Polymer Dispersions Market by Resin Type (Acrylic, SB, Vinyl, Polyurethane), Application (Decorative & Protective Coating, Paper, Printing Ink, Carpet & Fabrics, Adhesives & Sealants), and Region - Global Forecast to 2022

[130 Pages Report] on Polymer Dispersions Market is projected to reach USD 10.27 Billion by 2022 at a CAGR of 8.0%, in terms of value. The base year considered for this study is 2016 while the forecast period is from 2017 to 2022. The polymer dispersions market is driven by the increasing demand for polyurethane dispersions and other polymer dispersions from applications such as decorative & protective coating, paper, printing ink, carpet & fabrics, and adhesives & sealants. The report includes an analysis of the polymer dispersions market by region, namely, North America, Europe, Asia-Pacific, Middle East & Africa, and South America.

Objectives of the Study:

- To estimate and forecast the size of the polymer dispersions market, in terms of value and volume

- To provide detailed information regarding the key factors (drivers, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the polymer dispersions market by resin type and application

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia-Pacific, the Middle East & Africa, and South America

- To analyze market opportunities for stakeholders and provide a competitive landscape for market players

- To analyze competitive developments such as acquisitions, product launches, expansions, collaborations, and divestments in the polymer dispersions market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

The top-down and bottom-up both approaches have been used to estimate and validate the size of the global polymer dispersions market and to estimate the size of various other dependent submarkets. This study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Commonwealth Scientific and Industrial Research Organization (CSIRO), Securities And Exchange Commission (SEC), American National Standards Institute (ANSI), Organisation for Economic Co-operation and Development (OECD), and other sources, to identify and collect information useful for the technical, market-oriented, and commercial study of the polymer dispersions market.

To know about the assumptions considered for the study, download the pdf brochure

The key market players in the polymer dispersions market include BASF SE (Germany), Synthomer Plc. (Germany), Mitsui Chemicals (Japan), Covestro AG (Germany), and Solvay SA (Germany). These companies are focusing on expanding their reach in the emerging markets of Asia-Pacific and South America. There is many domestic players in the emerging markets.

Key Target Audience:

- Polymer dispersions manufacturers

- Polymer dispersions traders, distributors, and suppliers

- Raw materials and resin suppliers

- Government and research organizations

- Regulatory bodies

- Associations and industry bodies

This study answers several questions for the stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments.

Scope of the Report:

- This research report categorizes the polymer dispersions market on the basis of resin type, application, and region.

By Resin Type:

- Acrylic Dispersions

- Vinyl Dispersions

- Polyurethane Dispersions

- SB Dispersions

- Others

Based on Applications:

- Decorative & Protective Coating

- Paper

- Carpet & Fabrics

- Printing Ink

- Adhesives & Sealants

- Others

Based on Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the polymer dispersions market is provided by application.

Company Information:

- Detailed analysis and profiles of additional market players.

The global polymer dispersions market is projected to reach USD 10.27 Billion by 2022 at a CAGR of 8.0%, in terms of value. Polymer dispersions are used in a wide range of applications such as decorative & protective coating, paper, carpet & fabrics, printing ink, adhesives & sealants, and other applications, as it provides properties such as enhanced processability, performance, and appearance to products. The properties of these dispersions are similar to those of emulsions. The major difference is the particle size of the polymer particles.

The main resin types are acrylic, vinyl, PU, and SB, among others. The acrylic dispersions segment is projected to lead the resin type segment of polymer dispersions in terms of value and volume, during the forecast period. This is due to the wide usage of acrylic dispersions in the manufacture of water-based coatings for decorative and paper coating applications. The cost effectiveness of acrylics over other types, is also leading to the high demand for this subsegment.

Polymer dispersions are used in various applications, and have been segmented into decorative & protective coating, paper, carpet & fabrics, printing ink, adhesives & sealants, and others, in this report. In 2016, the decorative & protective coating application accounted held the largest share of the application segment, in terms of value and volume. This is due to the increasing housing projects in the emerging markets and the increasing consumer awareness regarding VOC contents associated with solvent based substitutes.

The bargaining power of the raw material suppliers in the polymer dispersions market is moderate. This is due to the low demand and supply gap, limited number of fixed global buyers, and threat of forward integration. The bargaining power of buyer is low. This is due to the specific quality requirements of buyers and the limited number of high quality global suppliers. The threat of substitute in the market is low. This is due to the low possibility of substitution and expensive substitutes. The intensity of competitive rivalry is high. This is due to the large number of application segments and large number of global and domestic players

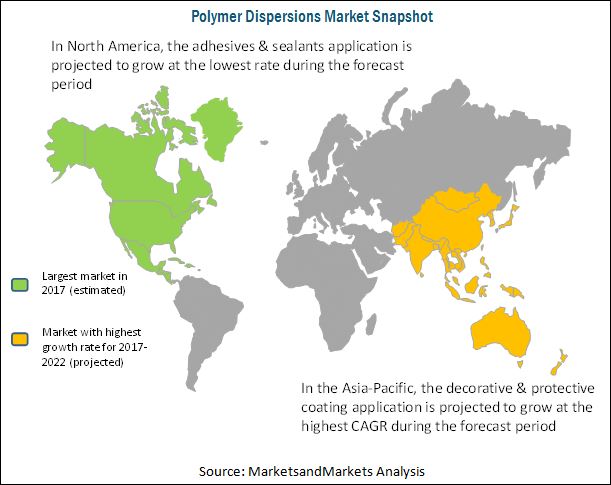

North America, Europe, Asia-Pacific, Middle East & Africa, and South America are the main regions covered for the polymer dispersions market in the report. North America is the largest polymer dispersions market. The rising demand for polymer dispersions in that geographical segment is mainly driven by its increased use in coating applications, especially in interior and furniture coating. Asia-Pacific is the second-largest consumer and manufacturer of polymer dispersions, globally, and is the fastest-growing region in the market. Increasing consumer awareness regarding VOC and the increasing demand for green coatings is contributing to the growing demand for polymer dispersions globally.

A few factors such as the high price of raw materials, shift of the application market from developed countries to emerging countries, and the rising cost of production is expected to hinder the growth of the market to a certain extent.

BASF SE (Germany), Synthomer Plc. (U.K.), Mitsui Chemicals Inc. (Japan), Eastman Chemical Company (U.S.), Covestro AG (Germany), and Solvay SA (Germany) are the leading companies in this market. Most of the market players adopted new product launches, merger & acquisition, and investment & expansions strategies, to maintain their share of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table Of Contents

1 Introduction (Page No. - 14)

1.1 Objectives Of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Package Size

1.7 Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Source

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Source

2.1.2.2 Key Industry Insights

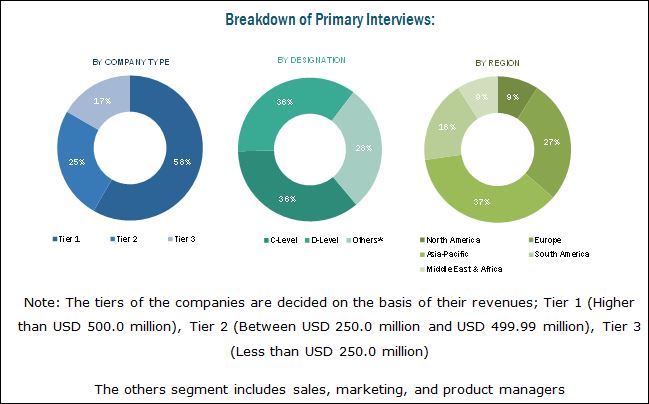

2.1.2.3 Breakdown Of Primary Interviews

2.2 Market Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insight (Page No. - 29)

4.1 Polymer Dispersions Market Overview, 2017 vs 2022

4.2 Polymer Dispersions Market, By Resin Type

4.3 Polymer Dispersions Market, By Application

4.4 Polymer Dispersions Market Share In North America, By Application And Country

4.5 Polymer Dispersions Market, By Application And Region

4.6 Polymer Dispersions Market Attractiveness

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand In Textile & Leather Applications

5.2.1.2 Increasing Demand for Polyurethane Dispersions

5.2.1.3 Increasing Demand for Green Coatings

5.2.2 Opportunities

5.2.2.1 Booming Demand for Water-Based Dispersions

5.2.2.2 Government Regulations Related to Voc Content In Dispersions

5.2.3 Challenges

5.2.3.1 Manufacturing Low Voc Content Or Solvent-Free Dispersions

5.3 Porters Five Force Analysis

5.3.1 Bargaining Power Of Suppliers

5.3.2 Bargaining Power Of Buyers

5.3.3 Threat Of New Entrants

5.3.4 Threat Of Substitutes

5.3.5 Intensity Of Competitive Rivalry

6 Polymer Dispersions Market, By Resin Type (Page No. - 39)

6.1 Introduction

6.2 Acrylic Dispersions

6.3 Vinyl Dispersions

6.4 Polyurethane (PU) Dispersions

6.5 Styrene-Butadiene (SB) Dispersions

6.6 Others

7 Polymer Dispersions Market, By Application (Page No. - 43)

7.1 Introduction

7.2 Decorative & Protective Coatings

7.2.1 Wood Coatings

7.2.2 Metal Coatings

7.2.3 Roof & Wall Coatings

7.3 Adhesives & Sealants

7.3.1 Water-Based Adhesives

7.3.2 Solvent-Based Adhesives

7.4 Paper

7.4.1 Surface Sizing

7.4.2 Paper Coating

7.5 Carpet & Fabrics

7.5.1 Upholstery

7.5.2 Home Furnishings

7.5.3 Others

7.6 Printing Ink

7.7 Others

8 Polymer Dispersions Market, By Region (Page No. - 49)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Asia-Pacific

8.3.1 China

8.3.2 Japan

8.3.3 India

8.3.4 South Korea

8.3.5 Malaysia

8.3.6 Thailand

8.3.7 Rest Of Asia-Pacific

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 U.K.

8.4.4 Italy

8.4.5 Spain

8.4.6 Netherlands

8.4.7 Rest Of Europe

8.5 South America

8.5.1 Brazil

8.5.2 Argentina

8.5.3 Chile

8.5.4 Rest Of South America

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.2 UAE

8.6.3 Qatar

8.7 Rest Of Middle East & Africa

9 Competitive Landscape (Page No. - 88)

9.1 Introduction

9.1.1 Dynamic Differentiators

9.1.2 Innovators

9.1.3 Visionary Leaders

9.1.4 Emerging Companies

9.2 Competitive Leadership Mapping

9.2.1 Strength Of Product Portfolio

9.2.2 Business Strategy Excellence

9.3 Market Share Analysis

9.3.1 BASF SE (Germany)

9.3.2 Mitsui Chemicals Inc. (Japan)

9.3.3 Synthomer PLC. (U.K.)

9.3.4 Eastman Chemical Company (U.S.)

9.3.5 Solvay SA (Belgium)

10 Company Profiles (Page No. - 94)

(Overview, Financial*, Products & Services, Strategy, And Developments)

10.1 BASF SE

10.2 Mitsui Chemicals, Inc.

10.3 Synthomer PLC.

10.4 Eastman Chemical Company

10.5 Solvay SA

10.6 Covestro AG

10.7 Huntsman International LLC.

10.8 Lanxess

10.9 Michelman, Inc.

10.10 The DOW Chemical Company

10.11 Wacker Chemie AG

10.12 Other Companies

10.12.1 Alberdingk Boley GmbH

10.12.2 Allnex Group

10.12.3 BIP (Oldbury) Limited

10.12.4 Chase Corporation

10.12.5 Coim S.P.A

10.12.6 DIC Corporation

10.12.7 Dupont

10.12.8 Evonik AG

10.12.9 Hexion Inc.

10.12.10 Icap-Sira S.P.A

10.12.11 Kamsons Chemicals Pvt. Ltd.

10.12.12 Lamberti S.P.A

10.12.13 Lubrizol Corporation

10.12.14 Vinavil S.P.A.

*Details Might Not Be Captured In Case Of Unlisted Companies

11 Appendix (Page No. - 123)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List Of Tables (76 Tables)

Table 1 Polymer Dispersions Market Size, By Resin Type, 20152022 (USD Million)

Table 2 Polymer Dispersions Market Size, By Resin Type, 20152022 (Kiloton)

Table 3 Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 4 Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 5 Polymer Dispersions Market Size, By Region, 20152022 (USD Million)

Table 6 Polymer Dispersions Market Size, By Region, 20152022 (Kiloton)

Table 7 Polymer Dispersions Market Size, By Country, 20152022 (USD Million)

Table 8 Polymer Dispersions Market Size, By Country, 20152022 (Kiloton)

Table 9 Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 10 Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 11 U.S.: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 12 U.S.: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 13 Canada: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 14 Canada: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 15 Mexico: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 16 Mexico: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 17 Asia-Pacific: Polymer Dispersions Market Size, By Country, 20152022 (USD Million)

Table 18 Asia-Pacific: Polymer Dispersions Market Size, By Country, 20152022 (Kiloton)

Table 19 Asia-Pacific: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 20 Asia-Pacific: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 21 China: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 22 China: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 23 Japan: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 24 Japan: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 25 India: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 26 India: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 27 South Korea: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 28 South Korea: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 29 Malaysia: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 30 Malaysia: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 31 Thailand: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 32 Thailand: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 33 Rest Of Asia-Pacific: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 34 Rest Of Asia-Pacific: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 35 Europe: Polymer Dispersions Market Size, By Country, 20152022 (USD Million)

Table 36 Europe: Polymer Dispersions Market Size, By Country, 20152022 (Kiloton)

Table 37 Europe: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 38 Europe: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 39 Germany: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 40 Germany: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 41 France: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 42 France: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 43 U.K.: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 44 U.K.: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 45 Italy: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 46 Italy: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 47 Spain: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 48 Spain: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 49 Netherlands: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 50 Netherlands: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 51 Rest Of Europe: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 52 Rest Of Europe: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 53 South America: Polymer Dispersions Market Size, By Country, 20152022 (USD Million)

Table 54 South America: Polymer Dispersions Market Size, By Country, 20152022 (Kiloton)

Table 55 South America: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 56 South America: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 57 Brazil: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 58 Brazil: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 59 Argentina: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 60 Argentina: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 61 Chile: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 62 Chile: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 63 Rest Of South America: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 64 Rest Of South America: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 65 Middle East & Africa: Polymer Dispersions Market Size, By Country, 20152022 (USD Million)

Table 66 Middle East & Africa: Polymer Dispersions Market Size, By Country, 20152022 (Kiloton)

Table 67 Middle East & Africa: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 68 Middle East & Africa: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 69 Saudi Arabia: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 70 Saudi Arabia: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 71 UAE: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 72 UAE: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 73 Qatar: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 74 Qatar: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

Table 75 Rest Of Middle East & Africa: Polymer Dispersions Market Size, By Application, 20152022 (USD Million)

Table 76 Rest Of Middle East & Africa: Polymer Dispersions Market Size, By Application, 20152022 (Kiloton)

List Of Figures (33 Figures)

Figure 1 Polymer Dispersions Market Segment

Figure 2 Polymer Dispersions Market: Research Design

Figure 3 Polymer Dispersions Market: Data Triangulation

Figure 4 Acrylic Dispersions to Account for Largest Share Of Polymer Dispersions Market During Forecast Period

Figure 5 Decorative & Protective Coating Application to Register Highest CAGR During Forecast Period

Figure 6 Asia-Pacific to Witness Fastest Growth During Forecast Period

Figure 7 North America Led Polymer Dispersions Market In Terms Of Volume In 2016

Figure 8 Polymer Dispersions Market to Witness High Growth Between 2017 And 2022

Figure 9 PU Dispersions to Register Highest CAGR During Forecast Period

Figure 10 Decorative & Protective Coating Application to Register Highest CAGR During Forecast Period

Figure 11 U.S. Accounted for Largest Market Share In North America In 2016

Figure 12 Decorative & Protective Coating Application Accounted for Largest Market Share In 2016

Figure 13 Asia-Pacific to Be Fastest-Growing Market Between 2017 And 2022

Figure 14 Increasing Demand for Polymer Dispersions In Decorative & Protective Coatings Driving the Market

Figure 15 Porters Five Force Analysis

Figure 16 Acrylic Dispersions is Expected to Lead the Polymer Dispersions Market

Figure 17 Decorative & Protective Coatings is Expected to Lead the Polymer Dispersions Market

Figure 18 Regional Snapshot: U.S., Canada, And Mexico to Lead Polymer Dispersions Market Till 2022

Figure 19 North America Market Snapshot: U.S. Accounted for Largest Share Of Global Polymer Dispersions Market

Figure 20 China Accounted for Largest Share Of Polymer Dispersions Market In 2016

Figure 21 Brazil Dominates Polymer Dispersions Market In South America

Figure 22 BASF SE (Germany), Synthomer PLC. (U.K.), & Mitsui Chemicals Inc. (Japan), to Lead the Market, In 2016

Figure 23 BASF SE Accounted for the Largest Share In the Polymer Dispersions Market, 2016

Figure 24 BASF SE: Company Snapshot

Figure 25 Mitsui Chemicals, Inc.: Company Snapshot

Figure 26 Synthomer PLC.: Company Snapshot

Figure 27 Eastman Chemical Company: Company Snapshot

Figure 28 Solvay SA: Company Snapshot

Figure 29 Covestro AG: Company Snapshot

Figure 30 Huntsman International LLC.: Company Snapshot

Figure 31 Lanxess: Company Snapshot

Figure 32 The DOW Chemical Company: Company Snapshot

Figure 33 Wacker Chemie AG: Company Snapshot

Growth opportunities and latent adjacency in Polymer Dispersions Market