Pesticide Residue Testing Market by Type (Herbicides, Insecticides, Fungicides), Technology (LC-MS/GC-MS, HPLC, Gas Chromatography), Class (Organochlorines, Organophosphates, Organonitrogens & Carbamates), Food Tested, and Region - Global Forecast to 2022

The pesticide residue testing market, in terms of value, is projected to reach USD 1.63 Billion by 2022, at a CAGR of 7.0% from 2016 to 2022. Implementation of stringent food safety regulations, increasing chemical contamination outbreaks, international trade of food materials, and advancements in testing technologies are some of the factors driving this market.

The years considered for the study are as follows:

- Base year 2015

- Estimated year 2016

- Projected year 2022

- Forecast period 2016 to 2022

The objectives of the Pesticide Residue Testing Market report

- To define, segment, and project the size of the global market on the basis of type, technology, food tested, and class

- To understand the structure of the market for pesticide residue testing by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market trends

- To project the size of the market and its submarkets, in terms of value, with respect to four regions (along with their respective key countries): North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was carried out to determine the number of tests conducted for pesticide residue in regions such as North America, Europe, Asia-Pacific, and RoW; trends for food testing industry, and their contribution

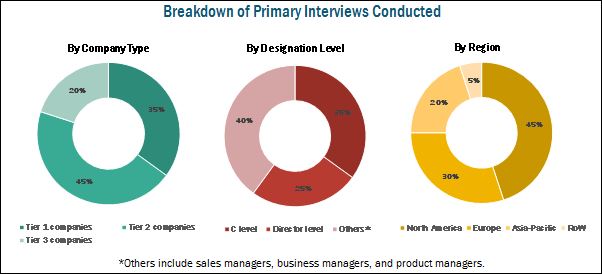

- The key players were identified through secondary sources such as Codex Alimentarius Commission (CODEX), Centers for Disease Control and Prevention (CDC), The European Federation of National Associations of Measurement, Testing, and Analytical Laboratories (EUROLAB), and Food and Agriculture Organization (FAO), while their market share in respective regions have been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both, quantitative and qualitative) for the pesticide residue testing market.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

The stakeholders for the report are as follows:

- Pesticide residue testing service providers

- Pesticide residue testing laboratories

- Food processors

- Food manufacturers

- Government and research organizations

- Trade associations and industry bodies

Scope of the Report:

This research report categorizes the pesticide residue testing market based on type, food tested, technology, class, and region.

Based on Type, the market has been segmented as follows:

- Herbicides

- Insecticides

- Fungicides

- Others (acaricides, nematicides, rodenticides, and disinfectants)

Based on Technology, the market has been segmented as follows:

- LC-MS/GC-MS

- HPCL

- Gas chromatography

- Other technologies (immunoassay and other test kits)

Based on Food Tested, the market has been segmented as follows:

- Meat & poultry

- Dairy products

- Processed foods

- Fruits & vegetables

- Other food tested (cereals & grains, nuts, seeds & spices, and food additives)

Based on Class, the market has been segmented as follows:

- Organochlorines

- Organophosphates

- Organonitrogens & carbamates

- Others (pyrethroids and fumigants)

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (Brazil, Argentina, and South Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The pesticide residue testing market is driven by advancements in testing technologies, the global movement of organic revolution, implementation of stringent food safety regulations, and international trade of food materials.

The global market, based on type, has been segmented into herbicides, insecticides, fungicides, and others which include acaricides, nematicides, rodenticides, and disinfectants. The herbicides segment is projected to be the largest and fastest growing in pesticide residue market through 2022. Some of the major herbicides include glyphosate, atrazine, 2, 4-d, dicamba, and trifluralin. Examples of insecticides include permethrin, aldicarb, and chloropyrifos.

The global market, on the basis of technology, is segmented into LC-MS/GC-MS, HPLC, gas chromatography, and others such as immunoassay and other test kits. The LC-MS/GC-MS and HPLC are the two largest technologies used in the pesticide residue testing. LC-MS, which is a combination of liquid chromatography with mass spectrometry, is a powerful technique that has very high sensitivity, making it useful in many applications. HPLC is the second largest technology used to detect residues in the food. The increase in the convenience and ease of use of chromatography devices is increasing the adoption rate of chromatography instruments in food safety testing.

The global market, based on class, is categorized into organochlorines, organophosphates, organonitrogens & carbamates, and others which include pyrethroids and fumigants. The organochlorines segment is projected to be the largest and the fastest growing class of pesticide residues in the pesticide residue testing market. Organochlorine pesticides include heptachlor, endosulfan, chlordane, and mirex. These pesticides are applied on fruits & vegetables to interfere with the ion channel receptors in insect neurons. The fruits & vegetables segment, based on food tested, is the fastest growing segment for this market.

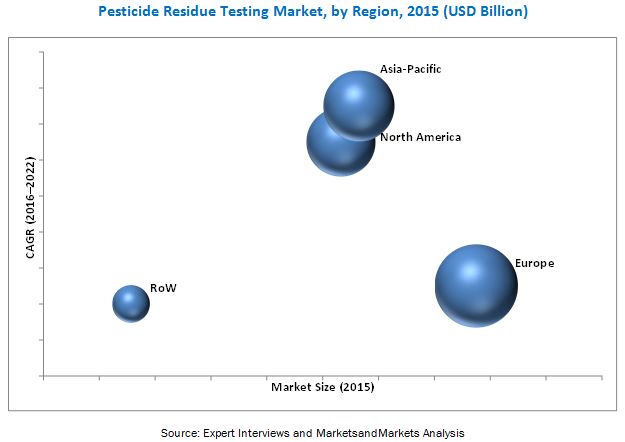

The pesticide residue testing market was dominated by the European region in 2015. The growth in this market is driven by the presence of large number of food industries and stringent regulatory laws, as well as the fact that it is the largest international trader of food products. Asia-Pacific is projected to be the fastest growing market owing to the growth prospects in countries such as China and India among others. This is due to the growing need for food safety and expansion of various food industries and testing laboratories.

Lack of food control infrastructure & resources in developing countries and lack of awareness about food safety regulations among food manufacturers are the restraining factors in the pesticide residue testing market. Some of the leading players include Eurofins Scientific SE (Luxembourg), Bureau Veritas S.A. (France), SGS S.A. (Switzerland), Intertek Group plc (U.K.), and Silliker, Inc. (U.S.). Eurofins focuses on increasing its geographic presence through acquisitions, which is evident from the number of acquisitions it has undertaken from 2011 to 2016. These acquisitions will help Eurofins Scientific in reinforcing the companys network and analytical capabilities to better serve the food and agricultural industries. With expansions, the company focuses on strengthening its food testing laboratories in the Asia-Pacific region. In 2016, Eurofins expanded its presence in Asia-Pacific, by increasing its capacity with an advanced food testing laboratory in Singapore to serve the growing food & beverages market in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Periodization Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 32)

3.1 Market Snapshot

4 Premium Insights (Page No. - 36)

4.1 Opportunities in this Market

4.2 Pesticide Residue Testing Market: Major Countries

4.3 Market, By Type

4.4 Developed vs Emerging Markets in Pesticide Residue Testing

4.5 Market Size, By Technology

4.6 Market, By Food Tested & Region

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Technology

5.2.3 By Food Tested

5.2.4 By Class

5.2.5 By Region

5.3 FDAs Pesticide Regulatory Monitoring Data, 2013

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Advancements in Testing Technologies

5.4.1.2 Global Movement of Organic Revolution

5.4.1.3 Implementation of Stringent Food Safety Regulations

5.4.1.4 International Trade of Food Materials

5.4.2 Restraints

5.4.2.1 Lack of Food Control Infrastructure & Resources in Developing Countries

5.4.2.2 Lack of Awareness About Safety Regulations Among Food Manufacturers

5.4.3 Opportunities

5.4.3.1 Expansion Opportunities in Emerging Markets for Pesticide Residue Testing

5.4.3.2 Increasing Consumers Demand for Food Safety

5.4.4 Challenges

5.4.4.1 Inappropriate Standard of Sample Collection

5.4.4.2 Lack of Standardization of Food Safety Regulations

6 Pesticide Residue Testing Market, By Type (Page No. - 54)

6.1 Introduction

6.1.1 Hazards of Pesticides

6.1.1.1 Impact on Human Life

6.1.1.2 Impact on Environment

6.2 Herbicides

6.3 Insecticides

6.4 Fungicides

6.5 Other Pesticides

7 Pesticide Residue Testing Market, By Technology (Page No. - 63)

7.1 Introduction

7.1.1 Single Residue Method

7.1.2 Multiple Residue Method

7.2 LC-MS/GC-MS

7.3 High Performance Liquid Chromatography (HPLC)

7.4 Gas Chromatography

7.5 Others

8 Pesticide Residue Testing Market, By Food Tested (Page No. - 70)

8.1 Introduction

8.2 Meat & Poultry

8.3 Dairy Products

8.4 Processed Food

8.5 Fruits & Vegetables

8.6 Cereals, Grains & Pulses

8.7 Others

9 Pesticide Residue Testing Market, By Class (Page No. - 79)

9.1 Introduction

9.2 Organochlorines

9.3 Organophosphates

9.4 Organonitrogens & Carbamates

9.5 Others

10 Pesticide Residue Testing Market, By Region (Page No. - 82)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Italy

10.3.5 Poland

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Australia & New Zealand

10.4.5 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.2 Argentina

10.5.3 South Africa

10.5.4 Others in RoW

11 Regulations (Page No. - 119)

11.1 Introduction

11.2 International Body for Food Safety Standards and Regulations

11.2.1 Codex Alimentarius Commission (CAC)

11.3 Global Food Safety Initiative (GFSI)

11.4 North America

11.4.1 U.S. Environmental Protection Agency (EPA)

11.4.1.1 Federal Pesticide Laws

11.4.1.2 Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA)

11.4.1.3 Federal Food, Drug, and Cosmetic Act (FFDCA)

11.4.1.4 Food Quality Protection Act of 1996

11.4.1.5 The Pesticide Registration Improvement Act of 2003 (PRIA)

11.4.1.5.1 The Pesticide Label

11.4.1.5.2 Food Safety Regulations for Fruit & Vegetable Growers

11.4.1.5.3 FDA Food Safety Modernization Act (FSMA)

11.4.1.5.4 U.S. Food and Drug Administration (FDA)

11.4.2 Canada

11.4.2.1 Pesticides

11.4.2.1.1 Federal (Pest Management Regulatory Agency of Health Canada)

11.4.2.1.2 Provincial/Territorial

11.4.2.1.3 Municipal

11.5 Mexico

11.6 Europe

11.6.1 European Union Regulations

11.6.1.1 General Food Law for Food Safety

11.6.2 Germany

11.6.3 U.K.

11.6.4 France

11.7 Asia-Pacific

11.7.1 China

11.7.2 Japan

11.7.3 India

11.7.3.1 Food Safety Standards Amendment Regulations, 2012

11.7.3.2 Food Safety Standards Amendment Regulations, 2011

11.7.3.3 Food Safety and Standards Act, 2006

11.7.4 Australia

11.7.4.1 Food Standards Australia New Zealand

11.7.5 New Zealand

11.8 RoW

11.8.1 Brazil

11.8.2 South Africa

12 Competitive Landscape (Page No. - 130)

12.1 Overview

12.2 Pesticide Residue Testing Market Share (Value), By Key Player, 2015

12.3 Key Market Strategies

12.4 Acquisitions: Popular Strategy for the Global Pesticide Residue Testing Market

12.5 Acquisitions

12.6 Expansions & Investments

12.7 Innovations, Accreditations, Partnerships, and Collaborations

12.8 New Service Launches

13 Company Profiles (Page No. - 139)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 Eurofins Scientific Se

13.3 Bureau Veritas S.A.

13.4 SGS S.A.

13.5 Intertek Group PLC

13.6 Silliker, Inc.

13.7 ALS Limited

13.8 Asurequality Ltd.

13.9 SCS Global Services

13.10 Microbac Laboratories, Inc.

13.11 Symbio Laboratories

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 165)

14.1 Industry Insights

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 More Company Developments

14.4.1 Acquisitions

14.4.2 Expansions & Investments

14.5 Introducing RT: Real Time Market Intelligence

14.6 Available Customizations

14.7 Related Reports

14.8 Author Details

List of Tables (79 Tables)

Table 1 Pesticide Residue Testing Market Size, By Type, 20142022 (USD Million)

Table 2 Herbicide Residue Testing Market Size, By Region, 20142022 (USD Million)

Table 3 Crops and Common Insecticides Used

Table 4 Major Types of Insecticide and Their Mode of Action, 2009

Table 5 Insecticide Residue Testing Market Size, By Region, 20142022 (USD Million)

Table 6 Fungicide Residue Testing Market Size, By Region, 20142022 (USD Million)

Table 7 Other: Pesticide Residue Testing: Market Size, By Region, 20142022 (USD Million)

Table 8 Market Size, By Technology, 20142022 (USD Million)

Table 9 LC-MS/GC-MS Testing Market, By Region, 2014 - 2022 (USD Million)

Table 10 HPLC Testing Market Size, By Region, 20142022 (USD Million)

Table 11 Gas Chromatography Testing Market Size, By Region, 20142022 (USD Million)

Table 12 Others Market Size, By Region, 20142022 (USD Million)

Table 13 Pesticide Residue Testing Market Size, By Food Tested, 2014-2022 (USD Million)

Table 14 Market in Meat & Poultry, By Region, 2014-2022 (USD Million)

Table 15 Market in Dairy, By Region, 2014-2022 (USD Million)

Table 16 Market in Processed Food, By Region, 2014-2022 (USD Million)

Table 17 Market in Fruits & Vegetables, By Region, 2014-2022 (USD Million)

Table 18 Market in Cereals, Grains & Pulses, By Region, 2014-2022 (USD Million)

Table 19 Market in Others, By Region, 2014-2022 (USD Million)

Table 20 Market Size, By Class, 20142022 (USD Million)

Table 21 Residue Testing Market Size, By Region, 20142022 (USD Million)

Table 22 North America: Residue Testing Market Size, By Country, 20142022 (USD Million)

Table 23 North America: Market for Pesticide Residue Testing, By Technology, 2014 - 2022 (USD Million)

Table 24 U.S.: Market Size, By Type, 20142022 (USD Million)

Table 25 U.S.: Market Size, By Food Tested, 20142022 (USD Million)

Table 26 Canada: Market Size, By Type, 20142022 (USD Million)

Table 27 Canada: Market Size, By Food Tested, 20142022 (USD Million)

Table 28 Mexico: Market Size for Pesticide Residue Testing, By Type, 20142022 (USD Million)

Table 29 Mexico: Market Size, By Food Tested, 20142022 (USD Million)

Table 30 Europe: Pesticide Residue Testing Market Size, By Country, 20142022 (USD Million)

Table 31 Europe: Market, By Technology, 2014 - 2022 (USD Million)

Table 32 Germany: Market Size, By Type, 20142022 (USD Million)

Table 33 Germany: Market Size, By Food Tested, 20142022 (USD Million)

Table 34 France: Market Size, By Type, 20142022 (USD Million)

Table 35 France: Market Size, By Food Tested, 20142022 (USD Million)

Table 36 U.K.: Market Size, By Type, 20142022 (USD Million)

Table 37 U.K.: Market Size, By Food Tested, 20142022 (USD Million)

Table 38 Italy: Market Size, By Type, 20142022 (USD Million)

Table 39 Italy: Market Size, By Food Tested, 20142022 (USD Million)

Table 40 Poland: Market Size, By Type, 20142022 (USD Million)

Table 41 Poland: Market Size, By Food Tested, 20142022 (USD Million)

Table 42 Rest of Europe: Market Size, By Type, 20142022 (USD Million)

Table 43 Rest of Europe: Market Size, By Food Tested, 20142022 (USD Million)

Table 44 Asia-Pacific: Market, By Country, 20142022 (USD Million)

Table 45 Asia-Pacific: Market, By Technology, 2014 - 2022 (USD Million)

Table 46 China: Market, By Type, 20142022 (USD Million)

Table 47 China: Market Size, By Food Tested, 20142022 (USD Million)

Table 48 India: Market, By Type, 20142022 (USD Million)

Table 49 India: Market Size, By Food Tested, 20142022 (USD Million)

Table 50 Japan: Market, By Type, 20142022 (USD Million)

Table 51 Japan: Market Size, By Food Tested, 20142022 (USD Million)

Table 52 Australia & New Zealand: Market for Pesticide Residue Testing, By Type, 20142022 (USD Million)

Table 53 Australia & New Zealand: Market Size, By Food Tested, 20142022 (USD Million)

Table 54 Rest of Asia-Pacific: Market Size for Pesticide Residue Testing, By Type, 20142022 (USD Million)

Table 55 Rest of Asia-Pacific: Market Size, By Food Tested, 20142022 (USD Million)

Table 56 RoW: Market, By Country, 20142022 (USD Million)

Table 57 RoW: Market, By Technology, 2014 - 2022 (USD Million)

Table 58 Brazil: Market for Pesticide Residue Testing, By Type, 20142022 (USD Million)

Table 59 Brazil: Market Size, By Food Tested, 20142022 (USD Million)

Table 60 Argentina: Market Size for Pesticide Residue Testing, By Type, 20142022 (USD Million)

Table 61 Argentina: Market Size, By Food Tested, 20142022 (USD Million)

Table 62 South Africa: Pesticide Residue Testing Market, By Type, 20142022 (USD Million)

Table 63 South Africa: Market Size, By Food Tested, 20142022 (USD Million)

Table 64 Others in RoW: Market for Pesticide Residue Testing, By Type, 20142022 (USD Million)

Table 65 Others in RoW: Market Size, By Food Tested, 20142022 (USD Million)

Table 66 Acquisitions, 20112016

Table 67 Expansions & Investments, 20112016

Table 68 Innovations, Accreditations, Partnerships, and Collaborations, 20112016

Table 69 New Service Launches, 20112016

Table 70 Eurofins Scientific: Services Offered

Table 71 Bureau Veritas S.A.: Services Offered

Table 72 Intertek Group PLC: Services Offered

Table 73 Silliker, Inc.: Services Offered

Table 74 ALS Limited: Services Offered

Table 75 SCS Global Services.: Services Offered

Table 76 Microbac Laboratories, Inc.: Services Offered

Table 77 Symbiolaboratories : Services Offered

Table 78 Acquisitions, 20112016

Table 79 Expansions & Investments, 20112016

List of Figures (55 Figures)

Figure 1 Market Segmentation

Figure 2 Market, By Region

Figure 3 Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Pesticide Residue Testing Market Snapshot, By Type, 2016 vs 2022

Figure 8 Market Size, By Technology, 20162022

Figure 9 Market Size, By Food Tested, 20162022

Figure 10 Market, By Region, 20162022

Figure 11 Pesticide Residue Testing Market Share (Value), By Region, 2015

Figure 12 Advancements is the Testing Technologies Drive the Growth of this Market

Figure 13 China is Projected to Be the Fastest-Growing Market During the Forecast Period

Figure 14 Herbicides Segment is Projected to Dominate the Market Through 2022

Figure 15 China and India Projected to Grow at the Highest CAGR During the Forecast Period

Figure 16 LC-MS/GC-MS Segment is Projected to Dominate the Global Market Through 2022

Figure 17 Processed Food Segment is Projected to Be Largest Market, 20162022

Figure 18 Market, By Type

Figure 19 Market, By Technology

Figure 20 Market, By Food Tested

Figure 21 Market, By Class

Figure 22 Market Snapshot, By Region

Figure 23 FDAs Pesticide Regulatory Monitoring Data, 2013

Figure 24 Market Dynamics: Pesticide Residue Testing

Figure 25 Chemical Products, Pesticides & Toxic Substances are A Major Concern for European Consumers

Figure 26 Herbicides Projected to Form the Fastest-Growing Segment in this Market

Figure 27 U.S. Agricultural Use of Herbicides in 2001

Figure 28 U.S. Insecticide Use in 2001

Figure 29 Europe to Dominate the Fungicide Pesticide Residue Testing Market

Figure 30 LC-MS/GC-MS is Projected to Be Fastest Growing Segment in this Market During the Forecast Period

Figure 31 Europe is Projected to Dominate the Global Market Through 2022

Figure 32 U.S.: Food Commodities Responsible for Illnesses, 20002014

Figure 33 Food Categories Associated With Food Recalls

Figure 34 Processed Food Dominated the Global Market, 2015

Figure 35 Processed Food Pesticide Testing in Asia-Pacific is Projected to Be the Fastest-Growing

Figure 36 The U.S. Accounted for the Largest Share in this Market, 2015

Figure 37 European Market Snapshot: Germany to Command the Largest Share in this Market During the Forecast Period

Figure 38 Asia-Pacific Market Snapshot: China & Japan Accounted for the Largest Share in this Market in 2015

Figure 39 Pesticides Production, Consumption, and Import/Export of China (10,000 Tons)

Figure 40 Acquistions and Expansions & Investments: Leading Approach of Key Companies

Figure 41 Top Five Players Led the Pesticide Residue Testing Market, 2015

Figure 42 Pesticide Residue Testing Market Developments, By Growth Strategy, 20112016

Figure 43 Market Growth Strategies, By Company, 20112016

Figure 44 Geographic Revenue Mix of Top Market Players

Figure 45 Eurofins Scientific Se: Company Snapshot

Figure 46 Eurofins Scientific Se: SWOT Analysis

Figure 47 Bureau Veritas S.A.: Company Snapshot

Figure 48 Bureau Veritas Sa: SWOT Analysis

Figure 49 SGS S.A.: Company Snapshot

Figure 50 SGS S.A.: SWOT Analysis

Figure 51 Intertek Group PLC: Company Snapshot

Figure 52 Intertek Group PLC: SWOT Analysis

Figure 53 Silliker Inc.:SWOT Analysis

Figure 54 ALS Limited: Company Snapshot

Figure 55 Asurequality Limited: Company Snapshot

Growth opportunities and latent adjacency in Pesticide Residue Testing Market