Cylinder Deactivation System Market by Component, No. of Cylinders (4 & 6 and Above), Valve Actuation Method (Overhead Camshaft & Pushrod Design), Fuel Type (Gasoline & Diesel), Vehicle Type (Passenger Vehicle & LCV), and Region - Global Forecast to 2025

Cylinder Deactivation System Market

Cylinder deactivation is a process in which select cylinders of the internal combustion engine are deactivated when the full power of the engine is not required. Cylinder deactivation helps to improve fuel economy and reduces CO2 emissions. Different OEMs use different methods to deactivate the cylinder according to the engine type. Cylinder deactivation technology improves fuel efficiency by disabling some cylinders in the internal combustion engine when the full power of the engine is not required. Hence, cylinder deactivation effectively cuts fuel injection for some cylinders by closing intake and exhaust valves of the engine.

Key Drivers:

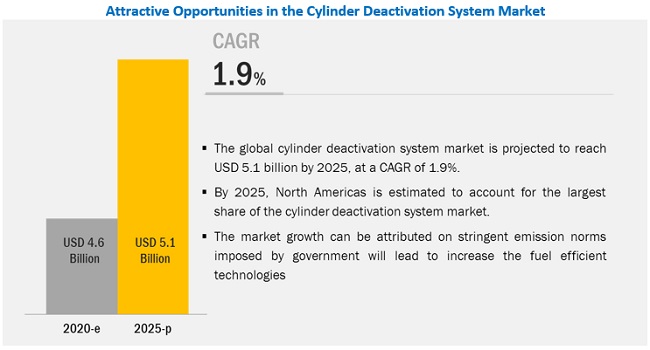

- Demand for the fuel efficient vehicles

- Stringent emission norms imposed by transportation or government authorities

- Increasing sales of vehicles equipped with large volume engines

Key Restraints:

- Excessive oil consumption in a vehicle

- Cylinder deactivation sometimes become prone to vibration or mechanical noises

Top Players

- Eaton (Ireland)

- Valeo (France)

- Delphi Technologies (UK)

- Robert Bosch (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Schaeffler (Germany)

- FEV (Germany)

- BorgWarner (US)

- Hitachi (Japan)

Top Start-ups/New Entrants

- Tula Technology (US)

- Hilite International (US)

- Gates Corporation (US)

- Eaton – Eaton Corporation is a diversified power management company providing energy-efficient solutions that help customers effectively manage electrical, hydraulic, and mechanical power. Eaton was founded in the year 1911 and is headquartered in Ireland. Eaton offers diesel variable actuations and engine valves under its engine valves and valve train product portfolio. On October 2019, Eaton announced its regulatory test cycles and real-world use of its cylinder-deactivation (CDA) technology. CDA can play a key role in helping commercial vehicle manufacturers meet or exceed 2024 and 2027 US emissions regulations. The company is a proven leader in CDA technology that is today utilized in more than 14 million passenger vehicles. Eaton’s CDA technology for commercial vehicles will be available by 2024 for single- and double-overhead cam engines, as well as cam-in-block engines.

- Valeo– Valeo was founded in 1923 and is headquartered in Paris, France. Valeo is an automotive supplier and partner to all leading automakers worldwide. As a technology company, Valeo proposes innovative products and systems that contribute to the reduction of CO2 emissions and to the development of intuitive driving. Valeo has contracts with OEMs such as BMW and Citroën for supplying multiple cylinder deactivation components. On October 2017, Valeo announced the acquisition of FTE Automotive, a leading producer of actuators, after clearances from the European Commission and the Turkish Competition Authority. This acquisition will help the company expand its offering of active hydraulic actuators.

- Tula Technology – Tula Technology is an American-based automotive company, founded in the year 2008. Tula is headquartered in Silicon Valley, CA and specializes in automotive engine controls, advanced digital signal processing, algorithms, controls software, fuel efficiency, noise, vibration & harshness (NVH), firmware, and embedded software technologies. Through a combination of a unique application of digital signal processing and sophisticated powertrain controls, the company has created the Dynamic Fuel Management (DFM) engine technology, thereby providing the most cost-effective, easily integrated fuel-reduction technology available. Tula’s Dynamic Skip Fire (DSF) has been recognized by the International Council of Clean Transportation (ICCT) as a fuel-efficient technology that can help global automakers meet emissions mandates. Delphi Technologies and GM are the two major partners of Tula Technology.

Cylinder Deactivation System Market and Key technology for vehicle based on fuel type

- Diesel Engine Vehicle –Cylinder deactivation in diesel engines can reduce fuel consumption by 20-25%. This also maintains high temperature flow during low load functioning and increases the rate of after treatment exhausts. Hence, active diesel particulates releases get reduced without requiring the traditional method of dosing the diesel oxidation catalyst. The problems associated with diesel engines include cold starting, low power output, and higher maintenance costs. However, with the development of new and advanced technologies, the scenario has changed. Diesel engines are gaining popularity in the market due to their increased efficiency and low emission levels. OEMs and Tier I companies across the globe have increased R&D activities for the implementation of cylinder deactivation technology in diesel engines of light-duty trucks. At the moment, there are no vehicle models available in the market.

- Gasoline Engine Vehicle –Cylinder deactivation in gasoline engines typically operates at high power that provides cylinder displacement on requirement. This optimizes the gasoline engine’s efficiency. In a gasoline engine, the fuel is mixed with air prior to its entrance into the engine cylinder. While cylinder deactivation was earlier meant for larger engines with V6 or V8 volumes, companies are now using this technology in V4 engines as well to meet the emission norms. Naturally aspirated gasoline engine, which is likely to play a major role in the US market, increases the adoption of fuel saving technologies such as high-compression engines with cooled exhaust gas recirculation, stop-start systems, and cylinder deactivation. Cylinder deactivation technology is primarily made for naturally aspirated gasoline engine.

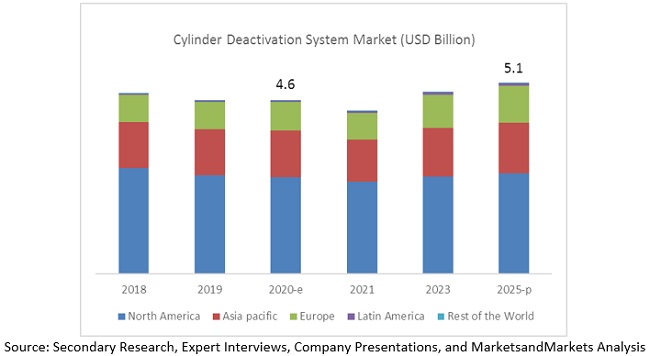

[160 Pages Report] The global cylinder deactivation system market is projected to grow at a CAGR of 1.9%, to reach USD 5.1 billion by 2025 from an estimated USD 4.6 billion in 2020. Increasing demand for fuel-efficient vehicles, stringent emission norms, and increasing sales of vehicles fitted with larger volume engine are the key growth drivers of the market. However, excessive oil consumption in vehicles and system prone to vibrations and mechanical noise can restrain the growth of the market during the forecast period.

By number of cylinders: 6 cylinders and above is expected to be the largest segment in the cylinder deactivation system market

Engines with 6 cylinders and above produce high power. These engines also have a large displacement. These engines are used in light commercial vehicles and modern passenger vehicles. The increasing consumer demand for vehicles with more power is expected to drive the 6 cylinder and above segment in the cylinder deactivation system market.

By valve actuation method: overhead cam design is expected to dominate the cylinder deactivation system market<

The overhead cam design of valve actuation is preferred to pushrod design. Thus, the overhead cam design segment is expected to grow at a rapid pace during the forecast period. Mechanical advantage of overhead cam design over pushrod design makes it a preferred choice for use in modern engine technology. Moreover, it is economical for the demand side of the ecosystem. These advantages are expected to drive the growth of overhead cam design.

By Vehicle Type: Passenger vehicle segment is estimated to be the largest market during the forecast period

Modern passenger vehicles have advanced fuel-efficient technologies and concierge services. The growth of passenger vehicles has been rapid in developing countries with high demand of young millennial population. OEMs have also attracted consumers with offers and continuous updating of services in the passenger vehicle category. Thus, the passenger vehicle segment is expected to dominate the cylinder deactivation system market.

North America is expected to account for the largest market size during the forecast period

North America is estimated to be the largest market during the forecast period. Leading automakers in the region have already deployed cylinder deactivation technology. Also, the North American region is the largest market for light commercial vehicles. Sales of light commercial vehicles have increased day by day. Vehicle emission mandates by regulatory authorities have also fueled the demand for modern technologies.

Key Market Players

The major cylinder deactivation system market players include Eaton (Ireland), Delphi Technologies (UK), Schaeffler (Germany), Bosch (Germany), and Continental (Germany). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume (‘000 units) and Value (USD) |

|

Segments covered |

Component, Number of cylinders, valve actuation method, fuel type, vehicle type, and region |

|

Geographies covered |

Asia Pacific, Europe, North America, Latin America, and the Rest of the World |

|

Companies covered |

Eaton (Ireland), Delphi Technologies (UK), Schaeffler (Germany), Bosch (Germany), Continental (Germany), and others |

This research report categorizes the market based on component, number of cylinders, valve actuation method, fuel type, vehicle type, and region.

Based on component, the market has been segmented as follows:

- Engine Control Unit

- Valve Solenoid

- Electronic Throttle Control

Based on valve actuation method, the market has been segmented as follows:

- Overhead Camshaft Design

- Pushrod Design

Based on number of cylinders, the market has been segmented as follows:

- 4 cylinders

- 6 cylinders and above

Based on fuel type, the market has been segmented as follows:

- Gasoline

- Diesel

Based on vehicle type, the market has been segmented as follows:

- Passenger Vehicle

- Light Commercial Vehicle

Based on the region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Russia

- Spain

- Turkey

- UK

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Latin America

- Argentina

- Brazil

- Rest of Latin America

-

RoW

- Iran

- South Africa

- Rest of RoW

Recent Developments

- In October 2019, Eaton announced its regulatory test cycles and real-world use of its cylinder-deactivation (CDA) technology. CDA can play a key role in helping commercial vehicle manufacturers meet or exceed 2024 and 2027 U.S. emissions regulations. The company is a proven leader in CDA technology that is today utilized in more than 14 million passenger vehicles. Eaton’s CDA technology for commercial vehicles will be available by 2024 for single- and double-overhead cam engines, as well as cam-in-block engines.

- In October 2019, Mitsubishi Electric Corporation announced that it will start the construction of a new plant on the premises of its subsidiary Mitsubishi Electric Automotive India Pvt. Ltd (MEAI) in Gujarat, India. The company's new plant will expand its output of products such as motor-control units for electric power steering, exhaust gas recirculation valves, and giant magnet-resistance sensors in the Indian market.

- In November 2018, Eaton and Shaanxi Fast Gear (SFGW) formed a joint venture to develop, manufacture, sell, and service light-duty manual transmissions in Asia Pacific, Eastern Europe, and Africa. This expansion will promote the use of Eaton’s automotive advanced valvetrain solutions in commercial vehicle engine brakes. It will start production with a major Chinese engine manufacturer.

- In October 2017, Valeo announced the acquisition of FTE Automotive, a leading producer of actuators, after clearances from the European Commission and the Turkish Competition Authority. This acquisition will help the company expand its offering of active hydraulic actuators.

Critical Questions:

- How are Tier I and Tier II tuning engine control unit to make a best fit for customized vehicle?

- How will the implementation of vehicle emission norms impact the overall market?

- What are cylinder deactivation system manufacturers doing to meet the requirement of smart powertrain?

- What could be a possible development in cylinder deactivation system for diesel engines?

- Which other technologies could hamper the market for cylinder deactivation system?

Frequently Asked Questions (FAQ):

What is the market size of the cylinder deactivation system market?

The global cylinder deactivation system market size is projected to reach USD 5.1 billion by 2025 from an estimated value of USD 4.6 billion in 2020, at a CAGR of 1.9%.

Who are the top players in the cylinder deactivation system market? What are their organic & inorganic strategies?

The global cylinder deactivation system market is dominated by major players such as Eaton (Ireland), Delphi Technologies (UK), Schaeffler (Germany), Bosch (Germany), and Continental (Germany). These companies have adopted strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

What are the latest technology or innovation in the field of cylinder deactivation system?

Recently Eaton has developed the cylinder deactivation system for diesel engine vehicles. There no significant development in the past in the diesel engine cylinder deactivation technology.

Which region holds the maximum portion of market share?

Which connectivity (DSRC or Cellular) will be the fastest market by 2028?

What are the challenges for the cylinder deactivation system market?

As cylinder deactivation is used in conventional ICE vehicles only, the increasing adoption of electric vehicles can impact the growth of cylinder deactivation system market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Product and Market Definition

1.2.1 Inclusions & Exclusions

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Demand Side Approach

2.4.2 Bottom-Up Approach

2.5 Market Breakdown

2.6 Assumptions

2.7 Limitations

2.8 Risk Assessment & Ranges

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Cylinder Deactivation System Market

4.2 Market, By Region

4.3 Market, By Vehicle Type

4.4 Market, By Component

4.5 Market, By Valve Actuation Method

4.6 Market, By Number of Cylinders

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for Fuel-Efficient Vehicles

5.2.1.2 Stringent Emission Norms

5.2.1.3 Increasing Sales of Larger Volume Engine

5.2.2 Revenue Shift and Hot Beds in Cylinder Deactivation System Market Growth

5.2.3 Restraints

5.2.3.1 Excessive Oil Consumption in Vehicles

5.2.3.2 System Prone to Vibration/Mechanical Noises

5.2.4 Opportunities

5.2.4.1 Diesel Engine Cylinder Deactivation

5.2.4.2 New Mobility Solutions Demand Fast and Highly Automated Transport

5.2.5 Challenges

5.2.5.1 Rise of E-Mobility

5.2.5.2 Difficulty in Procuring Complex Internal Components

5.2.6 Impact of Market Dynamics

5.3 Cylinder Deactivation Market, Scenarios (2018–2025)

5.3.1 Most Likely Scenario

5.3.2 Optimistic Scenario

5.3.3 Pessimistic Scenario

6 Industry Trends (Page No. - 51)

6.1 Cylinder Deactivation System Life Cycle

6.2 Technology Overview

6.2.1 What is Cylinder Deactivation?

6.2.2 Early Adoption of Cylinder Deactivation Based on Engine Types

6.3 Cylinder Deactivation System Market Trends

6.3.1 Use of Software for Cylinder Deactivation

6.3.2 Use of Electronic Components to Support Cylinder Deactivation System

6.4 Value Chain Analysis: Cylinder Deactivation System Market

6.5 Porter’s Five Forces

7 Cylinder Deactivation System Market, By Component (Page No. - 54)

7.1 Introduction

7.1.1 Assumptions

7.1.2 Research Methodology for Component Segment

7.2 Engine Control Unit

7.2.1 Continuous Innovation in the Field of Programming of Engine Control Unit Will Drive the Market

7.3 Valve Solenoid

7.3.1 Use of Modern Technologies Engine Valve Actuation to Drive the Market for Valve Solenoid

7.4 Electronic Throttle Control

7.4.1 Improving Engine Technologies Across the Globe to Drive the Market for Electronic Throttle Control

7.5 Key Industry Insights

8 Cylinder Deactivation System Market, By Number of Cylinders (Page No. - 60)

8.1 Introduction

8.1.1 Assumptions

8.1.2 Research Methodology for Number of Cylinders Segment

8.2 4 Cylinders

8.2.1 Increasing Sales of Vehicle Equipped With 4 Cylinders to Drive the Market

8.3 6 Cylinders and Above

8.3.1 Increasing Customer Preferences Towards Buying the Vehicles Equipped With Larger Engine to Fuel the Market

8.4 Key Industry Insights

9 Cylinder Deactivation System Market, By Valve Actuation Method (Page No. - 66)

9.1 Introduction

9.1.1 Assumptions

9.1.2 Research Methodology for Valve Actuation Method Segment

9.2 Overhead CAM Design

9.2.1 Mechanical Advantage of Overhead CAM Design Over Other Valve Actuation Method to Drive the Market

9.3 Pushrod Design

9.3.1 Changing Preference of Using Overhead CAM Design Will Affect the Market for Pushrod Design

9.4 Key Industry Insights

10 Cylinder Deactivation System Market, By Fuel Type (Page No. - 72)

10.1 Introduction

10.2 Gasoline

10.3 Diesel

11 Cylinder Deactivation System Market, By Vehicle Type (Page No. - 73)

11.1 Introduction

11.1.1 Assumptions

11.1.2 Research Methodology for Vehicle Segment

11.2 Light Commercial Vehicle (LCV)

11.2.1 Changing Customer Preferences Will Drive the Light Commercial Vehicle Market

11.3 Passenger Vehicle

11.3.1 Adoption of Fuel Efficient Technologies to Drive the Passenger Vehicle Market

11.4 Key Industry Insights

12 Cylinder Deactivation System Market, By Region (Page No. - 79)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.1.1 Engine Customization and High Investments in Logistics Will Drive the Market

12.2.2 Canada

12.2.2.1 Fuel Efficiency Regulations Will Boost the Demand for Cylinder Deactivation Technology

12.2.3 Mexico

12.2.3.1 Increased Demand for Fuel-Efficient Trucks and Light Commercial Vehicles Will Boost the Cylinder Deactivation System Market in Mexico

12.3 Asia Pacific

12.3.1 China

12.3.1.1 China’s Focus on Reducing Vehicle Carbon Emission Will Drive the Cylinder Deactivation System Market

12.3.2 India

12.3.2.1 Rapid Industrialization and Urbanization in India Will Boost Investments in Fuel Saving Technologies

12.3.3 Japan

12.3.3.1 High Adoption of Specialized Vehicles and Advanced Technologies is Expected to Drive the Cylinder Deactivation System Market

12.3.4 South Korea

12.3.4.1 Ghg Emission Standards Set By South Korea Will Boost the Market

12.3.5 Thailand

12.3.5.1 Foreign Investments and Favorable Government Tax Policies Will Drive the Market

12.3.6 Rest of Asia Pacific

12.3.6.1 Business Expansion By OEMs in the Region Will Drive the Market

12.4 Europe

12.4.1 Germany

12.4.1.1 Increasing Demand for Commercial Vehicles and Innovative Technology Will Drive the Cylinder Deactivation System Market

12.4.2 France

12.4.2.1 Increasing Demand for High Performance Engines in Premium Passenger Cars Will Boost the Market

12.4.3 UK

12.4.3.1 Advancements in Automotive Designs Would Boost the Demand for Cylinder Deactivation

12.4.4 Spain

12.4.4.1 Increasing Vehicle Production and Exports Will Boost the Demand for Fuel-Efficient Technologies in Spain

12.4.5 Russia

12.4.5.1 OEM Expansions in Russia Will Boost the Demand for Cylinder Deactivation

12.4.6 Turkey

12.4.6.1 Presence of Leading OEMs and Component Suppliers Would Drive the Market for Cylinder Deactivation

12.4.7 Rest of Europe

12.4.7.1 Increasing Vehicle Production Will Boost Demand

12.5 Latin America

12.5.1 Brazil

12.5.1.1 Government Support for Imports and Increased Truck Sales in Brazil Will Drive the Market

12.5.2 Argentina

12.5.2.1 Increased Production of Passenger Cars Will Drive the Demand for Cylinder Deactivation Technology

12.5.3 Rest of Latin America

12.5.3.1 Increasing Demand for Engine Downsizing and Presence of Leading Automotive Players Will Impact the Market Positively

12.6 Rest of the World (RoW)

12.6.1 Iran

12.6.1.1 Partnerships With Global OEMs Will Drive the Demand for Cylinder Deactivation

12.6.2 South Africa

12.6.2.1 Demand for High-Performance Trucks and OEM Expansion in South Africa Will Drive the Market for Cylinder Deactivation

12.6.3 Others

12.6.3.1 Government Initiatives Will Drive the Demand for Cylinder Deactivation

13 Competitive Landscape (Page No. - 118)

13.1 Overview

13.2 Market Ranking Analysis

13.3 Competitive Leadership Mapping

13.3.1 Visionary Leaders

13.3.2 Innovators

13.3.3 Dynamic Differentiators

13.3.4 Emerging Companies

13.4 Strength of Product Portfolio

13.5 Business Strategy Excellence

13.6 Winners Vs. Losers

13.6.1 Winners

13.6.2 Losers

13.7 Competitive Scenario

13.7.1 New Product Development

13.7.2 Joint Venture

13.7.3 Expansion

14 Company Profiles (Page No. - 127)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 Delphi Technologies

14.2 Schaeffler AG

14.3 Eaton

14.4 Robert Bosch

14.5 Continental AG

14.6 Denso

14.7 Valeo

14.8 FEV

14.9 Mitsubishi Electric Corporation

14.10 Hitachi

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

14.11 Other Major Players

14.11.1 North America

14.11.1.1 Borgwarner Inc.

14.11.1.2 Tenneco Inc.

14.11.1.3 Hilite International

14.11.1.4 Tula Technology, Inc

14.11.1.5 Gates Corporation

14.11.2 Europe

14.11.2.1 Pmg Holding GmbH

14.11.2.2 ZF Friedrichshafen AG

14.11.3 Asia Pacific

14.11.3.1 Aisin Seiki Co. Ltd.

14.11.3.2 Mikuni Corporation

14.11.3.3 Hyundai Kefico Corporation

15 Appendix (Page No. - 154)

15.1 Currency

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (156 Tables)

Table 1 Inclusions & Exclusions for Cylinder Deactivation System Market

Table 2 Risk Assessment & Ranges

Table 3 Cylinder Deactivation System Market: Impact of Market Dynamics

Table 4 Passenger Cars Manufacturer: Co2 Emissions Status and Future Targets

Table 5 Country Wise Co2 Status and Future Targets

Table 6 Acronyms Used By Manufacturers for Vvt System

Table 7 Variable Valve Timing (Vvt) Solenoid Replacement Cost

Table 8 Cylinder Deactivation Market: Impact of Market Dynamics

Table 9 Cylinder Deactivation System Market (Most Likely), By Region, 2018–2025 (USD Million)

Table 10 Market (Optimistic), By Region, 2018–2025 (USD Million)

Table 11 Market (Pessimistic), By Region, 2018–2025 (USD Million)

Table 12 Market, By Component, 2018–2025 (USD Million)

Table 13 Engine Control Unit: Market, By Region, 2018–2025 (USD Million)

Table 14 Valve Solenoid: Market, By Region, 2018–2025 (USD Million)

Table 15 Electronic Throttle Control: Market, By Region, 2018–2025 (USD Million)

Table 16 Market, By Number of Cylinders, 2018–2025 (‘000 Units)

Table 17 Cylinder Deactivation System Market, By Number of Cylinders, 2018–2025 (USD Million)

Table 18 4 Cylinders: Market, By Region, 2018–2025 (‘000 Units)

Table 19 4 Cylinders: Market, By Region, 2018–2025 (USD Million)

Table 20 6 Cylinders and Above: Market, By Region, 2018–2025 (‘000 Units)

Table 21 6 Cylinders and Above: Market, By Region, 2018–2025 (USD Million)

Table 22 Market, By Valve Actuation Method, 2018–2025 (‘000 Units)

Table 23 Market, By Valve Actuation Method, 2018–2025 (USD Million)

Table 24 Overhead CAM Design: Market, By Region, 2018–2025 (‘000 Units)

Table 25 Overhead CAM Design: Market, By Region, 2018–2025 (USD Million)

Table 26 Pushrod Design: Market, By Region, 2018–2025 (‘000 Units)

Table 27 Pushrod Design: Market, By Region, 2018–2025 (USD Million)

Table 28 Cylinder Deactivation System Market, By Vehicle Type, 2018–2025 (‘000 Units)

Table 29 Market, By Vehicle Type, 2018–2025 (USD Million)

Table 30 Light Commercial Vehicle: Market, By Region, 2018–2025 (‘000 Units)

Table 31 Light Commercial Vehicle: Market, By Region, 2018–2025 (USD Million)

Table 32 Passenger Vehicle: Market, By Region, 2018–2025 (‘000 Units)

Table 33 Passenger Vehicle: Market, By Region, 2018–2025 (USD Million)

Table 34 Market, By Region, 2018–2025 (’000 Units)

Table 35 Market, By Region, 2018–2025 (USD Million)

Table 36 North America: Market, By Country, 2018–2025 (’000 Units)

Table 37 North America: Market, By Country, 2018–2025 (USD Million)

Table 38 US: Vehicle Production Data (Units)

Table 39 US: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 40 US: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 41 US: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 42 Canada: Vehicle Production Data (Units)

Table 43 Canada: Market, By Component, 2018–2025 (USD Million)

Table 44 Canada: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 45 Canada: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 46 Mexico: Vehicle Production Data (Units)

Table 47 Mexico: Market, By Component, 2018–2025 (USD Million)

Table 48 Mexico: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 49 Mexico: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 50 Asia Pacific: Market, By Country, 2018–2025 (’000 Units)

Table 51 Asia Pacific: Market, By Country, 2018–2025 (USD Million)

Table 52 China: Vehicle Production Data (Units)

Table 53 China: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 54 China: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 55 China: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 56 India: Vehicle Production Data (Units)

Table 57 India: Market, By Component, 2018–2025 (USD Million)

Table 58 India: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 59 India: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 60 Japan: Vehicle Production Data (Units)

Table 61 Japan: Market, By Component, 2018–2025 (USD Million)

Table 62 Japan: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 63 Japan: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 64 South Korea: Vehicle Production Data (Units)

Table 65 South Korea: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 66 South Korea: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 67 South Korea: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 68 Thailand: Market, By Component, 2018–2025 (USD Million)

Table 69 Thailand: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 70 Thailand: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 71 Rest of Asia Pacific: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 72 Rest of Asia Pacific: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 73 Rest of Asia Pacific: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 74 Europe: Market, By Country, 2018–2025 (’000 Units)

Table 75 Europe: Market, By Country, 2018–2025 (USD Million)

Table 76 Germany: Vehicle Production Data (Units)

Table 77 Germany: Market, By Component, 2018–2025 (USD Million)

Table 78 Germany: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 79 Germany: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 80 France: Vehicle Production Data (Units)

Table 81 France: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 82 France: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 83 France: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 84 UK: Vehicle Production Data (Units)

Table 85 UK: Market, By Component, 2018–2025 (USD Million)

Table 86 UK: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 87 UK: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 88 Spain: Vehicle Production Data (Units)

Table 89 Spain: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 90 Spain: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 91 Spain: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 92 Russia: Vehicle Production Data (Units)

Table 93 Russia: Market, By Component, 2018–2025 (USD Million)

Table 94 Russia: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 95 Russia: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 96 Turkey: Vehicle Production Data (Units)

Table 97 Turkey: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 98 Turkey: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 99 Turkey: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 100 Rest of Europe: Market, By Component, 2018–2025 (USD Million)

Table 101 Rest of Europe: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 102 Rest of Europe: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 103 Latin America: Market, By Country, 2018–2025 (’000 Units)

Table 104 Latin America: Market, By Country, 2018–2025 (USD Million)

Table 105 Brazil: Vehicle Production Data (Units)

Table 106 Brazil: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 107 Brazil: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 108 Brazil: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 109 Argentina: Vehicle Production Data (Units)

Table 110 Argentina: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 111 Argentina: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 112 Argentina: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 113 Rest of Latin America: Market, By Component, 2018–2025 (USD Million)

Table 114 Rest of Latin America: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 115 Rest of Latin America: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 116 RoW: Market, By Country, 2018–2025 (’000 Units)

Table 117 RoW: Market, By Country, 2018–2025 (USD Million)

Table 118 Iran: Vehicle Production Data (Units)

Table 119 Iran: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 120 Iran: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 121 Iran: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 122 South Africa: Vehicle Production Data (Units)

Table 123 South Africa: Market, By Component, 2018–2025 (USD Million)

Table 124 South Africa: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 125 South Africa: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 126 Others: Cylinder Deactivation System Market, By Component, 2018–2025 (USD Million)

Table 127 Others: Market, By Vehicle Type, 2018–2025 (’000 Units)

Table 128 Others: Market, By Vehicle Type, 2018–2025 (USD Million)

Table 129 New Product Development, 2019

Table 130 Acquisitions, 2017

Table 131 Joint Venture, 2017–2018

Table 132 Expansion, 2019

Table 133 Delphi Technologies: Key Financials

Table 134 Delphi Technologies: Product Offerings

Table 135 Schaeffler Ag: Key Financials

Table 136 Schaeffler Ag: Product Offerings

Table 137 Eaton: Key Financials

Table 138 Eaton : Product Offerings

Table 139 Organic Growth Strategies (New Product Developments/Expansions)

Table 140 Eaton: Inorganic Growth Strategy (Partnerships/Collaborations/ Joint Ventures/Mergers & Acquisitions)

Table 141 Robert Bosch: Key Financials

Table 142 Robert Bosch : Product Offerings

Table 143 Continental: Key Financials

Table 144 Continental: Product Offerings

Table 145 Denso: Key Financials

Table 146 Denso: Product Offerings

Table 147 Valeo: Key Financials

Table 148 Valeo: Product Offerings

Table 149 Valeo: Inorganic Growth Strategy (Partnerships/Collaborations/ Joint Ventures/Mergers & Acquisitions)

Table 150 Fev: Product Offerings

Table 151 Mitsubishi Electric Corp: Key Financials

Table 152 Mitsubishi Electric: Product Offerings

Table 153 Organic Growth Strategy (Expansion/New Product Development)

Table 154 Hitachi: Key Financials

Table 155 Hitachi: Product Offerings

Table 156 Currency Exchange Rates (W.R.T USD)

List of Figures (44 Figures)

Figure 1 Cylinder Deactivation System Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Demand Side Approach: Market

Figure 6 Bottom-Up Approach: Market

Figure 7 Data Triangulation

Figure 8 Revenue Shift Driving the Cylinder Deactivation System Market Growth

Figure 9 Market: Market Dynamics

Figure 10 Market, By Region, Market Share and Growth Rate, 2020–2025

Figure 11 Market, By Component, 2020 Vs. 2025

Figure 12 Increasing Sales of Light Commercial Vehicles in Asia Pacific and North America is Expected to Drive the Market

Figure 13 North America is Expected to Dominate the Cylinder Deactivation System Market During the Forecast Period

Figure 14 Passenger Vehicle Segment is Expected to Hold the Largest Market Share By 2025

Figure 15 Valve Solenoid is Projected to Become the Largest Market By 2025

Figure 16 Overhead CAM Design is Projected to be the Largest Market By 2025

Figure 17 6 Cylinders and Above is Expected to Hold the Largest Market During the Forecast Period

Figure 18 Cylinder Deactivation System Market: Market Dynamics

Figure 19 Cylinder Deactivation System: Life Cycle

Figure 20 Value Chain Analysis: Market

Figure 21 Porter’s Five Forces: Market

Figure 22 Valve Solenoid is Expected to Account for the Largest Market Share (USD Billion)

Figure 23 6 Cylinders and Above Segment is Expected to Account for the Largest Market Share (USD Billion)

Figure 24 Overhead CAM Design is Expected to Account for the Largest Market Share (USD Billion)

Figure 25 Passenger Vehicle Segment is Expected to Account for the Largest Market Share (USD Billion)

Figure 26 Cylinder Deactivation System Market, By Region, 2020 Vs. 2025 (USD Million)

Figure 27 North America: Market Snapshot

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Market (Global): Competitive Leadership Mapping, 2020

Figure 30 Key Developments By Leading Players in the Market, 2016–2019

Figure 31 Delphi Technologies: Company Snapshot

Figure 32 Deplhi Technologies: SWOT Analysis

Figure 33 Schaeffler AG: Company Snapshot

Figure 34 Schaeffler AG: SWOT Analysis

Figure 35 Eaton: Company Snapshot

Figure 36 Eaton: SWOT Analysis

Figure 37 Robert Bosch: Company Snapshot

Figure 38 Robert Bosch: SWOT Analysis

Figure 39 Continental Ag: Company Snapshot

Figure 40 Continental: SWOT Analysis

Figure 41 Denso: Company Snapshot

Figure 42 Valeo: Company Snapshot

Figure 43 Mitsubishi Electric Corp: Company Snapshot

Figure 44 Hitachi: Company Snapshot

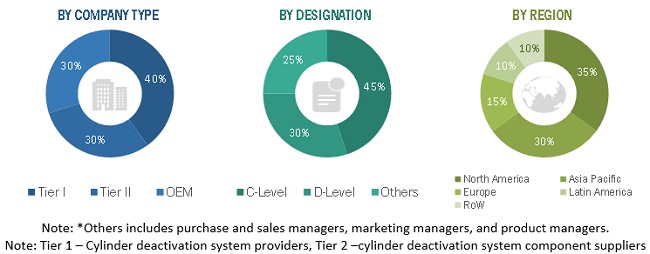

The study involved four major activities for estimating the market size of the cylinder deactivation system. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Market breakdown and data triangulation were then used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been used in the secondary research process to identify and collect information useful for an extensive commercial study of the global market. Secondary sources include company annual reports/presentations, press releases, industry association publications, ARTEMIS Industry Association, European Automotive Research Partners Association (EARPA), International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), China Association of Automobile Manufacturers (CAAM), automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (Marklines and Factiva).

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs [(in terms of component supply), country-level government associations, and trade associations] and component manufacturers across major regions—Asia Pacific, Europe, North America, Latin America, and the Rest of the World. Approximately 20% and 80% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter expert’s opinions, has led us to the findings as described in the remainder of this report.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, segment, analyze, and forecast the market size, in terms of value (USD million) and volume (thousand/million), of the cylinder deactivation system market

- To provide a detailed analysis of the numerous factors influencing the market (drivers, restraints, opportunities, and challenges)

- To define, describe, and project the market based on component, number of cylinders, valve actuation method, fuel type, vehicle type, and region

- To project the market in 5 key regions, namely, Asia Pacific, Europe, North America, Latin America and the Rest of the World (RoW)

- To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically shortlist and profile key players and comprehensively analyze their respective market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the cylinder deactivation system market

Available Customizations

Detailed analysis of cylinder deactivation system market, diesel engine

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Cylinder Deactivation System Market