Service Delivery Automation Market by Type (IT Process Automation, Business Process Automation), Organization Size (Large Enterprises, SME’s), Vertical (BFSI, Travel & Hospitality, Telecommunication & Media) and Region - Global Forecast to 2021

[121 Pages Report] The service delivery automation market is estimated to grow from USD 1.82 Billion in 2016 to USD 6.31 Billion by 2021, at a CAGR of 28.2%. Major growth drivers of the market include the need to go agile for faster time-to-service and to replace or compliment manpower with automation to deliver quality services. The study considers 2015 as the base year and 2016-2021 as the forecast period.

Objectives of the Study:

The main objective of this report is to define, describe, and forecast the global service delivery automation market the basis of type, organization size, vertical, and region. The report provides detailed information regarding the major factors influencing growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The report aims to strategically analyze micro markets with respect to individual growth trends, future prospects, and contribution to the total market. The report attempts to forecast the market size with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and Latin America. The report strategically profiles key players and comprehensively analyzes their core competencies. This report also tracks and analyzes competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) activities in the market.

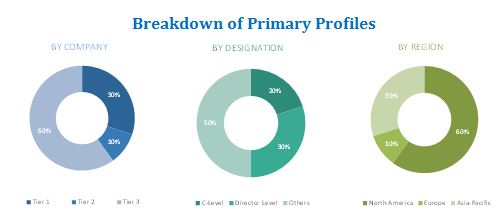

The research methodology used to estimate and forecast the service delivery automation market begins with capturing data on key vendors’ revenues through secondary research. Vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of service delivery automation from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The service delivery automation ecosystem comprises vendors, such as International Business Machine (IBM) Corporation (U.S.), CA Technologies (U.S.), Automation Anywhere, Inc. (U.S.), Blue Prism Ltd. (U.K.), UiPath (Romania), Xerox (XAI) Corporation (U.S.), Celaton Ltd. (U.K.), Exilant Technologies Pvt. Ltd (India), IPsoft Pvt. Ltd. (India), Openspan Pvt. Ltd. (U.S.).

The Target Audiences of the service delivery automation market report are:

- Workforce Optimization Solution Providers

- Customer Experience Solution Providers

- Value Added Resellers

- Government Bodies and Departments

- Cloud Service Providers

- System Integrators

- Technology Consultants

“Study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments”.

Scope of the Report

The research report categorizes the service delivery automation market to forecast the revenues and analyze the trends in each of the following subsegments:

By Type

- IT Process Automation

- Business Process Automation

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Industry Vertical

- BFSI

- IT, Telecommunication & Media

- Travel, Hospitality & Transportation

- Retail & Consumer Goods

- Healthcare & Pharmaceuticals

- Manufacturing & Logistics

- Others

By Region

- North America

- Europe

- Middle East & Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin America service delivery automation market

Company Information

- Detailed analysis and profiling of additional market players

The service delivery automation market is estimated to grow from USD 1.82 Billion in 2016 to USD 6.31 Billion by 2021, at a high CAGR of 28.2% from 2016 to 2021. The market is driven by the need to go agile for faster time to service, and to replace or complement existing workforce with automation to deliver quality services. For service delivery automation vendors, tremendous opportunities lie in implementing advanced technologies, such as artificial intelligence and cognitive abilities, into their existing service delivery automation products. In case of service delivery automation solutions, one size doesn’t fit all. Vendors need to understand the automation need of organizations to deliver a solution that best meet their business need. Factors such as lack of awareness about service delivery automation and high training cost associated with its deployment hinder the market growth.

Service delivery automation offers IT process automation and business process automation to organizations. In general, most end users utilize IT process automation. However, the demand for business process automation has also increased due to the growing need to automate generic and industry specific processes. As the service delivery automation market is still at a nascent stage, the technology is quite unknown to the masses. Earlier, service delivery automation solutions were primarily utilized to bring automation to core IT processes in HR, procurement, and finance department. However, their adoption has gradually shifted from generic IT activities to process specific activities.

The large enterprises segment of the global service delivery automation market, by organization size, is estimated to hold the major share in 2016. However, with service delivery automation vendors offering attractive packages to small and medium-sized enterprises (SMEs), the adoption rate has significantly increased among SMEs. By vertical, the BFSI segment currently accounts for the highest market share. However, the IT, telecommunication & media segment is expected to dominate the market from 2017 onwards. On the other hand, the healthcare segment is expected to reflect the highest growth rate during the forecast period. This is attributed to the increasing deployment of digital healthcare services in North America and Europe.

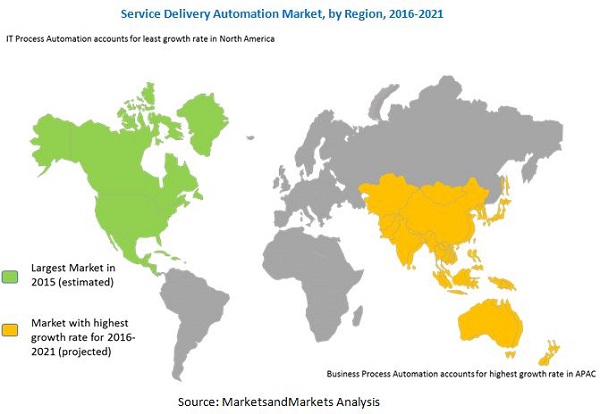

North America accounted for the largest share of the global service delivery automation market due to the implementation of service delivery automation solutions across varied industries in this region. However, major growth will be witnessed in the Asia-Pacific region, mainly attributed to the increasing adoption of service delivery automation solutions across India, China, Japan, and South Korea. The market in the Latin American and MEA regions is growing at a comparatively slower rate due to lack of commercialization of technologies.

IT departments as well as business processing across enterprises are dramatically changing and adopting various advanced technologies in which service delivery automation has been gaining tremendous popularity. Still, various organizations have not yet been automating their business activities simply because they are not aware about service delivery automation.

IBM Corporation (U.S.), Xerox Corporation (U.S.), Blue Prism Group Plc (U.K.), and Automation Anywhere, Inc. (U.S.) are some of the dominant players in the service delivery automation market. IBM has been one of the top players in this market catering to various industries. The company expects its cloud technologies, business analytics, and service delivery automation products will help create a competitive advantage for the company, and also increase the competition in the market. IBM also focuses on mobile and social technologies. It has substantially increased its R&D spending to innovate and launch new products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Year Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.3.1 Assumptions

3 Service Delivery Automation Market: Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Market

4.2 Market – Top Vertical, By Region

4.3 Global Service Delivery Automation Market

4.4 Market Potential

4.5 Market By Organization Size

4.6 Lifecycle Analysis, By Region (2015)

5 Service Delivery Automation Market: Overview (Page No. - 32)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Market, By Type

5.3.2 Market, By Organization Size

5.3.3 Market, By Vertical

5.3.4 Market, By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Need to Go Agile for Faster Time-To-Service

5.4.1.2 Need to Replace Or Compliment Manpower With Automation to Deliver Quality Services

5.4.2 Restraints

5.4.2.1 Lack of Awareness

5.4.3 Opportunities

5.4.3.1 Integration With New Technologies

5.4.3.2 Understanding the Automation Needs of Organizations

5.4.4 Challenges

5.4.4.1 High Training Investments By the Organizations

6 Service Delivery Automation Market, By Type (Page No. - 39)

6.1 Introduction

6.2 IT Process Automation

6.2.1 Infrastructure Automation

6.2.2 Application Lifecycle Automation

6.3 Business Process Automation

6.3.1 Generic Automation

6.3.2 Process Specific Automation

6.3.3 Industry Specific Automation

7 Service Delivery Automation Market, By Organization Size (Page No. - 46)

7.1 Introduction

7.2 Large Enterprises

7.3 SMES

8 Global Service Delivery Automation Market, By Vertical (Page No. - 50)

8.1 Introduction

8.2 BFSI

8.3 IT, Telecommunication & Media

8.4 Travel, Hospitality & Transportation

8.5 Retail & Consumer Goods

8.6 Healthcare & Pharmaceuticals

8.7 Manufacturing & Logistics

8.8 Others

9 Geographic Analysis (Page No. - 57)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia-Pacific

9.5 Latin America

9.6 Middle East & Africa

10 Competitive Landscape (Page No. - 77)

10.1 Overview

10.2 Competitive Situation and Trends

10.3 Mergers & Acquisitions

10.4 Partnerships, Agreements & Collaborations

10.5 New Product Launches

10.6 Expansions

10.7 Contracts

11 Company Profiles (Page No. - 84)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

11.1 IBM

11.2 Uipath SRL

11.3 Ipsoft

11.4 Blue Prism

11.5 Xerox Corporation

11.6 Nice Systems Ltd.

11.7 Celaton Limited

11.8 Openspan Inc.

11.9 Automation Anywhere Inc.

11.10 Arago Us, Inc.

11.11 Genfour Ltd.

11.12 Exilant Technologies Private Limited

11.13 Softomotive Solutions Ltd. (Winautomation)

11.14 Sutherland Global Services

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 112)

12.1 Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (60 Tables)

Table 1 Global Market Size and Growth Rate, 2014-2021 (USD Billion, Y-O-Y %)

Table 2 Service Delivery Automation Market, By Type, 2016–2021 (USD Million)

Table 3 IT Process Automation: Market, By Type, 2016-2021 (USD Million)

Table 4 Infrastructure Automation : IT Process Automation Market, By Type, 2016-2021 (USD Million)

Table 5 Application Lifecycle Automation: IT Process Automation Market, By Type, 2016-2021 (USD Million)

Table 6 Business Process Automation: Market, By Type, 2016-2021 (USD Million)

Table 7 Generic Automation: Business Process Automation Market, By Region, 2016-2021 (USD Million)

Table 8 Process Specific Automation: Business Process Automation Market, By Region, 2016-2021 (USD Million)

Table 9 Industry Specific : Business Process Automation Market, By Region, 2016-2021 (USD Million)

Table 10 Service Delivery Automation Market, By Organization Size, 2014-2021(USD Million)

Table 11 Large Enterprises: Market, By Region , 2014-2021 (USD Million)

Table 12 SMES: Market, By Region, 2014-2021 (USD Million)

Table 13 Global Market, By Vertical, 2014-2021 (USD Million)

Table 14 BFSI: Market, By Region, 2014-2021 (USD Million)

Table 15 IT, Telecommunication & Media: Market, By Region, 2014-2021 (USD Million)

Table 16 Travel, Hospitality & Transportation: Market, By Region, 2014-2021 (USD Million)

Table 17 Retail & Consumer Goods: Market, By Region, 2014-2021 (USD Million)

Table 18 Healthcare & Pharmaceuticals: Market, By Region, 2014-2021 (USD Million)

Table 19 Manufacturing & Logistics: Market, By Region, 2014-2021 (USD Million)

Table 20 Other Verticals: Market, By Region, 2014-2021 (USD Million)

Table 21 Global Service Delivery Automation Market, By Region, 2014-2021 (USD Million)

Table 22 North America: Market, By Type, 2014-2021 (USD Million)

Table 23 North America: IT Process Automation Market, By Type, 2014-2021 (USD Million)

Table 24 North America: Business Process Automation Market, By Type, 2014-2021 (USD Million)

Table 25 North America: Market, By Organization Size, 2014-2021 (USD Million)

Table 26 North America: IT Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 27 North America: Business Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 28 Europe: Market, By Type, 2014-2021 (USD Million)

Table 29 Europe: IT Process Automation Market, By Type, 2014-2021 (USD Million)

Table 30 Europe: Business Process Automation Market, By Type, 2014-2021 (USD Million)

Table 31 Europe: Market, By Organization Size, 2014-2021 (USD Million)

Table 32 Europe: Market, By Vertical, 2014-2021 (USD Million)

Table 33 Europe: IT Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 34 Europe: Business Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 35 Asia Pacific: Service Delivery Automation Market, By Type, 2014-2021 (USD Million)

Table 36 Asia Pacific: IT Process Automation Market, By Type, 2014-2021 (USD Million)

Table 37 Asia Pacific: Business Process Automation Market, By Type, 2014-2021 (USD Million)

Table 38 Asia Pacific: Market, By Organization Size, 2014-2021 (USD Million)

Table 39 Asia Pacific: Market, By Vertical, 2014-2021 (USD Million)

Table 40 Asia Pacific: IT Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 41 Asia Pacific: Business Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 42 Latin America: Market, By Type, 2014-2021 (USD Million)

Table 43 Latin America: IT Process Automation Market, By Type, 2014-2021 (USD Million)

Table 44 Latin America: Business Process Automation Market, By Type, 2014-2021 (USD Million)

Table 45 Latin America: Market, By Organization Size, 2014-2021 (USD Million)

Table 46 Latin America: Market, By Vertical, 2014-2021 (USD Million)

Table 47 Latin America: IT Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 48 Latin America: Business Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 49 Middle East & Africa: Market, By Type, 2014-2021 (USD Million)

Table 50 Middle East & Africa: IT Process Automation Market, By Type, 2014-2021 (USD Million)

Table 51 Middle East & Africa: Business Process Automation Market, By Type, 2014-2021 (USD Million)

Table 52 Middle East & Africa: Market, By Organization Size, 2014-2021 (USD Million)

Table 53 Middle East & Africa: Market, By Vertical, 2014-2021 (USD Million)

Table 54 Middle East & Africa: IT Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 55 Middle East & Africa: Business Process Automation Market, By Vertical, 2014-2021 (USD Million)

Table 56 Mergers & Acquisitions, 2014–2015

Table 57 Partnerships, Agreements, Joint Ventures & Collaborations, 2014–2016

Table 58 New Product Launches, 2014–2016

Table 59 Expansions, 2015

Table 60 Contracts, 2016

List of Figures (37 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation Methodology: Bottom Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown Data Triangulation Approach

Figure 5 Service Delivery Automation Market Size, Regional Snapshot (2016-2021): the Market in Asia-Pacific Region is Expected to Grow at the Highest CAGR Over the Next Five Years

Figure 6 Market Size, Type Snapshot (2016-2021): IT Process Automation is Expected to Dominate the Market By 2021

Figure 7 Market Size, Organization Size Snapshot (2016-2021): Smbs Segment Expected to Dominate the Market By 2021

Figure 8 Market Size, Vertical Snapshot (2016-2021): Healthcare Segment Expected to Grow at the Highest CAGR Over the Next Five Years

Figure 9 Global Market Share (2016): North America is Expected to Account for the Largest Share

Figure 10 Increasing Need to Replace Manpower With Automation to Deliver Services is Driving the Market

Figure 11 BFSI Sector is Expected to Dominate the North America Market From 2016 to 2021

Figure 12 BFSI Among Verticals and North America Among Regions Expected to Dominate the Market

Figure 13 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Enterprise Segment is Expected to Dominate the Market From 2016 to 2021

Figure 15 Regional Lifecycle –Service Delivery Automation Market in Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Need for Enterprise Mobility in Existing Business Process Management Solutions has Resulted in Evolution of Service Delivery Automation

Figure 17 Market Segmentation: By Type

Figure 18 Market Segmentation: By Organization Size

Figure 19 Market Segmentation: By Vertical

Figure 20 Market Segmentation: By Region

Figure 21 Global Service Delivery Automation Market: Drivers, Restraints, Opportunities, and Challenges

Figure 22 The Infrastructure Automation Segment Expected to Lead the IT Process Automation Market During the Forecast Period

Figure 23 Industry Specific Automation is Expected to Lead the Market in 2016

Figure 24 The SMES Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 The Healthcare & Pharmaceuticals Segment of the Global Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 26 The Market in the Asia-Pacific Region is Expected to Grow at the Highest CAGR From 2016 to 2021

Figure 27 Geographic Snapshot (2016-2021): Asia-Pacific Region is an Attractive Destination for the Market

Figure 28 North America Market Snapshot

Figure 29 Asia-Pacific Market Snapshot

Figure 30 Companies Adopted Partnership, Collaboration, Contract & Agreement as the Key Growth Strategy to Expand Their Presence in the Market

Figure 31 Market Evaluation Framework

Figure 32 Battle for Market Share: Partnerships, Collaborations & Agreements has Been the Key Growth Strategy Adopted By Market Players

Figure 33 IBM: Business Overview

Figure 34 IBM: SWOT Analysis

Figure 35 Blue Prism: Business Overview

Figure 36 Xerox Corporation: Business Overview

Figure 37 Nice Systems Ltd.: Business Overview

Growth opportunities and latent adjacency in Service Delivery Automation Market