Video Conferencing Market by Component (Hardware, Solutions, and Services), Application (Corporate Communications, Training and Development, and Marketing and Client Engagement), Deployment Mode, Vertical and Region - Global Forecast to 2027

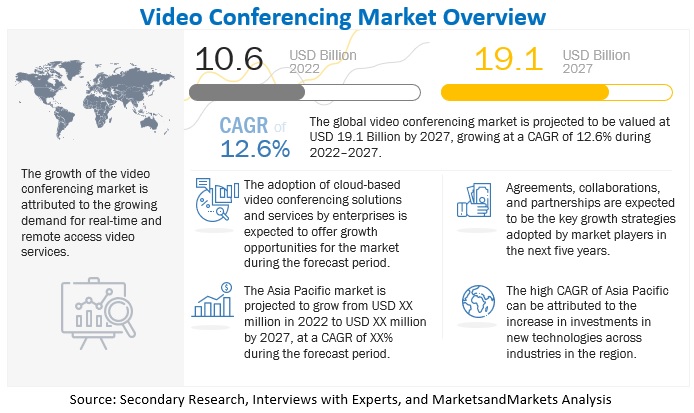

The global Video Conferencing Market was valued at $10.6 billion in 2022 and is projected to grow to $19.1 billion by 2027, at a compound annual growth rate (CAGR) of 12.6%. The necessity of incorporating employees in establishing strategic goals, the decreased travel time and expense, and the growing demand for virtual meeting spaces have all contributed to a growth in business spending on video conferencing systems.

With relation to the market for video conferencing, the new edition of the study offers updated financial data. The ecology of the video conferencing industry is included in the recent research report. The market for video conferencing is the subject of a technical analysis in the new research report. The market size for important nations across all regions is also included in the research report. The top five participants in the video conferencing industry are ranked according to the study's analysis of the market. The top five video conferencing market companies' historical revenue analysis is included in the most recent market report.

To know about the assumptions considered for this study, Request for Free Sample Report

The businesses are set for profitable expansion due to the development of conferencing platforms based on machine learning and artificial intelligence. By utilizing facial recognition and virtual assistant technology, these solutions enable businesses to maximize the use of collaboration platforms and increase meeting productivity. Organizations can learn more about the perfect meeting size, ideal meeting duration, and best meeting time of day with the use of AI in conferencing systems.

Market Dynamics

Driver: Growing cloud-native enterprises

Organizations can run their businesses with the help of the information received through face-to-face and direct communication with several company divisions, clients, distributors, suppliers, and customers. As a result, businesses are investing more money in the use of cloud services. In the video conferencing market, during the forecast period, spending on cloud conferencing, cloud infrastructure, and business intelligence software is anticipated to increase overall. Businesses are spending more on cloud-based video services due to the growing number of players in the industry, decreased travel time and expense, the significance of involving employees in setting strategic goals, and the growing need for virtual meeting spaces.

Restraint: Network Infrastructure Issues

Few emerging and underdeveloped nations are lacking in the necessary communication infrastructure to facilitate high-quality video transmission, despite the fact that the majority of developed nations have highly developed communication infrastructure. To avoid the annoyance of poor video and intermittent disconnections, people in these nations rely primarily on audio-based communication. When compared to video communications, audio-based communication needs a lot less bandwidth and can run on infrastructure with a lot less capacity. The lack of a strong communication infrastructure represents a significant market growth challenge for video conferencing market.

Opportunity: Boom in video conferencing hardware market

Companies such as Cisco, and Huawei are aggressively investing in hardware solutions to address video conferencing hardware-related difficulties, such as poor camera, microphone, and display unit quality. Intuitive collaborative whiteboards for smart offices, telepresence systems, end-point solutions, ultra 4K UHD cameras, and premium microphones are all available on the hardware market. The compact IP-based all-in-one endpoint device is simple to set up and use and has a camera, microphone, and HD codec. This gear helps SMEs and big enterprises to priorities things such as collaboration to build trustworthy work environments and be more agile.

Challenge: Difficulty in tapping non-agile market

Some users of video conferencing find that video systems are less comfortable than older technology or audio conferencing. In a recent poll by West Unified Communications of over 230 full-time US employees, 23% of the participants claimed that they are uncomfortable using video conferencing, and 75% said they still prefer audio to video. Many businesses are struggling to embrace video conferencing solutions and expand employee utilization because of the difficulties brought on by employee unease during video conferences.

Marketing and Client Engagement is expected to grow at a highest CAGR during forecast period

Among applications, marketing and client engagement is anticipated to grow at a highest CAGR during the forecast period. Organizations are able to reach a wider audience, connect with them more effectively, and quickly engage audiences with the aid of video conferencing for marketing objectives. By enabling more connection with the customers and improving their relationship with the company, video conferencing solutions assist in improving customer engagement. It engages and educates potential clients via high-quality video, polls, surveys, and open dialogue as well.

Solutions segment to account for largest market share during forecast period

Vendors of video conferencing solutions give businesses the ability to securely centralize, manage, and deliver videos. The solutions assist in managing every step of the process, from the initial phases of video capture and ingest through the last stages of distribution to end-user devices. The growing demand for video conferencing solutions, such as Microsoft Teams, Google Meet, Zoom and others, across many industries is attributable to the market and is anticipated to account for the largest video conferencing market share during the forecast period.

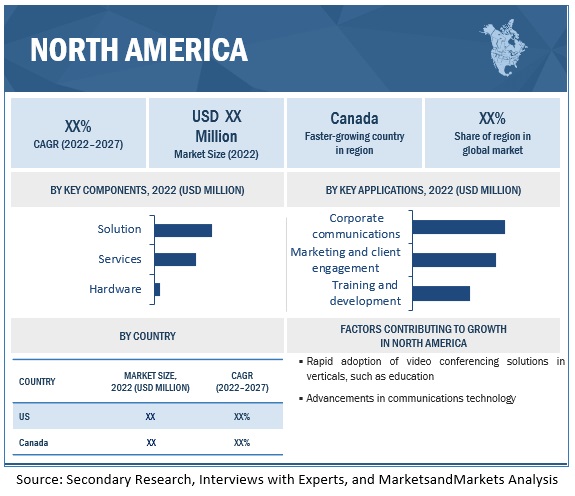

North America to account for largest market size during forecast period

By region, North America is estimated to lead the video conferencing market during the forecast period. It is one of the early adopters of video conferencing solution, since the majority of large enterprises are located in this region. The large-scale investments made by the various businesses for outsourcing the video conferencing solutions is one of the major key driver in the North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The video conferencing providers have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major players in the video conferencing market include Microsoft (US), Zoom Video Communications (US), Cisco (US), Adobe (US), Huawei (China), Avaya, Inc. (US), AWS (US), Google, LLC (US), HP (US), GoTo (US), Enghouse Systems (Canada), Pexip (Norway), Qumu Corporation (US), Sonic Foundry Inc. (US), Lifesize, Inc. (US), Kaltura Inc. (US), BlueJeans Network (US), Kollective Technology, Inc. (US), StarLeaf Inc. (UK), Dialpad (US), Logitech (US), Barco (Belgium), Fuze Inc. (US), Haivision Inc. (Canada), and Premium Global Services Inc. (US).

Scope of the Report

|

Report Metrics |

Details |

| Market size value in 2022 | US $10.6 billion |

| Market size value in 2027 | US $19.1 billion |

| Growth Rate | 12.6% CAGR |

| Largest Market | North America |

| Segments covered | Component, Application, Deployment Mode, Vertical, and Region |

| Geographies covered | North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

| Companies covered | Microsoft (US), Zoom Video Communications (US), Cisco (US), Adobe (US), Huawei (China), Avaya, Inc. (US), AWS (US), Google, LLC (US), HP (US), GoTo (US), Enghouse Systems (Canada), Pexip (Norway), Qumu Corporation (US), Sonic Foundry Inc. (US), Lifesize, Inc. (US), Kaltura Inc. (US), BlueJeans Network (US) and many more. |

|

Other Players |

Enghouse Systems, Qumu, Lifesize, Kaltura, Kollective, Sonic Foundry, Fuze, Dialpad, Haivision, Premiere Global Services |

|

Startups/SMES |

Daily, Owl Labs, Airmeet, Livestorm, 100ms, Kudo, Starleaf |

This research report categorizes the video conferencing market based on component, application, deployment type, vertical, and region.

Market by Component

- Solution

- Services

Market by Application:

- Corporate Communications

- Training and Development

- Marketing and Client Engagement

Market by Deployment Mode:

- On-premises

- Cloud

Market by Verticals:

- BFSI

- IT and Telecom

- Healthcare & Lifescience

- Education

- Media and Entertainment

- Other Verticals

Market by Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- ANZ

- Rest of Asia Pacific

-

Middle East and Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in Video Conferencing Market:

- In October 2022, Cisco partnered with Microsoft, which would bring Microsoft Teams to Cisco meeting room devices. It enables customers to choose to run Microsoft Teams by default on Cisco Room and Desk devices.

- In August 2022, HP announced the complete acquisition of Poly, with an intent to fuel its strategy for establishing a more growth-oriented portfolio and to further improve its industry opportunity in hybrid work solutions.

- In May 2022, Zoom announced the acquisition of Solvvy; it intended to deliver an elevated customer service experience to a global company base and move rapidly to seize new contact center and customer support possibilities.

- In May 2022, Iristick collaborated with Microsoft and launched Microsoft Teams which enables multifunctional video conferencing on its smart glasses. Microsoft Teams on Iristick offers a complete hand-free option for collaboration and remote assistance.

- In January 2022, Cisco collaborated with Lockheed Martin and Amazon to integrate novel human-machine interface technologies that would enable future astronauts to take advantage of far-field voice technology, artificial intelligence, and tablet-based video communication.

- In September 2021, Google partnered with Avocor and unveiled two new devices that combine video conferencing and digital whiteboarding to create meeting equity in shared meeting venues and on desktops.

- In May 2021, Pexip collaborated with Avaya and revealed the availability of Pexip Service registration for Avaya endpoints. This makes it possible for Avaya customers to join meetings from service providers such as Pexip, Cisco, Microsoft, Google, Zoom, and BlueJeans using their hardware instead of having to set up additional video conferencing infrastructure.

Frequently Asked Questions (FAQ):

What is the projected market value of the global video conferencing market?

The global market of video conferencing is projected to reach USD 19.1 billion

What is the estimated growth rate (CAGR) of the global video conferencing market for the next five years?

The global video conferencing market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.6% from 2022 to 2027.

What are the major revenue pockets in the video conferencing market currently?

North America is estimated to lead the video conferencing market during the forecast period. It is one of the early adopters of video conferencing solution, since the majority of large enterprises are located in this region. The large-scale investments made by the various businesses for outsourcing the video conferencing solutions is one of the major key driver in the North America.

Which are the key drivers supporting the growth of the video conferencing market?

The key drivers supporting the growth of the video conferencing market include the transformed global workforce, growing cloud-native enterprises, reduced OPEX and CAPEX, and inter penetration to pave way in digital world.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATE, 2019–2021

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 VIDEO CONFERENCING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary interviews

TABLE 2 PRIMARY INTERVIEWS

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE FROM VIDEO CONFERENCING HARDWARE, SOLUTIONS, AND SERVICES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM VIDEO CONFERENCING SOLUTIONS, HARDWARE, AND SERVICES

FIGURE 5 VIDEO CONFERENCING MARKET SIZE ESTIMATION METHODOLOGY– APPROACH 2 (DEMAND SIDE)

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 38)

TABLE 4 GLOBAL VIDEO CONFERENCING MARKET AND GROWTH RATE, 2020–2027 (USD MILLION, Y-O-Y%)

FIGURE 6 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2022

FIGURE 7 PERIPHERAL DEVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 8 CORPORATE COMMUNICATIONS SEGMENT TO LEAD MARKET IN 2022

FIGURE 9 CLOUD SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2022

FIGURE 10 HEALTHCARE AND LIFE SCIENCES SEGMENT TO LEAD MARKET IN 2022

FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VIDEO CONFERENCING MARKET

FIGURE 12 GROWING DIGITALIZATION AND SELLING PLATFORMS TO BOOST MARKET GROWTH

4.2 MARKET, BY REGION

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2022

4.3 NORTH AMERICA: MARKET, BY COMPONENT AND COUNTRY

FIGURE 14 SOLUTIONS SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

4.4 ASIA PACIFIC: MARKET, BY COMPONENT AND COUNTRY

FIGURE 15 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 VIDEO CONFERENCING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Global transition toward remote working culture

5.2.1.2 Rising growth of cloud-native enterprises

5.2.1.3 Growing need to reduce cost of developing infrastructure

5.2.1.4 Increasing number of internet users

5.2.2 RESTRAINTS

5.2.2.1 Privacy and security concerns

5.2.2.2 Low bandwidth and quality

5.2.3 OPPORTUNITIES

5.2.3.1 5G network to pave way for video conferencing solutions

5.2.3.2 Boom in video conferencing hardware market

5.2.3.3 Rising inclination for cell phone-based video conferencing

5.2.4 CHALLENGES

5.2.4.1 Technical issues

5.2.4.2 Preference for audio conferences

5.3 VIDEO CONFERENCING MARKET EVOLUTION

FIGURE 17 MARKET EVOLUTION

5.4 MARKET: ECOSYSTEM ANALYSIS

TABLE 5 MARKET: ECOSYSTEM ANALYSIS

5.5 CASE STUDY ANALYSIS

5.5.1 HEALTHCARE & LIFE SCIENCES

5.5.1.1 Use Case 1: BAYADA Home Healthcare implemented Zoom’s video conferencing solution and Logitech’s hardware to improve productivity

5.5.2 EDUCATION

5.5.2.1 Use Case 1: University of Washington upgraded its eLearning solutions with Zoom and Kubi

5.5.2.2 Use Case 2: Coastal Bend College deployed Lifesize video system across its campuses

5.5.3 GOVERNMENT

5.5.3.1 Use Case 1: Pexip helped Federal Employment Agency provide secured video communication

5.5.3.2 Use Case 2: PEA deployed Huawei’s video conferencing technology

5.5.4 MEDIA AND ENTERTAINMENT

5.5.4.1 Use Case 1: Avaya helped Koch Media share large game files between multiple sites

5.6 TECHNOLOGY ANALYSIS

5.6.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.6.2 FACIAL AND VOICE RECOGNITION

5.6.3 CLOUD SERVICES

5.7 TRADE ANALYSIS

TABLE 6 IMPORT OF VIDEO CONFERENCING EQUIPMENT IN US, 2020

5.8 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 18 SUPPLY/VALUE CHAIN ANALYSIS

5.9 PORTER’S FIVE FORCE ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 VIDEO CONFERENCING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 BARGAINING POWER OF SUPPLIERS

5.9.5 COMPETITIVE RIVALRY

5.10 ANALYSIS OF PRICING MODELS

5.11 PATENT ANALYSIS

5.11.1 METHODOLOGY

5.11.2 DOCUMENT TYPE

TABLE 8 PATENTS FILED, 2019–2021

5.11.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 20 PATENTS GRANTED, 2019–2021

5.11.3.1 Top applicants

FIGURE 21 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2021

TABLE 9 TOP TEN PATENT OWNERS (US), 2019–2021

TABLE 10 PATENTS FILED/GRANTED, 2020–2022

6 VIDEO CONFERENCING MARKET, BY COMPONENT (Page No. - 64)

6.1 INTRODUCTION

FIGURE 22 SERVICES SEGMENT TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 11 MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 HARDWARE: MARKET DRIVERS

FIGURE 23 PERIPHERAL DEVICES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 12 HARDWARE: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 13 HARDWARE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2.2 MULTIPOINT CONTROL UNIT (MCU)

TABLE 14 MULTIPOINT CONTROL UNIT MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.3 HARD CODEC

TABLE 15 HARD CODEC MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.4 PERIPHERAL DEVICES

TABLE 16 PERIPHERAL DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.4.1 Camera

6.2.4.2 Microphone

6.2.4.3 Speaker

6.2.4.4 Display devices

6.3 SOLUTIONS

6.3.1 SOLUTIONS: VIDEO CONFERENCING MARKET DRIVERS

TABLE 17 SOLUTIONS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 SERVICES

6.4.1 SERVICES: MARKET DRIVERS

TABLE 18 SERVICES: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.2 PROFESSIONAL SERVICES

6.4.3 MANAGED SERVICES

7 VIDEO CONFERENCING MARKET, BY DEPLOYMENT MODE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 24 CLOUD SEGMENT TO ACHIEVE HIGHER GROWTH DURING FORECAST PERIOD

TABLE 19 MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

7.2 ON-PREMISES

7.2.1 ON-PREMISES: MARKET DRIVERS

TABLE 20 ON-PREMISES: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 CLOUD

7.3.1 CLOUD: MARKET DRIVERS

TABLE 21 CLOUD: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3.2 CLOUD AND ON-PREMISES DEPLOYMENT SOLUTIONS

8 VIDEO CONFERENCING MARKET, BY APPLICATION (Page No. - 79)

8.1 INTRODUCTION

FIGURE 25 MARKETING AND CLIENT ENGAGEMENT SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 22 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 CORPORATE COMMUNICATIONS

8.2.1 CORPORATE COMMUNICATIONS: MARKET DRIVERS

TABLE 23 CORPORATE COMMUNICATIONS: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 TRAINING AND DEVELOPMENT

8.3.1 TRAINING AND DEVELOPMENT: MARKET DRIVERS

TABLE 24 TRAINING AND DEVELOPMENT: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 MARKETING AND CLIENT ENGAGEMENT

8.4.1 MARKETING AND CLIENT ENGAGEMENT: MARKET DRIVERS

TABLE 25 MARKETING AND CLIENT ENGAGEMENT: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 VIDEO CONFERENCING MARKET, BY VERTICAL (Page No. - 84)

9.1 INTRODUCTION

FIGURE 26 HEALTHCARE AND LIFE SCIENCES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 26 MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

9.2.1 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

9.2.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: VENDORS WITH REMOTE WORK PLANS

9.2.3 BANKING, FINANCIAL SERVICES, AND INSURANCE: HARDWARE EQUIPMENT USED BY VENDORS

TABLE 27 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 IT AND TELECOM

9.3.1 IT AND TELECOM: MARKET DRIVERS

9.3.2 IT AND TELECOM: VENDORS WITH REMOTE WORK PLANS

TABLE 28 IT AND TELECOM: VIDEO CONFERENCING MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 HEALTHCARE AND LIFE SCIENCES

9.4.1 HEALTHCARE AND LIFE SCIENCES: VIDEO CONFERENCING MARKET DRIVERS

TABLE 29 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.5 EDUCATION

9.5.1 EDUCATION: MARKET DRIVERS

TABLE 30 EDUCATION: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.6 MEDIA AND ENTERTAINMENT

9.6.1 MEDIA AND ENTERTAINMENT: MARKET DRIVERS

TABLE 31 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.7 OTHER VERTICALS

TABLE 32 OTHER VERTICALS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 VIDEO CONFERENCING MARKET, BY REGION (Page No. - 94)

10.1 INTRODUCTION

TABLE 33 MARKET, BY REGION, 2020–2027 (USD MILLION)

FIGURE 27 NORTH AMERICA TO LEAD GLOBAL MARKET DURING FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: REGULATORY FRAMEWORK

10.2.2 NORTH AMERICA: MARKET DRIVERS

10.2.3 NORTH AMERICA: IMPACT OF RECESSION ON MARKET

FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

TABLE 34 NORTH AMERICA: VIDEO CONFERENCING MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.2.4 US

TABLE 40 US: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 41 US: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 42 US: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 43 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 44 US: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.2.5 CANADA

TABLE 45 CANADA: VIDEO CONFERENCING MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 46 CANADA: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 47 CANADA: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 48 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 49 CANADA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: REGULATORY FRAMEWORK

10.3.2 EUROPE: VIDEO CONFERENCING MARKET DRIVERS

10.3.3 EUROPE: IMPACT OF RECESSION ON MARKET

TABLE 50 EUROPE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 53 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 54 EUROPE: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 55 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.3.4 UK

TABLE 56 UK: VIDEO CONFERENCING MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 57 UK: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 58 UK: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 59 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 60 UK: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.3.5 GERMANY

TABLE 61 GERMANY: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 62 GERMANY: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 63 GERMANY: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 64 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 65 GERMANY: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.3.6 FRANCE

TABLE 66 FRANCE: VIDEO CONFERENCING MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 67 FRANCE: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 68 FRANCE: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 69 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 70 FRANCE: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.3.7 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: REGULATORY FRAMEWORK

10.4.2 ASIA PACIFIC: VIDEO CONFERENCING MARKET DRIVERS

10.4.3 ASIA PACIFIC: IMPACT OF RECESSION ON MARKET

FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 71 ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.4.4 CHINA

TABLE 77 CHINA: VIDEO CONFERENCING MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 78 CHINA: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 79 CHINA: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 80 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 81 CHINA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.4.5 JAPAN

TABLE 82 JAPAN: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 83 JAPAN: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 84 JAPAN: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 85 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 JAPAN: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.4.6 AUSTRALIA AND NEW ZEALAND

TABLE 87 AUSTRALIA AND NEW ZEALAND: VIDEO CONFERENCING MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 88 AUSTRALIA AND NEW ZEALAND: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 89 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 90 AUSTRALIA AND NEW ZEALAND: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 91 AUSTRALIA AND NEW ZEALAND: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: REGULATORY FRAMEWORK

10.5.2 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.3 MIDDLE EAST AND AFRICA: IMPACT OF RECESSION ON MARKET

TABLE 92 MIDDLE EAST AND AFRICA: VIDEO CONFERENCING MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 93 MIDDLE EAST AND AFRICA: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 94 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 95 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.5.4 UAE

TABLE 98 UAE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 99 UAE: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 100 UAE: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 101 UAE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 102 UAE: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.5.5 SAUDI ARABIA

TABLE 103 SAUDI ARABIA: VIDEO CONFERENCING MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 104 SAUDI ARABIA: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 105 SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 106 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 107 SAUDI ARABIA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.5.6 SOUTH AFRICA

TABLE 108 SOUTH AFRICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 109 SOUTH AFRICA: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 110 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 111 SOUTH AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 112 SOUTH AFRICA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.5.7 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: REGULATORY FRAMEWORK

10.6.2 LATIN AMERICA: VIDEO CONFERENCING MARKET DRIVERS

10.6.3 LATIN AMERICA: IMPACT OF RECESSION ON MARKET

TABLE 113 LATIN AMERICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 114 LATIN AMERICA: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 115 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 116 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 117 LATIN AMERICA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 118 LATIN AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.6.4 BRAZIL

TABLE 119 BRAZIL: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 120 BRAZIL: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 121 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 122 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 123 BRAZIL: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.6.5 MEXICO

TABLE 124 MEXICO: VIDEO CONFERENCING MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 125 MEXICO: MARKET, BY HARDWARE, 2020–2027 (USD MILLION)

TABLE 126 MEXICO: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 127 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 128 MEXICO: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 139)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 30 MARKET EVALUATION FRAMEWORK, 2019–2022

11.3 KEY MARKET STRATEGIES

11.3.1 PRODUCT LAUNCHES

TABLE 129 VIDEO CONFERENCING MARKET: PRODUCT LAUNCHES, 2019–2022

11.3.2 DEALS

TABLE 130 MARKET: DEALS, 2019–2022

11.3.3 OTHERS

TABLE 131 MARKET: OTHERS, 2019–2022

11.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 132 MARKET: DEGREE OF COMPETITION

11.5 HISTORICAL REVENUE ANALYSIS

FIGURE 31 HISTORICAL REVENUE ANALYSIS OF TOP PLAYERS

11.6 EVALUATION MATRIX FOR KEY PLAYERS, 2022

11.6.1 EVALUATION MATRIX: METHODOLOGY AND DEFINITIONS

TABLE 133 PRODUCT FOOTPRINT WEIGHTAGE

11.6.2 STARS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

11.6.5 EMERGING LEADERS

FIGURE 32 EVALUATION MATRIX FOR KEY PLAYERS, 2022

11.7 EVALUATION MATRIX FOR STARTUPS/SMES, 2022

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 33 EVALUATION MATRIX FOR STARTUPS/SMES, 2022

11.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 134 COMPANY PRODUCT FOOTPRINT

TABLE 135 COMPANY APPLICATION FOOTPRINT

TABLE 136 COMPANY INDUSTRY FOOTPRINT

TABLE 137 COMPANY REGIONAL FOOTPRINT

11.9 KEY PLAYER RANKING, 2022

FIGURE 34 KEY PLAYER RANKING, 2022

12 COMPANY PROFILES (Page No. - 159)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products, Solutions & Services offered, Recent Developments, MnM View)*

12.2.1 MICROSOFT

TABLE 138 MICROSOFT: BUSINESS OVERVIEW

FIGURE 35 MICROSOFT: COMPANY SNAPSHOT

TABLE 139 MICROSOFT: PRODUCTS OFFERED

TABLE 140 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 141 MICROSOFT: DEALS

12.2.2 HUAWEI

TABLE 142 HUAWEI: BUSINESS OVERVIEW

FIGURE 36 HUAWEI: COMPANY SNAPSHOT

TABLE 143 HUAWEI: PRODUCTS OFFERED

TABLE 144 HUAWEI: PRODUCT LAUNCHES AND ENHANCEMENTS

12.2.3 CISCO

TABLE 145 CISCO: BUSINESS OVERVIEW

FIGURE 37 CISCO: COMPANY SNAPSHOT

TABLE 146 CISCO: PRODUCTS OFFERED

TABLE 147 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 148 CISCO: DEALS

12.2.4 ADOBE

TABLE 149 ADOBE: BUSINESS OVERVIEW

FIGURE 38 ADOBE: COMPANY SNAPSHOT

TABLE 150 ADOBE: PRODUCTS OFFERED

TABLE 151 ADOBE: DEALS

12.2.5 ZOOM VIDEO COMMUNICATIONS

TABLE 152 ZOOM VIDEO COMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 39 ZOOM VIDEO COMMUNICATIONS: COMPANY SNAPSHOT

TABLE 153 ZOOM VIDEO COMMUNICATIONS: PRODUCTS OFFERED

TABLE 154 ZOOM VIDEO COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 155 ZOOM VIDEO COMMUNICATIONS: DEALS

12.2.6 GOOGLE

TABLE 156 GOOGLE: BUSINESS OVERVIEW

TABLE 157 GOOGLE: SOLUTIONS OFFERED

TABLE 158 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 159 GOOGLE: DEALS

12.2.7 HP

TABLE 160 HP: BUSINESS OVERVIEW

TABLE 161 HP: PRODUCTS OFFERED

TABLE 162 HP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 163 HP: DEALS

12.2.8 AVAYA

TABLE 164 AVAYA: BUSINESS OVERVIEW

TABLE 165 AVAYA: PRODUCTS OFFERED

TABLE 166 AVAYA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 167 AVAYA: DEALS

12.2.9 GOTO

TABLE 168 GOTO: BUSINESS OVERVIEW

TABLE 169 GOTO: PRODUCTS OFFERED

TABLE 170 GOTO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 171 GOTO: DEALS

12.2.10 LOGITECH

TABLE 172 LOGITECH: BUSINESS OVERVIEW

TABLE 173 LOGITECH: PRODUCTS OFFERED

TABLE 174 LOGITECH: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 175 LOGITECH: DEALS

12.2.11 BARCO

TABLE 176 BARCO: BUSINESS OVERVIEW

TABLE 177 BARCO: PRODUCTS OFFERED

TABLE 178 BARCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 179 BARCO: DEALS

12.2.12 PEXIP

TABLE 180 PEXIP: BUSINESS OVERVIEW

TABLE 181 PEXIP: PRODUCTS OFFERED

TABLE 182 PEXIP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 183 PEXIP: DEALS

12.2.13 AWS

TABLE 184 AWS: BUSINESS OVERVIEW

TABLE 185 AWS: PRODUCTS OFFERED

TABLE 186 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 187 AWS: DEALS

12.2.14 BLUEJEANS NETWORK

TABLE 188 BLUEJEANS NETWORK: BUSINESS OVERVIEW

TABLE 189 BLUEJEANS NETWORK: PRODUCTS OFFERED

TABLE 190 BLUEJEANS NETWORK: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 191 BLUEJEANS NETWORK: DEALS

*Details on Business Overview, Products, Solutions & Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

12.3.1 ENGHOUSE SYSTEMS

12.3.2 QUMU

12.3.3 LIFESIZE

12.3.4 KALTURA

12.3.5 KOLLECTIVE

12.3.6 SONIC FOUNDRY

12.3.7 FUZE

12.3.8 DIALPAD

12.3.9 HAIVISION

12.3.10 PREMIERE GLOBAL SERVICES

12.4 STARTUPS/SMES

12.4.1 DAILY

12.4.2 OWL LABS

12.4.3 AIRMEET

12.4.4 LIVESTORM

12.4.5 100MS

12.4.6 KUDO

12.4.7 STARLEAF

13 ADJACENT AND RELATED MARKETS (Page No. - 218)

13.1 INTRODUCTION

13.1.1 VIDEO ANALYTICS MARKET – GLOBAL FORECAST TO 2027

13.1.1.1 Market definition

13.1.1.2 Market overview

13.1.1.3 Video analytics market, by component

TABLE 192 VIDEO ANALYTICS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 193 VIDEO ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.1.1.4 Video analytics market, by deployment model

TABLE 194 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018–2021 (USD MILLION)

TABLE 195 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

13.1.1.5 Video analytics market, by application

TABLE 196 VIDEO ANALYTICS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 197 VIDEO ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.1.1.6 Video analytics market, by type

TABLE 198 VIDEO ANALYTICS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 199 VIDEO ANALYTICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.1.1.7 Video analytics market, by vertical

TABLE 200 VIDEO ANALYTICS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 201 VIDEO ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.1.1.8 Video analytics market, by region

TABLE 202 VIDEO ANALYTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 203 VIDEO ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

13.1.2 VIDEO STREAMING SOFTWARE MARKET – GLOBAL FORECAST TO 2027

13.1.2.1 Market definition

13.1.2.2 Market overview

13.1.2.3 Video management software market, by component

TABLE 204 VIDEO MANAGEMENT SOFTWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 205 VIDEO MANAGEMENT SOFTWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.1.2.4 Video management software market, by deployment mode

TABLE 206 VIDEO MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 207 VIDEO MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

13.1.2.5 Video management software market, by vertical

TABLE 208 VIDEO MANAGEMENT SOFTWARE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 209 VIDEO MANAGEMENT SOFTWARE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.1.2.6 Video management software market, by region

TABLE 210 VIDEO MANAGEMENT SOFTWARE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 211 VIDEO MANAGEMENT SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

14 APPENDIX (Page No. - 230)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the video conferencing market. The primary sources were mainly industry experts from the core and related industries, software and service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects.

Secondary Research

The video conferencing market size of companies that offer video conferencing hardware, solution, and services globally was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of the major companies and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from secondary sources, such as the Technology and Services Industry Association (TSIA), International Association of Business Communicators (IABC), Entertainment Software Association of Canada, WEO, Local Government Association (LGA) of the UK, and the Asia Video Industry Association (AVIA). Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players by various solutions, services, market classifications, and segmentation according to offerings of the major players and industry trends related to technologies, applications, and regions, and key developments from both market and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the video conferencing market. The primary sources from the supply side included various industry experts, including Chief Technology Officers (CTOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from digital payment solution and service vendors, system integrators, professional and managed service providers, industry associations, and consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and installation teams of governments/end users using video conferencing solutions, were interviewed to understand the buyer’s perspective on suppliers, products, and service providers and their current usage of video conferencing Solution, which will affect the overall global video conferencing market.

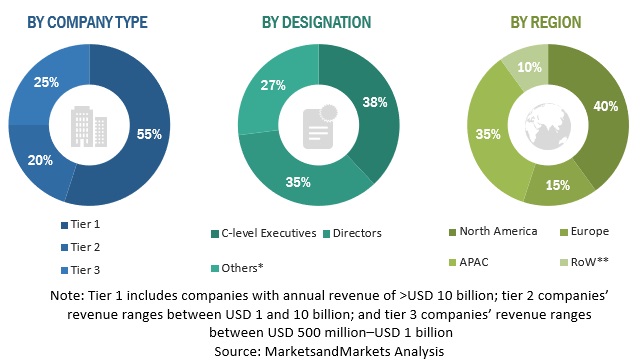

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Video Conferencing Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the video conferencing market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative). The percentage share, splits, and breakdowns were determined using secondary sources and verified through primary research. All possible parameters that affect the video conferencing market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

- The pricing trend is assumed to vary over time.

- All the forecasts were made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates were used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website was used.

- All the forecasts were made under the standard assumption that the globally accepted currency USD will remain constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services were factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions were analyzed in terms of market spending on video conferencing based on some of the key use cases. These factors for the video conferencing industry per region were separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor was derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To determine and forecast the global video conferencing market by component, deployment mode, application, vertical, and region from 2020 to 2027, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America,

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall video conferencing market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To profile key market players and provide a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American video conferencing market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle Eastern and African market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Video Conferencing Market

What will be key challenges for growing video conferencing business in the future Market?