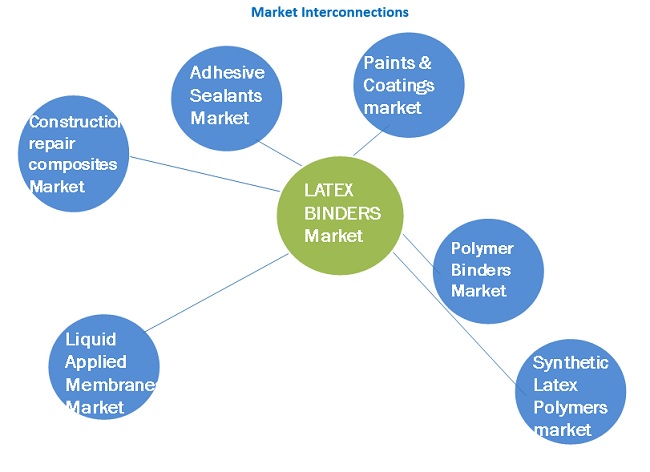

Latex Binders Market by Type (Styrene Acrylic, Styrene Butadiene), End-use Industry (Paints & Coating, Adhesive & Sealant, Paper & Paperboard, Textile & Carpet, Construction & Fiber Bonding Materials), and Region - Global Forecast to 2026

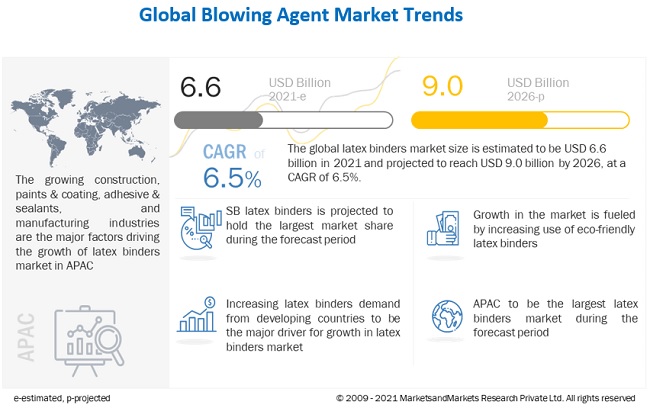

[248 Pages Report] The global latex binders market size is estimated at USD 6.6 billion in 2021 and is projected to reach USD 9.0 billion by 2026, at a CAGR of 6.5%. The latex binders market growth is majorly driven by the growing paints & coating, adhesive & sealant, textile & carpet, construction & fiber bonding materials, and other industries, in the emerging economies of APAC. Also, the increasing styrene-butadiene applications globally will drive market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Latex binders Market

Production of different types of latex binders, such as SA, SB, and other was normal till mid-march but after the COVID-19 pandemic the situation deteriorates at a huge scale due to the following reasons:

- Lack of demand for latex binders in construction

- Reduced workforce availability

- Government regulations to close the production facility

- Reduced operating capacity of the production facility

- Disruption in foam supply chain from raw material sourcing to end products

- Closing of international borders for shipment

COVID-19 has created disruption in all end-use industries, such as paints & coating, automotive, textile & carpet, adhesive & sealant, building & construction, automotive, and electronics. Due to disruption, the demand for latex binders type has reduced drastically. Manufacturing facilities are either forced to close due to government regulations or voluntarily due to lack of demand.

Export activities have reduced drastically or completely shut down to prevent the spread of COVID-19 across the world, subsequently, transportation through air, water, and land were suspended for almost 3 months across the world. All these factors have lowered the demand for foam products across industries, which has caused a shrink in market size, growth rate, and potential investment in the latex binders industry. Consumer spending has also reduced and limits to necessary daily products due to uncertain future situations.

Latex binders Market Dynamics

Driver: Increasing demand for technical textiles

Technical textile is a fabric designed for specific purposes with unique and exclusive characteristics which are different to those of regular fabrics. This textile is a combination of advanced technology and excellent properties such as mechanical resistance, elasticity, reinforcement, anti-dust, tenacity, insulation, thermal & fire resistance, and resistance to ultraviolet (UV) rays and insulation. Technical textiles are used for non-aesthetic applications in the automotive, personal hygiene, sports & leisure, industrial, packaging, and textile industries. Rise in the consumption of technical textiles in these applications is increasing the demand for latex binders which are used to impart advanced properties to technical textiles. Latex binders are majorly used for solvent-resistant surface coatings, print coatings, and flocking applications.

Technical textiles is one of the most innovative product segments in the global textile industry due to its increasing attractiveness and adaptability in nonwoven fabrics. The continuous growth of the automotive industry is fueling the demand for technical textiles. Emerging economies such as China and India are focusing on adopting the latest technologies and manufacturing processes in various industry segments. This has initiated the adoption of technical textiles across various industrial verticals, thereby increasing demand for latex binders.

Restraint: Volatility in raw materials prices

There is volatility in raw material prices and the cost of energy used in manufacturing latex binders. Latex binders are man-made and essential material used in various end-use industries to enhance the physical and mechanical properties of products. The main raw materials used in the manufacture of latex binders are the petroleum compounds, styrene, and butadiene. However, the latex binders are man-made. Thus, sudden increases or decreases in prices affect the profit margins of manufacturers. Fluctuations in the final prices of the products is also attributed to the changes in the prices of energy and crude oil which are used for manufacturing and transporting these materials. These fluctuations, in turn, result in the volatility of prices of the finished products.

Opportunity: Increasing Industrial & commercial construction

Industrial growth after the economic slowdown has led to a rise in new constructions, both, commercial and residential. The construction of factories, manufacturing plants, stadiums, and offices has increased. This is projected to directly drive the demand for sustainable and safe roof and flooring solutions for this infrastructure. Latex styrene-acrylic binders offer a good balance of properties such as weatherability, elongation, water resistance, caustic resistance, and excellent dirt resistance capabilities. Due to these factors, the demand for latex-based roof and floor coatings in industries is projected to remain high. According to the European Construction Industry Federation (FIEC), construction activity in the European Union (EU) is expected to increase by approximately 3.3% in 2021 as compared to 2019. Furthermore, initiatives for the construction of green buildings are projected to contribute to the growth of the construction sector, and thus the demand for roof and floor paints & coating globally remains high, as they are durable and cost-effective solutions.

Challenges: Rising demand for bio-based latex binders in Europes

Bio-based latex was introduced in Europe as a substitute for carboxylated styrene-butadiene and styrene acrylate binders. The bio-based latex is manufactured using starch along with other bio-based and chemical components. These binders offer a direct substitute to the traditionally used SA and SB latex binders in the paper and board industry. Apart from being an environment-friendly alternative to the traditional SA and SB latex binders, bio-based binders offer other commercial benefits such as superior binder performance and cost savings for the paper and board industry. It can be transported in the form of dry product, thus saving transactional costs associated with the transportation of SA binders and SB binders. These binders also offer other physical benefits such as improved runnability, water retention, fiber coverage, coating holdout, and superior binder performance. Thus, developing bio-based binders pose challenges in substituting SA and SB latex binders, particularly in the graphical paper subsegment of the paper & paperboard industry.

Styrene-butadiene segment is estimated to dominate the overall latex binders market.

The styrene-butadiene binder has a high demand from latex binder manufactures for applications in various end-use industries. This segment can further be classified into styrene-butadiene rubber and styrene-butadiene copolymer. Some of the primary advantages of styrene-butadiene binders are good handling properties, ease of application, and high bonding strength. These binders are projected to dominate the market due to their high aging resistance.

Paints & coating is the largest market for latex binders by end-use industry.

The paints & coating end-use industry is projected to dominate the global latex binder market during the forecast period. The latex binder is used as an emulsion in architectural paints. The primary function of the latex binder in the paints & coating segment is to decorate and protect new construction as well as the maintenance of existing structures. Other miscellaneous applications of the latex binder in this segment include traffic paints, vehicle refinishing, high-performance coatings for industrial plants and equipment, and protection of marine structures and vessels. Increasing construction activities in the APAC and MEA regions are the major drivers for this end-use industry, which is projected to lead the market during the forecast period from 2021 to 2026.

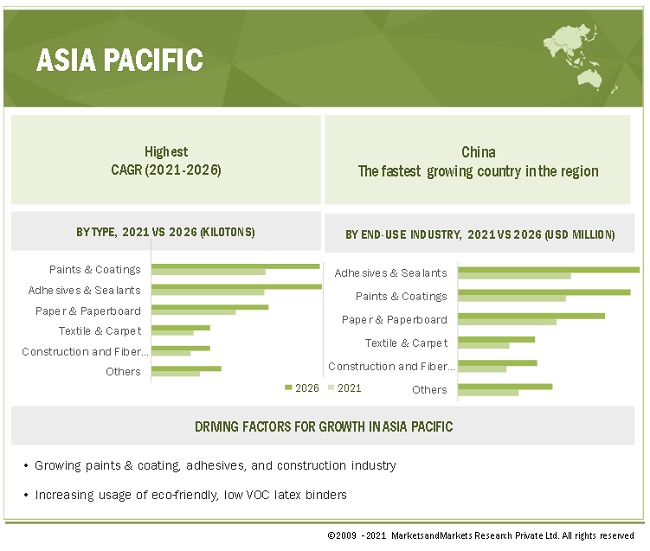

APAC is projected to be the largest latex binders market.

APAC is estimated to be the largest latex binders market during the forecast period. Among China, Japan, South Korea, India, Thailand, Indonesia and Rest of APAC, China was the largest consumer of latex binders in the region as of 2020 in terms of value as well as volume. The major production base of SB latex binders situated in China and the increasing usage of this latex binders in various end-use industries are the major factors driving the latex binders market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Trinseo (US), BASF (Germany), Wacker Chemie (Germany), Arkema (France), Celanese Corporation (UK), Dow(US), DIC Corporation(Japan), Synthomer Plc (UK), Omnova Solutions (US), Dairen Chemical Corporation (Taiwan) are the key players operating in the latex binders market. These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for latex binders from emerging economies.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

20192026 |

|

Base year |

2020 |

|

Forecast period |

20212026 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Type, End-use Industry |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

Trinseo (US), BASF SE (Germany), Wacker Chemie (Germany), Arkema (France), Synthomer Plc (UK), Celanese Corporation (US), Omnova Solutions (US), Dairen Chemical (Taiwan), Arlanxeo (Netherlands), Kalpana Polymers (India), Shandong Hearst Building Material (China), Visen Industries (India), Jesons (India), Acquos (Australia), Organik Kimya (Turkey), Puyang Yintai Industrial Trading (China), Bosson Union Tech (China), ADPL Group (India), Sakshi Chem Sciences (India), Apcotex (India), Bangkok Synthetics (Bangkok), Goodyear Chemical (US), Jubilant Agri & Consumer Products (India), Kumho Petrochemical (South Korea), Lion Elastomers (US), Lubrizol (US), Shanghai Baolijia (China), Shanxi Sanwei (China), Sibur (Russia), and Sumitomo Chemical (Japan) |

This research report categorizes the latex binders market based on type, end-use industry, and region.

Based on the type:

- Styrene Acrylic

- Styrene-Butadiene

- Others

Based on the end-use industry:

- Paints & Coating

- Adhesive & Sealant

- Paper & Paperboard

- Textile & Carpet

- Construction & Fiber Bonding Materials

- Others

Based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2020, Trinseo announced the usage of its SB latex binders for geogrid applications in construction. Geogrids are commonly used as a reinforcement treatment on soft soil foundation, roadbeds, dams, hillsides, and in mining projects to strengthen foundations and enhance their protective capabilities, thereby improving the bearing capacity and stability of materials. Trinseos styrene-butadiene (SB) latex is expected to be an important binding material for geogrids which enables excellent fiber positioning ability, adhesion, and retention. This product improves the overall quality and durability of infrastructure projects.

- In April 2021, BASF SE extended its paper and board coatings partnership with Omya for minimum four years. Under this partnership, BASF SE is expected to continue to supply its binders and coating additives for the formulation of paper and board coatings.

- In March 2020, Wacker Chemie AG launched a new product range of polymeric binders based on renewable raw materials. This product line is launched under the VINNECO brand of the company. The product line finds application primarily in the construction end-use industry, in waterproofing membranes or dry-mix mortars. The new product launch helped the company in venturing into the sustainable products category for the construction industry.

- In April 2020, Arkema launched a new vinyl acrylic binder under the variant name, ENCOR DC 3478, for soil stabilization and dust control applications. The new product offers a chemical binding process aid for use in spray-applied products and is ideal for both, topical and full-depth formulations.

- In March 2021, Celanese Corporation expanded the production capacity of its vinyl acetate monomer facility, located in Nanjing, China. Celanese is expected to initially increase the annual VAM production capacity at its Nanjing facility by 50KT to 60KT, with a phased approach of up to 90KT additional annual production capacity expected. Overall, the expansion is expected to increase the annual VAM capacity at the Nanjing facility from approximately 300KT to 400KT. This is expected to enhance the company's binders market position in the Asian region.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the latex binders market?

Increasing demand for latex binders from developing countries in different applications such as paints & coating, adhesive & sealants, textile & carpet, construction & fiber bonding materials, and other end-use industries. High growth in SB latex market from these end-use industries is the major factor influencing the growth of the latex binders market.

What are the major types of latex binders market?

The latex binders market is segmented based on type (SA, SB, and other) and by end-use industry (paints & coating, adhesive & sealants, textile & carpet, construction & fiber bonding materials, and others).

Who are the major manufacturers operating in the market?

Trinseo (US), BASF (Germany), Wacker Chemie (Germany), Arkema (France), Celanese Corporation (UK), Dow(US), DIC Corporation(Japan), Synthomer Plc (UK), Omnova Solutions (US), Dairen Chemical Corporation (Taiwan) among others, are some of the major manufacturers

What is the most significant restraint for the latex binders market?

Risks associated with spray drying process during the production of powdered latex binders and legislative problems which need to be addressed may create additional limitations.

What is the projected growth rate for latex binders market?

The latex binders market is projected to grow at a CAGR of 6.5% from 2021 till 2026. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 LATEX BINDERS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 LATEX BINDERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.3 PRIMARIES

2.1.3.1 Latex binders

2.2 MARKET SIZE ESTIMATION

FIGURE 2 LATEX BINDERS MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for arriving at market size using top-down analysis

FIGURE 3 TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for arriving at market size using bottom-up analysis

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND SIDE)

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY SIDE)

2.3 DATA TRIANGULATION

FIGURE 7 LATEX BINDERS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISKS

TABLE 1 RISKS ASSOCIATED

2.7 GROWTH FORECAST ASSUMPTIONS

2.7.1 GROWTH RATE ASSUMPTIONS /GROWTH FORECAST

2.7.2 LATEX BINDERS MARKET

2.7.2.1 Supply Side

FIGURE 8 MARKET CAGR PROJECTIONS FROM THE SUPPLY SIDE

2.7.2.2 Demand Side

FIGURE 9 APPROACH FOR MARKET SIZING FROM THE DEMAND SIDE

2.7.2.3 Insights from primary experts

FIGURE 10 MARKET VALIDATION FROM PRIMARY EXPERTS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 11 STYRENE BUTADIENE BINDER SEGMENT TO LEAD THE MARKET BY 2026

FIGURE 12 PAINTS & COATING TO BE THE LARGEST END-USE INDUSTRY OF LATEX BINDERS DURING THE FORECAST PERIOD

FIGURE 13 EUROPE TO LEAD THE LATEX BINDERS MARKET BETWEEN 2021 AND 2026

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 EMERGING ECONOMIES TO WITNESS A RELATIVELY HIGHER DEMAND FOR LATEX BINDERS

FIGURE 14 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN THE LATEX BINDER MARKET DURING THE FORECAST PERIOD

4.2 LATEX BINDERS MARKET, BY TYPE

FIGURE 15 STYRENE BUTADIENE BINDERS TO LEAD THE LATEX BINDERS MARKET DURING THE FORECAST PERIOD

4.3 LATEX BINDERS MARKET, BY END-USE INDUSTRY

FIGURE 16 PAINTS & COATING END-USE INDUSTRY IS PROJECTED TO LEAD THE LATEX BINDERS MARKET BY 2026

4.4 APAC: LATEX BINDERS MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 17 CHINA WAS THE LARGEST MARKET FOR LATEX BINDERS IN THE APAC IN 2020

4.5 LATEX BINDERS MARKET, BY COUNTRY

FIGURE 18 THE LATEX BINDERS MARKET IN INDIA IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 OVERVIEW OF FACTORS GOVERNING THE LATEX BINDERS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand from technical textiles

5.2.1.2 Increase in demand for protective coatings for roofs and floors in industrial and commercial facilities

5.2.1.3 Increasing demand from emerging economies

5.2.1.4 Rising per capita consumption of paints

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

FIGURE 20 CRUDE OIL PRICE TRENDS

5.2.2.2 Risks associated with spray drying during the production of powdered latex binders

5.2.3 OPPORTUNITIES

5.2.3.1 Increased demand for water-based acrylic latex binders in emerging markets

5.2.3.2 Increase in industrial and commercial construction

5.2.3.3 Increase in population and rapid urbanization leading to large number of construction projects

5.2.4 CHALLENGES

5.2.4.1 Manufacture of low-VOC latex binders

5.2.4.2 Rise in demand for bio-based latex binders in Europe

5.3 PORTERS FIVE FORCES ANALYSIS

FIGURE 21 PORTERS FIVE FORCES ANALYSIS: LATEX BINDERS MARKET

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 22 LATEX BINDERS MARKET: SUPPLY CHAIN/VALUE CHAIN

5.4.1 LATEX BINDER RAW MATERIAL SUPPLIERS

5.4.2 LATEX BINDER MANUFACTURERS

5.4.3 END-USE INDUSRIES

5.5 LATEX BINDERS MARKET ECOSYSTEM

FIGURE 23 LATEX BINDER ECOSYSTEM

TABLE 2 LATEX BINDERS MARKET: ECOSYSTEM

5.6 LATEX BINDERS: YC AND YCC SHIFT

FIGURE 24 LATEX BINDERS: YC AND YCC SHIFT

5.7 PRICING ANALYSIS

TABLE 3 GLOBAL AVERAGE PRICES OF LATEX BINDERS (USD/KT)

5.8 LATEX BINDER: PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 METHODOLOGY

5.8.3 DOCUMENT TYPE

FIGURE 25 THE GRANTED PATENTS ARE 29% OF THE TOTAL DURING THE LAST TEN YEARS.

FIGURE 26 PUBLICATION TRENDS - LAST TEN YEARS

5.8.4 INSIGHT

5.8.5 JURISDICTION ANALYSIS

5.8.6 TOP COMPANIES/APPLICANTS

5.9 CASE STUDY ANALYSIS

5.9.1 CASE STUDY FOR TRINSEO

5.9.1.1 Construction geogrid application using SB latex binders

5.9.1.2 Latex binders in open mesh applications

5.10 TARIFFS & REGULATIONS

5.10.1 VOC REGULATIONS IN THE US

5.11 TRADE ANALYSIS

5.11.1 IMPORT-EXPORT SCENARIO OF THE LATEX BINDERS MARKET

TABLE 4 IMPORT TRADE DATA FOR CARPETS & OTHER TEXTILE FLOOR COVERINGS FOR SELECTED COUNTRIES, 2019 & 2020

TABLE 5 EXPORT TRADE DATA FOR CARPETS & OTHER TEXTILE FLOOR COVERINGS FOR SELECTED COUNTRIES, 2019 & 2020

TABLE 6 IMPORT TRADE DATA FOR PRINTED BOOKS, NEWSPAPERS, PICTURES AND OTHER PRODUCTS OF THE PRINTING INDUSTRY; MANUSCRIPTS FOR SELECTED COUNTRIES, 2019 & 2020

TABLE 7 EXPORT TRADE DATA FOR PRINTED BOOKS, NEWSPAPERS, PICTURES AND OTHER PRODUCTS OF THE PRINTING INDUSTRY; MANUSCRIPTS FOR SELECTED COUNTRIES, 2019 & 2020

5.12 MACROECONOMIC INDICATORS

5.12.1 INTRODUCTION

5.12.2 GDP GROWTH RATE OF MAJOR ECONOMIES

TABLE 8 OVERVIEW OF GDP PROJECTIONS FOR SELECTED COUNTRIES FROM 2019 TO 2022

5.12.3 TRENDS AND FORECAST FOR THE GLOBAL CONSTRUCTION INDUSTRY

FIGURE 27 GLOBAL SPENDING IN THE CONSTRUCTION INDUSTRY, 20172025

5.13 COVID-19 IMPACT ANALYSIS

5.13.1 COVID-19 ECONOMIC ASSESSMENT

5.13.2 MAJOR ECONOMIC EFFECTS OF COVID-19 IN 2020 AND 2021

5.13.3 EFFECTS ON GDPS OF COUNTRIES

FIGURE 28 GDP FORECASTS ON END APPLICATIONS IN 2020

5.13.4 SCENARIO ASSESSMENT

FIGURE 29 FACTORS IMPACTING ECONOMIES OF COUNTRIES IN 2020

5.13.5 IMPACT ON LATEX BINDERS INDUSTRY

6 LATEX BINDERS MARKET, BY TYPE (Page No. - 80)

6.1 INTRODUCTION

FIGURE 30 STYRENE BUTADIENE BINDER SEGMENT TO LEAD THE LATEX BINDERS MARKET

TABLE 9 LATEX BINDERS MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 10 LATEX BINDERS MARKET SIZE, BY TYPE, 20212026 (KILOTON)

TABLE 11 LATEX BINDERS MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 12 LATEX BINDERS MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

6.2 STYRENE BUTADIENE

6.2.1 HIGH AGING RESISTANCE TO FUEL THE DEMAND FOR STYRENE BUTADIENE RUBBER IN THE SPORTS SURFACE COATINGS APPLICATION

6.2.2 STYRENE BUTADIENE COPOLYMER

6.2.3 STYRENE BUTADIENE RUBBER

6.3 STYRENE ACRYLIC

6.3.1 STYRENE ACRYLIC IS LOW-VOC CONTENT, AND HENCE HAS HIGH DEMAND IN VARIOUS APPLICATIONS

6.4 OTHERS

7 LATEX BINDERS MARKET, BY END-USE INDUSTRY (Page No. - 85)

7.1 INTRODUCTION

FIGURE 31 PAINTS & COATING SEGMENT TO LEAD THE LATEX BINDERS MARKET

TABLE 13 LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 14 LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 15 LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 16 LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

7.2 PAINTS & COATING

7.2.1 PAINTS & COATING WAS THE LARGEST SEGMENT OF THE LATEX BINDERS MARKET IN 2020

TABLE 17 LATEX BINDERS: PAINTS & COATING MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 18 LATEX BINDERS: PAINTS & COATING MARKET SIZE, BY REGION, 20212026 (KILOTON)

TABLE 19 LATEX BINDERS: PAINTS & COATING MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 20 LATEX BINDERS: PAINTS & COATING MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7.3 ADHESIVE & SEALANT

7.3.1 FAST CURING TIME AND EXCELLENT OXIDATION-RESISTANCE OF LATEX BINDER MAKES IT SUITABLE FOR USE IN ADHESIVES & SEALANTS

TABLE 21 LATEX BINDERS: ADHESIVE & SEALANT MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 22 LATEX BINDERS: ADHESIVE & SEALANT MARKET SIZE, BY REGION, 20212026 (KILOTON)

TABLE 23 LATEX BINDERS: ADHESIVE & SEALANT MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 24 LATEX BINDERS: ADHESIVE & SEALANT MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7.4 TEXTILE & CARPET

7.4.1 TEXTILE COATINGS

7.4.1.1 Excellent abrasion and oil-resistance properties of latex binders to boost demand in the textile coatings end use

7.4.2 CARPET BACKING

7.4.2.1 Latex binder has excellent adhesion to fabric and is water-resistant, making it suitable for carpet backing

TABLE 25 LATEX BINDERS: TEXTILE & CARPET MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 26 LATEX BINDERS: TEXTILE & CARPET MARKET SIZE, BY REGION, 20212026 (KILOTON)

TABLE 27 LATEX BINDERS: TEXTILE & CARPET MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 28 LATEX BINDERS: TEXTILE & CARPET MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7.5 CONSTRUCTION & FIBER BONDING MATERIALS

7.5.1 TILING & FLOORING

7.5.1.1 Latex binder has excellent adhesion strength for use in tiling & flooring

7.5.2 MORTAR MIX

7.5.2.1 Mortar modification is expected to generate significant demand for latex binders

7.5.3 PLASTERING

7.5.3.1 Increased adoption of latex binder in plastering owing to its excellent bonding property

7.5.4 INSULATION SYSTEMS

7.5.4.1 High flexibility, bonding strength, and durability of latex binders to boost their demand in insulation systems

TABLE 29 LATEX BINDERS: CONSTRUCTION & FIBER BONDING MATERIALS MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 30 LATEX BINDERS: CONSTRUCTION & FIBER BONDING MATERIALS MARKET SIZE, BY REGION, 20212026 (KILOTON)

TABLE 31 LATEX BINDERS: CONSTRUCTION & FIBER BONDING MATERIALS MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 32 LATEX BINDERS: CONSTRUCTION & FIBER BONDING MATERIALS MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7.6 PAPER & PAPERBOARD

7.6.1 EXCELLENT PIGMENT BINDING PROPERTY OF LATEX BINDER TO DRIVE DEMAND FOR COATINGS IN PAPER & PAPERBOARD

TABLE 33 LATEX BINDERS: PAPER & PAPERBOARD MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 34 LATEX BINDERS: PAPER & PAPERBOARD MARKET SIZE, BY REGION, 20212026 (KILOTON)

TABLE 35 LATEX BINDERS: PAPER & PAPERBOARD MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 36 LATEX BINDERS: PAPER & PAPERBOARD MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7.7 OTHERS

TABLE 37 LATEX BINDERS: OTHERS MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 38 LATEX BINDERS: OTHERS MARKET SIZE, BY REGION, 20212026 (KILOTON)

TABLE 39 LATEX BINDERS: OTHERS MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 40 LATEX BINDERS: OTHERS MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8 LATEX BINDERS MARKET, BY REGION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 32 THE LATEX BINDERS MARKET IN INDIA TO GROW AT THE HIGHEST CAGR

TABLE 41 LATEX BINDERS MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 42 LATEX BINDERS MARKET SIZE, BY REGION, 20212026 (KILOTON)

TABLE 43 LATEX BINDERS MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 44 LATEX BINDERS MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8.2 APAC

FIGURE 33 APAC: LATEX BINDERS MARKET SNAPSHOT

TABLE 45 APAC: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (KILOTON)

TABLE 46 APAC: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (KILOTON)

TABLE 47 APAC: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 48 APAC: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

TABLE 49 APAC: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 50 APAC: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 51 APAC: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 52 APAC: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.2.1 CHINA

8.2.1.1 China to be the largest latex binders market in the APAC

TABLE 53 CHINA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 54 CHINA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 55 CHINA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 56 CHINA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.2.2 INDIA

8.2.2.1 Government initiatives to drive the construction industry in India, thus supporting market growth

TABLE 57 INDIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 58 INDIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 59 INDIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 60 INDIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.2.3 JAPAN

8.2.3.1 Electronics industry to drive demand for latex binders in the adhesive & sealant end-use industry

TABLE 61 JAPAN: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 62 JAPAN: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 63 JAPAN: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 64 JAPAN: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.2.4 SOUTH KOREA

8.2.4.1 Government regulations to support the growth of low-VOC latex binders in South Korea

TABLE 65 SOUTH KOREA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 66 SOUTH KOREA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 67 SOUTH KOREA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 68 SOUTH KOREA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.2.5 REST OF APAC

TABLE 69 REST OF APAC: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 70 REST OF APAC: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 71 REST OF APAC: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 72 REST OF APAC: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.3 EUROPE

FIGURE 34 PAINTS & COATING INDUSTRY TO DOMINATE THE EUROPE LATEX BINDERS MARKET DURING THE FORECAST PERIOD

TABLE 73 EUROPE: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (KILOTON)

TABLE 74 EUROPE: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (KILOTON)

TABLE 75 EUROPE: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 76 EUROPE: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

TABLE 77 EUROPE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 78 EUROPE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 79 EUROPE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 80 EUROPE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Growing end-use industries to boost the latex binders market

TABLE 81 GERMANY: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 82 GERMANY: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 83 GERMANY: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 84 GERMANY: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.3.2 UK

8.3.2.1 Government subsidies to influence market growth

TABLE 85 UK: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 86 UK: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 87 UK: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 88 UK: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Housing plans, along with government initiatives to drive the latex binders market

TABLE 89 FRANCE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 90 FRANCE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 91 FRANCE: LATEX BINDER MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 92 FRANCE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Investments in residential buildings and construction projects to drive the market 125

TABLE 93 ITALY: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 94 ITALY: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 95 ITALY: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 96 ITALY: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.3.5 RUSSIA

8.3.5.1 Commercial end-use industry to lead the consumption of latex binders during the forecast period

TABLE 97 RUSSIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 98 RUSSIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 99 RUSSIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 100 RUSSIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 101 REST OF EUROPE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 102 REST OF EUROPE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 103 REST OF EUROPE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 104 REST OF EUROPE: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.4 NORTH AMERICA

FIGURE 35 NORTH AMERICA: LATEX BINDERS MARKET SNAPSHOT

TABLE 105 NORTH AMERICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (KILOTON)

TABLE 106 NORTH AMERICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (KILOTON)

TABLE 107 NORTH AMERICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 108 NORTH AMERICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

TABLE 109 NORTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 110 NORTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 111 NORTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 112 NORTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.4.1 US

8.4.1.1 The US leads the market due to the presence of the regions largest paints & coating industry

TABLE 113 US: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 114 US: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 115 US: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 116 US: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.4.2 CANADA

8.4.2.1 Increased consumption of paints & coating owing to the growing number of construction projects to drive the demand for latex binders

TABLE 117 CANADA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 118 CANADA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 119 CANADA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 120 CANADA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.4.3 MEXICO

8.4.3.1 Rising residential construction is expected to drive the latex binders market in the country

TABLE 121 MEXICO: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 122 MEXICO: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 123 MEXICO: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 124 MEXICO: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 125 MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (KILOTON)

TABLE 126 MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (KILOTON)

TABLE 127 MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 130 MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 131 MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Saudi Arabia dominates the latex binders market in the Middle East & Africa

TABLE 133 SAUDI ARABIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 134 SAUDI ARABIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 135 SAUDI ARABIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 136 SAUDI ARABIA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.5.2 SOUTH AFRICA

8.5.2.1 Increased adoption of latex binders as coating emulsions in to lead to the growth of the latex binders market

TABLE 137 SOUTH AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 138 SOUTH AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 139 SOUTH AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 140 SOUTH AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 141 REST OF MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 142 REST OF MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 143 REST OF MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 144 REST OF MIDDLE EAST & AFRICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 145 SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (KILOTON)

TABLE 146 SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (KILOTON)

TABLE 147 SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 148 SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

TABLE 149 SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 150 SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 151 SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 152 SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 The presence of the largest construction industry in the region to lead to the growth of the latex binders market 150

TABLE 153 BRAZIL: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 154 BRAZIL: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 155 BRAZIL: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 156 BRAZIL: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Strategic Industrial Plan 2020 supporting the market foradhesive & sealant

TABLE 157 ARGENTINA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 158 ARGENTINA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 159 ARGENTINA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 160 ARGENTINA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 161 REST OF SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (KILOTON)

TABLE 162 REST OF SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (KILOTON)

TABLE 163 REST OF SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20172020 (USD MILLION)

TABLE 164 REST OF SOUTH AMERICA: LATEX BINDERS MARKET SIZE, BY END-USE INDUSTRY, 20212026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 156)

9.1 KEY PLAYERS STRATEGIES

TABLE 165 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 20152021

9.2 MARKET RANKING OF KEY PLAYERS

FIGURE 36 LATEX BINDER MANUFACTURER RANKING

9.3 MARKET SHARE ANALYSIS OF THE TOP FIVE PLAYERS

TABLE 166 LATEX BINDERS MARKET: DEGREE OF COMPETITION

FIGURE 37 LATEX BINDERS MARKET SHARE ANALYSIS, 2020

9.4 MARKET EVALUATION MATRIX

TABLE 167 MARKET EVALUATION MATRIX

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STAR

9.5.2 EMERGING LEADERS

9.5.3 PERVASIVE

9.5.4 PARTICIPANTS

FIGURE 38 COMPETITIVE LEADERSHIP MAPPING: LATEX BINDERS MARKET, 2020

9.5.5 STRENGTH OF PRODUCT PORTFOLIO

9.5.6 BUSINESS STRATEGY EXCELLENCE

TABLE 168 COMPANY PRODUCT FOOTPRINT

TABLE 169 COMPANY INDUSTRY FOOTPRINT

TABLE 170 COMPANY REGION FOOTPRINT

9.6 COMPETITIVE LEADERSHIP MAPPING OF SMES

9.6.1 STAR

9.6.2 EMERGING LEADERS

9.6.3 EMERGING COMPANIES

9.6.4 PERVASIVE

FIGURE 39 COMPETITIVE LEADERSHIP MAPPING OF SMES, 2020

9.7 COMPETITIVE SITUATIONS & TRENDS

TABLE 171 LATEX BINDERS MARKET: DEALS, JANUARY 2015JUNE 2021

TABLE 172 LATEX BINDERS MARKET: PRODUCT LAUNCHES, JANUARY 2015JUNE 2021

TABLE 173 LATEX BINDERS MARKET: OTHERS, JANUARY 2015JUNE 2021

10 COMPANY PROFILES (Page No. - 177)

10.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, Product launches, SWOT Analysis, Winning imperatives, Current strategies, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats)*

10.1.1 TRINSEO

TABLE 174 TRINSEO: BUSINESS OVERVIEW

FIGURE 40 TRINSEO: COMPANY SNAPSHOT

TABLE 175 TRINSEO: PRODUCT LAUNCHES

TABLE 176 TRINSEO: DEALS

TABLE 177 TRINSEO: OTHERS

FIGURE 41 TRINSEO: SWOT ANALYSIS

10.1.2 BASF SE

TABLE 178 BASF: BUSINESS OVERVIEW

FIGURE 42 BASF: COMPANY SNAPSHOT

TABLE 179 BASF: PRODUCT LAUNCHES

TABLE 180 BASF: DEALS

TABLE 181 BASF: OTHERS

FIGURE 43 BASF: SWOT ANALYSIS

10.1.3 WACKER CHEMIE

TABLE 182 WACKER CHEMIE: BUSINESS OVERVIEW

FIGURE 44 WACKER CHEMIE: COMPANY SNAPSHOT

TABLE 183 WACKER CHEMIE: DEALS

TABLE 184 WACKER CHEMIE: PRODUCT LAUNCHES

TABLE 185 WACKER CHEMIE: OTHERS

FIGURE 45 WACKER CHEMIE: SWOT ANALYSIS

10.1.4 ARKEMA

TABLE 186 ARKEMA: BUSINESS OVERVIEW

FIGURE 46 ARKEMA: COMPANY SNAPSHOT

TABLE 187 ARKEMA: DEALS

TABLE 188 ARKEMA: PRODUCT LAUNCHES

TABLE 189 ARKEMA: OTHERS

FIGURE 47 ARKEMA: SWOT ANALYSIS

10.1.5 CELANESE CORPORATION

TABLE 190 CELANESE CORPORATION: BUSINESS OVERVIEW

FIGURE 48 CELANESE CORPORATION: COMPANY SNAPSHOT

TABLE 191 CELANESE CORPORATION: DEALS

TABLE 192 CELANESE CORPORATION: PRODUCT LAUNCHES

TABLE 193 CELANESE CORPORATION: OTHERS

FIGURE 49 CELANESE CORPORATION: SWOT ANALYSIS

10.1.6 DOW

TABLE 194 DOW: BUSINESS OVERVIEW

FIGURE 50 DOW: COMPANY SNAPSHOT

TABLE 195 DOW: PRODUCT LAUNCHES

TABLE 196 DOW: OTHERS

10.1.7 DIC CORPORATION

TABLE 197 DIC CORPORATION: BUSINESS OVERVIEW

FIGURE 51 DIC CORPORATION: COMPANY SNAPSHOT

TABLE 198 DIC CORPORATION: DEALS

10.1.8 SYNTHOMER PLC

TABLE 199 SYNTHOMER: BUSINESS OVERVIEW

FIGURE 52 SYNTHOMER PLC: COMPANY SNAPSHOT

TABLE 200 SYNTHOMER PLC: PRODUCT LAUNCHES

TABLE 201 SYNTHOMER PLC: DEALS

TABLE 202 SYNTHOMER PLC: OTHERS

10.1.9 OMNOVA SOLUTIONS

TABLE 203 OMNOVA: BUSINESS OVERVIEW

FIGURE 53 OMNOVA SOLUTIONS: COMPANY SNAPSHOT

TABLE 204 OMNOVA: DEALS

TABLE 205 OMNOVA: PRODUCT LAUNCHES

10.1.10 DAIREN CHEMICAL CORPORATION

TABLE 206 DAIREN CHEMICAL CORPORATION: BUSINESS OVERVIEW

10.1.11 ARLANXEO

TABLE 207 ARLANXEO: BUSINESS OVERVIEW

10.1.12 KALPANA POLYMERS

TABLE 208 KALPANA POLYMERS: BUSINESS OVERVIEW

10.2 OTHER KEY COMPANIES

10.2.1 SHANDONG HEARST BUILDING MATERIAL

10.2.2 VISEN INDUSTRIES

10.2.3 JESONS

10.2.4 ACQUOS

10.2.5 ORGANIK KIMYA

10.2.6 PUYANG YINTAI INDUSTRIAL TRADING

10.2.7 BOSSON UNION TECH(BEIJING)

10.2.8 ADPL GROUP

10.2.9 SAKSHI CHEM SCIENCES

10.2.10 APCOTEX

10.2.11 BANGKOK SYNTHETICS

10.2.12 GOODYEAR CHEMICAL

10.2.13 JUBILANT AGRI & CONSUMER PRODUCTS

10.2.14 KUMHO PETROCHEMICAL

10.2.15 LION ELASTOMERS

10.2.16 LUBRIZOL

10.2.17 SHANGHAI BAOLIJIA

10.2.18 SHANXI SANWEI

10.2.19 SIBUR

10.2.20 SUMITOMO CHEMICAL

*Details on Business Overview, Products Offered, Recent Developments, Product launches, SWOT Analysis, Winning imperatives, Current strategies, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 241)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

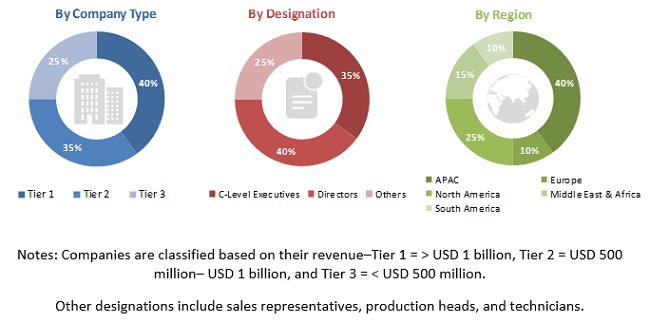

The study involved four major activities in estimating the current size of the latex binders market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the latex binders market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The latex binders market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing the end-use industry, such as paints & coating, adhesive & sealant, paper & paperboard, textile & carpet, construction & fiber bonding materials, and others. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the latex binders market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market sizeusing the estimation processes explained abovethe latex binders market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the latex binders market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the latex binders market

- To analyze and forecast the size of the market based on type and end-use industry

- To estimate and forecast the market size based on five regions, namely, North America, Europe, APAC, the Middle East & Africa, and South America

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition, investment & expansion, new product launch/development, and partnerships, contracts & agreements in the latex binders market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the latex binders market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the latex binders market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Latex Binders Market