Automotive Transmission Engineering Services Outsourcing Market by Service Type (Designing, Prototyping, Testing, and System Engineering & Integration), Transmission Type (Automatic and Manual), Powertrain (Conventional and Hybrid), and by Region - Global Forecast to 2021

[154 Pages Report] The global automotive transmission engineering services outsourcing market is driven by the increased demand for technologically advanced transmission for both, conventional and hybrid cars. Increasingly stringent government regulations related to emission and fuel efficiency have also boosted the growth of the market. The global automotive transmission engineering services outsourcing market is estimated to be USD 9.81 Billion in 2016, and is projected to grow at a CAGR of 5.66% during the forecast period. The base year for the study is 2015, and the forecast period is 2016 to 2021.

The objective of the study is to define, describe, and provide a detailed analysis of the outsourcing of transmission engineering services in the global automotive industry, in terms of value. The report segments the market by service type, transmission type, powertrain type, and region. The primary aim of the research study is to provide an in-depth analysis of the global automotive transmission engineering services outsourcing market, by value, and to provide a detailed analysis of the market dynamics influencing the growth of the market. A detailed study of various market leaders has been conducted, and an extensive analysis of their recent developments, such as mergers & acquisitions and expansions, has been provided in the report.

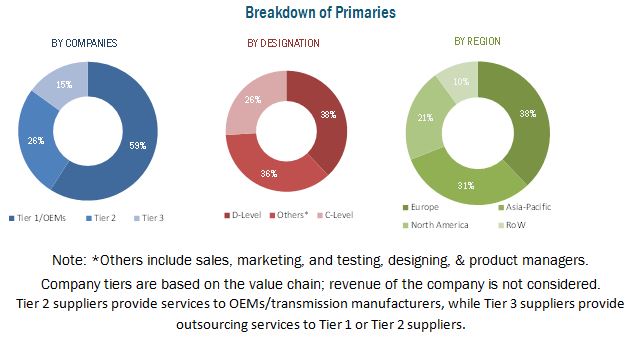

Various secondary sources, such as company annual reports/presentations, press releases, industry association publications, automotive magazine articles, encyclopedias, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, have been used to identify and collect information useful for an extensive commercial study of the global automotive transmission engineering services outsourcing market. The primary sources experts from related industries, automobile OEMs, and transmission service providers—have been interviewed to obtain and verify critical information, as well as to assess future prospects and market estimations. Both, the top-down and bottom-up approaches have been used for market estimation and calculation of the automotive transmission engineering services outsourcing market size.

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The automotive transmission engineering services outsourcing ecosystem consists of various transmission service providers such as Ricardo Plc (U.K.), AVL (Austria), FEV GmbH (Germany), IAV GmbH (Germany), Magna International Inc. (U.S.), and Intertek Group plc (U.K.), along with major transmission manufacturers such as ZF Friedrichshafen AG (Germany), Jatco (Japan), Aisin Seiki Co., Ltd. (Japan), and Getrag (Germany), which integrate the solutions provided by these transmission service providers and according to specifications, manufacture the transmission and sell it to the end-user that is, automotive OEMs.

Target Audience

- Automotive OEMs

- Automotive transmission engineering service providers

- Automotive transmission manufacturers

- Automotive transmission engineering equipment manufacturers

Scope of the Report

-

By Service Type

- Designing

- Prototyping

- Testing

- System Engineering and Integration

- Simulation

-

By Transmission Type

- Automatic Transmission

- Manual Transmission

-

By Powertrain

- Conventional Powertrain

- Hybrid Powertrain

-

By Region

- Asia-Pacific

- North America

- Europe

- RoW

Available Customizations

- Automotive transmission engineering services outsourcing market, by transmission, at country level

- Automotive transmission engineering services outsourcing market, by powertrain, at country level

-

Company information

- Profiling of additional market players (Up to 3)

The global automotive transmission engineering services outsourcing market is projected to grow at a CAGR of 5.66% during the forecast period, to reach USD 12.92 Billion by 2021, from an estimated USD 9.81 Billion in 2016. The base year for the report is 2015, and the forecast year is 2021. The increasing sales of passenger cars, stringent emission norms, and adoption of new technologies such as hybrid transmission are driving the automotive transmission engineering services outsourcing market.

Hybrid transmission services are projected to witness the fastest growth during the forecast period, owing to the increased demand for fuel-efficient vehicles and stringent emission norms. New government regulations to control pollution levels have led to multiple subsidies and tax benefits for automotive manufacturers as well as customers to promote the sales of hybrid cars. This has boosted the market for hybrid transmission engineering services.

Automatic transmission is estimated to be the fastest-growing segment of the automotive transmission engineering services outsourcing market, in terms of transmission type. This growth can be attributed to the high demand for fuel efficiency and smooth gear shifting and the rising income levels of citizens in developing nations. Other factors contributing to this growth are the increasing demand for automatic transmission such as automated manual transmission (AMT), dual clutch transmission (DCT), and continuously variable transmission (CVT), which offer fuel efficiency similar to that of manual transmission and are not as expensive as conventional automatic transmission, in countries such as India, China, Germany, and Brazil.

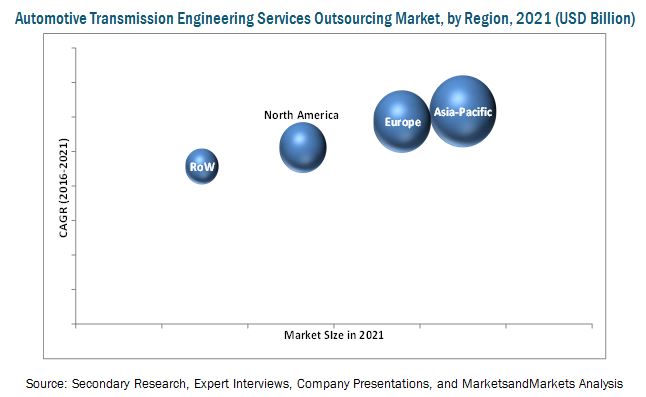

Asia-Pacific is estimated to account for the largest share in the global automotive transmission engineering services outsourcing market; however, at a country-level, Germany is the largest market for such services, owing to its advanced technological infrastructure and the presence of luxury car manufacturers such as Mercedes-Benz, BMW, Volkswagen, and Audi.

The increasing demand for fuel-efficient vehicles, availability of low-cost skilled labor, progressively stringent government regulations, and growing focus of OEMs on expanding in Asia-Pacific are the key factors contributing to the growth of the automotive transmission engineering services market in this region.

A major market restraint considered in the study is the high investments made by automotive OEMs in R&D, which enable them to design and test the transmission internally, thereby limiting the growth of the market for the outsourcing of transmission engineering services. The low penetration of high-end automatic transmission in countries such as China, Germany, and India is another hurdle for transmission service providers. Countries in Asia-Pacific and Europe are more inclined towards manual transmission, while passenger cars with automatic transmission are generally preferred in North American countries. The global automotive transmission engineering services outsourcing market comprises many international as well as domestic players, including Ricardo Plc (U.K.), AVL (Austria), IAV GmbH (Germany), FEV GmbH (Germany), and Intertek Group plc (U.K.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Secondary Data

2.1.1 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Primary Participants

2.3 Factor Analysis

2.3.1 Demand Side Analysis

2.4 Market Size Estimation

2.5 Data Triangulation

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 Global Automotive Transmission Engineering Services Outsourcing Market Segmentations: By Service Type

5.2.2 Global Automotive Transmission Engineering Services Outsourcing Market Segmentations

5.2.3 Global Automotive Transmission Engineering Services Outsourcing Market Segmentation: By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.2 Restraints

5.3.3 Opportunities

5.3.4 Chaleenges

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

6 Automotive Transmission Engineering Services Outsourcing Market, By Region

6.1 Introduction

6.2 Asia-Pacific

6.2.1 China

6.2.2 India

6.2.3 Japan

6.2.4 South Korea

6.3 North America

6.3.1 U.S.

6.3.2 Canada

6.3.3 Mexico

6.4 Europe

6.4.1 Germany

6.4.2 France

6.4.3 U.K.

6.5 Rest of the World (RoW)

6.5.1 Brazil

6.5.2 Russia

6.5.3 Thailand

7 Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type

7.1 Introduction

7.2 Manual Transmission

7.3 Automatic Transmission

8 Automotive Transmission Engineering Services Outsourcing Market, By Powertrain Type

8.1 Introduction

8.2 Hybrid Powertrain

8.3 Conventional Powertrain

9 Automotive Transmission Engineering Services Outsourcing Market, By Services

9.1 Introduction

9.2 Designing

9.3 Prototyping

9.4 Testing

9.5 System Engineering & Integration

9.6 Simulation

10 Competitive Landscape

10.1 Overview

10.2 Battle for Market Share: New Product Launch Was the Key Strategy

10.3 Expansions

10.4 New Product Launches

10.5 Agreements/ Joint Ventures

10.6 Mergers & Acquisitions

11 Company Profiles

11.1 Introduction

11.2 AVL

11.2.1 Business Overview

11.2.2 Products & Services Offered

11.2.3 Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Ricardo PLC

11.3.1 Business Overview

11.3.2 Services Offered

11.3.3 Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 FEV GmbH

11.4.1 Business Overview

11.4.2 Services Offered

11.4.3 Developments

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Magna International

11.5.1 Business Overview

11.5.2 Products & Services Offered

11.5.3 Recent Developments

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 IAV GmbH

11.6.1 Business Overview

11.6.2 Products & Services Offered

11.6.3 Key Strategy

11.6.4 Developments

11.6.5 SWOT Analysis

11.6.6 MnM View

11.7 Horiba, Ltd

11.7.1 Business Overview

11.7.2 Services Offered

11.7.3 Developments

11.8 Intertek Group PLC

11.8.1 Business Overview

11.8.2 Services Offered

11.8.3 Developments

11.9 Magneti Marelli S.P.A

11.9.1 Business Overview

11.9.2 Products & Services Offered

11.9.3 Developments

11.10 Porsche Engineering

11.10.1 Business Overview

11.10.2 Products & Services Offered

11.10.3 Developments

List OfTables (70 Tables)

Table 1 Global Automotive Transmission Engineering Services Outsourcing Market, By Region, 2014–2021(USD Billion)

Table 2 Asia–Pacific Automotive Transmission Engineering Services Outsourcing Market, By Country, 2014–2021 (USD Million)

Table 3 China : Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type, 2014–2021 (USD Million)

Table 4 India : Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type, 2014–2021 (USD Million)

Table 5 Japan: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type , 2014–2021 (USD Million)

Table 6 South Korea: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type, 2014–2021 (USD Million)

Table 7 North America: Automotive Transmission Engineering Services Outsourcing Market, By Country, 2014–2021 (USD Million)

Table 8 U.S.: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type, 2014–2021 (USD Million)

Table 9 Canada: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type, 2014–2021 (USD Million)

Table 10 Mexico: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type, 2014–2021 (USD Million)

Table 11 Europe: Automotive Transmission Engineering Services Outsourcing Market, By Country, 2014–2021 (USD Million)

Table 12 Germany: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type , 2014–2021 (USD Million)

Table 13 France: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type , 2014–2021 (USD Million)

Table 14 U.K.: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type , 2014–2021 (USD Million)

Table 15 RoW Automotive Transmission Engineering Services Outsourcing Market Size, By Country, 2014 –2021 (USD Million)

Table 16 Brazil: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type , 2014–2021 (USD Million)

Table 17 Russia: : Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type , 2014–2021 (USD Million)

Table 18 Thailand: Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type , 2014–2021 (USD Million)

Table 19 Global Automotive Transmission Engineering Services Outsourcing Market, By Powertrain Type, 2014–2021 (USD Billion)

Table 20 Hybrid Transmission: Global Automotive Transmission Engineering Services Outsourcing Market, By Region, 2014–2021 (USD Million)

Table 21 Hybrid Transmission : Automotive Transmission Engineering Services Outsourcing Market for Asia–Pacific Region, 2014–2021 (USD Million)

Table 22 Hybrid Transmission : Automotive Transmission Engineering Services Outsourcing Market for Europe Region, 2014–2021 (USD Million)

Table 23 Hybrid Transmission : Automotive Transmission Engineering Services Outsourcing Market for North America Region, 2014–2021 (USD Million)

Table 24 Hybrid Transmission : Automotive Transmission Engineering Services Outsourcing Market for Rest of the World Region, 2014–2021 (USD Million)

Table 25 Conventional Transmission : Global Automotive Transmission Engineering Services Outsourcing Market , By Region, 2014–2021 (USD Billion)

Table 26 Conventional Transmission : Transmission Engineering Services Outsourcing Market for Asia–Pacific,2014–2021 (USD Million)

Table 27 Conventional Transmission : Transmission Engineering Services Outsourcing Market for Europe ,2014–2021 (USD Million)

Table 28 Conventional Transmission : Transmission Engineering Services Outsourcing Market for North America, 2014–2021 (USD Million)

Table 29 Conventional Transmission : Transmission Engineering Services Outsourcing Market for RoW,2014–2021 (USD Million)

Table 30 Global Automotive Transmission Engineering Services Outsourcing Market, By Service Type, 2014–2021 (USD Billion)

Table 31 Global Automotive Transmission Engineering Services Outsourcing Market (Designing), By Region, 2014–2021 (USD Million)

Table 32 Asia–Pacific: Automotive Transmission Engineering Services Outsourcing Market (Designing), By Country, 2014–2021 (USD Million)

Table 33 Europe: Automotive Transmission Engineering Services Outsourcing Market (Designing), By Country, 2014–2021 (USD Million)

Table 34 North America: Automotive Transmission Engineering Services Outsourcing Market (Designing), By Country, 2014–2021 (USD Million)

Table 35 Rest of the World : Automotive Transmission Engineering Services Outsourcing Market (Designing), By Country, 2014–2021 (USD Million)

Table 36 Global Automotive Transmission Engineering Services Outsourcing Market (Prototyping), By Region, 2014–2021 (USD Million)

Table 37 Asia–Pacific : Automotive Transmission Engineering Services Outsourcing Market (Prototyping), By Country, 2014–2021 (USD Million)

Table 38 Europe : Automotive Transmission Engineering Services Outsourcing Market (Prototyping), By Country, 2014–2021 (USD Million)

Table 39 North America : Automotive Transmission Engineering Services Outsourcing Market (Prototyping), By Country, 2014–2021 (USD Million)

Table 40 Rset of the World : Automotive Transmission Engineering Services Outsourcing Market (Prototyping), By Country, 2014–2021 (USD Million)

Table 41 Global Automotive Transmission Engineering Services Outsourcing Market (Testing), By Region, 2014–2021 (USD Million)

Table 42 Asia–Pacific : Automotive Transmission Engineering Services Outsourcing Market (Testing), By Country, 2014–2021 (USD Million)

Table 43 Europe : Automotive Transmission Engineering Services Outsourcing Market (Testing), By Country, 2014–2021 (USD Million)

Table 44 North America : Automotive Transmission Engineering Services Outsourcing Market (Testing), By Country, 2014–2021 (USD Million)

Table 45 Rest of the World : Automotive Transmission Engineering Services Outsourcing Market (Testing), By Country, 2014–2021 (USD Million)

Table 46 Global Automotive Transmission Engineering Services Outsourcing Market (System Engineering & Integration), By Region, 2014–2021 (USD Million)

Table 47 Asia–Pacific : Automotive Transmission Engineering Services Outsourcing Market (System Engineering & Integration), By Country, 2014–2021 (USD Million)

Table 48 Europe : Automotive Transmission Engineering Services Outsourcing Market (System Engineering & Integration), By Country, 2014–2021 (USD Million)

Table 49 North America : Automotive Transmission Engineering Services Outsourcing Market (System Engineering & Integration), By Country, 2014–2021 (USD Million)

Table 50 Rest of the World : Automotive Transmission Engineering Services Outsourcing Market (System Engineering & Integration), By Country, 2014–2021 (USD Million)

Table 51 Global Automotive Transmission Engineering Services Outsourcing Market (Simulation), By Region, 2014–2021 (USD Million)

Table 52 Asia–Pacific : Automotive Transmission Engineering Services Outsourcing Market (Simulation), By Country, 2014–2021 (USD Million)

Table 53 Europe : Automotive Transmission Engineering Services Outsourcing Market (Simulation), By Country, 2014–2021 (USD Million)

Table 54 North America : Automotive Transmission Engineering Services Outsourcing Market (Simulation), By Country, 2014–2021 (USD Million)

Table 55 Rest of the World : Automotive Transmission Engineering Services Outsourcing Market (Simulation), By Country, 2014–2021 (USD Million)

Table 56 Global Automotive Transmission Engineering Services Outsourcing Market, By Transmission Type, 2014–2021 (USD Billion)

Table 57 Global Automotive Transmission Engineering Services Outsourcing Market, By Region, By Manual Transmission, 2014–2021 (USD Million)

Table 58 Asia–Pacific: Automotive Transmission Engineering Services Outsourcing Market, By Country, By Manual Transmission, 2014–2021 (USD Million)

Table 59 Europe: Automotive Transmission Engineering Services Outsourcing Market, By Country, By Manual Transmission, 2014–2021 (USD Million)

Table 60 North America: Automotive Transmission Engineering Services Outsourcing Market, By Country, By Manual Transmission 2014–2021 (USD Million)

Table 61 Rest of the World : Automotive Transmission Engineering Services Outsourcing Market, By Country, By Manual Transmission, 2014–2021 (USD Million)

Table 62 Global Autmotive Transmission Engineering Services Outsourcing Market, By Region, By Automatic Transmsission, 2014–2021 (USD Million)

Table 63 Asia–Pacific: Autmotive Transmission Engineering Services Outsourcing Market, By Region, By Automatic Transmsission, 2014–2021 (USD Million)

Table 64 North America: Autmotive Transmission Engineering Services Outsourcing Market, By Region, By Automatic Transmsission, 2014–2021 (USD Million)

Table 65 Europe: Autmotive Transmission Engineering Services Outsourcing Market, By Region, By Automatic Transmsission, 2014–2021 (USD Million)

Table 66 Rest of the World : Autmotive Transmission Engineering Services Outsourcing Market, By Region, By Automatic Transmsission, 2014–2021 (USD Million)

Table 67 Expansion, 2010–2016

Table 68 New Product Development 2010–2016

Table 69 Joint Ventures 2010–2016

Table 70 Merger and Acquisition 2010–2016

List OfFigures (58 Figures)

Figure 1 Automotive Transmission Engineering Services Outsourcing: Markets Covered

Figure 2 Research Design Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Gross Domestic Product (GDP) vs Passenger Vehicle Sales

Figure 5 Vehicle Production, 2014–15

Figure 6 Market Size Estimation Methodology: Top–Down Approach

Figure 7 Market Size Estimation Methodology: Bottom–Up Approach

Figure 8 Asia–Pacific Region Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 9 Emerging Market Opportunities in Asia–Pacific for Automotive Transmission Engineering Services Outsourcing Market

Figure 10 China Automotive Transmission Engineering Services Outsourcing Market : at Estimated to Register Highest Growth By 2021

Figure 11 North American Automotive Transmission Market Trends

Figure 12 At Adoption in Us Estimated to Increase Owing to the Rising Need for Comfort While Travelling

Figure 13 European Automotive Transmission Market Trends

Figure 14 German Automotive Transmission Market: at to Grow at the Highest CAGR.

Figure 15 RoW Automotive Transmission Market Trends

Figure 16 Automatic Tranmsission Market in Brazil Projected to Grow in Forecasted Period

Figure 17 Automotive Transmission Engineering Services Outsourcing Market, By Powertrain Type 2016 vs 2021 (USD Billion)

Figure 18 Growing Demand of Hybrid Transmission Will Drive the Market for Automotive Transmission Engineering Services Outsourcing Market (2016–2021)

Figure 19 China, Germany and India are Estimated to Witness Highest Growth During the Forecast Period (2016–2021)

Figure 20 At Constitutes 58 % of the Global Automotive Transmission Engineering Services Outsourcing Market

Figure 21 Market Size & Share Overview for at and MT for 2016.

Figure 22 At is Projected to Gain the Maximum Market Share During the Forecast Period (2016–2021)

Figure 23 Market Size & Share Overview for at and MT for 2021

Figure 24 Conventional Cars Estimated to Dominate Automotive Transmission Engineering Services Outsourcing Market During 2016 – 2021

Figure 25 Designing Accounts for the Maximum Market in the Outssourcing Service for an Automotive Transmission

Figure 26 Increasing Demand for Better Performance & Higher Efficiency in Automobiles Will Push the Market for Transmission Engineering Services

Figure 27 Global Automotive Transmission Engineering Services Outsourcing Market, By Region, 2016 & 2021

Figure 28 Key Countries in the Global Automotive Transmission Engineering Services Outsourcing Market: Germany Estimated to Be the Largest Market By 2021

Figure 29 Global Automotive Transmission Engineering Services Outsourcing Market Outlook, By Type: at Expected to Lead the Market

Figure 30 Asia-Pacific Projected to Be the Fastest–Growing Market During the Forecast Period (2016-2021).

Figure 31 At to Register the Highest Growth in the Forecast Period Due to Increasing Customer Preference

Figure 32 Global Automotive Transmission Engineering Services Outsourcing Outlook, By Service Type: Designing Incurs the Maximum Cost in Transmission Engineering Services

Figure 33 Global Automotive Transmission Engineering Services Outsourcing Outlook, By Powertrain Type, 2016 & 2021: Hybrid to Register the Highest Growth in the Forecast Period

Figure 34 Automotive Transmission Engineering Services Outsourcing Market, By Service Type, 2016 vs 2021 (USD Billion)

Figure 35 Europe Accounts for the Major Market Share in Outsourcing of Engineering Services (Designing) for Automotive Transmission Worldwide

Figure 36 Asia–Pacific Estimated to Grow at Highest CAGR for Prototyping Service Outsourcing

Figure 37 Europe is Projected to Have Highest Market Share in Outsourcing of Testing Transmission Engineering Service

Figure 38 Asia–Pacific Region is Estimated to Grow With Highest CAGR for Outsourcing of System Engineering & Integration

Figure 39 Outsourcing of Simulation Servicesto Registered Highest CAGR in Asia–Pacific Region

Figure 40 At Expected to Grow at High CAGR in Forescasted Period(USD Million)

Figure 41 Global Projected Market Share of Conventional Transmission for 2021

Figure 42 Global Projected Market Share of Hybrid Transmission for 2021

Figure 43 Asia–Pacific is Estimated to Account for Largest Share in Manual Transmission

Figure 44 Asia–Pacific and Europe Major Markets for MT Owing to Lower Cost and Customer Preference

Figure 45 North America is Estimated to Account for Largest Share in Automatic Transmission Engineering Services in 2016

Figure 46 North America Estimated to Hold the Market in the at Segment in 2016 (USD Billion)

Figure 47 Companies Adopted New Product Launch and Expansion as the Key Growth Strategy From 2010 to 2016

Figure 48 Market Evaluation Framework: Expansion Fuelled Market Growth From 2010 to 2016

Figure 49 AVL: Company Snapshot

Figure 50 Ricardo PLC : Company Snapshot

Figure 51 FEV GmbH:Company Snapshot

Figure 52 Magna International : Company Snapshot

Figure 53 IAV : Company Snapshot

Figure 54 Horiba Pvt Ltd : Company Snapshot

Figure 55 Intertek Group PLC: Company Snapshot

Figure 56 Magneti Marelli S.P.A : Business Overview

Figure 57 Porsche Engineering: Company Snapshot

Figure 58 Tata Consultancy Services : Company Snapshot

Growth opportunities and latent adjacency in Automotive Transmission Engineering Services Outsourcing Market