Solenoid valve Market by Body Material (Stainless Steel, Brass, Aluminum, and Plastic), Valve Design (2-way, 3-way, 4-way, and 5-way), Industry, and Geography - Global Forecast to 2022

The global solenoid valve market was valued at USD 3.44 Billion in 2015 and is expected reach USD 4.41 Billion by 2022, at a CAGR of 3.54% during the forecast period. The market is expected to register a shipment of 20.29 Million units by 2022 from 12.94 Million units in 2015. The base year considered for the study is 2015 and the market size has been forecast between 2016 and 2022.

The main objectives of the report include:

- To define, describe, and forecast the global solenoid valve market segmented on the basis of body material, valve design type

- To forecast the size of the market segments with respect to four main geographies

- To provide the market statistics with detailed classifications and split in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market

- To strategically profile the key players operating in this market and comprehensively analyze their market rankings and core competencies

The global solenoid valve market is expected to grow from USD 3.44 Billion in 2015 to USD 4.41 Billion by 2022, at a CAGR of 3.54% during the forecast period. The market registered a shipment of 12.94 million units in 2015 and is expected to reach 20.29 million units by 2022. The major factors driving the market include growing adoption of solenoid valves in various process industries and increasing preference for greater process automation. In addition, raising demand for water treatment plants provide significant opportunities for the market.

The major solenoid valve body materials considered for the market study are stainless steel, brass, aluminum, and plastic. Among these body materials, the market for brass material is expected to hold the largest size during the forecast period. Some of the major reasons for this growth include the increasing adoption of brass solenoid valves as they are best suited for most non-aggressive and non-corrosive applications. It also has high thermal conductivity compared to other materials such as stainless steel or carbon steel. In addition, the brass material is easier to machine than stainless steel that lowers the manufacturing costs.

The oil & gas, chemical & petrochemical, water & wastewater, food & beverages, power generation, pharmaceuticals, automotive, and medical are some of the key industry verticals where solenoid valves are utilized. The chemical & petrochemical industry held the largest market share in 2015, followed by oil & gas, water & wastewater, power generation, food & beverages, and automotive industries. The major reasons for this growth include the highest deployment of solenoid valves in this industry. Also, the retrofit works in various phases of oil & gas extraction process further contribute to this growing market.

The solenoid valve market in the Americas region held the highest market size, in terms of value in 2015, while the market in APAC is expected to exhibit the fastest-growth rate between 2016 and 2022. The factors contributing to this growth include growing importance for providing safe and clean drinking water worldwide, which is leading to the increasing investments in water treatment plants thereby creating a demand for utilization of solenoid valves.

However, various technical problems associated with solenoid valves may hinder the growth of the market. For instance, solenoid valves faces various difficulties such as part closure of valves, valves not opening properly, valves making erratic sounds, and coil problems. Moreover, flow factor of the valve and the compatibility with medium also effects its operations.

ASCO Valve, Inc. (U.S.) is one of the leading manufacturers of quality fluid controls products worldwide. It offers wide range of fluid automation products that include compressors, solenoid valves, generator controls, air-operated valves, manual reset valves, and pressure and temperature switches among others. The company aims to strengthen its market presence with the wide range of strategic initiatives such as new product launches.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Adoption of Solenoid Valves in the Pharmaceutical Industry Would Drive the Demand for This Market

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities for the Solenoid Valves Market

4.2 Solenoid Valve Market, By Industry

4.3 Market in APAC

4.4 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Body Material

5.2.2 Operating Procedures of Solenoid Valves

5.2.3 Market, By Valve Design

5.2.4 Market, By Industry

5.2.5 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Adoption of Solenoid Valves in the Food & Beverages Industry

5.3.1.2 Shift to Renewable Sources for Power Generation

5.3.2 Restraints

5.3.2.1 Technical Problems Associated With Solenoid Valves May Affect the Market

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Wastewater Treatment Industries

5.3.3.2 Growing Adoption of Solenoid Valves in A Wide Range of Process Industries

5.3.4 Challenges

5.3.4.1 Reliability of Solenoid Valve

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

6.4 Strategic Benchmarking

6.4.1 Technology Integration and Product Enhancement

7 Operating Procedures of Solenoid Valves (Page No. - 57)

7.1 Introduction

7.2 Direct Operated

7.3 Indirect (Pilot) Operated

7.4 Semi-Direct Operated

8 Market, By Body Material (Page No. - 60)

8.1 Introduction

8.2 Stainless Steel Body Material

8.3 Brass Body Material

8.4 Aluminum Body Material

8.5 Plastic Body Material

9 Market, By Valve Design (Page No. - 69)

9.1 Introduction

9.2 2-Way Solenoid Valves

9.3 3-Way Solenoid Valves

9.4 4-Way Solenoid Valves

9.5 5-Way Solenoid Valves

10 Market, By Industry (Page No. - 77)

10.1 Introduction

10.2 Oil & Gas

10.3 Chemical & Petrochemical

10.4 Water & Wastewater

10.5 Food & Beverages

10.6 Power Generation

10.7 Pharmaceutical

10.8 Automotive

10.9 Medical

10.10 Others

11 Market, By Geography (Page No. - 104)

11.1 Introduction

11.2 Americas

11.2.1 North America

11.2.1.1 U.S.

11.2.1.1.1 Upgrading of Existing Facilities Would Drive the Market in the U.S.

11.2.1.2 Canada

11.2.1.2.1 Growing Medical and Healthcare Industry

11.2.1.3 Mexico

11.2.1.3.1 Growing Manufacturing Industry Would Further Drive the Utilization of Solenoid Valves

11.2.2 South America

11.3 Europe

11.3.1 Germany

11.3.1.1 Advanced Manufacturing Capabilities

11.3.2 France

11.3.2.1 Second-Largest Solenoid Valve Market in Europe

11.3.3 Italy

11.3.3.1 Third-Largest Solenoid Valve Market in Europe

11.3.4 U.K.

11.3.4.1 Growing Automation Technologies Would Drive the Solenoid Valves Market

11.3.5 Rest of Europe

11.3.5.1 Growing Economic Conditions

11.4 Asia-Pacific

11.4.1 Japan

11.4.1.1 A Substantial Mature Market

11.4.2 China

11.4.2.1 Second-Largest Solenoid Valve Market in Asia-Pacific

11.4.3 South Korea

11.4.3.1 Growth From Semiconductor Manufacturing Companies

11.4.4 India

11.4.4.1 Prominent Growth in the Water Treatment Plants

11.4.5 Rest of APAC

11.4.5.1 Australia & Indonesia are Potential Countries for Solenoid Valves

11.5 Rest of the World (RoW)

11.5.1 Middle East

11.5.1.1 Huge Oil & Gas Reserves and Petrochemical Industries Would Drive the Solenoid Valve Market

11.5.2 Africa

11.5.2.1 Emerging Region for Various Industries

12 Competitive Landscape (Page No. - 134)

12.1 Introduction

12.2 Market Ranking of Players in the Market, 2015

12.3 Competitive Scenario

12.4 Recent Developments

13 Company Profiles (Page No. - 139)

13.1 Introduction

13.2 Asco Valve, Inc.

13.3 Christian Bürkert GmbH & Co. Kg

13.4 Curtiss-Wright Corporation

13.5 Danfoss A/S

13.6 GSR Ventiltechnik GmbH & Co. Kg

13.7 IMI PLC

13.8 Parker Hannifin Corporation

13.9 Rotex Controls B.V.

13.10 SMC Corporation

13.11 The LEE Company

14 Appendix (Page No. - 161)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (74 Tables)

Table 1 Increasing Adoption of Solenoid Valves in Food & Beverages Industry Would Drive the Market

Table 2 Technical Problems Assocaited With Solenoid Valves May Affect the Solenoid Valve Market

Table 3 Increasing Demand for Solenoid Valves in Waste Water Treatment Plants Might Witness A Huge Opportunity for This Industry

Table 4 Porter’s Five Forces Analysis: Low Degree of Threat of Substitutes Likely to Have Minimum Impact on the Overall Market in 2015

Table 5 Market, By Body Material, 2013–2022 (USD Million)

Table 6 Market, By Body Material, 2013–2022 (Million Units)

Table 7 Market for Stainless Steel Body Material, By Region, 2013–2022 (USD Million)

Table 8 Market for Stainless Steel Body Material, By Region, 2013–2022 (Thousand Units)

Table 9 Market for Brass Body Material, By Region, 2013–2022 (USD Million)

Table 10 Market for Brass Body Material, By Region, 2013–2022 (Million Units)

Table 11 Solenoid Valve Market for Aluminum Body Material, By Region, 2013–2022 (USD Million)

Table 12 Market for Aluminum Body Material, By Region, 2013–2022 (Thousand Units)

Table 13 Market for Plastic Body Material, By Region, 2013–2022 (USD Million)

Table 14 Market for Plastic Body Material, By Region, 2013–2022 (Thousand Units)

Table 15 Market, By Valve Design Type, 2013–2022 (USD Million)

Table 16 Market for 2-Way Valve Design Type, By Industry, 2013–2022 (USD Million)

Table 17 Market for 3-Way Valve Design Type, By Industry, 2013–2022 (USD Million)

Table 18 Market for 4-Way Valve Design Type, By Industry, 2013–2022 (USD Million)

Table 19 Market for 5-Way Valve Design Type, By Industry, 2013–2022 (USD Million)

Table 20 Market, By Industry, 2013–2022 (USD Million)

Table 21 Market, By Industry, 2013–2022 (Million Units)

Table 22 Market for Oil & Gas Industry, By Region, 2013–2022 (USD Million)

Table 23 Market for Oil & Gas Industry, By Region, 2013–2022 (Thousand Units)

Table 24 Market for Oil & Gas Industry, By Valve Design Type, 2013–2022 (USD Million)

Table 25 Market for Chemical & Petrochemical Industry, By Region, 2013–2022 (USD Million)

Table 26 Market for Chemical & Petrochemical Industry, By Region, 2013–2022 (Thousand Units)

Table 27 Market for Chemical & Petrochemical Industry, By Valve Design Type, 2013–2022 (USD Million)

Table 28 Market for Water & Wastewater Industry, By Region, 2013–2022 (USD Million)

Table 29 Market for Water & Wastewater Industry, By Region, 2013–2022 (Thousand Units)

Table 30 Market for Water & Wastewater Industry, By Valve Design Type, 2013–2022 (USD Million)

Table 31 Market for Food & Beverages Industry, By Region, 2013–2022 (USD Million)

Table 32 Market for Food & Beverages Industry, By Region, 2013–2022 (Thousand Units)

Table 33 Market for Food & Beverages Industry, By Valve Design Type, 2013–2022 (USD Million)

Table 34 Market for Power Generation Industry, By Region, 2013–2022 (USD Million)

Table 35 Market for Power Generation Industry, By Region, 2013–2022 (Thousand Units)

Table 36 Market for Power Generation Industry, By Valve Design Type, 2013–2022 (USD Million)

Table 37 Market for Pharmaceuticals Industry, By Region, 2013–2022 (USD Million)

Table 38 Market for Pharmaceuticals Industry, By Region, 2013–2022 (Thousand Units)

Table 39 Market for Pharmaceuticals Industry, By Valve Design Type, 2013–2022 (USD Million)

Table 40 Market for Automotive Industry, By Region, 2013–2022 (USD Million)

Table 41 Market for Automotive Industry, By Region, 2013–2022 (Thousand Units)

Table 42 Market for Automotive Industry, By Valve Design Type, 2013–2022 (USD Million)

Table 43 Market for Medical Industry, By Region, 2013–2022 (USD Million)

Table 44 Market for Medical Industry, By Region, 2013–2022 (Thousand Units)

Table 45 Market for Medical Industry, By Valve Design Type, 2013–2022 (USD Million)

Table 46 Market for Other Industries, By Region, 2013–2022 (USD Million)

Table 47 Market for Other Industries, By Region, 2013–2022 (Thousand Units)

Table 48 Market for Others Industry, By Valve Design, 2013–2022 (USD Million)

Table 49 Market, By Region, 2013–2022 (USD Million)

Table 50 Market, By Region, 2013–2022 (Million Units)

Table 51 Market in Americas, By Region, 2013–2022 (USD Million)

Table 52 Market in North America, By Country, 2013–2022 (USD Million)

Table 53 Market in Americas, By Industry, 2013–2022 (USD Million)

Table 54 Market in Americas, By Industry, 2013–2022 (Thousand Units)

Table 55 Market in Americas, By Body Material, 2013–2022 (USD Million)

Table 56 Market in Americas, By Body Material, 2013–2022 (Thousand Units)

Table 57 Market in Europe, By Country, 2013–2022 (USD Million)

Table 58 Market in Europe, By Industry, 2013–2022 (USD Million)

Table 59 Market in Europe, By Industry, 2013–2022 (Thousand Units)

Table 60 Market in Europe, By Body Material, 2013–2022 (USD Million)

Table 61 Market in Europe, By Body Material, 2013–2022 (Thousand Units)

Table 62 Market in APAC, By Country, 2013–2022 (USD Million)

Table 63 Market in APAC, By Industry, 2013–2022 (USD Million)

Table 64 Market in APAC, By Industry, 2013–2022 (Thousand Units)

Table 65 Market in APAC, By Body Material, 2013–2022 (USD Million)

Table 66 Market in APAC, By Body Material, 2013–2022 (Thousand Units)

Table 67 Market in RoW, By Region, 2013–2022 (USD Million)

Table 68 Market in RoW, By Industry, 2013–2022 (USD Million)

Table 69 Market in RoW, By Industry, 2013–2022 (Thousand Units)

Table 70 Market in RoW, By Body Material, 2013–2022 (USD Million)

Table 71 Market in RoW, By Body Material, 2013–2022 (Thousand Units)

Table 72 Market Ranking of the Top 5 Players in the Solenoid Valve Market in 2015

Table 73 New Product Launches, 2014–2015

Table 74 Contracts, Agreements & Partnerships, 2014–2015

List of Figures (96 Figures)

Figure 1 Overview of the Micromarkets Covered

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market, 2013–2022 (In Terms of Value and Volume)

Figure 7 Market for the Chemical & Petrochemical Industry Expected to Witness the Largest Market Size During the Forecast Period

Figure 8 Solenoid Valves With Brass Body Material Expected to Hold the Largest Market Size Between 2016 and 2022

Figure 9 Solenoid Valves With Brass Body Material Expected to Hold the Largest Market Size Between 2016 and 2022

Figure 10 3-Way Design Solenoid Valves Expected to Grow at the Highest Rate During the Forecast Period

Figure 11 Solenoid Valve Market, By Region, 2015

Figure 12 Increasing Adoption of Solenoid Valves for Water & Wastewater Treatment Industry Expected to Drive the Market During the Forecast Period

Figure 13 The Chemical & Petrochemical Industry Expected to Dominate the Solenoid Valve Market in 2016

Figure 14 The Chemical & Petrochemical Industry Expected to Dominate the Solenoid Valve Market in the APAC Region in 2015

Figure 15 The Market in the APAC Region Experienced the Growth Phase in 2015

Figure 16 Market Dynamics: Overview

Figure 17 Global Renewable Energy Capacity (Installed)

Figure 18 Major Value Added During the Manufacturing and Assembly Phases

Figure 19 The Porter’s Five Forces Analysis (2015)

Figure 20 Market: Porter’s Five Forces Analysis

Figure 21 Intensity of Competitive Rivalry: Medium Competition in the Market Owing to the Presence of Well-Established Players

Figure 22 Threat of Substitutes Would Be Medium Due to the Buyers Propensity to Substitute

Figure 23 Bargaining Power of Buyers Expected to Be Medium Owing to the Availability of Wide Range of Solenoid Valves in the Market

Figure 24 Bargaining Power of Suppliers Expected to Be Low Due to the Presence of Substantial Players

Figure 25 New Entrants Less Likely to Enter This Market Owing to the Retaliation From Already Existing Firms

Figure 26 Strategic Benchmarking: Key Players Largely Adopted Organic Growth Strategies for New Product and Technology Development

Figure 27 Operating Principles of Solenoid Valves

Figure 28 Market, By Body Material

Figure 29 Brass Body Material Expected to Hold the Largest Size of the Solenoid Valve Market During the Forecast Period

Figure 30 Americas Expected to Hold the Largest Market Size for the Stainless Steel Solenoid Body Material Market During the Forecast Period

Figure 31 APAC Expected to Grow at the Highest Rate in the Brass Solenoid Body Material Market During the Forecast Period

Figure 32 APAC Expected to Grow at the Highest Rate in the Brass Solenoid Body Material Market During the Forecast Period

Figure 33 Rest of the World Expected to Witness the Highest Growth Rate for Plastic Solenoid Valves Market During the Forecast Period

Figure 34 Market, By Valve Design Type

Figure 35 2-Way Solenoid Valves Expected to Hold the Largest Market Size During the Forecast Period

Figure 36 Chemical & Petrochemical Industry Expected to Hold the Largest Size of the 2-Way Solenoid Valve Design Between 2016 and 2022

Figure 37 Water & Wastewater Industry Expected to Grow at the Highest Rate in the 3-Way Solenoid Valve Design Market During the Forecast Period

Figure 38 Oil & Gas Industry Expected to Hold the Largest Size in the 4-Way Solenoid Design Valves Market Between 2016 and 2022

Figure 39 Food & Beverages Industry Expected to Hold the Largest Size in the 5-Way Solenoid Design Valves Market During the Forecast Period

Figure 40 Market: By Industry

Figure 41 Market for the Chemical & Petrochemical Industry is Expected to Hold the Largest Market Size During the Forecast Period

Figure 42 Americas Expected to Hold the Largest Market Size in the Oil & Gas Industry During the Forecast Period

Figure 43 2-Way Solenoid Valves are Expected to Hold the Largest Market Size in the Oil & Gas Industry During the Forecast Period

Figure 44 RoW Region Expected to Grow at the Highest Rate in the Chemical & Petrochemical Industry Between 2016 and 2022

Figure 45 3-Way Solenoid Valves are Expected to Grow at the Highest Rate in the Chemical & Petrochemical Industry During the Forecast Period

Figure 46 Market in APAC Expected to Grow at the Highest Rate in the Water & Wastewater Industry During the Forecast Period

Figure 47 2-Way Solenoid Valves Expected to Hold the Largest Market Size in the Water & Wastewater Industry Between 2016 and 2022

Figure 48 Americas Expected to Hold the Largest Market in the Food & Beverages Industry During the Forecast Period

Figure 49 3-Way Solenoid Valves are Expected to Witness the Highest Growth in the Food & Beverages Industry Between 2016 and 2022

Figure 50 APAC Region Expected to Grow at the Highest Rate in the Power Generation Industry During the Forecast Period

Figure 51 Market for the Chemical & Petrochemical Industry is Expected to Hold the Largest Size During the Forecast Period

Figure 52 Market in APAC Region Expected to Witness the Highest Growth Rate in the Pharmaceutical Industry Between 2016 and 2022

Figure 53 3-Way Solenoid Valves are Expected to Grow at A Highest CAGR in the Pharmaceuticals Industry During the Forecast Period

Figure 54 Europe Expected to Hold the Largest Market Size in the Automotive Industry Between 2016 and 2022

Figure 55 2-Way Solenoid Valves are Expected to Hold the Largest Size in the Automotive Industry Between 2016 and 2022

Figure 56 Europe Expected to Hold the Largest Market Size of the Medical Industry During the Forecast Period

Figure 57 2-Way Solenoid Valves Expected to Hold the Largest Market Size in the Medical Industry Between 2016 and 2022

Figure 58 Americas Expected to Hold the Largest Market Size in the Other Industries During the Forecast Period

Figure 59 2-Way Solenoid Valves are Expected to Hold the Largest Market Size of the Other Industries During the Forecast Period

Figure 60 Solenoid Valve Market, By Region

Figure 61 Americas Expected to Dominate the Solenoid Valve Market During the Forecast Period

Figure 62 Americas: Solenoid Valve Market Snapshot

Figure 63 The Market in the Americas

Figure 64 The Market in the U.S. Expected to Hold the Largest Size During the Forecast Period

Figure 65 Water & Wastewater Industry Expected to Dominate the Solenoid Valve Market in the Americas Between 2016 and 2022

Figure 66 Brass Solenoid Valves Expected to Hold the Largest Market in the Solenoid Valve Market in the Americas During the Forecast Period

Figure 67 Europe: Solenoid Valve Market Snapshot

Figure 68 The Market in Europe

Figure 69 Germany Expected to Hold the Major Market for Solenoid Valves in Europe Between 2016 and 2022

Figure 70 Automotive Industry Expected to Hold the Major Market for Solenoid Valves in Europe Between 2016 and 2022

Figure 71 Brass Solenoid Valves Expected to Hold the Major Market for Solenoid Valves in Europe Between 2016 and 2022

Figure 72 APAC: Solenoid Valve Market Snapshot

Figure 73 The Market in Asia-Pacific

Figure 74 India Expected to Witness the Highest Growth Rate in the Solenoid Valve Market in the APAC Region Between 2016 and 2022

Figure 75 Water & Wastewater Industry Expected to Witness the Highest Growth Rate in the Market in the APAC Region Between 2016 and 2022

Figure 76 Brass Solenoid Valves Expected to Hold the Largest Market of the Market in APAC Between 2016 and 2022

Figure 77 The Markets in the RoW

Figure 78 Middle East to Hold the Largest Market for Solenoid Valves in RoW During the Forecast Period

Figure 79 Middle East to Hold the Largest Market for Solenoid Valves in RoW During the Forecast Period

Figure 80 Aluminum Solenoid Valves Expected to Grow at the Highest Rate in the Solenoid Valves Market in RoW During the Forecast Period

Figure 81 Key Growth Strategies Adopted By the Top Companies Between 2013 and 2015

Figure 82 Market Evaluation Framework: New Product Launches Fuelled the Growth and Innovation Between 2013 and 2015

Figure 83 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 84 Geographic Revenue Mix of Major Players in the Market

Figure 85 Asco Valve, Inc.: SWOT Analysis

Figure 86 Christian Bürkert GmbH & Co. Kg: SWOT Analysis

Figure 87 Curtiss-Wright Corporation: Company Snapshot

Figure 88 Danfoss A/S: Company Snapshot

Figure 89 Danfoss A/S: SWOT Analysis

Figure 90 IMI PLC: Company Snapshot

Figure 91 IMI PLC: SWOT Analysis

Figure 92 Parker Hannifin Corporation: Company Snapshot

Figure 93 Parker Hannifin Corporation: SWOT Analysis

Figure 94 SMC Corporation: Company Snapshot

Figure 95 Marketsandmarkets Knowledge Store Snapshot

Figure 96 Marketsandmarkets Knowledge Store: Semiconductor & Electronics Industry Snapshot

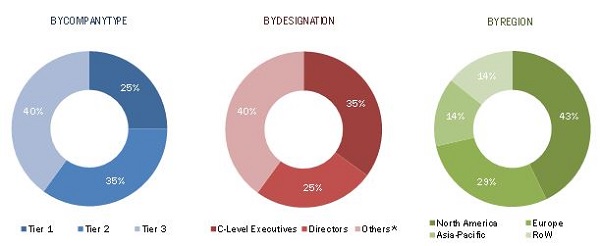

The research methodology used to estimate and forecast the solenoid valve market begins with gathering data on key vendor revenues through secondary research. The top-down and bottom-up approaches have been used to estimate and validate the size of the global market. The research methodology also includes the study of annual and financial reports of the top market players as well as interviews of industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both, quantitative and qualitative) on the market. All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the following figure.

The solenoid valve ecosystem comprises valve manufacturers such as ASCO Valve, Inc. (U.S.), Christian Bürkert GmbH & Co. KG (Germany), Curtiss-Wright Corporation (U.S.), Danfoss A/S (Denmark), GSR Ventiltechnik GmbH & Co. KG (Germany) among others; component manufacturers such as CEME S.p.A. (Italy), CKD Corporation (Japan), ODE S.r.l. (Italy), KANEKO SANGYO Co., Ltd. (Japan), and Takasago Electric Industry Co., Ltd. (Japan) among others

The distributors include MAC Valves (U.S.), Applied Industrial Technologies (U.S.), Nison Consultants Pvt. Ltd. (India), and Yashima Export & Import Company (Japan) among others.

Target Audience of the Report:

The intended audience for this report includes:

- Solenoid valve equipment products and solutions providers

- Solenoid valve systems related service providers

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to solenoid valve engineering

- Government bodies such as regulating authorities and policy makers

- Venture capitalists, private equity firms, and start-up companies

- End users who want to know more about the market

Scope of the Report:

This report categorizes the global solenoid valve market on the basis of body material, valve design, industry vertical, and geography.

By Body Material:

- Stainless Steel

- Brass

- Aluminium

- Plastic

By Valve Design Type:

- 2-way

- 3-way

- 4-way

- 5-way

By Industry:

- Oil & Gas

- Chemical & Petrochemical

- Water & Wastewater

- Food & Beverages

- Power Generation

- Pharmaceuticals

- Automotive

- Medical

- Others

By Region:

- Americas

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Market Analysis

- Further breakdown of the global solenoid valves market, by geography

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Solenoid valve Market

Dose report includes further segmentation of each industry into sub-application. Also what can be provides on solenoid actuators?