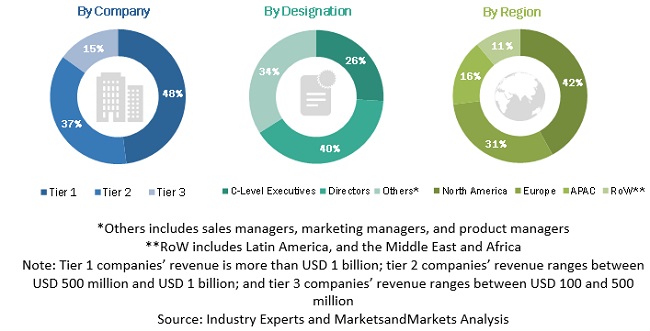

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the UCaaS. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Unified Communications as a Service Market Size Estimation

For making market estimates and forecasting the UCaaS market, and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global UCaaS market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the Unified Communications as a Service market by component (telephony, unified messaging, conferencing, and collaboration platforms and applications), organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the UCaaS market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the UCaaS market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as new product launches and product enhancements, partnerships, collaborations, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

- country wise split for MEA Unified Communications as a Service market

Growth opportunities and latent adjacency in Unified Communications as a Service Market

Need intelligence on a SaaS Cloud service provider to SMB segment

Gather insights into regional statistics on Hosted IP PBX with softphone with conferencing, voice mail, call center features market share, pricing model.

Gather insights into North American Market Size, Drivers & Special needs in Vertical Market, Decision criteria and Adoption rate.

Gather insights into UCAAS and Small and medium businesses, market size, market projections, Adoption rates, competition in North America region.

Detailed understanding of the Unified Communication as a service (UCaaS) Market and its Global Advancements, Worldwide Forecasts and Analysis.

Understand the Impact of Lync 2013 and Skype for Business on overall market and integration with other UCaaS solutions.