Automotive Solenoid Market by Application (Body Control & Interiors, Engine Control & Cooling System, Safety, HVAC), Vehicle Type (PC, LCV, Truck, Bus), EV Type (BEV, PHEV, FCEV), Valve Design, Function, Operation, and Region - Global Forecast to 2026

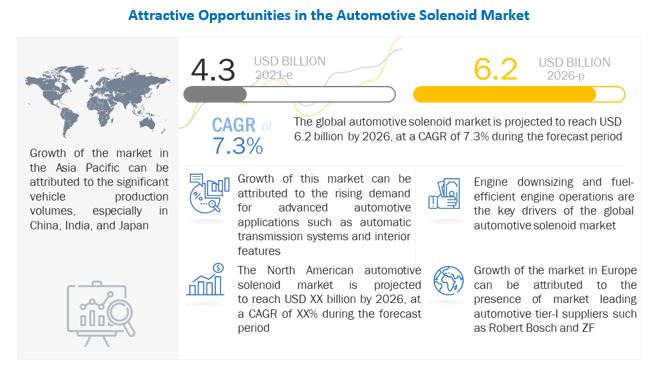

[246 Pages Report] The global automotive solenoid market was valued at USD 4.3 billion in 2021 and is expected to reach USD 6.2 billion by 2026 at a CAGR of 7.3 % during the forecast period 2021-2026. This increase is triggered by various factors which cover various aspects, like rising demand for automation in vehicles, as well as the increasing vehicle production globally.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Automotive solenoid market:

The production and sales of new vehicles had come to a halt across the globe as the whole ecosystem had been disrupted in the initial outbreak of COVID 19. OEMs had to wait until lockdowns were lifted to resume production, which affected their businesses. Hence, vehicle manufacturers had to adjust the production volume. Also, component manufacturing was suspended, and small Tier II and Tier III manufacturers faced liquidity issues. The automotive industry is highly capital-intensive and relies on frequent financing to continue operations. Thus, the production suspension during the initial months of the outbreak and lower demand had an unprecedented impact on EV manufacturers in the initial months of the pandemic.

Due to the COVID-19 pandemic, many countries had imposed a complete lockdown of more than two months, which, in turn, has impacted vehicle production. Manufacturing units around the world were shut down, and vehicle sales have taken a huge hit. However, the majority of the automakers resumed vehicle production with limited production and necessary measures.

Market Dynamics:

Driver: Rise in demand for advanced automation systems

Rising automation and digitalization have revolutionized the automotive industry. Earlier, automakers manufactured mechanical actuators, which enabled only manually operated applications, such as winding up and down of windows and seat adjustments.

Increasing demand for high fuel efficiency and advanced automated applications will boost the market for solenoids, also known as electromechanical actuators. Solenoids are widely used in trucks and heavy-duty vehicles, for lifting, tilting, adjusting, positioning, retracting, extracting, controlling, opening, and closing all automated applications.

Restraint: Decrease in vehicle production in last few years

The automotive industry is witnessing a global slowdown. A decline of 16% in 2020 vehicle production was witnessed, which is equivalent to 2010 sales levels as per the International Organization of Motor Vehicle Manufacturers (OICA). Europe witnessed a drop of more than 21% on average in 2020. All main producing countries had sharp declines, ranging from 11% to almost 40%. Europe represented an almost 22% share of global production. In North America, the 2020 production of 15.7 million units represented a 20% share of global production. The region saw production declining by more than 20%, with US manufacturing declining by 19%. While in South America, the percentage dropped by more than 30%, with Brazil down by almost 32%. This decline in global vehicle production negatively impacts the overall automotive solenoid market.

Opportunity: Wide array of applications employing the use of solenoids

Solenoids are used in many applications in modern cars to improve their performance and efficiency. Some of the major applications are as follows:

- Door locks and trunk release solenoid

- Starter solenoid functions, automatic transmission control, dual clutch transmission control, turbocharger control, and variable valve timing

- EGR controls, evaporative emission control (EVAP) system, fuel ignition coils, and engine fuel shut off valve

- ABS, air suspension system, and HVAC system

Increasing consumer preference for new improved transmission systems, such as AMT, DCT, and CVT which provide an enhanced driving experience with a better control and acceleration of the vehicle. This is mainly because in transmission systems enable real-time control of torque with each gearshift. The friction losses create during the shifting of gears are reduced, and they are quickly synchronized with the torque required for the new gear, which in turn increase the time taken for the torque to set with the new gear. This has further improved the fuel efficiency of the vehicle along with the elimination of any scope for human error as most of the work while shifting the gears is controlled by sensors, solenoids, and computers.

Challenge: Technical problems associated with solenoid valves may affect the market

There are few problems that consistently affect the performance of the solenoid valves. Some of the common problems that are associated with solenoid valves include part closure of valves, valves not opening properly, valves making erratic sounds, and coil problems. For instance, part closure of valves occurs due to manual override, pressure difference, residual coil power, damaged armature tube, and damaged valve seats. Additionally, some solenoid valves do not open because of power failure, wrong voltage, dirt gathering under the diaphragm, and uneven pressure. Similarly, the valves make erratic sounds during the opening and closing operation. The sound is due to the difference in the inlet or outlet pressure inside system. Additionally, some other factors such as flow factor of the valve and compatibility with the media also affects its operation.

Solenoid valves are utilized in several applications where there is a need to automate the flow of various mediums including air, water, and gases among others. So, durability is one of the major requirements for solenoid valves. Sometimes, these valves would not work with very low pressure which would lessen its working performance. Similarly, solenoid valves also fail due to the overheating and failure of the insulation used in the solenoid coil. However, to overcome these effects most of the players are employing motorized ball valves to replace their current solenoid valves. Therefore, the industry faces competition from motorized valve manufacturers who are relying on the durability of the solenoid valves. Thus, reliability of the solenoid valve is the key requirement to sustain the market.

BEV segment is estimated to account for the largest market during the forecast period

The automotive solenoid market, by EV type, is projected to grow at a very fast rate due to the increase in the demand for EVs as countries around the world aim at emission reductions from automobiles. The BEV accounts for the largest market share as it does not require a gasoline engine which requires fuel and routine maintenance. The prices of batteries for EVs are decreasing due to the advancements in technology which are expected to result in the reduced overall prices of BEVs. The PHEV segment is expected to account for the second-largest share in the electric vehicle segment with countries such as Japan, China, US, Germany, France, etc. increasing their demand over time. FCEVs are expected to be the fastest-growing segment owing to their superior features such as longer range, faster fuelling, and decreasing prices in the coming decade.

Fluid control is estimated to account for the largest market size during the forecast period

The fluid control segment is estimated to dominate the automotive solenoid market. Fluid control solenoids play a significant role in regulating the flow of fluids or actuating pumps to build the pressure used in several applications such as braking and steering. Apart from this, the increased adoption of electric vehicles is expected to boost the motion control segment.

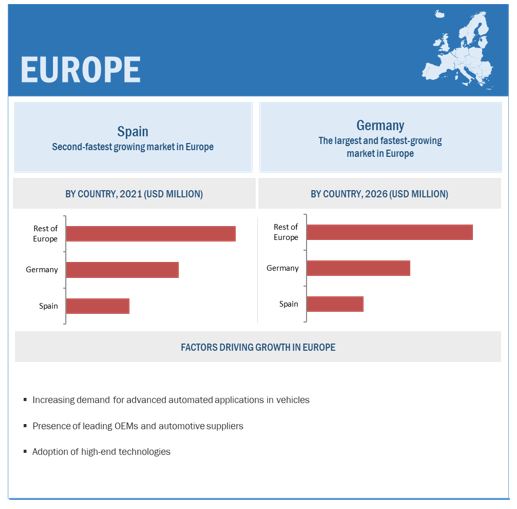

Europe is expected to witness significant growth during the forecast period.

The European region is estimated to be dominated by countries such as Germany, France, Spain, and the UK. The presence of OEMs such as Volkswagen (Germany), Daimler (Germany), Renault (France), and AB Volvo (Sweden) offers growth opportunities for automotive solenoids in the region. European automotive enterprises dominate the global automotive landscape, accounting for almost 50% of the R&D spending led by firms such as BMW, Continental, and Daimler. The region is among the largest markets for passenger cars, particularly for premium cars (C segment and above). The high volume of premium car sales can be attributed to the high purchasing power of European buyers. The demand for premium cars has accentuated the need for fewer emissions, automated applications, and luxurious features, which can be achieved with the help of components such as solenoids and actuators.

Key Market Players

The global the automotive solenoid market is dominated by global players such as Robert Bosch GmbH (Germany, Hitachi Ltd. (Japan), Mitsubishi Electric Corporation (Japan, MAHLE Group (Germany), Johnson Electric (US), and BorgWarner (US). These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in this market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Volume (Thousand Units), Value (USD Million) |

|

Segments covered |

Vehicle Type, Application Type, EV Type, Function, Operation, and Valve Design |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Companies Covered |

Robert Bosch GmbH (Germany, Hitachi Ltd. (Japan), Mitsubishi Electric Corporation (Japan, MAHLE Group (Germany), Johnson Electric (US), and BorgWarner (US). |

This research report categorizes the automotive solenoid market based on Application, Level of Autonomy, Vehicle, Propulsion, Component, Service Type, and Region.

By Vehicle Type

- Passenger vehicle

- Light commercial vehicle

- Truck

- Bus

By Electric Vehicle Type

- BEV

- PHEV

- FCEV

By Application

- Engine control and cooling system

- Fuel and Emission Control

- Safety and Security

- Body Control and Interiors

- HVAC

- Other application

By Function

- Fluid Control

- Gas Control

- Motion Control

By Valve Design

- 2-way valve

- 3-way valve

- 4-way valve

- 5-way valve

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Spain

- UK

- Italy

- Rest of Europe

-

Rest of the World

- Brazil

- Russia

- South Africa

- Rest of RoW

Recent Developments

- In October 2020, ZF Friedrichshafen AG completely acquired ZF Sachs Micro Mobility GmbH, which has become its wholly owned subsidiary and a part of its Industrial Technology Division. The previous shareholders, BMZ Batterien-Montage-Zentrum GmbH and Gustav Magenwirth GmbH & Co. KG, transferred their shares to ZF Friedrichshafen AG. ZF Sachs Micro Mobility GmbH manufactures traction motors and related products for micro-mobility (e-bikes & bicycles).

- In July 2020, BluE Nexus Corporation (a joint venture between Aisin Seiki Co., Ltd. and DENSO Corporation) and Toyota Motor Corporation announced a collaboration wherein both companies utilize their core competencies to increase their competitiveness in products related to vehicle electrification. The collaboration will utilize Toyota's control calibration technologies for engines, batteries, and other major peripheral components and BluE Nexus's well-developed lineup of electric drive modules. Toyota announced that it would provide investment for new advanced products by taking a 10 percent stake in BluE Nexus.

- In January 2019, Robert Bosch GmbH (Bosch) announced the complete acquisition of EM-motive GmbH that was set up as a fifty-fifty joint venture in 2011 between Bosch and Daimler. By the time of the acquisition, EM-motive GmbH had manufactured around 450,000 electric motors that were installed in electric vehicles of companies like Daimler, Porsche, Fiat, Volvo, Peugeot, etc.

Frequently Asked Questions (FAQ):

What is the current size of the global automotive solenoid market?

The global automotive solenoid market is estimated to be USD 4.3 billion in 2021 and projected to reach USD 6.2 billion by 2026, at a CAGR of 7.3%

Who are the winners in the global automotive solenoid market?

The automotive solenoid market is dominated by global players such as Robert Bosch GmbH (Germany, Hitachi Ltd. (Japan), Mitsubishi Electric Corporation (Japan, MAHLE Group (Germany), Johnson Electric (US), and BorgWarner (US). These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth automotive solenoid market.

What is the Covid-19 impact on automotive solenoid manufacturers?

Most automotive manufacturers and component suppliers incurred losses due to sales reduction during the pandemic in the initial months. The sales recovered in the latter months as demand for vehicles surged in the following months, however overall the companies suffered varying amount of losses.

What are the new market trends impacting the growth of the automotive solenoid market?

Automatic transmission systems, automated features, and advanced safety features are some of the major trends affecting this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AUTOMOTIVE SOLENOID MARKET SEGMENTATION

1.3.2 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE SOLENOID MARKET

1.3.3 YEARS CONSIDERED

1.4 PACKAGE SIZE

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 GLOBAL MARKET SIZE: BOTTOM-UP APPROACH

FIGURE 7 GLOBAL MARKET SIZE ESTIMATION APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY FOR AUTOMOTIVE SOLENOID MARKET: TOP-DOWN APPROACH

FIGURE 9 AUTOMOTIVE SOLENOID MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 10 AUTOMOTIVE SOLENOID MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF BORGWARNER REVENUE ESTIMATION

FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 12 DATA TRIANGULATION METHODOLOGY

2.4 FACTOR ANALYSIS

2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 13 AUTOMOTIVE SOLENOID: MARKET OVERVIEW

FIGURE 14 AUTOMOTIVE SOLENOID MARKET, BY REGION, 2021–2026

FIGURE 15 BEV SEGMENT IS ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN GLOBAL AUTOMOTIVE SOLENOID MARKET

FIGURE 16 AUTOMOTIVE SOLENOID MARKET GROWTH CAN BE ATTRIBUTED TO RISING AUTOMATION IN VEHICLES GLOBALLY

4.2 REGION-WISE SHARE OF GLOBAL AUTOMOTIVE SOLENOID MARKET

FIGURE 17 APAC TO HOLD LARGEST SHARE OF GLOBAL MARKET, 2021

4.3 AUTOMOTIVE SOLENOID MARKET, BY VEHICLE TYPE

FIGURE 18 PASSENGER CARS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 AUTOMOTIVE SOLENOID MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 19 BEV TO HOLD LARGEST SIZE OF GLOBAL MARKET DURING FORECAST PERIOD

4.5 AUTOMOTIVE SOLENOID MARKET, BY APPLICATION

FIGURE 20 BODY CONTROL AND INTERIORS APPLICATION SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.6 AUTOMOTIVE SOLENOID MARKET, BY FUNCTION

FIGURE 21 FLUID CONTROL FUNCTION TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 GLOBAL AUTOMOTIVE SOLENOID: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.2 Growing trend of engine downsizing to boost use of solenoids

FIGURE 23 ENGINE DOWNSIZING TREND, BY CYLINDER TYPE, 2012–2020

TABLE 2 POWER OUTPUT OF VARIOUS TURBOCHARGED PETROL MODELS VS NON-TURBOCHARGED VARIANTS

5.2.1.3 Increasing government regulations for fuel-efficient vehicles

FIGURE 24 ON-ROAD LIGHT AND HEAVY-DUTY VEHICLE EMISSION REGULATION OUTLOOK

TABLE 3 EMISSION NORM SPECIFICATIONS IN KEY COUNTRIES FOR PASSENGER CARS

FIGURE 25 GLOBAL FUEL ECONOMY AND CO2 EMISSION DATA (2016–2025)

5.2.1.4 Significant effectiveness of solenoid valves over other valves

5.2.2 RESTRAINTS

5.2.2.1 Low preference for diesel passenger cars

5.2.2.2 Decrease in vehicle production in last few years

FIGURE 26 GLOBAL PASSENGER CAR PRODUCTION, 2017–2020 (UNITS)

FIGURE 27 GLOBAL LIGHT COMMERCIAL VEHICLE SALES, 2017–2020 (UNITS)

5.2.3 OPPORTUNITIES

5.2.3.1 Wide array of applications employing solenoids

5.2.3.2 Increasing trend of electric vehicles to uplift demand for automotive valves in long term

FIGURE 28 GLOBAL EV SALES, 2017–2020

TABLE 4 GOVERNMENT PROGRAMS FOR PROMOTION OF ELECTRIC COMMERCIAL VEHICLE SALES

5.2.4 CHALLENGES

5.2.4.1 Technical problems associated with solenoid valves

5.2.5 IMPACT OF MARKET DYNAMICS

5.3 PORTER’S FIVE FORCES

TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON AUTOMOTIVE SOLENOID MARKET

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS: AUTOMOTIVE SOLENOID MARKET

5.3.1 INTENSITY OF COMPETITIVE RIVALRY

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 THREAT OF NEW ENTRANTS

5.4 AUTOMOTIVE SOLENOID MARKET ECOSYSTEM

FIGURE 30 GLOBAL MARKET: ECOSYSTEM ANALYSIS

TABLE 6 ROLE OF COMPANIES IN AUTOMOTIVE SOLENOID ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 SMART ACTUATORS

5.5.2 MEMS

5.6 PATENT ANALYSIS

TABLE 7 IMPORTANT PATENT REGISTRATIONS RELATED TO PISTON PIN MARKET

5.7 PRICING ANALYSIS

FIGURE 31 AUTOMOTIVE SOLENOID MARKET: APPROXIMATE PRICE BY YEAR

5.8 VALUE CHAIN ANALYSIS

FIGURE 32 MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

5.9 CASE STUDY

5.9.1 TLX TECHNOLOGIES DEVELOPED CUSTOMIZED COMPACT LATCHING SOLENOID

5.9.2 BORGWARNER LAUNCHED THE SMART INTEGRAL MAGNETIC SWITCH (IMS) FOR ON/OFF-HIGHWAY COMMERCIAL VEHICLES

5.10 COVID-19 HEALTH ASSESSMENT

FIGURE 33 COVID-19: GLOBAL PROPAGATION

FIGURE 34 COVID-19 PROPAGATION: SELECT COUNTRIES

5.11 COVID-19 ECONOMIC ASSESSMENT

FIGURE 35 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.11.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 36 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 37 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

5.12 GLOBAL MARKET: COVID-19 IMPACT

5.12.1 IMPACT ON AUTOMOTIVE SOLENOID SALES

5.12.2 IMPACT ON VEHICLE SALES

5.13 AUTOMOTIVE SOLENOID MARKET, SCENARIOS (2021–2026)

FIGURE 38 GLOBAL MARKET– FUTURE TRENDS & SCENARIOS, 2021–2026 (USD MILLION)

5.13.1 GLOBAL MARKET – MOST LIKELY SCENARIO

TABLE 8 GLOBAL MARKET (MOST LIKELY), BY REGION, 2021–2026 (USD MILLION)

5.13.2 GLOBAL MARKET – OPTIMISTIC SCENARIO

TABLE 9 GLOBAL MARKET (OPTIMISTIC SCENARIO), BY REGION, 2021–2026 (USD MILLION)

5.13.3 GLOBAL MARKET – PESSIMISTIC SCENARIO

TABLE 10 GLOBAL MARKET (PESSIMISTIC), BY REGION, 2021–2026 (USD MILLION)

5.14 GLOBAL MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 39 REVENUE SHIFT DRIVING MARKET GROWTH

6 AUTOMOTIVE SOLENOID MARKET, BY VALVE DESIGN (Page No. - 79)

6.1 INTRODUCTION

6.2 2-WAY SOLENOID VALVES

6.3 3-WAY SOLENOID VALVES

6.4 4-WAY SOLENOID VALVES

6.5 5-WAY SOLENOID VALVES

7 AUTOMOTIVE SOLENOID MARKET, BY APPLICATION (Page No. - 81)

7.1 INTRODUCTION

7.2 AUTOMOTIVE SOLENOID MARKET, BY APPLICATION

FIGURE 40 BODY CONTROL AND INTERIORS SEGMENT TO HOLD LARGEST MARKET SHARE, BY VALUE, IN 2026

TABLE 11 GLOBAL MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 12 GLOBAL MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 13 GLOBAL MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 14 GLOBAL MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2.1 OPERATIONAL DATA

7.2.2 ASSUMPTIONS

TABLE 15 ASSUMPTIONS, BY APPLICATION

7.2.3 RESEARCH METHODOLOGY

7.3 ENGINE CONTROL AND COOLING SYSTEM

7.3.1 ADVANCEMENTS SUCH AS DOWNSIZING AND TURBOCHARGING IN IC ENGINES TO BOOST SEGMENTAL GROWTH

TABLE 16 ENGINE CONTROL AND COOLING SYSTEM: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 17 ENGINE CONTROL AND COOLING SYSTEM: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 18 ENGINE CONTROL AND COOLING SYSTEM: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 19 ENGINE CONTROL AND COOLING SYSTEM: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 FUEL AND EMISSION CONTROL

7.4.1 GROWING EMPHASIS ON FUEL-EFFICIENT VEHICLES TO DRIVE DEMAND FOR SOLENOIDS FOR FUEL & EMISSION CONTROL

TABLE 20 FUEL AND EMISSION CONTROL: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 21 FUEL AND EMISSION CONTROL: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 22 FUEL AND EMISSION CONTROL: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 23 FUEL AND EMISSION CONTROL: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 BODY CONTROL AND INTERIORS

7.5.1 RISING VEHICLE PRODUCTION WITH MODERN BODY CONTROL FUNCTIONS TO DRIVE SEGMENTAL GROWTH

TABLE 24 BODY CONTROL AND INTERIORS: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 25 BODY CONTROL AND INTERIORS: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 26 BODY CONTROL AND INTERIORS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 27 BODY CONTROL AND INTERIORS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.6 HVAC SYSTEM

7.6.1 ADVANCEMENTS IN HVAC SYSTEMS FOR BETTER CABIN COMFORT DRIVE SEGMENTAL GROWTH

TABLE 28 HVAC SYSTEM: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 29 HVAC SYSTEM: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 30 HVAC SYSTEM: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 31 HVAC SYSTEM: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.7 SAFETY AND SECURITY

7.7.1 INCREASING NUMBER OF SAFETY FEATURES IN AUTOMOBILES TO DRIVE SEGMENTAL GROWTH

TABLE 32 SAFETY AND SECURITY: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 33 SAFETY AND SECURITY: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 34 SAFETY AND SECURITY: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 35 SAFETY AND SECURITY: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.8 OTHERS

TABLE 36 OTHERS: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 37 OTHERS: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 38 OTHERS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 39 OTHERS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.9 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE SOLENOID MARKET, BY FUNCTION (Page No. - 97)

8.1 INTRODUCTION

8.2 GLOBAL AUTOMOTIVE SOLENOID MARKET, BY FUNCTION

FIGURE 41 FLUID CONTROL SEGMENT TO HOLD LARGEST MARKET SHARE, BY VALUE, BY 2026 (USD MILLION)

TABLE 40 GLOBAL MARKET, BY FUNCTION, 2018–2020 (THOUSAND UNITS)

TABLE 41 GLOBAL MARKET, BY FUNCTION, 2021–2026 (THOUSAND UNITS)

TABLE 42 GLOBAL MARKET, BY FUNCTION, 2018–2020 (USD MILLION)

TABLE 43 GLOBAL MARKET, BY FUNCTION, 2021–2026 (USD MILLION)

8.2.1 OPERATIONAL DATA

TABLE 44 GLOBAL PASSENGER CAR AND COMMERCIAL VEHICLE PRODUCTION DATA, 2020 (UNITS)

8.2.2 ASSUMPTIONS

TABLE 45 ASSUMPTIONS, BY FUNCTION

8.2.3 RESEARCH METHODOLOGY

8.3 FLUID CONTROL

8.3.1 GROWING DEMAND FOR FUEL-EFFICIENT VEHICLES TO BOOST MARKET GROWTH

TABLE 46 FLUID CONTROL: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 47 FLUID CONTROL: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 48 FLUID CONTROL: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 49 FLUID CONTROL: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.4 GAS CONTROL

8.4.1 HIGH PENETRATION OF HVAC SYSTEMS AND GROWING EMISSION NORMS TO SUPPORT SEGMENTAL GROWTH

TABLE 50 GAS CONTROL: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 51 GAS CONTROL: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 52 GAS CONTROL: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 53 GAS CONTROL: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.5 MOTION CONTROL

8.5.1 INCREASING BODY CONTROL FUNCTIONS IN MODERN VEHICLES TO BOOST SEGMENTAL GROWTH

TABLE 54 MOTION CONTROL: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 55 MOTION CONTROL: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 56 MOTION CONTROL: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 57 MOTION CONTROL: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.6 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE SOLENOID MARKET, BY VEHICLE TYPE (Page No. - 107)

9.1 INTRODUCTION

FIGURE 42 GLOBAL MARKET, BY VEHICLE TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 58 GLOBAL MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 59 GLOBAL MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

TABLE 60 GLOBAL MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 61 GLOBAL MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

9.1.1 OPERATIONAL DATA

TABLE 62 GLOBAL VEHICLE PRODUCTION (THOUSAND UNITS)

9.1.2 ASSUMPTIONS

TABLE 63 ASSUMPTIONS, BY VEHICLE TYPE

9.1.3 RESEARCH METHODOLOGY

9.2 PASSENGER CAR

9.2.1 GROWING TREND OF AUTOMATIC TRANSMISSION SYSTEMS AND ADVANCEMENTS IN BODY CONTROL & INTERIORS TO DRIVE MARKET

TABLE 64 PASSENGER CAR: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 65 PASSENGER CAR: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 66 PASSENGER CAR: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 67 PASSENGER CAR: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3 LCV

9.3.1 INCREASING DEMAND FOR LCV IN LAST-MILE DELIVERY TO DRIVE SEGMENTAL GROWTH

TABLE 68 LCV: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 69 LCV: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 70 LCV: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 71 LCV: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4 TRUCK

9.4.1 HIGH PROMINENCE IN ROAD TRANSPORT TO DRIVE DEMAND FOR TRUCK SOLENOIDS

TABLE 72 TRUCK: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 73 TRUCK: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 74 TRUCK: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 75 TRUCK: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.5 BUS

9.5.1 RAPIDLY GROWING PREVALENCE OF ELECTRIC BUSES MAY HAMPER SEGMENTAL GROWTH OF ICE BUSES

TABLE 76 BUS: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 77 BUS: MARKET, BY REGION, 2021–2026 (THOUSANDUNITS)

TABLE 78 BUS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 79 BUS: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.6 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE SOLENOID MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 119)

10.1 INTRODUCTION

10.2 GLOBAL MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 43 BEV SEGMENT TO HOLD LARGEST MARKET SHARE, BY VALUE, BY 2026 (USD MILLION)

TABLE 80 GLOBAL MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 81 GLOBAL MARKET, BY ELECTRIC VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

TABLE 82 GLOBAL MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2020 (USD THOUSAND)

TABLE 83 GLOBAL MARKET, BY ELECTRIC VEHICLE TYPE, 2021–2026 (USD THOUSAND)

10.2.1 OPERATIONAL DATA

TABLE 84 ELECTRIC VEHICLE SALES, BY PROPULSION TYPE, 2018–2020 (THOUSAND UNITS)

10.2.2 ASSUMPTIONS

TABLE 85 ASSUMPTIONS, BY ELECTRIC VEHICLE TYPE

10.2.3 RESEARCH METHODOLOGY

10.3 BEV

10.3.1 INCREASE IN VEHICLE DRIVING RANGE PER CHARGE EXPECTED TO BOOST DEMAND

TABLE 86 BEV: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 87 BEV: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 88 BEV: MARKET, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 89 BEV: MARKET, BY REGION, 2021–2026 (USD THOUSAND)

10.4 PHEV

10.4.1 SIGNIFICANT ACCEPTANCE OF PHEVS IN PASSENGER CARS TO SUPPORT SEGMENTAL GROWTH

TABLE 90 PHEV: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 91 PHEV: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 92 PHEV: MARKET, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 93 PHEV: MARKET, BY REGION, 2021–2026 (USD THOUSAND)

10.5 FCEV

10.5.1 LUCRATIVE INCENTIVES ON FCEV TO SUPPORT SEGMENTAL GROWTH

TABLE 94 FCEV: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 95 FCEV: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 96 FCEV: MARKET, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 97 FCEV: MARKET, BY REGION, 2021–2026 (USD THOUSAND)

10.6 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE SOLENOID MARKET, BY OPERATION (Page No. - 131)

11.1 INTRODUCTION

FIGURE 44 AUTOMOTIVE SOLENOID VALVES, BY OPERATION

11.2 DIRECT OPERATED

11.3 INDIRECT (PILOT) OPERATED

11.4 SEMI-DIRECT OPERATED

12 AUTOMOTIVE SOLENOID MARKET, BY REGION (Page No. - 133)

12.1 INTRODUCTION

FIGURE 45 GLOBAL MARKET, BY REGION, 2021 VS. 2026

TABLE 98 GLOBAL MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 99 GLOBAL MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 100 GLOBAL MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 101 GLOBAL MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 46 ASIA PACIFIC: AUTOMOTIVE SOLENOID MARKET SNAPSHOT

TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 103 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (THOUSAND UNITS)

TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.1 CHINA

12.2.1.1 Significant vehicle production with increased comfort and safety to drive automotive solenoid market in China

TABLE 106 CHINA: VEHICLE PRODUCTION DATA, 2018-2020 (UNITS)

TABLE 107 CHINA: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 108 CHINA: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 109 CHINA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 110 CHINA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.2.2 JAPAN

12.2.2.1 Demand for technologically advanced vehicles to drive automotive solenoid market in Japan

TABLE 111 JAPAN: VEHICLE PRODUCTION DATA, 2018-2020 (UNITS)

TABLE 112 JAPAN: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 113 JAPAN: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 114 JAPAN: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 115 JAPAN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.2.3 INDIA

12.2.3.1 Automotive solenoid market in India to grow at second-highest CAGR

TABLE 116 INDIA: VEHICLE PRODUCTION DATA, 2018–2020 (UNITS)

TABLE 117 INDIA: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 118 INDIA: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 119 INDIA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 120 INDIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.2.4 SOUTH KOREA

12.2.4.1 Semi-autonomous and autonomous vehicles to drive automotive solenoid market in South Korea

TABLE 121 SOUTH KOREA: VEHICLE PRODUCTION DATA, 2018–2020 (UNITS)

TABLE 122 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 123 SOUTH KOREA: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 124 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 125 SOUTH KOREA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.2.5 REST OF ASIA PACIFIC

TABLE 126 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 127 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 128 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 129 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 47 NORTH AMERICA: AUTOMOTIVE SOLENOID MARKET, 2021 VS. 2026

TABLE 130 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 131 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (THOUSAND UNITS)

TABLE 132 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 133 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.1 US

12.3.1.1 Emission norms and growing trend of advanced features to drive market in US

TABLE 134 US: VEHICLE PRODUCTION DATA, 2018-2020 (UNITS)

TABLE 135 US: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 136 US: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 137 US: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 138 US: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.3.2 MEXICO

12.3.2.1 Substantial exports drive market in Mexico

TABLE 139 MEXICO: VEHICLE PRODUCTION DATA, 2018–2020 (UNITS)

TABLE 140 MEXICO: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 141 MEXICO: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 142 MEXICO: MARKET, BY APPLICATION TYPE, 2018–2020 (USD MILLION)

TABLE 143 MEXICO: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.3.3 CANADA

12.3.3.1 Emission regulations to drive market in Canada

TABLE 144 CANADA: VEHICLE PRODUCTION DATA, 2018–2020 (UNITS)

TABLE 145 CANADA: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 146 CANADA: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 147 CANADA: MARKET, BY APPLICATION TYPE, 2018–2020 (USD MILLION)

TABLE 148 CANADA: MARKET, BY APPLICATION TYE, 2021–2026 (USD MILLION)

12.4 EUROPE

TABLE 149 EUROPE: CO2 EMISSIONS BY VEHICLE MANUFACTURER

FIGURE 48 EUROPE AUTOMOTIVE SOLENOID MARKET SNAPSHOT

TABLE 150 EUROPE: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 151 EUROPE: MARKET, BY COUNTRY, 2021–2026 (THOUSAND UNITS)

TABLE 152 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 153 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.1 GERMANY

12.4.1.1 Presence of leading OEMs and component suppliers to drive German automotive solenoid market

TABLE 154 GERMANY: VEHICLE PRODUCTION DATA, 2018–2020 (UNITS)

TABLE 155 GERMANY: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 156 GERMANY: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 157 GERMANY: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 158 GERMANY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.4.2 FRANCE

12.4.2.1 Significant production of passenger cars and LCVs to drive market in France

TABLE 159 FRANCE: VEHICLE PRODUCTION DATA, 2018–2020 (UNITS)

TABLE 160 FRANCE: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 161 FRANCE: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 162 FRANCE: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 163 FRANCE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.4.3 UK

12.4.3.1 Demand for premium passenger cars to drive market in UK

TABLE 164 UK: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 165 UK: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 166 UK: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 167 UK: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 168 UK: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.4.4 SPAIN

12.4.4.1 Rising demand for passenger vehicles to drive market in Spain

TABLE 169 SPAIN: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 170 SPAIN: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 171 SPAIN: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 172 SPAIN: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 173 SPAIN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.4.5 ITALY

12.4.5.1 Government emphasis on fuel-efficient cars to drive market in Italy

TABLE 174 ITALY: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 175 ITALY: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 176 ITALY: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 177 ITALY: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 178 ITALY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.4.6 REST OF EUROPE

TABLE 179 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 180 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 181 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 182 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5 ROW

FIGURE 49 BRAZIL TO LEAD MARKET IN ROW, BY VALUE, 2021–2026 (USD MILLION)

TABLE 183 ROW: AUTOMOTIVE SOLENOID MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 184 ROW: MARKET, BY COUNTRY, 2021–2026 (THOUSAND UNITS)

TABLE 185 ROW: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 186 ROW: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Economic vehicles to drive market in Brazil

TABLE 187 BRAZIL: VEHICLE PRODUCTION DATA, 2018–2020 (UNITS)

TABLE 188 BRAZIL: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 189 BRAZIL: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 190 BRAZIL: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 191 BRAZIL: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.2 RUSSIA

12.5.2.1 High production volumes of passenger cars to drive market in Russia

TABLE 192 RUSSIA: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 193 RUSSIA: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 194 RUSSIA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 195 RUSSIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.3 SOUTH AFRICA

12.5.3.1 Production of economy passenger cars to drive market in South Africa

TABLE 196 SOUTH AFRICA: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 197 SOUTH AFRICA: MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 198 SOUTH AFRICA: MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 199 SOUTH AFRICA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 200 SOUTH AFRICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.4 OTHERS

TABLE 201 OTHERS: AUTOMOTIVE SOLENOID MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 202 OTHERS: AUTOMOTIVE SOLENOID MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 203 OTHERS: AUTOMOTIVE SOLENOID MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 204 OTHERS: AUTOMOTIVE SOLENOID MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 183)

13.1 OVERVIEW

TABLE 205 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMOTIVE SOLENOID MARKET

13.2 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 50 TOP PUBLIC/LISTED PLAYERS HAVE DOMINATED THE AUTOMOTIVE SOLENOID MARKET DURING THE LAST THREE YEARS

13.3 MARKET RANKING ANALYSIS

FIGURE 51 AUTOMOTIVE SOLENOID: MARKET RANKING ANALYSIS

13.4 COMPETITIVE LEADERSHIP MAPPING FOR THE AUTOMOTIVE SOLENOID MARKET

13.4.1 STAR

13.4.2 PERVASIVE

13.4.3 EMERGING LEADER

13.4.4 PARTICIPANT

FIGURE 52 AUTOMOTIVE SOLENOID MARKET: COMPANY EVALUATION MATRIX, 2021

13.5 COMPANY EVALUATION QUADRANT

TABLE 206 COMPANY REGION FOOTPRINT

TABLE 207 COMPANY VEHICLE TYPE FOOTPRINT (14 COMPANIES)

TABLE 208 COMPANY APPLICATION & GEOGRAPHIC FOOTPRINT

13.6 START-UP/SME EVALUATION MATRIX, 2020

FIGURE 53 AUTOMOTIVE SOLENOID MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SME, 2021

13.7 COMPETITIVE SCENARIO AND TRENDS

13.7.1 PRODUCT LAUNCHES

TABLE 209 AUTOMOTIVE SOLENOID MARKET: PRODUCT LAUNCHES, 2018–2021

13.7.2 DEALS

TABLE 210 AUTOMOTIVE SOLENOID MARKET: DEALS, 2018–2021

13.7.3 OTHERS

TABLE 211 AUTOMOTIVE SOLENOID MARKET: OTHERS, 2018–2021

13.8 WINNERS VS. TAIL-ENDERS

TABLE 212 WINNERS VS. TAIL-ENDERS

14 COMPANY PROFILES (Page No. - 199)

(Business overview, Products offered, Recent developments & MnM View)*

14.1 KEY PLAYERS

14.1.1 BORGWARNER INC.

TABLE 213 BORGWARNER: BUSINESS OVERVIEW

FIGURE 54 BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 214 BORGWARNER INC.: PRODUCTS OFFERED

TABLE 215 BORGWARNER INC.: NEW PRODUCT DEVELOPMENTS

TABLE 216 BORGWARNER INC.: DEALS

TABLE 217 BORGWARNER: OTHERS

14.1.2 ROBERT BOSCH

TABLE 218 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 55 ROBERT BOSCH: COMPANY SNAPSHOT

TABLE 219 ROBERT BOSCH: PRODUCTS OFFERED

TABLE 220 ROBERT BOSCH GMBH: DEALS

TABLE 221 ROBERT BOSCH: OTHERS

14.1.3 DENSO CORPORATION

TABLE 222 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 56 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 223 DENSO CORPORATION: PRODUCTS OFFERED

TABLE 224 DENSO CORPORATION: DEALS

TABLE 225 DENSO CORPORATION: OTHERS

14.1.4 ZF FRIEDRICHSHAFEN AG

TABLE 226 ZF FRIEDRICHSHAFEN: BUSINESS OVERVIEW

FIGURE 57 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

TABLE 227 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

TABLE 228 ZF FRIEDRICHSHAFEN AG: NEW PRODUCT DEVELOPMENTS

TABLE 229 ZF FRIEDRICHSHAFEN AG: DEALS

TABLE 230 ZF: OTHERS

14.1.5 MAHLE GMBH

TABLE 231 MAHLE GMBH: BUSINESS OVERVIEW

FIGURE 58 MAHLE GMBH: COMPANY SNAPSHOT

TABLE 232 MAHLE GMBH: PRODUCTS OFFERED

TABLE 233 MAHLE GMBH: DEALS

14.1.6 NIDEC CORPORATION

TABLE 234 NIDEC CORPORATION: BUSINESS OVERVIEW

FIGURE 59 NIDEC CORPORATION: COMPANY SNAPSHOT

TABLE 235 NIDEC CORPORATION: PRODUCTS OFFERED

TABLE 236 NIDEC CORPORATION: DEALS

14.1.7 JOHNSON ELECTRIC HOLDINGS LIMITED

TABLE 237 JOHNSON ELECTRIC: BUSINESS OVERVIEW

FIGURE 60 JOHNSON ELECTRIC: COMPANY SNAPSHOT

TABLE 238 JOHNSON ELECTRIC: PRODUCTS OFFERED

14.1.8 SCHAEFFLER AG

TABLE 239 SCHAEFFLER: BUSINESS OVERVIEW

FIGURE 61 SCHAEFFLER: COMPANY SNAPSHOT

TABLE 240 SCHAEFFLER: PRODUCTS OFFERED

TABLE 241 SCHAEFFLER: DEALS

TABLE 242 SCHAEFFLER: OTHERS

14.1.9 RHEINMETALL AUTOMOTIVE

TABLE 243 RHEINMETALL AUTOMOTIVE: BUSINESS OVERVIEW

FIGURE 62 RHEINMETALL AUTOMOTIVE: COMPANY SNAPSHOT

TABLE 244 RHEINMETALL: PRODUCTS OFFERED

TABLE 245 RHEINMETALL: NEW PRODUCT DEVELOPMENTS

TABLE 246 RHEINMETALL: DEALS

14.1.10 HITACHI ASTEMO

TABLE 247 HITACHI AUTOMOTIVE: BUSINESS OVERVIEW

FIGURE 63 HITACHI ASTEMO: COMPANY SNAPSHOT

TABLE 248 HITACHI ASTEMO: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14.2 OTHER KEY PLAYERS

14.2.1 STONERIDGE INC

TABLE 249 STONERIDGE: BUSINESS OVERVIEW

14.2.2 GKN GROUP

TABLE 250 GKN GROUP: BUSINESS OVERVIEW

14.2.3 MITSUBISHI ELECTRIC CORPORATION

TABLE 251 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

14.2.4 TLX TECHNOLOGIES

TABLE 252 TLX TECHNOLOGIES: BUSINESS OVERVIEW

14.2.5 ROTEX AUTOMATION

TABLE 253 ROTEX AUTOMATION: BUSINESS OVERVIEW

14.2.6 GIDEON AUTOMOTIVE INDUSTRIES

TABLE 254 GIDEON AUTOMOTIVE INDUSTRIES: BUSINESS OVERVIEW

14.2.7 SOLENOID SYSTEMS

TABLE 255 SOLENOID SYSTEMS: BUSINESS OVERVIEW

14.2.8 KENDRION

TABLE 256 KENDRION: BUSINESS OVERVIEW

14.2.9 MZW MOTOR

TABLE 257 MZW MOTOR: BUSINESS OVERVIEW

14.2.10 BICOLEX

TABLE 258 BICOLEX: BUSINESS OVERVIEW

14.2.11 ZONHEN ELECTRIC APPLIANCES

TABLE 259 ZONHEN ELECTRIC APPLIANCES: BUSINESS OVERVIEW

14.2.12 PADMINI VNA MECHATRONICS

TABLE 260 PADMINI VNA MECHATRONICS: BUSINESS OVERVIEW

14.2.13 JAKSA

TABLE 261 JAKSA: BUSINESS OVERVIEW

14.2.14 EMERSON ELECTRIC

TABLE 262 EMERSON ELECTRIC: BUSINESS OVERVIEW

15 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 239)

15.1 ASIA PACIFIC IS KEY MARKET FOR AUTOMOTIVE SOLENOIDS

15.2 CONCLUSION

16 APPENDIX (Page No. - 240)

16.1 KEY INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

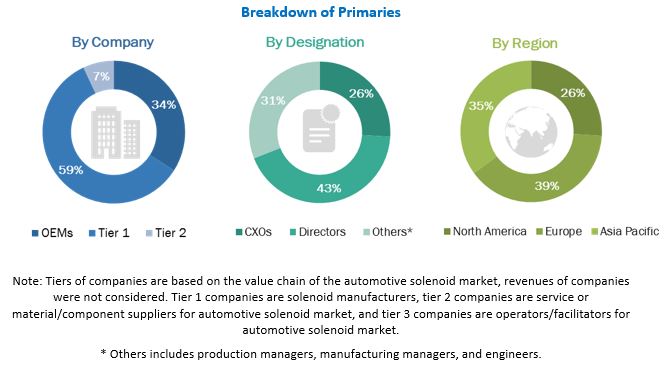

The study involved 4 major activities in estimating the current size of the automotive solenoid market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of automobile OEMs, American Automobile Association (AAA), country-level automotive associations and European Alternative Fuels Observatory (EAFO)], automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the global market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side and supply-side (OEMs and component manufacturers) across 4 major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 14% and 86% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the size of the global automotive solenoid market, in terms of volume (million units)

- To define, describe, and forecast the market on the basis of valve design, application, function, vehicle type, operation type, electric vehicle type, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market on the basis of valve design into 2-way solenoid valve, 3-way solenoid valve, 4-way solenoid valve, and 5-way solenoid valve

- To segment and forecast the market, on the basis of application type into engine control and cooling system, fuel and emission control, body control and interiors, HVAC system, safety and security, and others

- To segment and forecast the market on the basis of function into fluid control, gas control, and motion control

- To segment and forecast the market, on the basis of operation type, into direct acting, indirect acting, and semi-direct acting

- To segment and forecast the market, on the basis of vehicle type, into passenger vehicle, light commercial vehicle, trucks, and buses

- To segment and forecast the market, on the basis of electric vehicle type, into BEV, PHEV, HEV, and FCEV

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive solenoid market, by vehicle at country level (for countries not covered in the report)

- Automotive solenoid market, by application at country level (for countries not covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Solenoid Market